Key Insights

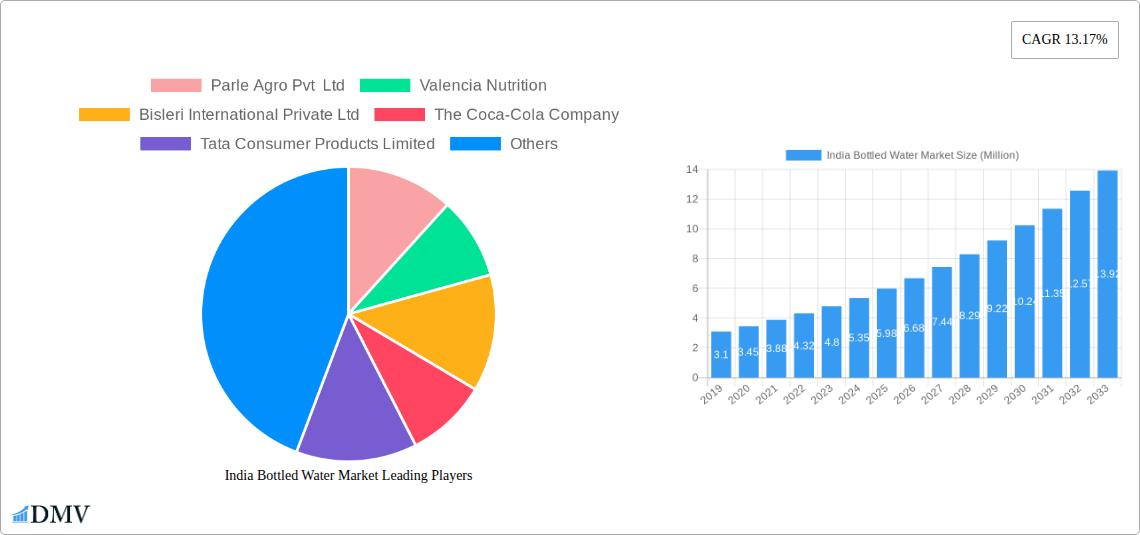

The India Bottled Water Market is poised for significant expansion, projected to reach USD 5.98 Billion by 2025, driven by a robust CAGR of 13.17% through 2033. This substantial growth is underpinned by several key factors, including increasing urbanization, a rising disposable income, and a growing health and wellness consciousness among Indian consumers. The demand for safe and hygienic drinking water, particularly in urban areas facing water quality challenges, continues to be a primary driver. Furthermore, the burgeoning middle class, coupled with a greater awareness of the benefits of hydration and the availability of premium and flavored variants, is fueling consumption. The "on-the-go" lifestyle prevalent in India also contributes to the sustained demand for convenient bottled water solutions. The market is witnessing a notable shift towards functional and fortified water products, catering to specific health needs and preferences, which represents a significant growth avenue.

India Bottled Water Market Market Size (In Million)

The market landscape is characterized by intense competition among established players and emerging brands, all vying for market share. Distribution channels play a crucial role, with off-trade segments, particularly supermarkets, hypermarkets, and online retail stores, witnessing accelerated growth due to their accessibility and wider product availability. While the market presents immense opportunities, certain restraints such as fluctuating raw material costs for packaging and the environmental concerns associated with single-use plastic bottles need to be strategically addressed by industry stakeholders. Innovations in sustainable packaging and the development of cost-effective solutions will be critical for long-term market sustainability and continued expansion. The strategic focus on expanding product portfolios to include flavored, fortified, and still water variants, alongside sparkling options, will continue to shape market dynamics and drive consumer engagement.

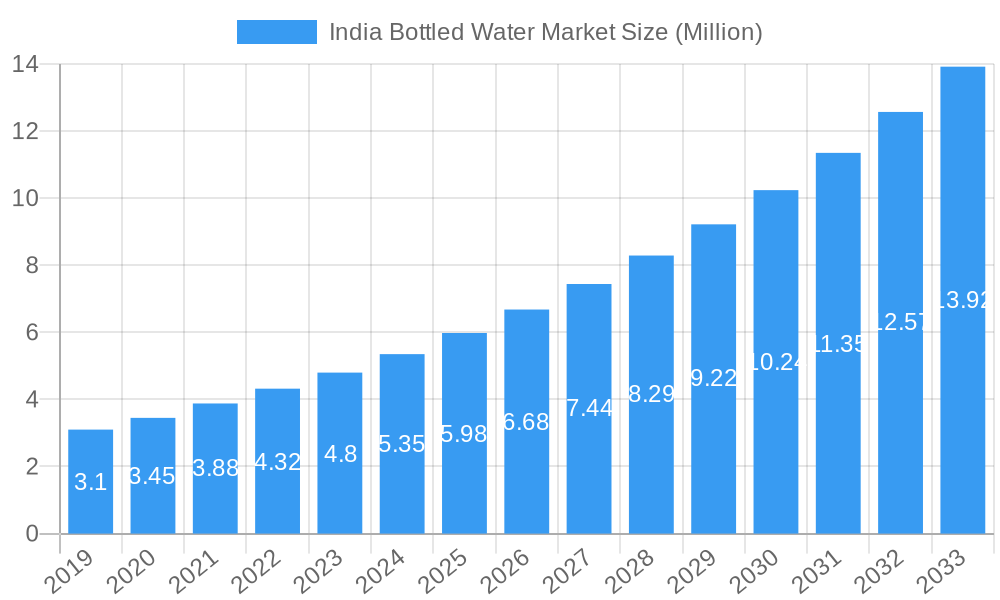

India Bottled Water Market Company Market Share

India Bottled Water Market: Comprehensive Insights & Future Outlook (2019-2033)

Gain a strategic advantage in the rapidly evolving India bottled water market with this definitive report. Covering the period from 2019 to 2033, with a deep dive into the base year of 2025 and an extensive forecast period of 2025-2033, this analysis offers unparalleled insights into market dynamics, growth drivers, and future potential. We meticulously examine the Indian packaged water industry, identifying key trends in still water, sparkling water, and functional/fortified/flavoured water. Understand the critical role of distribution channels, including on-trade and off-trade segments like supermarkets/hypermarkets, convenience/grocery stores, and online retail stores. This report is essential for stakeholders seeking to navigate the competitive landscape, driven by leading companies such as Parle Agro Pvt Ltd, Bisleri International Private Ltd, The Coca-Cola Company, Tata Consumer Products Limited, and PepsiCo Inc.

India Bottled Water Market Market Composition & Trends

The India bottled water market is characterized by a moderate to high degree of concentration, with established players holding significant market share. Innovation remains a key catalyst for growth, driven by increasing consumer demand for healthier and more convenient hydration options. The regulatory landscape, particularly concerning plastic waste management and food safety standards, is a crucial factor influencing market operations and strategic decision-making. Substitute products, such as tap water purification systems and other beverages, pose a competitive challenge, necessitating continuous product differentiation and value proposition enhancement. End-user profiles are diverse, ranging from health-conscious urban dwellers to rural populations seeking convenient access to safe drinking water. Merger and acquisition (M&A) activities are expected to play a role in market consolidation, with potential deal values influencing strategic partnerships and market entry strategies.

- Market Share Distribution: Dominated by key players, with emerging brands gaining traction in niche segments.

- Innovation Catalysts: Growing health consciousness, convenience, and premiumization trends.

- Regulatory Landscape: Focus on plastic waste reduction, recycling mandates, and quality control.

- Substitute Products: Tap water, home filtration systems, and other beverage categories.

- End-User Profiles: Urban millennials, health-conscious consumers, travelers, and rural populations.

- M&A Activities: Potential for consolidation and strategic alliances to expand market reach.

India Bottled Water Market Industry Evolution

The India bottled water market has witnessed remarkable evolution, driven by a confluence of economic, social, and technological advancements. From its nascent stages, the industry has transformed into a robust sector, projected to experience substantial growth rates in the coming years. The historical period of 2019–2024 saw steady expansion, fueled by increasing disposable incomes, urbanization, and a growing awareness of water quality concerns. Technological advancements in bottling, purification, and packaging have been pivotal in enhancing product quality and sustainability, thereby influencing adoption metrics. As the base year of 2025 arrives, the market stands poised for accelerated growth during the forecast period of 2025–2033. This expansion is underpinned by evolving consumer demands, with a noticeable shift towards healthier, fortified, and sustainably packaged options. The Indian packaged water industry is actively responding to these shifts by introducing innovative product lines and adopting eco-friendly manufacturing processes. The market's growth trajectory is further bolstered by effective distribution strategies that ensure widespread availability across diverse geographical regions and consumer demographics. The overall industry evolution paints a picture of a dynamic and responsive market, adept at adapting to changing consumer preferences and technological innovations, setting the stage for continued robust performance.

Leading Regions, Countries, or Segments in India Bottled Water Market

The India bottled water market exhibits distinct regional dominance and segment preferences, with Still Water emerging as the leading product type due to its widespread appeal and accessibility. The Off-Trade distribution channel, particularly Supermarkets/Hypermarkets, commands the largest market share, offering consumers a convenient and diverse selection of bottled water brands. However, the Online Retail Stores segment is experiencing rapid growth, reflecting the increasing digital penetration and changing shopping habits across India.

Key Drivers for Segment Dominance:

- Still Water:

- Consumer Preference: High demand for basic hydration needs.

- Cost-Effectiveness: Generally more affordable than specialized water types.

- Wide Availability: Produced and distributed by a vast majority of players.

- Off-Trade (Supermarkets/Hypermarkets):

- Convenience: One-stop shopping for household needs.

- Visibility: Prominent shelf space for leading brands.

- Promotional Activities: Frequent discounts and bulk purchase offers.

- Online Retail Stores:

- Growing E-commerce Penetration: Increasing adoption of online shopping.

- Product Variety & Price Comparison: Easy access to a wide range of brands and competitive pricing.

- Home Delivery Convenience: Appeal to busy urban consumers.

While Still Water dominates in volume, Functional/Fortified/Flavoured Water is a rapidly growing segment, catering to health-conscious consumers seeking added benefits like vitamins, minerals, or natural flavors. The On-Trade channel, encompassing hotels, restaurants, and cafes, remains a significant contributor, particularly for premium and flavored water variants, driven by the burgeoning HoReCa sector. Investment trends are leaning towards expanding production capacities for still water and innovating within the functional water space. Regulatory support for sustainable packaging is also influencing production and distribution strategies. The dominance of Still Water and Off-Trade channels is expected to continue, but the rapid expansion of Online Retail Stores and the premiumization trend in Functional/Fortified/Flavoured Water present significant growth opportunities.

India Bottled Water Market Product Innovations

Product innovation in the India bottled water market is increasingly focused on enhancing consumer well-being and environmental sustainability. The introduction of functional/fortified/flavoured water variants, enriched with essential vitamins, minerals, or natural fruit extracts, caters to the growing demand for health-conscious hydration solutions. Performance metrics for these products are measured by their perceived health benefits, taste profiles, and ingredient transparency. Furthermore, advancements in packaging technology are addressing environmental concerns, with a rise in eco-friendly materials, lightweight designs, and improved recyclability. Unique selling propositions often revolve around natural sourcing, purification techniques, and the absence of artificial additives. Technological advancements are enabling the development of smart packaging that can indicate water quality or temperature, further differentiating brands in a competitive market.

Propelling Factors for India Bottled Water Market Growth

The India bottled water market is propelled by several critical factors. Economic growth and rising disposable incomes lead to increased consumer spending on packaged goods, including bottled water. Urbanization drives demand for convenient and safe hydration solutions in densely populated areas. Growing health and wellness consciousness fuels the consumption of functional/fortified/flavoured water, as consumers seek added health benefits. Government initiatives promoting safe drinking water access and increasing awareness of waterborne diseases also contribute significantly. Furthermore, technological advancements in purification and packaging enhance product quality and shelf-life, making bottled water a reliable choice for consumers. The robust expansion of the retail infrastructure, both traditional and online, ensures wider accessibility.

Obstacles in the India Bottled Water Market Market

Despite robust growth, the India bottled water market faces several obstacles. Stringent regulations regarding plastic packaging and waste management impose compliance costs and necessitate investment in sustainable solutions. Intense competition from both organized and unorganized players, including local bottlers, can lead to price wars and reduced profit margins. Supply chain disruptions, particularly in raw material procurement and logistics, can impact production and delivery efficiency. Economic downturns and fluctuating currency exchange rates can affect import costs for machinery and packaging materials. Furthermore, consumer skepticism regarding the actual benefits of some premium bottled water products and the availability of affordable tap water in some regions act as restraints.

Future Opportunities in India Bottled Water Market

The India bottled water market presents significant future opportunities. The expanding middle class and rising disposable incomes will continue to drive demand for both standard and premium bottled water. The growing health and wellness trend will fuel the growth of the functional/fortified/flavoured water segment, with opportunities for specialized formulations catering to specific health needs (e.g., immunity, hydration for athletes). The increasing adoption of e-commerce opens new avenues for direct-to-consumer sales and wider product reach. There is also a growing opportunity in developing and marketing sustainable packaging solutions, including biodegradable or plant-based materials, to meet environmental consciousness. Penetrating underserved rural markets with affordable and accessible options also presents a substantial growth avenue.

Major Players in the India Bottled Water Market Ecosystem

- Parle Agro Pvt Ltd

- Valencia Nutrition

- Bisleri International Private Ltd

- The Coca-Cola Company

- Tata Consumer Products Limited

- PepsiCo Inc

- DS Group

- The Manikchand Group

- AV Organics Private Ltd

- Narang Group

Key Developments in India Bottled Water Market Industry

- September 2024: Bisleri International partnered with the Goa government to enhance plastic waste management in Mormugao. The collaboration, solidified at the Green Goa Summit 2024, aims to improve waste collection, segregation, and recycling processes under the CSR initiative, 'Bottles for Change'.

- August 2024: Bisleri International forged a strategic partnership with the Professional Golf Tour of India (PGTI) to become the Official Hydration Partner. The collaboration spans across 15 tournaments in India at some of the most challenging and prestigious golf courses.

- August 2024: As part of its expansion, EVOCUS partnered with prominent hotel chains, including Marriott, Radisson, Taj, Hyatt, and Accor. Additionally, the company collaborated with hospitality groups such as Impresario Entertainment and Hospitality and Specialty Restaurants. Through these strategic partnerships, EVOCUS broadened its market reach, establishing a presence in over 250 HoReCa outlets throughout India.

Strategic India Bottled Water Market Market Forecast

The strategic India bottled water market forecast indicates a promising future, driven by sustained economic development and evolving consumer lifestyles. The increasing demand for convenience and health-centric products, particularly functional/fortified/flavoured water, will be a significant growth catalyst. Investments in sustainable packaging and efficient supply chain management will be crucial for long-term success. The expansion of online retail channels presents a vast opportunity to reach a wider consumer base. Addressing environmental concerns through innovative recycling programs and eco-friendly practices will be paramount, shaping brand perception and market leadership. The Indian packaged water industry is poised for continued robust growth, offering substantial returns for strategic investors and market participants.

India Bottled Water Market Segmentation

-

1. Product Type

- 1.1. Still Water

- 1.2. Sparkling Water

- 1.3. Functional/Fortified/Flavoured Water

-

2. Distribution Channel

- 2.1. On-Trade

-

2.2. Off-Trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience/Grocery Stores

- 2.2.3. Online Retail Stores

India Bottled Water Market Segmentation By Geography

- 1. India

India Bottled Water Market Regional Market Share

Geographic Coverage of India Bottled Water Market

India Bottled Water Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Tourism and Hospitality Sectors; Scarcity of Safe Drinking Water

- 3.3. Market Restrains

- 3.3.1. Expanding Tourism and Hospitality Sectors; Scarcity of Safe Drinking Water

- 3.4. Market Trends

- 3.4.1. Still Water Is In High Demand In India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Bottled Water Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Still Water

- 5.1.2. Sparkling Water

- 5.1.3. Functional/Fortified/Flavoured Water

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience/Grocery Stores

- 5.2.2.3. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Parle Agro Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Valencia Nutrition

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bisleri International Private Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Coca-Cola Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tata Consumer Products Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PepsiCo Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DS Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Manikchand Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AV Organics Private Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Narang Group*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Parle Agro Pvt Ltd

List of Figures

- Figure 1: India Bottled Water Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Bottled Water Market Share (%) by Company 2025

List of Tables

- Table 1: India Bottled Water Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: India Bottled Water Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: India Bottled Water Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: India Bottled Water Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: India Bottled Water Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Bottled Water Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: India Bottled Water Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: India Bottled Water Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: India Bottled Water Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: India Bottled Water Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: India Bottled Water Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Bottled Water Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Bottled Water Market?

The projected CAGR is approximately 13.17%.

2. Which companies are prominent players in the India Bottled Water Market?

Key companies in the market include Parle Agro Pvt Ltd, Valencia Nutrition, Bisleri International Private Ltd, The Coca-Cola Company, Tata Consumer Products Limited, PepsiCo Inc, DS Group, The Manikchand Group, AV Organics Private Ltd, Narang Group*List Not Exhaustive.

3. What are the main segments of the India Bottled Water Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Tourism and Hospitality Sectors; Scarcity of Safe Drinking Water.

6. What are the notable trends driving market growth?

Still Water Is In High Demand In India.

7. Are there any restraints impacting market growth?

Expanding Tourism and Hospitality Sectors; Scarcity of Safe Drinking Water.

8. Can you provide examples of recent developments in the market?

September 2024: Bisleri International partnered with the Goa government to enhance plastic waste management in Mormugao. The collaboration, solidified at the Green Goa Summit 2024, aims to improve waste collection, segregation, and recycling processes under the CSR initiative, 'Bottles for Change'.August 2024: Bisleri International forged a strategic partnership with the Professional Golf Tour of India (PGTI) to become the Official Hydration Partner. The collaboration spans across 15 tournaments in India at some of the most challenging and prestigious golf courses.August 2024: As part of its expansion, EVOCUS partnered with prominent hotel chains, including Marriott, Radisson, Taj, Hyatt, and Accor. Additionally, the company collaborated with hospitality groups such as Impresario Entertainment and Hospitality and Specialty Restaurants. Through these strategic partnerships, EVOCUS broadened its market reach, establishing a presence in over 250 HoReCa outlets throughout India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Bottled Water Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Bottled Water Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Bottled Water Market?

To stay informed about further developments, trends, and reports in the India Bottled Water Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence