Key Insights

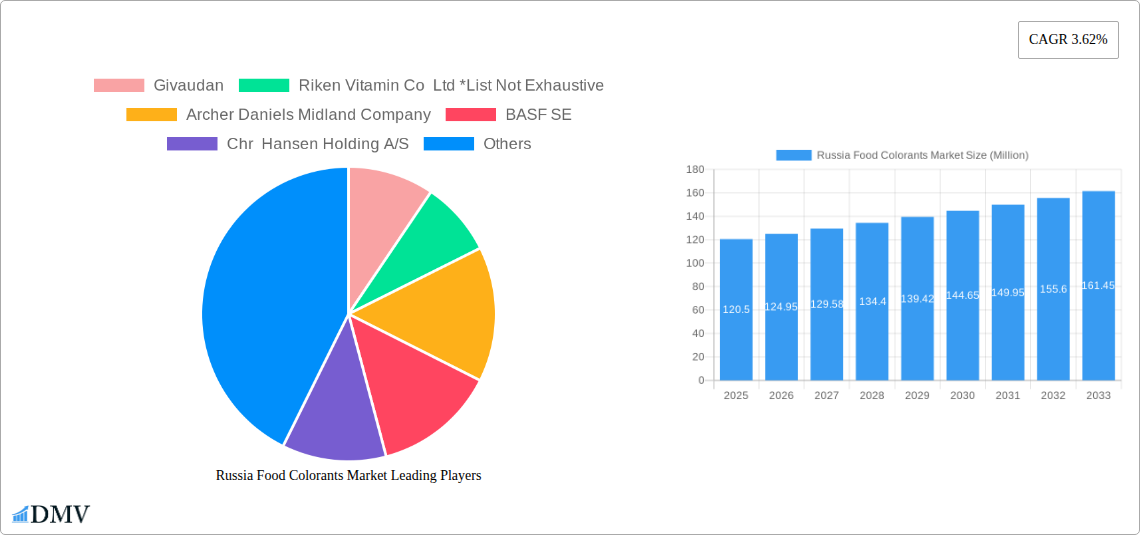

The Russian food colorants market is poised for steady growth, driven by evolving consumer preferences for visually appealing and natural food products. With a projected market size of approximately USD 120 million and a Compound Annual Growth Rate (CAGR) of 3.62% from 2025 to 2033, the sector is set to expand significantly. This growth is fueled by an increasing demand for vibrant and diverse food options across various applications, including beverages, dairy, bakery, confectionery, and meat and poultry products. The rising disposable incomes and a growing middle class in Russia are contributing to a greater willingness to spend on premium food items that offer both taste and aesthetic appeal. Furthermore, a heightened awareness of food safety and regulatory compliance is prompting manufacturers to opt for high-quality, certified food colorants, both synthetic and natural, to meet stringent standards and consumer expectations.

Russia Food Colorants Market Market Size (In Million)

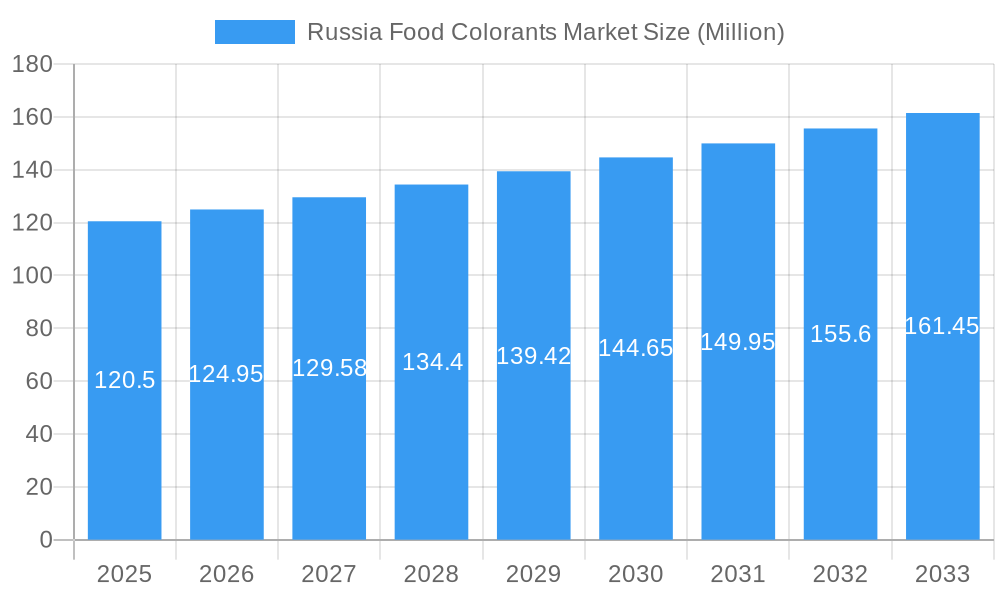

The market landscape for food colorants in Russia is characterized by a dynamic interplay of drivers and restraints. Key growth drivers include the expanding food and beverage processing industry, the increasing popularity of ready-to-eat meals and convenience foods, and the growing trend towards clean-label products, which favors natural colorants derived from fruits, vegetables, and other botanical sources. However, challenges such as fluctuating raw material prices, intense competition among global and local players, and potential shifts in consumer perception towards specific types of colorants may temper the market's expansion. Nonetheless, the strategic importance of food colorants in enhancing product appeal and marketability ensures their continued relevance. Companies like Givaudan, Archer Daniels Midland Company, BASF SE, Chr Hansen Holding A/S, GNT Group B V, Sensient Technologies Corporation, and Eco Resource are actively participating, catering to the diverse needs of the Russian food industry through innovation and a broad product portfolio.

Russia Food Colorants Market Company Market Share

This in-depth report offers an exhaustive analysis of the Russia food colorants market, providing critical insights for stakeholders navigating this dynamic sector. From understanding market composition and industry evolution to identifying key growth drivers, obstacles, and future opportunities, this report equips you with the data and strategic foresight necessary for informed decision-making. We meticulously examine synthetic food colorants and natural food colorants, alongside their diverse applications in beverages, dairy, bakery, meat and poultry, confectionery, and others. Our study covers the historical period from 2019–2024, the base and estimated year of 2025, and projects growth through 2033.

Russia Food Colorants Market Market Composition & Trends

The Russia food colorants market exhibits a moderate to highly concentrated landscape, with established global players and a growing number of regional manufacturers vying for market share. Innovation is a significant catalyst, driven by increasing consumer demand for natural and clean-label ingredients, pushing manufacturers to invest heavily in R&D for novel natural food colorants. Regulatory frameworks, such as those governing food safety and labeling of artificial additives, play a crucial role in shaping market dynamics. The availability of substitute products, including fruit and vegetable concentrates and spice extracts, presents both a challenge and an opportunity for innovation. End-user profiles are diversifying, with major food and beverage manufacturers increasingly seeking colorants that align with health and wellness trends. Mergers and acquisitions (M&A) activities are anticipated to continue, as larger entities seek to consolidate their market position, expand their product portfolios, and gain access to new technologies and distribution channels. For instance, a hypothetical M&A deal in the recent past might have been valued in the range of XX Million, illustrating the strategic importance of market consolidation. The market share distribution is influenced by the price, efficacy, and perceived safety of different colorant types.

Russia Food Colorants Market Industry Evolution

The Russia food colorants market has undergone a significant transformation over the past decade, characterized by evolving consumer preferences, technological advancements, and a shifting regulatory environment. Historically, synthetic food colorants dominated the market due to their cost-effectiveness, stability, and vibrant hues. However, the study period from 2019 to 2024 witnessed a burgeoning demand for natural food colorants, spurred by growing health consciousness and a desire for perceived "clean labels." This trend has prompted substantial investment in research and development to enhance the stability, functionality, and cost-competitiveness of natural alternatives. Market growth trajectories have been influenced by macroeconomic factors, including disposable income levels and the overall growth of the food and beverage industry in Russia. Technological advancements have focused on extraction methods for natural pigments, microencapsulation techniques to improve colorant stability, and the development of novel colorants from underutilized sources. Shifting consumer demands are evident in the rising preference for products free from artificial additives, impacting product formulation and ingredient sourcing strategies across various food segments. For example, the adoption rate of natural colorants in the bakery segment has seen an estimated growth of XX% between 2019 and 2024. The market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033, driven by these persistent trends and emerging innovations. The base year of 2025 is expected to see a market valuation of approximately XXX Million, with further expansion anticipated throughout the forecast period.

Leading Regions, Countries, or Segments in Russia Food Colorants Market

The Russia food colorants market is characterized by distinct regional and segmental dominance. Within the Type segment, natural food colorants are emerging as the leading category, driven by robust consumer demand for healthier and cleaner-label products. This shift is particularly pronounced in major urban centers and among younger demographics. The Application segment reveals that beverages and confectionery are the largest end-use sectors, owing to their high volume consumption and the critical role color plays in product appeal and brand differentiation. The dairy and bakery sectors also represent significant markets, with a growing emphasis on natural coloring solutions.

Key drivers for the dominance of natural colorants include:

- Consumer Awareness: Increased media attention and educational campaigns about the potential health impacts of synthetic additives.

- Regulatory Support: Evolving regulations that favor natural alternatives and may impose restrictions on certain synthetic dyes.

- Ingredient Innovation: Advancements in extraction and stabilization technologies for natural colorants, making them more viable for industrial applications.

- Brand Differentiation: Food and beverage manufacturers are leveraging natural colorants as a unique selling proposition to attract health-conscious consumers.

The natural food colorants segment is projected to witness a higher growth rate compared to synthetic food colorants throughout the forecast period. This is supported by ongoing investment trends from both global ingredient suppliers and local Russian manufacturers aiming to capitalize on this burgeoning demand. For instance, R&D investments in natural pigment extraction and formulation in Russia are estimated to have increased by XX% in the last two years. Furthermore, the beverages application segment, encompassing juices, carbonated drinks, and functional beverages, continues to be a stronghold due to the inherent visual appeal of colored drinks and the ongoing innovation in flavor profiles that are often complemented by vibrant colors. The confectionery sector, including candies, chocolates, and baked goods, also remains a significant consumer of food colorants, where visual attractiveness is paramount for impulse purchases.

Russia Food Colorants Market Product Innovations

Recent product innovations in the Russia food colorants market are primarily centered on enhancing the naturality, stability, and functionality of colorants. Manufacturers are developing novel natural food colorants derived from sources like algae, fruits, and vegetables, offering a broader spectrum of vibrant and appealing shades previously difficult to achieve with natural alternatives. Innovations in microencapsulation and spray-drying technologies are improving the heat and light stability of these natural colors, making them suitable for a wider range of food processing applications, including high-temperature baking and pasteurization. Performance metrics such as color yield, lightfastness, and pH stability are being meticulously optimized to meet the rigorous demands of the food industry. Unique selling propositions often revolve around "clean label" claims, allergen-free formulations, and sustainable sourcing practices, resonating strongly with an increasingly discerning consumer base. Technological advancements are also focusing on creating synergistic color blends and developing water-dispersible and oil-soluble natural colorants to simplify formulation for food manufacturers.

Propelling Factors for Russia Food Colorants Market Growth

The Russia food colorants market growth is being propelled by several key factors. Foremost is the escalating consumer demand for natural food colorants driven by growing health consciousness and a preference for "clean label" products, moving away from artificial additives. Technological advancements in extraction, stabilization, and application of natural colorants are making them more viable and cost-effective for a wider range of food and beverage products. The expansion of the processed food and beverage industry in Russia, particularly in segments like beverages, dairy, and confectionery, directly translates to increased demand for various food colorants. Furthermore, evolving regulatory landscapes, which may favor natural ingredients and place stricter controls on certain synthetic dyes, are indirectly stimulating the adoption of natural alternatives. Economic growth and rising disposable incomes also contribute by increasing consumer spending on processed foods, which often feature vibrant coloring for enhanced appeal.

Obstacles in the Russia Food Colorants Market Market

Despite robust growth potential, the Russia food colorants market faces several obstacles. The higher cost of many natural food colorants compared to their synthetic counterparts remains a significant barrier for price-sensitive manufacturers and consumers. Supply chain disruptions, including sourcing challenges for specific natural ingredients and logistical complexities within Russia, can impact availability and price stability. Regulatory hurdles and variations in interpretation or enforcement of food additive regulations can create uncertainty for manufacturers. Intense competition from both global and domestic players, coupled with the established presence of synthetic alternatives, adds to market pressures. Moreover, the technical limitations of certain natural colorants, such as reduced stability under extreme processing conditions (heat, light, pH), continue to pose formulation challenges for food technologists.

Future Opportunities in Russia Food Colorants Market

The Russia food colorants market presents significant future opportunities. The ongoing consumer shift towards healthier and more natural products will continue to drive demand for innovative natural food colorants, particularly those derived from novel sources or offering superior stability and color intensity. Emerging markets within Russia, and potential export opportunities to neighboring countries, represent untapped growth avenues. Technological advancements in areas like bio-engineering and precision fermentation could lead to the development of cost-effective and highly sustainable natural colorants. The growing demand for functional foods and beverages also opens doors for colorants that offer additional health benefits or are fortified with vitamins and antioxidants. Furthermore, the increasing focus on transparency and traceability in the food supply chain will create opportunities for suppliers who can demonstrate ethical sourcing and sustainable production practices for their food colorants.

Major Players in the Russia Food Colorants Market Ecosystem

- Givaudan

- Riken Vitamin Co Ltd

- Archer Daniels Midland Company

- BASF SE

- Chr Hansen Holding A/S

- GNT Group B V

- Sensient Technologies Corporation

- Eco Resource

Key Developments in Russia Food Colorants Market Industry

- 2023/09: Launch of a new range of vibrant, natural food colorants derived from purple sweet potato for the confectionery sector, enhancing visual appeal and meeting clean-label demands.

- 2023/05: A major Russian beverage manufacturer announced a commitment to exclusively use natural food colorants in its entire product line by 2025, signaling a significant market shift.

- 2022/11: Introduction of an improved microencapsulation technology for natural food colorants, significantly enhancing their heat and light stability for bakery applications.

- 2022/07: Acquisition of a regional Russian producer of natural food colorants by a global ingredient supplier, aiming to expand its market reach and product portfolio.

- 2021/04: Government initiatives launched to support research and development in the production of natural food colorants from local agricultural resources.

- 2020/10: Increased consumer interest and media coverage on the potential health benefits of anthocyanins, a type of natural food colorant, boosting demand in the beverage segment.

Strategic Russia Food Colorants Market Market Forecast

The strategic outlook for the Russia food colorants market remains highly positive, driven by the enduring consumer preference for natural food colorants and the continuous pursuit of cleaner labels. Future growth will be significantly influenced by ongoing innovations in natural pigment extraction and stabilization technologies, making these alternatives more cost-effective and versatile. The expansion of applications in the beverages, dairy, and confectionery sectors, coupled with potential growth in emerging segments, will provide substantial market opportunities. Regulatory shifts and increasing consumer awareness regarding ingredient transparency will further cement the dominance of natural solutions. Strategic partnerships and potential M&A activities are expected to shape the competitive landscape, fostering consolidation and driving further investment in R&D. The market is poised for sustained growth, with an estimated market size projected to reach XXX Million by 2033.

Russia Food Colorants Market Segmentation

-

1. Type

- 1.1. Synthetic

- 1.2. Natural

-

2. Application

- 2.1. Beverages

- 2.2. Dairy

- 2.3. Bakery

- 2.4. Meat and Poultry

- 2.5. Confectionery

- 2.6. Others

Russia Food Colorants Market Segmentation By Geography

- 1. Russia

Russia Food Colorants Market Regional Market Share

Geographic Coverage of Russia Food Colorants Market

Russia Food Colorants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Health Consciousness among consumer

- 3.3. Market Restrains

- 3.3.1. High Cost of natural Ingredients

- 3.4. Market Trends

- 3.4.1. High Import of Food Colorants

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Food Colorants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Synthetic

- 5.1.2. Natural

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Beverages

- 5.2.2. Dairy

- 5.2.3. Bakery

- 5.2.4. Meat and Poultry

- 5.2.5. Confectionery

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Givaudan

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Riken Vitamin Co Ltd *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Archer Daniels Midland Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BASF SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chr Hansen Holding A/S

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GNT Group B V

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sensient Technologies Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eco Resource

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Givaudan

List of Figures

- Figure 1: Russia Food Colorants Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Russia Food Colorants Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Food Colorants Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Russia Food Colorants Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Russia Food Colorants Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Russia Food Colorants Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Russia Food Colorants Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Russia Food Colorants Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Food Colorants Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Russia Food Colorants Market?

Key companies in the market include Givaudan, Riken Vitamin Co Ltd *List Not Exhaustive, Archer Daniels Midland Company, BASF SE, Chr Hansen Holding A/S, GNT Group B V, Sensient Technologies Corporation, Eco Resource.

3. What are the main segments of the Russia Food Colorants Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Health Consciousness among consumer.

6. What are the notable trends driving market growth?

High Import of Food Colorants.

7. Are there any restraints impacting market growth?

High Cost of natural Ingredients.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Food Colorants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Food Colorants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Food Colorants Market?

To stay informed about further developments, trends, and reports in the Russia Food Colorants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence