Key Insights

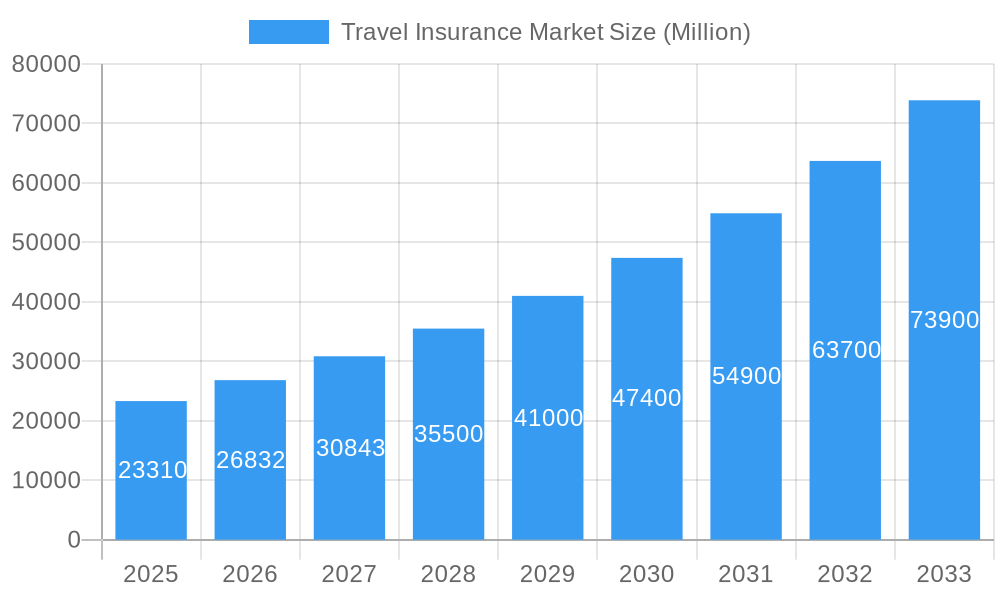

The global travel insurance market, valued at $23.31 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 15.40% from 2025 to 2033. This expansion is fueled by several key factors. Increased international travel, particularly among younger demographics, is a major driver. Concerns regarding health emergencies, trip cancellations, and lost luggage are prompting a higher demand for comprehensive coverage. The rising popularity of adventure tourism and experiential travel also contributes to market growth, as these activities often carry higher risks. Furthermore, the increasing availability of online travel insurance platforms and bundled travel packages that include insurance are streamlining the purchasing process and expanding market reach. Competitive pricing strategies and innovative product offerings from major players like Allianz, AIG, Generali, and AXA are further stimulating market expansion.

Travel Insurance Market Market Size (In Billion)

However, the market faces some challenges. Economic downturns can significantly impact discretionary spending on travel insurance. Fluctuations in currency exchange rates and geopolitical instability can also create uncertainty and influence travel patterns, consequently impacting demand. Furthermore, the increasing prevalence of pre-existing medical conditions can pose underwriting challenges for insurers, potentially limiting market growth in specific segments. Despite these restraints, the long-term outlook for the travel insurance market remains positive, driven by the enduring appeal of global travel and a growing awareness of the importance of risk mitigation. The market's segmentation, while not explicitly detailed, likely includes various coverage levels (basic, comprehensive, luxury), product types (single trip, annual multi-trip), and distribution channels (online, offline).

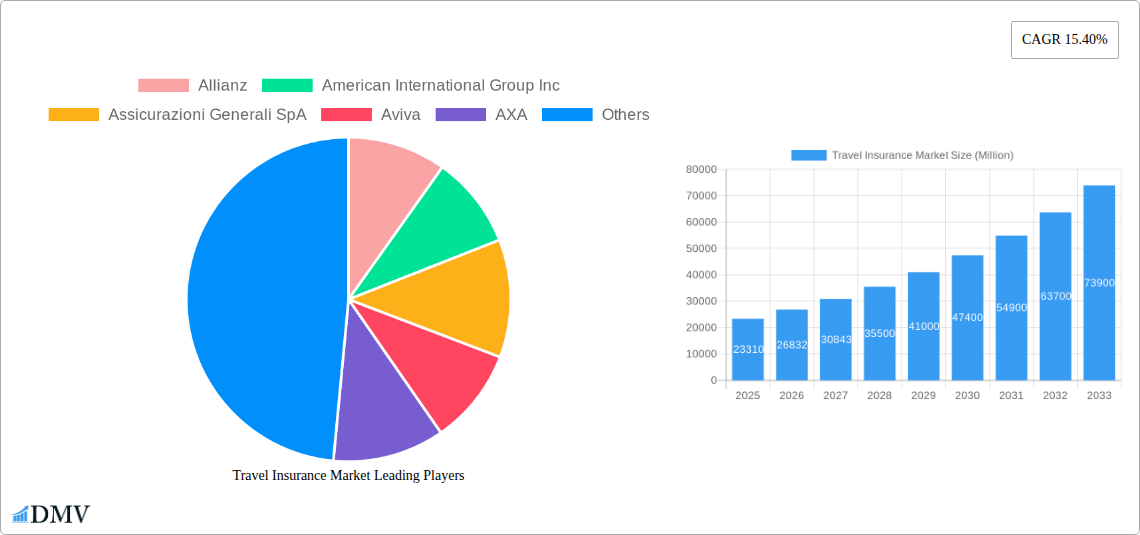

Travel Insurance Market Company Market Share

Travel Insurance Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the global Travel Insurance Market, offering a comprehensive analysis of its current state, future trajectory, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This detailed market research encompasses historical data (2019-2024), current market dynamics, and robust forecasts (2025-2033), enabling stakeholders to make informed strategic decisions. The report is meticulously crafted, incorporating high-ranking keywords to ensure maximum search engine visibility and deliver valuable insights for investors, industry professionals, and business strategists. Expected market value figures are presented in Millions (M).

Travel Insurance Market Composition & Trends

This section examines the competitive landscape of the travel insurance market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user demographics, and significant M&A activity. We explore the market share distribution among key players, including but not limited to Allianz, American International Group Inc, Assicurazioni Generali SpA, Aviva, AXA, Berkshire Hathaway Travel Protection, Saga PLC, HTH Worldwide, Insure & Go Insurance Services Limited, Medgulf, Nationwide Mutual Insurance Company, Ping An Insurance, Travelex Travel Insurance, Zurich Insurance, and Chubb Insurance. The report analyzes the impact of recent mergers and acquisitions, such as the EUR 280M acquisition of Tua by Allianz in March 2024, providing insights into deal values and their influence on market dynamics. The analysis will also quantify market concentration using metrics such as the Herfindahl-Hirschman Index (HHI) to illustrate competitive intensity. Specific data points on market share will be included in the report. The section also examines the role of innovation, including technological advancements and new product offerings, in shaping market trends, coupled with the impact of evolving regulatory landscapes and substitute products available to consumers. Finally, we look at evolving end-user preferences and their impact on market segmentation.

- Market Concentration: Analysis of market share distribution among major players. XX% market share held by top 5 players (estimated).

- Innovation Catalysts: Examination of technological advancements and their impact on product offerings.

- Regulatory Landscape: Assessment of the influence of regulations on market growth and competition.

- Substitute Products: Analysis of alternative solutions and their impact on market share.

- End-User Profiles: Segmentation of the market based on demographics and travel behaviors.

- M&A Activity: Analysis of recent mergers and acquisitions, including deal values and market impact (e.g., Allianz's acquisition of Tua).

Travel Insurance Market Industry Evolution

This section delves into the historical and projected growth trajectories of the travel insurance market. We will analyze the market's evolution, factoring in technological advancements such as online platforms and AI-driven risk assessment, alongside shifts in consumer preferences and travel patterns. We'll explore the impact of macroeconomic factors on market growth. The section will present specific data points such as compound annual growth rates (CAGR) for the historical period (2019-2024) and the projected growth rate for the forecast period (2025-2033). Furthermore, we will examine adoption metrics for new technologies and products within the travel insurance sector, illustrating the market's readiness for innovative solutions. The growth of specific segments, such as travel insurance for adventure tourism or long-stay travel, will be analyzed. The impact of global events, such as pandemics, on market growth will also be assessed.

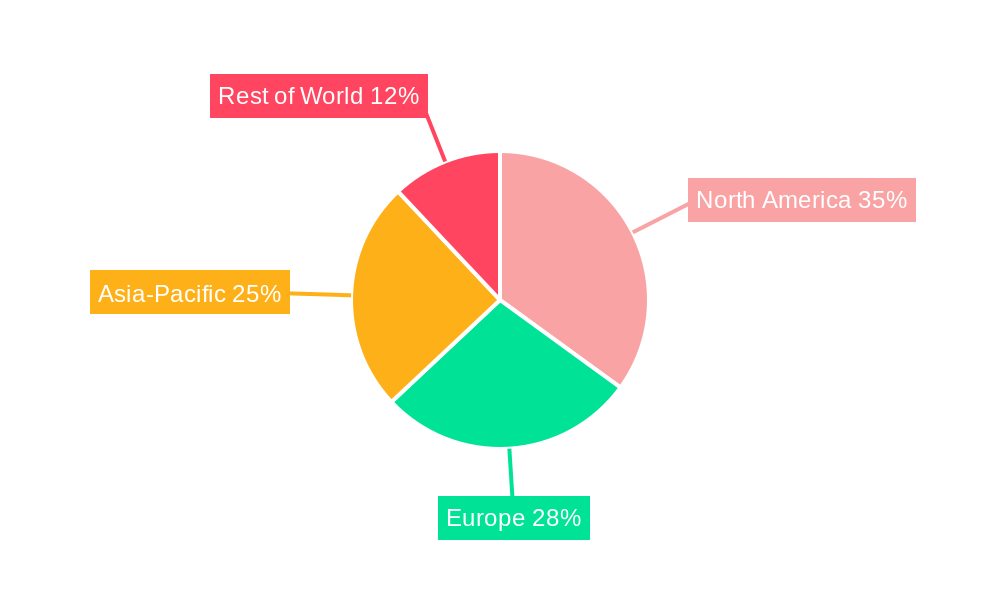

Leading Regions, Countries, or Segments in Travel Insurance Market

This section identifies the leading regions, countries, or segments within the travel insurance market. We will provide an in-depth analysis of the factors contributing to their dominance. This analysis will include quantitative data, such as market size and growth rates by region/segment, highlighting regional disparities and growth potential.

- Key Drivers for Dominant Regions/Segments:

- Investment Trends (e.g., government funding for travel infrastructure)

- Regulatory Support (e.g., policies promoting tourism)

- Consumer Behavior (e.g., increased travel frequency in specific regions)

- Economic Factors (e.g., disposable income levels)

Travel Insurance Market Product Innovations

This section details recent product innovations in the travel insurance market, emphasizing unique selling propositions (USPs) and technological advancements. Examples include the incorporation of AI for faster claims processing, personalized policy offerings based on individual travel profiles, and the integration of travel insurance with other travel services (e.g., flight booking platforms). The performance metrics of these innovations, such as customer satisfaction scores and claim settlement times, will also be assessed.

Propelling Factors for Travel Insurance Market Growth

Several factors contribute to the growth of the travel insurance market. Increased global travel, rising disposable incomes in developing economies, and the growing awareness of potential travel risks are key drivers. Technological advancements, such as online platforms and mobile apps that facilitate easy policy purchase and claims management, also fuel market expansion. Furthermore, favorable regulatory environments in certain regions promote growth.

Obstacles in the Travel Insurance Market

The travel insurance market faces challenges, including increased competition, regulatory hurdles (e.g., data privacy regulations), and fluctuating economic conditions impacting consumer spending. Supply chain disruptions can also impact the ability to provide timely services. These factors can hinder market expansion and profitability. The report quantifies the impact of these challenges on market growth using data and projections.

Future Opportunities in Travel Insurance Market

The travel insurance market presents promising opportunities for growth. Expansion into untapped markets (e.g., developing economies with increasing tourism), development of specialized insurance products (e.g., for adventure travel or medical emergencies), and the integration of innovative technologies (e.g., blockchain for secure data management and faster claims) offer significant potential. Changes in consumer preferences related to sustainability and responsible travel will also shape future opportunities.

Major Players in the Travel Insurance Market Ecosystem

- Allianz

- American International Group Inc

- Assicurazioni Generali SpA

- Aviva

- AXA

- Berkshire Hathaway Travel Protection

- Saga PLC

- HTH Worldwide

- Insure & Go Insurance Services Limited

- Medgulf

- Nationwide Mutual Insurance Company

- Ping An Insurance

- Travelex Travel Insurance

- Zurich Insurance

- Chubb Insurance (List Not Exhaustive)

Key Developments in Travel Insurance Market Industry

- March 2024: Allianz SpA completed the acquisition of Tua from Assicurazioni Generali SpA for EUR 280 million.

- May 2023: InsureMyTrip launched its travel insurance platform in Canada (insuremytrip.ca).

- February 2023: Vistara partnered with Allianz Partners to offer travel insurance to its passengers.

Strategic Travel Insurance Market Forecast

The travel insurance market is poised for substantial growth over the forecast period (2025-2033), driven by factors such as increased global travel, technological advancements, and evolving consumer preferences. The market's future potential is significant, with numerous opportunities for innovation and expansion into new markets and segments. The report provides detailed projections for market size and growth rates, considering various scenarios and potential disruptions.

Travel Insurance Market Segmentation

-

1. Coverage Type

- 1.1. Single-Trip Travel Insurance

- 1.2. Annual Multi-Trip Travel Insurance

-

2. Product Type

- 2.1. Trip Cancellation/Delay

- 2.2. Travel Medical Insurance (Personal Accident)

- 2.3. Other Product Types

-

3. Distribution Channel

- 3.1. Insurance Companies

- 3.2. Insurance Intermediaries

- 3.3. Banks

- 3.4. Insurance Brokers

- 3.5. Other Distribution Channels

Travel Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Argentina

- 4.4. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Travel Insurance Market Regional Market Share

Geographic Coverage of Travel Insurance Market

Travel Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Role of Social Media in Fueling the Global Travel Insurance Market; Growing International Travelers and Changing Demographics Drive Demand

- 3.3. Market Restrains

- 3.3.1. Role of Social Media in Fueling the Global Travel Insurance Market; Growing International Travelers and Changing Demographics Drive Demand

- 3.4. Market Trends

- 3.4.1. Single-journey Travel Insurance Driving the Travel Insurance Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coverage Type

- 5.1.1. Single-Trip Travel Insurance

- 5.1.2. Annual Multi-Trip Travel Insurance

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Trip Cancellation/Delay

- 5.2.2. Travel Medical Insurance (Personal Accident)

- 5.2.3. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Insurance Companies

- 5.3.2. Insurance Intermediaries

- 5.3.3. Banks

- 5.3.4. Insurance Brokers

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Coverage Type

- 6. North America Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Coverage Type

- 6.1.1. Single-Trip Travel Insurance

- 6.1.2. Annual Multi-Trip Travel Insurance

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Trip Cancellation/Delay

- 6.2.2. Travel Medical Insurance (Personal Accident)

- 6.2.3. Other Product Types

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Insurance Companies

- 6.3.2. Insurance Intermediaries

- 6.3.3. Banks

- 6.3.4. Insurance Brokers

- 6.3.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Coverage Type

- 7. Europe Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Coverage Type

- 7.1.1. Single-Trip Travel Insurance

- 7.1.2. Annual Multi-Trip Travel Insurance

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Trip Cancellation/Delay

- 7.2.2. Travel Medical Insurance (Personal Accident)

- 7.2.3. Other Product Types

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Insurance Companies

- 7.3.2. Insurance Intermediaries

- 7.3.3. Banks

- 7.3.4. Insurance Brokers

- 7.3.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Coverage Type

- 8. Asia Pacific Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Coverage Type

- 8.1.1. Single-Trip Travel Insurance

- 8.1.2. Annual Multi-Trip Travel Insurance

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Trip Cancellation/Delay

- 8.2.2. Travel Medical Insurance (Personal Accident)

- 8.2.3. Other Product Types

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Insurance Companies

- 8.3.2. Insurance Intermediaries

- 8.3.3. Banks

- 8.3.4. Insurance Brokers

- 8.3.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Coverage Type

- 9. Latin America Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Coverage Type

- 9.1.1. Single-Trip Travel Insurance

- 9.1.2. Annual Multi-Trip Travel Insurance

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Trip Cancellation/Delay

- 9.2.2. Travel Medical Insurance (Personal Accident)

- 9.2.3. Other Product Types

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Insurance Companies

- 9.3.2. Insurance Intermediaries

- 9.3.3. Banks

- 9.3.4. Insurance Brokers

- 9.3.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Coverage Type

- 10. Middle East and Africa Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Coverage Type

- 10.1.1. Single-Trip Travel Insurance

- 10.1.2. Annual Multi-Trip Travel Insurance

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Trip Cancellation/Delay

- 10.2.2. Travel Medical Insurance (Personal Accident)

- 10.2.3. Other Product Types

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Insurance Companies

- 10.3.2. Insurance Intermediaries

- 10.3.3. Banks

- 10.3.4. Insurance Brokers

- 10.3.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Coverage Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Allianz

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 American International Group Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Assicurazioni Generali SpA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aviva

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AXA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Berkshire Hathaway Travel Protection

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Saga PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 HTH Worldwide

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Insure & Go Insurance Services Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Medgulf

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nationwide Mutual Insurance Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ping An Insurance

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Travelex Travel Insurance

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Zurich Insurance

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Chubb Insurance**List Not Exhaustive

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Allianz

List of Figures

- Figure 1: Global Travel Insurance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Travel Insurance Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Travel Insurance Market Revenue (Million), by Coverage Type 2025 & 2033

- Figure 4: North America Travel Insurance Market Volume (Billion), by Coverage Type 2025 & 2033

- Figure 5: North America Travel Insurance Market Revenue Share (%), by Coverage Type 2025 & 2033

- Figure 6: North America Travel Insurance Market Volume Share (%), by Coverage Type 2025 & 2033

- Figure 7: North America Travel Insurance Market Revenue (Million), by Product Type 2025 & 2033

- Figure 8: North America Travel Insurance Market Volume (Billion), by Product Type 2025 & 2033

- Figure 9: North America Travel Insurance Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: North America Travel Insurance Market Volume Share (%), by Product Type 2025 & 2033

- Figure 11: North America Travel Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 12: North America Travel Insurance Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 13: North America Travel Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: North America Travel Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 15: North America Travel Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Travel Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 17: North America Travel Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Travel Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Travel Insurance Market Revenue (Million), by Coverage Type 2025 & 2033

- Figure 20: Europe Travel Insurance Market Volume (Billion), by Coverage Type 2025 & 2033

- Figure 21: Europe Travel Insurance Market Revenue Share (%), by Coverage Type 2025 & 2033

- Figure 22: Europe Travel Insurance Market Volume Share (%), by Coverage Type 2025 & 2033

- Figure 23: Europe Travel Insurance Market Revenue (Million), by Product Type 2025 & 2033

- Figure 24: Europe Travel Insurance Market Volume (Billion), by Product Type 2025 & 2033

- Figure 25: Europe Travel Insurance Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 26: Europe Travel Insurance Market Volume Share (%), by Product Type 2025 & 2033

- Figure 27: Europe Travel Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 28: Europe Travel Insurance Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 29: Europe Travel Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Europe Travel Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 31: Europe Travel Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Travel Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Europe Travel Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Travel Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Travel Insurance Market Revenue (Million), by Coverage Type 2025 & 2033

- Figure 36: Asia Pacific Travel Insurance Market Volume (Billion), by Coverage Type 2025 & 2033

- Figure 37: Asia Pacific Travel Insurance Market Revenue Share (%), by Coverage Type 2025 & 2033

- Figure 38: Asia Pacific Travel Insurance Market Volume Share (%), by Coverage Type 2025 & 2033

- Figure 39: Asia Pacific Travel Insurance Market Revenue (Million), by Product Type 2025 & 2033

- Figure 40: Asia Pacific Travel Insurance Market Volume (Billion), by Product Type 2025 & 2033

- Figure 41: Asia Pacific Travel Insurance Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: Asia Pacific Travel Insurance Market Volume Share (%), by Product Type 2025 & 2033

- Figure 43: Asia Pacific Travel Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 44: Asia Pacific Travel Insurance Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 45: Asia Pacific Travel Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Asia Pacific Travel Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Asia Pacific Travel Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Travel Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Asia Pacific Travel Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Travel Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Travel Insurance Market Revenue (Million), by Coverage Type 2025 & 2033

- Figure 52: Latin America Travel Insurance Market Volume (Billion), by Coverage Type 2025 & 2033

- Figure 53: Latin America Travel Insurance Market Revenue Share (%), by Coverage Type 2025 & 2033

- Figure 54: Latin America Travel Insurance Market Volume Share (%), by Coverage Type 2025 & 2033

- Figure 55: Latin America Travel Insurance Market Revenue (Million), by Product Type 2025 & 2033

- Figure 56: Latin America Travel Insurance Market Volume (Billion), by Product Type 2025 & 2033

- Figure 57: Latin America Travel Insurance Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 58: Latin America Travel Insurance Market Volume Share (%), by Product Type 2025 & 2033

- Figure 59: Latin America Travel Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 60: Latin America Travel Insurance Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 61: Latin America Travel Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 62: Latin America Travel Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 63: Latin America Travel Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Latin America Travel Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 65: Latin America Travel Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Latin America Travel Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Travel Insurance Market Revenue (Million), by Coverage Type 2025 & 2033

- Figure 68: Middle East and Africa Travel Insurance Market Volume (Billion), by Coverage Type 2025 & 2033

- Figure 69: Middle East and Africa Travel Insurance Market Revenue Share (%), by Coverage Type 2025 & 2033

- Figure 70: Middle East and Africa Travel Insurance Market Volume Share (%), by Coverage Type 2025 & 2033

- Figure 71: Middle East and Africa Travel Insurance Market Revenue (Million), by Product Type 2025 & 2033

- Figure 72: Middle East and Africa Travel Insurance Market Volume (Billion), by Product Type 2025 & 2033

- Figure 73: Middle East and Africa Travel Insurance Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 74: Middle East and Africa Travel Insurance Market Volume Share (%), by Product Type 2025 & 2033

- Figure 75: Middle East and Africa Travel Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 76: Middle East and Africa Travel Insurance Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 77: Middle East and Africa Travel Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 78: Middle East and Africa Travel Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 79: Middle East and Africa Travel Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Middle East and Africa Travel Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Middle East and Africa Travel Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Travel Insurance Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Travel Insurance Market Revenue Million Forecast, by Coverage Type 2020 & 2033

- Table 2: Global Travel Insurance Market Volume Billion Forecast, by Coverage Type 2020 & 2033

- Table 3: Global Travel Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: Global Travel Insurance Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Travel Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Travel Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Travel Insurance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Travel Insurance Market Revenue Million Forecast, by Coverage Type 2020 & 2033

- Table 10: Global Travel Insurance Market Volume Billion Forecast, by Coverage Type 2020 & 2033

- Table 11: Global Travel Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Global Travel Insurance Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 13: Global Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Travel Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Travel Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Travel Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Travel Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Travel Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Global Travel Insurance Market Revenue Million Forecast, by Coverage Type 2020 & 2033

- Table 22: Global Travel Insurance Market Volume Billion Forecast, by Coverage Type 2020 & 2033

- Table 23: Global Travel Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 24: Global Travel Insurance Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 25: Global Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 26: Global Travel Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global Travel Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Travel Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 29: United Kingdom Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Travel Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Germany Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Travel Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: France Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: France Travel Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Italy Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Italy Travel Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Spain Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Spain Travel Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Europe Travel Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Global Travel Insurance Market Revenue Million Forecast, by Coverage Type 2020 & 2033

- Table 42: Global Travel Insurance Market Volume Billion Forecast, by Coverage Type 2020 & 2033

- Table 43: Global Travel Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 44: Global Travel Insurance Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 45: Global Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 46: Global Travel Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 47: Global Travel Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Travel Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 49: China Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: China Travel Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: India Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: India Travel Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Japan Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan Travel Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Rest of Asia Pacific Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Rest of Asia Pacific Travel Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Global Travel Insurance Market Revenue Million Forecast, by Coverage Type 2020 & 2033

- Table 58: Global Travel Insurance Market Volume Billion Forecast, by Coverage Type 2020 & 2033

- Table 59: Global Travel Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 60: Global Travel Insurance Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 61: Global Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 62: Global Travel Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 63: Global Travel Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 64: Global Travel Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 65: Mexico Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Mexico Travel Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: Brazil Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Brazil Travel Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: Argentina Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Argentina Travel Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 71: Rest of Latin America Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Latin America Travel Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: Global Travel Insurance Market Revenue Million Forecast, by Coverage Type 2020 & 2033

- Table 74: Global Travel Insurance Market Volume Billion Forecast, by Coverage Type 2020 & 2033

- Table 75: Global Travel Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 76: Global Travel Insurance Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 77: Global Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 78: Global Travel Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 79: Global Travel Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 80: Global Travel Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 81: United Arab Emirates Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: United Arab Emirates Travel Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 83: Saudi Arabia Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Saudi Arabia Travel Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 85: South Africa Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Africa Travel Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 87: Rest of Middle East and Africa Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: Rest of Middle East and Africa Travel Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Travel Insurance Market?

The projected CAGR is approximately 15.40%.

2. Which companies are prominent players in the Travel Insurance Market?

Key companies in the market include Allianz, American International Group Inc, Assicurazioni Generali SpA, Aviva, AXA, Berkshire Hathaway Travel Protection, Saga PLC, HTH Worldwide, Insure & Go Insurance Services Limited, Medgulf, Nationwide Mutual Insurance Company, Ping An Insurance, Travelex Travel Insurance, Zurich Insurance, Chubb Insurance**List Not Exhaustive.

3. What are the main segments of the Travel Insurance Market?

The market segments include Coverage Type, Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.31 Million as of 2022.

5. What are some drivers contributing to market growth?

Role of Social Media in Fueling the Global Travel Insurance Market; Growing International Travelers and Changing Demographics Drive Demand.

6. What are the notable trends driving market growth?

Single-journey Travel Insurance Driving the Travel Insurance Market.

7. Are there any restraints impacting market growth?

Role of Social Media in Fueling the Global Travel Insurance Market; Growing International Travelers and Changing Demographics Drive Demand.

8. Can you provide examples of recent developments in the market?

In March 2024, Allianz SpA completed the acquisition of the Italian insurance and reinsurance company Tua from Assicurazzioni Generali SpA for an agreed price of EUR 280 million. The transaction was first announced on October 12th, 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Travel Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Travel Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Travel Insurance Market?

To stay informed about further developments, trends, and reports in the Travel Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence