Key Insights

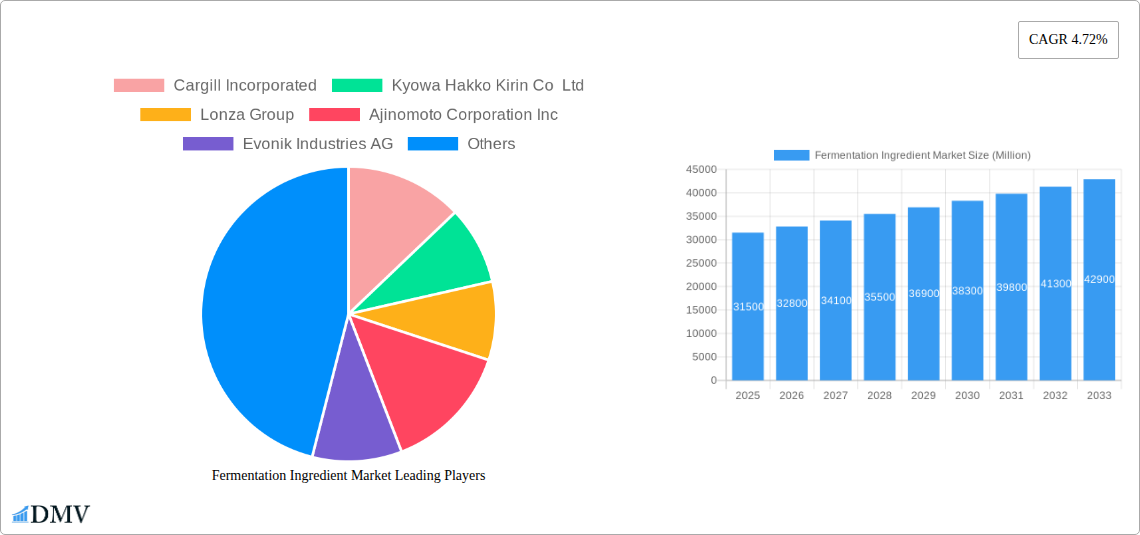

The global Fermentation Ingredient Market is poised for significant expansion, projected to reach $31.5 billion in 2025. This growth is driven by an anticipated Compound Annual Growth Rate (CAGR) of 4.2% during the forecast period of 2025-2033. A key driver of this upward trajectory is the increasing demand for natural and sustainable ingredients across various industries, particularly in food and beverages and animal feed, where fermentation-derived products offer enhanced nutritional profiles and improved functional properties. The pharmaceutical sector also contributes substantially, leveraging fermentation for the production of vital therapeutics and active pharmaceutical ingredients (APIs). Furthermore, rising consumer awareness regarding health and wellness fuels the demand for fermented foods and supplements, indirectly boosting the market for their constituent ingredients.

Fermentation Ingredient Market Market Size (In Billion)

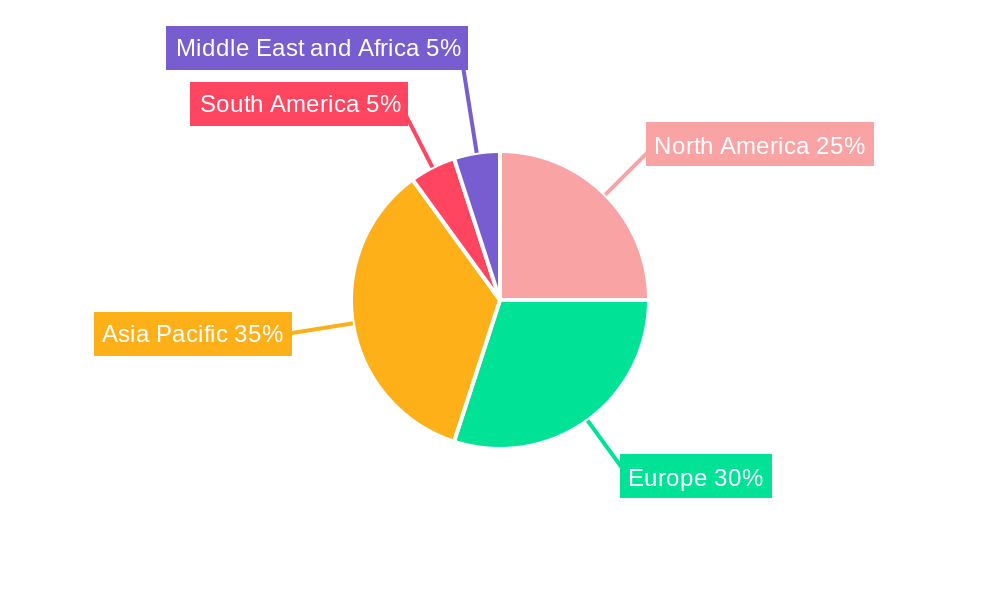

The market is characterized by a diverse range of segments, including Amino Acids, Organic Acids, Polymers, Vitamins, Industrial Enzymes, and Antibiotics, all contributing to its robust expansion. The dominance of dry and liquid forms reflects the varied applications and ease of integration into different product formulations. Geographically, the Asia Pacific region is expected to emerge as a significant growth engine, fueled by rapid industrialization, a burgeoning middle class with increasing disposable income, and a strong emphasis on food security and innovation. While the market exhibits strong growth potential, potential restraints such as stringent regulatory frameworks for certain fermentation products and fluctuations in raw material prices could present challenges. However, ongoing technological advancements in fermentation processes and a growing emphasis on bio-based solutions are expected to mitigate these restraints, ensuring a dynamic and evolving market landscape.

Fermentation Ingredient Market Company Market Share

Dive deep into the rapidly evolving fermentation ingredient market with this insightful report. Explore the dynamic interplay of amino acids, organic acids, polymers, vitamins, industrial enzymes, and antibiotics shaping the future of food and beverages, animal feed, pharmaceutical, and industrial use applications. Understand the significant growth projected from a base year of 2025, with a comprehensive forecast spanning 2025–2033, building upon historical data from 2019–2024. This report offers unparalleled insights for stakeholders seeking to capitalize on the burgeoning demand for fermented ingredients.

Fermentation Ingredient Market Market Composition & Trends

The fermentation ingredient market exhibits a moderately consolidated landscape, driven by continuous innovation and stringent regulatory frameworks. Key innovation catalysts include the increasing demand for natural and sustainable ingredients, advancements in biotechnology, and a growing consumer preference for functional foods and nutraceuticals. The regulatory environment, particularly concerning food safety and labeling, plays a crucial role in shaping market entry and product development. Substitute products, such as synthetic ingredients and novel processing techniques, pose a competitive challenge, though the unique benefits of fermentation often provide a distinct advantage. End-user profiles are diverse, encompassing food manufacturers, animal feed producers, pharmaceutical companies, and industrial entities, each with specific quality and performance requirements. Merger and acquisition (M&A) activities are strategic, focused on expanding product portfolios, enhancing technological capabilities, and gaining market share. While exact M&A deal values are dynamic, the trend indicates significant investment in companies with strong fermentation expertise. Market share distribution is influenced by the performance of leading players and the emergence of niche ingredient suppliers.

Fermentation Ingredient Market Industry Evolution

The fermentation ingredient market has witnessed a remarkable evolution, transforming from a niche sector to a mainstream driver of innovation across multiple industries. The historical period of 2019–2024 laid the groundwork for robust growth, characterized by increasing consumer awareness of the health benefits associated with fermented products and a growing emphasis on sustainable sourcing. Technological advancements in fermentation processes, including the development of novel microbial strains, optimization of bioreactor technology, and improved downstream processing techniques, have significantly enhanced efficiency and scalability. These advancements have directly contributed to the market growth trajectories, making fermentation a more viable and cost-effective production method for a wider range of ingredients. Shifting consumer demands have been a pivotal force, with a pronounced move towards natural, clean-label, and plant-based alternatives. This trend has spurred the development of fermented ingredients for the food and beverage sector, offering enhanced flavor profiles, improved digestibility, and added nutritional value. For instance, the rise of fermented dairy alternatives and plant-based proteins has been directly fueled by consumer preferences. In the pharmaceutical industry, fermentation remains a cornerstone for producing essential antibiotics and biopharmaceuticals, with ongoing research into new therapeutic agents derived from microbial processes. The animal feed segment is increasingly leveraging fermented ingredients for improved gut health and nutrient utilization in livestock, contributing to animal welfare and reducing the need for antibiotics. The industrial applications are also expanding, with fermentation playing a key role in the production of biofuels, bioplastics, and specialty chemicals, aligning with global sustainability goals. The adoption of these fermented solutions has seen a steady increase, with growth rates exceeding general market expansion in many sub-segments.

Leading Regions, Countries, or Segments in Fermentation Ingredient Market

The fermentation ingredient market is experiencing robust growth across various regions and segments, driven by a confluence of factors. North America and Europe currently lead the market due to established regulatory frameworks, strong R&D infrastructure, and a high consumer demand for naturally derived and functional ingredients in the Food and Beverages and Pharmaceutical applications. The dominance of specific segments is evident:

- Type: Amino Acids and Industrial Enzymes are experiencing exceptional demand.

- Key Drivers: Increasing awareness of amino acid benefits in sports nutrition and dietary supplements. Growing adoption of industrial enzymes in food processing, detergents, and biofuels for enhanced efficiency and sustainability. Significant investment in R&D by major players like BASF SE and Evonik Industries AG.

- Application: Food and Beverages remains the largest and fastest-growing application.

- Key Drivers: Rising popularity of fermented foods (e.g., yogurt, kimchi, kombucha) and beverages. Demand for natural preservatives and flavor enhancers. Growth in the plant-based food sector, where fermentation plays a crucial role in texture and taste development.

- Form: Dry fermentation ingredients often hold a larger market share due to their extended shelf life and ease of transportation and handling.

- Key Drivers: Cost-effectiveness and logistical advantages for global distribution. Wider applicability in various product formulations where moisture content is a concern.

Asia Pacific is emerging as a significant growth region, fueled by a large population, rising disposable incomes, and increasing adoption of processed foods and pharmaceuticals. Key drivers in this region include supportive government initiatives for biotechnology and a growing awareness of health and wellness. The Animal Feed segment is also witnessing substantial growth globally, driven by the need for improved animal nutrition and a reduction in antibiotic usage.

Fermentation Ingredient Market Product Innovations

Product innovation is a cornerstone of the fermentation ingredient market. Companies are actively developing novel ingredients that offer enhanced nutritional profiles, improved functionality, and superior sustainability. For instance, innovations in producing specific amino acids through precision fermentation are yielding higher purity and tailored functionalities for dietary supplements and functional foods. The development of specialized industrial enzymes with improved thermostability and pH tolerance is expanding their applicability in challenging industrial processes. Furthermore, the creation of unique organic acids and polymers through advanced fermentation techniques is unlocking new possibilities in biodegradable plastics and specialty chemicals. These innovations often boast unique selling propositions such as improved bioavailability, reduced environmental impact, and novel sensory attributes, directly addressing evolving consumer and industry demands.

Propelling Factors for Fermentation Ingredient Market Growth

Several key growth drivers are propelling the fermentation ingredient market forward. Technological advancements in genetic engineering and bioprocessing are enabling the cost-effective and large-scale production of complex ingredients. The increasing global demand for natural, sustainable, and health-promoting ingredients is a major catalyst, aligning perfectly with the inherent benefits of fermentation. Regulatory support in various regions, promoting the use of bio-based products and sustainable manufacturing, further fuels market expansion. Economic factors, such as the growing disposable incomes in emerging economies, are increasing consumer purchasing power for premium and functional food and beverage products that often utilize fermented ingredients.

Obstacles in the Fermentation Ingredient Market Market

Despite its robust growth, the fermentation ingredient market faces certain obstacles. Stringent regulatory hurdles and lengthy approval processes for new ingredients, particularly in the pharmaceutical and food sectors, can hinder market entry and slow down innovation. Supply chain disruptions, exacerbated by geopolitical events or raw material availability, can impact production consistency and cost. Competitive pressures from established synthetic ingredient manufacturers and the development of alternative processing technologies also pose challenges. Furthermore, the perception of fermented products, while generally positive, can sometimes be influenced by concerns regarding taste or texture, requiring ongoing consumer education and product refinement.

Future Opportunities in Fermentation Ingredient Market

The fermentation ingredient market is ripe with future opportunities. Emerging markets in Asia and Latin America represent significant untapped potential for both established and new players. Advancements in synthetic biology and metabolic engineering are opening doors for the production of novel, high-value ingredients previously unattainable through conventional fermentation. The growing consumer interest in personalized nutrition and functional foods will drive demand for specialized fermented ingredients tailored to specific health needs. Furthermore, the increasing focus on a circular economy and waste valorization presents opportunities for developing fermentation processes that utilize by-products from other industries, enhancing sustainability and creating new revenue streams.

Major Players in the Fermentation Ingredient Market Ecosystem

- Cargill Incorporated

- Kyowa Hakko Kirin Co Ltd

- Lonza Group

- Ajinomoto Corporation Inc

- Evonik Industries AG

- BASF SE

- Associated British Foods PLC

- Dohler Group SE

- Lesaffre

- Lallemand Inc

Key Developments in Fermentation Ingredient Market Industry

- December 2022: Foodiq, a Nordic food innovator, launched Fabea+, a fermented fava bean ingredient. This development highlights a growing trend in plant-based protein innovation, with claims of superior nutritional value, sustainability, and marketability compared to traditional plant proteins.

- November 2022: Arla Food Ingredients introduced its whey-based solution, Lacprodan Hydro.365 and Nutrilac FO-8571. This launch signifies innovation in high-protein fermented beverages, offering a viable alternative to traditional protein sources.

- July 2022: Cellevant launched a fermented turmeric ingredient possessing antibiotic properties and bioactive ingredients like postbiotics and parabiotics. This product's EU organic certification and application in nutraceuticals and food underscore the expanding use of fermentation in health-focused applications.

Strategic Fermentation Ingredient Market Market Forecast

The fermentation ingredient market is poised for substantial growth driven by continued innovation and evolving consumer preferences. Strategic initiatives by major players, focusing on expanding production capacities, investing in R&D for novel ingredients, and forging partnerships, will be critical. The increasing demand for sustainable and natural products in the food, beverage, and pharmaceutical sectors will act as a significant growth catalyst. Furthermore, the exploration of new applications in industrial biotechnology and the increasing focus on health and wellness will unlock new market potential. The market's trajectory is strongly indicative of a future where fermented ingredients play an indispensable role in a wide array of products and processes.

Fermentation Ingredient Market Segmentation

-

1. Type

- 1.1. Amino Acids

- 1.2. Organic Acids

- 1.3. Polymers

- 1.4. Vitamins

- 1.5. Industrial Enzymes

- 1.6. Antibiotics

-

2. Form

- 2.1. Dry

- 2.2. Liquid

-

3. Application

- 3.1. Food and Beverages

- 3.2. Animal Feed

- 3.3. Pharmaceutical

- 3.4. Industrial Use

- 3.5. Other Applications

Fermentation Ingredient Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Fermentation Ingredient Market Regional Market Share

Geographic Coverage of Fermentation Ingredient Market

Fermentation Ingredient Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Low Price and Easy Availability of Synthetic Phenethyl Alcohol

- 3.3. Market Restrains

- 3.3.1. Availability of Substitutes

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Fermented Ingredients in Cosmetics and Personal Care

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fermentation Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Amino Acids

- 5.1.2. Organic Acids

- 5.1.3. Polymers

- 5.1.4. Vitamins

- 5.1.5. Industrial Enzymes

- 5.1.6. Antibiotics

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Dry

- 5.2.2. Liquid

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Food and Beverages

- 5.3.2. Animal Feed

- 5.3.3. Pharmaceutical

- 5.3.4. Industrial Use

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Fermentation Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Amino Acids

- 6.1.2. Organic Acids

- 6.1.3. Polymers

- 6.1.4. Vitamins

- 6.1.5. Industrial Enzymes

- 6.1.6. Antibiotics

- 6.2. Market Analysis, Insights and Forecast - by Form

- 6.2.1. Dry

- 6.2.2. Liquid

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Food and Beverages

- 6.3.2. Animal Feed

- 6.3.3. Pharmaceutical

- 6.3.4. Industrial Use

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Fermentation Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Amino Acids

- 7.1.2. Organic Acids

- 7.1.3. Polymers

- 7.1.4. Vitamins

- 7.1.5. Industrial Enzymes

- 7.1.6. Antibiotics

- 7.2. Market Analysis, Insights and Forecast - by Form

- 7.2.1. Dry

- 7.2.2. Liquid

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Food and Beverages

- 7.3.2. Animal Feed

- 7.3.3. Pharmaceutical

- 7.3.4. Industrial Use

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Fermentation Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Amino Acids

- 8.1.2. Organic Acids

- 8.1.3. Polymers

- 8.1.4. Vitamins

- 8.1.5. Industrial Enzymes

- 8.1.6. Antibiotics

- 8.2. Market Analysis, Insights and Forecast - by Form

- 8.2.1. Dry

- 8.2.2. Liquid

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Food and Beverages

- 8.3.2. Animal Feed

- 8.3.3. Pharmaceutical

- 8.3.4. Industrial Use

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Fermentation Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Amino Acids

- 9.1.2. Organic Acids

- 9.1.3. Polymers

- 9.1.4. Vitamins

- 9.1.5. Industrial Enzymes

- 9.1.6. Antibiotics

- 9.2. Market Analysis, Insights and Forecast - by Form

- 9.2.1. Dry

- 9.2.2. Liquid

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Food and Beverages

- 9.3.2. Animal Feed

- 9.3.3. Pharmaceutical

- 9.3.4. Industrial Use

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Fermentation Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Amino Acids

- 10.1.2. Organic Acids

- 10.1.3. Polymers

- 10.1.4. Vitamins

- 10.1.5. Industrial Enzymes

- 10.1.6. Antibiotics

- 10.2. Market Analysis, Insights and Forecast - by Form

- 10.2.1. Dry

- 10.2.2. Liquid

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Food and Beverages

- 10.3.2. Animal Feed

- 10.3.3. Pharmaceutical

- 10.3.4. Industrial Use

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cargill Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kyowa Hakko Kirin Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lonza Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ajinomoto Corporation Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Evonik Industries AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Associated British Foods PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dohler Group SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Lesaffre*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lallemand Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Cargill Incorporated

List of Figures

- Figure 1: Global Fermentation Ingredient Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Fermentation Ingredient Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Fermentation Ingredient Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Fermentation Ingredient Market Revenue (undefined), by Form 2025 & 2033

- Figure 5: North America Fermentation Ingredient Market Revenue Share (%), by Form 2025 & 2033

- Figure 6: North America Fermentation Ingredient Market Revenue (undefined), by Application 2025 & 2033

- Figure 7: North America Fermentation Ingredient Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Fermentation Ingredient Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Fermentation Ingredient Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Fermentation Ingredient Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: Europe Fermentation Ingredient Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Fermentation Ingredient Market Revenue (undefined), by Form 2025 & 2033

- Figure 13: Europe Fermentation Ingredient Market Revenue Share (%), by Form 2025 & 2033

- Figure 14: Europe Fermentation Ingredient Market Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Fermentation Ingredient Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Fermentation Ingredient Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Fermentation Ingredient Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Fermentation Ingredient Market Revenue (undefined), by Type 2025 & 2033

- Figure 19: Asia Pacific Fermentation Ingredient Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Fermentation Ingredient Market Revenue (undefined), by Form 2025 & 2033

- Figure 21: Asia Pacific Fermentation Ingredient Market Revenue Share (%), by Form 2025 & 2033

- Figure 22: Asia Pacific Fermentation Ingredient Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: Asia Pacific Fermentation Ingredient Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Fermentation Ingredient Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Fermentation Ingredient Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Fermentation Ingredient Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: South America Fermentation Ingredient Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Fermentation Ingredient Market Revenue (undefined), by Form 2025 & 2033

- Figure 29: South America Fermentation Ingredient Market Revenue Share (%), by Form 2025 & 2033

- Figure 30: South America Fermentation Ingredient Market Revenue (undefined), by Application 2025 & 2033

- Figure 31: South America Fermentation Ingredient Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America Fermentation Ingredient Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: South America Fermentation Ingredient Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Fermentation Ingredient Market Revenue (undefined), by Type 2025 & 2033

- Figure 35: Middle East and Africa Fermentation Ingredient Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Fermentation Ingredient Market Revenue (undefined), by Form 2025 & 2033

- Figure 37: Middle East and Africa Fermentation Ingredient Market Revenue Share (%), by Form 2025 & 2033

- Figure 38: Middle East and Africa Fermentation Ingredient Market Revenue (undefined), by Application 2025 & 2033

- Figure 39: Middle East and Africa Fermentation Ingredient Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Fermentation Ingredient Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East and Africa Fermentation Ingredient Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fermentation Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Fermentation Ingredient Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 3: Global Fermentation Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Fermentation Ingredient Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Fermentation Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Fermentation Ingredient Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 7: Global Fermentation Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Fermentation Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Fermentation Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Fermentation Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Fermentation Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Fermentation Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Global Fermentation Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global Fermentation Ingredient Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 15: Global Fermentation Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 16: Global Fermentation Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Fermentation Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Germany Fermentation Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: France Fermentation Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Russia Fermentation Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Italy Fermentation Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Spain Fermentation Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Fermentation Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global Fermentation Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 25: Global Fermentation Ingredient Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 26: Global Fermentation Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 27: Global Fermentation Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: China Fermentation Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Japan Fermentation Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: India Fermentation Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Australia Fermentation Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Fermentation Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Global Fermentation Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 34: Global Fermentation Ingredient Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 35: Global Fermentation Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 36: Global Fermentation Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Brazil Fermentation Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Argentina Fermentation Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Fermentation Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Global Fermentation Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 41: Global Fermentation Ingredient Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 42: Global Fermentation Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 43: Global Fermentation Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 44: South Africa Fermentation Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Saudi Arabia Fermentation Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East and Africa Fermentation Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fermentation Ingredient Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Fermentation Ingredient Market?

Key companies in the market include Cargill Incorporated, Kyowa Hakko Kirin Co Ltd, Lonza Group, Ajinomoto Corporation Inc, Evonik Industries AG, BASF SE, Associated British Foods PLC, Dohler Group SE, Lesaffre*List Not Exhaustive, Lallemand Inc.

3. What are the main segments of the Fermentation Ingredient Market?

The market segments include Type, Form, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Low Price and Easy Availability of Synthetic Phenethyl Alcohol.

6. What are the notable trends driving market growth?

Increasing Demand for Fermented Ingredients in Cosmetics and Personal Care.

7. Are there any restraints impacting market growth?

Availability of Substitutes.

8. Can you provide examples of recent developments in the market?

In December 2022, Foodiq, a Nordic food innovator developed a new ingredient namely, Fabea+, which is a fermented fava. The company claimed that this fermented ingredient was more nutritious, sustainable, and saleable as compared to other plant proteins like soy, peas, and oats.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fermentation Ingredient Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fermentation Ingredient Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fermentation Ingredient Market?

To stay informed about further developments, trends, and reports in the Fermentation Ingredient Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence