Key Insights

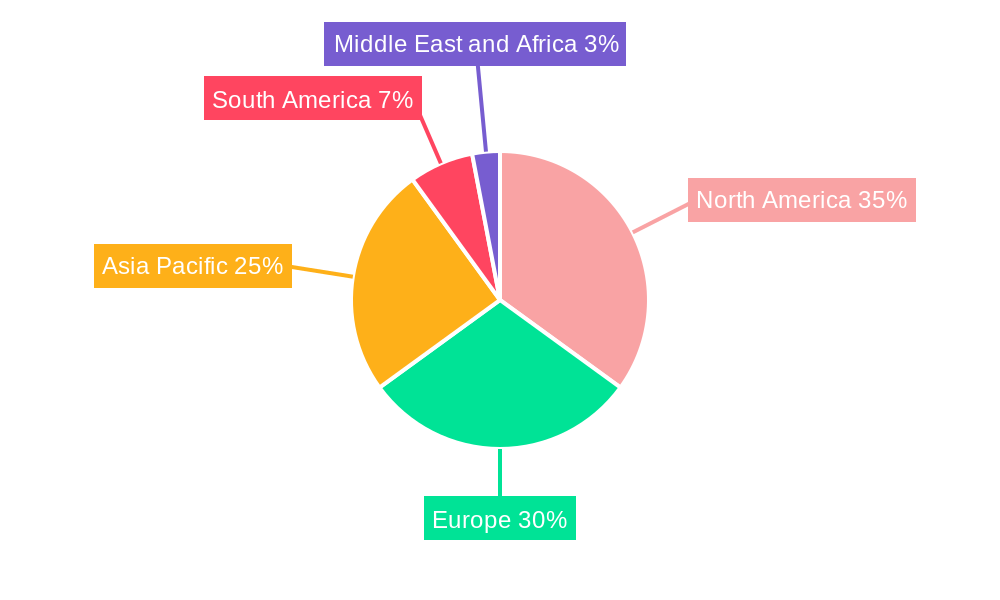

The global premium alcoholic beverages market, encompassing beer, wine, and spirits, is projected to expand significantly, with an estimated market size of $1762.12 billion by 2024, and is forecast to grow at a Compound Annual Growth Rate (CAGR) of 9.7%. This growth is driven by rising disposable incomes, particularly in emerging economies, and an increasing consumer preference for high-quality, sophisticated alcoholic beverages. The on-trade segment benefits from the popularity of premium cocktails and curated experiences, while the off-trade segment, including e-commerce, offers enhanced convenience. Effective marketing strategies emphasizing brand heritage and exclusivity further boost market appeal. Asia Pacific shows substantial growth potential due to its burgeoning middle class. Key challenges include evolving excise duties, regulations, raw material price fluctuations, and supply chain disruptions. Intense competition from established brands and emerging craft players necessitates continuous innovation.

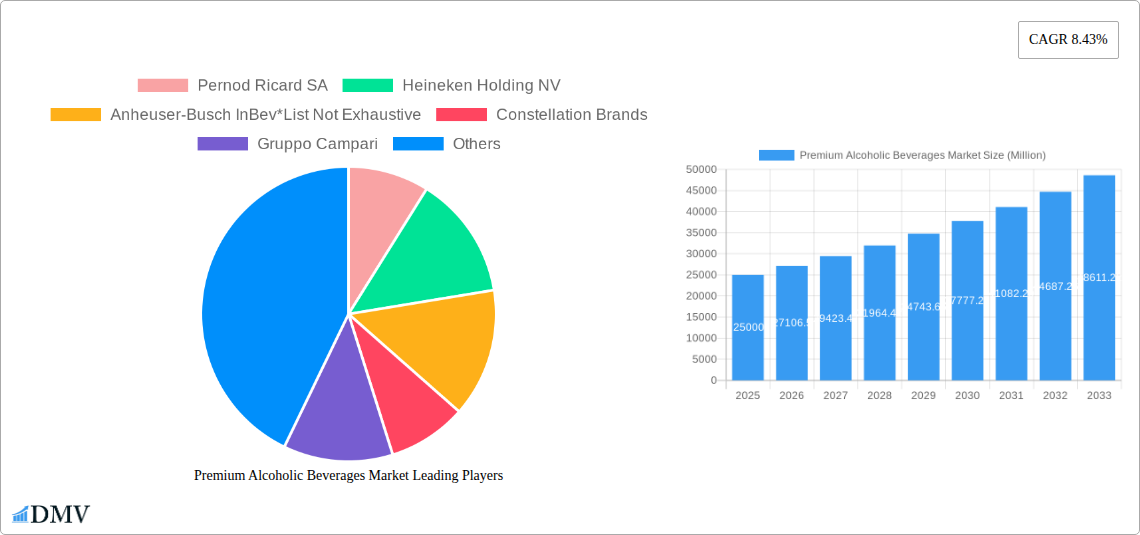

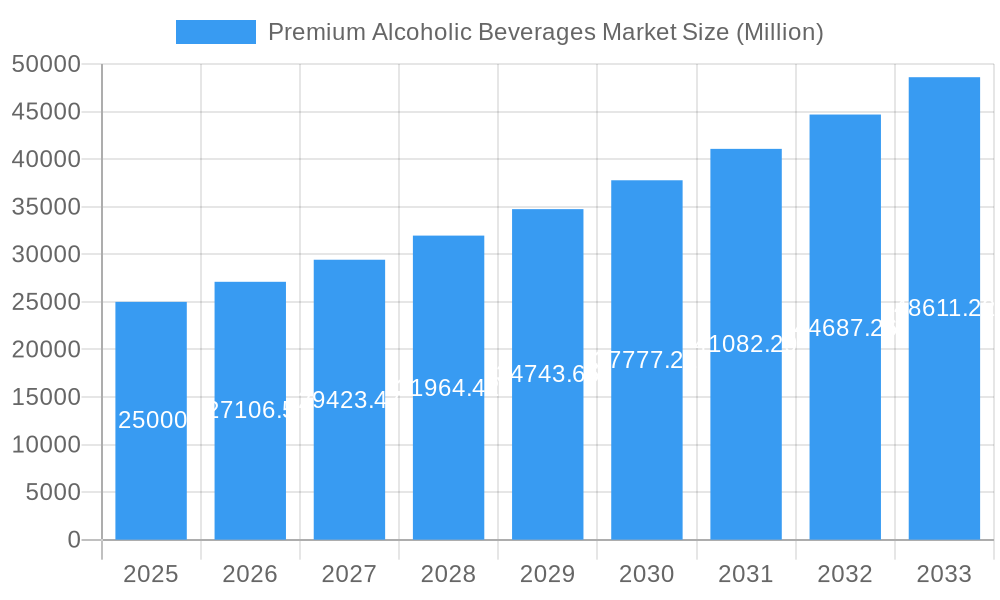

Premium Alcoholic Beverages Market Market Size (In Million)

Major global players like Pernod Ricard SA, Heineken Holding NV, Anheuser-Busch InBev, Constellation Brands, and Diageo PLC dominate through established portfolios and extensive distribution. The emergence of craft brands spurs innovation among larger companies. Regional preferences and regulations shape market dynamics, with North America and Europe currently leading, though Asia-Pacific is poised for the most rapid expansion. Future success will hinge on sustainable practices, personalized marketing, and catering to health-conscious consumer demands within the premium sector. The market presents sustained growth opportunities for investment and expansion across all segments and geographies.

Premium Alcoholic Beverages Market Company Market Share

Premium Alcoholic Beverages Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Premium Alcoholic Beverages Market, encompassing the historical period (2019-2024), base year (2025), and forecast period (2025-2033). Valued at xx Million in 2025, the market is poised for significant growth, driven by evolving consumer preferences and innovative product launches. This report is an invaluable resource for stakeholders seeking to understand market dynamics, competitive landscapes, and future opportunities within this lucrative sector.

Premium Alcoholic Beverages Market Composition & Trends

This section delves into the intricate composition of the premium alcoholic beverages market, examining key trends that shape its evolution. Market concentration is analyzed, revealing the dominant players and their respective market shares. We explore the innovative catalysts driving product development, scrutinize the regulatory landscape impacting market access and pricing, and identify substitute products posing potential threats. Furthermore, the report profiles end-users, categorized by demographics and consumption patterns, and assesses the impact of mergers and acquisitions (M&A) activities on market consolidation. The analysis includes detailed data on M&A deal values (xx Million in total deal value during 2019-2024), and market share distribution (e.g., Diageo PLC holding xx% market share in 2024).

- Market Concentration: High, with a few multinational corporations dominating.

- Innovation Catalysts: Consumer demand for premiumization, craft beverages, and unique flavor profiles.

- Regulatory Landscape: Varying regulations across regions influencing pricing and distribution.

- Substitute Products: Non-alcoholic premium beverages, and other luxury goods.

- End-User Profiles: Affluent consumers, age 25-55, with disposable income.

- M&A Activities: Significant consolidation through acquisitions and mergers aiming for market share expansion and diversification.

Premium Alcoholic Beverages Market Industry Evolution

This section meticulously charts the evolution of the premium alcoholic beverages market, examining its growth trajectory from 2019 to 2033. We analyze technological advancements, such as sustainable packaging and sophisticated production techniques, and how they influence market dynamics. The report also explores the shifting consumer demands driving premiumization, including a preference for craft spirits, organic wines, and unique flavor combinations. The market is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching a value of xx Million by 2033. Specific data points on growth rates and adoption metrics for various premium beverage segments are provided, detailing the success of specific products and marketing strategies.

Leading Regions, Countries, or Segments in Premium Alcoholic Beverages Market

This section identifies the dominant regions, countries, and segments within the premium alcoholic beverage market. The analysis distinguishes between various types (beer, wine, spirits) and distribution channels (on-trade, off-trade), revealing which categories command the largest market share and exhibit the strongest growth potential.

Dominant Segment: Spirits segment holds a xx% market share in 2025 driven by the increasing popularity of craft spirits and premium whiskies. The on-trade channel holds the lion's share (xx%) due to its association with upscale dining and social experiences.

- Key Drivers (Spirits):

- Strong investment in brand building and marketing.

- Growing interest in craft distilleries and unique flavor profiles.

- Relatively high profit margins.

- Key Drivers (On-Trade):

- Rise of experiential consumption and social drinking trends.

- Increased tourism and international travel.

- Growth of premium bars and restaurants.

The detailed analysis explores the factors underpinning the dominance of these segments, including investment trends, regulatory support, and consumer preferences. North America and Europe are currently the leading regions, with Asia-Pacific showing significant growth potential.

Premium Alcoholic Beverages Market Product Innovations

Recent years have witnessed a surge in product innovation within the premium alcoholic beverage sector. Distilleries and wineries are constantly introducing new flavors, blends, and premium variations to cater to discerning palates. Technological advancements are employed to enhance quality, create unique taste profiles, and improve the overall consumer experience. Examples include the use of sustainable packaging, innovative filtration techniques, and precise temperature control during fermentation and aging. This commitment to innovation ensures the market’s continuous appeal to consumers seeking sophisticated and high-quality beverages.

Propelling Factors for Premium Alcoholic Beverages Market Growth

The growth of the premium alcoholic beverage market is fueled by a confluence of factors. Technological advancements in production and packaging contribute to higher quality and more appealing products. The rising disposable incomes in emerging markets, coupled with a growing preference for premium experiences, further stimulate demand. Favorable regulatory environments in some regions, such as reduced excise duties or simplified licensing procedures, also contribute to market expansion. Moreover, targeted marketing campaigns emphasizing luxury positioning and brand heritage significantly influence consumer choices.

Obstacles in the Premium Alcoholic Beverages Market

Despite its growth potential, the premium alcoholic beverage market faces several challenges. Stringent regulations regarding alcohol content, labeling, and advertising vary significantly across regions, increasing operational complexity and potentially limiting market expansion. Supply chain disruptions, particularly concerning raw materials and transportation, can negatively impact production and pricing. Intense competition amongst established brands and the emergence of new players create pressure on profit margins and market share. These factors pose considerable obstacles to sustained growth.

Future Opportunities in Premium Alcoholic Beverages Market

The future of the premium alcoholic beverages market presents numerous opportunities. Expanding into emerging markets with growing middle classes offers significant potential for growth. The incorporation of innovative technologies such as personalized flavor profiles and augmented reality experiences can create unique customer interactions. Furthermore, catering to growing consumer demands for sustainability and ethically sourced products will open up new avenues for market expansion. These opportunities warrant careful consideration for long-term success.

Major Players in the Premium Alcoholic Beverages Market Ecosystem

- Pernod Ricard SA

- Heineken Holding NV

- Anheuser-Busch InBev

- Constellation Brands

- Gruppo Campari

- Bacardi Limited

- Treasury Wine Estates

- The Brown-Forman Corporation

- Carlsberg Group

- Diageo PLC

Key Developments in Premium Alcoholic Beverages Market Industry

- September 2022: Heineken launched Heineken Silver in India, aiming to accelerate premium beer market growth.

- May 2022: Jack Daniel's introduced Jack Daniel's Bonded and Jack Daniel's Triple Mash, expanding its super-premium whiskey offerings.

- April 2022: Frisky Whiskey launched a new premium flavored whiskey in Charleston, South Carolina.

These developments highlight the ongoing efforts by key players to innovate, expand market reach, and cater to evolving consumer preferences, thereby shaping the dynamics of the premium alcoholic beverages market.

Strategic Premium Alcoholic Beverages Market Forecast

The premium alcoholic beverages market is projected to experience robust growth throughout the forecast period, driven by ongoing product innovation, expanding consumer bases in emerging markets, and the increasing preference for premium experiences. The market's resilience to economic downturns and its inherent adaptability to evolving consumer preferences ensure its sustained growth trajectory. Further diversification into innovative product categories and expansion into untapped regions will significantly contribute to the market’s overall potential.

Premium Alcoholic Beverages Market Segmentation

-

1. Type

- 1.1. Beer

- 1.2. Wine

- 1.3. Spirits

-

2. Distribution Channel

- 2.1. On-Trade

- 2.2. Off-Trade

Premium Alcoholic Beverages Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Premium Alcoholic Beverages Market Regional Market Share

Geographic Coverage of Premium Alcoholic Beverages Market

Premium Alcoholic Beverages Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits

- 3.3. Market Restrains

- 3.3.1. Affordability of the Product is Restraining the Market's Growth

- 3.4. Market Trends

- 3.4.1. Craft Beer Gaining Importance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Premium Alcoholic Beverages Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Beer

- 5.1.2. Wine

- 5.1.3. Spirits

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Premium Alcoholic Beverages Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Beer

- 6.1.2. Wine

- 6.1.3. Spirits

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-Trade

- 6.2.2. Off-Trade

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Premium Alcoholic Beverages Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Beer

- 7.1.2. Wine

- 7.1.3. Spirits

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-Trade

- 7.2.2. Off-Trade

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Premium Alcoholic Beverages Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Beer

- 8.1.2. Wine

- 8.1.3. Spirits

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-Trade

- 8.2.2. Off-Trade

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Premium Alcoholic Beverages Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Beer

- 9.1.2. Wine

- 9.1.3. Spirits

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-Trade

- 9.2.2. Off-Trade

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Premium Alcoholic Beverages Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Beer

- 10.1.2. Wine

- 10.1.3. Spirits

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-Trade

- 10.2.2. Off-Trade

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Pernod Ricard SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Heineken Holding NV

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Anheuser-Busch InBev*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Constellation Brands

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Gruppo Campari

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bacardi Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Treasury Wine Estates

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Brown-Forman Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Carlsberg Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Diageo PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Pernod Ricard SA

List of Figures

- Figure 1: Global Premium Alcoholic Beverages Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Premium Alcoholic Beverages Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Premium Alcoholic Beverages Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Premium Alcoholic Beverages Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Premium Alcoholic Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Premium Alcoholic Beverages Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Premium Alcoholic Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Premium Alcoholic Beverages Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Premium Alcoholic Beverages Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Premium Alcoholic Beverages Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: Europe Premium Alcoholic Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Premium Alcoholic Beverages Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Premium Alcoholic Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Premium Alcoholic Beverages Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Premium Alcoholic Beverages Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Premium Alcoholic Beverages Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Premium Alcoholic Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Premium Alcoholic Beverages Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Premium Alcoholic Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Premium Alcoholic Beverages Market Revenue (billion), by Type 2025 & 2033

- Figure 21: South America Premium Alcoholic Beverages Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Premium Alcoholic Beverages Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: South America Premium Alcoholic Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Premium Alcoholic Beverages Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Premium Alcoholic Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Premium Alcoholic Beverages Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Premium Alcoholic Beverages Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Premium Alcoholic Beverages Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Premium Alcoholic Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Premium Alcoholic Beverages Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Premium Alcoholic Beverages Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Premium Alcoholic Beverages Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Premium Alcoholic Beverages Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Premium Alcoholic Beverages Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Premium Alcoholic Beverages Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Premium Alcoholic Beverages Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Premium Alcoholic Beverages Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Premium Alcoholic Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Premium Alcoholic Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Premium Alcoholic Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Premium Alcoholic Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Premium Alcoholic Beverages Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Premium Alcoholic Beverages Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Premium Alcoholic Beverages Market Revenue billion Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Premium Alcoholic Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Premium Alcoholic Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: France Premium Alcoholic Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Russia Premium Alcoholic Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Premium Alcoholic Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Premium Alcoholic Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Premium Alcoholic Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Premium Alcoholic Beverages Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Global Premium Alcoholic Beverages Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Premium Alcoholic Beverages Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: India Premium Alcoholic Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: China Premium Alcoholic Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Japan Premium Alcoholic Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Premium Alcoholic Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Premium Alcoholic Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Premium Alcoholic Beverages Market Revenue billion Forecast, by Type 2020 & 2033

- Table 30: Global Premium Alcoholic Beverages Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Premium Alcoholic Beverages Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Premium Alcoholic Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Premium Alcoholic Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Premium Alcoholic Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Premium Alcoholic Beverages Market Revenue billion Forecast, by Type 2020 & 2033

- Table 36: Global Premium Alcoholic Beverages Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Premium Alcoholic Beverages Market Revenue billion Forecast, by Country 2020 & 2033

- Table 38: South Africa Premium Alcoholic Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: United Arab Emirates Premium Alcoholic Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Premium Alcoholic Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Premium Alcoholic Beverages Market?

The projected CAGR is approximately 9.7%.

2. Which companies are prominent players in the Premium Alcoholic Beverages Market?

Key companies in the market include Pernod Ricard SA, Heineken Holding NV, Anheuser-Busch InBev*List Not Exhaustive, Constellation Brands, Gruppo Campari, Bacardi Limited, Treasury Wine Estates, The Brown-Forman Corporation, Carlsberg Group, Diageo PLC.

3. What are the main segments of the Premium Alcoholic Beverages Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1762.12 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits.

6. What are the notable trends driving market growth?

Craft Beer Gaining Importance.

7. Are there any restraints impacting market growth?

Affordability of the Product is Restraining the Market's Growth.

8. Can you provide examples of recent developments in the market?

September 2022: The Heineken Group, located in Amsterdam, announced the launch of Heineken Silver, increasing its position in the premium beer market in India. They asserted that the launch would fuel and hasten the expansion of the premium beer market in India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Premium Alcoholic Beverages Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Premium Alcoholic Beverages Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Premium Alcoholic Beverages Market?

To stay informed about further developments, trends, and reports in the Premium Alcoholic Beverages Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence