Key Insights

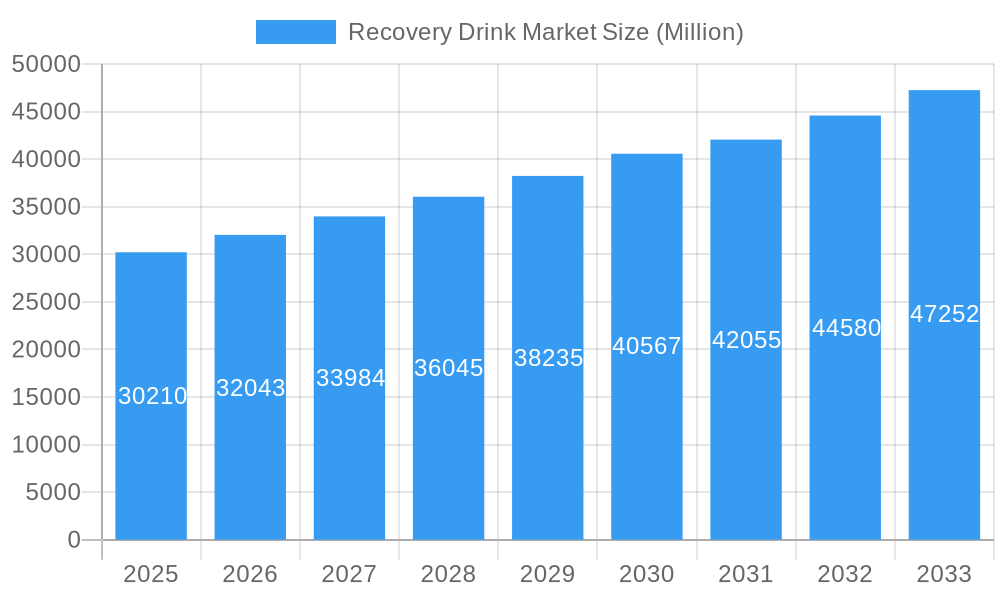

The global Recovery Drink Market is poised for substantial growth, projected to reach $30.21 billion in 2025 with a robust Compound Annual Growth Rate (CAGR) of 6.01%. This upward trajectory is fueled by a confluence of factors, most notably the increasing consumer focus on health and wellness, coupled with a surge in the popularity of sports and fitness activities worldwide. Athletes, from professionals to amateurs, are increasingly recognizing the critical role of post-exercise nutrition in muscle repair, energy replenishment, and overall performance enhancement. This growing awareness drives demand for scientifically formulated recovery beverages that offer targeted nutritional benefits. Furthermore, the expansion of the sports nutrition industry, with a greater emphasis on accessible and convenient product formats, is also a significant catalyst. The rising disposable incomes in emerging economies are further broadening the consumer base for these specialized drinks, making them more attainable for a larger segment of the population.

Recovery Drink Market Market Size (In Billion)

The market is characterized by dynamic trends, including the burgeoning demand for RTD (Ready-to-Drink) formats due to their convenience and ease of consumption, and a notable shift towards healthier, natural, and plant-based ingredients. Consumers are actively seeking recovery drinks with fewer artificial additives and enhanced nutritional profiles, such as added electrolytes and proteins. Innovation in flavor profiles and product formulations is also a key differentiator. However, the market faces certain restraints, including the high cost of premium ingredients, which can impact product pricing and affordability for some consumer segments. Additionally, stringent regulatory frameworks surrounding health claims and product labeling in various regions can pose challenges for market participants. Despite these hurdles, the market's inherent growth drivers, stemming from an ever-expanding health-conscious consumer base and the continuous evolution of sports nutrition science, ensure a promising outlook for the recovery drink sector.

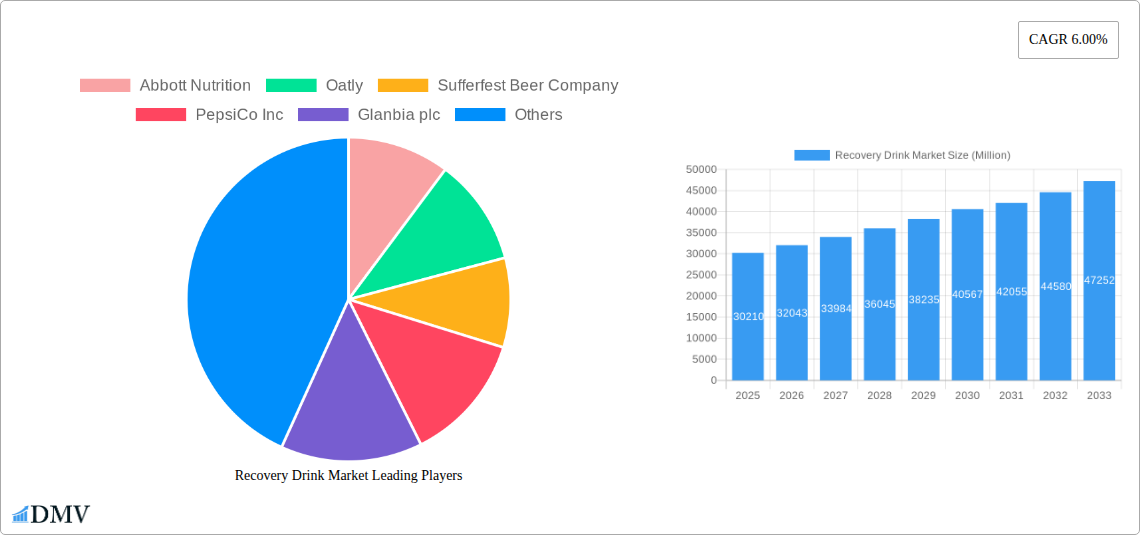

Recovery Drink Market Company Market Share

This in-depth recovery drink market report offers a strategic overview of the global landscape, providing actionable insights for stakeholders. Leveraging advanced analytics and extensive primary and secondary research, we dissect market dynamics, identify growth opportunities, and forecast future trends. Our analysis covers the period from 2019 to 2033, with a detailed focus on the base year 2025 and the forecast period 2025–2033. The historical period 2019–2024 provides crucial context for understanding current market evolution.

Recovery Drink Market Market Composition & Trends

The recovery drink market is characterized by a dynamic interplay of innovation, evolving consumer preferences, and a shifting regulatory environment. Market concentration varies across regions, with established players and emerging brands vying for market share. Key innovation catalysts include advancements in nutritional science, the integration of novel ingredients like adaptogens and nootropics, and the growing demand for plant-based and allergen-free options. The regulatory landscape, while generally supportive of functional beverages, can present hurdles related to ingredient claims and labeling standards in different jurisdictions. Substitute products, ranging from traditional food-based recovery methods to other functional beverages, pose a competitive challenge, necessitating clear differentiation through superior efficacy and targeted marketing. End-user profiles are increasingly diverse, encompassing elite athletes, recreational fitness enthusiasts, and individuals seeking post-exercise replenishment and general well-being. Merger and acquisition (M&A) activities are on the rise as larger corporations seek to expand their portfolios and gain access to innovative brands and technologies within the sports nutrition market.

- Market Share Distribution: The top 10 players are estimated to hold approximately 60% of the global market share in 2025, with significant contributions from both multinational corporations and specialized sports nutrition brands.

- M&A Deal Values: Recent M&A activities in the functional beverage and sports nutrition sectors have seen deal values ranging from $50 million to over $500 million, reflecting strategic acquisitions aimed at market expansion and product diversification.

- Innovation Drivers: Focus on natural ingredients, functional benefits beyond muscle recovery (e.g., cognitive function, hydration), and sustainable packaging.

- Regulatory Landscape: Navigating FDA (US), EFSA (EU), and other regional food safety and labeling regulations is critical for market entry and expansion.

Recovery Drink Market Industry Evolution

The recovery drink market has witnessed a remarkable evolution, driven by burgeoning health and wellness consciousness and the increasing professionalization of sports and fitness activities globally. Over the historical period 2019–2024, the market experienced robust growth, fueled by a growing understanding of post-exercise nutrient replenishment's role in muscle repair, reduced fatigue, and enhanced performance. This period saw a significant shift from niche sports products to mainstream consumer adoption. Technological advancements have played a pivotal role, with improved formulation techniques enabling the creation of more palatable, effective, and bioavailable recovery drinks. The development of specialized blends catering to specific athletic demands, such as endurance sports or strength training, has also contributed to market expansion. Shifting consumer demands have been a primary driver, with a pronounced trend towards natural ingredients, transparency in labeling, and functional benefits extending beyond simple muscle recovery. Consumers are increasingly seeking products that support holistic well-being, including immune support, stress reduction, and improved sleep, all of which are being integrated into advanced recovery drink formulations. This evolving demand has spurred significant research and development efforts, leading to a wider array of product offerings. The estimated market size for recovery drinks is projected to reach approximately $12.5 billion in 2025, with an anticipated compound annual growth rate (CAGR) of around 8.5% during the 2025–2033 forecast period. This sustained growth trajectory underscores the enduring appeal and expanding applications of recovery beverages.

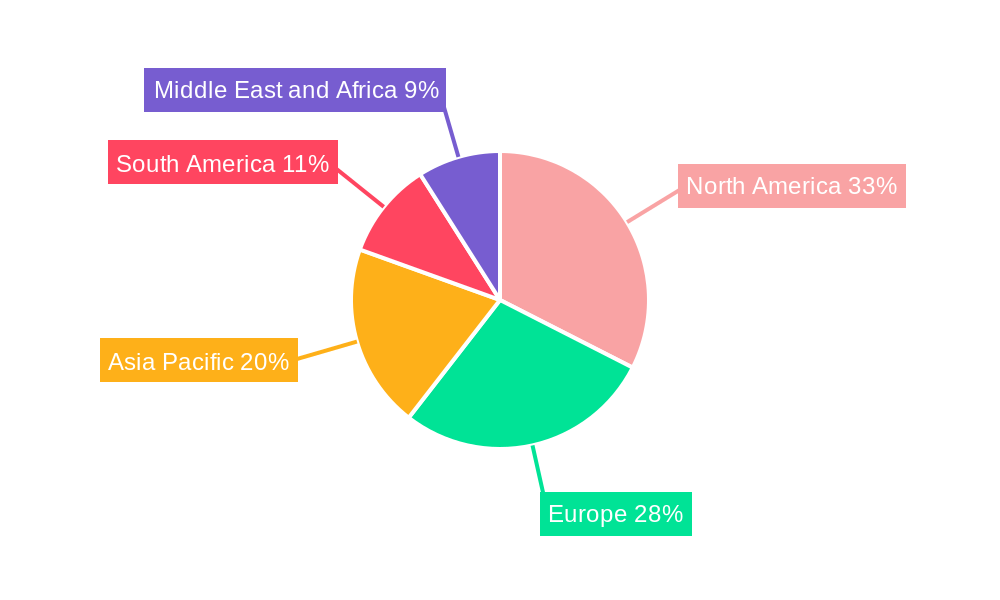

Leading Regions, Countries, or Segments in Recovery Drink Market

North America currently stands as the dominant region in the recovery drink market, propelled by a highly developed sports nutrition infrastructure, high disposable incomes, and a deeply ingrained culture of health and fitness. Within this region, the United States leads significantly due to its large consumer base, extensive distribution networks, and a high adoption rate of functional beverages. The RTD (Ready-to-Drink) segment within the Type category is particularly strong, driven by convenience and immediate consumption needs among busy consumers. For Category, Isotonic recovery drinks maintain a leading position due to their proven efficacy in replenishing electrolytes and fluids lost during intense physical activity.

- Dominant Distribution Channel: Online Retail Stores are experiencing exponential growth, driven by e-commerce penetration and the convenience of direct-to-consumer sales. This channel offers wider product selection and competitive pricing, appealing to a broad spectrum of consumers.

- Key Drivers: Convenience, personalized recommendations, subscription models, and efficient logistics.

- Market Share: Online retail is estimated to capture over 30% of the recovery drink market share by 2025.

- Type Dominance: RTD (Ready-to-Drink) products lead the market due to their immediate consumption convenience, appealing to both athletes and everyday consumers seeking quick post-workout replenishment.

- Key Drivers: Portability, ease of use, and wide availability in various retail settings.

- Market Share: RTD is expected to constitute approximately 60% of the total recovery drink market in 2025.

- Category Strength: Isotonic formulations continue to dominate due to their scientifically proven ability to rehydrate and replenish electrolytes, crucial for athletic performance and recovery.

- Key Drivers: Efficacy in rapid rehydration and electrolyte balance, established consumer trust.

- Market Share: Isotonic drinks are projected to hold around 45% of the market share in 2025.

- Regional Nuances: While North America leads, Europe shows robust growth, particularly in Western European countries with strong athletic communities. The Asia-Pacific region is emerging as a significant growth market, driven by increasing disposable incomes and rising participation in sports and fitness activities.

Recovery Drink Market Product Innovations

Product innovations in the recovery drink market are increasingly focused on enhanced functionality and targeted benefits. Manufacturers are incorporating novel ingredients such as probiotics for gut health, adaptogens like ashwagandha for stress management, and nootropics for cognitive enhancement, moving beyond traditional protein and carbohydrate replenishment. The development of personalized recovery solutions, tailored to specific sport types, training intensities, and individual dietary needs (e.g., vegan, gluten-free, low-sugar), is a significant trend. Advanced delivery systems, including powders with superior mixability and RTD beverages with extended shelf life, are also key areas of innovation. Performance metrics are being enhanced through the inclusion of specific amino acid profiles, antioxidants, and anti-inflammatory compounds designed to accelerate muscle repair and reduce exercise-induced soreness.

Propelling Factors for Recovery Drink Market Growth

The recovery drink market is experiencing significant growth due to several propelling factors. The increasing global participation in sports and fitness activities, from elite athletics to amateur workouts, directly fuels demand for effective post-exercise replenishment. Growing consumer awareness regarding the importance of nutrition for muscle recovery, injury prevention, and performance enhancement is a major driver. Technological advancements in product formulation and ingredient science have led to more sophisticated and effective recovery solutions. Furthermore, the expanding distribution channels, particularly online retail and specialized sports nutrition stores, enhance accessibility for consumers. Government initiatives promoting healthy lifestyles and sports participation also contribute indirectly to market expansion.

- Rising Health & Wellness Trends: Growing emphasis on proactive health management and performance optimization.

- Increased Sports Participation: A surge in recreational and professional athletes across diverse disciplines.

- Technological Advancements: Innovations in ingredient sourcing, bioavailability, and formulation.

- Evolving Consumer Preferences: Demand for natural, plant-based, and functional ingredients.

Obstacles in the Recovery Drink Market Market

Despite its promising growth, the recovery drink market faces several obstacles. Intense competition from established brands and new entrants can lead to price wars and reduced profit margins. The cost of sourcing premium, scientifically-backed ingredients can impact product pricing and affordability for some consumer segments. Regulatory hurdles and differing labeling requirements across various countries can complicate global market expansion and increase compliance costs. Supply chain disruptions, particularly for specialized ingredients or packaging materials, can affect product availability and manufacturing timelines. Consumer skepticism or lack of awareness regarding specific functional ingredients can also limit adoption.

- Intense Competition: Saturated market with numerous brands vying for consumer attention.

- Ingredient Sourcing & Cost: High costs associated with premium and specialized recovery ingredients.

- Regulatory Complexity: Diverse and evolving regulations across different geographic markets.

- Consumer Education Gaps: Need for clearer communication on the benefits of advanced recovery ingredients.

Future Opportunities in Recovery Drink Market

The recovery drink market presents numerous future opportunities. The burgeoning demand for plant-based and vegan recovery options offers significant growth potential. Expanding into emerging markets with increasing disposable incomes and growing interest in fitness and sports will unlock new consumer bases. The integration of personalized nutrition solutions, leveraging AI and genetic profiling, represents a frontier for highly targeted recovery products. Innovations in sustainable packaging and environmentally friendly manufacturing processes will appeal to eco-conscious consumers. Furthermore, the application of recovery drinks beyond traditional sports, such as for post-surgical recovery or elderly mobility support, opens up new market segments.

- Plant-Based & Vegan Alternatives: Growing segment driven by ethical and dietary preferences.

- Emerging Market Penetration: Untapped potential in developing economies with rising health consciousness.

- Personalized Nutrition: Tailored recovery solutions based on individual needs and biometrics.

- Sustainable Practices: Focus on eco-friendly ingredients and packaging to attract conscious consumers.

Major Players in the Recovery Drink Market Ecosystem

Abbott Nutrition, Oatly, Sufferfest Beer Company, PepsiCo Inc, Glanbia plc, Fluid Sports Nutrition, Mountain Fuel, Rockstar Inc

Key Developments in Recovery Drink Market Industry

- 2024 February: Oatly launched a new range of oat-based recovery beverages fortified with essential vitamins and minerals to cater to athletes.

- 2023 October: PepsiCo Inc. acquired a majority stake in a leading functional beverage company, signaling a strategic expansion into the health and wellness sector.

- 2023 July: Glanbia plc expanded its sports nutrition portfolio with the introduction of a novel protein isolate for enhanced muscle synthesis.

- 2023 April: Fluid Sports Nutrition introduced a line of hydration and electrolyte replenishment drinks formulated with natural fruit extracts and no artificial sweeteners.

- 2022 December: Abbott Nutrition unveiled a scientifically advanced recovery drink with a unique carbohydrate-protein blend to optimize glycogen replenishment.

- 2022 September: Sufferfest Beer Company launched a non-alcoholic recovery beverage infused with electrolytes and antioxidants, targeting endurance athletes.

Strategic Recovery Drink Market Market Forecast

The recovery drink market is poised for substantial growth, driven by escalating health and wellness consciousness, continuous product innovation, and expanding consumer access. The forecast period anticipates sustained demand for convenient, effective, and functionally diverse recovery solutions. Key growth catalysts include the increasing adoption of plant-based alternatives, the penetration of online retail channels, and the ongoing integration of advanced ingredients for holistic well-being. Strategic partnerships and M&A activities will continue to shape the market, fostering greater consolidation and innovation. The market's trajectory indicates a robust expansion, making it an attractive sector for investment and development.

Recovery Drink Market Segmentation

-

1. Type

- 1.1. RTD

- 1.2. Powder

-

2. Category

- 2.1. Isotonic

- 2.2. Hypotonic

- 2.3. Hypertonic

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Sports Nutrition chain

- 3.3. Convenience Stores

- 3.4. Online Retail Stores

- 3.5. Other Distribution Channels

Recovery Drink Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Recovery Drink Market Regional Market Share

Geographic Coverage of Recovery Drink Market

Recovery Drink Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Popularity of On-the-Go Snacking Options; Trend Of Clean Label and Plant-Based Bars

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increased demand of organic recovery drinks

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Recovery Drink Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. RTD

- 5.1.2. Powder

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Isotonic

- 5.2.2. Hypotonic

- 5.2.3. Hypertonic

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Sports Nutrition chain

- 5.3.3. Convenience Stores

- 5.3.4. Online Retail Stores

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Recovery Drink Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. RTD

- 6.1.2. Powder

- 6.2. Market Analysis, Insights and Forecast - by Category

- 6.2.1. Isotonic

- 6.2.2. Hypotonic

- 6.2.3. Hypertonic

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Sports Nutrition chain

- 6.3.3. Convenience Stores

- 6.3.4. Online Retail Stores

- 6.3.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Recovery Drink Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. RTD

- 7.1.2. Powder

- 7.2. Market Analysis, Insights and Forecast - by Category

- 7.2.1. Isotonic

- 7.2.2. Hypotonic

- 7.2.3. Hypertonic

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Sports Nutrition chain

- 7.3.3. Convenience Stores

- 7.3.4. Online Retail Stores

- 7.3.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Recovery Drink Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. RTD

- 8.1.2. Powder

- 8.2. Market Analysis, Insights and Forecast - by Category

- 8.2.1. Isotonic

- 8.2.2. Hypotonic

- 8.2.3. Hypertonic

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Sports Nutrition chain

- 8.3.3. Convenience Stores

- 8.3.4. Online Retail Stores

- 8.3.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Recovery Drink Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. RTD

- 9.1.2. Powder

- 9.2. Market Analysis, Insights and Forecast - by Category

- 9.2.1. Isotonic

- 9.2.2. Hypotonic

- 9.2.3. Hypertonic

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets/Hypermarkets

- 9.3.2. Sports Nutrition chain

- 9.3.3. Convenience Stores

- 9.3.4. Online Retail Stores

- 9.3.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Recovery Drink Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. RTD

- 10.1.2. Powder

- 10.2. Market Analysis, Insights and Forecast - by Category

- 10.2.1. Isotonic

- 10.2.2. Hypotonic

- 10.2.3. Hypertonic

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Supermarkets/Hypermarkets

- 10.3.2. Sports Nutrition chain

- 10.3.3. Convenience Stores

- 10.3.4. Online Retail Stores

- 10.3.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Abbott Nutrition

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Oatly

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sufferfest Beer Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PepsiCo Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Glanbia plc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fluid Sports Nutrition*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mountain Fuel

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rockstar Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Abbott Nutrition

List of Figures

- Figure 1: Global Recovery Drink Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Recovery Drink Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Recovery Drink Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Recovery Drink Market Revenue (undefined), by Category 2025 & 2033

- Figure 5: North America Recovery Drink Market Revenue Share (%), by Category 2025 & 2033

- Figure 6: North America Recovery Drink Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 7: North America Recovery Drink Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Recovery Drink Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Recovery Drink Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Recovery Drink Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: Europe Recovery Drink Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Recovery Drink Market Revenue (undefined), by Category 2025 & 2033

- Figure 13: Europe Recovery Drink Market Revenue Share (%), by Category 2025 & 2033

- Figure 14: Europe Recovery Drink Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 15: Europe Recovery Drink Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Recovery Drink Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Recovery Drink Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Recovery Drink Market Revenue (undefined), by Type 2025 & 2033

- Figure 19: Asia Pacific Recovery Drink Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Recovery Drink Market Revenue (undefined), by Category 2025 & 2033

- Figure 21: Asia Pacific Recovery Drink Market Revenue Share (%), by Category 2025 & 2033

- Figure 22: Asia Pacific Recovery Drink Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Recovery Drink Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Recovery Drink Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Recovery Drink Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Recovery Drink Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: South America Recovery Drink Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Recovery Drink Market Revenue (undefined), by Category 2025 & 2033

- Figure 29: South America Recovery Drink Market Revenue Share (%), by Category 2025 & 2033

- Figure 30: South America Recovery Drink Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 31: South America Recovery Drink Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: South America Recovery Drink Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: South America Recovery Drink Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Recovery Drink Market Revenue (undefined), by Type 2025 & 2033

- Figure 35: Middle East and Africa Recovery Drink Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Recovery Drink Market Revenue (undefined), by Category 2025 & 2033

- Figure 37: Middle East and Africa Recovery Drink Market Revenue Share (%), by Category 2025 & 2033

- Figure 38: Middle East and Africa Recovery Drink Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 39: Middle East and Africa Recovery Drink Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Middle East and Africa Recovery Drink Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East and Africa Recovery Drink Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Recovery Drink Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Recovery Drink Market Revenue undefined Forecast, by Category 2020 & 2033

- Table 3: Global Recovery Drink Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Recovery Drink Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Recovery Drink Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Recovery Drink Market Revenue undefined Forecast, by Category 2020 & 2033

- Table 7: Global Recovery Drink Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Recovery Drink Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Recovery Drink Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Recovery Drink Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Recovery Drink Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Recovery Drink Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Global Recovery Drink Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global Recovery Drink Market Revenue undefined Forecast, by Category 2020 & 2033

- Table 15: Global Recovery Drink Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Recovery Drink Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Spain Recovery Drink Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Recovery Drink Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Germany Recovery Drink Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: France Recovery Drink Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Italy Recovery Drink Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Russia Recovery Drink Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Recovery Drink Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global Recovery Drink Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 25: Global Recovery Drink Market Revenue undefined Forecast, by Category 2020 & 2033

- Table 26: Global Recovery Drink Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global Recovery Drink Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: China Recovery Drink Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Japan Recovery Drink Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: India Recovery Drink Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Australia Recovery Drink Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Recovery Drink Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Global Recovery Drink Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 34: Global Recovery Drink Market Revenue undefined Forecast, by Category 2020 & 2033

- Table 35: Global Recovery Drink Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 36: Global Recovery Drink Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Brazil Recovery Drink Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Argentina Recovery Drink Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Recovery Drink Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Global Recovery Drink Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 41: Global Recovery Drink Market Revenue undefined Forecast, by Category 2020 & 2033

- Table 42: Global Recovery Drink Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 43: Global Recovery Drink Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 44: South Africa Recovery Drink Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: United Arab Emirates Recovery Drink Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East and Africa Recovery Drink Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Recovery Drink Market?

The projected CAGR is approximately 6.01%.

2. Which companies are prominent players in the Recovery Drink Market?

Key companies in the market include Abbott Nutrition, Oatly, Sufferfest Beer Company, PepsiCo Inc, Glanbia plc, Fluid Sports Nutrition*List Not Exhaustive, Mountain Fuel, Rockstar Inc.

3. What are the main segments of the Recovery Drink Market?

The market segments include Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Popularity of On-the-Go Snacking Options; Trend Of Clean Label and Plant-Based Bars.

6. What are the notable trends driving market growth?

Increased demand of organic recovery drinks.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Recovery Drink Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Recovery Drink Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Recovery Drink Market?

To stay informed about further developments, trends, and reports in the Recovery Drink Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence