Key Insights

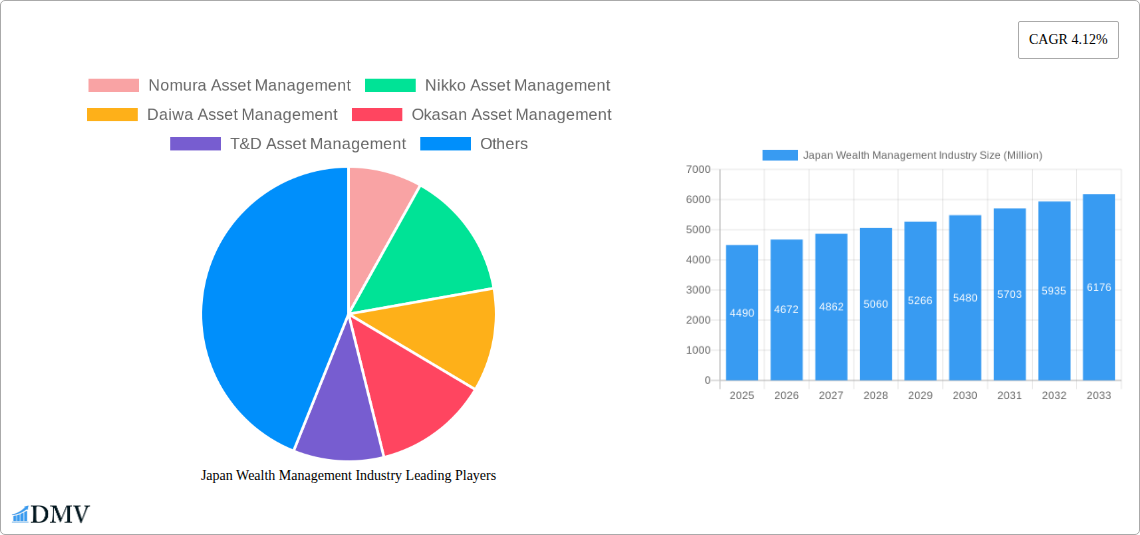

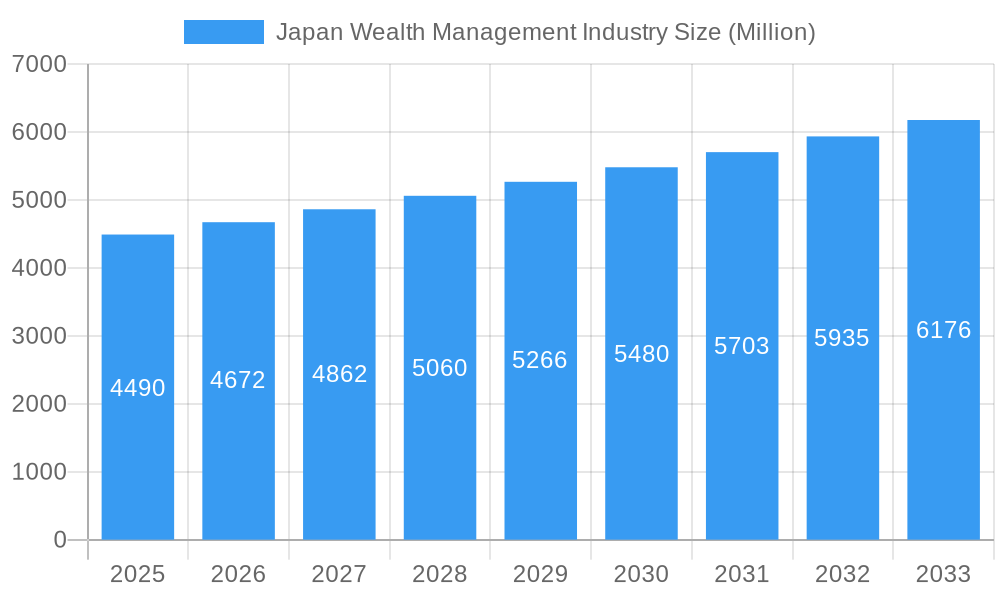

The Japan wealth management industry, valued at approximately ¥4.49 trillion (assuming "Million" refers to millions of Japanese Yen) in 2025, is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) of 4.12% from 2025 to 2033. This growth is fueled by several key drivers. An aging population with significant accumulated assets is a primary factor, leading to increased demand for sophisticated investment strategies and retirement planning services. Furthermore, a rising affluent middle class and a growing awareness of wealth preservation and management techniques are contributing to market expansion. Technological advancements, such as the adoption of robo-advisors and digital platforms, are enhancing accessibility and efficiency within the sector, attracting a wider range of clients. However, regulatory changes and intense competition among established players like Nomura Asset Management, Nikko Asset Management, and Daiwa Asset Management, as well as international firms, pose challenges to sustained growth. The industry is also navigating shifts in investor sentiment and global economic uncertainties which impact investment strategies.

Japan Wealth Management Industry Market Size (In Billion)

The segmentation of the Japanese wealth management market likely includes high-net-worth individuals (HNWI), institutional investors, and retail investors, each with unique needs and investment preferences. The competitive landscape is characterized by both domestic giants and international players vying for market share. Successful firms will need to adapt to evolving client needs by offering personalized, technologically advanced, and globally diversified investment solutions. Continued regulatory compliance and the ability to navigate macroeconomic volatility will be critical factors determining long-term market success within the Japanese wealth management landscape. Future growth will depend on effective adaptation to changing demographics, advancements in financial technology, and strategic responses to shifts in the global financial climate.

Japan Wealth Management Industry Company Market Share

Japan Wealth Management Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Japan Wealth Management industry, offering crucial insights for stakeholders seeking to navigate this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a comprehensive overview of market trends, key players, and future growth prospects. The report utilizes data from the historical period of 2019-2024 to inform its robust projections.

Japan Wealth Management Industry Market Composition & Trends

This section meticulously examines the competitive landscape of the Japanese wealth management market, encompassing market concentration, innovation drivers, regulatory frameworks, substitute products, client profiles, and merger & acquisition (M&A) activities. The report quantifies market share distribution among key players and analyzes M&A deal values, providing a granular understanding of market dynamics. The total market size in 2025 is estimated at ¥xx Million.

- Market Concentration: The market exhibits a moderate level of concentration, with several large players holding significant market share. Further analysis reveals specific market share percentages for top players like Nomura Asset Management, Nikko Asset Management, and Daiwa Asset Management. We also detail the dynamics of smaller players and niche players.

- Innovation Catalysts: Technological advancements, including robo-advisors and AI-powered investment platforms, are transforming the industry. Regulatory changes focused on financial technology (Fintech) adoption and data privacy are shaping innovation. XX Million is predicted to be invested in Fintech initiatives by 2033.

- Regulatory Landscape: The Financial Services Agency (FSA) of Japan plays a critical role in shaping the regulatory landscape. Recent policy changes in areas such as investment regulations and client protection are analyzed thoroughly.

- Substitute Products: The report also analyzes alternative investment vehicles and their impact on the wealth management market's growth.

- End-User Profiles: Detailed segmentation of end-users is provided, including high-net-worth individuals (HNWIs), institutional investors, and retail clients. The investment preferences and needs of each segment are discussed.

- M&A Activities: The report details recent M&A activities, including the USD 1.94 Billion acquisition of Mitsubishi Corp.-UBS Realty Inc. by KKR in 2022, and the impact on the market consolidation. The total value of M&A deals within the study period is estimated at ¥xx Million.

Japan Wealth Management Industry Industry Evolution

This section provides a comprehensive analysis of the Japan Wealth Management Industry's evolution, encompassing market growth trajectories, technological innovations, and changing consumer preferences. The analysis incorporates specific data points like growth rates and adoption metrics, offering a robust picture of the industry's transformation. The CAGR (Compound Annual Growth Rate) for the forecast period (2025-2033) is projected to be xx%.

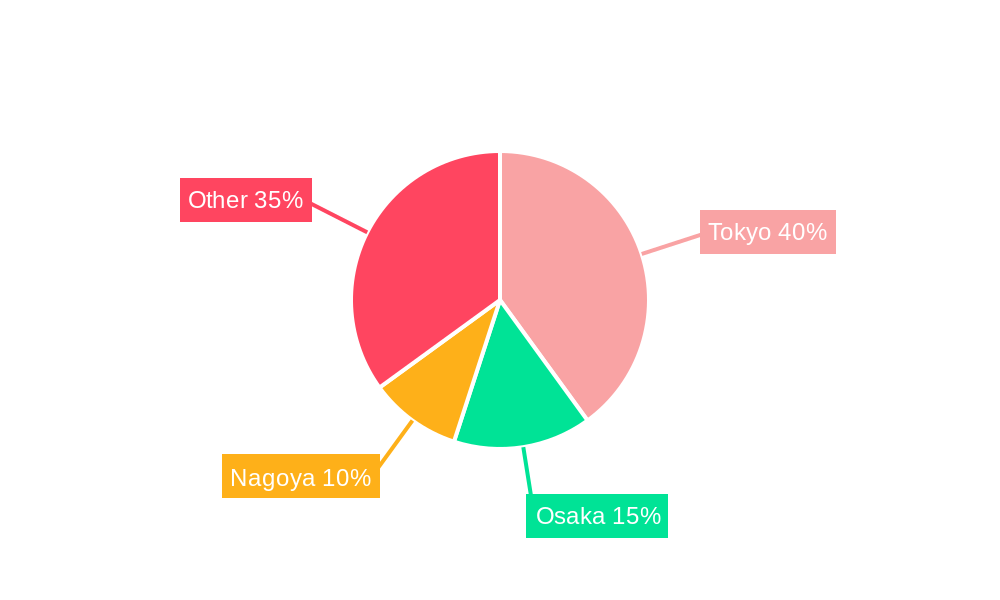

Leading Regions, Countries, or Segments in Japan Wealth Management Industry

This section identifies the dominant regions, countries, or segments within the Japanese wealth management industry. A detailed examination of the factors contributing to the dominance of specific areas provides strategic insights for market entry and growth.

- Key Drivers:

- Increasing HNWIs population in Tokyo and other major urban areas.

- Growing adoption of digital wealth management platforms.

- Favorable government policies supporting investment.

- In-depth Analysis: The report delves into the factors driving the dominance of Tokyo as a key financial hub and analyzes the role of regional disparities in wealth distribution.

Japan Wealth Management Industry Product Innovations

This section highlights recent product innovations, applications, and performance metrics in the Japanese wealth management market, emphasizing their unique selling propositions and technological advancements. The emergence of robo-advisors, personalized investment strategies, and ESG-focused investment products are discussed, along with their impact on the market.

Propelling Factors for Japan Wealth Management Industry Growth

This section identifies and analyzes the key growth drivers of the Japanese wealth management market, focusing on technological advancements, favorable economic conditions, and supportive regulatory policies. Specific examples of each growth driver are highlighted. The growing aging population and increasing awareness of retirement planning significantly contribute to market expansion.

Obstacles in the Japan Wealth Management Industry Market

This section discusses potential barriers and restraints impacting the Japanese wealth management industry, including regulatory hurdles, supply chain disruptions, and intensifying competition. Specific examples and quantifiable impacts are provided, enabling a comprehensive understanding of market challenges.

Future Opportunities in Japan Wealth Management Industry

This section outlines emerging opportunities within the Japan Wealth Management industry, focusing on new market segments, innovative technologies, and evolving consumer preferences. The potential for growth in areas such as sustainable investing and digital wealth management is highlighted.

Major Players in the Japan Wealth Management Industry Ecosystem

- Nomura Asset Management

- Nikko Asset Management

- Daiwa Asset Management

- Okasan Asset Management

- T&D Asset Management

- Meiji Yasuda Asset Management

- Schroder Investment Management

- Aberdeen Standard Investment Limited

- Norinchukin Zenkyoren Asset Management

- Nissay Asset Management Corporation

- (List Not Exhaustive)

Key Developments in Japan Wealth Management Industry Industry

- July 2023: Nikko Asset Management and Osmosis (Holdings) Limited announced a non-binding agreement for a strategic partnership, aiming for Nikko AM to acquire a minority stake in Osmosis and obtain distribution rights for Osmosis' investment products.

- March 2022: Allianz Real Estate acquired a portfolio of multi-family residential properties in Tokyo for around USD 90 Million.

- March 2022: KKR & Co. acquired Mitsubishi Corp.-UBS Realty Inc. for JPY 230 Billion (USD 1.94 Billion), significantly bolstering its presence in the Japanese real estate market.

Strategic Japan Wealth Management Industry Market Forecast

This section summarizes the key growth catalysts and projects the future trajectory of the Japanese wealth management market, highlighting emerging opportunities and untapped potential. The market is poised for sustained growth driven by technological advancements, evolving investor preferences, and supportive government policies. The report concludes with recommendations for stakeholders seeking to capitalize on the market's promising outlook.

Japan Wealth Management Industry Segmentation

-

1. Client Type

- 1.1. Retail

- 1.2. Pension Fund

- 1.3. Insurance Companies

- 1.4. Banks

- 1.5. Other Institutions

-

2. Type of Mandate

- 2.1. Investment Funds

- 2.2. Discretionary Mandates

-

3. Asset Class

- 3.1. Equity

- 3.2. Fixed Income

- 3.3. Cash/Money Market

- 3.4. Other Asset Classes

Japan Wealth Management Industry Segmentation By Geography

- 1. Japan

Japan Wealth Management Industry Regional Market Share

Geographic Coverage of Japan Wealth Management Industry

Japan Wealth Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aging Population Led to a Growing Demand for Retirement Planning and Wealth Management Services; Growing Demand for Investment Products and Services

- 3.3. Market Restrains

- 3.3.1. Aging Population Led to a Growing Demand for Retirement Planning and Wealth Management Services; Growing Demand for Investment Products and Services

- 3.4. Market Trends

- 3.4.1. ESG Integration Reshaping Japan's Asset Management Landscape

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 5.1.1. Retail

- 5.1.2. Pension Fund

- 5.1.3. Insurance Companies

- 5.1.4. Banks

- 5.1.5. Other Institutions

- 5.2. Market Analysis, Insights and Forecast - by Type of Mandate

- 5.2.1. Investment Funds

- 5.2.2. Discretionary Mandates

- 5.3. Market Analysis, Insights and Forecast - by Asset Class

- 5.3.1. Equity

- 5.3.2. Fixed Income

- 5.3.3. Cash/Money Market

- 5.3.4. Other Asset Classes

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nomura Asset Management

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nikko Asset Management

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Daiwa Asset Management

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Okasan Asset Management

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 T&D Asset Management

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Meiji Yasuda Asset Management

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schroder Investment Management

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Aberdeen Standard Investment Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Norinchukin Zenkyoren Asset Management

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nissay Asset Management Corporation**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nomura Asset Management

List of Figures

- Figure 1: Japan Wealth Management Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Wealth Management Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 2: Japan Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 3: Japan Wealth Management Industry Revenue Million Forecast, by Type of Mandate 2020 & 2033

- Table 4: Japan Wealth Management Industry Volume Trillion Forecast, by Type of Mandate 2020 & 2033

- Table 5: Japan Wealth Management Industry Revenue Million Forecast, by Asset Class 2020 & 2033

- Table 6: Japan Wealth Management Industry Volume Trillion Forecast, by Asset Class 2020 & 2033

- Table 7: Japan Wealth Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Japan Wealth Management Industry Volume Trillion Forecast, by Region 2020 & 2033

- Table 9: Japan Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 10: Japan Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 11: Japan Wealth Management Industry Revenue Million Forecast, by Type of Mandate 2020 & 2033

- Table 12: Japan Wealth Management Industry Volume Trillion Forecast, by Type of Mandate 2020 & 2033

- Table 13: Japan Wealth Management Industry Revenue Million Forecast, by Asset Class 2020 & 2033

- Table 14: Japan Wealth Management Industry Volume Trillion Forecast, by Asset Class 2020 & 2033

- Table 15: Japan Wealth Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Japan Wealth Management Industry Volume Trillion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Wealth Management Industry?

The projected CAGR is approximately 4.12%.

2. Which companies are prominent players in the Japan Wealth Management Industry?

Key companies in the market include Nomura Asset Management, Nikko Asset Management, Daiwa Asset Management, Okasan Asset Management, T&D Asset Management, Meiji Yasuda Asset Management, Schroder Investment Management, Aberdeen Standard Investment Limited, Norinchukin Zenkyoren Asset Management, Nissay Asset Management Corporation**List Not Exhaustive.

3. What are the main segments of the Japan Wealth Management Industry?

The market segments include Client Type, Type of Mandate, Asset Class.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Aging Population Led to a Growing Demand for Retirement Planning and Wealth Management Services; Growing Demand for Investment Products and Services.

6. What are the notable trends driving market growth?

ESG Integration Reshaping Japan's Asset Management Landscape.

7. Are there any restraints impacting market growth?

Aging Population Led to a Growing Demand for Retirement Planning and Wealth Management Services; Growing Demand for Investment Products and Services.

8. Can you provide examples of recent developments in the market?

July 2023: Nikko Asset Management and Osmosis (Holdings) Limited announced a non-binding agreement for a strategic partnership. Under this agreement, Nikko AM aims to acquire a minority stake in Osmosis and obtain distribution rights for Osmosis' investment products and strategies.March 2022: Allianz Real Estate, a global real estate investment manager, finalized an agreement to purchase a portfolio of high-quality multi-family residential properties in Tokyo for around USD 90 million. This acquisition was made on behalf of the Allianz Real Estate Asia-Pacific Japan Multi-Family Fund.March 2022: KKR & Co. announced its acquisition of Japanese real estate asset manager Mitsubishi Corp.-UBS Realty Inc. (MC-UBSR) for JPY 230 billion (USD 1.94 billion). This move was expected to strengthen the US private equity firm's footprint in Japan. The acquisition involved KKR purchasing MC-UBSR from Mitsubishi Corp. (8058.T) and UBS Asset Management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Wealth Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Wealth Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Wealth Management Industry?

To stay informed about further developments, trends, and reports in the Japan Wealth Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence