Key Insights

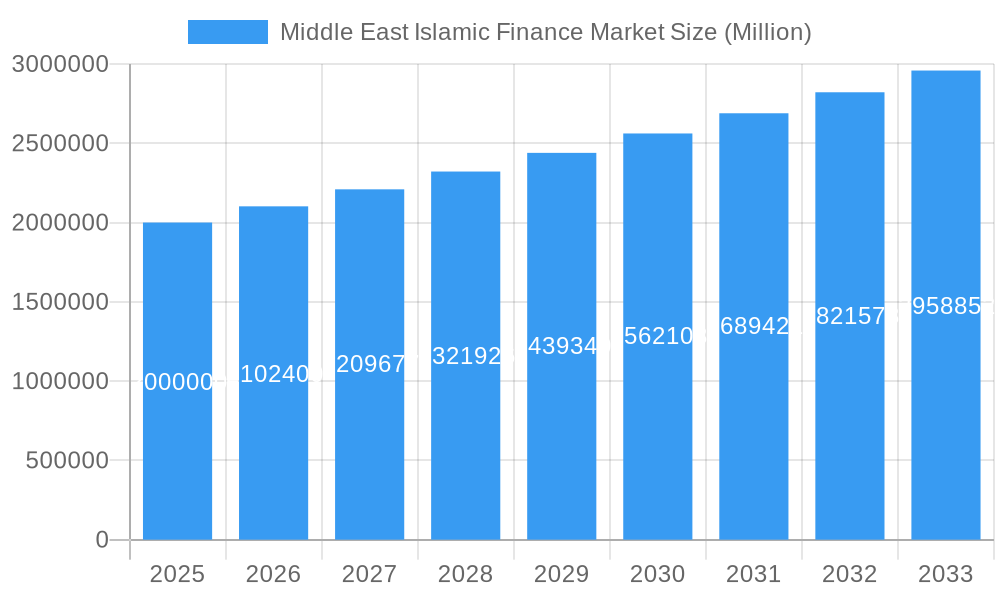

The Middle East Islamic finance market, currently valued at approximately $2 trillion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.12% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the region's predominantly Muslim population naturally aligns with the principles of Islamic finance, fostering high demand for Sharia-compliant products and services. Secondly, supportive government initiatives and regulatory frameworks in countries like Saudi Arabia and the UAE are actively promoting the growth of this sector. Increased awareness among both individuals and corporations about the ethical and socially responsible nature of Islamic finance is further bolstering its adoption. Finally, technological advancements, including the rise of fintech solutions tailored to Islamic finance, are streamlining processes and expanding access to a wider customer base. This growth is expected to be particularly noticeable in retail banking, wealth management, and Takaful (Islamic insurance) segments.

Middle East Islamic Finance Market Market Size (In Million)

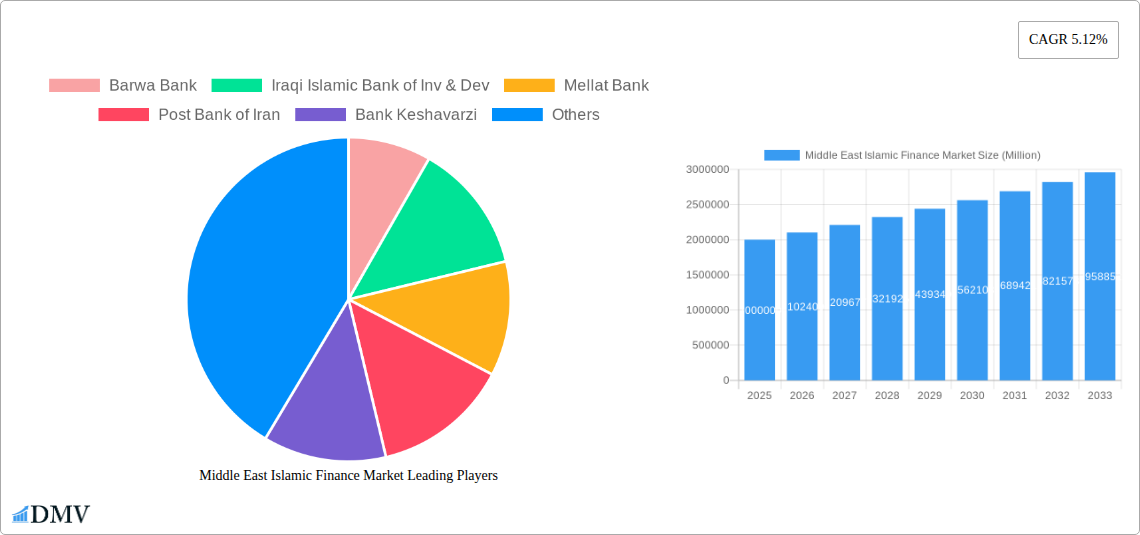

However, certain challenges remain. Competition from conventional financial institutions, a need for greater standardization of Islamic financial products across different jurisdictions, and the potential impact of global economic fluctuations could present headwinds. Despite these challenges, the long-term outlook for the Middle East Islamic finance market remains positive, driven by the region's young and growing population, rising disposable incomes, and the increasing integration of Islamic finance into the global financial system. Key players like Barwa Bank, Iraqi Islamic Bank of Investment & Development, Mellat Bank, and others are well-positioned to capitalize on this growth, though competition is likely to intensify as new entrants and existing players seek to expand their market share. The market is segmented geographically across various Middle Eastern countries, with growth varying depending on the regulatory environment and economic performance of each nation.

Middle East Islamic Finance Market Company Market Share

Middle East Islamic Finance Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Middle East Islamic Finance Market, offering a detailed overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this study presents invaluable data and strategic insights for stakeholders across the industry. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Middle East Islamic Finance Market Composition & Trends

This section delves into the intricacies of the Middle East Islamic finance market, evaluating its competitive landscape, innovation drivers, regulatory framework, substitute products, end-user profiles, and merger and acquisition (M&A) activity. The market exhibits a moderately concentrated structure, with a few key players holding significant market share. For instance, in 2024, Riyad Bank held an estimated 15% market share, while Abu Dhabi Commercial Bank held approximately 12%. However, smaller players and fintech startups are increasingly active, driving innovation and competition.

- Market Concentration: Moderately concentrated, with top players commanding significant shares but facing increasing competition from smaller players and FinTech firms.

- Innovation Catalysts: Sharia-compliant fintech solutions, growing demand for ethical investments, and government support for Islamic finance.

- Regulatory Landscape: Evolving regulations focused on enhancing transparency, risk management, and investor protection are shaping market dynamics.

- Substitute Products: Conventional financial instruments pose a competitive threat; however, growing awareness of ethical finance is increasing the demand for Islamic alternatives.

- End-User Profiles: The market caters to a diverse range of end-users, including individuals, businesses, and governments, each with varying financial needs and risk appetites.

- M&A Activities: The value of M&A deals in the Islamic finance sector during the historical period (2019-2024) totaled approximately xx Million, with deals driven by expansion strategies and technological integration. Deal sizes varied considerably, ranging from xx Million to xx Million.

Middle East Islamic Finance Market Industry Evolution

The Middle East Islamic finance market has witnessed substantial growth during the historical period (2019-2024), driven by factors such as increasing religious awareness, government support, and technological advancements. The market experienced a CAGR of xx% from 2019 to 2024, reaching xx Million in 2024. Technological advancements like blockchain and AI are being increasingly adopted, improving efficiency and transparency. Consumer demand is shifting towards digital Islamic financial products and services, requiring financial institutions to adapt and innovate. This evolution is further fueled by the rising middle class and increased financial inclusion initiatives across the region. The forecast period (2025-2033) is expected to see continued growth, driven by government initiatives to promote Islamic finance, technological innovation in the financial sector, and a growing demand for ethical and sustainable investment products. The market is projected to witness a CAGR of xx% during this period.

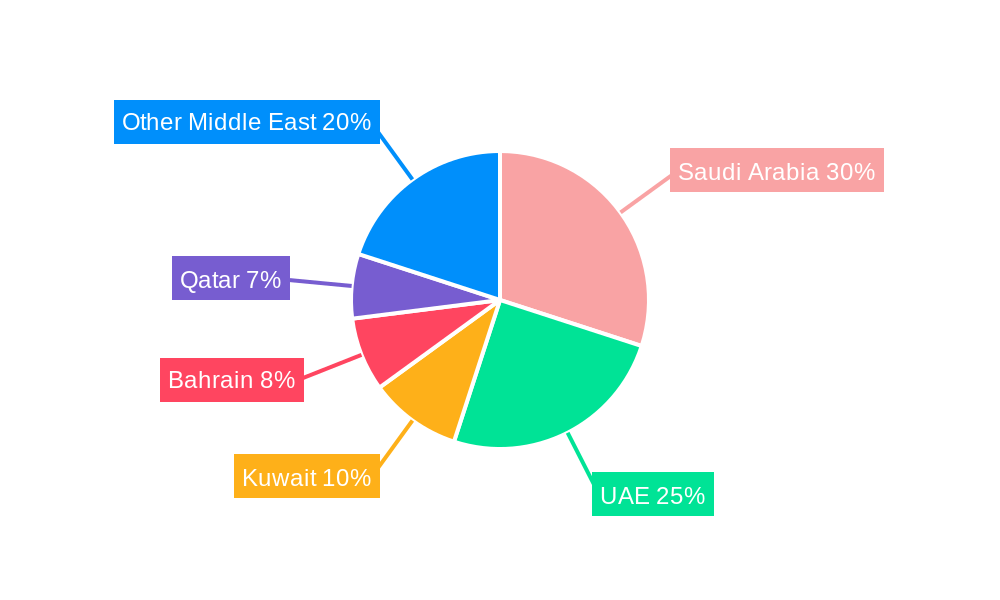

Leading Regions, Countries, or Segments in Middle East Islamic Finance Market

The United Arab Emirates (UAE) and Saudi Arabia are the dominant players in the Middle East Islamic finance market. These countries boast well-established regulatory frameworks, strong government support, and a significant concentration of Islamic financial institutions.

- Key Drivers for UAE Dominance:

- Established regulatory environment supportive of Islamic finance.

- Strategic location, acting as a regional hub for Islamic finance.

- Significant investments in fintech and technology to improve access and efficiency.

- Key Drivers for Saudi Arabia Dominance:

- Large and growing economy with substantial investment in infrastructure projects.

- Government initiatives to promote Islamic finance and attract foreign investments.

- Significant domestic demand for Sharia-compliant financial products and services.

The dominance of these two countries is driven by a number of factors, including robust regulatory frameworks, strong government support, and significant investments in the sector. However, other countries in the region are also experiencing growth, creating a more diverse and competitive landscape. The growth of Islamic banking and Sukuk issuance in markets like Kuwait, Bahrain, and Qatar contributes to the overall market expansion.

Middle East Islamic Finance Market Product Innovations

Recent years have witnessed a surge in innovative Sharia-compliant financial products and services, driven by the increasing demand for ethical and transparent financial solutions. These innovations include enhanced online platforms for Sukuk trading, tailored investment solutions for specific risk profiles and investment goals, and integrated digital banking solutions providing seamless access to a wider range of financial services. Unique selling propositions often center around enhanced transparency, reduced risk, and alignment with religious principles. Technological advancements, including blockchain, AI, and big data analytics, are playing a significant role in shaping these innovations, leading to improved efficiency, security, and accessibility.

Propelling Factors for Middle East Islamic Finance Market Growth

Several factors are driving the growth of the Middle East Islamic finance market:

- Technological Advancements: The adoption of FinTech solutions such as blockchain and AI is improving efficiency, transparency, and accessibility.

- Economic Growth: Strong economic growth across the region is creating increased demand for financial services.

- Regulatory Support: Government initiatives promoting Islamic finance are creating a favorable environment for market expansion.

These factors are collectively contributing to the significant growth potential of the market.

Obstacles in the Middle East Islamic Finance Market

Despite the immense potential, the Middle East Islamic finance market faces several challenges:

- Regulatory Complexity: Evolving and sometimes fragmented regulations can create complexities for financial institutions.

- Shortage of Skilled Professionals: A lack of qualified professionals specializing in Islamic finance hinders growth.

- Competition from Conventional Finance: Conventional financial products still represent strong competition.

These factors pose significant hurdles, and their impact needs to be considered when making strategic decisions.

Future Opportunities in Middle East Islamic Finance Market

Future opportunities lie in expanding into untapped markets, particularly across the region and in developing economies. The increasing adoption of technology will continue to play a significant role in unlocking new opportunities and enhancing existing services. Finally, a growing focus on sustainable and ethical investing provides lucrative avenues for growth.

Major Players in the Middle East Islamic Finance Market Ecosystem

- Barwa Bank

- Iraqi Islamic Bank of Inv & Dev

- Mellat Bank

- Post Bank of Iran

- Bank Keshavarzi

- Abu Dhabi Commercial Bank

- Saudi British Bank

- Riyad Bank List Not Exhaustive

Key Developments in Middle East Islamic Finance Market Industry

- September 2023: The Abu Dhabi Securities Exchange (ADX) collaborated with Sharjah Islamic Bank (SIB) to enhance and streamline access to Initial Public Offering (IPO) subscriptions for investors, improving market efficiency and investor participation.

- March 2023: Aafaq Islamic Finance partnered with Rasmala to develop and broaden product offerings, expanding their product portfolio and enhancing their client base.

Strategic Middle East Islamic Finance Market Forecast

The Middle East Islamic finance market is poised for sustained growth, driven by technological advancements, strong economic growth, and increasing regulatory support. The expanding adoption of fintech and the growing awareness of ethical and sustainable investments will further stimulate market expansion, unlocking immense opportunities for both established players and new entrants. The predicted growth trajectory indicates considerable potential for future market expansion and significant returns on investment.

Middle East Islamic Finance Market Segmentation

-

1. Financial Sector

- 1.1. Islamic Banking

- 1.2. Islamic Insurance 'Takaful'

- 1.3. Islamic Bonds 'Sukuk'

- 1.4. Other Fi

-

2. Geography

- 2.1. Saudi Arabia

- 2.2. Qatar

- 2.3. Iraq

- 2.4. Iran

- 2.5. United Arab Emirates

- 2.6. Rest of Middle East

Middle East Islamic Finance Market Segmentation By Geography

- 1. Saudi Arabia

- 2. Qatar

- 3. Iraq

- 4. Iran

- 5. United Arab Emirates

- 6. Rest of Middle East

Middle East Islamic Finance Market Regional Market Share

Geographic Coverage of Middle East Islamic Finance Market

Middle East Islamic Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Muslim Population is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Growing Muslim Population is Driving the Market

- 3.4. Market Trends

- 3.4.1. Growing Fintech Digital Sukuk

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Financial Sector

- 5.1.1. Islamic Banking

- 5.1.2. Islamic Insurance 'Takaful'

- 5.1.3. Islamic Bonds 'Sukuk'

- 5.1.4. Other Fi

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Saudi Arabia

- 5.2.2. Qatar

- 5.2.3. Iraq

- 5.2.4. Iran

- 5.2.5. United Arab Emirates

- 5.2.6. Rest of Middle East

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.3.2. Qatar

- 5.3.3. Iraq

- 5.3.4. Iran

- 5.3.5. United Arab Emirates

- 5.3.6. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Financial Sector

- 6. Saudi Arabia Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Financial Sector

- 6.1.1. Islamic Banking

- 6.1.2. Islamic Insurance 'Takaful'

- 6.1.3. Islamic Bonds 'Sukuk'

- 6.1.4. Other Fi

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Saudi Arabia

- 6.2.2. Qatar

- 6.2.3. Iraq

- 6.2.4. Iran

- 6.2.5. United Arab Emirates

- 6.2.6. Rest of Middle East

- 6.1. Market Analysis, Insights and Forecast - by Financial Sector

- 7. Qatar Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Financial Sector

- 7.1.1. Islamic Banking

- 7.1.2. Islamic Insurance 'Takaful'

- 7.1.3. Islamic Bonds 'Sukuk'

- 7.1.4. Other Fi

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Saudi Arabia

- 7.2.2. Qatar

- 7.2.3. Iraq

- 7.2.4. Iran

- 7.2.5. United Arab Emirates

- 7.2.6. Rest of Middle East

- 7.1. Market Analysis, Insights and Forecast - by Financial Sector

- 8. Iraq Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Financial Sector

- 8.1.1. Islamic Banking

- 8.1.2. Islamic Insurance 'Takaful'

- 8.1.3. Islamic Bonds 'Sukuk'

- 8.1.4. Other Fi

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Saudi Arabia

- 8.2.2. Qatar

- 8.2.3. Iraq

- 8.2.4. Iran

- 8.2.5. United Arab Emirates

- 8.2.6. Rest of Middle East

- 8.1. Market Analysis, Insights and Forecast - by Financial Sector

- 9. Iran Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Financial Sector

- 9.1.1. Islamic Banking

- 9.1.2. Islamic Insurance 'Takaful'

- 9.1.3. Islamic Bonds 'Sukuk'

- 9.1.4. Other Fi

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Saudi Arabia

- 9.2.2. Qatar

- 9.2.3. Iraq

- 9.2.4. Iran

- 9.2.5. United Arab Emirates

- 9.2.6. Rest of Middle East

- 9.1. Market Analysis, Insights and Forecast - by Financial Sector

- 10. United Arab Emirates Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Financial Sector

- 10.1.1. Islamic Banking

- 10.1.2. Islamic Insurance 'Takaful'

- 10.1.3. Islamic Bonds 'Sukuk'

- 10.1.4. Other Fi

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Saudi Arabia

- 10.2.2. Qatar

- 10.2.3. Iraq

- 10.2.4. Iran

- 10.2.5. United Arab Emirates

- 10.2.6. Rest of Middle East

- 10.1. Market Analysis, Insights and Forecast - by Financial Sector

- 11. Rest of Middle East Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Financial Sector

- 11.1.1. Islamic Banking

- 11.1.2. Islamic Insurance 'Takaful'

- 11.1.3. Islamic Bonds 'Sukuk'

- 11.1.4. Other Fi

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Saudi Arabia

- 11.2.2. Qatar

- 11.2.3. Iraq

- 11.2.4. Iran

- 11.2.5. United Arab Emirates

- 11.2.6. Rest of Middle East

- 11.1. Market Analysis, Insights and Forecast - by Financial Sector

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Barwa Bank

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Iraqi Islamic Bank of Inv & Dev

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Mellat Bank

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Post Bank of Iran

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Bank Keshavarzi

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Abu Dhabi Commercial Bank

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Saudi British Bank

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Riyad Bank**List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Barwa Bank

List of Figures

- Figure 1: Global Middle East Islamic Finance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Middle East Islamic Finance Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: Saudi Arabia Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 4: Saudi Arabia Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 5: Saudi Arabia Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 6: Saudi Arabia Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 7: Saudi Arabia Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 8: Saudi Arabia Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 9: Saudi Arabia Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 10: Saudi Arabia Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 11: Saudi Arabia Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 12: Saudi Arabia Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 13: Saudi Arabia Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Saudi Arabia Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Qatar Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 16: Qatar Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 17: Qatar Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 18: Qatar Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 19: Qatar Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 20: Qatar Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 21: Qatar Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 22: Qatar Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 23: Qatar Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Qatar Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 25: Qatar Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Qatar Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Iraq Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 28: Iraq Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 29: Iraq Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 30: Iraq Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 31: Iraq Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 32: Iraq Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 33: Iraq Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 34: Iraq Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 35: Iraq Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Iraq Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 37: Iraq Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Iraq Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Iran Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 40: Iran Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 41: Iran Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 42: Iran Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 43: Iran Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 44: Iran Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 45: Iran Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 46: Iran Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 47: Iran Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Iran Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 49: Iran Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Iran Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 51: United Arab Emirates Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 52: United Arab Emirates Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 53: United Arab Emirates Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 54: United Arab Emirates Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 55: United Arab Emirates Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 56: United Arab Emirates Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 57: United Arab Emirates Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 58: United Arab Emirates Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 59: United Arab Emirates Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 60: United Arab Emirates Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 61: United Arab Emirates Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: United Arab Emirates Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Rest of Middle East Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 64: Rest of Middle East Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 65: Rest of Middle East Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 66: Rest of Middle East Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 67: Rest of Middle East Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 68: Rest of Middle East Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 69: Rest of Middle East Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 70: Rest of Middle East Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 71: Rest of Middle East Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Rest of Middle East Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 73: Rest of Middle East Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Rest of Middle East Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 2: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 3: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 5: Global Middle East Islamic Finance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 7: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 8: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 9: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 11: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 13: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 14: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 15: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 17: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 19: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 20: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 21: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 23: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 26: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 27: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 29: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 31: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 32: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 33: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 34: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 35: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 37: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 38: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 39: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 40: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 41: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Islamic Finance Market?

The projected CAGR is approximately 5.12%.

2. Which companies are prominent players in the Middle East Islamic Finance Market?

Key companies in the market include Barwa Bank, Iraqi Islamic Bank of Inv & Dev, Mellat Bank, Post Bank of Iran, Bank Keshavarzi, Abu Dhabi Commercial Bank, Saudi British Bank, Riyad Bank**List Not Exhaustive.

3. What are the main segments of the Middle East Islamic Finance Market?

The market segments include Financial Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Muslim Population is Driving the Market.

6. What are the notable trends driving market growth?

Growing Fintech Digital Sukuk.

7. Are there any restraints impacting market growth?

Growing Muslim Population is Driving the Market.

8. Can you provide examples of recent developments in the market?

September 2023: Abu Dhabi Securities Exchange (ADX) collaborated with Sharjah Islamic Bank (SIB) to enhance and streamline access to Initial Public Offering (IPO) subscriptions for investors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Islamic Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Islamic Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Islamic Finance Market?

To stay informed about further developments, trends, and reports in the Middle East Islamic Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence