Key Insights

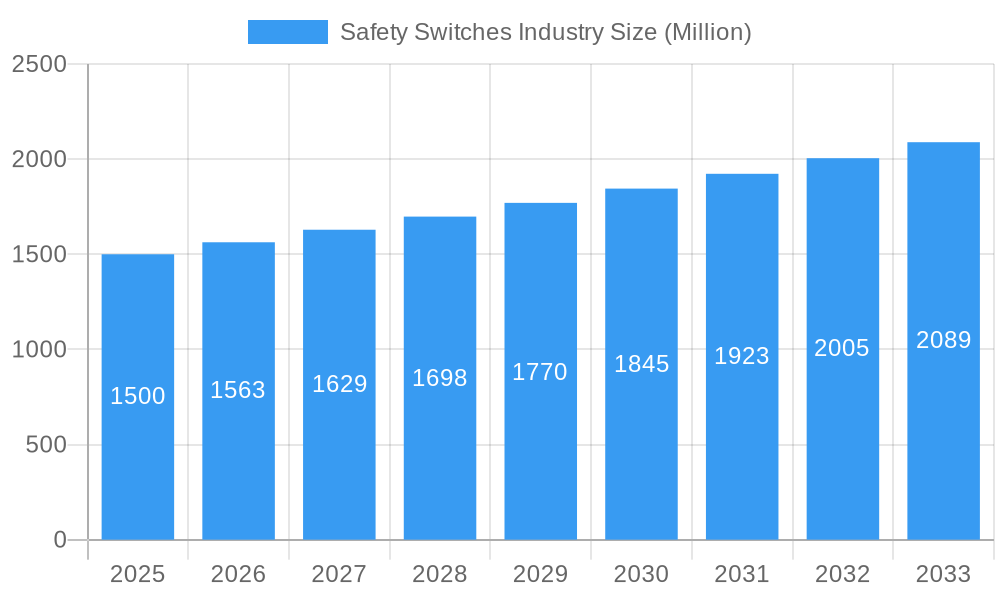

The global Safety Switches market is poised for significant expansion, projected to reach $1,500 Million by the end of 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 4.25% through 2033. This robust growth is primarily fueled by the escalating adoption of automation across various industries and the increasing stringency of workplace safety regulations worldwide. The Industrial segment is expected to lead this growth, driven by the demand for advanced safety mechanisms in manufacturing, automotive, and heavy machinery operations. Key technological advancements, such as the integration of IoT and AI for predictive maintenance and enhanced monitoring capabilities, are further propelling market momentum. Electromagnetic switches, offering reliable and precise operation, are anticipated to dominate the market share in terms of type, alongside the growing influence of non-contact switches in applications requiring high levels of hygiene or where mechanical wear is a concern.

Safety Switches Industry Market Size (In Billion)

Several factors are contributing to this positive market trajectory. The proactive implementation of safety standards by governments and international bodies is compelling businesses to invest in sophisticated safety switch solutions to prevent accidents and ensure compliance. Furthermore, the digital transformation wave, encouraging the integration of smart technologies, is creating new avenues for innovation in safety switch design and functionality, leading to improved efficiency and reduced operational risks. While the market demonstrates strong growth potential, certain restraints, such as the initial cost of implementing advanced safety systems and the need for skilled personnel to manage and maintain them, may pose challenges. However, the long-term benefits of enhanced safety, reduced downtime, and improved productivity are expected to outweigh these concerns, making safety switches an indispensable component of modern industrial and commercial operations. The market is witnessing increasing adoption in healthcare for patient safety and in the oil and gas sector for hazardous environment operations.

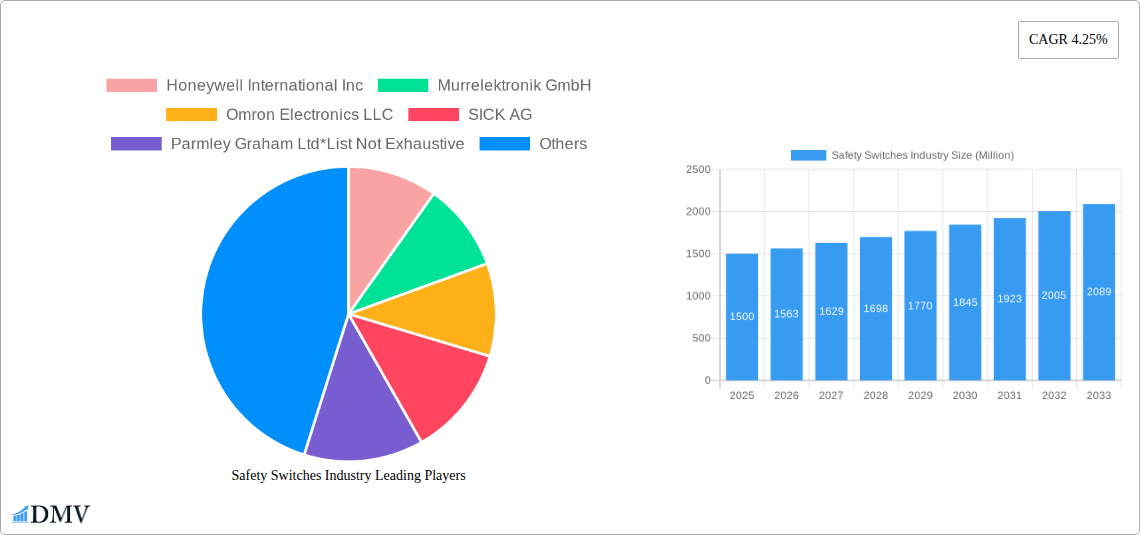

Safety Switches Industry Company Market Share

This in-depth safety switches industry report provides a granular analysis of the global market, offering critical insights for stakeholders navigating this dynamic sector. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period from 2025 to 2033, this comprehensive report leverages historical data (2019-2024) and expert estimations to deliver actionable intelligence. Discover key trends, technological advancements, regional dominance, and future growth prospects within the industrial safety switches, machine safety switches, and emergency stop switches markets.

Safety Switches Industry Market Composition & Trends

The safety switches industry exhibits a moderately consolidated market landscape, characterized by strategic collaborations and continuous innovation. Key players are investing heavily in research and development to introduce advanced safety solutions, driven by stringent industrial safety regulations and the increasing adoption of automation across various sectors. The market is segmented by safety switch types, including electromagnetic safety switches, non-contact safety switches, and other specialized variants. End-user industries such as industrial safety, commercial safety, healthcare safety, and the oil and gas industry are primary consumers, each with unique safety requirements. Market share distribution sees leading companies like Siemens AG, Rockwell Automation Inc., and Schneider Electric holding significant portions, while emerging players focus on niche applications and innovative technologies. Mergers and acquisitions (M&A) activity, with estimated deal values in the hundreds of millions, are strategically employed to expand product portfolios and market reach. The presence of substitute products, though limited in core functionality, necessitates a constant focus on superior performance and integrated safety features. The evolving profiles of end-users, driven by digitalization and smart manufacturing initiatives, are reshaping demand patterns for sophisticated safety switch solutions. The overall market concentration is influenced by technological expertise, global distribution networks, and the ability to comply with diverse international safety standards.

Safety Switches Industry Industry Evolution

The safety switches industry has undergone a significant evolution, marked by robust market growth trajectories fueled by increasing global emphasis on workplace safety and the proliferation of automated industrial processes. Over the study period (2019-2033), this sector has witnessed a consistent upward trend, with a projected Compound Annual Growth Rate (CAGR) in the high single digits. Technological advancements have been the primary catalysts, with a notable shift towards non-contact safety switches and smart, integrated safety solutions. The adoption of technologies like RFID and intelligent sensor integration in safety interlock switches has enhanced functionality and reliability, driving higher adoption rates among end-users. Consumer demand has evolved from basic safety mechanisms to comprehensive safety systems that offer diagnostics, connectivity, and predictive maintenance capabilities. The demand for machine safety solutions, particularly in sectors like automotive manufacturing, logistics, and pharmaceuticals, has surged, necessitating advanced safety switches that can seamlessly integrate with complex machinery and robotic systems. Government regulations and international safety standards, such as IEC 61508 and ISO 13849, have played a pivotal role in shaping product development and market penetration, compelling manufacturers to adhere to rigorous performance and reliability metrics. The continuous drive for enhanced worker protection, reduction of operational downtime, and compliance with evolving safety mandates ensures a sustained growth impetus for the safety switches market. The increasing sophistication of manufacturing, coupled with the inherent risks associated with industrial operations, further propels the demand for advanced safety switch solutions.

Leading Regions, Countries, or Segments in Safety Switches Industry

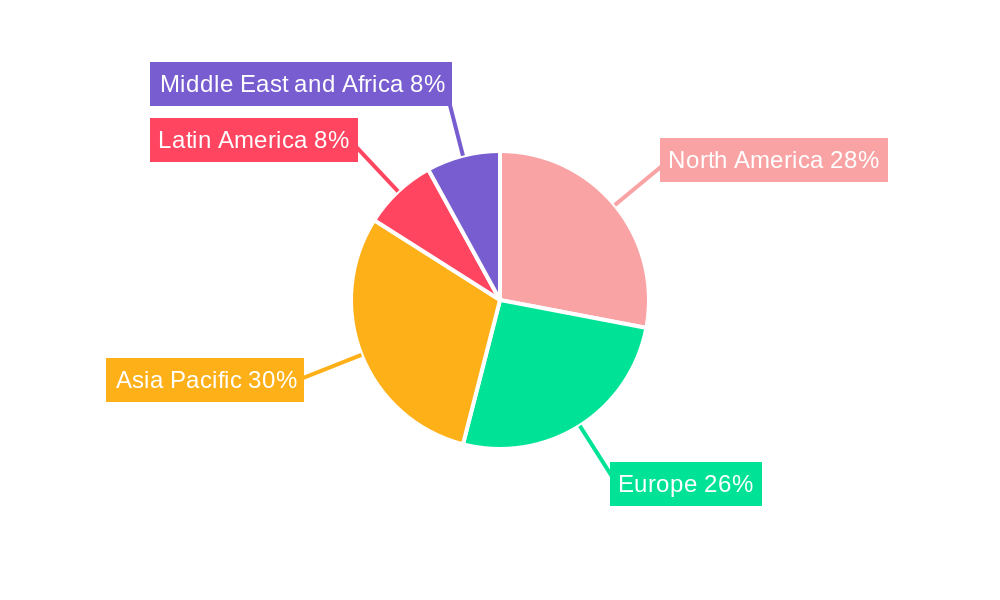

The safety switches industry is experiencing significant dominance and growth across several key regions and segments. In terms of safety switch types, non-contact safety switches are emerging as the most dynamic segment, driven by their superior performance, reduced wear and tear, and enhanced safety capabilities in demanding industrial environments. The Industrial segment remains the largest end-user, with a substantial share of the market, driven by stringent safety regulations and the widespread adoption of automation in manufacturing, automotive, and heavy industries.

- Dominant Region: North America currently leads the safety switches market, propelled by a strong industrial base, significant investments in automation and Industry 4.0 initiatives, and a mature regulatory framework that prioritizes workplace safety. The United States, in particular, contributes a substantial portion of this regional dominance, with a high concentration of manufacturing facilities that require advanced safety solutions.

- Key Country Drivers (North America):

- Technological Advancements: Early adoption of innovative safety switch technologies like RFID-enabled safety sensors and intelligent interlocks.

- Regulatory Support: Robust enforcement of workplace safety regulations, such as OSHA standards, mandating the use of compliant safety devices.

- Investment Trends: High levels of investment in manufacturing modernization and automation projects.

- Dominant Segment (End-User): The Industrial end-user segment commands the largest market share. This is due to the inherent risks associated with heavy machinery, automated production lines, and the continuous operation of factories. Industries such as automotive manufacturing, food and beverage processing, and material handling rely heavily on a wide array of safety switches to prevent accidents and ensure operational continuity.

- Key Drivers for Industrial Segment Dominance:

- Automation Expansion: The global surge in industrial automation directly correlates with the increased need for safety interlocks and monitoring devices.

- Risk Mitigation: High-risk environments necessitate the deployment of reliable safety switches to minimize personnel injuries and property damage.

- Productivity Enhancement: Advanced safety systems, including sophisticated safety switches, contribute to operational efficiency by reducing downtime due to accidents.

- Emerging Segment (Safety Switch Type): Non-contact safety switches are experiencing accelerated growth. These switches, including magnetic, optical, and RFID-based variants, offer advantages over traditional mechanical switches. Their ability to detect the presence or absence of a safety guard without physical contact translates to longer lifespans and reduced maintenance, making them increasingly preferred in modern industrial applications.

- Drivers for Non-Contact Safety Switch Growth:

- Enhanced Durability: Resistance to environmental factors and wear, leading to greater reliability.

- Tamper Resistance: More difficult to bypass than mechanical switches, improving overall machine safety.

- Integration Capabilities: Seamless integration with PLC systems and other safety control components.

The Commercial and Healthcare sectors are also showing significant growth potential, with increasing awareness and implementation of safety protocols in facilities like hospitals, laboratories, and commercial buildings. The Oil and Gas industry, while facing its own set of operational challenges, continues to be a crucial market for rugged and reliable safety switches designed to withstand harsh environmental conditions. The interplay of these segments and regions, driven by specific needs and regulatory landscapes, shapes the overall market dynamics of the safety switches industry.

Safety Switches Industry Product Innovations

The safety switches industry is witnessing a wave of groundbreaking product innovations designed to enhance machine safety and operational efficiency. Leading companies are developing highly integrated safety sensors that combine multiple functions into a single device, reducing installation complexity and cost. For instance, the introduction of flex function CTS safety switch devices allows for a single unit to perform various safety tasks, streamlining planning and operational processes. Innovations in non-contact safety technology, particularly utilizing RFID and advanced magnetic principles, are offering superior tamper resistance and diagnostics capabilities. These advancements are critical for applications in high-risk industrial settings, ensuring robust protection against accidental activation and unauthorized access. Performance metrics such as improved response times, higher ingress protection ratings (IP ratings), and extended operational lifespans are key selling propositions for these next-generation safety switches.

Propelling Factors for Safety Switches Industry Growth

The safety switches industry is experiencing robust growth driven by several interconnected factors. Foremost is the increasing global emphasis on workplace safety, compelling industries to invest in advanced safety solutions to comply with stringent regulations and protect personnel. The accelerating pace of industrial automation and digitalization across sectors like manufacturing, automotive, and logistics directly fuels the demand for sophisticated machine safety switches and safety interlock systems. Technological advancements, particularly in non-contact safety switch technology, offering enhanced reliability, durability, and integration capabilities, are also significant growth catalysts. Furthermore, the rising adoption of Industry 4.0 principles, which necessitate connected and intelligent safety systems, is pushing the market towards more advanced and feature-rich safety switch solutions.

Obstacles in the Safety Switches Industry Market

Despite its strong growth trajectory, the safety switches industry faces several notable obstacles. Stringent and evolving regulatory landscapes across different countries can create compliance challenges and increase product development costs. Supply chain disruptions, particularly in the sourcing of critical electronic components, can impact production timelines and lead to price volatility for safety switch manufacturers. Intense competitive pressure among established players and emerging low-cost providers can squeeze profit margins. Additionally, the high initial investment cost for advanced safety interlock switches and integrated systems can be a barrier for small and medium-sized enterprises (SMEs) in adopting state-of-the-art safety solutions, potentially leading to a preference for less sophisticated alternatives.

Future Opportunities in Safety Switches Industry

The safety switches industry is poised for significant future opportunities, driven by emerging trends and evolving market needs. The growing adoption of cobots (collaborative robots) in manufacturing creates a burgeoning market for specialized safety switches designed to work alongside human operators safely. The expansion of smart manufacturing and Industry 4.0 initiatives worldwide presents opportunities for the integration of intelligent, connected safety sensors and switches that provide real-time diagnostics and predictive maintenance capabilities. Emerging markets in developing economies, with increasing industrialization and a growing awareness of safety standards, offer substantial untapped potential. Furthermore, advancements in wireless safety switch technology are expected to simplify installations and enhance flexibility in complex industrial environments. The continued focus on energy efficiency and sustainability within industrial operations also presents an opportunity for the development of energy-saving safety switch solutions.

Major Players in the Safety Switches Industry Ecosystem

- Honeywell International Inc

- Murrelektronik GmbH

- Omron Electronics LLC

- SICK AG

- Parmley Graham Ltd

- Siemens AG

- Pilz GmbH & Co KG

- Banner Engineering Corp

- Schneider Electric

- Euchner GmbH

- Rockwell Automation Inc

- Eaton Corporation

Key Developments in Safety Switches Industry Industry

- August 2022: Siemens and MAHLE intend to collaborate in the field of inductive charging of electric vehicles. Both companies have signed a letter of intent to this effect. The two companies intend to work together to close gaps in the standardization of inductive charging systems.

- June 2022: Euchner launched the new flex function CTS safety switch device. The CTS switch's key innovation is the new FlexFunction feature, which allows a single device to perform a wide variety of functions that would otherwise require several switch variants. FlexFunction paves the way for new approaches to planning and operation.

Strategic Safety Switches Industry Market Forecast

The strategic safety switches industry market forecast indicates continued robust growth, driven by an expanding industrial automation landscape and an unwavering global focus on enhancing workplace safety. Key growth catalysts include the widespread adoption of Industry 4.0 technologies, the increasing integration of sophisticated non-contact safety switches, and the development of solutions for collaborative robotics. Emerging markets present significant untapped potential, while ongoing technological advancements in areas like wireless connectivity and embedded intelligence will further propel market expansion. The industry is expected to witness sustained demand for reliable, high-performance safety solutions, ensuring a positive outlook for safety switch manufacturers and suppliers globally, with market potential projected to reach tens of billions by the end of the forecast period.

Safety Switches Industry Segmentation

-

1. Type

- 1.1. Electromagnetic

- 1.2. Non-contact

- 1.3. Other Types

-

2. End-users

- 2.1. Industrial

- 2.2. Commercial

- 2.3. Healthcare

- 2.4. Oil and Gas

- 2.5. Other End-users

Safety Switches Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Safety Switches Industry Regional Market Share

Geographic Coverage of Safety Switches Industry

Safety Switches Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Emphasis on Workplace Safety; Stringent Regulations on Machine and Personnel Safety

- 3.3. Market Restrains

- 3.3.1. Adaptability Requirements and Power Outages

- 3.4. Market Trends

- 3.4.1. Safety Switches for Industrial Application to Show Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Safety Switches Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Electromagnetic

- 5.1.2. Non-contact

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-users

- 5.2.1. Industrial

- 5.2.2. Commercial

- 5.2.3. Healthcare

- 5.2.4. Oil and Gas

- 5.2.5. Other End-users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Safety Switches Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Electromagnetic

- 6.1.2. Non-contact

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End-users

- 6.2.1. Industrial

- 6.2.2. Commercial

- 6.2.3. Healthcare

- 6.2.4. Oil and Gas

- 6.2.5. Other End-users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Safety Switches Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Electromagnetic

- 7.1.2. Non-contact

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End-users

- 7.2.1. Industrial

- 7.2.2. Commercial

- 7.2.3. Healthcare

- 7.2.4. Oil and Gas

- 7.2.5. Other End-users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Safety Switches Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Electromagnetic

- 8.1.2. Non-contact

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End-users

- 8.2.1. Industrial

- 8.2.2. Commercial

- 8.2.3. Healthcare

- 8.2.4. Oil and Gas

- 8.2.5. Other End-users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Safety Switches Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Electromagnetic

- 9.1.2. Non-contact

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End-users

- 9.2.1. Industrial

- 9.2.2. Commercial

- 9.2.3. Healthcare

- 9.2.4. Oil and Gas

- 9.2.5. Other End-users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Safety Switches Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Electromagnetic

- 10.1.2. Non-contact

- 10.1.3. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End-users

- 10.2.1. Industrial

- 10.2.2. Commercial

- 10.2.3. Healthcare

- 10.2.4. Oil and Gas

- 10.2.5. Other End-users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Murrelektronik GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Omron Electronics LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SICK AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Parmley Graham Ltd*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siemens AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pilz GmbH & Co KG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Banner Engineering Corp

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Schneider Electric

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Euchner GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rockwell Automation Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Eaton Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Safety Switches Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Safety Switches Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Safety Switches Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Safety Switches Industry Revenue (undefined), by End-users 2025 & 2033

- Figure 5: North America Safety Switches Industry Revenue Share (%), by End-users 2025 & 2033

- Figure 6: North America Safety Switches Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Safety Switches Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Safety Switches Industry Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Safety Switches Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Safety Switches Industry Revenue (undefined), by End-users 2025 & 2033

- Figure 11: Europe Safety Switches Industry Revenue Share (%), by End-users 2025 & 2033

- Figure 12: Europe Safety Switches Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Safety Switches Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Safety Switches Industry Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific Safety Switches Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Safety Switches Industry Revenue (undefined), by End-users 2025 & 2033

- Figure 17: Asia Pacific Safety Switches Industry Revenue Share (%), by End-users 2025 & 2033

- Figure 18: Asia Pacific Safety Switches Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Safety Switches Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Safety Switches Industry Revenue (undefined), by Type 2025 & 2033

- Figure 21: Latin America Safety Switches Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Safety Switches Industry Revenue (undefined), by End-users 2025 & 2033

- Figure 23: Latin America Safety Switches Industry Revenue Share (%), by End-users 2025 & 2033

- Figure 24: Latin America Safety Switches Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Safety Switches Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Safety Switches Industry Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East and Africa Safety Switches Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Safety Switches Industry Revenue (undefined), by End-users 2025 & 2033

- Figure 29: Middle East and Africa Safety Switches Industry Revenue Share (%), by End-users 2025 & 2033

- Figure 30: Middle East and Africa Safety Switches Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Safety Switches Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Safety Switches Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Safety Switches Industry Revenue undefined Forecast, by End-users 2020 & 2033

- Table 3: Global Safety Switches Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Safety Switches Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Safety Switches Industry Revenue undefined Forecast, by End-users 2020 & 2033

- Table 6: Global Safety Switches Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Safety Switches Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Safety Switches Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Safety Switches Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global Safety Switches Industry Revenue undefined Forecast, by End-users 2020 & 2033

- Table 11: Global Safety Switches Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Safety Switches Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Germany Safety Switches Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: France Safety Switches Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Safety Switches Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Safety Switches Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: Global Safety Switches Industry Revenue undefined Forecast, by End-users 2020 & 2033

- Table 18: Global Safety Switches Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: China Safety Switches Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: India Safety Switches Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Japan Safety Switches Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Safety Switches Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Global Safety Switches Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 24: Global Safety Switches Industry Revenue undefined Forecast, by End-users 2020 & 2033

- Table 25: Global Safety Switches Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Global Safety Switches Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 27: Global Safety Switches Industry Revenue undefined Forecast, by End-users 2020 & 2033

- Table 28: Global Safety Switches Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Safety Switches Industry?

The projected CAGR is approximately 3.4%.

2. Which companies are prominent players in the Safety Switches Industry?

Key companies in the market include Honeywell International Inc, Murrelektronik GmbH, Omron Electronics LLC, SICK AG, Parmley Graham Ltd*List Not Exhaustive, Siemens AG, Pilz GmbH & Co KG, Banner Engineering Corp, Schneider Electric, Euchner GmbH, Rockwell Automation Inc, Eaton Corporation.

3. What are the main segments of the Safety Switches Industry?

The market segments include Type, End-users.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Emphasis on Workplace Safety; Stringent Regulations on Machine and Personnel Safety.

6. What are the notable trends driving market growth?

Safety Switches for Industrial Application to Show Significant Growth.

7. Are there any restraints impacting market growth?

Adaptability Requirements and Power Outages.

8. Can you provide examples of recent developments in the market?

August 2022 - Siemens and MAHLE intend to collaborate in the field of inductive charging of electric vehicles. Both companies have signed a letter of intent to this effect. The two companies intend to work together to close gaps in the standardization of inductive charging systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Safety Switches Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Safety Switches Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Safety Switches Industry?

To stay informed about further developments, trends, and reports in the Safety Switches Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence