Key Insights

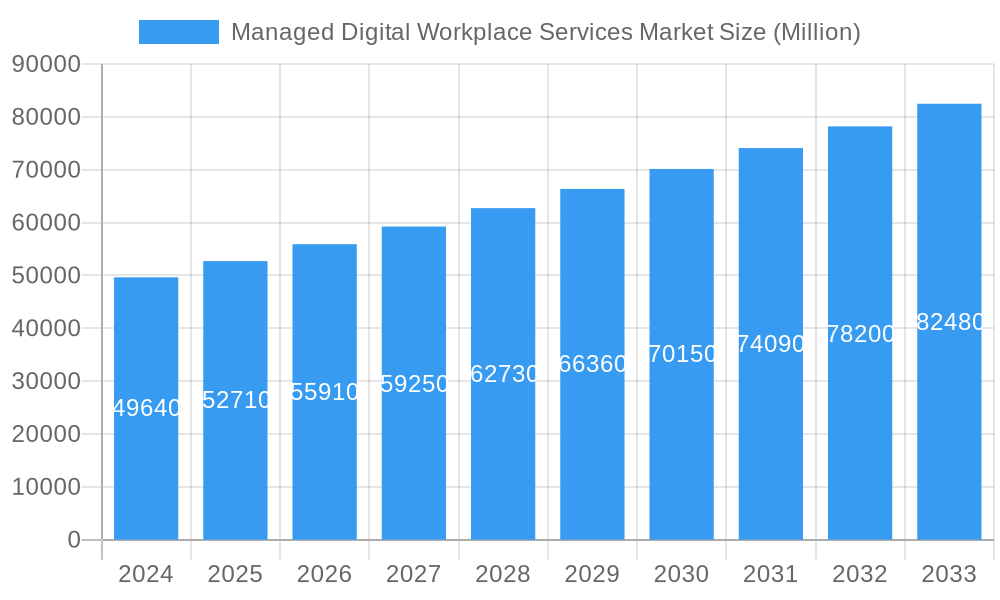

The Managed Digital Workplace Services Market is poised for significant expansion, projected to reach a substantial USD 52.82 billion in market size, with a Compound Annual Growth Rate (CAGR) of 6.36% expected throughout the forecast period of 2025-2033. This robust growth is primarily fueled by the increasing adoption of hybrid work models, the escalating demand for enhanced employee productivity, and the critical need for streamlined IT operations. Organizations across all sectors are recognizing the strategic importance of a well-managed digital workplace to foster agility, improve collaboration, and ensure seamless access to resources, irrespective of employee location. Key services driving this expansion include Service Desk, End-user Device Support, and Digital Workplace solutions, all of which are crucial for maintaining operational efficiency and a positive employee experience in today's dynamic business environment. The BFSI, Healthcare, and Manufacturing sectors are anticipated to be major contributors to this growth, driven by their extensive reliance on digital infrastructure and the imperative to secure sensitive data while enabling remote workforces.

Managed Digital Workplace Services Market Market Size (In Billion)

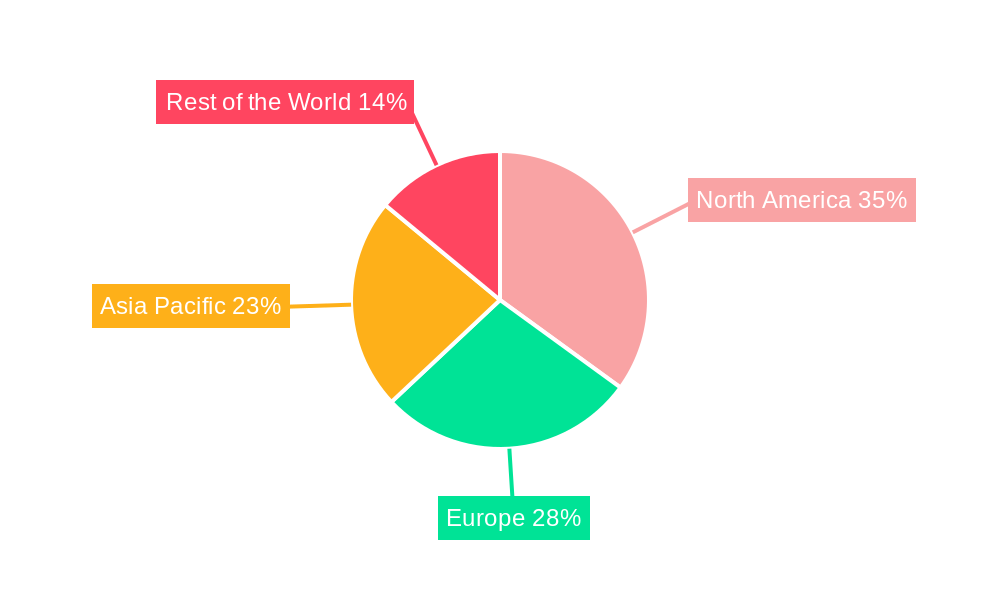

The market's trajectory is further shaped by evolving trends such as the integration of artificial intelligence and automation to enhance service delivery, the growing emphasis on cybersecurity within the digital workplace, and the continuous need for personalized employee experiences. However, challenges such as the high cost of implementing and maintaining advanced digital workplace solutions, along with the complexity of integrating diverse IT systems, present potential restraints. Geographically, North America is expected to lead the market due to its early adoption of advanced technologies and a mature digital infrastructure. Asia Pacific, on the other hand, is projected to witness the fastest growth, propelled by rapid digital transformation initiatives and a burgeoning demand for cloud-based services. Companies like DXC Technology, IBM, Wipro, and Tata Consultancy Services are at the forefront of this market, offering comprehensive solutions and innovations that cater to the evolving needs of businesses worldwide, solidifying the market's upward momentum.

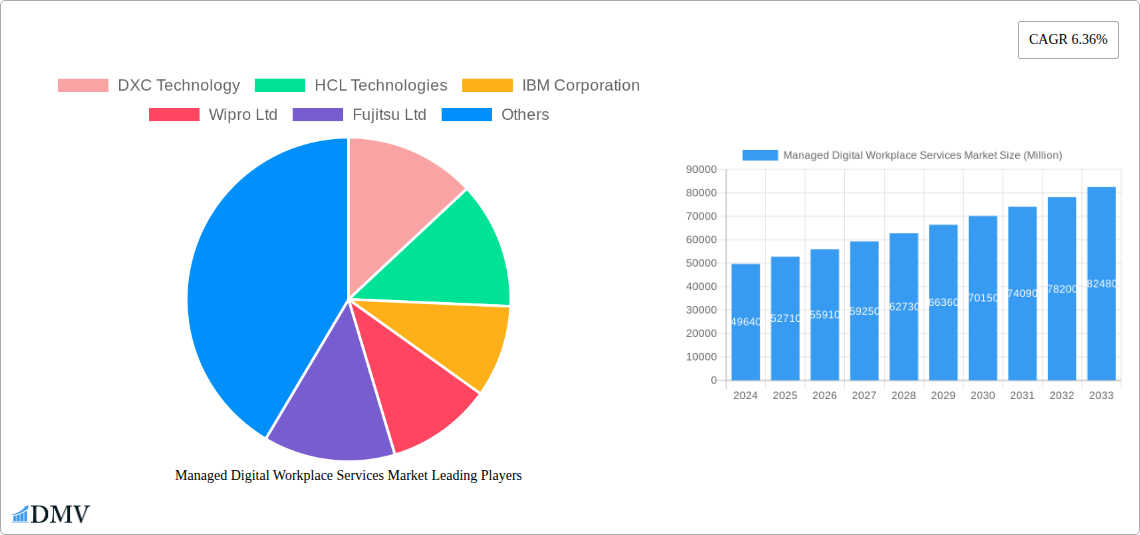

Managed Digital Workplace Services Market Company Market Share

Gain unparalleled insights into the Managed Digital Workplace Services Market, a rapidly expanding sector essential for modern enterprise agility and employee productivity. This in-depth report, covering the Study Period: 2019–2033 with a Base Year: 2025, provides critical data, strategic analysis, and future projections. Discover the key drivers, leading players, and emerging trends shaping the future of work, from Service Desk optimization to comprehensive Digital Workplace transformation. Understand how leading companies are leveraging advanced technologies and strategic partnerships to deliver superior end-user support across industries like BFSI, Healthcare, Manufacturing, Energy and Utility, and Government and Public Sector.

Managed Digital Workplace Services Market Market Composition & Trends

The Managed Digital Workplace Services Market exhibits moderate to high concentration, with several global IT giants holding significant market share. Innovation is a key catalyst, driven by the relentless pursuit of enhanced employee experience, cybersecurity, and operational efficiency. Regulatory landscapes, while varied globally, are increasingly emphasizing data privacy and compliance, influencing service delivery models. Substitute products, such as in-house IT management, are becoming less viable due to complexity and cost. End-user profiles are diverse, with a growing demand for flexible, mobile-first, and secure work environments. Mergers and acquisitions (M&A) are prevalent, as larger players acquire niche service providers to expand their capabilities and market reach. Recent M&A activities have seen significant deal values, reflecting the strategic importance of this market. For instance, the acquisition of smaller, specialized digital transformation firms by established Managed Service Providers (MSPs) aims to consolidate offerings and capture a larger share of the managed IT services ecosystem. The overall market is characterized by a dynamic interplay of technological adoption, evolving business needs, and competitive consolidation, pushing the boundaries of what constitutes an optimal digital employee experience.

Managed Digital Workplace Services Market Industry Evolution

The Managed Digital Workplace Services Market has undergone a significant transformation, evolving from basic IT support to a strategic imperative for business success. Over the Historical Period: 2019–2024, the market witnessed steady growth, fueled by increasing enterprise reliance on technology and the imperative for seamless end-user device support. As businesses adopted cloud computing and mobile technologies, the demand for managed services that could ensure connectivity, security, and productivity escalated. The base year 2025 marks a pivotal point, with the market poised for accelerated growth. Technological advancements, including AI-powered service desks, automation for routine tasks, and advanced analytics for proactive issue resolution, are reshaping the digital workplace. The forecast period 2025–2033 is expected to see a CAGR of approximately 12.5%, driven by a burgeoning need for comprehensive digital employee experience solutions. Shifting consumer demands, particularly the rise of remote and hybrid work models post-pandemic, have intensified the need for secure, scalable, and user-centric digital work environments. Companies are increasingly outsourcing complex IT infrastructure management to focus on core business activities, further propelling the adoption of managed digital workplace services. The penetration of advanced collaboration tools and the integration of IoT devices within the workplace also contribute to the expanding service offerings and market value, estimated to reach over $150 Billion by 2033. The continuous innovation in areas like unified communication and collaboration (UCC) and digital employee onboarding are critical growth trajectories.

Leading Regions, Countries, or Segments in Managed Digital Workplace Services Market

The Managed Digital Workplace Services Market is experiencing robust growth across all major regions, with North America currently leading in market share, followed closely by Europe. This dominance is driven by a combination of factors including a high concentration of large enterprises, significant IT spending, and a mature ecosystem of technology providers and managed service partners. The BFSI sector stands out as a key end-user vertical, demanding stringent security protocols and high availability for their digital operations. The healthcare industry is also a significant contributor, with an increasing need for secure remote access and efficient patient data management.

Key Drivers for Dominance:

- Investment Trends: High levels of investment in digital transformation initiatives across major enterprises, particularly in the BFSI and Healthcare sectors, are fueling demand for advanced managed workplace solutions.

- Regulatory Support: Favorable government initiatives promoting digitalization and data security in developed economies encourage the adoption of robust managed services.

- Technological Adoption: Early and widespread adoption of cloud technologies, AI, and automation technologies by businesses in these regions allows for more sophisticated and efficient managed service offerings.

- Skilled Workforce: Availability of a highly skilled workforce adept at managing complex digital environments and providing advanced IT support.

Dominance Factors in Key Segments:

- Service Desk: The evolution of the Service Desk from a reactive support function to a proactive, intelligent hub for employee assistance is a major growth area. AI-powered chatbots and virtual support agents are increasingly being integrated to handle routine queries, freeing up human agents for complex issues. This segment is crucial for maintaining high employee satisfaction and productivity.

- End-user Device Support: With the proliferation of diverse end-user devices, including laptops, tablets, and smartphones, comprehensive and secure device management is paramount. Managed services ensure devices are configured, secured, updated, and supported remotely, enabling a seamless user experience irrespective of location.

- Digital Workplace: This overarching segment encompasses the integration of various technologies and services to create a cohesive and productive work environment. It includes collaboration tools, unified communications, endpoint security, and application management. The demand for a personalized and efficient digital workspace is driving significant growth.

Within the End-user Verticals, BFSI continues to be the largest segment due to its critical need for secure and reliable IT infrastructure, followed by Healthcare which prioritizes data security and remote accessibility for healthcare professionals. Manufacturing is also rapidly adopting these services to streamline operations and enhance supply chain visibility. The continued focus on employee experience, cybersecurity, and operational efficiency across these sectors underscores the sustained dominance of these regions and segments in the Managed Digital Workplace Services Market.

Managed Digital Workplace Services Market Product Innovations

Product innovations in the Managed Digital Workplace Services Market are centered on enhancing user experience and operational efficiency through intelligent automation and AI. We are witnessing the rise of proactive IT support, where AI-powered analytics predict potential issues before they impact users, minimizing downtime. Advanced Service Desk solutions now integrate virtual support agents (VSAs) that can handle a wide range of employee queries and requests autonomously, improving response times and reducing costs. Furthermore, the development of integrated Digital Workplace platforms, offering unified communication, collaboration, and application management, is a key trend. These platforms aim to provide a seamless, secure, and personalized work environment. Enhanced endpoint security solutions, leveraging machine learning for threat detection and response, are also critical innovations, ensuring data integrity and protecting against evolving cyber threats across a diverse range of end-user devices.

Propelling Factors for Managed Digital Workplace Services Market Growth

The Managed Digital Workplace Services Market is propelled by a confluence of powerful factors. Technological advancements such as AI, automation, and cloud computing are enabling more sophisticated and efficient service delivery. The pervasive adoption of remote and hybrid work models necessitates robust and secure digital infrastructure, driving demand for managed solutions that ensure employee productivity and data protection. Economic influences, including the need for cost optimization and a focus on core competencies, push businesses to outsource IT management. Furthermore, increasing regulatory compliance requirements across industries like BFSI and Healthcare mandate advanced security and data management capabilities, which are often best provided by specialized managed service providers. The growing complexity of IT environments, coupled with a shortage of in-house IT talent, further fuels the reliance on expert-led managed IT services.

Obstacles in the Managed Digital Workplace Services Market Market

Despite its growth, the Managed Digital Workplace Services Market faces several obstacles. Regulatory challenges, particularly concerning data privacy and cross-border data transfer, can create complexity and increase compliance costs for service providers. Supply chain disruptions, although easing, can still impact the timely procurement and deployment of hardware necessary for supporting end-user devices. Competitive pressures are intense, with numerous players vying for market share, leading to potential price wars and reduced profit margins for some. Furthermore, resistance to change within organizations and the perceived risk of vendor lock-in can sometimes hinder adoption. The increasing sophistication of cyber threats also presents a constant challenge, requiring continuous investment in advanced security measures.

Future Opportunities in Managed Digital Workplace Services Market

The Managed Digital Workplace Services Market presents significant future opportunities. The expanding adoption of Artificial Intelligence (AI) and Machine Learning (ML) in service delivery promises more personalized and predictive support. The continued growth of the hybrid work model will drive demand for solutions that enable seamless collaboration and secure access from any location. Emerging markets in Asia Pacific and Latin America offer substantial untapped potential. The increasing integration of Internet of Things (IoT) devices in the workplace will create new avenues for managed security and support services. Furthermore, the growing focus on employee experience (EX) as a critical business differentiator will push organizations to invest in comprehensive digital workplace solutions that foster engagement and productivity. The development of specialized managed services tailored to specific industry needs, such as for the burgeoning renewable energy sector, also represents a promising avenue.

Major Players in the Managed Digital Workplace Services Market Ecosystem

- DXC Technology

- HCL Technologies

- IBM Corporation

- Wipro Ltd

- Fujitsu Ltd

- Stefanini Group

- NTT Data Corporation

- Tata Consultancy Services Limited

- Capgemini Services SAS

- Atos SE

- Cognizant Technology Solutions Corporation

Key Developments in Managed Digital Workplace Services Market Industry

- June 2023: Tech Mahindra announced a collaboration with Espressive, an automating digital workplace assistance firm. The collaboration will offer their customers cost-effective and autonomous work environment assistance through Espressive Barista, an AI-based virtual support agent (VSA), enhancing AI-powered IT support offerings.

- May 2023: Lenovo Solutions and Services Group (SSG) launched Digital Workplace Solutions (DWS), a new managed services portfolio of intelligent tools and systems. Digital Workplace Solutions (DWS) delivers work-related technology, efficiency, security, and employee satisfaction so executives can achieve key performance outcomes, focusing on integrated Digital Workplace solutions.

- May 2023: Stefanini announced a new collaboration with the major automotive brand Mazda, having been appointed to provide an end-to-end workplace solution, including remote technical specialists, service desk support, local technical support, and enterprise services such as Office 365, showcasing comprehensive end-to-end workplace solutions.

Strategic Managed Digital Workplace Services Market Market Forecast

The strategic Managed Digital Workplace Services Market forecast indicates sustained and accelerated growth, driven by the intrinsic link between employee productivity and business success. The increasing complexity of IT environments and the persistent demand for seamless remote and hybrid work experiences are fundamental growth catalysts. Organizations are increasingly recognizing the value of outsourcing their digital workplace management to specialized providers to enhance operational efficiency, bolster cybersecurity, and improve employee experience. Investments in AI-driven automation for Service Desk operations and proactive end-user device support will continue to shape the market. The forecast period is expected to witness significant expansion driven by a deeper integration of intelligent tools and platforms, ultimately fostering more agile, secure, and productive workforces across diverse industries. The market potential is substantial, projected to reach unprecedented levels as digital transformation continues to be a top priority for global enterprises.

Managed Digital Workplace Services Market Segmentation

-

1. Services

- 1.1. Service Desk

- 1.2. End-user Device Support

- 1.3. Digital Workplace

-

2. End-user Vertical

- 2.1. BFSI

- 2.2. Healthcare

- 2.3. Manufacturing

- 2.4. Energy and Utility

- 2.5. Government and Public Sector

- 2.6. Other End-user Verticals

Managed Digital Workplace Services Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Managed Digital Workplace Services Market Regional Market Share

Geographic Coverage of Managed Digital Workplace Services Market

Managed Digital Workplace Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Higher Levels of Digitization in the Service Desk for Contact Resolution; Increase in Adoption of Digital Solutions as part of Digital Transformation Initiatives; Rise of Work from Home Employees with Several Companies Considering it as a Permanent Alternative

- 3.3. Market Restrains

- 3.3.1. Increasing Incidents of Cybercrime

- 3.4. Market Trends

- 3.4.1. Healthcare Sector Expected to Witness Robust Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Managed Digital Workplace Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Service Desk

- 5.1.2. End-user Device Support

- 5.1.3. Digital Workplace

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. BFSI

- 5.2.2. Healthcare

- 5.2.3. Manufacturing

- 5.2.4. Energy and Utility

- 5.2.5. Government and Public Sector

- 5.2.6. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. North America Managed Digital Workplace Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Services

- 6.1.1. Service Desk

- 6.1.2. End-user Device Support

- 6.1.3. Digital Workplace

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. BFSI

- 6.2.2. Healthcare

- 6.2.3. Manufacturing

- 6.2.4. Energy and Utility

- 6.2.5. Government and Public Sector

- 6.2.6. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Services

- 7. Europe Managed Digital Workplace Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Services

- 7.1.1. Service Desk

- 7.1.2. End-user Device Support

- 7.1.3. Digital Workplace

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. BFSI

- 7.2.2. Healthcare

- 7.2.3. Manufacturing

- 7.2.4. Energy and Utility

- 7.2.5. Government and Public Sector

- 7.2.6. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Services

- 8. Asia Pacific Managed Digital Workplace Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Services

- 8.1.1. Service Desk

- 8.1.2. End-user Device Support

- 8.1.3. Digital Workplace

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. BFSI

- 8.2.2. Healthcare

- 8.2.3. Manufacturing

- 8.2.4. Energy and Utility

- 8.2.5. Government and Public Sector

- 8.2.6. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Services

- 9. Rest of the World Managed Digital Workplace Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Services

- 9.1.1. Service Desk

- 9.1.2. End-user Device Support

- 9.1.3. Digital Workplace

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. BFSI

- 9.2.2. Healthcare

- 9.2.3. Manufacturing

- 9.2.4. Energy and Utility

- 9.2.5. Government and Public Sector

- 9.2.6. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Services

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 DXC Technology

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 HCL Technologies

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 IBM Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Wipro Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Fujitsu Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Stefanini Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 NTT Data Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Tata Consultancy Services Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Capgemini Services SAS

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Atos SE

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Cognizant Technology Solutions Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 DXC Technology

List of Figures

- Figure 1: Global Managed Digital Workplace Services Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Managed Digital Workplace Services Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Managed Digital Workplace Services Market Revenue (Million), by Services 2025 & 2033

- Figure 4: North America Managed Digital Workplace Services Market Volume (K Unit), by Services 2025 & 2033

- Figure 5: North America Managed Digital Workplace Services Market Revenue Share (%), by Services 2025 & 2033

- Figure 6: North America Managed Digital Workplace Services Market Volume Share (%), by Services 2025 & 2033

- Figure 7: North America Managed Digital Workplace Services Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 8: North America Managed Digital Workplace Services Market Volume (K Unit), by End-user Vertical 2025 & 2033

- Figure 9: North America Managed Digital Workplace Services Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 10: North America Managed Digital Workplace Services Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 11: North America Managed Digital Workplace Services Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Managed Digital Workplace Services Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Managed Digital Workplace Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Managed Digital Workplace Services Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Managed Digital Workplace Services Market Revenue (Million), by Services 2025 & 2033

- Figure 16: Europe Managed Digital Workplace Services Market Volume (K Unit), by Services 2025 & 2033

- Figure 17: Europe Managed Digital Workplace Services Market Revenue Share (%), by Services 2025 & 2033

- Figure 18: Europe Managed Digital Workplace Services Market Volume Share (%), by Services 2025 & 2033

- Figure 19: Europe Managed Digital Workplace Services Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 20: Europe Managed Digital Workplace Services Market Volume (K Unit), by End-user Vertical 2025 & 2033

- Figure 21: Europe Managed Digital Workplace Services Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 22: Europe Managed Digital Workplace Services Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 23: Europe Managed Digital Workplace Services Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Managed Digital Workplace Services Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Managed Digital Workplace Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Managed Digital Workplace Services Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Managed Digital Workplace Services Market Revenue (Million), by Services 2025 & 2033

- Figure 28: Asia Pacific Managed Digital Workplace Services Market Volume (K Unit), by Services 2025 & 2033

- Figure 29: Asia Pacific Managed Digital Workplace Services Market Revenue Share (%), by Services 2025 & 2033

- Figure 30: Asia Pacific Managed Digital Workplace Services Market Volume Share (%), by Services 2025 & 2033

- Figure 31: Asia Pacific Managed Digital Workplace Services Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 32: Asia Pacific Managed Digital Workplace Services Market Volume (K Unit), by End-user Vertical 2025 & 2033

- Figure 33: Asia Pacific Managed Digital Workplace Services Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 34: Asia Pacific Managed Digital Workplace Services Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 35: Asia Pacific Managed Digital Workplace Services Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Managed Digital Workplace Services Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Managed Digital Workplace Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Managed Digital Workplace Services Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Rest of the World Managed Digital Workplace Services Market Revenue (Million), by Services 2025 & 2033

- Figure 40: Rest of the World Managed Digital Workplace Services Market Volume (K Unit), by Services 2025 & 2033

- Figure 41: Rest of the World Managed Digital Workplace Services Market Revenue Share (%), by Services 2025 & 2033

- Figure 42: Rest of the World Managed Digital Workplace Services Market Volume Share (%), by Services 2025 & 2033

- Figure 43: Rest of the World Managed Digital Workplace Services Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 44: Rest of the World Managed Digital Workplace Services Market Volume (K Unit), by End-user Vertical 2025 & 2033

- Figure 45: Rest of the World Managed Digital Workplace Services Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 46: Rest of the World Managed Digital Workplace Services Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 47: Rest of the World Managed Digital Workplace Services Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Rest of the World Managed Digital Workplace Services Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Rest of the World Managed Digital Workplace Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of the World Managed Digital Workplace Services Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Managed Digital Workplace Services Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Global Managed Digital Workplace Services Market Volume K Unit Forecast, by Services 2020 & 2033

- Table 3: Global Managed Digital Workplace Services Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Managed Digital Workplace Services Market Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 5: Global Managed Digital Workplace Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Managed Digital Workplace Services Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Managed Digital Workplace Services Market Revenue Million Forecast, by Services 2020 & 2033

- Table 8: Global Managed Digital Workplace Services Market Volume K Unit Forecast, by Services 2020 & 2033

- Table 9: Global Managed Digital Workplace Services Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 10: Global Managed Digital Workplace Services Market Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 11: Global Managed Digital Workplace Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Managed Digital Workplace Services Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Managed Digital Workplace Services Market Revenue Million Forecast, by Services 2020 & 2033

- Table 14: Global Managed Digital Workplace Services Market Volume K Unit Forecast, by Services 2020 & 2033

- Table 15: Global Managed Digital Workplace Services Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 16: Global Managed Digital Workplace Services Market Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 17: Global Managed Digital Workplace Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Managed Digital Workplace Services Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global Managed Digital Workplace Services Market Revenue Million Forecast, by Services 2020 & 2033

- Table 20: Global Managed Digital Workplace Services Market Volume K Unit Forecast, by Services 2020 & 2033

- Table 21: Global Managed Digital Workplace Services Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 22: Global Managed Digital Workplace Services Market Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 23: Global Managed Digital Workplace Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Managed Digital Workplace Services Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Managed Digital Workplace Services Market Revenue Million Forecast, by Services 2020 & 2033

- Table 26: Global Managed Digital Workplace Services Market Volume K Unit Forecast, by Services 2020 & 2033

- Table 27: Global Managed Digital Workplace Services Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 28: Global Managed Digital Workplace Services Market Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 29: Global Managed Digital Workplace Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Managed Digital Workplace Services Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Managed Digital Workplace Services Market?

The projected CAGR is approximately 6.36%.

2. Which companies are prominent players in the Managed Digital Workplace Services Market?

Key companies in the market include DXC Technology, HCL Technologies, IBM Corporation, Wipro Ltd, Fujitsu Ltd, Stefanini Group, NTT Data Corporation, Tata Consultancy Services Limited, Capgemini Services SAS, Atos SE, Cognizant Technology Solutions Corporation.

3. What are the main segments of the Managed Digital Workplace Services Market?

The market segments include Services, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 52.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Higher Levels of Digitization in the Service Desk for Contact Resolution; Increase in Adoption of Digital Solutions as part of Digital Transformation Initiatives; Rise of Work from Home Employees with Several Companies Considering it as a Permanent Alternative.

6. What are the notable trends driving market growth?

Healthcare Sector Expected to Witness Robust Growth.

7. Are there any restraints impacting market growth?

Increasing Incidents of Cybercrime.

8. Can you provide examples of recent developments in the market?

June 2023: Tech Mahindra, a provider of digital transformation, business re-engineering, and consulting services and solutions, announced a collaboration with Espressive, an automating digital workplace assistance firm. The collaboration will offer their customers cost-effective and autonomous work environment assistance through Espressive Barista, an AI-based virtual support agent (VSA).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Managed Digital Workplace Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Managed Digital Workplace Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Managed Digital Workplace Services Market?

To stay informed about further developments, trends, and reports in the Managed Digital Workplace Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence