Key Insights

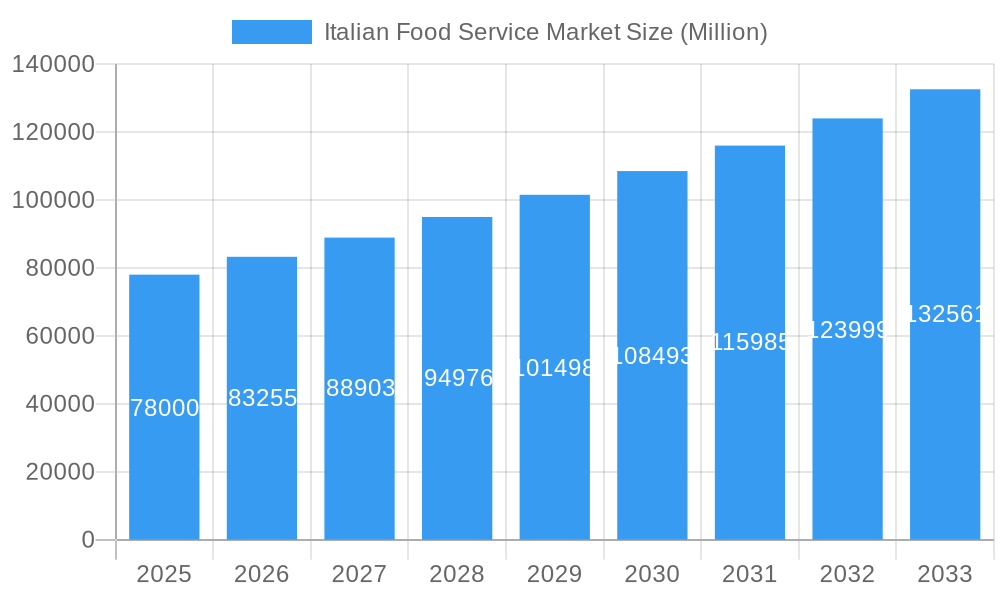

The Italian foodservice market is set for significant expansion, projected to reach a market size of 25.52 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.92% from 2025 to 2033. This growth is fueled by shifting consumer demands for convenience, diverse culinary experiences, and the widespread adoption of digital ordering. Cloud kitchens are rapidly gaining traction, catering to the increasing need for efficient delivery. Full-service restaurants, especially those featuring Asian, European, and Latin American cuisines, are expected to perform well, driven by a growing consumer interest in authentic international flavors. Quick Service Restaurants (QSRs), including burger outlets and bakeries, will remain a vital segment due to their accessibility and value. The market features a competitive mix of chained and independent establishments, with chains benefiting from economies of scale and independents focusing on unique offerings.

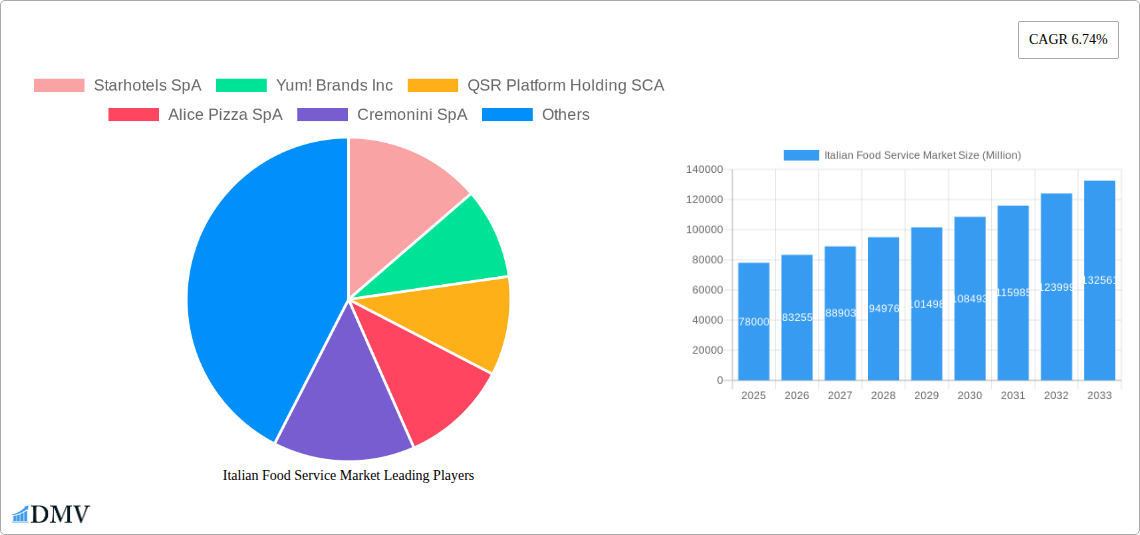

Italian Food Service Market Market Size (In Billion)

Market expansion is evident across various outlet types, including leisure, lodging, retail, standalone, and travel hubs, demonstrating the deep integration of food services into daily life and travel. Leading companies like Yum! Brands Inc., McDonald's Corporation, and Autogrill SpA are instrumental in shaping the market through innovation and strategic investments. Key trends include a rising demand for healthy and sustainable food options and the integration of technology to enhance customer experience. Potential challenges such as increasing operational costs, labor shortages, and fierce competition may influence growth. Despite these factors, the Italian foodservice market's outlook is highly positive, supported by a stable economy, a robust tourism sector, and consumers seeking quality and variety.

Italian Food Service Market Company Market Share

Italian Food Service Market: Comprehensive Growth Analysis & Forecast (2019-2033)

Unlock critical insights into the Italian food service market, a dynamic sector poised for significant expansion. This in-depth report delves into market composition, industry evolution, leading segments, product innovations, growth drivers, challenges, and future opportunities. With a study period spanning from 2019 to 2033, a base year of 2025, and an estimated year of 2025, this analysis provides a robust outlook for stakeholders. Discover key trends shaping Italy's catering industry, restaurant market growth, and QSR expansion.

Italian Food Service Market Market Composition & Trends

The Italian food service market exhibits a diverse landscape with moderate concentration, influenced by a blend of established giants and nimble independent operators. Innovation is a key catalyst, driven by evolving consumer preferences for convenience, health-conscious options, and authentic culinary experiences. The Italian restaurant market sees continuous introduction of new concepts, from artisanal cafes to innovative cloud kitchen models. Regulatory frameworks, while ensuring food safety and quality, also present a dynamic environment for business operations. Substitute products, including home meal replacements and pre-packaged meals, exert some influence, yet the enduring appeal of dine-in experiences and freshly prepared meals remains strong. End-user profiles are increasingly segmented, with a growing demand for personalized service, digital ordering, and sustainable practices. Mergers and acquisitions (M&A) activities, though not at the highest tier globally, are strategic, aimed at consolidating market share, expanding geographical reach, and acquiring technological capabilities. For instance, a recent acquisition in the travel retail segment highlights the strategic importance of high-traffic locations. The overall market share distribution reflects a competitive ecosystem where both large chain outlets and independent outlets vie for consumer attention.

Italian Food Service Market Industry Evolution

The Italian food service industry has undergone a remarkable transformation, driven by a confluence of technological advancements, shifting consumer demands, and economic influences. Historically, the market was characterized by a strong emphasis on traditional, family-run establishments, deeply rooted in regional culinary heritage. However, the advent of the digital age has irrevocably altered this landscape. The Italian food delivery market has witnessed exponential growth, propelled by the proliferation of online ordering platforms and a surge in consumer reliance on convenience. This evolution is further amplified by the increasing adoption of cloud kitchen models, allowing for greater operational efficiency and wider reach without the overhead of traditional brick-and-mortar restaurants. Consumer preferences have also become more sophisticated. There's a pronounced shift towards healthier eating, with a growing demand for organic, plant-based, and locally sourced ingredients. This trend has spurred innovation in menu development, with many establishments re-evaluating their offerings to cater to these discerning palates. The Italian fast-casual market is a prime example of this evolution, offering a blend of speed, quality, and customization. Furthermore, the rise of specialist coffee shops and artisanal bakeries signifies a growing appreciation for premium, craft food and beverage experiences. The overall market growth trajectory, projected to be a robust XX% annually in the forecast period, reflects the industry's resilience and adaptability. Technological advancements, such as AI-powered inventory management and personalized marketing, are becoming increasingly integral to operational success, enabling businesses to optimize their offerings and enhance customer engagement. The Italian cafe and bar segment, in particular, has seen significant growth in specialized offerings, moving beyond traditional coffee service to include unique beverage creations and light snacks. This continuous adaptation to evolving consumer expectations and technological opportunities underscores the dynamic nature of the Italian food service market.

Leading Regions, Countries, or Segments in Italian Food Service Market

The Italian food service market showcases distinct regional strengths and segment dominance. Among the Foodservice Types, Quick Service Restaurants (QSR), particularly Pizza and Burger outlets, consistently lead in market penetration and volume, driven by affordability, speed, and widespread consumer appeal. Full Service Restaurants (FSR), especially those specializing in European and Italian cuisines, maintain a strong presence, catering to both locals and tourists seeking authentic dining experiences. The Cafes & Bars segment, encompassing Specialist Coffee & Tea Shops and Juice/Smoothie/Desserts Bars, is experiencing significant growth, reflecting a rising demand for premium beverages and quick, healthy snack options. Cloud Kitchens are rapidly emerging as a disruptive force, primarily in urban centers, optimizing delivery operations and expanding reach without the need for physical storefronts.

In terms of Outlet Types, Chained Outlets are steadily increasing their market share due to brand recognition, standardized operations, and efficient supply chains. However, Independent Outlets continue to hold significant sway, especially in areas renowned for their unique culinary heritage and personalized service, contributing to the rich tapestry of Italy's food scene.

Geographically, regions with high population density and strong tourism appeal, such as Lombardy, Lazio, and Campania, often exhibit the highest concentration of food service establishments and revenue. Within these regions, Location plays a crucial role. Travel hubs (airports, train stations) and Leisure destinations (shopping malls, tourist attractions) are prime areas for QSR and FSR operations. Retail locations benefit from high foot traffic, while Standalone outlets often thrive through unique branding and destination appeal.

- Key Drivers for QSR Dominance:

- Affordability and value for money.

- Convenience and speed of service.

- Strong brand marketing and franchise expansion.

- Adaptability to delivery and takeaway models.

- Growth Factors for Cafes & Bars:

- Rising disposable incomes and a desire for premium beverages.

- The "third place" concept, offering spaces for work and socializing.

- Increasing interest in specialty coffee and artisanal teas.

- Health-conscious trends favoring smoothies and fresh juices.

- Impact of Cloud Kitchens:

- Reduced operational costs and real estate dependency.

- Ability to serve wider delivery zones.

- Flexibility in menu adaptation and testing new concepts.

- Facilitation of growth for emerging food brands.

- Regional Dominance Factors:

- High population density and urban centers.

- Strong tourism influx throughout the year.

- Presence of major transportation networks.

- Established culinary traditions that attract both locals and visitors.

The ongoing investment trends and evolving consumer behavior continue to shape the dominance of specific segments and locations within the Italian food service market. Regulatory support for new business models and a growing appetite for diverse culinary experiences further fuel this dynamic evolution.

Italian Food Service Market Product Innovations

Product innovation in the Italian food service market is increasingly focused on customization, health-conscious offerings, and unique flavor profiles. From artisanal gelato flavors incorporating exotic fruits to plant-based alternatives for classic Italian dishes, operators are actively diversifying their menus. Technological integration, such as AI-driven menu optimization and personalized recommendations through apps, enhances the customer experience. Performance metrics often revolve around increased customer engagement, higher average order values, and reduced food waste through efficient inventory management. Unique selling propositions now center on sustainable sourcing, ethical production, and catering to specific dietary needs, such as gluten-free or vegan options.

Propelling Factors for Italian Food Service Market Growth

The Italian food service market is propelled by a combination of robust economic factors, evolving consumer behavior, and supportive industry developments. A steady increase in disposable incomes across key demographics enhances consumer spending power on dining out and takeaway services. The growing demand for convenience, driven by busy lifestyles and the widespread adoption of digital platforms, fuels the expansion of delivery and quick-service formats. Furthermore, Italy's rich culinary heritage, coupled with a global appreciation for its cuisine, acts as a perpetual magnet for both domestic and international consumers, fostering continuous growth in traditional and innovative food concepts. Technological advancements in ordering systems, kitchen automation, and data analytics are also critical enablers, improving operational efficiency and customer experience.

Obstacles in the Italian Food Service Market Market

Despite its growth trajectory, the Italian food service market faces several obstacles. Intense competition, particularly in urban areas, can lead to price wars and reduced profit margins for many operators. Stringent labor laws and the rising cost of labor present significant challenges for businesses, impacting profitability. Furthermore, supply chain disruptions, exacerbated by global events, can lead to increased ingredient costs and availability issues, affecting menu consistency and operational stability. Navigating complex and evolving food safety regulations also requires constant vigilance and investment. The economic sensitivity of the sector means that downturns can significantly impact consumer discretionary spending on dining out.

Future Opportunities in Italian Food Service Market

The Italian food service market is ripe with future opportunities, particularly in the realm of sustainable and plant-based dining, catering to a growing environmentally conscious consumer base. The continued expansion of the Italian food delivery market presents significant potential for cloud kitchens and ghost restaurants, optimizing for convenience and reach. Emerging technologies like augmented reality for menu visualization and personalized ordering apps offer avenues for enhanced customer engagement. Furthermore, tapping into niche markets, such as gourmet vegetarian/vegan options, ethnic cuisines beyond Italian, and experiential dining concepts, can unlock new revenue streams and cater to diverse preferences. The focus on local, seasonal produce also presents an opportunity to build strong brand narratives and connect with consumers seeking authenticity.

Major Players in the Italian Food Service Market Ecosystem

Starhotels SpA Yum! Brands Inc QSR Platform Holding SCA Alice Pizza SpA Cremonini SpA Gruppo Sebeto Autogrill SpA Lagardère Group La Piadineria Group McDonald's Corporation Compagna Generale Ristorazione SpA Camst Group

Key Developments in Italian Food Service Market Industry

- December 2022: KFC announced that the KFC Drive at the La Corte del Sole shopping center is the company’s newest outlet in Sestu.

- November 2022: Lagardère Travel Retail signed an agreement to acquire 100% of the shares in Marché International AG, the holding company of the Marché Group.

- November 2022: KFC announced that it had invested USD 21.81 million to open more restaurants in Italy. The fried chicken brand had planned to launch 25 new outlets in 2022.

Strategic Italian Food Service Market Market Forecast

The strategic forecast for the Italian food service market is exceptionally promising, driven by sustained consumer demand for convenience, diverse culinary experiences, and a growing emphasis on health and sustainability. Continued investment in the Italian food delivery ecosystem and the expansion of cloud kitchens will redefine accessibility and operational models. The market is poised for growth fueled by innovative menu development, technological integration in customer service, and a keen understanding of evolving generational preferences. Opportunities abound for brands that can effectively blend traditional Italian culinary excellence with modern, health-conscious, and digitally enabled solutions, ensuring a robust and expanding market landscape throughout the forecast period.

Italian Food Service Market Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

Italian Food Service Market Segmentation By Geography

- 1. Italia

Italian Food Service Market Regional Market Share

Geographic Coverage of Italian Food Service Market

Italian Food Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Escalating Consumer Investment in Preventive Healthcare Products; Increasing Algal Protein Applications Among Various Supplements

- 3.3. Market Restrains

- 3.3.1. Availability of Alternative Protein Sources

- 3.4. Market Trends

- 3.4.1. Rising tourism and expansion in commercial real estate propelling sales in the country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italian Food Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italia

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Starhotels SpA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Yum! Brands Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 QSR Platform Holding SCA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Alice Pizza SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cremonini SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gruppo Sebeto

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Autogrill SpA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lagardère Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 La Piadineria Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 McDonald's Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Compagna Generale Ristorazione SpA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Camst Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Starhotels SpA

List of Figures

- Figure 1: Italian Food Service Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italian Food Service Market Share (%) by Company 2025

List of Tables

- Table 1: Italian Food Service Market Revenue billion Forecast, by Foodservice Type 2020 & 2033

- Table 2: Italian Food Service Market Revenue billion Forecast, by Outlet 2020 & 2033

- Table 3: Italian Food Service Market Revenue billion Forecast, by Location 2020 & 2033

- Table 4: Italian Food Service Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Italian Food Service Market Revenue billion Forecast, by Foodservice Type 2020 & 2033

- Table 6: Italian Food Service Market Revenue billion Forecast, by Outlet 2020 & 2033

- Table 7: Italian Food Service Market Revenue billion Forecast, by Location 2020 & 2033

- Table 8: Italian Food Service Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italian Food Service Market?

The projected CAGR is approximately 6.92%.

2. Which companies are prominent players in the Italian Food Service Market?

Key companies in the market include Starhotels SpA, Yum! Brands Inc, QSR Platform Holding SCA, Alice Pizza SpA, Cremonini SpA, Gruppo Sebeto, Autogrill SpA, Lagardère Group, La Piadineria Group, McDonald's Corporation, Compagna Generale Ristorazione SpA, Camst Group.

3. What are the main segments of the Italian Food Service Market?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.52 billion as of 2022.

5. What are some drivers contributing to market growth?

Escalating Consumer Investment in Preventive Healthcare Products; Increasing Algal Protein Applications Among Various Supplements.

6. What are the notable trends driving market growth?

Rising tourism and expansion in commercial real estate propelling sales in the country.

7. Are there any restraints impacting market growth?

Availability of Alternative Protein Sources.

8. Can you provide examples of recent developments in the market?

December 2022: KFC announced that the KFC Drive at the La Corte del Sole shopping center is the company’s newest outlet in Sestu.November 2022: Lagardère Travel Retail signed an agreement to acquire 100% of the shares in Marché International AG, the holding company of the Marché Group. November 2022: KFC announced that it had invested USD 21.81 million to open more restaurants in Italy. The fried chicken brand had planned to launch 25 new outlets in 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italian Food Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italian Food Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italian Food Service Market?

To stay informed about further developments, trends, and reports in the Italian Food Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence