Key Insights

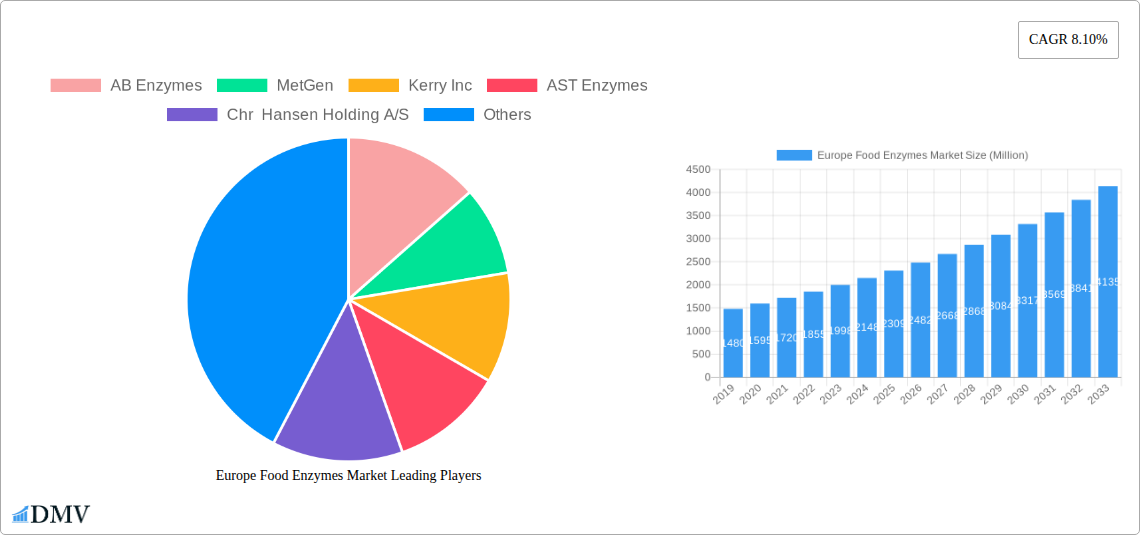

The Europe Food Enzymes Market is projected for substantial growth, expected to reach $3.6 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 5.2%. This expansion, forecasted to reach $4.5 billion by 2033 from a base year of 2025, is driven by increasing consumer preference for healthier, natural food options and a growing understanding of enzyme functionalities. The food processing industry's adoption of enzyme-based solutions for enhanced texture, flavor, shelf-life, and nutritional value further supports this trend. Stringent regulations promoting cleaner labels and reduced artificial additives are also creating opportunities for enzyme alternatives. The sector is shifting towards sustainable and efficient food production, with enzymes playing a key role in waste reduction and resource optimization.

Europe Food Enzymes Market Market Size (In Billion)

Continuous innovation in enzyme technology is a significant market driver, leading to the development of more effective and specific enzymes. Key segments like Bakery, Dairy & Frozen Products, and Beverages are anticipated to experience considerable growth due to the specific benefits enzymes offer. For instance, enzymes are vital for dough conditioning in bakery, lactose-free dairy production, and clarifying beverages. While market growth is robust, challenges such as high R&D costs for novel enzymes and specialized handling requirements may arise. However, strategic partnerships between enzyme manufacturers and food producers, alongside increased R&D investments, are expected to address these challenges, fostering a dynamic market landscape. Leading companies, including Novozymes, DSM, and Kerry Inc., are spearheading innovation.

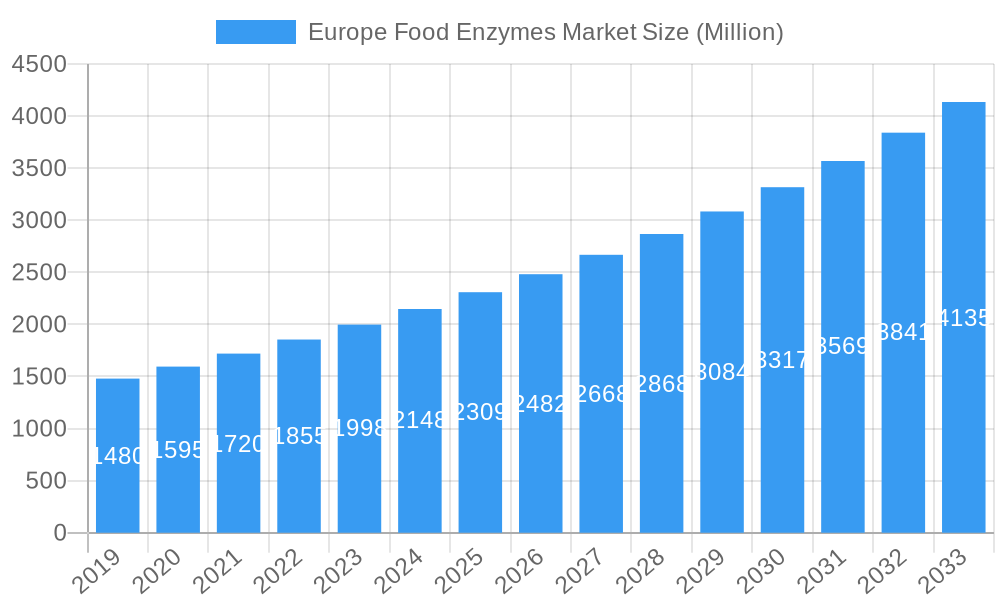

Europe Food Enzymes Market Company Market Share

This comprehensive report, "Europe Food Enzymes Market: Trends, Opportunities, and Forecast (2019–2033)," provides an in-depth analysis of the European food enzymes sector. It is designed for manufacturers, suppliers, investors, and R&D professionals, offering insights into market trends, technological advancements, regulatory environments, and future growth prospects. Utilizing a rigorous methodology, the study delivers actionable intelligence for strategic decision-making.

Europe Food Enzymes Market Market Composition & Trends

The European food enzymes market is characterized by a moderate level of concentration, with established players like Novozymes and DuPont holding significant market share, estimated collectively at 35% in the base year 2025. Innovation remains a critical catalyst, driven by ongoing research into novel enzyme applications, particularly in the bakery and dairy segments, which are projected to account for over 55% of the market by 2033. The regulatory landscape, guided by bodies like the European Food Safety Authority (EFSA), is increasingly focusing on enzyme safety and sustainability, influencing product development and market entry. Substitute products, such as chemical additives, are gradually being replaced by enzymatic solutions due to their perceived natural origin and improved functional benefits. End-user profiles are diversifying, with a growing demand from the processed food industry and a rising interest from smaller, specialized food manufacturers. Mergers and acquisitions (M&A) have played a pivotal role in market consolidation, with key deals valued in the hundreds of millions of Euros driving portfolio expansion and technological integration. For instance, strategic partnerships and acquisitions are expected to continue, with an estimated M&A deal value of over €300 Million in the forecast period. The market's trajectory is shaped by the interplay of these factors, creating a competitive yet opportunity-rich environment.

Europe Food Enzymes Market Industry Evolution

The Europe food enzymes market has witnessed significant evolution driven by a confluence of technological innovation, shifting consumer preferences, and increasing regulatory scrutiny. Over the historical period of 2019–2024, the market demonstrated a steady upward trajectory, fueled by the growing demand for clean-label products and the desire for improved food processing efficiency. The base year, 2025, marks a pivotal point where these trends are expected to accelerate, with a projected annual growth rate of approximately 7.5% during the forecast period of 2025–2033. Technological advancements have been instrumental, with breakthroughs in enzyme discovery, genetic engineering, and fermentation processes leading to the development of more potent, stable, and application-specific enzymes. For example, the development of novel proteases and amylases has revolutionized the baking industry, enabling enhanced dough handling, improved texture, and extended shelf life. Similarly, advancements in lipases have optimized fat modification in dairy and confectionery applications, leading to premium product development. Consumer demand for healthier and more natural food ingredients has been a significant propellant. Food enzymes, derived from natural sources and contributing to reduced use of artificial additives, align perfectly with this trend. This has led to increased adoption in sectors like dairy and frozen products, where enzymes are used for texture improvement, lactose reduction, and flavor enhancement, contributing an estimated 20% of the market share in 2025. The meat, poultry, and seafood segment is also experiencing growth, with enzymes aiding in tenderization, flavor development, and processing efficiency, projected to capture 15% of the market by 2033. The oils and fats sector is witnessing increased use of enzymes for interesterification and modification, leading to healthier fat profiles and enhanced functionality. This sustained growth is underpinned by a robust R&D pipeline and a growing understanding of enzyme functionalities across diverse food applications. The industry's capacity to adapt to evolving consumer demands and leverage technological breakthroughs positions it for continued expansion and innovation.

Leading Regions, Countries, or Segments in Europe Food Enzymes Market

Within the broader European food enzymes market, the Bakery segment is emerging as a dominant force, projected to command a significant market share exceeding 25% by 2033. This dominance is fueled by several key drivers, including the region's established baking tradition, the increasing consumer demand for convenient and premium baked goods, and the continuous innovation in enzyme technology that enhances dough properties, crumb structure, and shelf life. The Dairy and Frozen Products segment also exhibits strong growth, expected to secure around 20% of the market by 2033, driven by the rising demand for lactose-free products, improved texture in frozen desserts, and the development of specialized cheese variants.

Bakery Dominance Factors:

- High Demand for Processed Foods: Europe's large population and high consumption of bread, pastries, and cakes create a consistent demand for ingredients that improve processing efficiency and product quality.

- Enzyme Applications: Enzymes like amylases, proteases, lipases, and xylanases play critical roles in optimizing gluten development, improving dough stability, enhancing crumb structure, and extending the freshness of baked goods.

- Clean Label Trend: The natural origin of enzymes aligns with consumer preference for clean-label ingredients, making them a preferred alternative to chemical additives.

- Technological Advancements: Continuous research and development in enzyme engineering has led to the creation of more effective and cost-efficient enzymes tailored for specific baking applications.

- Investment Trends: Significant investments by major players in R&D and production capacity for bakery-specific enzymes are further bolstering the segment's growth.

Dairy and Frozen Products Growth Drivers:

- Lactose Intolerance Solutions: Enzymes like lactase are crucial for producing lactose-free dairy products, catering to a growing segment of the population.

- Texture and Flavor Enhancement: Proteases and lipases are employed to improve the texture and flavor profiles of yogurts, cheeses, and ice cream.

- Frozen Food Innovation: Enzymes contribute to better freeze-thaw stability and improved texture in a variety of frozen food products.

- Regulatory Support: Favorable regulations regarding the use of enzymes in dairy processing further encourage their adoption.

The Beverages segment is also a significant contributor, projected to hold approximately 18% of the market by 2033, driven by applications in brewing, winemaking, and fruit juice processing. The Meat, Poultry, and Seafood Products segment, while smaller, is experiencing robust growth due to enzymes aiding in tenderization and flavor development. The Oils and Fats and Confectionery segments are also important, with enzymes facilitating processes like interesterification and cocoa processing, respectively.

Europe Food Enzymes Market Product Innovations

Recent product innovations in the Europe food enzymes market are centered around enhanced specificity, stability, and sustainability. Companies are developing novel enzyme formulations with improved performance in challenging processing conditions, such as high temperatures or extreme pH levels. For instance, new generations of amylases are offering greater resistance to heat, leading to more consistent results in bread production. Proteases are being engineered for precise protein modification, unlocking new textural possibilities in dairy and meat products. Furthermore, advancements in enzyme immobilization techniques are enabling greater reusability and cost-effectiveness in industrial applications. The focus on 'natural' and 'clean label' continues to drive innovation, with a growing portfolio of enzymes derived from sustainable sources and produced through eco-friendly fermentation processes. Unique selling propositions often lie in enzymes that reduce processing time, minimize waste, or improve the nutritional profile of food products, directly addressing evolving consumer demands for healthier and more responsibly produced food.

Propelling Factors for Europe Food Enzymes Market Growth

The Europe food enzymes market is propelled by a multifaceted growth strategy. Technologically, ongoing advancements in enzyme discovery, genetic engineering, and fermentation techniques are continuously expanding the application range and efficiency of enzymes. Economically, the increasing consumer preference for natural, clean-label ingredients and the demand for enhanced food processing efficiency drive significant market uptake. Regulatory bodies, while stringent, are also facilitating the adoption of safe and approved enzyme technologies, particularly those contributing to sustainability. For example, the increasing demand for reduced sugar and salt content in food products is being met by enzyme solutions that enhance sweetness perception or flavor intensity naturally. This synergistic interplay of technological prowess, consumer-driven demand, and supportive regulatory frameworks underpins the market's robust growth trajectory, with an estimated market value of over €4,500 Million by 2033.

Obstacles in the Europe Food Enzymes Market Market

Despite its promising growth, the Europe food enzymes market faces several obstacles. Stringent and evolving regulatory requirements across different European Union member states can create complexities and delays in product approval and market access. Supply chain disruptions, particularly for specialized enzyme precursors or during periods of global instability, can impact production volumes and costs. Furthermore, the high cost of research and development for novel enzymes, coupled with the need for significant investment in advanced manufacturing facilities, presents a barrier to entry for smaller players. Competitive pressures from established giants with extensive product portfolios and market reach also pose a challenge, demanding continuous innovation and strategic pricing to maintain market share.

Future Opportunities in Europe Food Enzymes Market

The Europe food enzymes market is ripe with future opportunities, particularly in emerging applications and geographical expansion. The growing interest in plant-based food alternatives presents a significant opportunity for enzymes that can improve the texture, flavor, and nutritional profile of these products. Advancements in enzyme engineering for personalized nutrition and functional foods are also on the horizon, catering to increasingly health-conscious consumers. Furthermore, the untapped potential in specific niche segments within the broader food industry, such as pet food and specialized dietary supplements, offers avenues for growth. The development of novel enzyme platforms through synthetic biology and bioinformatics holds the promise of unlocking entirely new functionalities and applications, driving future market expansion. The exploration of enzymes for waste valorization within the food industry also presents a sustainable and economically attractive opportunity.

Major Players in the Europe Food Enzymes Market Ecosystem

- AB Enzymes

- MetGen

- Kerry Inc

- AST Enzymes

- Chr Hansen Holding A/S

- DuPont

- Novozymes

- Cargill Inc

Key Developments in Europe Food Enzymes Market Industry

- 2023/08: Novozymes launches a new range of xylanase enzymes for enhanced baking performance, offering improved dough stability and crumb structure.

- 2023/05: Chr Hansen Holding A/S expands its enzyme portfolio with a focus on dairy applications, introducing novel proteases for improved cheese ripening.

- 2022/11: DuPont secures regulatory approval for a new enzyme cocktail designed to reduce sugar content in fruit juices, aligning with clean label trends.

- 2022/06: MetGen announces a strategic partnership to accelerate the development of enzyme solutions for the biorefinery sector, hinting at future food industry applications.

- 2021/10: AB Enzymes introduces an innovative lipase enzyme offering enhanced fat modification capabilities for confectionery products.

Strategic Europe Food Enzymes Market Market Forecast

The strategic outlook for the Europe food enzymes market remains exceptionally positive, driven by innovation and evolving consumer demands. The forecast period (2025–2033) is expected to witness robust growth, propelled by the increasing adoption of enzymes for creating healthier, more sustainable, and functional food products. Key growth catalysts include the continued expansion of the bakery and dairy segments, the emerging potential in plant-based alternatives, and advancements in enzyme technology enabling novel applications. Significant investment in R&D, coupled with strategic collaborations and potential M&A activities, will further shape the market landscape, ensuring a dynamic and expanding ecosystem for food enzymes in Europe. The market is projected to reach a valuation of over €4,500 Million by 2033, reflecting its sustained importance in the modern food industry.

Europe Food Enzymes Market Segmentation

-

1. Application

- 1.1. Bakery

- 1.2. Dairy and Frozen Products

- 1.3. Oils and Fats

- 1.4. Confectionery

- 1.5. Beverages

- 1.6. Meat Poultry and Seafood Products

- 1.7. Others

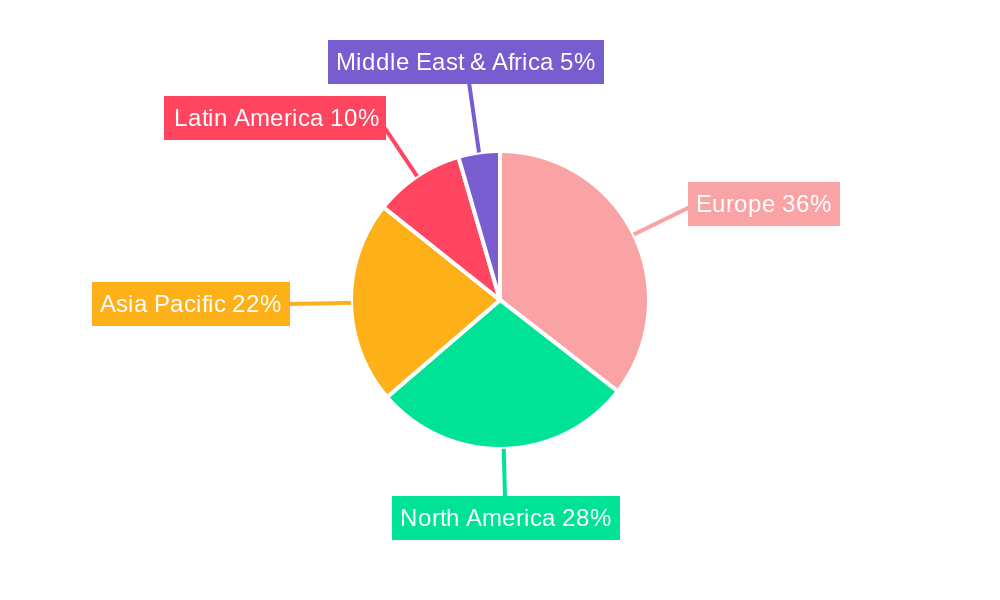

Europe Food Enzymes Market Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. United Kingdom

- 1.3. Italy

- 1.4. Spain

- 1.5. France

- 1.6. Russia

- 1.7. Rest of Europe

Europe Food Enzymes Market Regional Market Share

Geographic Coverage of Europe Food Enzymes Market

Europe Food Enzymes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Natural Food Colors

- 3.4. Market Trends

- 3.4.1. Germany has the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Food Enzymes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Bakery

- 5.1.2. Dairy and Frozen Products

- 5.1.3. Oils and Fats

- 5.1.4. Confectionery

- 5.1.5. Beverages

- 5.1.6. Meat Poultry and Seafood Products

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AB Enzymes

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MetGen

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kerry Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AST Enzymes

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chr Hansen Holding A/S

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DuPont

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Novozymes*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cargill Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 AB Enzymes

List of Figures

- Figure 1: Europe Food Enzymes Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Food Enzymes Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Food Enzymes Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Europe Food Enzymes Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Europe Food Enzymes Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Europe Food Enzymes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Germany Europe Food Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: United Kingdom Europe Food Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Italy Europe Food Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Spain Europe Food Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Food Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Russia Europe Food Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of Europe Europe Food Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Food Enzymes Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Europe Food Enzymes Market?

Key companies in the market include AB Enzymes, MetGen, Kerry Inc, AST Enzymes, Chr Hansen Holding A/S, DuPont, Novozymes*List Not Exhaustive, Cargill Inc.

3. What are the main segments of the Europe Food Enzymes Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products.

6. What are the notable trends driving market growth?

Germany has the Largest Market Share.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Natural Food Colors.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Food Enzymes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Food Enzymes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Food Enzymes Market?

To stay informed about further developments, trends, and reports in the Europe Food Enzymes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence