Key Insights

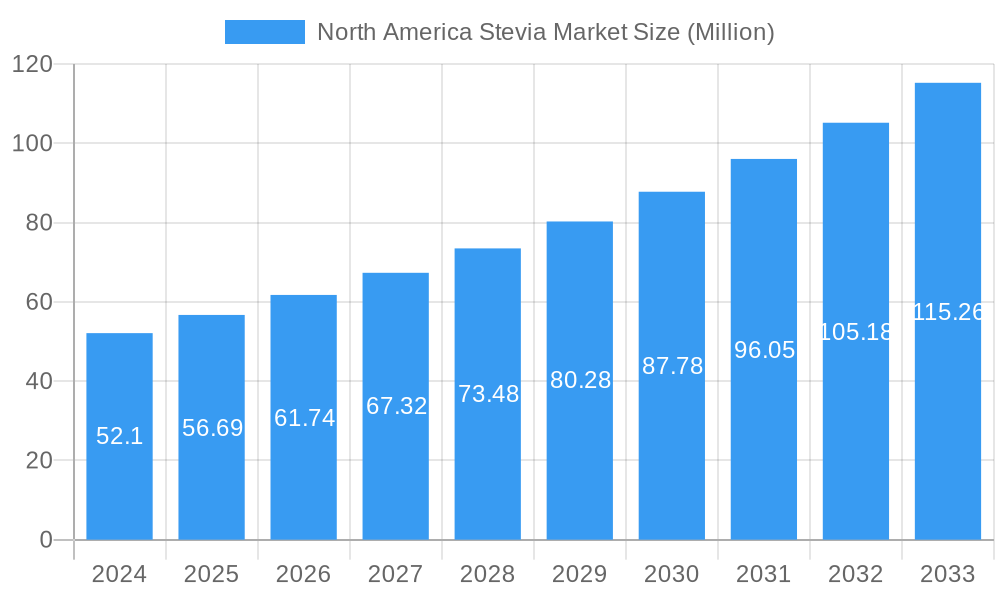

The North American stevia market is poised for significant expansion, driven by a confluence of health-conscious consumer demand and advancements in stevia extraction and refinement technologies. As of 2024, the market is estimated at $52.1 million, and it is projected to witness a robust Compound Annual Growth Rate (CAGR) of 10.8% through 2033. This growth trajectory is primarily fueled by increasing consumer awareness regarding the adverse health effects of sugar and artificial sweeteners, leading to a surge in demand for natural, zero-calorie alternatives. The expanding application of stevia in the food and beverage sector, particularly in bakery, dairy, and confectionery products, along with its growing adoption in the pharmaceutical industry for masking the taste of medications, are key contributors. Emerging trends like the development of higher-purity stevia extracts and novel formulations are further bolstering market penetration, making it an attractive segment for investment and innovation.

North America Stevia Market Market Size (In Million)

Despite the overwhelmingly positive outlook, certain factors could influence the market's growth trajectory. Potential restraints might include fluctuating raw material prices due to agricultural factors, stringent regulatory landscapes in certain sub-regions within North America, and the ongoing need for consumer education to overcome any lingering perceptions or misinformation about stevia. However, the inherent advantages of stevia, such as its natural origin and perceived health benefits, are likely to outweigh these challenges. The market is segmented into various forms, including powder, liquid, and leaf, with powder and liquid dominating due to ease of use and integration in manufacturing processes. Geographically, North America, encompassing the United States, Canada, and Mexico, represents a key market, characterized by high disposable incomes and a strong inclination towards healthier food choices. Leading companies like Cargill, Archer Daniels Midland Company, and PureCircle are actively investing in research and development to enhance product quality and expand their market reach.

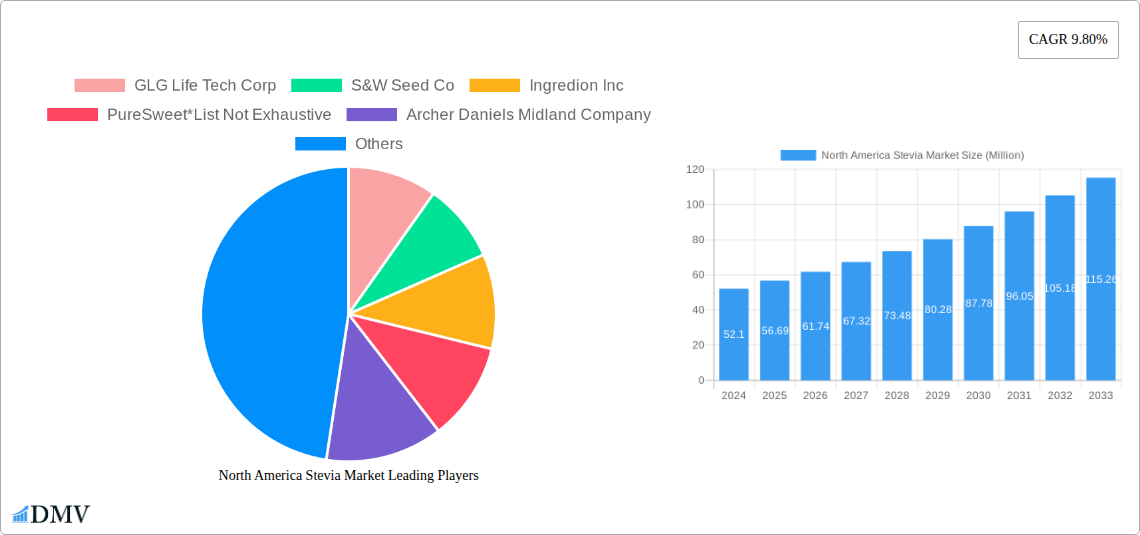

North America Stevia Market Company Market Share

North America Stevia Market Market Composition & Trends

The North America stevia market is characterized by a dynamic competitive landscape, with key players actively shaping its trajectory. Market concentration is moderate, with established giants like Cargill, Archer Daniels Midland Company, Ingredion Inc, and PureCircle holding significant sway, complemented by specialized innovators such as GLG Life Tech Corp and PureSweet. Innovation is a key catalyst, driven by the continuous demand for natural, zero-calorie sweeteners. The regulatory landscape, primarily influenced by the FDA in the United States, has generally been favorable, permitting the use of high-purity steviol glycosides. Substitute products, predominantly artificial sweeteners and other natural sweeteners like monk fruit, present ongoing competition, necessitating constant product differentiation and cost-effectiveness. End-user profiles are diverse, spanning health-conscious consumers, manufacturers of food and beverages, and the pharmaceutical sector seeking sugar alternatives. Mergers and acquisitions (M&A) activity has been strategic, aiming to consolidate market share, expand product portfolios, and enhance technological capabilities. The overall market is valued in the $1,500 million range, with M&A deals reaching substantial figures in the tens to hundreds of millions.

- Market Share Distribution: Dominated by a handful of major players, with a growing share for emerging innovators.

- Innovation Focus: Development of novel steviol glycosides, improved extraction methods, and enhanced taste profiles.

- Regulatory Environment: Generally supportive for GRAS-certified stevia ingredients.

- Substitute Landscape: Continuous pressure from artificial sweeteners and other natural alternatives.

- End-User Segmentation: Food & Beverage manufacturers constitute the largest segment, followed by pharmaceuticals and nutraceuticals.

- M&A Drivers: Capacity expansion, portfolio diversification, and technology acquisition.

North America Stevia Market Industry Evolution

The North America stevia market has witnessed a remarkable evolution, driven by a confluence of factors that have fundamentally reshaped its growth trajectory. The historical period from 2019 to 2024 saw an average annual growth rate of approximately 8.5%, a testament to the escalating consumer preference for healthier food and beverage options. This surge was propelled by increasing awareness of the detrimental health effects associated with high sugar consumption, including obesity, diabetes, and cardiovascular diseases. Technological advancements have been pivotal in this evolution. Innovations in extraction and purification processes have led to higher yields of premium steviol glycosides, such as Rebaudioside A (Reb A) and Rebaudioside M (Reb M), which offer a cleaner taste profile and reduced bitterness, addressing a key historical drawback of stevia. The base year of 2025 is estimated to see the market reach a valuation of $1,850 million, reflecting continued robust expansion.

Shifting consumer demands are at the core of this market's dynamism. The "clean label" movement, emphasizing natural ingredients and minimal processing, has significantly boosted stevia's appeal over artificial sweeteners. Consumers are actively seeking out products free from artificial additives and high-fructose corn syrup, positioning stevia as a preferred choice. This demand is not confined to specific demographics; it spans a broad spectrum of age groups and income levels, indicating a widespread societal shift towards healthier lifestyle choices. The integration of stevia across a wider array of applications, from beverages and baked goods to dairy products and confectionery, further underscores its growing acceptance and versatility. The forecast period from 2025 to 2033 anticipates a sustained Compound Annual Growth Rate (CAGR) of around 9.0%, projecting the market to exceed $3,800 million by 2033. This sustained growth will be fueled by ongoing research into new steviol glycosides with even more desirable taste characteristics and expanded applications, coupled with supportive government initiatives promoting public health and sugar reduction. The adoption metrics for stevia-based products have steadily increased, with manufacturers increasingly reformulating their offerings to incorporate stevia, driving demand from the ingredient supplier side.

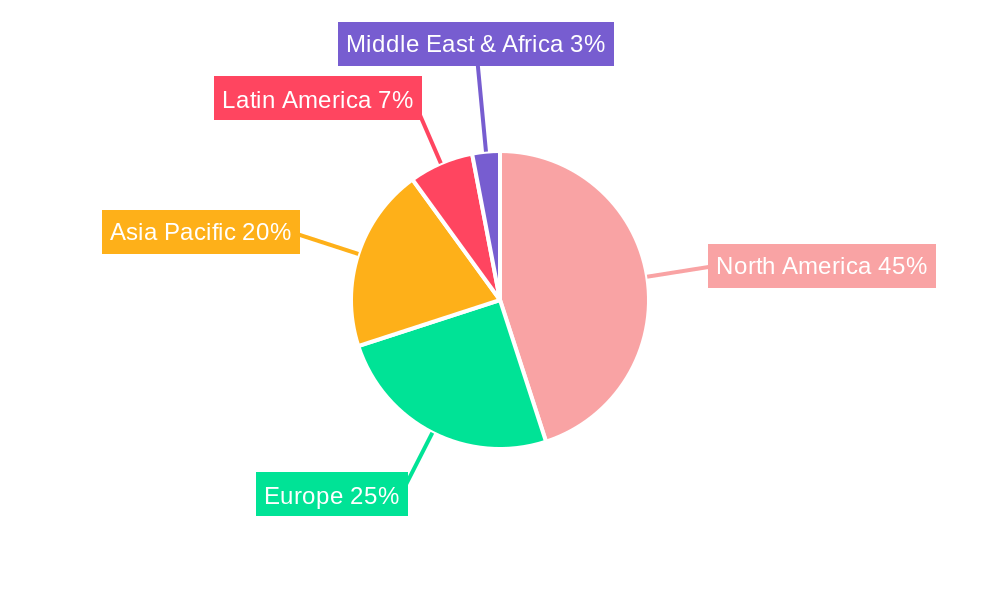

Leading Regions, Countries, or Segments in North America Stevia Market

The North America stevia market is predominantly led by the United States, a powerhouse in both consumption and innovation. This dominance is driven by a confluence of factors including a large and health-conscious consumer base, robust food and beverage manufacturing sectors, and a favorable regulatory environment for natural sweeteners. The market in the United States is projected to account for over 65% of the total North American market value in 2025, estimated at $1,202.5 million. This leadership is underpinned by significant investments in research and development by major players and a proactive approach to adopting new food technologies.

Within the United States, the Beverages segment emerges as the most dominant application, driven by the widespread demand for low-calorie and sugar-free soft drinks, juices, and flavored waters. This segment alone is expected to represent 35% of the total stevia market in North America, valued at approximately $647.5 million in 2025. The growing popularity of diet and zero-sugar beverages, fueled by health trends and marketing campaigns, makes this application a consistent growth engine.

Key Drivers of Dominance:

- United States:

- High Consumer Awareness: Extensive public health campaigns and media coverage highlighting the benefits of sugar reduction.

- Robust Food & Beverage Industry: A large number of manufacturers actively reformulating products to include stevia.

- FDA Approvals: Favorable regulatory framework for high-purity steviol glycosides.

- Investment in R&D: Significant capital allocation towards developing new stevia applications and improved taste profiles.

- Growing E-commerce Penetration: Facilitates wider distribution and consumer access to stevia-sweetened products.

- Beverages Segment:

- Mass Market Appeal: Wide range of sugar-free and diet beverage options available.

- Taste Improvement: Advancements in stevia formulations have made it a viable and appealing sweetener for various beverages.

- Premiumization: Manufacturers are increasingly using stevia to appeal to health-conscious consumers seeking premium, guilt-free options.

- Regulatory Support for Sugar Reduction: Government initiatives encouraging a decrease in sugar content in food and beverages.

Canada and Mexico, while smaller contributors, are also exhibiting steady growth. Canada's market is influenced by similar health trends as the US, while Mexico's growth is being spurred by increasing disposable incomes and a rising middle class that is becoming more health-aware. The Bakery and Dairy Food Products segments are also significant, demonstrating a steady upward trend as manufacturers continue to explore sugar reduction in these product categories. The pharmaceutical segment, while smaller in volume, represents a high-value application due to the stringent quality and purity requirements for ingredients.

North America Stevia Market Product Innovations

Product innovations in the North America stevia market are primarily focused on enhancing taste profiles and expanding application versatility. Companies are investing heavily in developing next-generation steviol glycosides, such as Reb M and Reb D, which offer a taste profile closer to sugar with significantly reduced off-notes. Advanced extraction and purification techniques are enabling higher purity levels and more cost-effective production, making stevia a more competitive option. Innovations also extend to blended solutions, where stevia is combined with other natural sweeteners or flavor enhancers to achieve optimal sweetness and mouthfeel across diverse applications like beverages, bakery items, and confectionery, ensuring a superior consumer experience.

Propelling Factors for North America Stevia Market Growth

The North America stevia market is experiencing robust growth driven by several key factors. A primary driver is the escalating consumer demand for natural, zero-calorie sweeteners, fueled by increasing health consciousness and a growing aversion to artificial ingredients. The well-established regulatory approval for high-purity steviol glycosides by bodies like the FDA in the United States provides a stable foundation for market expansion. Furthermore, technological advancements in extraction and purification are leading to improved taste profiles and cost efficiencies, making stevia a more attractive alternative to sugar and artificial sweeteners. Economic factors, including rising disposable incomes in some segments of the population, allow for greater adoption of premium, healthier food and beverage options.

Obstacles in the North America Stevia Market Market

Despite its promising growth, the North America stevia market faces certain obstacles. Regulatory hurdles, though generally favorable, can still present challenges in specific applications or for novel stevia derivatives, requiring extensive testing and approval processes. Supply chain disruptions, including those related to agricultural yields of stevia plants or logistical complexities, can impact availability and pricing. The competitive pressure from other natural sweeteners, such as monk fruit, and established artificial sweeteners necessitates continuous innovation and cost-competitiveness. Additionally, lingering consumer perceptions regarding the taste of stevia, despite advancements, can still present a barrier to wider adoption in certain product categories.

Future Opportunities in North America Stevia Market

The North America stevia market is poised for significant future opportunities. The continuous exploration and commercialization of new, better-tasting steviol glycosides will unlock wider application possibilities and improve consumer acceptance. Emerging markets within North America, particularly in underserved regions or specific demographic groups, offer untapped potential. Technological advancements in plant breeding and cultivation could lead to more sustainable and cost-effective stevia production. Furthermore, the growing trend towards plant-based diets and functional foods presents avenues for stevia integration in new product categories. The expansion of the pharmaceutical and nutraceutical sectors also offers high-value opportunities for pure stevia extracts.

Major Players in the North America Stevia Market Ecosystem

- GLG Life Tech Corp

- S&W Seed Co

- Ingredion Inc

- PureSweet

- Archer Daniels Midland Company

- Cargill

- PureCircle

- Tate & Lyle

Key Developments in North America Stevia Market Industry

- 2023/2024: Increased focus on Reb M and Reb D development and commercialization for improved taste profiles.

- 2023: Expansion of manufacturing capacities by major players to meet growing demand.

- 2022: Launch of new stevia-based product lines by major beverage and food manufacturers.

- 2021: Strategic partnerships and collaborations aimed at enhancing R&D and market reach.

- 2020: Regulatory approvals for new steviol glycoside applications in specific food categories.

- 2019: Growing consumer demand for natural and low-calorie sweeteners significantly impacts ingredient sourcing and innovation.

Strategic North America Stevia Market Market Forecast

The strategic North America stevia market forecast indicates sustained and strong growth, driven by a powerful combination of escalating consumer health consciousness and ongoing product innovation. The demand for natural, sugar-free alternatives is set to remain a dominant force, propelling the market beyond an estimated $1,850 million in 2025 to well over $3,800 million by 2033, reflecting a healthy CAGR of approximately 9.0%. Key growth catalysts include the continuous refinement of stevia's taste profile through the development of novel glycosides, making it a more palatable and versatile sweetener across a broader range of food and beverage applications. Favorable regulatory environments and increasing investment in R&D by leading global ingredient suppliers will further solidify stevia's market position, making it an indispensable component in the future of food and beverage formulation.

North America Stevia Market Segmentation

-

1. Type

- 1.1. Powder

- 1.2. Liquid

- 1.3. Leaf

-

2. Application

- 2.1. Bakery

- 2.2. Dairy Food Products

- 2.3. Beverages

- 2.4. Pharmaceuticals

- 2.5. Confectionery

- 2.6. Other Applications

-

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

- 3.1.3. Mexico

- 3.1.4. Rest of North America

-

3.1. North America

North America Stevia Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

North America Stevia Market Regional Market Share

Geographic Coverage of North America Stevia Market

North America Stevia Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits

- 3.3. Market Restrains

- 3.3.1. Affordability of the Product is Restraining the Market's Growth

- 3.4. Market Trends

- 3.4.1. Rapid Growth in the North America Stevia Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Stevia Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Powder

- 5.1.2. Liquid

- 5.1.3. Leaf

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Dairy Food Products

- 5.2.3. Beverages

- 5.2.4. Pharmaceuticals

- 5.2.5. Confectionery

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.1.3. Mexico

- 5.3.1.4. Rest of North America

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 GLG Life Tech Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 S&W Seed Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ingredion Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PureSweet*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Archer Daniels Midland Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cargill

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PureCircle

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tate & Lyle

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 GLG Life Tech Corp

List of Figures

- Figure 1: North America Stevia Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Stevia Market Share (%) by Company 2025

List of Tables

- Table 1: North America Stevia Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: North America Stevia Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: North America Stevia Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: North America Stevia Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: North America Stevia Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: North America Stevia Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: North America Stevia Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: North America Stevia Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States North America Stevia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Stevia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Stevia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America North America Stevia Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Stevia Market?

The projected CAGR is approximately 10.8%.

2. Which companies are prominent players in the North America Stevia Market?

Key companies in the market include GLG Life Tech Corp, S&W Seed Co, Ingredion Inc, PureSweet*List Not Exhaustive, Archer Daniels Midland Company, Cargill, PureCircle, Tate & Lyle.

3. What are the main segments of the North America Stevia Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits.

6. What are the notable trends driving market growth?

Rapid Growth in the North America Stevia Market.

7. Are there any restraints impacting market growth?

Affordability of the Product is Restraining the Market's Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Stevia Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Stevia Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Stevia Market?

To stay informed about further developments, trends, and reports in the North America Stevia Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence