Key Insights

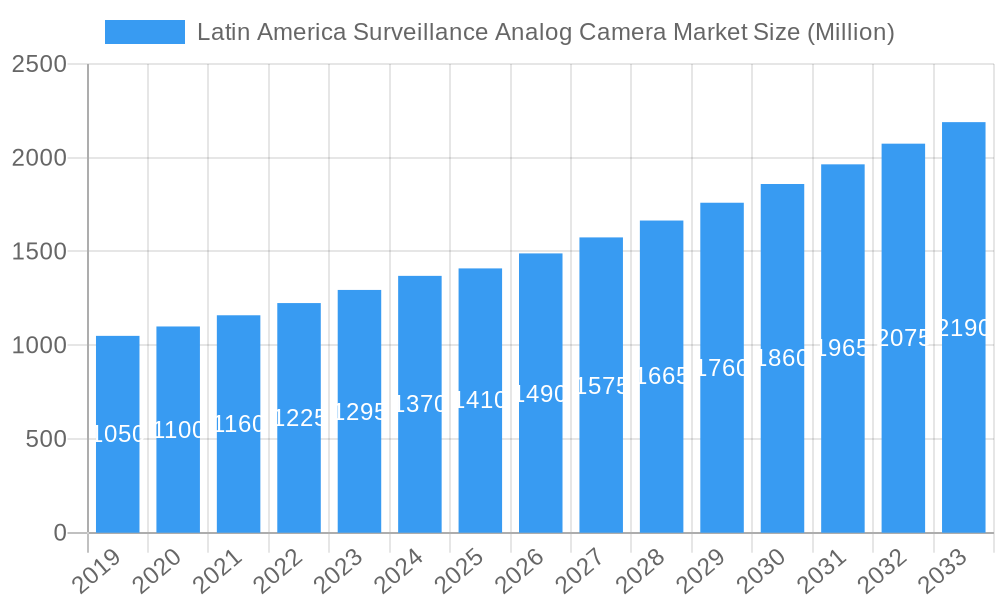

The Latin America Surveillance Analog Camera Market is poised for robust growth, projected to reach approximately USD 1.41 billion by 2025 with a Compound Annual Growth Rate (CAGR) of 5.97% from 2019 to 2033. This expansion is driven by several key factors, including the increasing demand for enhanced security and surveillance solutions across diverse end-user industries. The government sector, in particular, is a significant contributor, investing heavily in public safety initiatives, smart city projects, and critical infrastructure protection. Similarly, the banking and financial services sector is prioritizing analog camera systems for their cost-effectiveness and reliability in securing branches, ATMs, and sensitive areas. The transportation and logistics sector is also witnessing a surge in adoption, driven by the need to monitor ports, airports, and supply chain operations for security and operational efficiency.

Latin America Surveillance Analog Camera Market Market Size (In Billion)

Emerging trends are further shaping the market landscape. The integration of analog cameras with existing digital infrastructures, offering hybrid surveillance solutions, is gaining traction. While analog technology is mature, its inherent affordability and ease of deployment continue to make it an attractive option for budget-conscious organizations in Latin America. However, certain restraints need to be addressed. The ongoing digital transformation and the increasing preference for IP-based surveillance systems pose a challenge to the dominance of analog cameras. Nevertheless, the cost advantage of analog solutions, coupled with continuous improvements in image quality and feature sets, is expected to sustain its market presence. Key players like Teledyne FLIR, Hangzhou Hikvision, and Honeywell are actively innovating, offering a range of analog camera solutions tailored to the specific needs of the Latin American market. The market's growth trajectory will be significantly influenced by the adoption rates in countries like Brazil, Mexico, and Colombia, which represent substantial opportunities due to their large economies and ongoing security concerns.

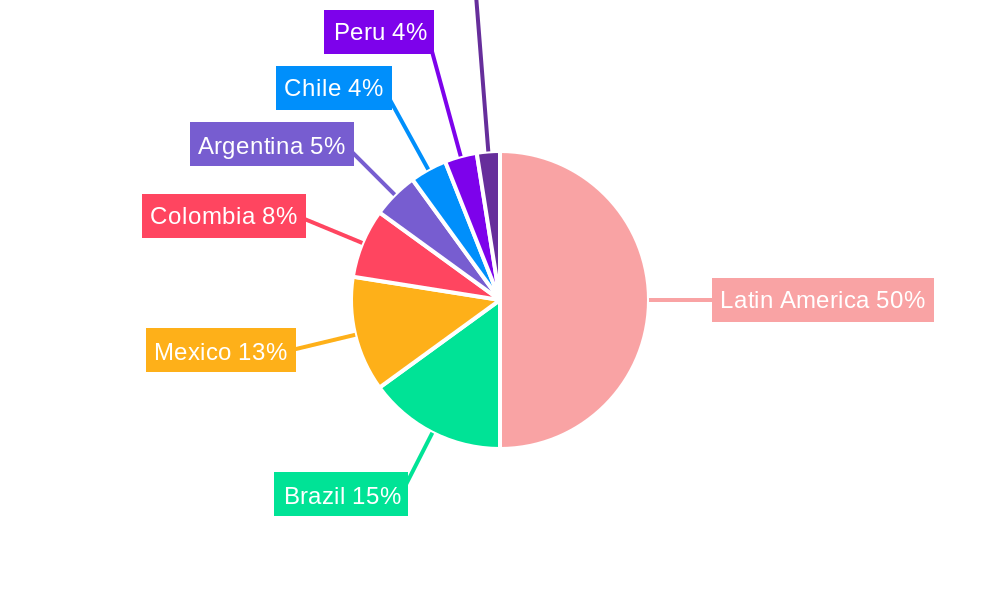

Latin America Surveillance Analog Camera Market Company Market Share

Latin America Surveillance Analog Camera Market: Comprehensive Insights and Future Outlook (2019-2033)

This in-depth report provides a meticulous analysis of the Latin America surveillance analog camera market, meticulously covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. Uncover critical trends, market drivers, challenges, and opportunities shaping this dynamic sector. With a focus on key industry players, technological advancements, and end-user demands, this report is an indispensable resource for stakeholders seeking to navigate and capitalize on the evolving Latin American security landscape.

Latin America Surveillance Analog Camera Market Market Composition & Trends

The Latin America surveillance analog camera market is characterized by a moderate concentration of leading players, with Teledyne FLIR LLC, Hangzhou Hikvision Digital Technology Co Ltd, and Hanwha Vision America holding significant market share distribution, estimated at over 40% combined. Innovation catalysts include the persistent demand for cost-effective security solutions and the ongoing need for reliable surveillance in diverse environments. Regulatory landscapes are evolving, with increasing emphasis on data privacy and the adoption of standardized security protocols across different countries. Substitute products, primarily IP-based surveillance systems, are gaining traction, but the affordability and ease of installation of analog cameras continue to sustain their market presence. End-user profiles vary significantly, with the government sector prioritizing large-scale public safety deployments, while banking and industrial sectors focus on asset protection and operational efficiency. M&A activities are expected to remain strategic, with potential deal values in the range of $50 Million to $150 Million as larger players seek to consolidate their market position and expand their product portfolios.

- Market Concentration: Moderate, with top 3 players holding >40% market share.

- Innovation Catalysts: Cost-effectiveness, reliable surveillance, and upgrading existing infrastructure.

- Regulatory Impact: Growing focus on data privacy and standardization.

- Substitute Products: IP cameras are a growing alternative.

- End-User Focus: Government (public safety), Banking (asset protection), Industrial (operational efficiency).

- M&A Activity: Strategic consolidation, estimated deal values between $50 Million and $150 Million.

Latin America Surveillance Analog Camera Market Industry Evolution

The Latin America surveillance analog camera market has undergone a significant evolutionary journey, driven by a confluence of technological advancements and shifting consumer demands. From its foundational stages, the market has witnessed consistent growth trajectories, primarily fueled by increasing security concerns across the region. The early years, encompassing the historical period of 2019-2024, saw a steady adoption of analog CCTV systems, valued for their robustness and lower initial investment compared to nascent digital alternatives. During this period, market growth rates hovered around 5% to 7% annually, driven by deployments in traditional sectors like retail and residential security.

As the forecast period from 2025-2033 approaches, the industry is poised for further evolution. Technological advancements have been a key driver, with manufacturers continuously innovating to enhance the performance of analog cameras. This includes improvements in resolution (moving towards higher definition over analog cabling), low-light performance, and integration capabilities with other security systems. For instance, the adoption of HD-over-coax technology has allowed for a significant upgrade path for existing analog infrastructure, enabling higher quality video feeds without the need for a complete overhaul. Consumer demand has also evolved; while cost remains a crucial factor, there is an increasing expectation for enhanced features like remote accessibility and better image clarity, even within the analog domain. This shift is compelling manufacturers to invest in R&D, leading to specialized product lines catering to specific end-user needs. The market size, which was estimated to be around $700 Million in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 6.5% over the forecast period, reaching an estimated $1.2 Billion by 2033. This growth is not merely in volume but also in value, as more sophisticated and feature-rich analog cameras enter the market. The industry's ability to adapt to these evolving demands and technological shifts will be critical for sustained success in the coming years.

Leading Regions, Countries, or Segments in Latin America Surveillance Analog Camera Market

Within the Latin America surveillance analog camera market, the Government end-user industry stands out as a dominant segment, spearheading market growth and adoption. This dominance is underpinned by several critical factors, including robust investment trends in public safety and national security initiatives across major Latin American nations. Governments are actively deploying surveillance systems to combat rising crime rates, monitor public spaces, and secure critical infrastructure, making analog cameras a compelling choice due to their cost-effectiveness and established infrastructure.

Brazil, Mexico, and Colombia represent key countries driving this segment's expansion. Brazil, with its vast urban centers and significant public events, consistently invests in large-scale surveillance projects for policing and event management. Mexico's ongoing efforts to enhance border security and urban safety contribute significantly to analog camera demand. Colombia, in its pursuit of peace and security, has also seen increased deployment of surveillance technologies in both urban and rural areas.

The regulatory support for surveillance technologies, aimed at enhancing public safety, further bolsters the government segment. Subsidies for security equipment, preferential procurement policies for local manufacturers, and government-led smart city projects all contribute to the sustained demand for analog surveillance solutions. While other end-user industries like Banking, Healthcare, Transportation & Logistics, and Industrial sectors are significant contributors, their adoption patterns often focus on specific security needs or are more readily transitioning to IP solutions where higher bandwidth and advanced analytics are paramount. The government's role as a large-scale procurer, coupled with ongoing security mandates, solidifies its position as the leading segment in the Latin America surveillance analog camera market, projected to account for an estimated 35% to 40% of the total market revenue during the forecast period.

- Dominant End-User Industry: Government.

- Key Countries: Brazil, Mexico, Colombia.

- Key Drivers:

- Increased investment in public safety and national security.

- Combating rising crime rates and enhancing urban security.

- Securing critical infrastructure and transportation networks.

- Government initiatives for smart cities and public surveillance.

- Regulatory Support: Favorable policies for security deployment and procurement.

- Market Share: Projected to account for 35% - 40% of the total market revenue.

Latin America Surveillance Analog Camera Market Product Innovations

Product innovations in the Latin America surveillance analog camera market are focused on enhancing core functionalities and bridging the gap with digital counterparts. Manufacturers are introducing higher resolution analog cameras, often referred to as HD-over-analog, capable of delivering significantly clearer images than traditional standard definition models. These cameras leverage advanced chipsets and signal processing to achieve this while maintaining compatibility with existing coaxial cabling infrastructure, thereby reducing upgrade costs for users. Enhanced low-light performance is another key innovation area, with the integration of improved sensors and wide dynamic range (WDR) technologies ensuring effective surveillance even in challenging lighting conditions. Furthermore, there is a growing emphasis on miniaturization and ruggedization, leading to more discreet and durable camera designs suitable for a wider range of environmental and installation requirements, with estimated improvements in image clarity by up to 50% over previous generations.

Propelling Factors for Latin America Surveillance Analog Camera Market Growth

Several key factors are propelling the growth of the Latin America surveillance analog camera market. Firstly, the persistent need for cost-effective and reliable security solutions in a region with diverse economic landscapes remains a primary driver. Analog cameras offer a lower total cost of ownership, especially for existing infrastructure, making them attractive for budget-conscious organizations and governments. Secondly, increasing urbanization and rising crime rates across various Latin American countries are directly fueling the demand for enhanced surveillance capabilities, particularly in public spaces and critical infrastructure. Thirdly, government initiatives aimed at improving public safety and national security are leading to significant investments in security systems, where analog cameras often form the backbone of many deployments due to their proven track record and ease of integration. Finally, the growing trend of upgrading existing analog systems with higher-resolution and more feature-rich analog cameras (HD-over-coax) provides a continuous demand stream without requiring a complete transition to IP systems, estimated to represent a market segment worth over $100 Million annually.

Obstacles in the Latin America Surveillance Analog Camera Market Market

Despite its growth, the Latin America surveillance analog camera market faces several obstacles. The primary restraint is the rapid technological advancement and increasing affordability of IP-based surveillance systems, which offer superior features like higher resolution, advanced analytics, remote access, and easier scalability. This presents a strong substitute threat. Regulatory complexities and varying compliance standards across different Latin American countries can also pose challenges for manufacturers and integrators. Furthermore, supply chain disruptions, exacerbated by global events, can impact the availability and cost of components, affecting production and delivery timelines, with potential delays of up to 20%. Finally, the perception of analog technology as outdated by some segments of the market, coupled with the learning curve for integrating newer analog technologies, can hinder widespread adoption.

Future Opportunities in Latin America Surveillance Analog Camera Market

The Latin America surveillance analog camera market is ripe with future opportunities. A significant opportunity lies in the continuous upgrade cycle of existing analog infrastructure. As businesses and governments seek to enhance their security without a complete overhaul, there is a growing demand for high-definition analog cameras (HD-TVI, HD-CVI, AHD) that offer improved performance over traditional systems. Furthermore, the growing demand for affordable surveillance solutions in emerging economies within Latin America presents a vast untapped market. The integration of analog cameras with emerging technologies like cloud-based storage for data backup and basic analytics platforms, while maintaining affordability, could unlock new market segments. Another opportunity lies in developing specialized analog cameras for niche applications, such as those requiring extreme ruggedization or specific environmental resistance, catering to industries like mining and agriculture, with potential market expansion in these sectors estimated at $50 Million by 2030.

Major Players in the Latin America Surveillance Analog Camera Market Ecosystem

- Teledyne FLIR LLC

- Hangzhou Hikvision Digital Technology Co Ltd

- Hanwha Vision America

- ACTi Corporation

- Bosch Sicherheitssysteme GmbH

- Pelco

- Zhejiang Uniview Technologies Co Ltd

- IDIS Ltd

- Honeywell International Inc

- Panasonic Corporation

- CP Plu

Key Developments in Latin America Surveillance Analog Camera Market Industry

- April 2024: Hikvision unveiled its latest iteration of analog security products, the Turbo HD 8.0. This upgraded version promises users a more immersive and interactive security experience, empowering them to enhance their visual security setups. Turbo HD 8.0 introduces four key innovations: real-time communication, 180-degree video coverage, and enhanced night vision capabilities, significantly improving situational awareness.

- October 2023: Hikvision launched the ColorVu Fixed Turret (DS-2CE70DF0T-MF) and Bullet Cameras, pioneering an F1.0 aperture. These 2 MP analog cameras offer continuous, high-quality, full-color imaging, support HD over analog cabling for easy upgrades, and feature 3D Digital Noise Reduction (DNR) technology. The F1.0 aperture on the ColorVu Cameras ensures vivid colors even in low-light settings, addressing a critical limitation of traditional analog cameras.

Strategic Latin America Surveillance Analog Camera Market Market Forecast

The strategic forecast for the Latin America surveillance analog camera market hinges on its ability to leverage cost-effectiveness and provide viable upgrade paths for existing infrastructure. Growth catalysts include ongoing government investments in public safety, the persistent need for reliable and affordable security solutions across burgeoning economies, and the technological evolution of analog cameras to offer improved resolution and low-light performance. The market is poised for steady growth, driven by the inertia of existing analog deployments and the introduction of more sophisticated analog products that bridge the gap with digital alternatives. Opportunities for market expansion also exist in catering to specific niche requirements and emerging economies within the region, with a projected overall market value to reach $1.2 Billion by 2033.

Latin America Surveillance Analog Camera Market Segmentation

-

1. End-user Industry

- 1.1. Government

- 1.2. Banking

- 1.3. Healthcare

- 1.4. Transportation & Logistics

- 1.5. Industrial

- 1.6. Other End-user Industries

Latin America Surveillance Analog Camera Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Surveillance Analog Camera Market Regional Market Share

Geographic Coverage of Latin America Surveillance Analog Camera Market

Latin America Surveillance Analog Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost Effectiveness and Affordability; Growing Emphasis on Technology to Reduce Crime Rate and Enhance Public Safety

- 3.3. Market Restrains

- 3.3.1. Cost Effectiveness and Affordability; Growing Emphasis on Technology to Reduce Crime Rate and Enhance Public Safety

- 3.4. Market Trends

- 3.4.1. Government Sector Witnessing Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Surveillance Analog Camera Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Government

- 5.1.2. Banking

- 5.1.3. Healthcare

- 5.1.4. Transportation & Logistics

- 5.1.5. Industrial

- 5.1.6. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Teledyne FLIR LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hanwha Vision America

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ACTi Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bosch Sicherheitssysteme GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pelco

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zhejiang Uniview Technologies Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IDIS Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Honeywell International Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CP Plu

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Teledyne FLIR LLC

List of Figures

- Figure 1: Latin America Surveillance Analog Camera Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Surveillance Analog Camera Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Surveillance Analog Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: Latin America Surveillance Analog Camera Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Latin America Surveillance Analog Camera Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Latin America Surveillance Analog Camera Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Latin America Surveillance Analog Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Latin America Surveillance Analog Camera Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 7: Latin America Surveillance Analog Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Latin America Surveillance Analog Camera Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: Brazil Latin America Surveillance Analog Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Brazil Latin America Surveillance Analog Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina Latin America Surveillance Analog Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Argentina Latin America Surveillance Analog Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: Chile Latin America Surveillance Analog Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Chile Latin America Surveillance Analog Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Colombia Latin America Surveillance Analog Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Colombia Latin America Surveillance Analog Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Latin America Surveillance Analog Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Latin America Surveillance Analog Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Peru Latin America Surveillance Analog Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Peru Latin America Surveillance Analog Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Venezuela Latin America Surveillance Analog Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Venezuela Latin America Surveillance Analog Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Ecuador Latin America Surveillance Analog Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Ecuador Latin America Surveillance Analog Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Bolivia Latin America Surveillance Analog Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Bolivia Latin America Surveillance Analog Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Paraguay Latin America Surveillance Analog Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Paraguay Latin America Surveillance Analog Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Surveillance Analog Camera Market?

The projected CAGR is approximately 5.97%.

2. Which companies are prominent players in the Latin America Surveillance Analog Camera Market?

Key companies in the market include Teledyne FLIR LLC, Hangzhou Hikvision Digital Technology Co Ltd, Hanwha Vision America, ACTi Corporation, Bosch Sicherheitssysteme GmbH, Pelco, Zhejiang Uniview Technologies Co Ltd, IDIS Ltd, Honeywell International Inc, Panasonic Corporation, CP Plu.

3. What are the main segments of the Latin America Surveillance Analog Camera Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Cost Effectiveness and Affordability; Growing Emphasis on Technology to Reduce Crime Rate and Enhance Public Safety.

6. What are the notable trends driving market growth?

Government Sector Witnessing Demand.

7. Are there any restraints impacting market growth?

Cost Effectiveness and Affordability; Growing Emphasis on Technology to Reduce Crime Rate and Enhance Public Safety.

8. Can you provide examples of recent developments in the market?

April 2024: Hikvision unveiled its latest iteration of analog security products, the Turbo HD 8.0. This upgraded version promises users a more immersive and interactive security experience, empowering them to enhance their visual security setups. Turbo HD 8.0 introduces four key innovations: real-time communication, 180-degree video coverage, and enhanced night vision capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Surveillance Analog Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Surveillance Analog Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Surveillance Analog Camera Market?

To stay informed about further developments, trends, and reports in the Latin America Surveillance Analog Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence