Key Insights

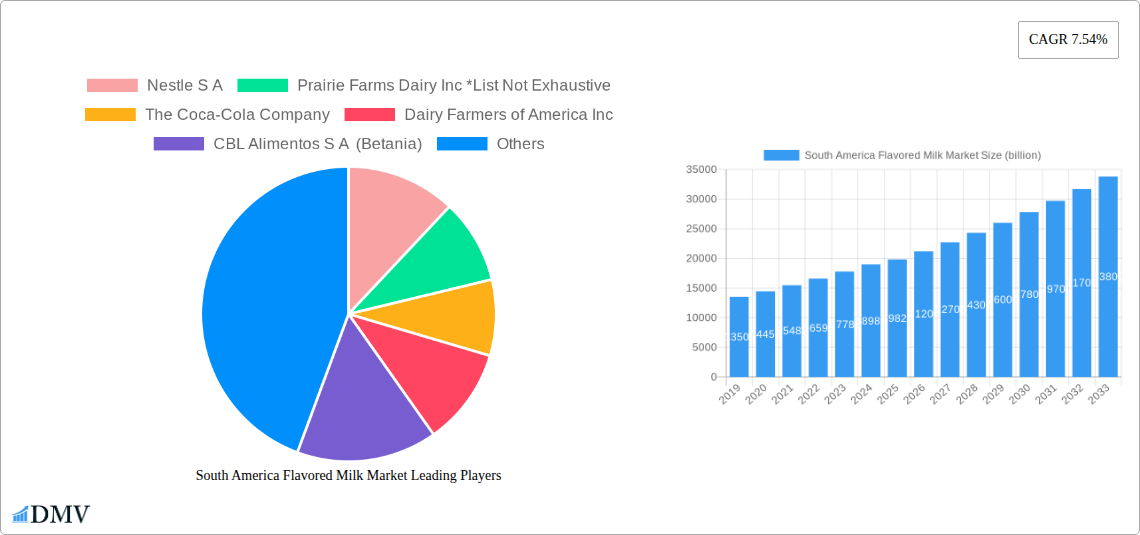

The South America Flavored Milk Market is poised for substantial growth, projected to reach USD 19.82 billion in 2025 with a robust CAGR of 7.54% through 2033. This expansion is primarily fueled by evolving consumer preferences towards convenient, healthier beverage options and the increasing demand for diverse flavor profiles. Dairy-based flavored milk continues to dominate, benefiting from established brand loyalty and perceived nutritional benefits. However, the plant-based segment is witnessing a rapid ascent, driven by growing health consciousness, lactose intolerance, and vegan dietary trends across key markets like Brazil and Argentina. Supermarkets and hypermarkets remain the leading distribution channels, offering wide product availability and promotional opportunities. Nevertheless, the burgeoning online retail sector is gaining significant traction, catering to the convenience-seeking urban population and expanding the market's reach.

South America Flavored Milk Market Market Size (In Billion)

The market's trajectory is further shaped by several key drivers including rising disposable incomes, particularly among the middle class in South America, which encourages premium product purchases. Innovative product development, such as the introduction of exotic fruit flavors and functional ingredients, is also a significant growth catalyst. Conversely, the market faces certain restraints, including fluctuating raw material prices for milk and flavorings, which can impact profitability. Stringent regulatory frameworks concerning food safety and labeling in some South American nations can also pose challenges for market players. Despite these headwinds, the overall outlook for the South America Flavored Milk Market remains exceptionally bright, characterized by a dynamic interplay between traditional dairy and innovative plant-based offerings, supported by expanding distribution networks and a growing consumer appetite for variety and convenience.

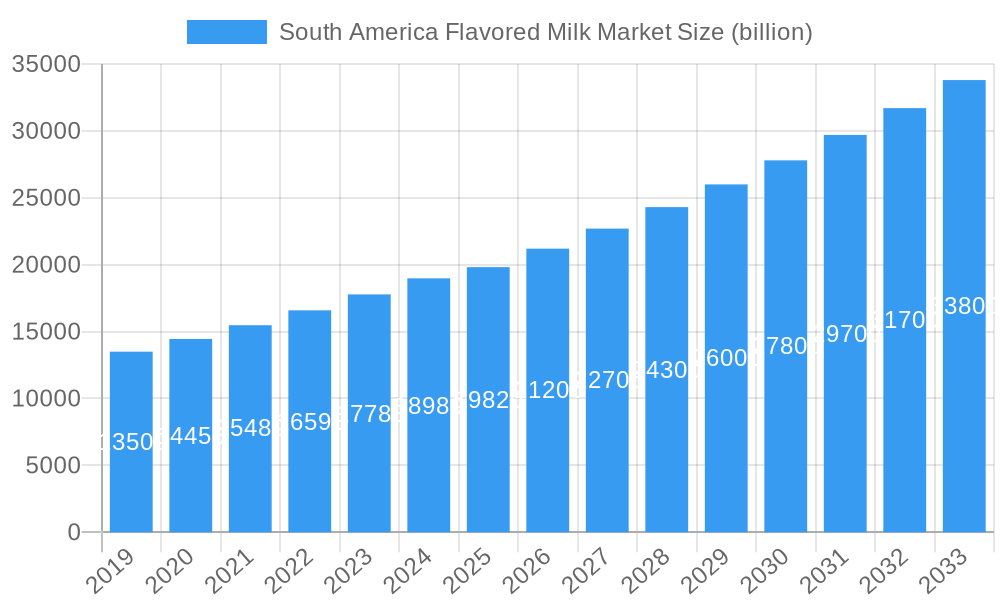

South America Flavored Milk Market Company Market Share

Embark on a deep dive into the dynamic South America Flavored Milk Market with this definitive report. Covering the extensive study period of 2019–2033, with a base and estimated year of 2025, this analysis provides unparalleled insights into market evolution, competitive landscapes, and future trajectories. Discover the burgeoning demand for flavored milk beverages across Brazil, Argentina, and the wider South American region, driven by evolving consumer preferences and innovative product offerings. This report is an indispensable resource for stakeholders seeking to understand and capitalize on the growth potential of the South American flavored milk industry.

South America Flavored Milk Market Market Composition & Trends

The South America Flavored Milk Market exhibits a moderately concentrated structure, with key players like Nestle S A, Prairie Farms Dairy Inc, and The Coca-Cola Company holding significant sway. Innovation remains a critical catalyst, fueled by a growing consumer appetite for novel flavors, healthier formulations, and plant-based alternatives. Regulatory landscapes are evolving, with a growing emphasis on food safety standards and nutritional labeling, particularly in Brazil and Argentina. Substitute products, such as fruit juices and ready-to-drink teas, present a moderate competitive pressure, yet the inherent nutritional benefits and perceived indulgence of flavored milk continue to drive demand. End-user profiles are diversifying, encompassing health-conscious millennials and Gen Z seeking convenient and tasty nutritional options, as well as families prioritizing fortified beverages for children. Merger and acquisition (M&A) activities are anticipated to increase as established players seek to expand their portfolios and gain market share in this attractive region. The market is projected to reach an estimated XXX billion USD by 2025, with M&A deal values expected to contribute significantly to market consolidation. Key trends include the rise of functional flavored milks offering added vitamins and minerals, and a surge in demand for ethically sourced and sustainably produced products.

South America Flavored Milk Market Industry Evolution

The South America Flavored Milk Market has witnessed a robust evolution over the historical period of 2019–2024, laying a strong foundation for projected growth. This evolution is characterized by a consistent upward trajectory in market size, driven by a confluence of factors including increasing disposable incomes, a growing young population, and a heightened awareness of the nutritional benefits associated with milk-based beverages. Technological advancements have played a pivotal role in shaping this industry. Innovations in processing techniques, such as aseptic packaging, have significantly extended shelf life and improved product quality, making flavored milk more accessible across diverse geographical regions within South America. Furthermore, advancements in flavor encapsulation and ingredient technology have enabled manufacturers to develop a wider array of appealing and sophisticated flavor profiles, catering to increasingly discerning consumer palates. Shifting consumer demands have been a primary propellant for this evolution. There has been a discernible move towards healthier options, with a growing preference for lower sugar content, natural ingredients, and fortified beverages offering added nutritional value, such as calcium and Vitamin D. The plant-based movement has also significantly impacted the market, prompting a substantial increase in the development and availability of plant-based flavored milk alternatives derived from almonds, oats, and soy. This diversification in product offerings has broadened the market's appeal, attracting a wider demographic of consumers. The convenience factor remains paramount, with ready-to-drink formats gaining considerable traction, aligning with the fast-paced lifestyles prevalent in urban centers across South America. The market has demonstrated a compound annual growth rate (CAGR) of approximately 5.5% during the historical period. The adoption of new product formulations, particularly those addressing health and wellness trends, has seen an estimated increase of 15% year-over-year.

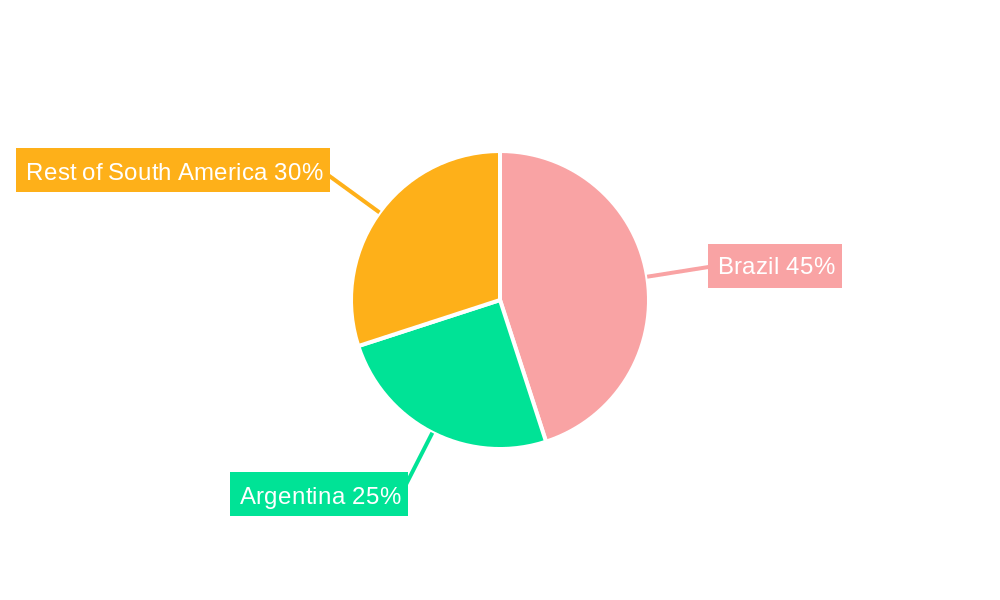

Leading Regions, Countries, or Segments in South America Flavored Milk Market

Brazil emerges as the dominant force within the South America Flavored Milk Market, spearheading growth and setting consumption trends. Its vast population, burgeoning middle class, and significant disposable income contribute to its leading position. The country’s advanced retail infrastructure, characterized by widespread supermarket and hypermarket penetration, facilitates easy access to a diverse range of flavored milk products. Furthermore, Brazil's progressive regulatory environment and receptiveness to new product launches by major players like Nestle S A and CBL Alimentos S A (Betania) foster a fertile ground for market expansion. Argentina follows closely, exhibiting strong growth potential driven by a similar demographic profile and a growing appreciation for premium and niche flavored milk offerings. The "Rest of South America" segment, encompassing countries like Colombia, Chile, and Peru, represents a rapidly expanding frontier, with increasing urbanization and rising consumer spending power creating significant opportunities for flavored milk brands.

Within product segmentation, Dairy-based flavored milk continues to hold the largest market share, driven by traditional consumer preferences and the perceived nutritional value of milk. Flavors like chocolate, strawberry, and vanilla remain perennial favorites, while innovative dairy-based combinations are gaining traction. However, the Plant-based segment is experiencing exponential growth, fueled by increasing health consciousness, lactose intolerance, and ethical considerations. Almond, oat, and soy-based beverages, in various enticing flavors, are capturing a significant and growing consumer base.

In terms of distribution channels, Supermarkets/Hypermarkets remain the primary avenue for flavored milk sales, offering extensive product variety and competitive pricing. Convenience Stores are crucial for impulse purchases and on-the-go consumption, particularly in urban areas. Online Stores are emerging as a significant growth channel, offering unparalleled convenience and a wider selection, appealing to tech-savvy consumers. Specialist stores, while a smaller segment, cater to niche markets and health-focused consumers.

Key drivers for Brazil's dominance include:

- High Population Density: A substantial consumer base readily accessible to manufacturers.

- Robust Retail Network: Extensive reach through supermarkets and hypermarkets, ensuring product availability.

- Consumer Preference for Indulgent Beverages: A cultural inclination towards flavored and sweetened drinks.

- Investment Trends: Significant investments by multinational and local dairy companies in production and marketing.

- Regulatory Support: A relatively stable regulatory framework that supports product innovation and market entry.

The dominance of the dairy-based segment is sustained by:

- Established Consumer Habits: Long-standing familiarity and trust in dairy products.

- Nutritional Perceptions: Flavored milk is often perceived as a good source of protein and calcium for families.

- Widespread Availability and Affordability: Dairy-based options are generally more accessible and cost-effective.

The rapid ascent of the plant-based segment is attributed to:

- Growing Health & Wellness Trend: Consumers actively seeking dairy-free, lower-lactose, and perceived "healthier" alternatives.

- Ethical and Environmental Concerns: A rising awareness of the environmental impact of dairy farming.

- Product Innovation: Continuous introduction of novel plant-based milk bases and exciting flavor combinations.

- Dietary Restrictions: Catering to individuals with lactose intolerance or dairy allergies.

South America Flavored Milk Market Product Innovations

Product innovation is a cornerstone of the South America Flavored Milk Market. Manufacturers are actively introducing functional flavored milks fortified with probiotics, prebiotics, and essential vitamins and minerals, targeting health-conscious consumers. The development of unique and exotic flavor profiles, beyond traditional options, is a key differentiator. For instance, introducing flavors like 'Açaí Berry Blast' or 'Dulce de Leche Swirl' taps into local tastes and preferences. Furthermore, advancements in natural flavoring and sweetener technologies are enabling the creation of healthier alternatives with reduced sugar content and without artificial additives, enhancing their appeal to a broader consumer base. The performance metrics for these innovations are evident in increased product trial rates and positive consumer feedback, driving repeat purchases and brand loyalty.

Propelling Factors for South America Flavored Milk Market Growth

The South America Flavored Milk Market is propelled by several key factors. Economically, rising disposable incomes across the region translate to increased consumer spending on premium and convenient food and beverage products. Technologically, advancements in packaging and processing technologies ensure extended shelf life and improved product quality, making flavored milk more accessible. Regulatory shifts, where supportive of food safety and nutritional labeling, foster consumer confidence. The growing demand for healthier alternatives, including reduced-sugar options and plant-based milk, is a significant driver. Furthermore, effective marketing campaigns and product diversification by major players like Nestle S A and The Coca-Cola Company are continuously stimulating consumer interest and market expansion.

Obstacles in the South America Flavored Milk Market Market

Despite its promising growth, the South America Flavored Milk Market faces certain obstacles. Regulatory hurdles and varying food safety standards across different South American countries can pose challenges for market entry and standardization. Supply chain disruptions, particularly those related to the availability and cost of raw materials like milk and flavorings, can impact production and pricing. Intense competition from established brands and emerging local players also presents a barrier. Additionally, fluctuating economic conditions and currency volatilities in some South American nations can affect consumer purchasing power, potentially impacting demand for non-essential items like premium flavored milk. The presence of cheaper substitute beverages also exerts competitive pressure.

Future Opportunities in South America Flavored Milk Market

The South America Flavored Milk Market is ripe with future opportunities. The burgeoning plant-based segment offers substantial growth potential as consumer awareness and demand for dairy-free alternatives continue to rise. Emerging economies within South America present untapped markets with growing disposable incomes and a developing taste for convenience beverages. Innovations in functional beverages, catering to specific health needs like bone health or gut health, represent a significant avenue for product development. Furthermore, the expansion of e-commerce and online grocery platforms provides new channels to reach a wider consumer base and cater to evolving shopping habits. The potential for regional export and strategic partnerships also offers lucrative growth prospects.

Major Players in the South America Flavored Milk Market Ecosystem

- Nestle S A

- Prairie Farms Dairy Inc

- The Coca-Cola Company

- Dairy Farmers of America Inc

- CBL Alimentos S A (Betania)

- Arla Food

- Mococa S A Produtos Alimenticios

Key Developments in South America Flavored Milk Market Industry

- 2023: Launch of new plant-based flavored milk lines by major dairy cooperatives in Brazil, targeting health-conscious consumers.

- 2023: Increased investment in marketing and promotional activities by The Coca-Cola Company to boost its flavored milk portfolio in Argentina.

- 2022: CBL Alimentos S A (Betania) expands its distribution network across key urban centers in Colombia, increasing accessibility of its flavored milk products.

- 2022: Arla Food introduces a range of premium, low-sugar flavored milk options in Chile, responding to growing consumer demand for healthier choices.

- 2021: Nestle S A enhances its fortified flavored milk offerings in Peru with added vitamins and minerals, emphasizing child nutrition.

- 2020: Mococa S A Produtos Alimenticios explores strategic partnerships to expand its reach into smaller, underserved markets within Brazil.

Strategic South America Flavored Milk Market Market Forecast

The strategic forecast for the South America Flavored Milk Market is exceptionally positive, projecting sustained growth through 2033. Key growth catalysts include the continued rise of health and wellness trends, driving demand for both reduced-sugar dairy options and the rapidly expanding plant-based segment. Economic development and increasing urbanization across the region will further fuel consumer spending on convenient and palatable beverages. Strategic investments in product innovation, particularly in unique flavor profiles and functional benefits, alongside expanded distribution channels, including a strong online presence, will solidify market expansion. The market is anticipated to reach an estimated XXX billion USD by 2033, driven by a CAGR of approximately 6.2%.

South America Flavored Milk Market Segmentation

-

1. Type

- 1.1. Dairy-based

- 1.2. Plant-based

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Stores

- 2.4. Online Stores

- 2.5. Other Distribution Channels

-

3. Geography

-

3.1. South America

- 3.1.1. Brazil

- 3.1.2. Argentina

- 3.1.3. Rest of South America

-

3.1. South America

South America Flavored Milk Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Rest of South America

South America Flavored Milk Market Regional Market Share

Geographic Coverage of South America Flavored Milk Market

South America Flavored Milk Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth In Foodservice Expenditure and Tourism Sector; Premiumization with the Growth of Fortified and Flavored Water

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding Plastic Waste and the Rising Inclination Toward Tap Water

- 3.4. Market Trends

- 3.4.1. Growing Demand For Fortified Food And Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Flavored Milk Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Dairy-based

- 5.1.2. Plant-based

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Stores

- 5.2.4. Online Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South America

- 5.3.1.1. Brazil

- 5.3.1.2. Argentina

- 5.3.1.3. Rest of South America

- 5.3.1. South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nestle S A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Prairie Farms Dairy Inc *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Coca-Cola Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dairy Farmers of America Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CBL Alimentos S A (Betania)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Arla Food

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mococa S A Produtos Alimenticios

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Nestle S A

List of Figures

- Figure 1: South America Flavored Milk Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Flavored Milk Market Share (%) by Company 2025

List of Tables

- Table 1: South America Flavored Milk Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South America Flavored Milk Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: South America Flavored Milk Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South America Flavored Milk Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South America Flavored Milk Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: South America Flavored Milk Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: South America Flavored Milk Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: South America Flavored Milk Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Brazil South America Flavored Milk Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Argentina South America Flavored Milk Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of South America South America Flavored Milk Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Flavored Milk Market?

The projected CAGR is approximately 7.54%.

2. Which companies are prominent players in the South America Flavored Milk Market?

Key companies in the market include Nestle S A, Prairie Farms Dairy Inc *List Not Exhaustive, The Coca-Cola Company, Dairy Farmers of America Inc, CBL Alimentos S A (Betania), Arla Food, Mococa S A Produtos Alimenticios.

3. What are the main segments of the South America Flavored Milk Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.82 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth In Foodservice Expenditure and Tourism Sector; Premiumization with the Growth of Fortified and Flavored Water.

6. What are the notable trends driving market growth?

Growing Demand For Fortified Food And Beverages.

7. Are there any restraints impacting market growth?

Concerns Regarding Plastic Waste and the Rising Inclination Toward Tap Water.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Flavored Milk Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Flavored Milk Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Flavored Milk Market?

To stay informed about further developments, trends, and reports in the South America Flavored Milk Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence