Key Insights

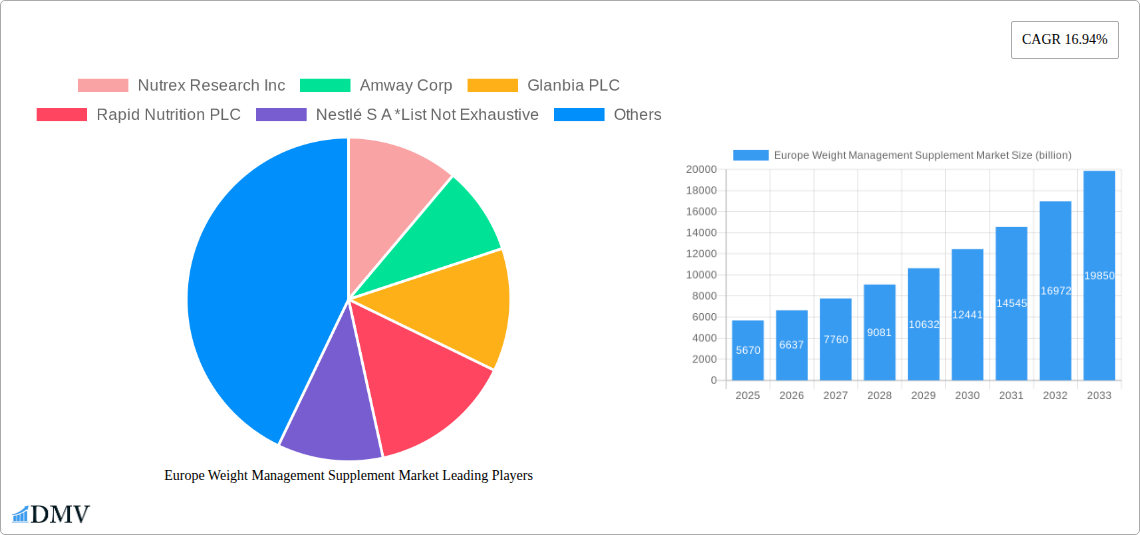

The Europe Weight Management Supplement Market is poised for significant expansion, projected to reach an impressive USD 5.67 billion in 2025. This robust growth is underpinned by a compelling compound annual growth rate (CAGR) of 16.94%, indicating a dynamic and expanding sector. The market is fueled by a growing consumer consciousness around health and wellness, leading to increased demand for solutions that support weight loss and maintenance. Key drivers include rising obesity rates across Europe, a proactive shift towards healthier lifestyles, and a greater acceptance and integration of dietary supplements into daily routines. The convenience and perceived efficacy of these supplements, coupled with increasing disposable incomes and sophisticated marketing efforts by manufacturers, are further propelling market growth. Consumers are actively seeking products that align with their wellness goals, ranging from appetite control to metabolic enhancement.

Europe Weight Management Supplement Market Market Size (In Billion)

The market's diverse segments reflect varied consumer needs and preferences. Within the Food and Beverage category, meal replacement products, including bars, ready-to-drink (RTD) beverages, and soups, are gaining traction due to their convenience and structured approach to calorie intake. Slimming teas also continue to hold a steady consumer base. The Supplements segment, encompassing capsules, softgels, powders, and tablets, is experiencing substantial innovation, with a focus on scientifically backed formulations and natural ingredients. Distribution channels are also evolving, with online retail stores emerging as a dominant force, offering wider accessibility and a plethora of choices. Supermarkets and hypermarkets remain significant, while pharmacies cater to consumers seeking trusted, often clinically supported, options. Specialty stores also play a role in reaching niche consumer groups.

Europe Weight Management Supplement Market Company Market Share

Europe Weight Management Supplement Market: Comprehensive Growth Analysis & Strategic Forecast (2019–2033)

Unlock the future of the European weight management supplement market with this in-depth report. Spanning from 2019 to 2033, with a base year of 2025, this study meticulously analyzes market dynamics, pivotal industry trends, and strategic opportunities. Discover the burgeoning demand for effective weight management solutions driven by rising obesity rates, health consciousness, and innovative product development. This report is an indispensable tool for stakeholders seeking to capitalize on the projected xx billion market by 2033.

Europe Weight Management Supplement Market Market Composition & Trends

The European weight management supplement market is characterized by a moderate concentration, with key players actively engaging in product innovation and strategic expansions. Innovation catalysts include a growing consumer demand for natural and scientifically backed ingredients, alongside advancements in delivery systems. The regulatory landscape, while stringent, is evolving to accommodate novel ingredients and claims. Substitute products, such as prescription weight loss drugs and bariatric surgery, present a competitive challenge, yet the accessibility and perceived affordability of supplements maintain their strong market position. End-user profiles are diverse, encompassing health-conscious individuals, fitness enthusiasts, and those seeking to manage chronic conditions linked to weight. Mergers and acquisitions (M&A) activities, while not pervasive, are strategically aimed at expanding product portfolios and market reach, with deal values projected to influence market consolidation. The market share distribution is dynamic, with a significant portion held by established brands and a growing segment attributed to emerging niche players.

Europe Weight Management Supplement Market Industry Evolution

The European weight management supplement market has witnessed a significant evolutionary trajectory over the historical period of 2019-2024, driven by a confluence of escalating health consciousness, a rise in lifestyle-related diseases, and advancements in scientific research. The market's growth trajectory has been consistently upward, fueled by an increasing awareness among consumers regarding the importance of maintaining a healthy weight for overall well-being and disease prevention. This heightened awareness has translated into a surging demand for dietary supplements and functional foods that aid in weight loss, fat reduction, and appetite control. Technological advancements have played a pivotal role, with manufacturers continuously innovating to develop more effective and convenient product formulations. This includes the development of novel delivery systems such as advanced capsules, powders with improved mixability, and ready-to-drink (RTD) meal replacements that offer sustained energy release and satiety. The adoption metrics for these advanced formulations have been robust, indicating a positive consumer reception. Shifting consumer demands have also shaped the industry. There is a discernible trend towards natural and organic ingredients, with consumers actively seeking products free from artificial additives and fillers. Furthermore, personalized nutrition and functional ingredients that offer multifaceted benefits beyond weight management, such as improved digestion, enhanced mood, and better sleep, are gaining traction. The market has also seen a rise in demand for science-backed products, with consumers increasingly scrutinizing the efficacy and safety of ingredients, often influenced by clinical studies and endorsements. The growing prevalence of obesity and overweight conditions across Europe, coupled with an aging population that is more susceptible to weight-related health issues, continues to be a primary growth driver. This persistent health challenge necessitates sustainable and accessible solutions, which the weight management supplement market aims to provide. The industry's evolution is also marked by increased investment in research and development, leading to a wider array of product offerings catering to diverse dietary preferences and lifestyle needs, including plant-based and vegan options, further broadening the market's appeal and growth potential.

Leading Regions, Countries, or Segments in Europe Weight Management Supplement Market

The dominance within the Europe Weight Management Supplement Market is a multifaceted phenomenon, influenced by a complex interplay of consumer demographics, purchasing power, regulatory frameworks, and distribution infrastructure. While a definitive single dominant region or country can be elusive due to market fragmentation and the interconnectedness of the European Union, Germany consistently emerges as a powerhouse in terms of market size and consumer engagement with weight management products. Its large and affluent population, coupled with a strong emphasis on health and wellness, fuels substantial demand across various segments.

Key Drivers of Dominance (Germany):

- High Consumer Spending on Health & Wellness: German consumers exhibit a strong propensity to invest in health-conscious products, including supplements and functional foods for weight management.

- Robust Regulatory Framework: While stringent, Germany's regulatory environment fosters trust in approved products, encouraging consistent consumer adoption.

- Extensive Retail Penetration: The presence of numerous supermarkets, hypermarkets, and pharmacies ensures widespread accessibility to weight management products, catering to diverse consumer shopping habits.

- Awareness of Lifestyle Diseases: A high prevalence of lifestyle-related health concerns drives proactive engagement with weight management solutions.

Delving into specific segments, Supplements, particularly Capsules/Softgels, have historically commanded a significant market share. This dominance stems from their convenience, precise dosage, and the perceived efficacy of concentrated active ingredients. Consumers often associate capsule-based supplements with targeted nutritional support for weight loss, fat metabolism, and appetite suppression. The ability to encapsulate a wide range of active compounds, including herbal extracts, vitamins, minerals, and protein isolates, makes this format highly versatile and appealing.

In parallel, the Food and Beverage segment, specifically Meal Replacements in RTD Products and Bars, is experiencing robust growth. The convenience and portion-controlled nature of these products align perfectly with busy modern lifestyles, offering a practical solution for individuals aiming to manage calorie intake and maintain satiety throughout the day. The increasing demand for on-the-go healthy options further propels the RTD and bar sub-segments.

The Distribution Channel landscape showcases a blend of traditional and digital influence. Online Retail Stores are rapidly ascending in importance, offering unparalleled convenience, wider product selection, and competitive pricing, thereby attracting a significant and growing consumer base. However, Supermarkets/Hypermarkets and Pharmacies continue to play a crucial role, providing immediate access and a level of consumer trust, especially for established brands and those seeking professional advice. The dominance of online channels is particularly evident in urban centers and among younger demographics.

Dominance Factors Analysis:

The supremacy of Germany is underpinned by its economic stability and a well-educated populace that actively seeks information about health and nutrition. This demographic is receptive to scientifically validated claims and innovative product formulations. The country's sophisticated retail infrastructure ensures that products, whether traditional supplements or convenient meal replacements, reach consumers efficiently through a variety of channels.

The preference for Capsules/Softgels within the supplement category is driven by their ease of use and the perception of contained efficacy. Consumers value the ability to incorporate specific nutrient blends into their daily routine without the need for extensive preparation. This format often appeals to individuals who are already accustomed to taking dietary supplements for various health purposes.

The burgeoning popularity of RTD Meal Replacements and Bars reflects a societal shift towards convenience without compromising nutritional goals. These products are designed to offer balanced macronutrient profiles, essential vitamins, and minerals, making them attractive alternatives to traditional meals for busy individuals. The innovation in flavors and textures further enhances their appeal.

The ascendancy of Online Retail Stores is a testament to the digital transformation of commerce. Consumers appreciate the ability to compare prices, read reviews, and access a broader spectrum of brands that might not be readily available in physical stores. This channel is particularly effective for niche products and emerging brands looking to gain market traction. Conversely, the continued strength of Supermarkets/Hypermarkets and Pharmacies highlights the enduring value of in-person shopping, where consumers can physically inspect products and benefit from immediate availability. Pharmacies, in particular, offer a trusted environment for health-related purchases, often featuring professional guidance.

Europe Weight Management Supplement Market Product Innovations

Product innovations in the Europe Weight Management Supplement Market are increasingly focused on natural ingredients, synergistic formulations, and enhanced bioavailability. For instance, the development of premium meal replacement shakes with advanced protein blends and slow-release carbohydrates offers prolonged satiety, supporting sustained calorie deficit. Furthermore, novel supplement capsules incorporating thermogenic botanical extracts, such as green tea and capsaicin, are engineered for optimal absorption, maximizing their fat-burning potential. The application of these innovations spans across diverse consumer needs, from targeted fat loss to metabolic support and appetite control, demonstrating a clear trend towards scientifically validated, performance-driven solutions with unique selling propositions like sustained energy release and reduced sugar content.

Propelling Factors for Europe Weight Management Supplement Market Growth

The European weight management supplement market is propelled by several key factors. Firstly, the escalating global obesity and overweight epidemic, coupled with increasing health awareness, is driving demand for accessible solutions. Secondly, advancements in nutritional science are leading to the development of more effective and targeted ingredients, such as enhanced protein formulations and natural appetite suppressants. Thirdly, the growing trend towards proactive health management and preventative care encourages consumers to invest in supplements that support their well-being. Economically, rising disposable incomes in many European nations allow for greater expenditure on health-related products. Regulatory bodies are also increasingly recognizing the role of supplements in overall health, albeit with stringent guidelines, which fosters a more structured and trustworthy market.

Obstacles in the Europe Weight Management Supplement Market Market

Despite its growth, the Europe Weight Management Supplement Market faces several obstacles. Strict and varied regulatory landscapes across different European countries can complicate market entry and product approval processes. Concerns about product safety and efficacy, along with instances of misleading claims, can lead to consumer skepticism and erode trust. Supply chain disruptions, particularly for natural and specialized ingredients, can impact product availability and cost. Intense competition from both established brands and emerging players, as well as from alternative weight management solutions like prescription drugs and medical interventions, further pressures market share and pricing strategies.

Future Opportunities in Europe Weight Management Supplement Market

The future of the Europe Weight Management Supplement Market is replete with opportunities. The growing demand for personalized nutrition presents a significant avenue, with companies developing tailored supplement regimes based on individual genetic profiles, gut microbiome analysis, and lifestyle factors. The increasing popularity of plant-based and vegan diets opens doors for innovative protein supplements and vegan-friendly formulations. Technological advancements in delivery systems, such as encapsulation technologies that enhance nutrient absorption and controlled release, will continue to drive product development. Furthermore, the burgeoning interest in holistic wellness, encompassing mental health and stress management, creates opportunities for supplements that address the psychological aspects of weight management. Emerging markets within Eastern Europe also offer untapped potential for market expansion.

Major Players in the Europe Weight Management Supplement Market Ecosystem

- Nutrex Research Inc

- Amway Corp

- Glanbia PLC

- Rapid Nutrition PLC

- Nestlé S A

- Herbalife Nutrition

- Novo Holdings A/S

- JNX Sports

- Supplement Paradise Ltd

- Bulk Powders

- Nexira

- TargEDys

- Evlution Nutrition LLC

- General Nutrition Centers Inc

Key Developments in Europe Weight Management Supplement Market Industry

- June 2023: Rapid Nutrition PLC announced the release of its new look and brand identity for the SystemLS weight loss products, signaling a strategic rebranding effort to enhance market appeal as the product continues its international expansion.

- April 2023: Nexira launched a holistic approach to weight management, introducing two new innovative products: VinOgrape Plus for microbiome modulation and Carolean for appetite control, catering to the growing consumer interest in gut health and satiety management.

- March 2023: Novo Nordisk announced plans to launch its highly anticipated weight loss drug Wegovy in the United Kingdom, following its approval by the UK Medicines and Health Products Regulatory Agency in September 2021 for individuals with a BMI as low as 27, indicating a significant development in the pharmaceutical sector's contribution to weight management.

- February 2023: Nestlé announced the introduction of brand-new product offerings at the Natural Products Expo West 2023 Trade Show, including the NEW Solgar Probiotic Line. These probiotics are designed to offer benefits beyond digestive support, with specific varieties targeted for everyday wellness, bowel health, sleep improvement, women's health, and crucially, weight management support, reflecting a diversification of offerings within the food and beverage giant's portfolio.

Strategic Europe Weight Management Supplement Market Market Forecast

The strategic forecast for the Europe Weight Management Supplement Market is overwhelmingly positive, projecting substantial growth from 2025 to 2033. This optimistic outlook is primarily fueled by the continuous rise in health consciousness across the continent, coupled with the persistent challenge of overweight and obesity rates. Innovations in product formulation, particularly in areas like personalized nutrition, advanced protein blends, and natural appetite suppressants, will drive consumer adoption and market expansion. The increasing penetration of online retail channels will further democratize access to a wider array of specialized weight management solutions. Moreover, strategic collaborations and potential mergers among key players are anticipated to consolidate the market and drive further innovation, ultimately contributing to an estimated market value of xx billion by 2033.

Europe Weight Management Supplement Market Segmentation

-

1. Type

-

1.1. Food and Beverage

-

1.1.1. Meal Replacement

- 1.1.1.1. Bars

- 1.1.1.2. RTD Products

- 1.1.1.3. Soups

- 1.1.1.4. Other Meal Replacements

- 1.1.2. Slimming Teas

-

1.1.1. Meal Replacement

-

1.2. Supplements

- 1.2.1. Capsule/ Softgels

- 1.2.2. Powder

- 1.2.3. Tablets

- 1.2.4. Other Supplements

-

1.1. Food and Beverage

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Pharmacies

- 2.3. Specialty Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

Europe Weight Management Supplement Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Russia

- 7. Rest of Europe

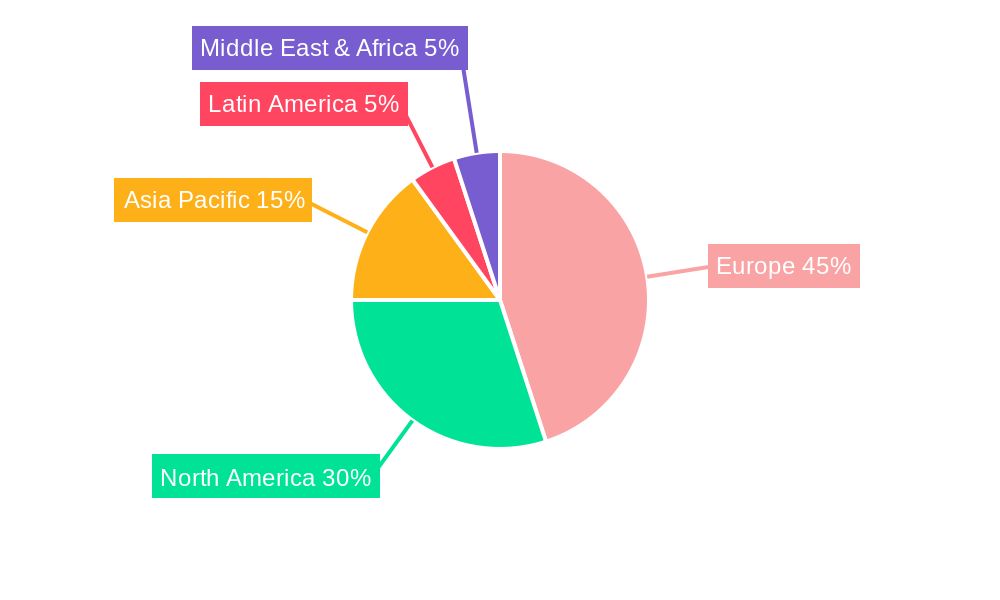

Europe Weight Management Supplement Market Regional Market Share

Geographic Coverage of Europe Weight Management Supplement Market

Europe Weight Management Supplement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Obesity Concerns Across the Region; Rising popularity of Natural and Organic Ingredients in Weight Management Supplement Products

- 3.3. Market Restrains

- 3.3.1. The High Cost of Weight Loss Products

- 3.4. Market Trends

- 3.4.1. Rising Obesity Concerns Across the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Weight Management Supplement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Food and Beverage

- 5.1.1.1. Meal Replacement

- 5.1.1.1.1. Bars

- 5.1.1.1.2. RTD Products

- 5.1.1.1.3. Soups

- 5.1.1.1.4. Other Meal Replacements

- 5.1.1.2. Slimming Teas

- 5.1.1.1. Meal Replacement

- 5.1.2. Supplements

- 5.1.2.1. Capsule/ Softgels

- 5.1.2.2. Powder

- 5.1.2.3. Tablets

- 5.1.2.4. Other Supplements

- 5.1.1. Food and Beverage

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Pharmacies

- 5.2.3. Specialty Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Spain

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Weight Management Supplement Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Food and Beverage

- 6.1.1.1. Meal Replacement

- 6.1.1.1.1. Bars

- 6.1.1.1.2. RTD Products

- 6.1.1.1.3. Soups

- 6.1.1.1.4. Other Meal Replacements

- 6.1.1.2. Slimming Teas

- 6.1.1.1. Meal Replacement

- 6.1.2. Supplements

- 6.1.2.1. Capsule/ Softgels

- 6.1.2.2. Powder

- 6.1.2.3. Tablets

- 6.1.2.4. Other Supplements

- 6.1.1. Food and Beverage

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Pharmacies

- 6.2.3. Specialty Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Weight Management Supplement Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Food and Beverage

- 7.1.1.1. Meal Replacement

- 7.1.1.1.1. Bars

- 7.1.1.1.2. RTD Products

- 7.1.1.1.3. Soups

- 7.1.1.1.4. Other Meal Replacements

- 7.1.1.2. Slimming Teas

- 7.1.1.1. Meal Replacement

- 7.1.2. Supplements

- 7.1.2.1. Capsule/ Softgels

- 7.1.2.2. Powder

- 7.1.2.3. Tablets

- 7.1.2.4. Other Supplements

- 7.1.1. Food and Beverage

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Pharmacies

- 7.2.3. Specialty Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Weight Management Supplement Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Food and Beverage

- 8.1.1.1. Meal Replacement

- 8.1.1.1.1. Bars

- 8.1.1.1.2. RTD Products

- 8.1.1.1.3. Soups

- 8.1.1.1.4. Other Meal Replacements

- 8.1.1.2. Slimming Teas

- 8.1.1.1. Meal Replacement

- 8.1.2. Supplements

- 8.1.2.1. Capsule/ Softgels

- 8.1.2.2. Powder

- 8.1.2.3. Tablets

- 8.1.2.4. Other Supplements

- 8.1.1. Food and Beverage

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Pharmacies

- 8.2.3. Specialty Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Italy Europe Weight Management Supplement Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Food and Beverage

- 9.1.1.1. Meal Replacement

- 9.1.1.1.1. Bars

- 9.1.1.1.2. RTD Products

- 9.1.1.1.3. Soups

- 9.1.1.1.4. Other Meal Replacements

- 9.1.1.2. Slimming Teas

- 9.1.1.1. Meal Replacement

- 9.1.2. Supplements

- 9.1.2.1. Capsule/ Softgels

- 9.1.2.2. Powder

- 9.1.2.3. Tablets

- 9.1.2.4. Other Supplements

- 9.1.1. Food and Beverage

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Pharmacies

- 9.2.3. Specialty Stores

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Spain Europe Weight Management Supplement Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Food and Beverage

- 10.1.1.1. Meal Replacement

- 10.1.1.1.1. Bars

- 10.1.1.1.2. RTD Products

- 10.1.1.1.3. Soups

- 10.1.1.1.4. Other Meal Replacements

- 10.1.1.2. Slimming Teas

- 10.1.1.1. Meal Replacement

- 10.1.2. Supplements

- 10.1.2.1. Capsule/ Softgels

- 10.1.2.2. Powder

- 10.1.2.3. Tablets

- 10.1.2.4. Other Supplements

- 10.1.1. Food and Beverage

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Pharmacies

- 10.2.3. Specialty Stores

- 10.2.4. Online Retail Stores

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Russia Europe Weight Management Supplement Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Food and Beverage

- 11.1.1.1. Meal Replacement

- 11.1.1.1.1. Bars

- 11.1.1.1.2. RTD Products

- 11.1.1.1.3. Soups

- 11.1.1.1.4. Other Meal Replacements

- 11.1.1.2. Slimming Teas

- 11.1.1.1. Meal Replacement

- 11.1.2. Supplements

- 11.1.2.1. Capsule/ Softgels

- 11.1.2.2. Powder

- 11.1.2.3. Tablets

- 11.1.2.4. Other Supplements

- 11.1.1. Food and Beverage

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Supermarkets/Hypermarkets

- 11.2.2. Pharmacies

- 11.2.3. Specialty Stores

- 11.2.4. Online Retail Stores

- 11.2.5. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe Europe Weight Management Supplement Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Food and Beverage

- 12.1.1.1. Meal Replacement

- 12.1.1.1.1. Bars

- 12.1.1.1.2. RTD Products

- 12.1.1.1.3. Soups

- 12.1.1.1.4. Other Meal Replacements

- 12.1.1.2. Slimming Teas

- 12.1.1.1. Meal Replacement

- 12.1.2. Supplements

- 12.1.2.1. Capsule/ Softgels

- 12.1.2.2. Powder

- 12.1.2.3. Tablets

- 12.1.2.4. Other Supplements

- 12.1.1. Food and Beverage

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Supermarkets/Hypermarkets

- 12.2.2. Pharmacies

- 12.2.3. Specialty Stores

- 12.2.4. Online Retail Stores

- 12.2.5. Other Distribution Channels

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Nutrex Research Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Amway Corp

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Glanbia PLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Rapid Nutrition PLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Nestlé S A *List Not Exhaustive

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Herbalife Nutrition

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Novo Holdings A/S

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 JNX Sports

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Supplement Paradise Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Bulk Powders

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Nexira

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 TargEDys

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Evlution Nutrition LLC

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 General Nutrition Centers Inc

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.1 Nutrex Research Inc

List of Figures

- Figure 1: Europe Weight Management Supplement Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Weight Management Supplement Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Weight Management Supplement Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Weight Management Supplement Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Europe Weight Management Supplement Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe Weight Management Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 5: Europe Weight Management Supplement Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Weight Management Supplement Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Europe Weight Management Supplement Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Europe Weight Management Supplement Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 9: Europe Weight Management Supplement Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Europe Weight Management Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 11: Europe Weight Management Supplement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe Weight Management Supplement Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: Europe Weight Management Supplement Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Europe Weight Management Supplement Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 15: Europe Weight Management Supplement Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 16: Europe Weight Management Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 17: Europe Weight Management Supplement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Europe Weight Management Supplement Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 19: Europe Weight Management Supplement Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Europe Weight Management Supplement Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 21: Europe Weight Management Supplement Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 22: Europe Weight Management Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 23: Europe Weight Management Supplement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Weight Management Supplement Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Europe Weight Management Supplement Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Europe Weight Management Supplement Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 27: Europe Weight Management Supplement Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: Europe Weight Management Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 29: Europe Weight Management Supplement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Europe Weight Management Supplement Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 31: Europe Weight Management Supplement Market Revenue billion Forecast, by Type 2020 & 2033

- Table 32: Europe Weight Management Supplement Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 33: Europe Weight Management Supplement Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 34: Europe Weight Management Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 35: Europe Weight Management Supplement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Europe Weight Management Supplement Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 37: Europe Weight Management Supplement Market Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Europe Weight Management Supplement Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 39: Europe Weight Management Supplement Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 40: Europe Weight Management Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 41: Europe Weight Management Supplement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Europe Weight Management Supplement Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 43: Europe Weight Management Supplement Market Revenue billion Forecast, by Type 2020 & 2033

- Table 44: Europe Weight Management Supplement Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 45: Europe Weight Management Supplement Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 46: Europe Weight Management Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 47: Europe Weight Management Supplement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Europe Weight Management Supplement Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Weight Management Supplement Market?

The projected CAGR is approximately 16.94%.

2. Which companies are prominent players in the Europe Weight Management Supplement Market?

Key companies in the market include Nutrex Research Inc, Amway Corp, Glanbia PLC, Rapid Nutrition PLC, Nestlé S A *List Not Exhaustive, Herbalife Nutrition, Novo Holdings A/S, JNX Sports, Supplement Paradise Ltd, Bulk Powders, Nexira, TargEDys, Evlution Nutrition LLC, General Nutrition Centers Inc.

3. What are the main segments of the Europe Weight Management Supplement Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.67 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Obesity Concerns Across the Region; Rising popularity of Natural and Organic Ingredients in Weight Management Supplement Products.

6. What are the notable trends driving market growth?

Rising Obesity Concerns Across the Region.

7. Are there any restraints impacting market growth?

The High Cost of Weight Loss Products.

8. Can you provide examples of recent developments in the market?

June 2023: Rapid Nutrition PLC announced the release of its new look and brand identity for the SystemLS weight loss products. The company also claims that it unveiled the new brand identity for the flagship SystemLS Weight Loss Brand as the product continues international expansion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Weight Management Supplement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Weight Management Supplement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Weight Management Supplement Market?

To stay informed about further developments, trends, and reports in the Europe Weight Management Supplement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence