Key Insights

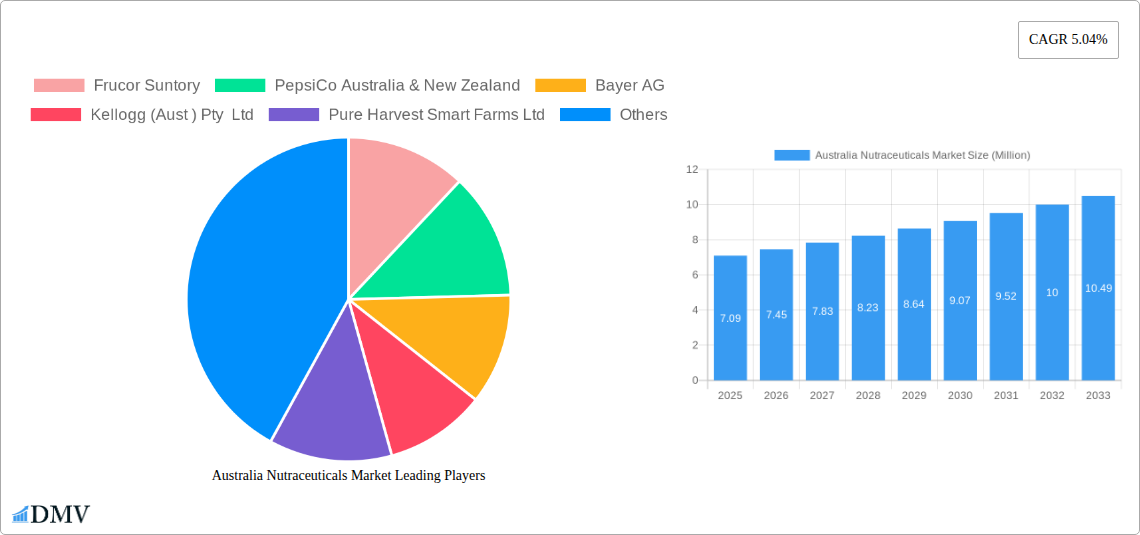

The Australian nutraceuticals market is poised for substantial growth, projected to reach $7.09 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.04% expected to propel it through 2033. This expansion is underpinned by a growing consumer awareness of preventative health and wellness, driving demand for products that offer specific health benefits beyond basic nutrition. Key market drivers include an aging population seeking to manage age-related health concerns, increasing prevalence of lifestyle diseases such as obesity and diabetes, and a heightened focus on immunity and mental well-being post-pandemic. Consumers are actively seeking functional foods and beverages, as well as dietary supplements, to integrate into their daily routines for enhanced health outcomes. The rising disposable incomes in Australia further support consumer spending on premium health-oriented products.

Australia Nutraceuticals Market Market Size (In Million)

The market's trajectory is further shaped by evolving consumer preferences towards natural and scientifically-backed ingredients. Trends such as the demand for plant-based functional foods, personalized nutrition solutions, and convenient, ready-to-consume formats are influencing product development and innovation. While the market is largely driven by increasing health consciousness, certain restraints could impede its full potential. These may include stringent regulatory frameworks governing health claims and product approvals, and price sensitivity among a segment of consumers for premium nutraceutical products. However, the expanding distribution channels, particularly the significant growth in online retail, are making nutraceuticals more accessible than ever before. Key segments such as Functional Foods and Dietary Supplements are expected to witness considerable traction, catering to diverse health needs across various demographic groups.

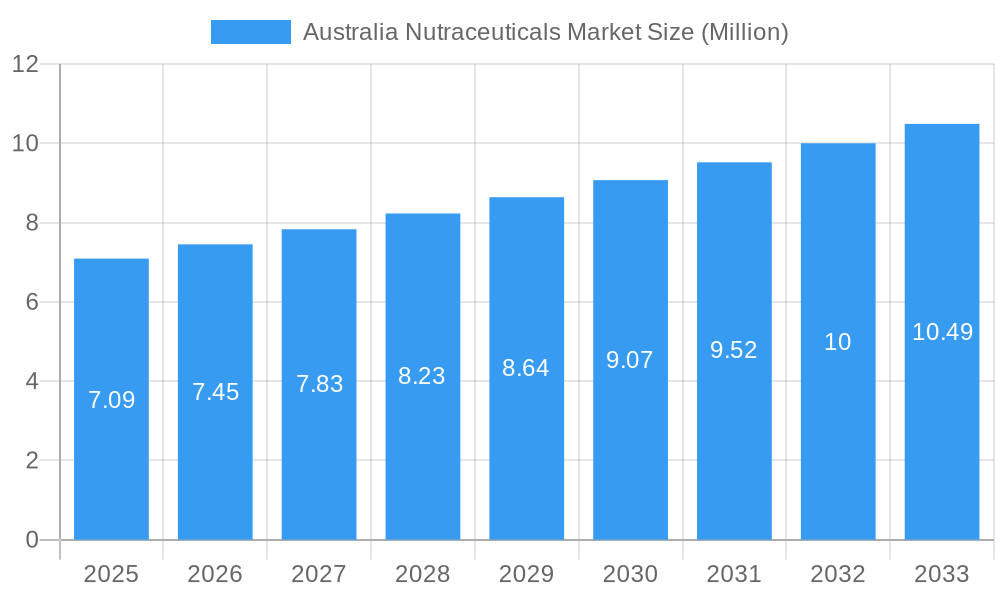

Australia Nutraceuticals Market Company Market Share

Gain unparalleled insights into the dynamic Australia Nutraceuticals Market with our in-depth report. This essential resource provides a detailed examination of market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, and future opportunities. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report is crucial for stakeholders seeking to navigate and capitalize on the burgeoning Australian nutraceuticals sector. Discover key trends, competitive landscapes, and strategic imperatives for success in this high-growth industry.

Australia Nutraceuticals Market Market Composition & Trends

The Australia Nutraceuticals Market exhibits a moderate concentration, with key players like Frucor Suntory, PepsiCo Australia & New Zealand, and Bayer AG holding significant market share. Innovation is primarily driven by a growing consumer demand for preventive healthcare and natural ingredients. Regulatory frameworks, overseen by bodies like the Therapeutic Goods Administration (TGA) and Food Standards Australia New Zealand (FSANZ), play a pivotal role in shaping product claims and market entry. Substitute products, such as conventional pharmaceuticals and general health foods, pose a competitive challenge. End-user profiles are diverse, ranging from health-conscious millennials and Gen Z seeking functional beverages and supplements to older demographics focused on specific health concerns addressed by dietary supplements. Mergers and acquisitions (M&A) are becoming increasingly strategic, as seen in recent consolidation activities aimed at expanding product portfolios and market reach. For instance, anticipated M&A deals in the next five years are projected to exceed $XXX Million in value, reflecting the market's attractiveness.

- Market Share Distribution: While specific figures fluctuate, the top 5-7 players collectively account for approximately 60-70% of the market.

- Innovation Catalysts: Increased consumer awareness of health benefits, rising disposable incomes, and advancements in food science and biotechnology.

- Regulatory Landscape: Strict guidelines on health claims, ingredient sourcing, and product manufacturing to ensure consumer safety and product efficacy.

- Substitute Products: Traditional medicines, general health foods with no specific functional claims, and emerging wellness services.

- End-User Profiles: Young adults prioritizing energy and sports nutrition, middle-aged individuals focusing on chronic disease prevention, and seniors seeking joint health and cognitive support.

- M&A Activities: Focus on acquiring innovative startups, expanding into niche product categories, and enhancing distribution networks. Projected M&A deal value in the next five years: $XXX Million.

Australia Nutraceuticals Market Industry Evolution

The Australia Nutraceuticals Market has witnessed remarkable growth and evolution over the historical period of 2019-2024, driven by a confluence of factors that continue to shape its trajectory through the forecast period of 2025-2033. Initial growth was spurred by an increasing consumer consciousness regarding health and wellness, a trend amplified by global health events. This led to a sustained demand for products that offer benefits beyond basic nutrition, such as enhanced immunity, improved gut health, and better cognitive function. The market's evolution is also intrinsically linked to technological advancements in ingredient extraction, formulation, and delivery systems, enabling the creation of more potent, bioavailable, and palatable nutraceutical products. For example, advancements in encapsulation technologies have significantly improved the shelf-life and efficacy of certain active ingredients in dietary supplements.

Consumer demand has shifted considerably, moving away from generic health supplements towards specialized products tailored to specific health needs and lifestyle preferences. This includes a surge in demand for plant-based nutraceuticals, probiotics, prebiotics, and adaptogens, reflecting a broader societal shift towards natural and sustainable living. The functional beverage segment, in particular, has experienced explosive growth, with innovations in energy drinks, sports drinks, and fortified juices catering to active lifestyles and the need for convenient health solutions. The base year of 2025 is expected to see the market size reach approximately $XXX Million, with a projected Compound Annual Growth Rate (CAGR) of XX.X% during the forecast period.

Key milestones in this evolution include the increasing sophistication of product claims, supported by a growing body of scientific research. Regulatory bodies have adapted, albeit sometimes slowly, to accommodate the growing market while maintaining consumer protection. The retail landscape has also transformed, with a significant rise in online retail channels complementing traditional brick-and-mortar stores like supermarkets, hypermarkets, and specialty health stores. This digital shift has democratized access to a wider range of nutraceutical products, further accelerating market penetration. The industry's ability to adapt to these shifting demands, coupled with continuous innovation, has positioned the Australia Nutraceuticals Market as a robust and expanding sector within the broader healthcare and food industries. The projected market value in 2033 is estimated to be $XXX Million.

Leading Regions, Countries, or Segments in Australia Nutraceuticals Market

The Australia Nutraceuticals Market is characterized by a dominant performance across several key segments and distribution channels, with specific regions exhibiting higher growth potential. While Australia as a whole is the primary market, the segmentation by Product Type reveals that Dietary Supplements are currently leading in terms of market share and projected growth. This dominance is driven by a deeply ingrained consumer habit of seeking targeted health solutions through capsules, tablets, and powders. Within Dietary Supplements, Vitamins and Minerals constitute the largest sub-segments due to their broad appeal and recognized health benefits. Botanicals are also experiencing significant growth, fueled by the "natural" trend and increasing consumer trust in herbal remedies. The Functional Beverage segment is a close second and is rapidly gaining ground, particularly Energy Drinks and Dairy and Dairy Alternative Beverages, which cater to on-the-go lifestyles and the growing demand for plant-based options.

The Distribution Channel landscape showcases Supermarkets/Hypermarkets as the leading channel due to their extensive reach and convenience for everyday grocery shopping. However, Online Retail Stores are exhibiting the most rapid growth, driven by ease of access, wider product selection, and competitive pricing. Drug Stores/Pharmacies also play a crucial role, particularly for products perceived to have medicinal or therapeutic benefits, leveraging their credibility in health advice. Specialty Stores cater to niche markets and premium products, offering curated selections for discerning consumers.

Dominance factors for these segments are multifaceted. For Dietary Supplements, the key drivers include:

- Investment Trends: Significant R&D investment by major players in developing new formulations and efficacy studies. Estimated investment in R&D for new supplements: $XXX Million annually.

- Regulatory Support: While stringent, clear guidelines for dietary supplements facilitate market entry for compliant products.

- Consumer Demand: A proactive approach to health management, leading consumers to seek preventive and therapeutic solutions.

- Product Availability: Wide availability across multiple distribution channels, from pharmacies to online platforms.

For Functional Beverages, the drivers are:

- Lifestyle Trends: Increased participation in sports and fitness activities, coupled with a demand for convenient and healthy on-the-go options.

- Product Innovation: Continuous introduction of new flavors, functional ingredients (e.g., adaptogens, nootropics), and sugar-free alternatives.

- Marketing & Promotion: Aggressive marketing campaigns by major beverage companies targeting younger demographics.

The Online Retail Stores channel's dominance is propelled by:

- E-commerce Penetration: High internet and smartphone usage across Australia.

- Convenience and Accessibility: 24/7 shopping, home delivery, and a wider range of international and niche products.

- Personalization: Algorithms and targeted marketing that offer personalized product recommendations.

- Price Competitiveness: Often offer discounts and promotions that attract price-sensitive consumers.

The Functional Food segment, while not leading, is also growing, with snacks and dairy products being popular categories. The "Other Functional Foods" sub-segment, encompassing fortified cereals and baked goods, contributes steadily to the market's overall expansion. The estimated market size for Dietary Supplements in 2025 is $XXX Million, while Functional Beverages are projected to reach $XXX Million. Online Retail Stores are anticipated to capture XX% of the total nutraceutical sales by 2033.

Australia Nutraceuticals Market Product Innovations

The Australia Nutraceuticals Market is a hotbed of innovation, with companies consistently introducing novel products and applications to meet evolving consumer demands. Recent advancements include the development of targeted delivery systems for enhanced bioavailability of active ingredients, such as microencapsulation for probiotics and liposomal technology for fat-soluble vitamins. Product innovations are increasingly focusing on personalized nutrition, with brands exploring genetic testing and AI-driven recommendations to tailor supplement regimens. Furthermore, the integration of novel superfoods and functional ingredients like adaptogens, nootropics, and plant-based proteins into beverages, snacks, and supplements is a significant trend. For example, the introduction of specialized gut health formulas, cognitive enhancers, and immunity-boosting elixirs with scientifically backed claims are gaining traction. The performance metrics for these innovations are often measured by increased absorption rates, targeted efficacy, and positive consumer feedback on perceived benefits and taste profiles.

Propelling Factors for Australia Nutraceuticals Market Growth

The Australia Nutraceuticals Market is propelled by several robust growth factors. A primary driver is the escalating consumer awareness and proactive approach towards health and wellness, fueled by a desire for preventive healthcare solutions. This is further amplified by an aging population, which seeks to manage chronic conditions and maintain a higher quality of life through dietary interventions. Technological advancements in product formulation and ingredient sourcing enable the development of more efficacious and palatable nutraceuticals, increasing consumer adoption. The expanding online retail infrastructure provides unprecedented accessibility to a wider range of products, breaking down geographical barriers. Furthermore, supportive government initiatives and increasing disposable incomes contribute significantly to the market's upward trajectory.

- Rising Health Consciousness: Proactive health management and demand for preventive solutions.

- Aging Population: Increased focus on managing age-related health issues like joint health and cognitive decline.

- Technological Advancements: Improved bioavailability, novel ingredients, and personalized formulations.

- E-commerce Expansion: Enhanced accessibility and convenience through online platforms.

- Economic Factors: Growing disposable incomes and a willingness to invest in health.

Obstacles in the Australia Nutraceuticals Market Market

Despite its promising growth, the Australia Nutraceuticals Market faces certain obstacles. Stringent regulatory frameworks, while ensuring safety, can sometimes lead to lengthy approval processes and limitations on product claims, hindering rapid innovation and market entry. Supply chain disruptions, exacerbated by global events, can impact the availability and cost of key raw materials, affecting production and pricing. Intense competition from both established players and emerging brands necessitates significant marketing investments to capture consumer attention and build brand loyalty. Furthermore, consumer skepticism and the need for robust scientific validation for all product claims can pose challenges in gaining widespread trust.

- Regulatory Hurdles: Lengthy approval processes and restrictions on health claims.

- Supply Chain Volatility: Dependence on global sourcing and potential disruptions.

- Intense Competition: High marketing costs and the need for effective differentiation.

- Consumer Skepticism: Demand for clear scientific evidence and avoidance of misleading claims.

Future Opportunities in Australia Nutraceuticals Market

The Australia Nutraceuticals Market is ripe with future opportunities. The burgeoning trend of personalized nutrition, driven by advancements in genomics and AI, presents a significant avenue for growth, allowing consumers to receive tailored supplement recommendations. The increasing demand for sustainable and ethically sourced ingredients opens doors for brands that prioritize eco-friendly practices and transparent sourcing. Emerging markets within the nutraceuticals space, such as the mental wellness and stress management segment, are poised for substantial expansion. Furthermore, collaborations between nutraceutical companies, healthcare providers, and research institutions can lead to the development of more scientifically validated and integrated health solutions. The rise of the "food as medicine" concept also presents opportunities for incorporating nutraceutical benefits into everyday food products.

- Personalized Nutrition: Leveraging genomics and AI for bespoke health solutions.

- Sustainable & Ethical Sourcing: Meeting consumer demand for environmentally conscious products.

- Mental Wellness & Stress Management: Addressing growing concerns around mental health.

- Cross-Industry Collaborations: Integrating nutraceuticals with healthcare and research.

- "Food as Medicine" Trend: Embedding functional benefits into staple food items.

Major Players in the Australia Nutraceuticals Market Ecosystem

- Frucor Suntory

- PepsiCo Australia & New Zealand

- Bayer AG

- Kellogg (Aust ) Pty Ltd

- Pure Harvest Smart Farms Ltd

- Pharmacare Laboratories Pty Ltd

- Remedy Drinks

- General Mills Australia Pty Ltd

- GlaxoSmithKline Plc

- Health & Happiness (H&H) International Holdings Ltd

- Herbalife Australia

- Nestle Australia Ltd

Key Developments in Australia Nutraceuticals Market Industry

- October 2022: Remedy Drinks introduced Remedy K! CK, an all-natural clean energy drink available at 7-Eleven stores across Australia. Remedy K! CK is available in three fruity flavors - Blackberry, Lemon Lime, and Mango Pineapple. This launch directly tapped into the growing demand for healthier energy drink alternatives.

- July 2022: PureHarvest, an Australian organic and natural food company, launched four new plant-based kinds of milk. The PureHarvest family now includes Organic Hazelnut Milk, Organic Cashew Milk, Australian Macadamia Milk, Creamy Oat Milk, and Organic Cashew Milk, adding to existing Almond, Oat, Soy, Rice, and Coconut milk options. This expansion caters to the increasing consumer preference for plant-based diets and dairy alternatives.

- June 2021: V Energy launched its new 'Can You Feel It' campaign in collaboration with Clemenger BBDO and Psyop, an award-winning animation production company; this campaign celebrates feeling your best and spreading positive vibes. This marketing initiative aimed to strengthen its brand positioning within the functional beverage market by connecting with consumers on an emotional level and emphasizing the positive impacts of their products on well-being.

Strategic Australia Nutraceuticals Market Market Forecast

The strategic forecast for the Australia Nutraceuticals Market indicates sustained and robust growth, driven by an escalating consumer focus on health and wellness. Key opportunities lie in the personalization of health solutions, leveraging data analytics and emerging technologies to offer tailored dietary supplements and functional foods. The increasing demand for plant-based and sustainable products will continue to shape product development and marketing strategies. Furthermore, the integration of nutraceuticals into everyday food and beverage choices, aligning with the "food as medicine" trend, presents a significant expansion potential. Strategic partnerships and a commitment to scientific validation will be crucial for building consumer trust and navigating the evolving regulatory landscape, ensuring continued market penetration and value creation through 2033.

Australia Nutraceuticals Market Segmentation

-

1. Product Type

-

1.1. Functional Food

- 1.1.1. Cereals

- 1.1.2. Bakery and Confectionery

- 1.1.3. Dairy

- 1.1.4. Snacks

- 1.1.5. Other Functional Foods

-

1.2. Functional Beverage

- 1.2.1. Energy Drinks

- 1.2.2. Sports Drinks

- 1.2.3. Fortified Juice

- 1.2.4. Dairy and Dairy Alternative Beverages

- 1.2.5. Other Functional Beverages

-

1.3. Dietary Supplements

- 1.3.1. Vitamins

- 1.3.2. Minerals

- 1.3.3. Botanicals

- 1.3.4. Enzymes

- 1.3.5. Fatty Acids

- 1.3.6. Proteins

- 1.3.7. Other Dietary Supplements

-

1.1. Functional Food

-

2. Distribution Channel

- 2.1. Specialty Stores

- 2.2. Supermarkets/Hypermarkets

- 2.3. Convenience Stores

- 2.4. Drug Stores/Pharmacies

- 2.5. Online Retail Stores

Australia Nutraceuticals Market Segmentation By Geography

- 1. Australia

Australia Nutraceuticals Market Regional Market Share

Geographic Coverage of Australia Nutraceuticals Market

Australia Nutraceuticals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Organic Ingredients in the Food Industry; Increasing Popularity of "Super Fruit" Ingredients in Functional Foods and Beverages

- 3.3. Market Restrains

- 3.3.1. Stringent Food Safety Regulations

- 3.4. Market Trends

- 3.4.1. Increasing Elderly Population boosting Nutraceuticals Market in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Nutraceuticals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Functional Food

- 5.1.1.1. Cereals

- 5.1.1.2. Bakery and Confectionery

- 5.1.1.3. Dairy

- 5.1.1.4. Snacks

- 5.1.1.5. Other Functional Foods

- 5.1.2. Functional Beverage

- 5.1.2.1. Energy Drinks

- 5.1.2.2. Sports Drinks

- 5.1.2.3. Fortified Juice

- 5.1.2.4. Dairy and Dairy Alternative Beverages

- 5.1.2.5. Other Functional Beverages

- 5.1.3. Dietary Supplements

- 5.1.3.1. Vitamins

- 5.1.3.2. Minerals

- 5.1.3.3. Botanicals

- 5.1.3.4. Enzymes

- 5.1.3.5. Fatty Acids

- 5.1.3.6. Proteins

- 5.1.3.7. Other Dietary Supplements

- 5.1.1. Functional Food

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Specialty Stores

- 5.2.2. Supermarkets/Hypermarkets

- 5.2.3. Convenience Stores

- 5.2.4. Drug Stores/Pharmacies

- 5.2.5. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Frucor Suntory

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PepsiCo Australia & New Zealand

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bayer AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kellogg (Aust ) Pty Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pure Harvest Smart Farms Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pharmacare Laboratories Pty Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Remedy Drinks

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Mills Australia Pty Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GlaxoSmithKline Plc*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Health & Happiness (H&H) International Holdings Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Herbalife Australia

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Nestle Australia Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Frucor Suntory

List of Figures

- Figure 1: Australia Nutraceuticals Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Nutraceuticals Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Nutraceuticals Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Australia Nutraceuticals Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Australia Nutraceuticals Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australia Nutraceuticals Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Australia Nutraceuticals Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Australia Nutraceuticals Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Nutraceuticals Market?

The projected CAGR is approximately 5.04%.

2. Which companies are prominent players in the Australia Nutraceuticals Market?

Key companies in the market include Frucor Suntory, PepsiCo Australia & New Zealand, Bayer AG, Kellogg (Aust ) Pty Ltd, Pure Harvest Smart Farms Ltd, Pharmacare Laboratories Pty Ltd, Remedy Drinks, General Mills Australia Pty Ltd, GlaxoSmithKline Plc*List Not Exhaustive, Health & Happiness (H&H) International Holdings Ltd, Herbalife Australia, Nestle Australia Ltd.

3. What are the main segments of the Australia Nutraceuticals Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Organic Ingredients in the Food Industry; Increasing Popularity of "Super Fruit" Ingredients in Functional Foods and Beverages.

6. What are the notable trends driving market growth?

Increasing Elderly Population boosting Nutraceuticals Market in the Country.

7. Are there any restraints impacting market growth?

Stringent Food Safety Regulations.

8. Can you provide examples of recent developments in the market?

In October 2022, Remedy Drinks introduced Remedy K! CK, an all-natural clean energy drink available at 7-Eleven stores across Australia. Remedy K! CK is available in three fruity flavors - Blackberry, Lemon Lime, and Mango Pineapple.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Nutraceuticals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Nutraceuticals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Nutraceuticals Market?

To stay informed about further developments, trends, and reports in the Australia Nutraceuticals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence