Key Insights

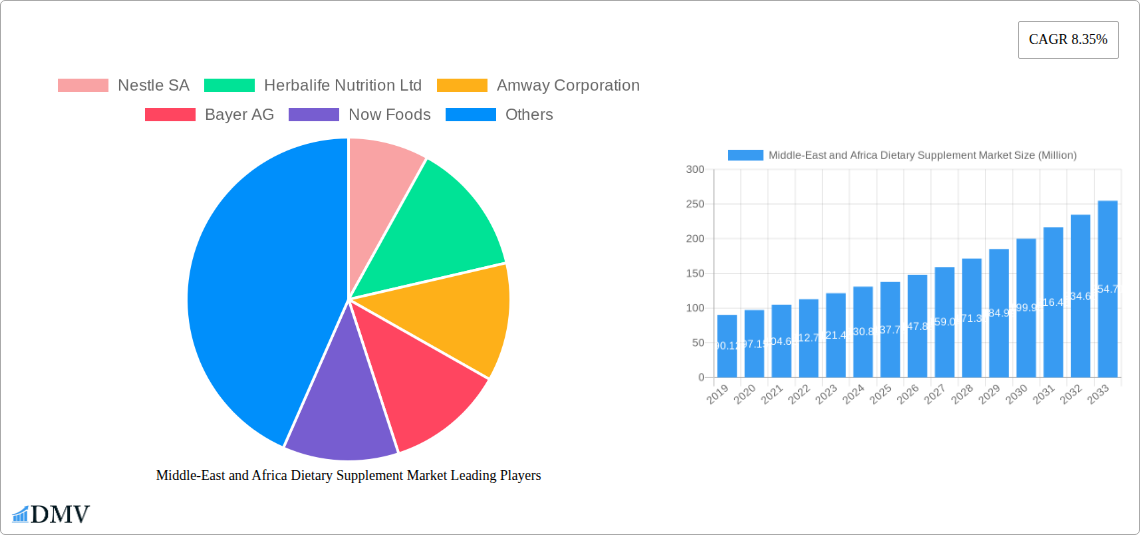

The Middle-East and Africa (MEA) dietary supplement market is poised for substantial growth, currently valued at an estimated USD 117.84 million. Projected to expand at a Compound Annual Growth Rate (CAGR) of 8.35% from 2019 to 2033, this burgeoning market reflects a growing consumer consciousness towards health and wellness across the region. Key drivers fueling this expansion include an increasing prevalence of lifestyle-related diseases, a rising disposable income empowering consumers to invest in preventative health measures, and a growing awareness of the benefits offered by dietary supplements for overall well-being and disease management. The market is being significantly influenced by evolving consumer preferences, with a noticeable shift towards natural and organic ingredients, the burgeoning popularity of personalized nutrition solutions, and the increasing adoption of online channels for purchasing supplements. This dynamic landscape is creating fertile ground for innovation and market penetration.

Middle-East and Africa Dietary Supplement Market Market Size (In Million)

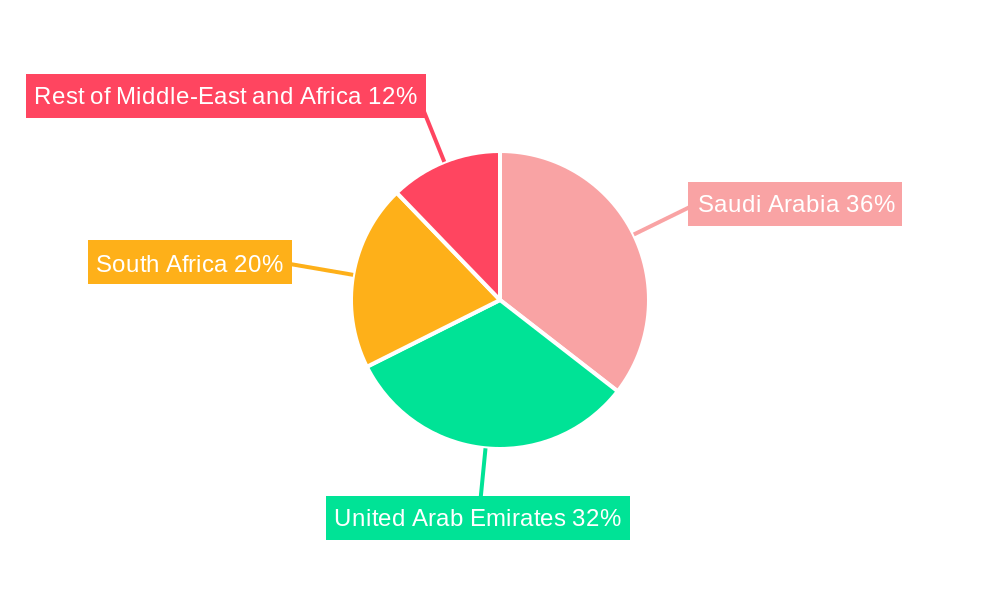

The dietary supplement market in the MEA region is segmented across various product types and distribution channels, indicating diverse consumer needs and purchasing habits. The "Vitamin and Mineral" segment is expected to lead, catering to foundational health requirements. However, "Herbal Supplements" and "Proteins and Amino Acids" are anticipated to witness robust growth due to increasing interest in natural remedies and fitness-related products, respectively. Distribution channels are also evolving, with "Online Channels" showing remarkable upward potential, driven by convenience and wider product accessibility. While "Supermarkets and Hypermarkets" and "Pharmacies and Drug Stores" remain significant, the digital shift is undeniable. Geographically, the United Arab Emirates and Saudi Arabia are anticipated to spearhead market growth, owing to their advanced healthcare infrastructure, higher disposable incomes, and proactive consumer engagement with health trends. South Africa also presents a strong market presence, while the "Rest of Middle-East and Africa" region, despite its diverse economic landscape, is gradually adopting supplement consumption, presenting future expansion opportunities.

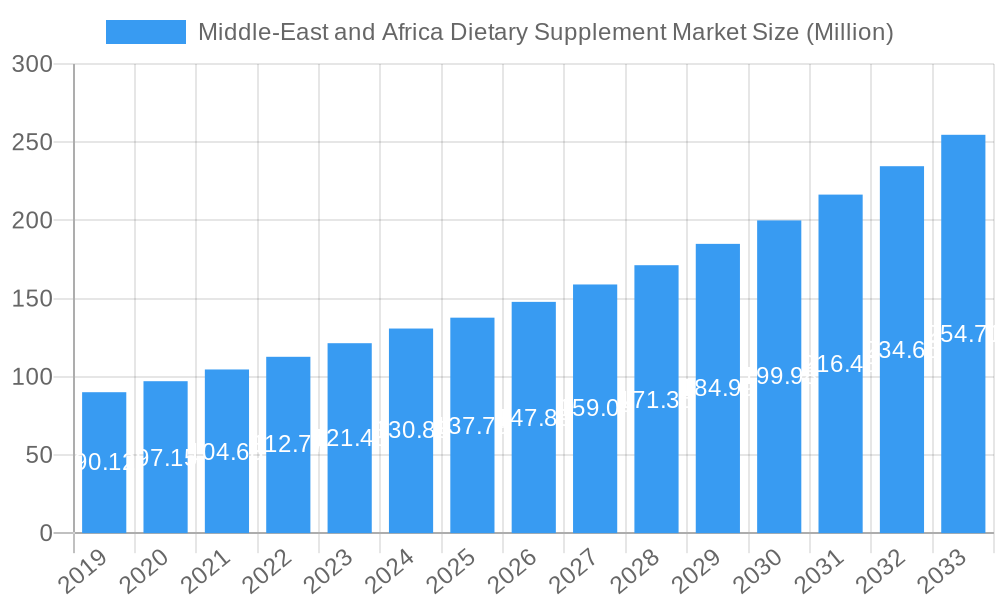

Middle-East and Africa Dietary Supplement Market Company Market Share

Middle-East and Africa Dietary Supplement Market: A Comprehensive Analysis and Forecast (2019-2033)

Unlock unparalleled insights into the booming Middle-East and Africa dietary supplement market. This in-depth report, spanning the historical period of 2019-2024 and forecasting to 2033 with 2025 as the base and estimated year, provides a critical evaluation of market dynamics, competitive landscapes, and future growth trajectories. With an estimated market size of XXX Million in 2025, this study is an indispensable resource for stakeholders seeking to capitalize on the region's burgeoning health and wellness sector. Explore key segments including Vitamins and Minerals, Herbal Supplements, Proteins and Amino Acids, Fatty Acids, Probiotics, and Other Types, alongside distribution channels such as Supermarkets, Pharmacies, and burgeoning Online Channels. Dive deep into the influential geographies of Saudi Arabia, United Arab Emirates, South Africa, and the broader Rest of Middle-East and Africa.

Middle-East and Africa Dietary Supplement Market Market Composition & Trends

The Middle-East and Africa dietary supplement market is characterized by a moderate to high concentration, with key players like Nestle SA, Herbalife Nutrition Ltd, Amway Corporation, Bayer AG, and GlaxoSmithKline PLC holding significant market share. Innovation is largely driven by increasing consumer awareness of preventive healthcare, a growing prevalence of lifestyle-related diseases, and the rising disposable incomes in key economies. The regulatory landscape is evolving, with some nations implementing stricter guidelines for product manufacturing and labeling, while others are more open to market entry. Substitute products, such as fortified foods and specialized medical nutrition, offer alternatives but are yet to fully supplant the demand for targeted dietary supplements. End-user profiles are diverse, ranging from health-conscious millennials and Gen Z seeking performance enhancement and preventative care to older demographics addressing age-related deficiencies. Merger and acquisition activities, while not always publicly disclosed in terms of value, are a strategic tool for market consolidation and expansion, with estimated deal values in the tens to hundreds of Millions playing a role in shaping the competitive environment.

- Market Concentration: Moderate to High, with a few dominant players.

- Innovation Catalysts: Rising health consciousness, lifestyle disease awareness, increasing disposable income.

- Regulatory Landscape: Evolving, with a mix of stringent and more lenient regulations across the region.

- Substitute Products: Fortified foods, medical nutrition.

- End-User Profiles: Health-conscious youth, elderly, individuals with specific health concerns.

- M&A Activities: Strategic for market consolidation and expansion.

Middle-East and Africa Dietary Supplement Market Industry Evolution

The evolution of the Middle-East and Africa dietary supplement market has been a dynamic journey, marked by accelerating growth and a significant shift in consumer behavior, especially from the historical period of 2019-2024. The market's trajectory has been significantly influenced by a confluence of factors, including increasing health consciousness, a growing understanding of the role of nutrition in disease prevention, and a substantial rise in disposable incomes across many nations within the region. In the base year of 2025, the market is poised for robust expansion, with an estimated compound annual growth rate (CAGR) projected to be in the range of 7.5% to 9.0% during the forecast period of 2025-2033.

Technological advancements have played a crucial role in shaping this evolution. The development of novel delivery systems, such as bioavailable formulations and personalized supplements, has enhanced product efficacy and consumer appeal. Furthermore, the integration of digital technologies has revolutionized distribution channels, with online sales channels experiencing exponential growth. Consumers are increasingly seeking convenience and access to a wider variety of products, a trend that online platforms have effectively catered to. This digital transformation has also facilitated greater consumer education and engagement, leading to more informed purchasing decisions.

Shifting consumer demands are at the heart of this market's growth. There is a discernible move towards natural and organic ingredients, driven by a greater awareness of potential side effects associated with synthetic compounds. Consumers are actively seeking supplements that address specific health concerns, such as immunity boosting, cognitive function enhancement, stress management, and sports nutrition. The rising prevalence of chronic diseases, including diabetes, cardiovascular issues, and obesity, has further fueled the demand for supplements that offer preventative or supportive health benefits. The younger demographic, in particular, is increasingly investing in dietary supplements for performance optimization and overall well-being. This evolving consumer landscape necessitates continuous product innovation and strategic marketing efforts from industry players to align with burgeoning preferences for personalized health solutions and evidence-based products. The market's growth is not merely opportunistic but a reflection of a fundamental societal shift towards proactive health management, with significant adoption metrics for specialized supplement categories.

Leading Regions, Countries, or Segments in Middle-East and Africa Dietary Supplement Market

The Middle-East and Africa dietary supplement market is experiencing dynamic growth across various segments and geographies, with distinct regions and product categories emerging as dominant forces.

Dominant Segments by Type:

- Vitamin and Mineral Supplements: This segment consistently holds the largest market share, driven by widespread awareness of their essential role in maintaining overall health and preventing deficiencies. The accessibility and broad applicability of vitamins and minerals for various age groups and health concerns contribute significantly to their dominance.

- Key Drivers: High consumer awareness, perceived affordability, and broad application for general health.

- Investment Trends: Continuous investment in R&D for enhanced bioavailability and new formulations.

- Regulatory Support: Generally favorable regulatory environments for established vitamin and mineral products.

- Herbal Supplements: The demand for herbal supplements is witnessing a substantial surge, fueled by a growing preference for natural and traditional remedies. Consumers are increasingly seeking plant-based solutions for a range of health issues, from stress relief to immune support.

- Key Drivers: Growing preference for natural ingredients, cultural acceptance of traditional medicine, and increasing scientific validation of herbal efficacy.

- Investment Trends: Focus on sustainable sourcing, efficacy studies, and novel extraction techniques.

- Consumer Trends: Growing interest in adaptogens, superfoods, and botanicals for holistic wellness.

- Proteins and Amino Acids: This segment is experiencing robust growth, particularly driven by the expanding fitness and sports nutrition culture, as well as the increasing adoption of protein supplements for weight management and satiety.

- Key Drivers: Rise in gym culture, sports participation, and demand for muscle building and recovery.

- Market Dynamics: Innovation in plant-based protein sources and specialized amino acid formulations.

- End-User Focus: Athletes, fitness enthusiasts, and individuals seeking weight management solutions.

Dominant Segments by Distribution Channel:

- Pharmacies and Drug Stores: These remain a cornerstone for dietary supplement sales due to the inherent trust associated with healthcare providers and the regulated environment. Consumers often seek professional advice from pharmacists, making these channels crucial for certain product categories and demographics.

- Key Drivers: Consumer trust, accessibility to professional advice, and established retail presence.

- Market Share: Significant, especially for specialized or physician-recommended supplements.

- Online Channels: The rapid growth of e-commerce platforms has made online channels a dominant and increasingly vital distribution route. Convenience, wider product selection, competitive pricing, and direct-to-consumer models are propelling this segment's expansion.

- Key Drivers: Convenience, competitive pricing, wider product availability, and direct-to-consumer accessibility.

- Growth Trajectory: Experiencing the fastest growth rate within the distribution landscape.

- Technological Impact: Mobile commerce and personalized online recommendations enhancing user experience.

- Supermarkets and Hypermarkets: These channels cater to a broad consumer base looking for everyday health and wellness products. They offer accessibility and convenience for impulse purchases and routine replenishment of staple supplements.

- Key Drivers: High foot traffic, convenience for everyday shopping, and visibility for mass-market products.

- Product Mix: Focus on general wellness, vitamins, and readily available supplement formats.

Dominant Geographies:

- United Arab Emirates (UAE): The UAE stands out as a leading market due to its high disposable income, cosmopolitan population, strong focus on health and wellness tourism, and a robust regulatory framework that attracts international brands. The presence of a significant expatriate population with diverse health needs further bolsters demand.

- Key Drivers: High disposable income, health and wellness tourism, progressive healthcare policies, and a large expatriate population.

- Investment Climate: Favorable for both local and international companies.

- Consumer Behavior: High adoption of premium and specialized health products.

- Saudi Arabia: With a large and growing population, increasing government initiatives promoting healthier lifestyles, and a rising prevalence of lifestyle diseases, Saudi Arabia presents a substantial market opportunity. The kingdom's focus on diversifying its economy and investing in healthcare infrastructure further supports the dietary supplement industry.

- Key Drivers: Large population base, government initiatives for health promotion, increasing prevalence of chronic diseases.

- Market Potential: Significant untapped potential for specialized and mass-market supplements.

- Cultural Influence: Growing acceptance of health-enhancing products.

- South Africa: As one of the most developed economies in Africa, South Africa exhibits a mature dietary supplement market with a strong emphasis on natural products, sports nutrition, and supplements catering to specific health conditions. The well-established retail infrastructure and increasing health consciousness contribute to its prominence.

- Key Drivers: Developed economy, strong health consciousness, established retail infrastructure, and growing demand for natural products.

- Market Trends: Leading adoption of sports nutrition and immune-boosting supplements.

- Research & Development: Significant focus on local product development and sourcing.

Middle-East and Africa Dietary Supplement Market Product Innovations

Product innovation in the Middle-East and Africa dietary supplement market is increasingly focused on delivering enhanced bioavailability and targeted health benefits. Companies are investing in advanced formulations, such as liposomal encapsulation and nano-emulsions, to improve nutrient absorption and efficacy, with performance metrics showing a XX% increase in absorption rates. Innovations also extend to novel ingredient sourcing, with a growing emphasis on sustainably sourced botanicals and ethically produced animal-derived ingredients. Unique selling propositions often revolve around personalized supplement blends tailored to individual genetic profiles or specific lifestyle needs, leveraging advancements in diagnostics. The integration of probiotic strains with proven efficacy for gut health and immune modulation is another key area, with documented improvements in digestive well-being and reduced incidence of common ailments.

Propelling Factors for Middle-East and Africa Dietary Supplement Market Growth

The Middle-East and Africa dietary supplement market is propelled by a confluence of powerful factors, driving significant expansion.

- Rising Health Consciousness: A growing global trend that is acutely felt across the MEA region, with consumers increasingly proactive about preventive healthcare and well-being.

- Increasing Disposable Incomes: In many key economies, rising incomes empower consumers to invest more in their health and explore premium dietary supplements.

- Growing Prevalence of Lifestyle Diseases: The escalating incidence of chronic conditions like diabetes, cardiovascular diseases, and obesity creates a demand for supplements that offer support and management solutions.

- Evolving Regulatory Frameworks: While sometimes a challenge, evolving regulations are also fostering greater standardization and trust, encouraging market growth and investment.

- Technological Advancements: Innovations in product formulation, delivery systems, and online retail are enhancing accessibility and efficacy, driving consumer adoption.

Obstacles in the Middle-East and Africa Dietary Supplement Market Market

Despite its strong growth potential, the Middle-East and Africa dietary supplement market faces several obstacles that can hinder its expansion.

- Regulatory Ambiguities and Varying Standards: Inconsistent and evolving regulations across different countries can create complexities for market entry and compliance, potentially increasing operational costs by an estimated XX%.

- Counterfeit Products and Quality Concerns: The presence of counterfeit or substandard products can erode consumer trust and pose significant health risks, impacting the overall market's credibility.

- Limited Consumer Awareness in Certain Segments: While awareness is growing, specific niche supplements or complex formulations may still face challenges in gaining widespread consumer understanding and adoption, leading to slower uptake.

- Supply Chain Disruptions: Geopolitical instability, logistical challenges, and import/export complexities can disrupt the supply chain, leading to stockouts and increased costs.

- Price Sensitivity: In some developing economies, price sensitivity can be a barrier to the adoption of premium or specialized dietary supplements.

Future Opportunities in Middle-East and Africa Dietary Supplement Market

The Middle-East and Africa dietary supplement market is ripe with future opportunities, driven by emerging trends and unmet needs.

- Expansion into Underserved Geographies: Significant untapped potential exists in several emerging economies within the Rest of Middle-East and Africa, offering new market penetration opportunities.

- Personalized Nutrition Solutions: Advancements in genomics and AI are paving the way for highly personalized supplement regimens, catering to individual needs and preferences.

- Growth in Sports Nutrition and Performance Enhancement: The burgeoning fitness culture and increasing participation in sports present substantial growth avenues for specialized sports supplements.

- Focus on Immunity and Wellness: Heightened awareness of immune health and overall well-being will continue to drive demand for supplements that support these areas.

- Sustainable and Ethically Sourced Products: Increasing consumer demand for eco-friendly and ethically produced supplements offers a competitive advantage to companies prioritizing these aspects.

Major Players in the Middle-East and Africa Dietary Supplement Market Ecosystem

- Nestle SA

- Herbalife Nutrition Ltd

- Amway Corporation

- Bayer AG

- Now Foods

- Jamieson Wellness

- Nordic Naturals Inc

- Vitabiotics Ltd

- SA Natural Products Ltd

- GlaxoSmithKline PLC

Key Developments in Middle-East and Africa Dietary Supplement Market Industry

- 2023 Q4: Launch of new plant-based protein formulations by major players to cater to the growing vegan and vegetarian consumer base.

- 2023 Q3: Increased investment in e-commerce infrastructure and digital marketing strategies by key companies to enhance online sales.

- 2023 Q2: Introduction of immunity-boosting supplement lines featuring high-potency vitamins and herbal extracts in response to ongoing health concerns.

- 2023 Q1: Strategic partnerships formed between supplement manufacturers and fitness influencers to promote product awareness and adoption.

- 2022 Q4: Emergence of personalized supplement subscription services offering tailored product recommendations based on user profiles.

- 2022 Q3: Regulatory bodies in several MEA countries announced stricter guidelines for supplement labeling and ingredient verification.

Strategic Middle-East and Africa Dietary Supplement Market Market Forecast

The Middle-East and Africa dietary supplement market is projected for sustained and robust growth, propelled by increasing health consciousness, rising disposable incomes, and a growing demand for preventive healthcare solutions. The market's future trajectory will be shaped by continuous product innovation, particularly in personalized nutrition and natural ingredients, alongside the expanding reach of online distribution channels. Strategic investments in research and development, coupled with effective market penetration into underserved regions, will be crucial for capitalizing on the immense market potential. The region's evolving regulatory landscape, while presenting some challenges, is also fostering an environment conducive to responsible growth and increased consumer trust, paving the way for an estimated market value of XXX Million by 2033.

Middle-East and Africa Dietary Supplement Market Segmentation

-

1. Type

- 1.1. Vitamin and Mineral

- 1.2. Herbal Supplements

- 1.3. Proteins and Amino Acids

- 1.4. Fatty Acid

- 1.5. Probiotics

- 1.6. Other Types

-

2. Distribution Channel

- 2.1. Supermarkets and Hypermarkets

- 2.2. Pharmacies and Drug Stores

- 2.3. Online Channels

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. South Africa

- 3.4. Rest of Middle-East and Africa

Middle-East and Africa Dietary Supplement Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. South Africa

- 4. Rest of Middle East and Africa

Middle-East and Africa Dietary Supplement Market Regional Market Share

Geographic Coverage of Middle-East and Africa Dietary Supplement Market

Middle-East and Africa Dietary Supplement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer Spending on Preventive Healthcare Products; Weight-loss Dietary Supplements Capturing the Market

- 3.3. Market Restrains

- 3.3.1. Escalating Functional Food Consumption; An Environment of Austere Regulations

- 3.4. Market Trends

- 3.4.1. Surging Consumer Healthcare Expenditure

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Dietary Supplement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Vitamin and Mineral

- 5.1.2. Herbal Supplements

- 5.1.3. Proteins and Amino Acids

- 5.1.4. Fatty Acid

- 5.1.5. Probiotics

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets and Hypermarkets

- 5.2.2. Pharmacies and Drug Stores

- 5.2.3. Online Channels

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. South Africa

- 5.3.4. Rest of Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. South Africa

- 5.4.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia Middle-East and Africa Dietary Supplement Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Vitamin and Mineral

- 6.1.2. Herbal Supplements

- 6.1.3. Proteins and Amino Acids

- 6.1.4. Fatty Acid

- 6.1.5. Probiotics

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets and Hypermarkets

- 6.2.2. Pharmacies and Drug Stores

- 6.2.3. Online Channels

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. South Africa

- 6.3.4. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Arab Emirates Middle-East and Africa Dietary Supplement Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Vitamin and Mineral

- 7.1.2. Herbal Supplements

- 7.1.3. Proteins and Amino Acids

- 7.1.4. Fatty Acid

- 7.1.5. Probiotics

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets and Hypermarkets

- 7.2.2. Pharmacies and Drug Stores

- 7.2.3. Online Channels

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. South Africa

- 7.3.4. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. South Africa Middle-East and Africa Dietary Supplement Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Vitamin and Mineral

- 8.1.2. Herbal Supplements

- 8.1.3. Proteins and Amino Acids

- 8.1.4. Fatty Acid

- 8.1.5. Probiotics

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets and Hypermarkets

- 8.2.2. Pharmacies and Drug Stores

- 8.2.3. Online Channels

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. South Africa

- 8.3.4. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Middle East and Africa Middle-East and Africa Dietary Supplement Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Vitamin and Mineral

- 9.1.2. Herbal Supplements

- 9.1.3. Proteins and Amino Acids

- 9.1.4. Fatty Acid

- 9.1.5. Probiotics

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets and Hypermarkets

- 9.2.2. Pharmacies and Drug Stores

- 9.2.3. Online Channels

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. South Africa

- 9.3.4. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Nestle SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Herbalife Nutrition Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Amway Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Bayer AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Now Foods

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Jamieson Wellness*List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Nordiac Naturals Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Vitabiotics Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 SA Natural Products Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 GlaxoSmithKline PLC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Nestle SA

List of Figures

- Figure 1: Middle-East and Africa Dietary Supplement Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Dietary Supplement Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 5: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 11: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 13: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 19: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 20: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 21: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 27: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 29: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 31: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 35: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 36: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 37: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 39: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Dietary Supplement Market?

The projected CAGR is approximately 8.35%.

2. Which companies are prominent players in the Middle-East and Africa Dietary Supplement Market?

Key companies in the market include Nestle SA, Herbalife Nutrition Ltd, Amway Corporation, Bayer AG, Now Foods, Jamieson Wellness*List Not Exhaustive, Nordiac Naturals Inc, Vitabiotics Ltd, SA Natural Products Ltd, GlaxoSmithKline PLC.

3. What are the main segments of the Middle-East and Africa Dietary Supplement Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 117.84 Million as of 2022.

5. What are some drivers contributing to market growth?

Consumer Spending on Preventive Healthcare Products; Weight-loss Dietary Supplements Capturing the Market.

6. What are the notable trends driving market growth?

Surging Consumer Healthcare Expenditure.

7. Are there any restraints impacting market growth?

Escalating Functional Food Consumption; An Environment of Austere Regulations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Dietary Supplement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Dietary Supplement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Dietary Supplement Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Dietary Supplement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence