Key Insights

The South American fermented drinks market is projected for substantial growth, reaching an estimated $2.5 million by 2025. This expansion is fueled by escalating consumer demand for healthier beverage alternatives and the rising popularity of functional drinks. The market is forecast to exhibit a Compound Annual Growth Rate (CAGR) of 5.1% between 2025 and 2033, indicating consistent upward trajectory. Key growth drivers include Brazil and Argentina, owing to an expanding middle class with increased disposable income and a growing appetite for diverse beverage choices. Innovations in product development, such as the introduction of fermented beverages enriched with probiotics and other functional ingredients, are further stimulating market expansion by catering to health-conscious consumers. The off-trade channel is anticipated to lead market share, driven by consumer preference for convenience and accessibility. Emerging challenges include volatility in raw material pricing and evolving regulatory landscapes for alcohol content and product labeling. Leading industry participants, including Nestle SA, Heineken NV, and Bacardi Limited, are strategically investing in product diversification and regional expansion to leverage this growth potential. The non-alcoholic segment is particularly poised for robust growth, propelled by prevailing health trends and a growing preference for low- or no-alcohol options among health-aware consumers.

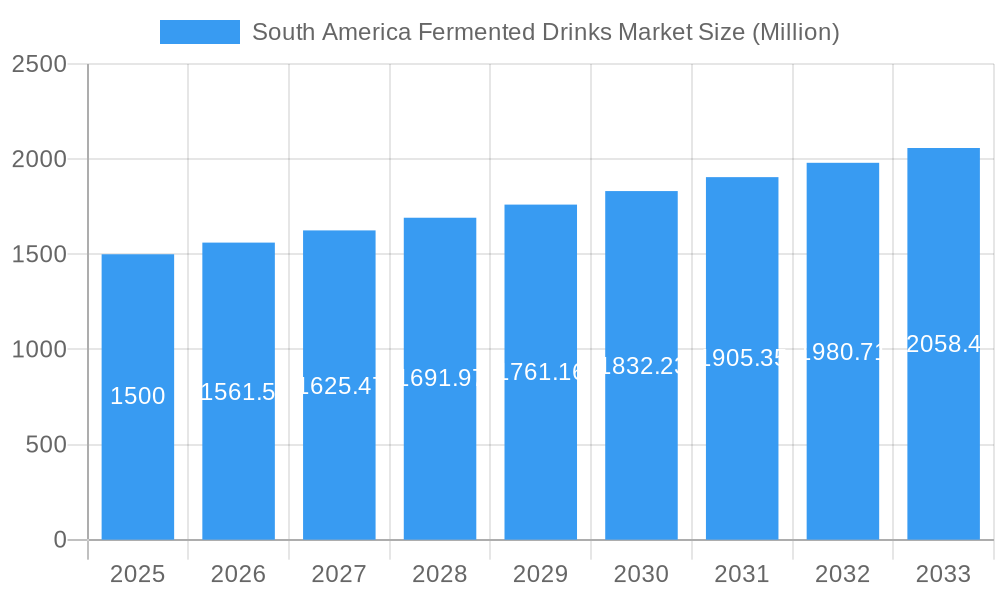

South America Fermented Drinks Market Market Size (In Million)

Market segmentation reveals significant contributions from both alcoholic and non-alcoholic fermented beverages. While alcoholic drinks may hold a larger market share due to established consumption habits in South America, the on-trade segment (restaurants, bars), though currently smaller, is expected to see growth, particularly in the premium fermented beverage category. The Rest of South America presents considerable growth opportunities as consumer preferences diversify and distribution networks broaden. Continuous innovation and targeted marketing campaigns emphasizing health benefits and diverse flavor profiles will be instrumental in sustaining market expansion. Competitive analysis indicates active participation from established multinational corporations and local players, intensifying competition and driving strategic acquisitions within the region. However, opportunities also exist for niche brands offering unique products with strong regional appeal.

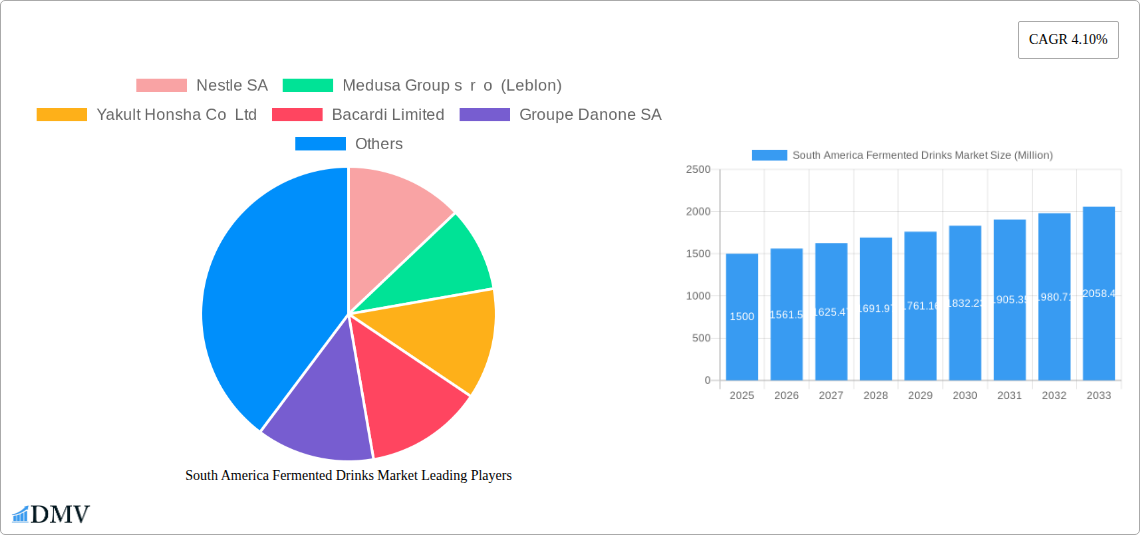

South America Fermented Drinks Market Company Market Share

South America Fermented Drinks Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the South America fermented drinks market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025, this study is essential for stakeholders seeking to understand and capitalize on the growth opportunities within this dynamic market. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

South America Fermented Drinks Market Composition & Trends

The South America fermented drinks market is characterized by a moderately fragmented landscape, with both large multinational corporations and smaller regional players vying for market share. Key players such as Nestle SA, Medusa Group s r o (Leblon), Yakult Honsha Co Ltd, Bacardi Limited, Groupe Danone SA, Heineken NV, Britvic PLC, and Amyris, along with numerous other players, contribute to the market's diverse offering. Market share distribution is currently skewed towards established brands, with Nestle SA and Groupe Danone SA holding significant positions. However, smaller, artisanal producers are gaining traction through innovative product offerings and targeted marketing campaigns.

Innovation is a crucial driver, fueled by consumer demand for healthier, more diverse, and ethically sourced fermented beverages. Regulatory landscapes vary across South American countries, impacting product labeling, alcohol content limits, and distribution channels. The market also faces competition from substitute products, such as juices, soft drinks, and other non-alcoholic beverages. The increasing preference for healthier options is driving growth in the non-alcoholic segment. M&A activity within the sector is moderate, with deal values varying significantly depending on the size and target of the acquisition. Recent years have witnessed a few significant acquisitions, primarily focused on expanding product portfolios and regional reach. The average M&A deal value over the historical period (2019-2024) was approximately xx Million.

- Market Concentration: Moderately fragmented.

- Innovation Catalysts: Consumer demand for health & diversity, technological advancements in production.

- Regulatory Landscape: Varies across countries; impacting labeling, alcohol content, distribution.

- Substitute Products: Juices, soft drinks, other non-alcoholic beverages.

- End-User Profiles: Diverse, encompassing various age groups and socio-economic backgrounds.

- M&A Activity: Moderate, average deal value around xx Million (2019-2024).

South America Fermented Drinks Market Industry Evolution

The South America fermented drinks market has witnessed substantial evolution over the historical period (2019-2024). Growth has been driven by increasing disposable incomes, changing consumer preferences towards healthier and functional beverages, and the growing popularity of fermented drinks among health-conscious consumers. Technological advancements in fermentation techniques have improved product quality, consistency, and efficiency. The market has seen a significant rise in the demand for non-alcoholic fermented drinks, driven primarily by health and wellness trends. The adoption rate of innovative fermentation technologies is gradually increasing, although the pace differs across countries. Growth rates have fluctuated in response to macroeconomic factors and specific regulatory changes. However, the overall trend indicates sustained growth, with the market expanding at a CAGR of approximately xx% during the historical period. The shift in consumer demand is evident in the increasing popularity of products featuring natural ingredients, probiotics, and functional benefits.

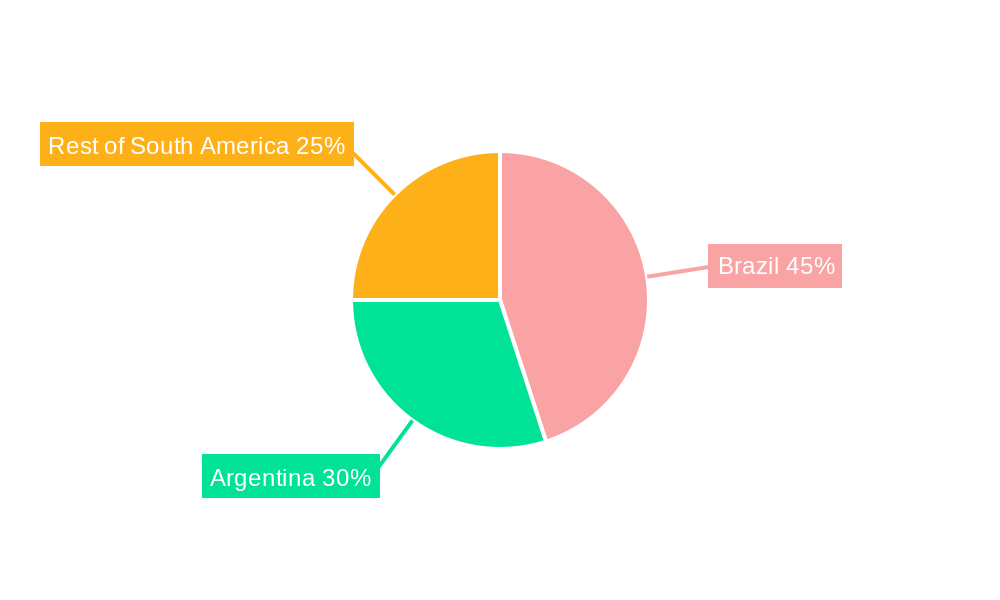

Leading Regions, Countries, or Segments in South America Fermented Drinks Market

The Brazilian market dominates the South American fermented drinks market, driven by its large population, high consumption rates, and robust economy. Within Brazil, major cities like São Paulo and Rio de Janeiro are key consumption hubs. The Alcoholic beverages segment holds a larger market share compared to the non-alcoholic segment, although the latter is experiencing faster growth. The on-trade channel (restaurants, bars) contributes significantly to the sales of alcoholic beverages, while the off-trade channel (retail stores, supermarkets) is crucial for both alcoholic and non-alcoholic products.

Key Drivers for Brazil's Dominance:

- Large and growing population.

- Strong consumer spending on beverages.

- Developed distribution networks.

- Favourable regulatory environment (varies across states).

Key Drivers for Alcoholic Beverages Segment:

- Strong cultural affinity for alcoholic fermented drinks.

- Diverse range of traditional and innovative products.

- Growth in craft brewing and artisanal distilleries.

Key Drivers for On-Trade Channel:

- Popular social gatherings in bars and restaurants.

- Strong preference for consumption outside home for certain drinks.

South America Fermented Drinks Market Product Innovations

Recent product innovations focus on incorporating functional ingredients, such as probiotics and adaptogens, enhancing the health benefits of fermented beverages. The use of natural sweeteners and reduced sugar content is also gaining traction, aligning with health-conscious consumer preferences. Technological advancements in fermentation processes have improved taste, texture, and shelf life, while also reducing production costs. Unique selling propositions include the use of locally sourced ingredients, sustainable production methods, and unique flavor profiles tailored to specific regional preferences. Companies are increasingly leveraging technology to enhance customer engagement and personalization through product customization and targeted marketing.

Propelling Factors for South America Fermented Drinks Market Growth

Several factors are propelling the growth of the South American fermented drinks market. Technological advancements in fermentation techniques have led to more efficient production and improved product quality. The increasing disposable income and urbanization are driving consumption growth, particularly in the middle- and upper-income segments. Favorable government policies and regulations supporting the food and beverage industry in certain countries contribute to a positive investment climate. The growing awareness of the health benefits of fermented beverages is further stimulating demand, particularly for non-alcoholic options.

Obstacles in the South America Fermented Drinks Market

The South America fermented drinks market faces several challenges. Fluctuations in raw material costs can impact profitability. Regulatory complexities and inconsistencies across different countries can create barriers to market entry and expansion. Supply chain disruptions, particularly concerning transportation and logistics, can affect product availability and pricing. Intense competition from both established and emerging players puts pressure on profit margins and market share. Economic instability in some regions can limit consumer spending and hinder market growth.

Future Opportunities in South America Fermented Drinks Market

The South American fermented drinks market offers significant future opportunities. The expanding middle class and rising disposable incomes in several countries present lucrative growth prospects. Exploration of new flavor profiles and functional ingredients can attract new consumer segments. Investment in sustainable and ethical sourcing practices can enhance brand image and attract environmentally conscious consumers. Further development of e-commerce and online distribution channels can expand market reach and convenience for consumers.

Major Players in the South America Fermented Drinks Market Ecosystem

- Nestle SA

- Medusa Group s r o (Leblon)

- Yakult Honsha Co Ltd

- Bacardi Limited

- Groupe Danone SA

- Heineken NV

- Britvic PLC

- Amyris

Key Developments in South America Fermented Drinks Market Industry

- 2024-Q4: Nestle SA launches a new line of probiotic-enhanced non-alcoholic fermented beverages in Brazil.

- 2023-Q3: Medusa Group s r o acquires a regional craft brewery in Argentina, expanding its market reach.

- 2022-Q2: A new regulation on alcohol content is introduced in Chile, affecting the alcoholic fermented drinks segment.

- 2021-Q1: Heineken NV invests in a new sustainable brewing facility in Colombia.

Strategic South America Fermented Drinks Market Forecast

The South America fermented drinks market is poised for continued growth over the forecast period (2025-2033), driven by evolving consumer preferences, technological advancements, and favorable economic conditions in several key markets. The increasing demand for healthier and functional beverages, coupled with innovative product development, will fuel market expansion. Growth will be particularly strong in the non-alcoholic segment. The market’s future potential rests on strategic investments in sustainable production, efficient distribution networks, and targeted marketing campaigns addressing the evolving needs of South American consumers.

South America Fermented Drinks Market Segmentation

-

1. Type

- 1.1. Alcoholic Beverages

-

1.2. Non-Alcoholic Beverages

- 1.2.1. Kombucha

- 1.2.2. Kefir

- 1.2.3. Others

-

2. Distribution Channel

- 2.1. On-Trade

-

2.2. Off-Trade

- 2.2.1. Supermarket/Hypermarket

- 2.2.2. Convenience Store

- 2.2.3. Specialty Stores

- 2.2.4. Others

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Fermented Drinks Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Fermented Drinks Market Regional Market Share

Geographic Coverage of South America Fermented Drinks Market

South America Fermented Drinks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives and E-commerce Penetration

- 3.3. Market Restrains

- 3.3.1. Detrimental Health Impact of Caffeine Intake

- 3.4. Market Trends

- 3.4.1. Increase in Demand for Functional Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Fermented Drinks Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Alcoholic Beverages

- 5.1.2. Non-Alcoholic Beverages

- 5.1.2.1. Kombucha

- 5.1.2.2. Kefir

- 5.1.2.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Supermarket/Hypermarket

- 5.2.2.2. Convenience Store

- 5.2.2.3. Specialty Stores

- 5.2.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Fermented Drinks Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Alcoholic Beverages

- 6.1.2. Non-Alcoholic Beverages

- 6.1.2.1. Kombucha

- 6.1.2.2. Kefir

- 6.1.2.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-Trade

- 6.2.2. Off-Trade

- 6.2.2.1. Supermarket/Hypermarket

- 6.2.2.2. Convenience Store

- 6.2.2.3. Specialty Stores

- 6.2.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Fermented Drinks Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Alcoholic Beverages

- 7.1.2. Non-Alcoholic Beverages

- 7.1.2.1. Kombucha

- 7.1.2.2. Kefir

- 7.1.2.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-Trade

- 7.2.2. Off-Trade

- 7.2.2.1. Supermarket/Hypermarket

- 7.2.2.2. Convenience Store

- 7.2.2.3. Specialty Stores

- 7.2.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Fermented Drinks Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Alcoholic Beverages

- 8.1.2. Non-Alcoholic Beverages

- 8.1.2.1. Kombucha

- 8.1.2.2. Kefir

- 8.1.2.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-Trade

- 8.2.2. Off-Trade

- 8.2.2.1. Supermarket/Hypermarket

- 8.2.2.2. Convenience Store

- 8.2.2.3. Specialty Stores

- 8.2.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Nestle SA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Medusa Group s r o (Leblon)

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Yakult Honsha Co Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Bacardi Limited

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Groupe Danone SA

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Heineken NV*List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Britvic PLC

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Amyris

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Nestle SA

List of Figures

- Figure 1: South America Fermented Drinks Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: South America Fermented Drinks Market Share (%) by Company 2025

List of Tables

- Table 1: South America Fermented Drinks Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: South America Fermented Drinks Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: South America Fermented Drinks Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: South America Fermented Drinks Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 5: South America Fermented Drinks Market Revenue million Forecast, by Geography 2020 & 2033

- Table 6: South America Fermented Drinks Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: South America Fermented Drinks Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: South America Fermented Drinks Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: South America Fermented Drinks Market Revenue million Forecast, by Type 2020 & 2033

- Table 10: South America Fermented Drinks Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 11: South America Fermented Drinks Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 12: South America Fermented Drinks Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 13: South America Fermented Drinks Market Revenue million Forecast, by Geography 2020 & 2033

- Table 14: South America Fermented Drinks Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: South America Fermented Drinks Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: South America Fermented Drinks Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: South America Fermented Drinks Market Revenue million Forecast, by Type 2020 & 2033

- Table 18: South America Fermented Drinks Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 19: South America Fermented Drinks Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 20: South America Fermented Drinks Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 21: South America Fermented Drinks Market Revenue million Forecast, by Geography 2020 & 2033

- Table 22: South America Fermented Drinks Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: South America Fermented Drinks Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: South America Fermented Drinks Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: South America Fermented Drinks Market Revenue million Forecast, by Type 2020 & 2033

- Table 26: South America Fermented Drinks Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 27: South America Fermented Drinks Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 28: South America Fermented Drinks Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 29: South America Fermented Drinks Market Revenue million Forecast, by Geography 2020 & 2033

- Table 30: South America Fermented Drinks Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 31: South America Fermented Drinks Market Revenue million Forecast, by Country 2020 & 2033

- Table 32: South America Fermented Drinks Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Fermented Drinks Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the South America Fermented Drinks Market?

Key companies in the market include Nestle SA, Medusa Group s r o (Leblon), Yakult Honsha Co Ltd, Bacardi Limited, Groupe Danone SA, Heineken NV*List Not Exhaustive, Britvic PLC, Amyris.

3. What are the main segments of the South America Fermented Drinks Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.5 million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives and E-commerce Penetration.

6. What are the notable trends driving market growth?

Increase in Demand for Functional Beverages.

7. Are there any restraints impacting market growth?

Detrimental Health Impact of Caffeine Intake.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Fermented Drinks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Fermented Drinks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Fermented Drinks Market?

To stay informed about further developments, trends, and reports in the South America Fermented Drinks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence