Key Insights

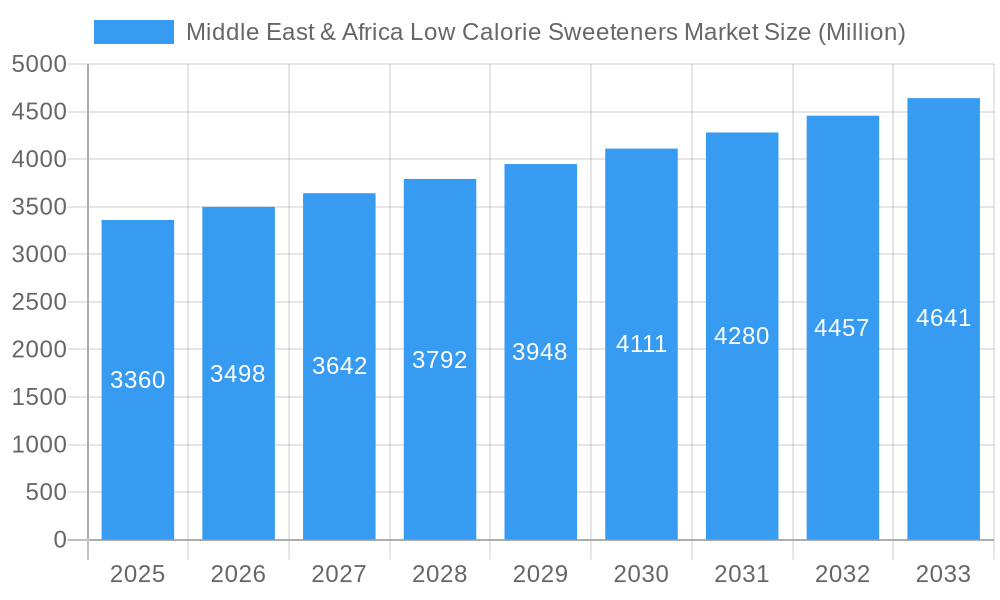

The Middle East & Africa (MEA) Low Calorie Sweeteners Market is poised for significant expansion, projecting a market size of $3.36 billion in 2025, with a robust Compound Annual Growth Rate (CAGR) of 4.1% throughout the forecast period extending to 2033. This growth is primarily fueled by an increasing consumer awareness regarding health and wellness, leading to a heightened demand for sugar-free and low-calorie food and beverage alternatives. The rising prevalence of lifestyle diseases like diabetes and obesity across the region further acts as a potent catalyst, compelling manufacturers and consumers alike to adopt healthier dietary choices. Government initiatives promoting public health and combating chronic diseases are also indirectly bolstering the market.

Middle East & Africa Low Calorie Sweeteners Market Market Size (In Billion)

The MEA low calorie sweeteners market is witnessing dynamic shifts, driven by evolving consumer preferences and technological advancements in product development. The Artificial source type, encompassing popular sweeteners like Sucralose, Aspartame, and Acesulfame Potassium, is expected to dominate the market due to their cost-effectiveness and widespread application. However, the increasing consumer preference for natural alternatives is driving the growth of Natural sweeteners such as Stevia. Key application segments including Beverages and Food (Dairy and Frozen Foods, Confectionery, Bakery) are expected to be the primary revenue generators. Despite the promising growth trajectory, challenges such as fluctuating raw material prices and stringent regulatory landscapes in certain countries may pose moderate restraints. Key players like Cargill Incorporated, Tate & Lyle PLC, and Ingredion Incorporated are actively investing in research and development to introduce innovative products and expand their market presence within the MEA region.

Middle East & Africa Low Calorie Sweeteners Market Company Market Share

This in-depth report provides a panoramic view of the Middle East & Africa Low Calorie Sweeteners Market, a rapidly evolving sector driven by increasing health consciousness, a growing diabetic population, and innovative product development. Delve into market dynamics, segment-specific insights, and strategic forecasts, empowering stakeholders with actionable intelligence for the period 2019–2033. The report leverages the base year 2025 for critical estimations and offers projections through the forecast period 2025–2033, building upon the historical period 2019–2024.

Middle East & Africa Low Calorie Sweeteners Market Market Composition & Trends

The Middle East & Africa Low Calorie Sweeteners Market exhibits a dynamic landscape characterized by moderate market concentration, with key players vying for significant market share. Innovation is a potent catalyst, fueled by advancements in extraction technologies for natural sweeteners and the development of novel artificial formulations offering improved taste profiles and functionalities. The regulatory environment, though varied across the region, is gradually aligning towards stricter health and safety standards, influencing product approvals and ingredient sourcing. Substitute products, including sugar alcohols and natural sweeteners like honey, present a competitive challenge, necessitating continuous product differentiation. End-user profiles are increasingly sophisticated, with a growing demand for sugar-free and reduced-calorie options across diverse applications. Merger and acquisition activities are anticipated to play a crucial role in market consolidation and expansion, with estimated deal values reaching several hundred million USD. Market share distribution for 2025 is estimated with artificial sweeteners holding approximately 60% and natural sweeteners around 40%. M&A deal values are projected to range from xx to xx million USD in the forecast period.

Middle East & Africa Low Calorie Sweeteners Market Industry Evolution

The Middle East & Africa Low Calorie Sweeteners Market has witnessed a significant transformation, evolving from niche applications to mainstream consumer products. This evolution is underscored by a projected Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033, signifying robust market expansion. Technological advancements have been instrumental, particularly in enhancing the taste neutrality and stability of low-calorie sweeteners, making them more appealing for a wider range of food and beverage applications. The rising global awareness of health-related issues, such as obesity and diabetes, has profoundly shifted consumer demands towards healthier alternatives to sugar. This surge in demand is further amplified by growing disposable incomes in many African and Middle Eastern nations, enabling consumers to opt for premium, health-conscious products. The increasing prevalence of lifestyle diseases like diabetes, estimated to affect over xx million people in the region by 2030, acts as a powerful impetus for the adoption of low-calorie sweeteners. Furthermore, manufacturers are investing heavily in research and development to create sweeteners that mimic the taste and texture of sugar more closely, thereby expanding their appeal in traditionally sugar-centric cuisines and products. The adoption rate of low-calorie sweeteners in the beverage sector is projected to reach 75% by 2033, while the food sector is expected to see an adoption rate of 65%.

Leading Regions, Countries, or Segments in Middle East & Africa Low Calorie Sweeteners Market

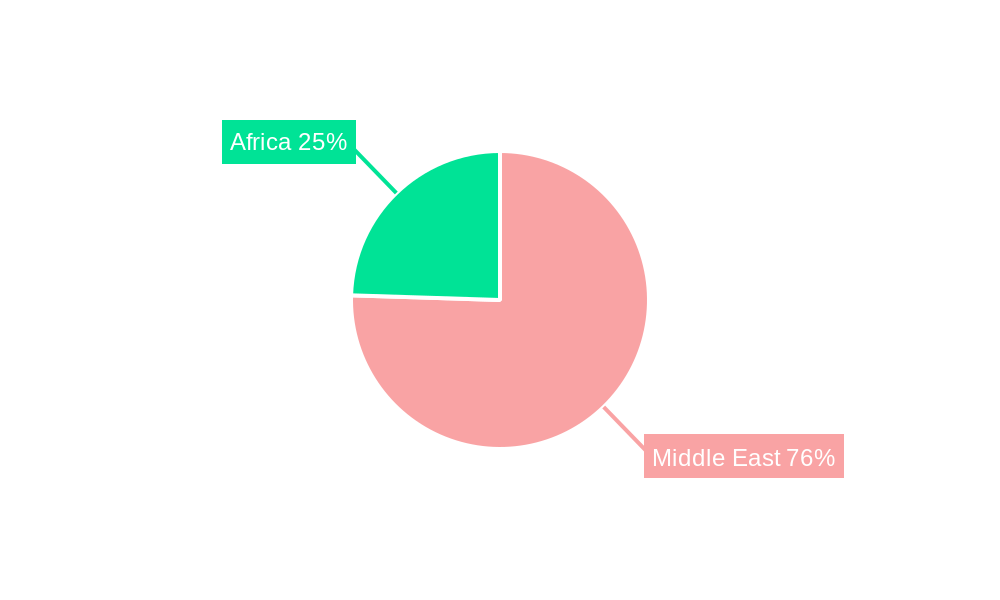

The Middle East & Africa Low Calorie Sweeteners Market is dominated by the Middle East region, driven by its higher disposable incomes, strong awareness of health and wellness, and established food and beverage industries. Within the Middle East, Saudi Arabia and the United Arab Emirates emerge as leading countries due to significant investments in the food processing sector and a large expatriate population with diverse dietary preferences. The Beverage application segment holds the lion's share of the market, accounting for an estimated 45% of the total market value in 2025, owing to the widespread use of low-calorie sweeteners in carbonated drinks, juices, and ready-to-drink beverages.

- Dominant Region: Middle East

- Key Drivers in the Middle East:

- High disposable income and increasing consumer spending on health-conscious products.

- Government initiatives promoting healthier lifestyles and tackling obesity.

- Presence of major multinational food and beverage manufacturers with established product lines.

- Significant demand for diet and sugar-free versions of popular beverages and confectioneries.

- Key Drivers in the Middle East:

- Dominant Country: Saudi Arabia

- Factors Contributing to Dominance:

- Large and growing population with increasing health awareness.

- Robust food and beverage manufacturing infrastructure.

- Government support for food product innovation and imports.

- High consumption of sugary beverages, driving demand for alternatives.

- Factors Contributing to Dominance:

- Dominant Segment: Beverage Application

- Reasons for Dominance:

- Widespread use of low-calorie sweeteners to reduce sugar content in soft drinks, juices, and energy drinks.

- Consumer preference for diet and zero-calorie beverage options.

- Technological advancements enabling better taste and stability in liquid applications.

- Targeting of health-conscious consumers through marketing campaigns.

- Reasons for Dominance:

- Product Type Dominance: Sucralose is projected to hold a significant market share within the artificial sweeteners category due to its excellent taste profile and heat stability, followed by Acesulfame Potassium. In the natural sweeteners segment, Stevia is expected to witness substantial growth owing to its natural origin and calorie-free properties.

- Source Type Dominance: While Artificial sweeteners currently dominate, the Natural source type is anticipated to exhibit a higher growth rate, driven by increasing consumer preference for 'clean label' and naturally derived ingredients.

Middle East & Africa Low Calorie Sweeteners Market Product Innovations

Product innovation in the Middle East & Africa Low Calorie Sweeteners Market is centered on enhancing taste profiles, improving cost-effectiveness, and expanding application versatility. Manufacturers are developing synergistic blends of sweeteners to achieve a taste closer to sugar while minimizing aftertastes. Novel extraction and purification techniques for natural sweeteners like Stevia are yielding high-purity ingredients with superior flavor. Performance metrics such as taste intensity, heat stability, and solubility are continually being optimized for various food and beverage matrices. Unique selling propositions include the development of non-GMO and sustainably sourced sweeteners, catering to a growing segment of environmentally conscious consumers. Technological advancements are also focusing on the creation of sweeteners with added functionalities, such as improved mouthfeel or digestive benefits, further differentiating them in the market.

Propelling Factors for Middle East & Africa Low Calorie Sweeteners Market Growth

The Middle East & Africa Low Calorie Sweeteners Market growth is propelled by a confluence of powerful factors. Firstly, the escalating health consciousness among consumers, fueled by rising rates of obesity and diabetes across the region, is a primary driver. Secondly, technological advancements in sweetener production, leading to improved taste, stability, and cost-effectiveness, are making these alternatives more viable and attractive. Thirdly, supportive government initiatives and public health campaigns promoting healthier lifestyles are indirectly boosting the demand for sugar substitutes. The increasing penetration of multinational food and beverage companies, coupled with localized product development, further expands market reach. Furthermore, the growing demand for sugar-free and reduced-calorie products in the burgeoning food and beverage processing industry, particularly in sectors like confectionery and bakery, significantly contributes to market expansion.

Obstacles in the Middle East & Africa Low Calorie Sweeteners Market Market

Despite its promising growth trajectory, the Middle East & Africa Low Calorie Sweeteners Market faces several obstacles. Stringent and sometimes inconsistent regulatory frameworks across different countries can hinder market entry and product approvals, creating compliance challenges for manufacturers. Consumer perception and lingering doubts about the safety and taste of artificial sweeteners, despite extensive scientific backing, remain a barrier. Supply chain disruptions, particularly in some African nations, can impact the availability and cost of raw materials and finished products. Intense competition from established sugar producers and the increasing availability of alternative natural sweeteners also exert downward pressure on pricing and market share. The cost differential between traditional sugar and some low-calorie sweeteners can also be a deterrent for price-sensitive consumers in certain segments.

Future Opportunities in Middle East & Africa Low Calorie Sweeteners Market

The Middle East & Africa Low Calorie Sweeteners Market is ripe with future opportunities. The burgeoning middle class in African countries presents a significant untapped market for sugar-free and reduced-calorie products. Innovations in plant-based and natural sweeteners, such as monk fruit and allulose, offer new avenues for product development and consumer appeal. The expanding pharmaceutical and nutraceutical sectors are creating new applications for low-calorie sweeteners beyond food and beverages, particularly in sugar-free medications and dietary supplements. Strategic partnerships and joint ventures with local manufacturers can help overcome regulatory hurdles and distribution challenges. Furthermore, the growing trend of personalized nutrition and functional foods opens doors for customized sweetener solutions.

Major Players in the Middle East & Africa Low Calorie Sweeteners Market Ecosystem

- Cargill Incorporated

- The Archer Daniels Midland Company

- Afriplex

- Tate & Lyle PLC

- Canderel

- PureCircle

- Ingredion Incorporated

Key Developments in Middle East & Africa Low Calorie Sweeteners Market Industry

- 2024/01: Launch of new sugar-free beverage formulations by a major beverage producer in the UAE, incorporating advanced sweetener blends.

- 2023/07: Tate & Lyle PLC expands its regional distribution network in East Africa, increasing accessibility to its sweetener portfolio.

- 2023/03: Ingredion Incorporated announces plans for enhanced R&D collaboration with regional food manufacturers to develop customized sweetener solutions.

- 2022/11: PureCircle launches a new generation of stevia-based sweeteners with improved taste profiles for the Middle Eastern market.

- 2022/05: Afriplex secures significant investment to scale up its production of natural sweetener ingredients for export within the MEA region.

Strategic Middle East & Africa Low Calorie Sweeteners Market Market Forecast

The Middle East & Africa Low Calorie Sweeteners Market is poised for sustained growth, driven by increasing health awareness, favorable demographics, and continuous product innovation. The strategic focus for market players will be on expanding their product portfolios to include a wider range of natural and high-intensity sweeteners, catering to diverse consumer preferences. Investments in R&D for taste enhancement and cost reduction will be crucial for maintaining competitiveness. Furthermore, developing robust distribution networks and forging strategic alliances with local food and beverage manufacturers will be key to unlocking the immense potential within emerging African markets. The market is expected to witness significant opportunities in the Food and Beverage applications, with a substantial shift towards Natural source types in the long term. The overall market value is projected to reach over $5 billion by 2033.

Middle East & Africa Low Calorie Sweeteners Market Segmentation

-

1. Source Type

- 1.1. Natural

- 1.2. Artificial

-

2. Product Type

- 2.1. Sucralose

- 2.2. Saccharin

- 2.3. Aspartame

- 2.4. Neotame

- 2.5. Advantame

- 2.6. Acesulfame Potassium

- 2.7. Stevia

- 2.8. Others

-

3. Application

-

3.1. Food

- 3.1.1. Dairy and Frozen Foods

- 3.1.2. Confectionery

- 3.1.3. Bakery

- 3.1.4. Others

- 3.2. Beverage

- 3.3. Pharmaceuticals

-

3.1. Food

Middle East & Africa Low Calorie Sweeteners Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East & Africa Low Calorie Sweeteners Market Regional Market Share

Geographic Coverage of Middle East & Africa Low Calorie Sweeteners Market

Middle East & Africa Low Calorie Sweeteners Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Application in Dietary Supplements

- 3.3. Market Restrains

- 3.3.1. Increasing prevalence of hydroglycemia

- 3.4. Market Trends

- 3.4.1. Government Taxes Curbing down the Consumption of Excess Sugar

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East & Africa Low Calorie Sweeteners Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source Type

- 5.1.1. Natural

- 5.1.2. Artificial

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Sucralose

- 5.2.2. Saccharin

- 5.2.3. Aspartame

- 5.2.4. Neotame

- 5.2.5. Advantame

- 5.2.6. Acesulfame Potassium

- 5.2.7. Stevia

- 5.2.8. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Food

- 5.3.1.1. Dairy and Frozen Foods

- 5.3.1.2. Confectionery

- 5.3.1.3. Bakery

- 5.3.1.4. Others

- 5.3.2. Beverage

- 5.3.3. Pharmaceuticals

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Source Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cargill Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Archer Daniels Midland Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Afriplex*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tate & Lyle PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Canderel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PureCircle

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ingredion Incorporated

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Cargill Incorporated

List of Figures

- Figure 1: Middle East & Africa Low Calorie Sweeteners Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East & Africa Low Calorie Sweeteners Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East & Africa Low Calorie Sweeteners Market Revenue undefined Forecast, by Source Type 2020 & 2033

- Table 2: Middle East & Africa Low Calorie Sweeteners Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 3: Middle East & Africa Low Calorie Sweeteners Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Middle East & Africa Low Calorie Sweeteners Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Middle East & Africa Low Calorie Sweeteners Market Revenue undefined Forecast, by Source Type 2020 & 2033

- Table 6: Middle East & Africa Low Calorie Sweeteners Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 7: Middle East & Africa Low Calorie Sweeteners Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Middle East & Africa Low Calorie Sweeteners Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle East & Africa Low Calorie Sweeteners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle East & Africa Low Calorie Sweeteners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Israel Middle East & Africa Low Calorie Sweeteners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Qatar Middle East & Africa Low Calorie Sweeteners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Kuwait Middle East & Africa Low Calorie Sweeteners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Oman Middle East & Africa Low Calorie Sweeteners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Bahrain Middle East & Africa Low Calorie Sweeteners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Jordan Middle East & Africa Low Calorie Sweeteners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Lebanon Middle East & Africa Low Calorie Sweeteners Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East & Africa Low Calorie Sweeteners Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Middle East & Africa Low Calorie Sweeteners Market?

Key companies in the market include Cargill Incorporated, The Archer Daniels Midland Company, Afriplex*List Not Exhaustive, Tate & Lyle PLC, Canderel, PureCircle, Ingredion Incorporated.

3. What are the main segments of the Middle East & Africa Low Calorie Sweeteners Market?

The market segments include Source Type, Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Application in Dietary Supplements.

6. What are the notable trends driving market growth?

Government Taxes Curbing down the Consumption of Excess Sugar.

7. Are there any restraints impacting market growth?

Increasing prevalence of hydroglycemia.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East & Africa Low Calorie Sweeteners Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East & Africa Low Calorie Sweeteners Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East & Africa Low Calorie Sweeteners Market?

To stay informed about further developments, trends, and reports in the Middle East & Africa Low Calorie Sweeteners Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence