Key Insights

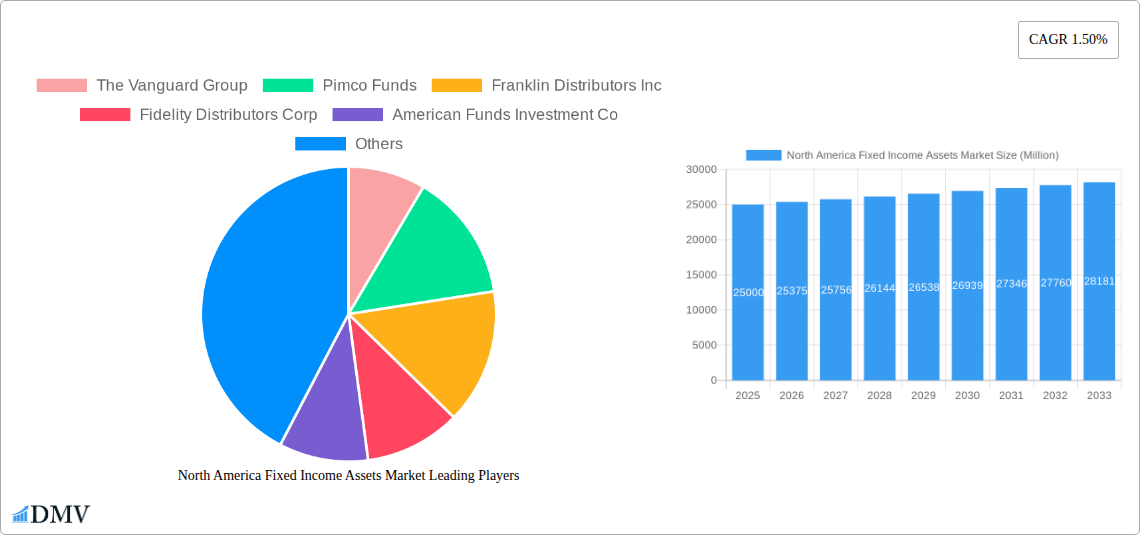

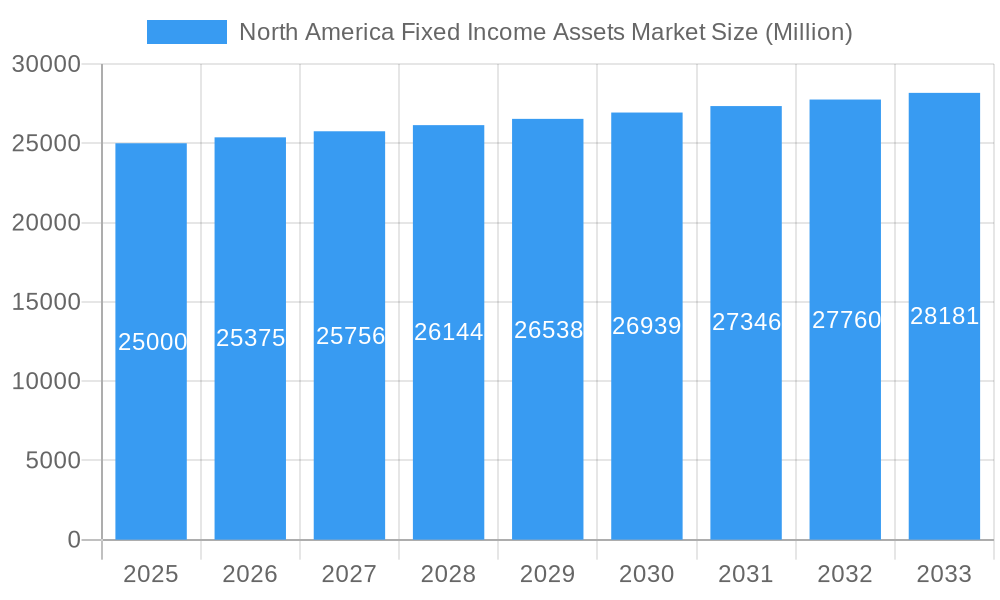

The North America fixed income assets market is a substantial and mature sector, exhibiting steady growth despite macroeconomic fluctuations. The 1.50% CAGR projected from 2025 to 2033 indicates a relatively stable expansion, driven primarily by institutional investors seeking diversification and stable returns in a volatile market. Increased regulatory scrutiny and demand for transparency are shaping market trends, pushing firms towards greater ethical and sustainable investing practices. While rising interest rates can present challenges, the market's resilience is supported by the continued demand for low-risk investments, particularly from pension funds, insurance companies, and high-net-worth individuals. The market's segmentation likely reflects the varying risk appetites and investment strategies of these diverse actors, with opportunities arising from the growing demand for ESG (Environmental, Social, and Governance) compliant fixed-income products. Competition among major players like The Vanguard Group, Pimco Funds, and Fidelity Distributors Corp remains fierce, necessitating innovation in product offerings and investment strategies to maintain market share.

North America Fixed Income Assets Market Market Size (In Billion)

The forecast period of 2025-2033 shows continued growth, albeit modest, fueled by consistent institutional demand and the ongoing need for diversification within investment portfolios. Strategic acquisitions and mergers within the sector are probable, as firms seek to expand their product lines and geographic reach. Technological advancements, particularly in areas like algorithmic trading and data analytics, are expected to further improve efficiency and transparency within the market. The regulatory landscape will remain a key factor impacting the market's trajectory, with ongoing efforts to enhance investor protection and market stability. The increasing adoption of sustainable and responsible investing practices will continue to influence product development and investment strategies within the North American fixed income assets market, creating new opportunities for firms demonstrating strong ESG commitments.

North America Fixed Income Assets Market Company Market Share

North America Fixed Income Assets Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the North America fixed income assets market, offering a detailed examination of market trends, competitive landscape, and future growth prospects. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for investors, industry professionals, and stakeholders seeking a deep understanding of this dynamic market. The total market value in 2025 is estimated at xx Million.

North America Fixed Income Assets Market Composition & Trends

This section delves into the intricate structure of the North America fixed income assets market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, and end-user profiles. We also explore mergers and acquisitions (M&A) activities, providing crucial insights into market dynamics.

Market Concentration & Share Distribution: The market exhibits a moderately concentrated structure, with the top five players – The Vanguard Group, Pimco Funds, Franklin Distributors Inc, Fidelity Distributors Corp, and American Funds Investment Co – collectively holding an estimated xx% market share in 2025. Smaller players contribute significantly to market activity, fostering a dynamic competitive landscape.

Innovation Catalysts & Regulatory Landscape: Technological advancements, particularly in algorithmic trading and data analytics, are driving innovation within the market. Regulatory changes, such as those impacting money market funds and bond trading, continuously reshape the industry.

Substitute Products & End-User Profiles: The market faces competition from alternative investment vehicles, such as real estate and private equity. Key end-users include institutional investors (pension funds, insurance companies), retail investors, and high-net-worth individuals.

M&A Activities: The historical period (2019-2024) witnessed xx M&A deals, with a total value of approximately xx Million. The forecast period is expected to see increased M&A activity driven by consolidation and expansion strategies.

North America Fixed Income Assets Market Industry Evolution

This section provides a detailed analysis of the North America fixed income assets market's evolutionary trajectory, encompassing growth trajectories, technological advancements, and the shifting preferences of investors.

The market witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), driven by factors including increasing demand for fixed-income securities, low-interest-rate environments, and diversification strategies among investors. Technological advancements, including the rise of robo-advisors and fintech platforms, have facilitated increased accessibility and efficiency in the market. The adoption rate of these technologies is projected to increase by xx% annually during the forecast period. Shifting investor preferences, notably towards ESG (Environmental, Social, and Governance) investing, are also shaping market dynamics. Growth is projected to moderate to a CAGR of xx% during the forecast period (2025-2033), with factors like interest rate fluctuations and global economic uncertainty influencing market performance.

Leading Regions, Countries, or Segments in North America Fixed Income Assets Market

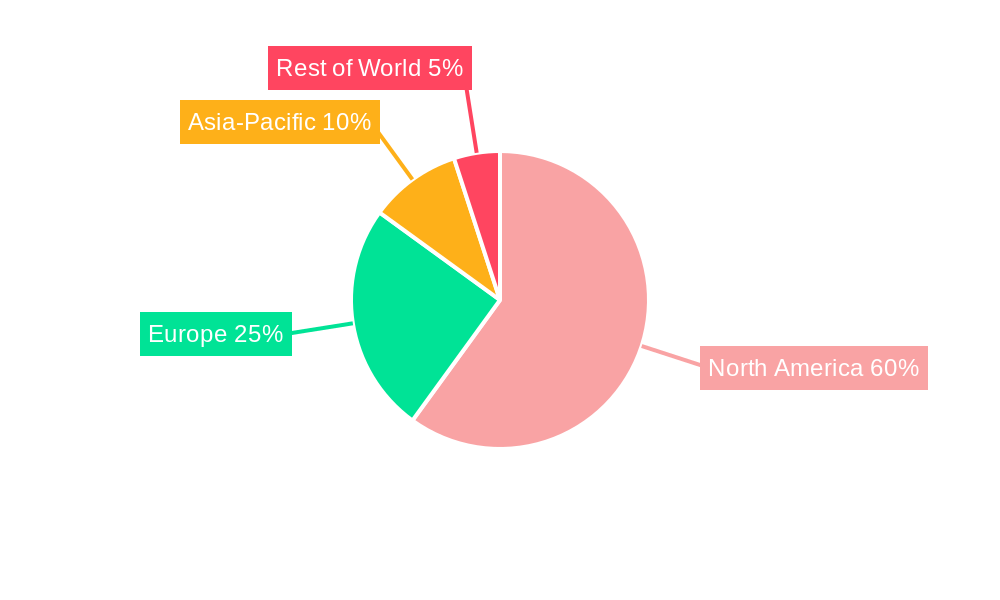

This section pinpoints the dominant regions, countries, and segments within the North American fixed income assets market.

Dominant Region/Country: The United States remains the dominant market, accounting for approximately xx% of the total market value in 2025. This dominance is primarily attributed to its mature financial markets, substantial investor base, and robust regulatory framework.

Key Drivers for U.S. Dominance:

- Large and Diverse Investor Base: The U.S. boasts a large pool of institutional and retail investors actively participating in the fixed-income market.

- Deep and Liquid Markets: The U.S. fixed-income markets are characterized by high liquidity, enabling efficient trading and price discovery.

- Robust Regulatory Framework: A well-established regulatory structure ensures market integrity and investor protection.

- Innovation Hub: The U.S. is a global center for financial innovation, driving technological advancements within the fixed-income sector.

The Canadian market, while smaller, also exhibits strong growth potential driven by increasing pension fund investments and government initiatives. Other North American markets hold significantly less share.

North America Fixed Income Assets Market Product Innovations

Recent product innovations focus on enhancing transparency, efficiency, and risk management within the fixed-income market. The introduction of Exchange-Traded Funds (ETFs) tracking specific fixed-income indices has broadened accessibility for investors. Technological advancements in data analytics allow for more sophisticated risk modeling and portfolio optimization strategies. These innovations improve portfolio construction efficiency, contributing to better risk-adjusted returns and appealing to a wider range of investor preferences.

Propelling Factors for North America Fixed Income Assets Market Growth

Several key factors contribute to the continued growth of the North America fixed income assets market. Low interest rate environments historically encouraged investment in fixed-income securities to seek yield. Furthermore, the increasing demand for diversification by investors adds to the market's expansion. Regulatory changes aimed at enhancing market transparency and investor protection also contribute to growth by building confidence in the sector.

Obstacles in the North America Fixed Income Assets Market

The North America fixed income assets market faces several challenges. Interest rate volatility can significantly impact the value of fixed-income securities, creating uncertainty for investors. Geopolitical risks and economic downturns can lead to decreased investor confidence and reduced market activity. Increased regulatory scrutiny may also create compliance costs for market participants.

Future Opportunities in North America Fixed Income Assets Market

Emerging opportunities exist within the market, particularly in areas such as green bonds and other ESG-focused investments. Technological advancements, particularly in artificial intelligence and machine learning, are expected to further enhance efficiency and risk management capabilities. Expanding into new market segments, such as emerging market debt, also presents significant growth potential.

Major Players in the North America Fixed Income Assets Market Ecosystem

- The Vanguard Group

- Pimco Funds

- Franklin Distributors Inc

- Fidelity Distributors Corp

- American Funds Investment Co

- Putnam Investments LLC

- Oppenheimer Funds Inc

- Scudder Investments

- Evergreen Investments

- Dreyfus Corp

- Federated Investors Inc

- T Rowe Price Group

Key Developments in North America Fixed Income Assets Market Industry

- 2022 Q3: Increased regulatory scrutiny on ESG investing practices.

- 2023 Q1: Launch of several new ESG-focused fixed-income ETFs.

- 2024 Q2: Significant M&A activity involving smaller players consolidating.

Strategic North America Fixed Income Assets Market Forecast

The North America fixed income assets market is projected to experience sustained growth over the forecast period (2025-2033), driven by increased investor demand for diversification, technological advancements, and the emergence of new investment products. The market will continue to evolve, with increased competition and a focus on ESG-related investments shaping future market dynamics. The increasing adoption of technological solutions and innovative product offerings will improve efficiency and access. This will create new opportunities for market participants while presenting challenges for players who fail to adapt to the changing landscape.

North America Fixed Income Assets Market Segmentation

-

1. Source of Funds

- 1.1. Pension Funds and Insurance Companies

- 1.2. Retail Investors

- 1.3. Institutional Investors

- 1.4. Government/Sovereign Wealth Fund

- 1.5. Others

-

2. Fixed Income Type

- 2.1. Core Fixed Income

- 2.2. Alternative Credit

-

3. Type of Asset Management Firms

- 3.1. Large financial institutions/Bulge bracket banks

- 3.2. Mutual Funds ETFs

- 3.3. Private Equity and Venture Capital

- 3.4. Fixed Income Funds

- 3.5. Managed Pension Funds

- 3.6. Others

North America Fixed Income Assets Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Fixed Income Assets Market Regional Market Share

Geographic Coverage of North America Fixed Income Assets Market

North America Fixed Income Assets Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Prominence of HNWIs in Fixed Income Investments in North America

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fixed Income Assets Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source of Funds

- 5.1.1. Pension Funds and Insurance Companies

- 5.1.2. Retail Investors

- 5.1.3. Institutional Investors

- 5.1.4. Government/Sovereign Wealth Fund

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Fixed Income Type

- 5.2.1. Core Fixed Income

- 5.2.2. Alternative Credit

- 5.3. Market Analysis, Insights and Forecast - by Type of Asset Management Firms

- 5.3.1. Large financial institutions/Bulge bracket banks

- 5.3.2. Mutual Funds ETFs

- 5.3.3. Private Equity and Venture Capital

- 5.3.4. Fixed Income Funds

- 5.3.5. Managed Pension Funds

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Source of Funds

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Vanguard Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pimco Funds

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Franklin Distributors Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fidelity Distributors Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 American Funds Investment Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Putnam Investments LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Oppenheimer Funds Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Scudder Investments

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Evergreen Investments

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dreyfus Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Federated Investors Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 T Rowe Price Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 The Vanguard Group

List of Figures

- Figure 1: North America Fixed Income Assets Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Fixed Income Assets Market Share (%) by Company 2025

List of Tables

- Table 1: North America Fixed Income Assets Market Revenue Million Forecast, by Source of Funds 2020 & 2033

- Table 2: North America Fixed Income Assets Market Revenue Million Forecast, by Fixed Income Type 2020 & 2033

- Table 3: North America Fixed Income Assets Market Revenue Million Forecast, by Type of Asset Management Firms 2020 & 2033

- Table 4: North America Fixed Income Assets Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Fixed Income Assets Market Revenue Million Forecast, by Source of Funds 2020 & 2033

- Table 6: North America Fixed Income Assets Market Revenue Million Forecast, by Fixed Income Type 2020 & 2033

- Table 7: North America Fixed Income Assets Market Revenue Million Forecast, by Type of Asset Management Firms 2020 & 2033

- Table 8: North America Fixed Income Assets Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Fixed Income Assets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Fixed Income Assets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Fixed Income Assets Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fixed Income Assets Market?

The projected CAGR is approximately 1.50%.

2. Which companies are prominent players in the North America Fixed Income Assets Market?

Key companies in the market include The Vanguard Group, Pimco Funds, Franklin Distributors Inc, Fidelity Distributors Corp, American Funds Investment Co, Putnam Investments LLC, Oppenheimer Funds Inc, Scudder Investments, Evergreen Investments, Dreyfus Corp, Federated Investors Inc, T Rowe Price Group.

3. What are the main segments of the North America Fixed Income Assets Market?

The market segments include Source of Funds, Fixed Income Type, Type of Asset Management Firms.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Prominence of HNWIs in Fixed Income Investments in North America.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fixed Income Assets Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fixed Income Assets Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fixed Income Assets Market?

To stay informed about further developments, trends, and reports in the North America Fixed Income Assets Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence