Key Insights

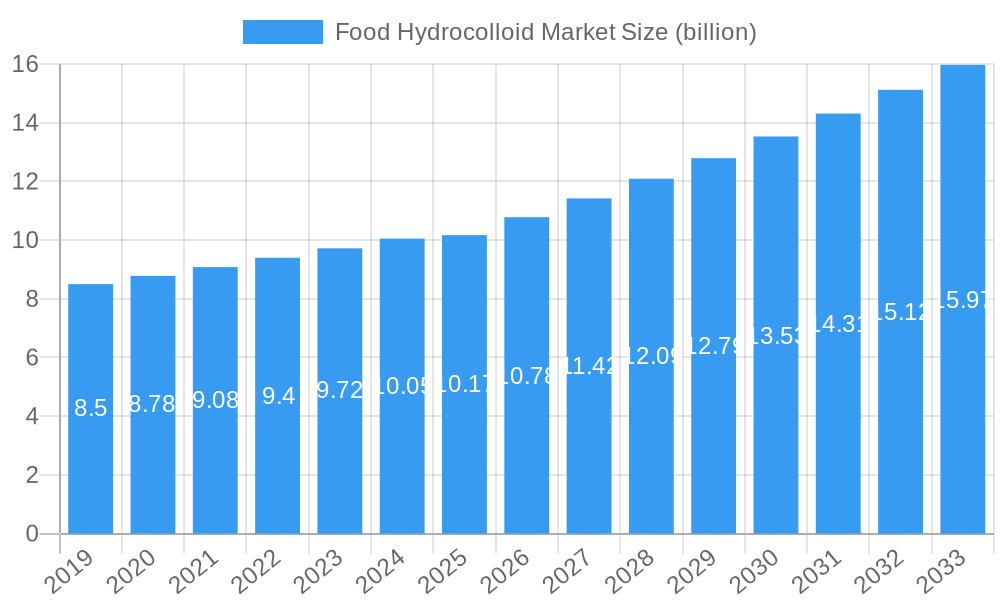

The global Food Hydrocolloid Market is poised for significant expansion, projected to reach $10.17 billion in 2025 and expand at a robust Compound Annual Growth Rate (CAGR) of 5.97% through 2033. This growth is fueled by an escalating consumer demand for processed and convenience foods, where hydrocolloids play a crucial role in enhancing texture, stability, and shelf life. Key drivers include the increasing adoption of clean-label ingredients, the demand for healthier food options with reduced fat and sugar content (where hydrocolloids can act as sugar and fat replacers), and the expanding dairy and bakery sectors. Furthermore, the rising trend of plant-based diets is significantly boosting the demand for plant-derived hydrocolloids such as pectin, xanthan gum, and guar gum, as they are essential for mimicking the texture and mouthfeel of animal-based products. The confectionery and beverage industries also represent substantial avenues for growth, driven by the need for improved product consistency and visual appeal.

Food Hydrocolloid Market Market Size (In Million)

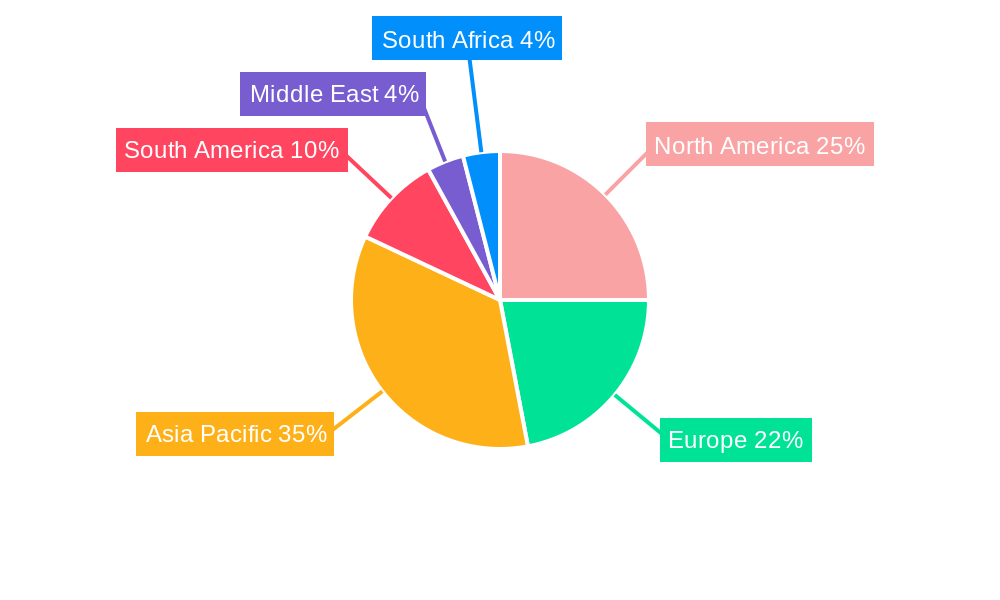

Despite the promising outlook, certain restraints may influence market dynamics. Fluctuations in the prices of raw materials, particularly those derived from natural sources, can impact profitability. Stringent regulatory landscapes concerning the use of certain hydrocolloids in different regions may also pose challenges, necessitating continuous adaptation and innovation by manufacturers. However, ongoing research and development efforts are focused on creating novel hydrocolloid solutions with improved functionalities and sustainability profiles. The market is characterized by intense competition among established players and emerging regional manufacturers, leading to strategic collaborations, mergers, and acquisitions aimed at expanding product portfolios and market reach. Asia Pacific is anticipated to emerge as a dominant region due to its large population, rapid urbanization, and a burgeoning food processing industry.

Food Hydrocolloid Market Company Market Share

Food Hydrocolloid Market Market Composition & Trends

The global Food Hydrocolloid Market is a dynamic and consolidated landscape, driven by an increasing demand for natural, clean-label ingredients and innovative food processing solutions. Market concentration is moderate, with key players continually investing in research and development to introduce novel hydrocolloid functionalities. Innovation catalysts include the pursuit of improved texture, stability, and shelf-life in food products, alongside a growing emphasis on sustainable sourcing and production. Regulatory landscapes, while generally supportive of food safety, can vary regionally, influencing product development and market entry. Substitute products, such as starches and proteins, present a degree of competition, though the unique functionalities of hydrocolloids often provide a distinct advantage. End-user profiles are diverse, spanning major food and beverage manufacturers seeking to enhance product appeal and processing efficiency. Mergers and acquisition (M&A) activities are a notable trend, with companies strategically consolidating to expand their product portfolios, geographical reach, and technological capabilities. For instance, a recent M&A deal in the sector involved a value of approximately $500 million, aimed at integrating complementary hydrocolloid technologies. Market share distribution remains concentrated among the top five players, who collectively hold an estimated 60% of the global market.

Food Hydrocolloid Market Industry Evolution

The Food Hydrocolloid Market has witnessed substantial evolution, driven by a confluence of technological advancements, shifting consumer preferences, and increasing global population. Over the historical period of 2019-2024, the market has demonstrated a robust Compound Annual Growth Rate (CAGR) of approximately 6.5%. This growth trajectory has been significantly influenced by the escalating demand for processed and convenience foods, where hydrocolloids play a crucial role in achieving desired textures, viscosities, and stabilities. Technological advancements have been pivotal, enabling the development of novel hydrocolloid formulations with enhanced functionalities and improved processing characteristics. For example, advancements in extraction and purification techniques have led to higher purity and more consistent performance of various hydrocolloids like xanthan gum and pectin.

Shifting consumer demands have also been a powerful propellant for market evolution. There's a discernible trend towards healthier and more natural food options, leading to an increased preference for plant-based and clean-label hydrocolloids such as pectin, guar gum, and carrageenan. This has spurred innovation in sourcing and processing methods to align with these consumer expectations. The market has also seen a growing adoption of hydrocolloids in emerging applications beyond traditional food products, including pharmaceuticals and personal care, further expanding its scope. The estimated market size for 2025 is projected to reach approximately $12.5 billion, with projections indicating a sustained growth rate of around 7.0% during the forecast period of 2025-2033. This sustained growth is underpinned by the irreplaceable functional properties hydrocolloids offer, coupled with ongoing innovation and the expanding application base across diverse industries. The industry's ability to adapt to evolving consumer needs and technological progress positions it for continued expansion and value creation.

Leading Regions, Countries, or Segments in Food Hydrocolloid Market

The Asia Pacific region is emerging as a dominant force in the global Food Hydrocolloid Market, driven by a confluence of rapidly expanding food processing industries, a burgeoning middle class with increasing disposable income, and a growing preference for convenient and processed food products. Within this region, China stands out as a key country, characterized by its vast manufacturing capabilities, significant domestic demand, and substantial investments in food technology. The dominance of Asia Pacific is further amplified by its substantial production of raw materials essential for hydrocolloid extraction, such as seaweed for carrageenan and citrus fruits for pectin.

Key drivers for this regional dominance include:

- Rapid Urbanization and Shifting Lifestyles: The increasing pace of urbanization and changing lifestyles in countries like China and India have led to a higher consumption of ready-to-eat meals, snacks, and beverages, all of which heavily rely on hydrocolloids for texture, mouthfeel, and stability.

- Government Support and Investments: Governments in several Asia Pacific nations are actively promoting the growth of their food processing sectors through favorable policies, subsidies, and investments in research and development, creating a conducive environment for the hydrocolloid market.

- Growing Demand for Clean-Label and Natural Ingredients: While the global trend towards natural ingredients is significant, Asia Pacific is also witnessing a substantial rise in consumer awareness and demand for healthier food options, driving the adoption of hydrocolloids derived from natural sources.

- Cost-Effectiveness and Manufacturing Prowess: The region's strong manufacturing base allows for cost-effective production of hydrocolloids, making them more accessible to a wider range of food manufacturers.

In terms of segments, Pectin is experiencing particularly strong growth within the Asia Pacific market. This is attributed to its widespread application in jams, jellies, dairy products, and confectionery, all of which are popular in the region. The increasing demand for fruit preparations and yogurt drinks further bolsters pectin's market share. The Dairy and Frozen Products application segment also exhibits significant dominance, reflecting the region's expanding dairy consumption and the integral role of hydrocolloids in improving the texture and preventing ice crystal formation in frozen desserts and dairy-based beverages. The Bakery segment also contributes significantly, with hydrocolloids enhancing shelf-life, texture, and moisture retention in various baked goods. This multifaceted growth, driven by regional economic development and evolving consumer tastes, firmly positions Asia Pacific as the leading market for food hydrocolloids.

Food Hydrocolloid Market Product Innovations

Product innovation in the Food Hydrocolloid Market is primarily focused on enhancing functionalities, sustainability, and clean-label appeal. Companies are developing novel hydrocolloid blends and modified versions to achieve precise textural properties, improved stability under processing conditions, and extended shelf-life for a variety of food applications. For instance, advancements in enzymatic modification of pectin are yielding variants with tailored gelling and viscosity profiles, ideal for low-sugar jams and dairy applications. Furthermore, there's a growing emphasis on creating hydrocolloids from underutilized or sustainable sources, such as algae or agricultural by-products, to meet the increasing demand for environmentally friendly ingredients. Unique selling propositions often revolve around multi-functional attributes, such as combined gelling and stabilizing effects, or the ability to replace synthetic additives, thereby appealing to the "free-from" trend. Technological advancements are also enabling better control over the rheological properties of hydrocolloids, leading to superior performance in applications like dressings, sauces, and beverages.

Propelling Factors for Food Hydrocolloid Market Growth

The growth of the Food Hydrocolloid Market is propelled by several interconnected factors. A primary driver is the ever-increasing global demand for processed and convenience foods, where hydrocolloids are indispensable for achieving desirable textures, mouthfeel, and stability. Secondly, the growing consumer preference for natural and clean-label ingredients is significantly boosting the adoption of plant-derived hydrocolloids like pectin and guar gum. Technological advancements in hydrocolloid extraction, modification, and application are continually expanding their utility and performance. Furthermore, the rising health consciousness and focus on functional foods are creating opportunities for hydrocolloids that offer specific health benefits or act as fat replacers. Economic growth in developing regions, leading to higher disposable incomes and increased food expenditure, also plays a crucial role.

Obstacles in the Food Hydrocolloid Market Market

Despite its robust growth, the Food Hydrocolloid Market faces certain obstacles. Fluctuations in raw material availability and pricing can impact production costs and market stability, particularly for hydrocolloids derived from agricultural produce or oceanic sources. Stringent and evolving regulatory landscapes across different regions can pose challenges for market entry and product development, requiring extensive testing and compliance. Supply chain disruptions, exacerbated by geopolitical events or climate change, can affect the timely delivery of raw materials and finished products. Additionally, competition from alternative ingredients, such as modified starches and proteins, although often possessing different functional profiles, can exert some pressure on market share. The perception and understanding of certain hydrocolloids by consumers, particularly those perceived as "artificial," can also present a barrier to adoption in specific markets.

Future Opportunities in Food Hydrocolloid Market

The Food Hydrocolloid Market is ripe with future opportunities. The expanding demand for plant-based and vegan food products presents a significant avenue for growth, particularly for hydrocolloids that can effectively replicate the textures and functionalities of animal-derived ingredients. The development of novel hydrocolloids from sustainable and underutilized sources, such as microalgae or agricultural waste, offers opportunities for differentiation and cost optimization. The increasing focus on functional foods and nutraceuticals opens doors for hydrocolloids that can encapsulate active ingredients or contribute to specific health benefits. Furthermore, the growth of emerging markets, with their rapidly expanding food processing sectors and increasing consumer spending power, represents a vast untapped potential. Innovations in bio-engineering and fermentation technologies for hydrocolloid production could also lead to more efficient and cost-effective manufacturing processes.

Major Players in the Food Hydrocolloid Market Ecosystem

- CP Kelco US Inc

- Cargill Incorporated

- Ashland Global Holdings Inc

- J F Hydrocolloids Inc

- Archer Daniels Midland Company

- Koninklijke DSM N V

- DuPont

- Behn Meyer Holding AG

- Lucid Colloids Ltd

- Hebei Xinhe Biochemical Co Ltd

Key Developments in Food Hydrocolloid Market Industry

- November 2021: Ingredion expanded its food and beverage portfolio by adding a range of single hydrocolloids, including Pre-Hydrated Gum Arabic Spray Dry Powder, TIC Gum Arabic FT Powder, Ticalose CMC 400 Granular Powder, TIC Tara Gum 100, and Ticaxan Xanthan EC, enhancing its offerings for texture and stabilization solutions.

- December 2020: CP Kelco launched GENU Pectin YM-FP-2100, a clean-label-friendly ingredient designed for fruited drinking yogurts, providing medium-to-high viscosity and improved pumpability during fruit preparation, catering to the demand for natural food additives.

- May 2019: Cargill invested USD 150 million in constructing a pectin plant in Bebedouro, Brazil. This facility focuses on producing HM pectin from citrus fruits to meet the escalating global demand for label-friendly pectins used in fruit preparations, dairy, confectionery, and bakery applications, underscoring a strategic focus on sustainable sourcing and clean-label solutions.

Strategic Food Hydrocolloid Market Market Forecast

The strategic forecast for the Food Hydrocolloid Market indicates a trajectory of sustained and accelerated growth, projected to reach approximately $18 billion by 2033, with a CAGR of around 7.2% during the forecast period (2025-2033). This optimistic outlook is fueled by the pervasive consumer demand for clean-label, natural, and plant-based ingredients, aligning perfectly with the inherent characteristics of many hydrocolloids. Continuous innovation in hydrocolloid functionality, driven by advanced processing technologies and a deeper understanding of their rheological properties, will unlock new applications and enhance performance in existing ones. The expansion of the processed food and beverage sector, particularly in emerging economies, will continue to be a significant growth catalyst. Furthermore, the exploration of novel sources for hydrocolloid production and the development of multi-functional hydrocolloid systems are expected to drive market value and competitive differentiation. Strategic collaborations, capacity expansions, and a focus on sustainability will be crucial for players to capitalize on the immense market potential.

Food Hydrocolloid Market Segmentation

-

1. Type

- 1.1. Gelatin Gum

- 1.2. Pectin

- 1.3. Xanthan Gum

- 1.4. Guar Gum

- 1.5. Carrageenan

- 1.6. Other Types

-

2. Application

- 2.1. Dairy and Frozen Products

- 2.2. Bakery

- 2.3. Beverages

- 2.4. Confectionery

- 2.5. Meat and Seafood Products

- 2.6. Oils and Fats

- 2.7. Other Applications

Food Hydrocolloid Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. South Africa

- 6.1. United Arab Emirates

- 6.2. Rest of Middle East

Food Hydrocolloid Market Regional Market Share

Geographic Coverage of Food Hydrocolloid Market

Food Hydrocolloid Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation

- 3.3. Market Restrains

- 3.3.1. ; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Bakery and Confectionery Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food Hydrocolloid Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Gelatin Gum

- 5.1.2. Pectin

- 5.1.3. Xanthan Gum

- 5.1.4. Guar Gum

- 5.1.5. Carrageenan

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy and Frozen Products

- 5.2.2. Bakery

- 5.2.3. Beverages

- 5.2.4. Confectionery

- 5.2.5. Meat and Seafood Products

- 5.2.6. Oils and Fats

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Food Hydrocolloid Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Gelatin Gum

- 6.1.2. Pectin

- 6.1.3. Xanthan Gum

- 6.1.4. Guar Gum

- 6.1.5. Carrageenan

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Dairy and Frozen Products

- 6.2.2. Bakery

- 6.2.3. Beverages

- 6.2.4. Confectionery

- 6.2.5. Meat and Seafood Products

- 6.2.6. Oils and Fats

- 6.2.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Food Hydrocolloid Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Gelatin Gum

- 7.1.2. Pectin

- 7.1.3. Xanthan Gum

- 7.1.4. Guar Gum

- 7.1.5. Carrageenan

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Dairy and Frozen Products

- 7.2.2. Bakery

- 7.2.3. Beverages

- 7.2.4. Confectionery

- 7.2.5. Meat and Seafood Products

- 7.2.6. Oils and Fats

- 7.2.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Food Hydrocolloid Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Gelatin Gum

- 8.1.2. Pectin

- 8.1.3. Xanthan Gum

- 8.1.4. Guar Gum

- 8.1.5. Carrageenan

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Dairy and Frozen Products

- 8.2.2. Bakery

- 8.2.3. Beverages

- 8.2.4. Confectionery

- 8.2.5. Meat and Seafood Products

- 8.2.6. Oils and Fats

- 8.2.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Food Hydrocolloid Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Gelatin Gum

- 9.1.2. Pectin

- 9.1.3. Xanthan Gum

- 9.1.4. Guar Gum

- 9.1.5. Carrageenan

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Dairy and Frozen Products

- 9.2.2. Bakery

- 9.2.3. Beverages

- 9.2.4. Confectionery

- 9.2.5. Meat and Seafood Products

- 9.2.6. Oils and Fats

- 9.2.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Food Hydrocolloid Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Gelatin Gum

- 10.1.2. Pectin

- 10.1.3. Xanthan Gum

- 10.1.4. Guar Gum

- 10.1.5. Carrageenan

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Dairy and Frozen Products

- 10.2.2. Bakery

- 10.2.3. Beverages

- 10.2.4. Confectionery

- 10.2.5. Meat and Seafood Products

- 10.2.6. Oils and Fats

- 10.2.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. South Africa Food Hydrocolloid Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Gelatin Gum

- 11.1.2. Pectin

- 11.1.3. Xanthan Gum

- 11.1.4. Guar Gum

- 11.1.5. Carrageenan

- 11.1.6. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Dairy and Frozen Products

- 11.2.2. Bakery

- 11.2.3. Beverages

- 11.2.4. Confectionery

- 11.2.5. Meat and Seafood Products

- 11.2.6. Oils and Fats

- 11.2.7. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 CP Kelco US Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Cargill Incorporated

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Ashland Global Holdings Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 J F Hydrocolloids Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Archer Daniels Midland Company

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Koninklijke DSM N V

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 DuPont

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Behn Meyer Holding AG

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Lucid Colloids Ltd *List Not Exhaustive

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Hebei Xinhe Biochemical Co Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 CP Kelco US Inc

List of Figures

- Figure 1: Global Food Hydrocolloid Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Food Hydrocolloid Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Food Hydrocolloid Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Food Hydrocolloid Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Food Hydrocolloid Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Food Hydrocolloid Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Food Hydrocolloid Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Food Hydrocolloid Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Food Hydrocolloid Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Food Hydrocolloid Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Food Hydrocolloid Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Food Hydrocolloid Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Food Hydrocolloid Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Food Hydrocolloid Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Food Hydrocolloid Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Food Hydrocolloid Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Food Hydrocolloid Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Food Hydrocolloid Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Food Hydrocolloid Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Food Hydrocolloid Market Revenue (billion), by Type 2025 & 2033

- Figure 21: South America Food Hydrocolloid Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Food Hydrocolloid Market Revenue (billion), by Application 2025 & 2033

- Figure 23: South America Food Hydrocolloid Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Food Hydrocolloid Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Food Hydrocolloid Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Food Hydrocolloid Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East Food Hydrocolloid Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East Food Hydrocolloid Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East Food Hydrocolloid Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East Food Hydrocolloid Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Food Hydrocolloid Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: South Africa Food Hydrocolloid Market Revenue (billion), by Type 2025 & 2033

- Figure 33: South Africa Food Hydrocolloid Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: South Africa Food Hydrocolloid Market Revenue (billion), by Application 2025 & 2033

- Figure 35: South Africa Food Hydrocolloid Market Revenue Share (%), by Application 2025 & 2033

- Figure 36: South Africa Food Hydrocolloid Market Revenue (billion), by Country 2025 & 2033

- Figure 37: South Africa Food Hydrocolloid Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Food Hydrocolloid Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Food Hydrocolloid Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Food Hydrocolloid Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Food Hydrocolloid Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Food Hydrocolloid Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Food Hydrocolloid Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Food Hydrocolloid Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Food Hydrocolloid Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Food Hydrocolloid Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Food Hydrocolloid Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Food Hydrocolloid Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Food Hydrocolloid Market Revenue billion Forecast, by Application 2020 & 2033

- Table 13: Global Food Hydrocolloid Market Revenue billion Forecast, by Country 2020 & 2033

- Table 14: Spain Food Hydrocolloid Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Food Hydrocolloid Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Food Hydrocolloid Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Food Hydrocolloid Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Food Hydrocolloid Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Russia Food Hydrocolloid Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Food Hydrocolloid Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Food Hydrocolloid Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Global Food Hydrocolloid Market Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Global Food Hydrocolloid Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: China Food Hydrocolloid Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Food Hydrocolloid Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: India Food Hydrocolloid Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Food Hydrocolloid Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Food Hydrocolloid Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Food Hydrocolloid Market Revenue billion Forecast, by Type 2020 & 2033

- Table 30: Global Food Hydrocolloid Market Revenue billion Forecast, by Application 2020 & 2033

- Table 31: Global Food Hydrocolloid Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Food Hydrocolloid Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Food Hydrocolloid Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Food Hydrocolloid Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Food Hydrocolloid Market Revenue billion Forecast, by Type 2020 & 2033

- Table 36: Global Food Hydrocolloid Market Revenue billion Forecast, by Application 2020 & 2033

- Table 37: Global Food Hydrocolloid Market Revenue billion Forecast, by Country 2020 & 2033

- Table 38: Global Food Hydrocolloid Market Revenue billion Forecast, by Type 2020 & 2033

- Table 39: Global Food Hydrocolloid Market Revenue billion Forecast, by Application 2020 & 2033

- Table 40: Global Food Hydrocolloid Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: United Arab Emirates Food Hydrocolloid Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East Food Hydrocolloid Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Hydrocolloid Market?

The projected CAGR is approximately 5.97%.

2. Which companies are prominent players in the Food Hydrocolloid Market?

Key companies in the market include CP Kelco US Inc, Cargill Incorporated, Ashland Global Holdings Inc, J F Hydrocolloids Inc, Archer Daniels Midland Company, Koninklijke DSM N V, DuPont, Behn Meyer Holding AG, Lucid Colloids Ltd *List Not Exhaustive, Hebei Xinhe Biochemical Co Ltd.

3. What are the main segments of the Food Hydrocolloid Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.17 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation.

6. What are the notable trends driving market growth?

Increasing Demand from Bakery and Confectionery Segment.

7. Are there any restraints impacting market growth?

; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition.

8. Can you provide examples of recent developments in the market?

In November 2021, Ingredion has added a range of single hydrocolloids to its extensive food and beverage portfolio. The new products offered are Pre-Hydrated Gum Arabic Spray Dry Powder, TIC Gum Arabic FT Powder, Ticalose CMC 400 Granular Powder, TIC Tara Gum 100, and Ticaxan Xanthan EC.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Food Hydrocolloid Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Food Hydrocolloid Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Food Hydrocolloid Market?

To stay informed about further developments, trends, and reports in the Food Hydrocolloid Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence