Key Insights

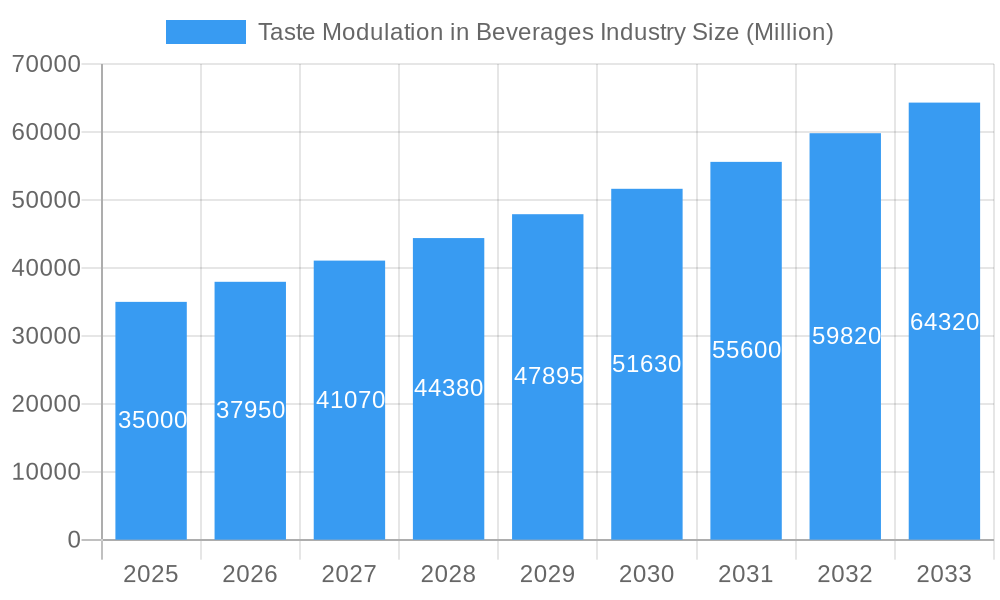

The global Taste Modulation market, projected to reach an estimated USD 35,000 Million by 2025, is experiencing robust growth with a Compound Annual Growth Rate (CAGR) of 8.60% during the forecast period of 2025-2033. This expansion is significantly fueled by increasing consumer demand for healthier food and beverage options, coupled with a growing awareness of the impact of taste on product preference. The "drivers" behind this market's ascent are multifaceted, including the rising incidence of lifestyle diseases like diabetes and obesity, which necessitates the reduction of sugar and salt content in processed foods. Furthermore, advancements in flavor science and technology are enabling the creation of sophisticated taste modulators that can effectively replicate or enhance desired taste profiles, thereby masking undesirable notes from reduced sugar or salt. The "trends" such as the clean label movement, demand for natural ingredients, and personalized nutrition are also playing a pivotal role, pushing manufacturers to innovate with taste modulation solutions that align with these consumer preferences. The "segments" highlight the broad applicability of taste modulators, with the Beverage sector, particularly Non-Alcoholic Beverages, showing immense potential due to the growing popularity of low-sugar and functional drinks. The Sweet Modulators segment is expected to dominate, reflecting the global challenge of sugar reduction.

Taste Modulation in Beverages Industry Market Size (In Billion)

However, certain "restrains" temper this optimistic outlook. The high cost of research and development for novel taste modulators, stringent regulatory frameworks surrounding food additives in various regions, and consumer skepticism towards artificial ingredients present significant hurdles. The complexity of achieving authentic taste profiles, especially in natural formulations, also requires substantial investment and expertise. Despite these challenges, the market is poised for continued expansion. Key "companies" like Givaudan, International Flavors & Fragrances Inc., and Kerry Inc. are at the forefront, investing heavily in R&D and strategic collaborations to address evolving consumer demands and regulatory landscapes. The Asia Pacific region, driven by burgeoning middle classes and increasing adoption of Western dietary habits, is anticipated to emerge as a significant growth hub, alongside established markets in North America and Europe. The focus on innovation in taste modulation will be crucial for overcoming current limitations and unlocking the full potential of this dynamic market.

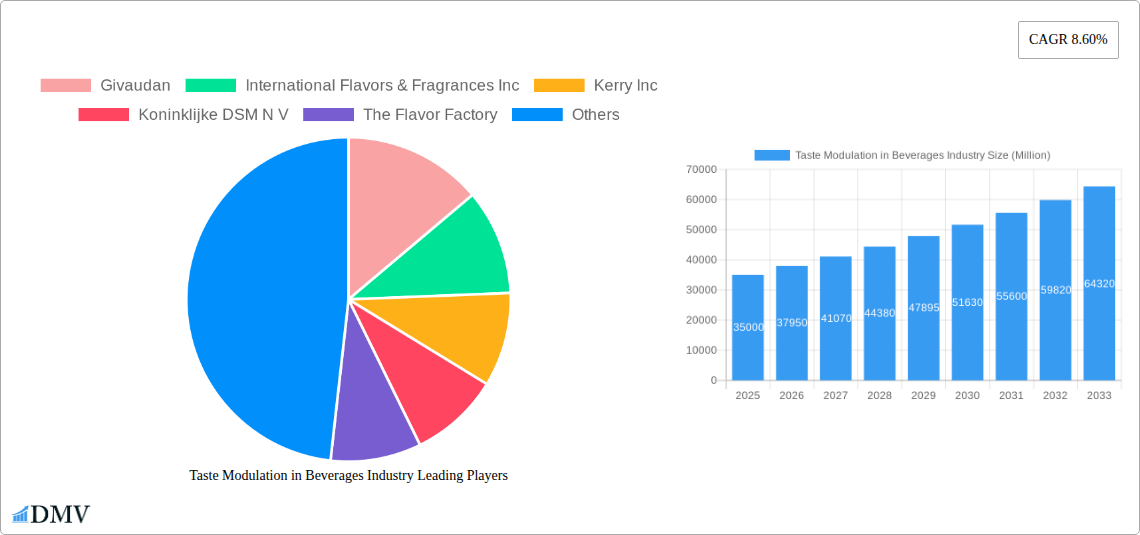

Taste Modulation in Beverages Industry Company Market Share

Taste Modulation in Beverages Industry Market Composition & Trends

The global taste modulation in beverages industry is a dynamic landscape characterized by increasing market concentration among key players and a relentless pursuit of innovation. Leading entities such as Givaudan, International Flavors & Fragrances Inc., and Kerry Inc. command significant market share, driven by extensive research and development capabilities and a broad product portfolio. The study period, spanning from 2019 to 2033, with a base year of 2025, encompasses a robust historical analysis and a forward-looking forecast, revealing an average annual growth rate (AAGR) projected at XX Million. Innovation catalysts, including advancements in natural ingredient sourcing and novel compound discovery, are paramount. Regulatory landscapes, particularly concerning labeling and ingredient safety, are constantly evolving, influencing product development and market access. The identification and strategic utilization of substitute products, alongside a deep understanding of end-user profiles – from health-conscious consumers seeking reduced sugar to sophisticated palates demanding nuanced flavor experiences – are critical for sustained success. Mergers and acquisitions (M&A) are a significant feature, with deal values estimated to reach XXX Million by 2033, indicative of consolidation and strategic expansion within the sector.

- Market Share Distribution (2025 Estimated):

- Givaudan: XX%

- International Flavors & Fragrances Inc.: XX%

- Kerry Inc.: XX%

- Koninklijke DSM N.V.: XX%

- Sensient Technologies Corporation: XX%

- Ingredion Incorporated: XX%

- Others: XX%

- M&A Deal Values (Forecast 2025-2033): Estimated to reach XXX Million

- Key Innovation Drivers: Natural sweeteners, bitterness blockers, salt enhancers, umami compounds.

- Regulatory Focus: Clean label initiatives, artificial ingredient restrictions, health claims substantiation.

Taste Modulation in Beverages Industry Industry Evolution

The taste modulation in beverages industry has witnessed a remarkable evolutionary trajectory, driven by a confluence of scientific breakthroughs, shifting consumer preferences, and a burgeoning demand for healthier yet equally palatable beverage options. Over the study period (2019–2033), the market has transformed from a niche segment to a mainstream necessity for beverage manufacturers. The historical period (2019–2024) laid the groundwork, characterized by initial advancements in synthetic flavor enhancers and a growing awareness of sugar reduction strategies. The base year of 2025 marks a pivotal point, with the market poised for accelerated expansion fueled by a CAGR of XX Million. Technological advancements have been the bedrock of this evolution. Innovations in encapsulation technologies have significantly improved the stability and controlled release of taste modulators, enabling manufacturers to achieve desired flavor profiles with greater precision and efficacy. Furthermore, the increasing sophistication of analytical techniques has facilitated the deeper understanding of taste receptors and the development of targeted modulator compounds.

Consumer demands have undergone a seismic shift, moving beyond mere taste to embrace health and wellness. The "better-for-you" trend has propelled the demand for solutions that reduce sugar, salt, and fat content without compromising on sensory appeal. This has directly translated into a higher adoption rate of sweet, salt, and fat modulators. For instance, the demand for Sweet Modulators has surged as consumers actively seek to reduce their sugar intake, leading to an estimated XX% increase in adoption by 2025. Similarly, Salt Modulators are gaining traction in savory beverage applications, responding to global health initiatives aimed at reducing sodium consumption. The adoption of Fat Modulators is also on an upward trend, particularly in low-fat dairy beverages and creamy non-alcoholic drinks, allowing for a richer mouthfeel without the addition of high-fat ingredients. The market has witnessed a significant growth rate, with the overall taste modulation in beverages sector projected to grow at an impressive XX% from 2025 to 2033. This sustained growth is indicative of the industry's ability to adapt and innovate in response to evolving consumer needs and regulatory pressures, solidifying its indispensable role in the beverage manufacturing ecosystem.

Leading Regions, Countries, or Segments in Taste Modulation in Beverages Industry

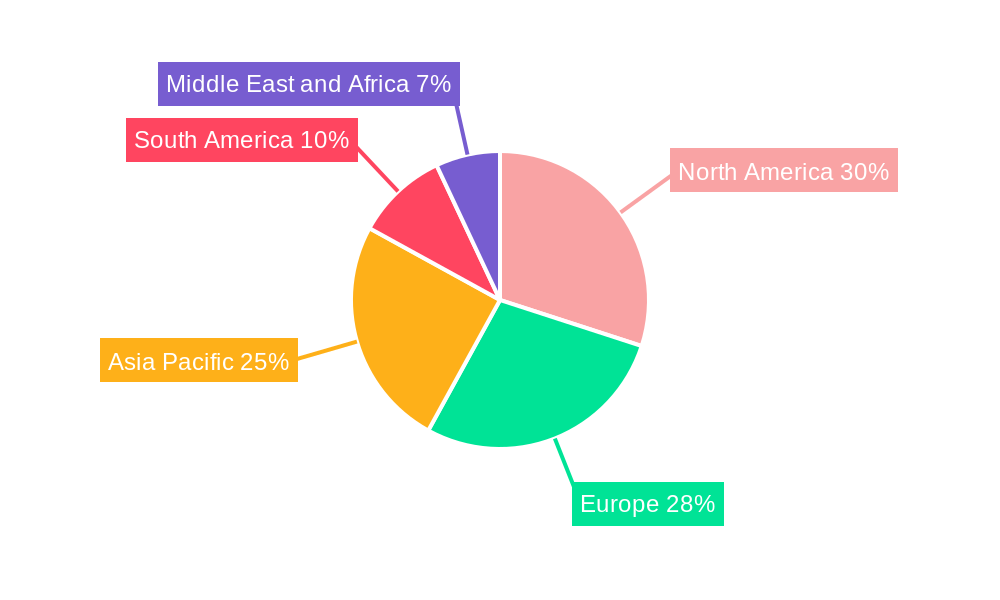

North America and Europe currently dominate the taste modulation in beverages industry, driven by a confluence of factors including high consumer awareness regarding health and wellness, established regulatory frameworks supporting product innovation, and the presence of major beverage manufacturers and flavor houses. The United States, in particular, stands out as a leading country due to its large consumer base, significant investment in food and beverage R&D, and a receptive market for novel ingredients and reduced-sugar/salt products. The beverage segment is the primary driver of this dominance, with both Alcoholic Beverages and Non-Alcoholic Beverages extensively utilizing taste modulation technologies. Within non-alcoholic beverages, the demand for functional drinks, enhanced waters, and reduced-sugar soft drinks fuels the need for effective sweet and flavor modulators. Alcoholic beverages, especially ready-to-drink (RTD) cocktails and flavored spirits, also leverage these technologies to achieve balanced and appealing taste profiles.

The Sweet Modulators segment is the most prominent type, owing to the global drive to curb sugar consumption. This segment is experiencing robust growth, estimated at XX% annually from 2025–2033, as manufacturers seek to replace or reduce added sugars while maintaining palatability. Key drivers for this dominance include:

- Investment Trends: Significant R&D investments by major players like Givaudan and International Flavors & Fragrances Inc. in developing advanced sweet modulation solutions. The estimated investment in sweet modulators alone is projected to reach XX Million by 2025.

- Regulatory Support: Government initiatives promoting reduced sugar intake, such as sugar taxes and public health campaigns, indirectly boost the demand for sweet modulators.

- Consumer Demand: Increasing consumer preference for "less sugar" and "natural sweeteners" creates a strong pull for products utilizing sweet modulators effectively.

- Technological Advancements: Development of high-intensity natural sweeteners and masking agents for off-notes associated with artificial sweeteners.

The Non-Alcoholic Beverages application segment is particularly significant due to its vast market size and the continuous innovation in product categories like juices, carbonated soft drinks, dairy-based beverages, and functional drinks. This segment is projected to contribute XX% of the total market revenue by 2025. The sophisticated demand for nuanced flavors and healthier alternatives in this segment makes taste modulation an indispensable tool for product development and differentiation. The synergy between evolving consumer palates and the innovative capabilities of taste modulation technology ensures its continued leadership within the industry.

Taste Modulation in Beverages Industry Product Innovations

The taste modulation in beverages industry is characterized by a wave of innovative product developments focused on enhancing sensory experiences while addressing evolving consumer demands for health and wellness. Companies are leveraging advanced techniques to create solutions that effectively reduce sugar, salt, and fat without compromising on taste and mouthfeel. Innovations include natural bitterness blockers that mask undesirable notes from artificial sweeteners, potent umami enhancers for savory beverages, and advanced salt replacers that mimic the characteristic taste of sodium chloride. For instance, Givaudan's latest range of natural flavor modulators offers enhanced sweetness perception with reduced sugar content, achieving up to XX% sugar reduction in carbonated beverages. Sensient Technologies Corporation has introduced its "FlavorWise" line, specifically designed to improve mouthfeel and body in low-fat dairy drinks. The performance metrics of these innovations are impressive, with many achieving comparable taste profiles to their full-sugar, salt, or fat counterparts, often with a unique selling proposition centered on clean labeling and sustainable sourcing.

Propelling Factors for Taste Modulation in Beverages Industry Growth

The taste modulation in beverages industry is experiencing robust growth propelled by several interconnected factors. Technologically, advancements in natural ingredient extraction and synthesis have led to the development of more effective and consumer-friendly taste modulators, such as sophisticated sweetness enhancers and bitterness blockers. Economically, the increasing consumer awareness and demand for healthier beverage options, including reduced-sugar and low-sodium products, are creating a significant market pull. Regulatory bodies worldwide are also promoting healthier diets, indirectly encouraging manufacturers to adopt taste modulation solutions. For example, the global trend towards reducing added sugar intake is a primary economic driver, creating a substantial market for sweet modulators. Furthermore, the rising disposable incomes in emerging economies are expanding the market for premium and functional beverages, where taste modulation plays a crucial role in delivering desired sensory experiences.

Obstacles in the Taste Modulation in Beverages Industry Market

Despite its promising growth, the taste modulation in beverages industry faces several obstacles. Regulatory challenges remain a concern, with evolving guidelines and approvals for novel ingredients potentially slowing down market penetration. For instance, some countries have stricter regulations regarding the use of certain high-intensity sweeteners, impacting their widespread adoption. Supply chain disruptions, as witnessed in recent global events, can also affect the availability and cost of key raw materials for taste modulators. Competitive pressures from established flavor houses and new entrants offering alternative solutions create a dynamic and sometimes challenging market environment. The perceived "artificiality" of some taste modulators by a segment of health-conscious consumers also presents a barrier, necessitating a focus on natural and clean-label solutions. Quantifiable impacts of these obstacles are seen in longer product development cycles and increased R&D expenditure to meet diverse regional regulatory requirements.

Future Opportunities in Taste Modulation in Beverages Industry

The taste modulation in beverages industry is ripe with emerging opportunities. The burgeoning demand for plant-based beverages presents a significant avenue, as these products often require sophisticated taste modulation to achieve desirable mouthfeel and flavor profiles. The expanding functional beverage market, encompassing everything from energy drinks to gut-health beverages, offers further scope for taste modulators to mask the often-unpleasant tastes of active ingredients. Moreover, the increasing interest in personalized nutrition and customized beverage experiences opens doors for highly targeted taste modulation solutions. Technological advancements in fermentation and biotechnology are also expected to yield novel natural taste modulators. The growing markets in Asia-Pacific and Latin America, with their rapidly expanding middle classes and increasing adoption of Western beverage trends, represent significant untapped geographical opportunities.

Major Players in the Taste Modulation in Beverages Industry Ecosystem

- Givaudan

- International Flavors & Fragrances Inc.

- Kerry Inc.

- Koninklijke DSM N.V.

- The Flavor Factory

- Sensient Technologies Corporation

- Ingredion Incorporated

- Flavorchem Corporation

Key Developments in Taste Modulation in Beverages Industry Industry

- 2023 Q4: Givaudan launches a new suite of natural sweetness enhancers, expanding their clean-label offerings for the beverage sector.

- 2023 Q3: International Flavors & Fragrances Inc. announces acquisition of a leading supplier of plant-based protein ingredients, aiming to bolster their functional beverage solutions.

- 2023 Q2: Kerry Inc. unveils an innovative platform for salt reduction in savory beverages, addressing growing consumer health concerns.

- 2023 Q1: Koninklijke DSM N.V. receives regulatory approval for a novel bitter blocker ingredient, enhancing the appeal of sugar-free beverages.

- 2022 Q4: Sensient Technologies Corporation introduces a new line of natural flavor modulators for alcoholic beverages, focusing on enhancing fruit notes and reducing harshness.

- 2022 Q3: Ingredion Incorporated expands its portfolio of sweetening solutions with the integration of stevia and monk fruit-based ingredients.

Strategic Taste Modulation in Beverages Industry Market Forecast

The strategic market forecast for taste modulation in beverages indicates continued robust growth, driven by an expanding global demand for healthier and more enjoyable beverage options. The market is projected to be shaped by ongoing consumer trends towards reduced sugar, salt, and fat content, coupled with an increasing preference for natural and clean-label ingredients. Key growth catalysts will include further innovations in sweetness, saltiness, and mouthfeel modulation technologies, particularly those derived from natural sources. The expanding functional beverage segment, along with the rise of plant-based alternatives, will offer significant new avenues for product development and market penetration. Emerging economies are expected to play a crucial role, driven by increasing disposable incomes and the adoption of global beverage trends. The strategic focus will remain on providing manufacturers with effective, consumer-appealing, and regulatory-compliant taste modulation solutions, ensuring sustained market expansion and profitability.

Taste Modulation in Beverages Industry Segmentation

-

1. Application

-

1.1. Food

- 1.1.1. Bakery and Confectionery Products

- 1.1.2. Dairy Products

- 1.1.3. Snacks & Savory Products

- 1.1.4. Meat Products

- 1.1.5. Others

-

1.2. Beverage

- 1.2.1. Alcoholic Beverages

- 1.2.2. Non-Alcoholic Beverages

-

1.1. Food

-

2. Type

- 2.1. Sweet Modulators

- 2.2. Salt Modulators

- 2.3. Fat Modulators

Taste Modulation in Beverages Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Taste Modulation in Beverages Industry Regional Market Share

Geographic Coverage of Taste Modulation in Beverages Industry

Taste Modulation in Beverages Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Demand For Functional Food and Beverage

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Taste Modulation in Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food

- 5.1.1.1. Bakery and Confectionery Products

- 5.1.1.2. Dairy Products

- 5.1.1.3. Snacks & Savory Products

- 5.1.1.4. Meat Products

- 5.1.1.5. Others

- 5.1.2. Beverage

- 5.1.2.1. Alcoholic Beverages

- 5.1.2.2. Non-Alcoholic Beverages

- 5.1.1. Food

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Sweet Modulators

- 5.2.2. Salt Modulators

- 5.2.3. Fat Modulators

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Taste Modulation in Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food

- 6.1.1.1. Bakery and Confectionery Products

- 6.1.1.2. Dairy Products

- 6.1.1.3. Snacks & Savory Products

- 6.1.1.4. Meat Products

- 6.1.1.5. Others

- 6.1.2. Beverage

- 6.1.2.1. Alcoholic Beverages

- 6.1.2.2. Non-Alcoholic Beverages

- 6.1.1. Food

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Sweet Modulators

- 6.2.2. Salt Modulators

- 6.2.3. Fat Modulators

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Taste Modulation in Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food

- 7.1.1.1. Bakery and Confectionery Products

- 7.1.1.2. Dairy Products

- 7.1.1.3. Snacks & Savory Products

- 7.1.1.4. Meat Products

- 7.1.1.5. Others

- 7.1.2. Beverage

- 7.1.2.1. Alcoholic Beverages

- 7.1.2.2. Non-Alcoholic Beverages

- 7.1.1. Food

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Sweet Modulators

- 7.2.2. Salt Modulators

- 7.2.3. Fat Modulators

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Taste Modulation in Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food

- 8.1.1.1. Bakery and Confectionery Products

- 8.1.1.2. Dairy Products

- 8.1.1.3. Snacks & Savory Products

- 8.1.1.4. Meat Products

- 8.1.1.5. Others

- 8.1.2. Beverage

- 8.1.2.1. Alcoholic Beverages

- 8.1.2.2. Non-Alcoholic Beverages

- 8.1.1. Food

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Sweet Modulators

- 8.2.2. Salt Modulators

- 8.2.3. Fat Modulators

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Taste Modulation in Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food

- 9.1.1.1. Bakery and Confectionery Products

- 9.1.1.2. Dairy Products

- 9.1.1.3. Snacks & Savory Products

- 9.1.1.4. Meat Products

- 9.1.1.5. Others

- 9.1.2. Beverage

- 9.1.2.1. Alcoholic Beverages

- 9.1.2.2. Non-Alcoholic Beverages

- 9.1.1. Food

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Sweet Modulators

- 9.2.2. Salt Modulators

- 9.2.3. Fat Modulators

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Taste Modulation in Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food

- 10.1.1.1. Bakery and Confectionery Products

- 10.1.1.2. Dairy Products

- 10.1.1.3. Snacks & Savory Products

- 10.1.1.4. Meat Products

- 10.1.1.5. Others

- 10.1.2. Beverage

- 10.1.2.1. Alcoholic Beverages

- 10.1.2.2. Non-Alcoholic Beverages

- 10.1.1. Food

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Sweet Modulators

- 10.2.2. Salt Modulators

- 10.2.3. Fat Modulators

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Givaudan

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 International Flavors & Fragrances Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kerry Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Koninklijke DSM N V

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Flavor Factory

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sensient Technologies Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ingredion Incorporated

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Flavorchem Corporatio

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Givaudan

List of Figures

- Figure 1: Global Taste Modulation in Beverages Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Taste Modulation in Beverages Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Taste Modulation in Beverages Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Taste Modulation in Beverages Industry Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Taste Modulation in Beverages Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Taste Modulation in Beverages Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Taste Modulation in Beverages Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Taste Modulation in Beverages Industry Revenue (Million), by Application 2025 & 2033

- Figure 9: Europe Taste Modulation in Beverages Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Taste Modulation in Beverages Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Taste Modulation in Beverages Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Taste Modulation in Beverages Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Taste Modulation in Beverages Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Taste Modulation in Beverages Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Asia Pacific Taste Modulation in Beverages Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Taste Modulation in Beverages Industry Revenue (Million), by Type 2025 & 2033

- Figure 17: Asia Pacific Taste Modulation in Beverages Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: Asia Pacific Taste Modulation in Beverages Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Taste Modulation in Beverages Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Taste Modulation in Beverages Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: South America Taste Modulation in Beverages Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: South America Taste Modulation in Beverages Industry Revenue (Million), by Type 2025 & 2033

- Figure 23: South America Taste Modulation in Beverages Industry Revenue Share (%), by Type 2025 & 2033

- Figure 24: South America Taste Modulation in Beverages Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Taste Modulation in Beverages Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Taste Modulation in Beverages Industry Revenue (Million), by Application 2025 & 2033

- Figure 27: Middle East and Africa Taste Modulation in Beverages Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Taste Modulation in Beverages Industry Revenue (Million), by Type 2025 & 2033

- Figure 29: Middle East and Africa Taste Modulation in Beverages Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East and Africa Taste Modulation in Beverages Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Taste Modulation in Beverages Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Taste Modulation in Beverages Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Taste Modulation in Beverages Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Taste Modulation in Beverages Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Taste Modulation in Beverages Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global Taste Modulation in Beverages Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Taste Modulation in Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Taste Modulation in Beverages Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Taste Modulation in Beverages Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Taste Modulation in Beverages Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Taste Modulation in Beverages Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Taste Modulation in Beverages Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Taste Modulation in Beverages Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Taste Modulation in Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Spain Taste Modulation in Beverages Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Taste Modulation in Beverages Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Taste Modulation in Beverages Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Taste Modulation in Beverages Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Taste Modulation in Beverages Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Russia Taste Modulation in Beverages Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Taste Modulation in Beverages Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Taste Modulation in Beverages Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Taste Modulation in Beverages Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Taste Modulation in Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Taste Modulation in Beverages Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Taste Modulation in Beverages Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Taste Modulation in Beverages Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Taste Modulation in Beverages Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Taste Modulation in Beverages Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Taste Modulation in Beverages Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Taste Modulation in Beverages Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 31: Global Taste Modulation in Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Taste Modulation in Beverages Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Taste Modulation in Beverages Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Taste Modulation in Beverages Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Taste Modulation in Beverages Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Taste Modulation in Beverages Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 37: Global Taste Modulation in Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South Africa Taste Modulation in Beverages Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: United Arab Emirates Taste Modulation in Beverages Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Taste Modulation in Beverages Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Taste Modulation in Beverages Industry?

The projected CAGR is approximately 8.60%.

2. Which companies are prominent players in the Taste Modulation in Beverages Industry?

Key companies in the market include Givaudan, International Flavors & Fragrances Inc, Kerry Inc, Koninklijke DSM N V, The Flavor Factory, Sensient Technologies Corporation, Ingredion Incorporated, Flavorchem Corporatio.

3. What are the main segments of the Taste Modulation in Beverages Industry?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth.

6. What are the notable trends driving market growth?

Increasing Demand For Functional Food and Beverage.

7. Are there any restraints impacting market growth?

Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Taste Modulation in Beverages Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Taste Modulation in Beverages Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Taste Modulation in Beverages Industry?

To stay informed about further developments, trends, and reports in the Taste Modulation in Beverages Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence