Key Insights

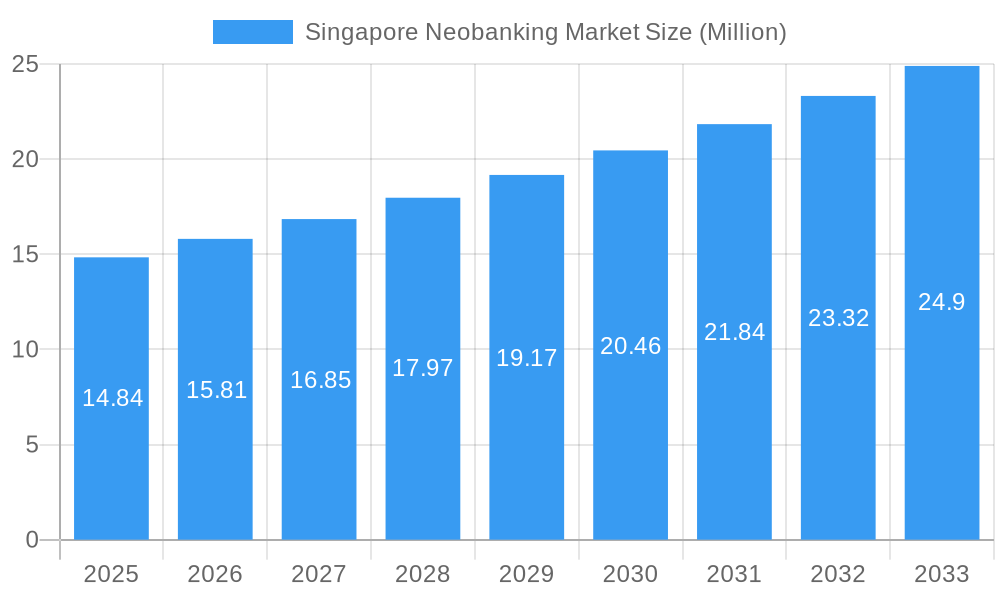

The Singapore neobanking market, valued at $14.84 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 6.00% from 2025 to 2033. This surge is driven by several key factors. Firstly, the increasing adoption of digital financial services among Singapore's tech-savvy population fuels demand for convenient and user-friendly banking solutions. Secondly, the competitive landscape, with established players like DBS DigiBank and newcomers such as TransferWise, Revolut, and Aspire, fosters innovation and drives down prices, benefiting consumers. Thirdly, regulatory support and a thriving fintech ecosystem in Singapore provide a fertile ground for neobanks to flourish. The market's segmentation likely includes retail banking, business banking, and specialized services catering to specific demographics or needs. While data on precise regional breakdowns within Singapore is unavailable, we can anticipate higher adoption rates in urban centers compared to rural areas.

Singapore Neobanking Market Market Size (In Million)

Despite the promising outlook, challenges remain. Intense competition necessitates continuous innovation and investment in technology and customer service to maintain a competitive edge. Concerns regarding data security and regulatory compliance continue to be paramount, demanding robust cybersecurity measures and adherence to evolving regulations. Furthermore, successfully navigating the complexities of customer acquisition and retention in a saturated market requires strategic marketing and customer relationship management. Despite these hurdles, the long-term forecast for the Singapore neobanking market remains positive, indicating substantial growth opportunities for existing players and potential entrants. The convenience, accessibility, and tailored services offered by neobanks are expected to steadily increase market penetration over the forecast period.

Singapore Neobanking Market Company Market Share

This insightful report provides a detailed analysis of the dynamic Singapore neobanking market, encompassing its evolution, key players, and future prospects. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report offers invaluable insights for stakeholders seeking to navigate this rapidly evolving landscape. The forecast period covers 2025-2033, building upon the historical period of 2019-2024. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

Singapore Neobanking Market Composition & Trends

This section meticulously examines the Singapore neobanking market's composition and prevailing trends. We delve into market concentration, revealing the market share distribution among key players like TransferWise, YouTrip, DBS DigiBank, Revolut Ltd, Aspire, CurrencyFair, TransferGo, NeatBiz, Frank by OCBC, and Go Solo (List Not Exhaustive). We analyze innovation catalysts driving market growth, including technological advancements and regulatory changes. The report also explores the competitive landscape, identifying substitute products and analyzing mergers and acquisitions (M&A) activities, including deal values (e.g., the Razorpay acquisition of Ezetap in August 2022 for xx Million). End-user profiles are segmented and analyzed, highlighting the diverse needs and preferences shaping market demand.

- Market Concentration: Analysis of market share held by top players, illustrating the level of competition. xx% market share held by the top 5 players in 2025.

- Innovation Catalysts: Discussion of key technological advancements and regulatory changes influencing market innovation. Examples include Open Banking initiatives and the rise of embedded finance.

- Regulatory Landscape: Evaluation of the regulatory framework impacting neobanks in Singapore, including licensing requirements and compliance standards.

- Substitute Products: Identification of alternative financial services that compete with neobanks.

- M&A Activities: Overview of significant M&A transactions within the Singapore neobanking market, including deal values and strategic implications. Example: Razorpay's acquisition of Ezetap for xx Million in August 2022.

- End-User Profiles: Segmentation of users based on demographics, financial behavior, and technological adoption.

Singapore Neobanking Market Industry Evolution

The Singapore neobanking market has undergone a dynamic transformation, evolving significantly from its nascent stages in 2019 to its projected trajectory up to 2033. This evolution is characterized by robust growth, underpinned by a confluence of technological innovation and shifting consumer paradigms. Key technological advancements have been instrumental, including the integration of artificial intelligence (AI) for hyper-personalized customer experiences, the exploration and implementation of blockchain technology for enhanced security and transparency, and the continuous refinement of robust security frameworks to safeguard sensitive financial data. Concurrently, consumer demands have pivoted towards seamless, digital-first financial ecosystems. This shift is evidenced by the escalating adoption of mobile banking platforms and a pronounced preference for tailored financial services that cater to individual needs and lifestyles. To quantify this growth, we will delve into specific data points, examining Compound Annual Growth Rates (CAGR) and critical adoption metrics such as mobile banking penetration rates and the burgeoning volume of digital payment transactions. The market's landscape has also been shaped by pivotal events, such as Opal's licensing in October 2022, which catalyzed strategic partnerships and further accelerated market development.

Leading Regions, Countries, or Segments in Singapore Neobanking Market

Given the specific focus on the Singapore neobanking market, the analysis naturally centers on the nation itself as the primary and dominant geographical entity. While the market is national in scope, we will dissect the key factors that contribute to its overall strength and leadership within the broader fintech landscape.

- Key Drivers of Dominance:

- Robust Investment Ecosystem: Singapore attracts substantial venture capital and private equity funding, providing neobanks with the capital necessary for innovation, product development, and aggressive market expansion.

- Pro-Innovation Regulatory Framework: The Monetary Authority of Singapore (MAS) actively fosters a conducive environment for digital innovation in finance. Supportive regulations, sandbox initiatives, and clear licensing pathways encourage the growth and development of neobanking services.

- Advanced Technological Infrastructure and Talent: Singapore boasts a world-class digital infrastructure and a highly skilled talent pool in technology and finance. This synergy accelerates the development and deployment of cutting-edge neobanking solutions.

- High Digital Penetration and Savvy Consumer Base: The population exhibits high smartphone ownership and strong digital literacy, coupled with an increasing demand for convenient, accessible, and digitally-native financial services.

Dominance Factors: The confluence of a young, tech-oriented demographic, a sophisticated digital infrastructure, and proactive government support creates a fertile ground for neobanking's success. These elements collectively empower neobanks to offer innovative, customer-centric solutions that resonate with the Singaporean populace, solidifying the nation's position as a leading hub for digital finance in the region.

Singapore Neobanking Market Product Innovations

This section will detail notable product innovations within the Singapore neobanking sector, covering novel financial products, applications, and their performance metrics. We will highlight unique selling propositions (USPs) of individual neobanks and showcase how they leverage technological advancements, such as AI and machine learning, to deliver personalized and efficient services. The analysis will also consider user feedback and adoption rates to assess the success of these innovations.

Propelling Factors for Singapore Neobanking Market Growth

The growth trajectory of the Singapore neobanking market is propelled by a multifaceted array of catalysts. Technological advancements stand at the forefront, with enhanced mobile interfaces offering intuitive user experiences and AI-powered personalization delivering bespoke financial insights and services, thereby driving significant user adoption. The supportive regulatory environment, meticulously crafted by the Monetary Authority of Singapore (MAS), plays a pivotal role by fostering innovation, promoting healthy competition, and ensuring a stable yet dynamic market. Furthermore, favorable economic factors, including a growing disposable income among its populace and an increasingly digitally adept demographic, contribute substantially to the burgeoning demand for convenient, cost-effective, and digitally-centric banking solutions that align with modern lifestyles.

Obstacles in the Singapore Neobanking Market

Despite its impressive growth potential, the Singapore neobanking market is not without its challenges. Stringent regulatory requirements, while crucial for financial stability and consumer protection, can present significant hurdles for both new market entrants and established players seeking to innovate and expand. Cybersecurity threats and data protection concerns remain an ever-present and evolving challenge, necessitating continuous investment in advanced security measures to build and maintain customer trust in an increasingly digital landscape. Moreover, the market faces intense competition, not only from other neobanks but also from incumbent traditional banks that are actively enhancing their digital offerings, thereby creating a dynamic and competitive battlefield for market share.

Future Opportunities in Singapore Neobanking Market

The Singapore neobanking market presents several promising future opportunities. The expansion into underserved segments, such as small and medium-sized enterprises (SMEs) and the unbanked population, offers significant growth potential. Innovations like embedded finance, integrating financial services into non-financial platforms, present new avenues for revenue generation and customer acquisition. Furthermore, leveraging blockchain technology for enhanced security and transparency could unlock new market opportunities.

Major Players in the Singapore Neobanking Market Ecosystem

- Wise (formerly TransferWise)

- YouTrip

- DBS DigiBank

- Revolut Ltd

- Aspire

- CurrencyFair

- TransferGo

- NeatBiz

- Frank by OCBC

- Go Solo

- (This list is not exhaustive and represents key players contributing to the market's vibrancy.)

Key Developments in Singapore Neobanking Market Industry

- October 2022: Opal, a pioneering neo-bank in Asia (Singapore), became one of the first licensed institutions of its kind in the region, establishing a strategic partnership with Choco Up.

- August 2022: Razorpay acquired Ezetap, a leading PoS company, significantly expanding its neo-banking capabilities.

Strategic Singapore Neobanking Market Forecast

The Singapore neobanking market is poised for continued strong growth, driven by factors such as increasing smartphone penetration, government support for fintech innovation, and rising demand for digital financial services. The market's future is bright, with ample opportunities for existing players and new entrants to capitalize on the growing adoption of digital banking solutions. The increasing focus on personalization, embedded finance, and improved security measures will further shape the market's trajectory, leading to sustained expansion in the years to come.

Singapore Neobanking Market Segmentation

-

1. Account Type

- 1.1. Business Account

- 1.2. Savings Account

-

2. Services

- 2.1. Mobile Banking

- 2.2. Payments and Money Transfers

- 2.3. Savings Account

- 2.4. Loans

- 2.5. Other Sevices

-

3. Application Type

- 3.1. Personal

- 3.2. Enterprises

- 3.3. Other Applications

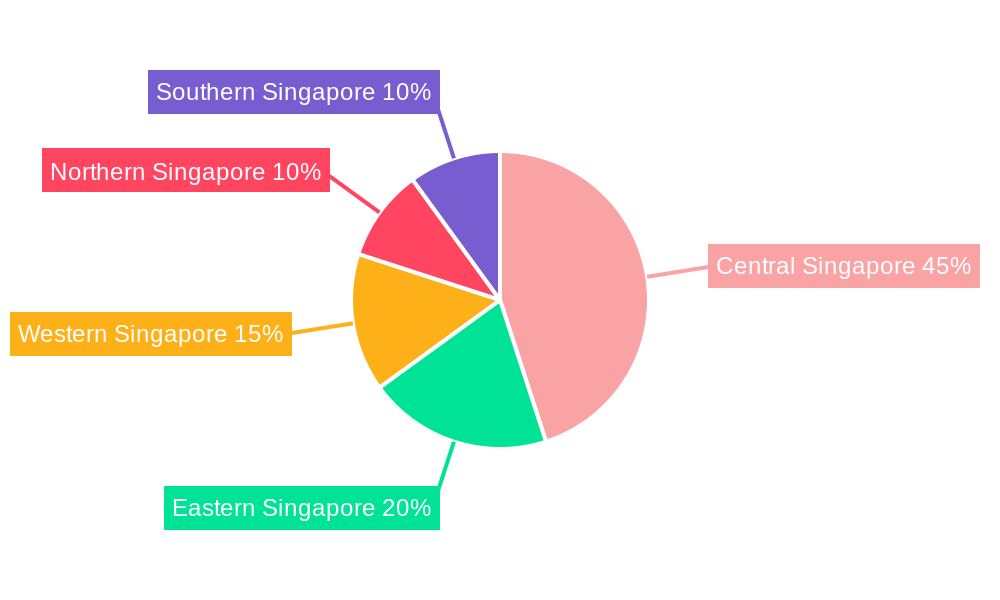

Singapore Neobanking Market Segmentation By Geography

- 1. Singapore

Singapore Neobanking Market Regional Market Share

Geographic Coverage of Singapore Neobanking Market

Singapore Neobanking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Digital Adoption among Consumers

- 3.3. Market Restrains

- 3.3.1. Increasing Digital Adoption among Consumers

- 3.4. Market Trends

- 3.4.1. Increasing Number of Partnership Banks

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Account Type

- 5.1.1. Business Account

- 5.1.2. Savings Account

- 5.2. Market Analysis, Insights and Forecast - by Services

- 5.2.1. Mobile Banking

- 5.2.2. Payments and Money Transfers

- 5.2.3. Savings Account

- 5.2.4. Loans

- 5.2.5. Other Sevices

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Personal

- 5.3.2. Enterprises

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Account Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 TransferWise

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 YouTrip

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DBS Digi Bank

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Revolut Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aspire

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CurrencyFair

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TransferGo

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NeatBiz

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Frank by OCBC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Go Solo**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 TransferWise

List of Figures

- Figure 1: Singapore Neobanking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Singapore Neobanking Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Neobanking Market Revenue Million Forecast, by Account Type 2020 & 2033

- Table 2: Singapore Neobanking Market Volume Billion Forecast, by Account Type 2020 & 2033

- Table 3: Singapore Neobanking Market Revenue Million Forecast, by Services 2020 & 2033

- Table 4: Singapore Neobanking Market Volume Billion Forecast, by Services 2020 & 2033

- Table 5: Singapore Neobanking Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 6: Singapore Neobanking Market Volume Billion Forecast, by Application Type 2020 & 2033

- Table 7: Singapore Neobanking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Singapore Neobanking Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Singapore Neobanking Market Revenue Million Forecast, by Account Type 2020 & 2033

- Table 10: Singapore Neobanking Market Volume Billion Forecast, by Account Type 2020 & 2033

- Table 11: Singapore Neobanking Market Revenue Million Forecast, by Services 2020 & 2033

- Table 12: Singapore Neobanking Market Volume Billion Forecast, by Services 2020 & 2033

- Table 13: Singapore Neobanking Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 14: Singapore Neobanking Market Volume Billion Forecast, by Application Type 2020 & 2033

- Table 15: Singapore Neobanking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Singapore Neobanking Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Neobanking Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Singapore Neobanking Market?

Key companies in the market include TransferWise, YouTrip, DBS Digi Bank, Revolut Ltd, Aspire, CurrencyFair, TransferGo, NeatBiz, Frank by OCBC, Go Solo**List Not Exhaustive.

3. What are the main segments of the Singapore Neobanking Market?

The market segments include Account Type, Services, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.84 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Digital Adoption among Consumers.

6. What are the notable trends driving market growth?

Increasing Number of Partnership Banks.

7. Are there any restraints impacting market growth?

Increasing Digital Adoption among Consumers.

8. Can you provide examples of recent developments in the market?

October 2022: Opal, a pioneering neo-bank in Asia (Singapore), became one of the first licensed institutions of its kind in the region. Opal has established a strategic partnership with Choco Up, a prominent player in revenue-based financing in Asia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Neobanking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Neobanking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Neobanking Market?

To stay informed about further developments, trends, and reports in the Singapore Neobanking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence