Key Insights

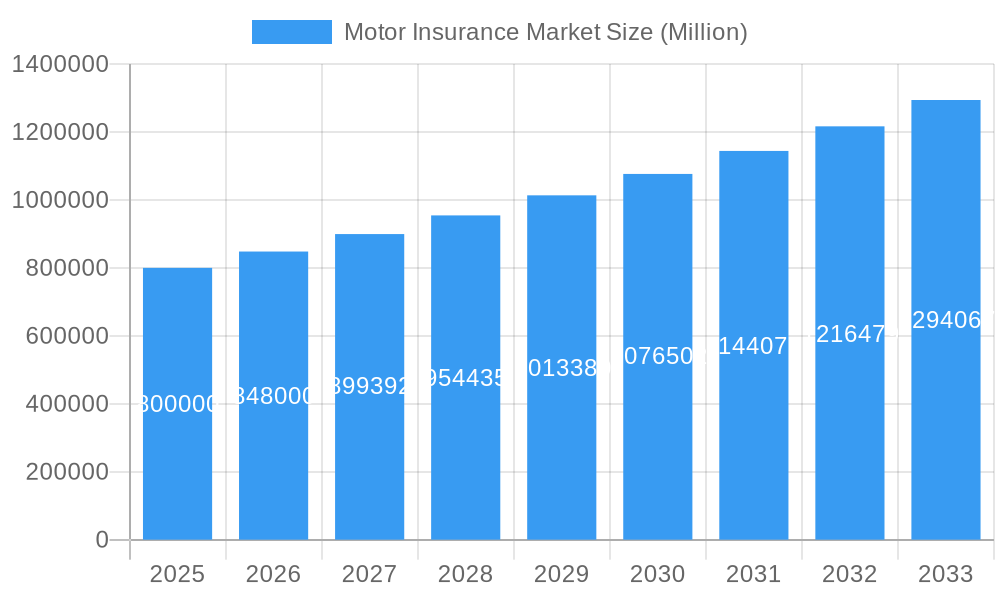

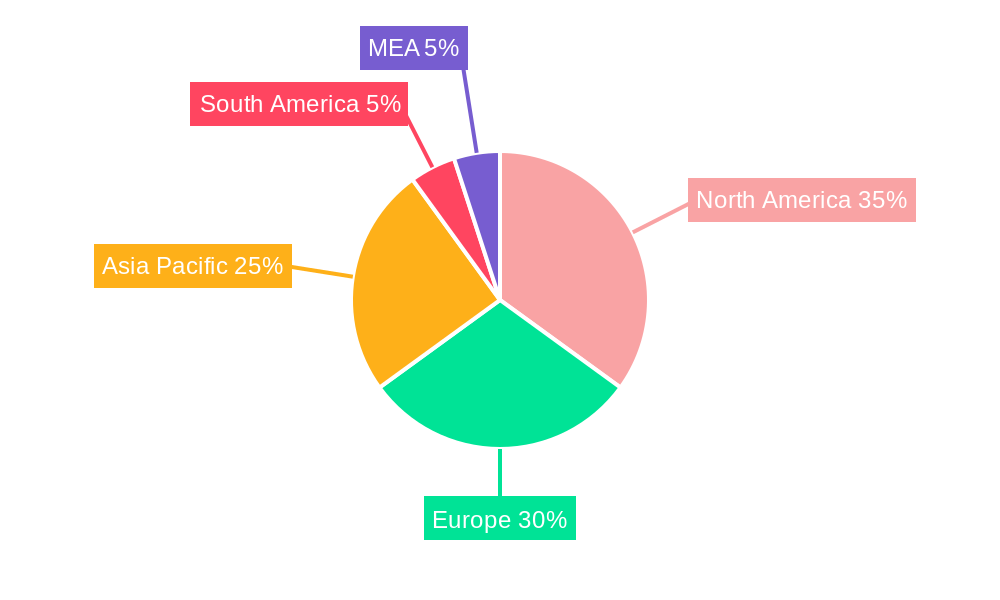

The global motor insurance market, currently exhibiting robust growth, is projected to maintain a Compound Annual Growth Rate (CAGR) of 6.00% from 2025 to 2033. This expansion is driven by several key factors. The rising number of vehicles globally, particularly in developing economies experiencing rapid motorization, fuels demand for insurance coverage. Furthermore, increasing awareness of the financial implications of accidents and stringent government regulations mandating insurance are significantly boosting market penetration. Technological advancements, including telematics and AI-powered risk assessment, are streamlining processes and improving the efficiency of insurance offerings, contributing to market growth. The market is segmented by product type (third-party liability, comprehensive, and collision), vehicle type (passenger cars, commercial vehicles, and motorcycles), and geography, revealing varied growth patterns across different regions. North America and Europe currently hold significant market shares, driven by higher vehicle ownership and insurance penetration, while Asia-Pacific is poised for substantial growth due to expanding middle classes and increasing vehicle sales. Competitive pressures from established players like Ping An Insurance, AXA SA, and Zurich AG, alongside regional insurers, are shaping market dynamics and driving innovation in product offerings and pricing strategies.

Motor Insurance Market Market Size (In Billion)

Despite promising growth prospects, the market faces certain challenges. Economic downturns and fluctuating fuel prices can impact consumer spending on insurance, potentially slowing growth. Furthermore, the increasing prevalence of fraudulent claims and the complexity of managing claims processes represent significant hurdles for insurers. Nonetheless, the long-term outlook for the motor insurance market remains positive, propelled by continued vehicle sales growth, evolving consumer preferences, and the integration of innovative technologies to enhance risk management and customer service. Specific regional variations in growth rates will depend on factors such as economic conditions, regulatory frameworks, and the level of insurance penetration within each market. The market's segmentation offers opportunities for insurers to tailor their products and services to meet the specific needs of diverse customer segments.

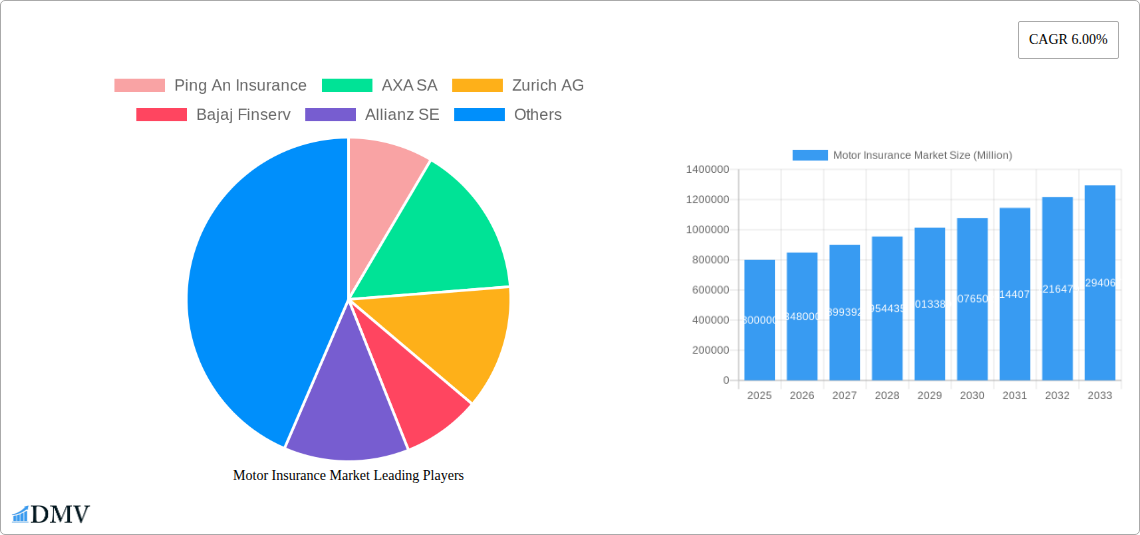

Motor Insurance Market Company Market Share

Motor Insurance Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the global motor insurance market, encompassing market size, growth trajectories, competitive landscape, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and navigate this dynamic sector. The report meticulously examines key segments, including passenger cars, commercial vehicles, and motorcycles, across various product types like third-party liability, comprehensive, and collision insurance. The market's value is projected to reach xx Million by 2033, fueled by technological advancements and evolving consumer demands.

Motor Insurance Market Composition & Trends

The global motor insurance market is characterized by a moderately concentrated landscape, with key players like Ping An Insurance, AXA SA, Zurich AG, Bajaj Finserv, Allianz SE, GEICO, PICC Property & Casualty Co Ltd, Assicurazioni Generali, State Farm, and Allstate holding significant market share. Market share distribution varies across regions and segments, with some companies demonstrating stronger presence in specific geographical areas or product categories. The market is witnessing significant innovation, driven by the adoption of telematics, AI-powered claims processing, and digital distribution channels. Regulatory landscapes vary across countries, influencing pricing strategies, product offerings, and operational practices. Substitute products, such as self-insurance schemes, are present but generally less prevalent due to the inherent risks involved. End-user profiles are diverse, encompassing individuals, businesses, and government entities. M&A activity remains relatively consistent, with deal values ranging from xx Million to xx Million in recent years, reflecting ongoing consolidation and expansion efforts within the industry.

- Market Concentration: Moderately concentrated, with top 10 players holding approximately xx% of market share.

- Innovation Catalysts: Telematics, AI, digital distribution channels.

- Regulatory Landscape: Varies significantly by region, impacting pricing and product offerings.

- Substitute Products: Limited, primarily self-insurance schemes.

- End-User Profiles: Individuals, businesses, government entities.

- M&A Activity: Consistent, with deal values ranging from xx Million to xx Million in recent years.

Motor Insurance Market Industry Evolution

The motor insurance market has experienced consistent growth throughout the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is anticipated to continue during the forecast period (2025-2033), albeit at a potentially moderated pace, reaching a projected CAGR of xx%. This evolution is shaped by several key factors. Technological advancements, particularly the integration of telematics and AI, are streamlining processes, improving risk assessment, and enhancing customer experience. Shifting consumer demands are driving the need for more personalized and digitally-enabled insurance products and services. The increasing adoption of connected cars and the rise of autonomous vehicles are reshaping the risk landscape and presenting both opportunities and challenges for insurers. The market is also experiencing significant penetration of mobile-first insurance offerings, leading to increased accessibility and convenience for customers. Furthermore, evolving regulatory frameworks are impacting insurers' operational strategies and product development. The increasing prevalence of cybersecurity threats is another important aspect influencing the market's evolution, leading to heightened investments in data security and fraud detection systems.

Leading Regions, Countries, or Segments in Motor Insurance Market

The report identifies [Specific Region/Country] as the leading region/country in the motor insurance market, driven by factors such as high vehicle ownership rates, robust economic growth, and favorable regulatory environments. Within the product types, Comprehensive Insurance demonstrates the highest market share due to its broader coverage and consumer preference for greater protection. Passenger Cars represent the largest vehicle type segment, owing to their widespread usage.

Key Drivers for [Specific Region/Country]:

- High vehicle ownership rates.

- Strong economic growth.

- Favorable regulatory support.

- Growing middle class with disposable income.

Key Drivers for Comprehensive Insurance:

- Enhanced protection compared to third-party liability.

- Growing consumer awareness of risk.

- Increased affordability options.

Key Drivers for Passenger Cars Segment:

- High volume of personal vehicle usage.

- Rising disposable incomes in developing markets.

- Increasing urbanization.

Motor Insurance Market Product Innovations

Recent innovations in motor insurance include the integration of telematics to offer usage-based insurance (UBI), leveraging data from vehicle sensors to personalize premiums. AI-powered claims processing is significantly reducing claim settlement times and improving efficiency. Blockchain technology is being explored to enhance transparency and security in insurance transactions. These innovations not only offer improved customer experiences but also contribute to enhanced risk management and operational efficiencies for insurers. The unique selling propositions revolve around personalized premiums, faster claim processing, and greater transparency.

Propelling Factors for Motor Insurance Market Growth

Several factors are propelling the growth of the motor insurance market. Technological advancements, particularly in telematics and AI, are improving risk assessment, claim processing, and customer experience. Economic growth in developing economies is driving increased vehicle ownership and demand for insurance. Favorable regulatory frameworks in certain regions are encouraging market expansion. The increasing adoption of connected cars and the rise of autonomous vehicles are reshaping the risk landscape, presenting new opportunities for innovation and growth.

Obstacles in the Motor Insurance Market Market

The motor insurance market faces several challenges. Stringent regulatory requirements and compliance costs can increase operational expenses. Supply chain disruptions, such as semiconductor shortages, can impact vehicle production and consequently the insurance market. Intense competition from established and emerging players puts pressure on pricing and profitability. Furthermore, increasing instances of fraudulent claims and the rising costs of repairs pose significant obstacles. These factors collectively can impede market growth and profitability for insurers.

Future Opportunities in Motor Insurance Market

Future opportunities lie in expanding into untapped markets, especially in developing economies with growing vehicle ownership. Further technological advancements, particularly in AI and predictive analytics, can improve risk management and customer personalization. The emergence of autonomous vehicles presents both opportunities and challenges, requiring insurers to adapt their risk assessment models and product offerings. The growing demand for sustainable mobility solutions also opens avenues for insurers to develop specialized products and services catering to electric and hybrid vehicles.

Major Players in the Motor Insurance Market Ecosystem

- Ping An Insurance

- AXA SA

- Zurich AG

- Bajaj Finserv

- Allianz SE

- GEICO

- PICC Property & Casualty Co Ltd

- Assicurazioni Generali

- State Farm

- Allstate

Key Developments in Motor Insurance Market Industry

- August 2021: AXA SA launched STeP, a digital claims solution significantly reducing claim processing time.

- May 2021: GEICO partnered with Tractable, an AI company, to accelerate auto claim and repair processes using computer vision technology.

Strategic Motor Insurance Market Forecast

The motor insurance market is poised for continued growth, driven by technological innovation, expanding vehicle ownership, and evolving consumer demands. The market's future potential is significant, with opportunities in new markets, product diversification, and enhanced risk management strategies. The adoption of advanced technologies and data analytics will be crucial for insurers to maintain competitiveness and capitalize on emerging opportunities.

Motor Insurance Market Segmentation

-

1. User

- 1.1. Personal Motor Insurance

- 1.2. Commercial Motor Insurance

-

2. Policy Type

- 2.1. Third Party Motor Insurance

- 2.2. Third Party, Fire & Theft Motor Insurance

- 2.3. Comprehensive Motor Insurance

Motor Insurance Market Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. UK

- 1.3. France

- 1.4. Switzerland

- 1.5. Rest Of Europe

-

2. North America

- 2.1. USA

- 2.2. Canada

-

3. Latin America

- 3.1. Brazil

- 3.2. Argentina

-

4. APAC

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. South Korea

- 4.5. Indonesia

- 4.6. Rest of APAC

-

5. MENA

- 5.1. UAE

- 5.2. Saudi Arabia

- 5.3. Lebanon

- 5.4. Rest of North Africa

Motor Insurance Market Regional Market Share

Geographic Coverage of Motor Insurance Market

Motor Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Sales of Cars in Europe Drives The Market; Increase in Road Traffic Accidents Drives The Market

- 3.3. Market Restrains

- 3.3.1. Increase in Cost of Claims Made; Increase in False Claims and Scams

- 3.4. Market Trends

- 3.4.1. Usage-based Insurance and Insurance Telematics in Motor Insurance is on Rise

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by User

- 5.1.1. Personal Motor Insurance

- 5.1.2. Commercial Motor Insurance

- 5.2. Market Analysis, Insights and Forecast - by Policy Type

- 5.2.1. Third Party Motor Insurance

- 5.2.2. Third Party, Fire & Theft Motor Insurance

- 5.2.3. Comprehensive Motor Insurance

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.3.2. North America

- 5.3.3. Latin America

- 5.3.4. APAC

- 5.3.5. MENA

- 5.1. Market Analysis, Insights and Forecast - by User

- 6. Europe Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by User

- 6.1.1. Personal Motor Insurance

- 6.1.2. Commercial Motor Insurance

- 6.2. Market Analysis, Insights and Forecast - by Policy Type

- 6.2.1. Third Party Motor Insurance

- 6.2.2. Third Party, Fire & Theft Motor Insurance

- 6.2.3. Comprehensive Motor Insurance

- 6.1. Market Analysis, Insights and Forecast - by User

- 7. North America Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by User

- 7.1.1. Personal Motor Insurance

- 7.1.2. Commercial Motor Insurance

- 7.2. Market Analysis, Insights and Forecast - by Policy Type

- 7.2.1. Third Party Motor Insurance

- 7.2.2. Third Party, Fire & Theft Motor Insurance

- 7.2.3. Comprehensive Motor Insurance

- 7.1. Market Analysis, Insights and Forecast - by User

- 8. Latin America Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by User

- 8.1.1. Personal Motor Insurance

- 8.1.2. Commercial Motor Insurance

- 8.2. Market Analysis, Insights and Forecast - by Policy Type

- 8.2.1. Third Party Motor Insurance

- 8.2.2. Third Party, Fire & Theft Motor Insurance

- 8.2.3. Comprehensive Motor Insurance

- 8.1. Market Analysis, Insights and Forecast - by User

- 9. APAC Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by User

- 9.1.1. Personal Motor Insurance

- 9.1.2. Commercial Motor Insurance

- 9.2. Market Analysis, Insights and Forecast - by Policy Type

- 9.2.1. Third Party Motor Insurance

- 9.2.2. Third Party, Fire & Theft Motor Insurance

- 9.2.3. Comprehensive Motor Insurance

- 9.1. Market Analysis, Insights and Forecast - by User

- 10. MENA Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by User

- 10.1.1. Personal Motor Insurance

- 10.1.2. Commercial Motor Insurance

- 10.2. Market Analysis, Insights and Forecast - by Policy Type

- 10.2.1. Third Party Motor Insurance

- 10.2.2. Third Party, Fire & Theft Motor Insurance

- 10.2.3. Comprehensive Motor Insurance

- 10.1. Market Analysis, Insights and Forecast - by User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ping An Insurance

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AXA SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Zurich AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bajaj Finserv

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Allianz SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GEICO

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PICC Property & Casualty Co Lt

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Assicurazioni Generali

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 State Farm

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 AllState

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Ping An Insurance

List of Figures

- Figure 1: Global Motor Insurance Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Europe Motor Insurance Market Revenue (undefined), by User 2025 & 2033

- Figure 3: Europe Motor Insurance Market Revenue Share (%), by User 2025 & 2033

- Figure 4: Europe Motor Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 5: Europe Motor Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 6: Europe Motor Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: Europe Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Motor Insurance Market Revenue (undefined), by User 2025 & 2033

- Figure 9: North America Motor Insurance Market Revenue Share (%), by User 2025 & 2033

- Figure 10: North America Motor Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 11: North America Motor Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 12: North America Motor Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Motor Insurance Market Revenue (undefined), by User 2025 & 2033

- Figure 15: Latin America Motor Insurance Market Revenue Share (%), by User 2025 & 2033

- Figure 16: Latin America Motor Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 17: Latin America Motor Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 18: Latin America Motor Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Latin America Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: APAC Motor Insurance Market Revenue (undefined), by User 2025 & 2033

- Figure 21: APAC Motor Insurance Market Revenue Share (%), by User 2025 & 2033

- Figure 22: APAC Motor Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 23: APAC Motor Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 24: APAC Motor Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: APAC Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: MENA Motor Insurance Market Revenue (undefined), by User 2025 & 2033

- Figure 27: MENA Motor Insurance Market Revenue Share (%), by User 2025 & 2033

- Figure 28: MENA Motor Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 29: MENA Motor Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 30: MENA Motor Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: MENA Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Motor Insurance Market Revenue undefined Forecast, by User 2020 & 2033

- Table 2: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 3: Global Motor Insurance Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Motor Insurance Market Revenue undefined Forecast, by User 2020 & 2033

- Table 5: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 6: Global Motor Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Germany Motor Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: UK Motor Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: France Motor Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Switzerland Motor Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest Of Europe Motor Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Motor Insurance Market Revenue undefined Forecast, by User 2020 & 2033

- Table 13: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 14: Global Motor Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: USA Motor Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Motor Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Motor Insurance Market Revenue undefined Forecast, by User 2020 & 2033

- Table 18: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 19: Global Motor Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: Brazil Motor Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Argentina Motor Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Motor Insurance Market Revenue undefined Forecast, by User 2020 & 2033

- Table 23: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 24: Global Motor Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: China Motor Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: India Motor Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Japan Motor Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: South Korea Motor Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Indonesia Motor Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of APAC Motor Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Global Motor Insurance Market Revenue undefined Forecast, by User 2020 & 2033

- Table 32: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 33: Global Motor Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: UAE Motor Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Saudi Arabia Motor Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Lebanon Motor Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of North Africa Motor Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Motor Insurance Market?

The projected CAGR is approximately 6.7%.

2. Which companies are prominent players in the Motor Insurance Market?

Key companies in the market include Ping An Insurance, AXA SA, Zurich AG, Bajaj Finserv, Allianz SE, GEICO, PICC Property & Casualty Co Lt, Assicurazioni Generali, State Farm, AllState.

3. What are the main segments of the Motor Insurance Market?

The market segments include User, Policy Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Sales of Cars in Europe Drives The Market; Increase in Road Traffic Accidents Drives The Market.

6. What are the notable trends driving market growth?

Usage-based Insurance and Insurance Telematics in Motor Insurance is on Rise.

7. Are there any restraints impacting market growth?

Increase in Cost of Claims Made; Increase in False Claims and Scams.

8. Can you provide examples of recent developments in the market?

In August 2021, the insurance giant AXA S.A has introduced STeP, a new digital claims solution to help customers simplify their motor insurance process. AXA claimed that through STeP the time taken from customer notification to partners arranging repair or salvage is now down to minutes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Motor Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Motor Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Motor Insurance Market?

To stay informed about further developments, trends, and reports in the Motor Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence