Key Insights

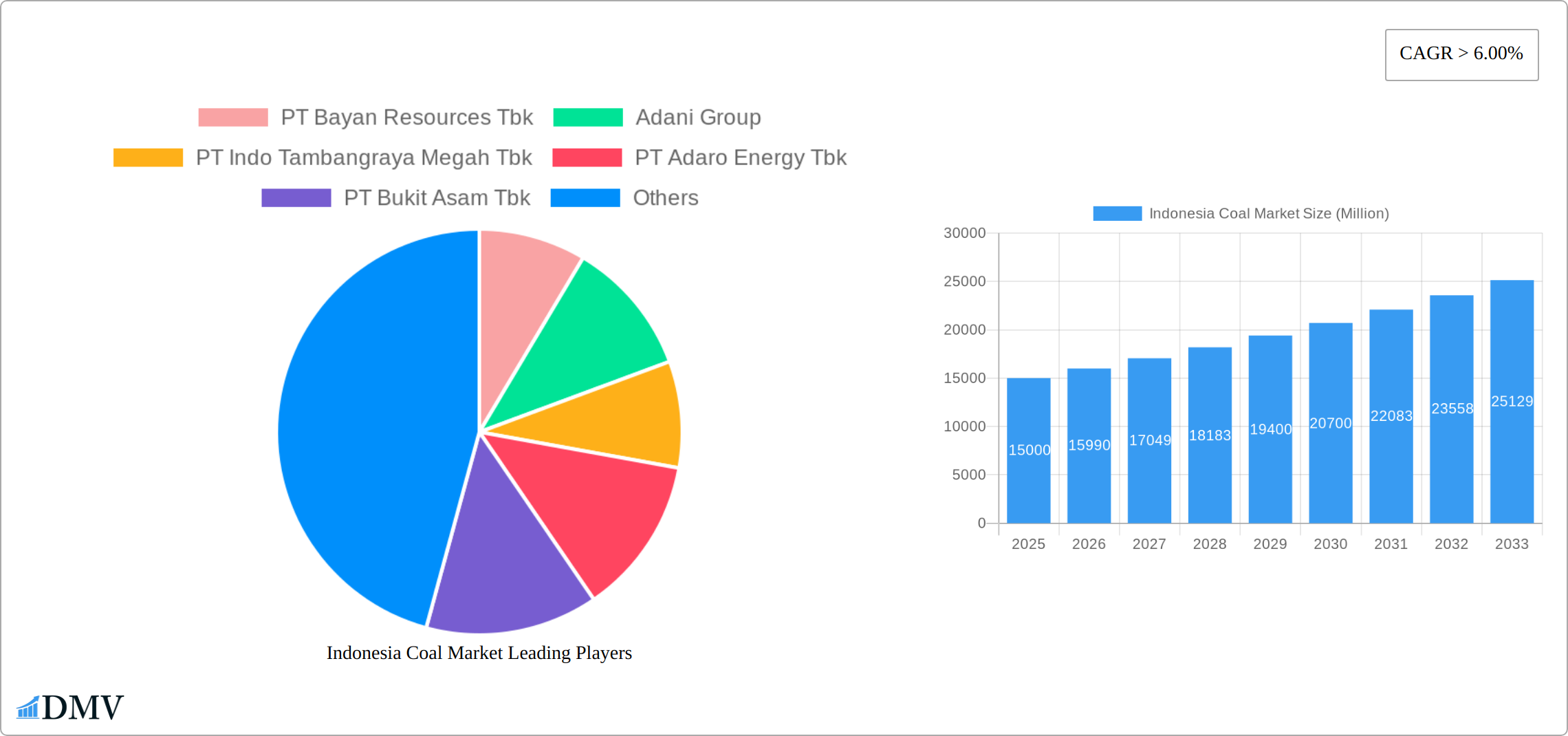

The Indonesian coal market, valued at approximately $XX million in 2025 (assuming a logical extrapolation based on the provided CAGR and market size), exhibits robust growth potential, driven by a CAGR exceeding 6% from 2025 to 2033. This expansion is fueled by increasing energy demands within the domestic electricity sector, particularly as Indonesia continues to develop its infrastructure and power generation capabilities. The iron and steel industry, a significant consumer of coal, also contributes significantly to market growth. While export markets play a role, the domestic focus, given Indonesia's ongoing infrastructure development and industrialization, is a primary driver.

Indonesia Coal Market Market Size (In Billion)

However, the market faces certain restraints. Environmental concerns regarding greenhouse gas emissions are increasingly impacting coal consumption globally, and Indonesia is not immune to this pressure. The government's focus on diversifying energy sources and promoting renewable energy will likely influence coal demand in the long term. Furthermore, competition from other energy sources and potential fluctuations in global coal prices pose challenges for market stability. Despite these headwinds, the strong domestic demand, particularly from the electricity and iron and steel sectors, along with the established infrastructure, should support continued growth, albeit potentially at a moderated pace towards the latter half of the forecast period. The key players, including PT Bayan Resources Tbk, Adani Group, and others, are well-positioned to capitalize on opportunities while navigating these challenges. This necessitates strategic diversification and adaptation to evolving environmental regulations to maintain a strong market presence in the coming years.

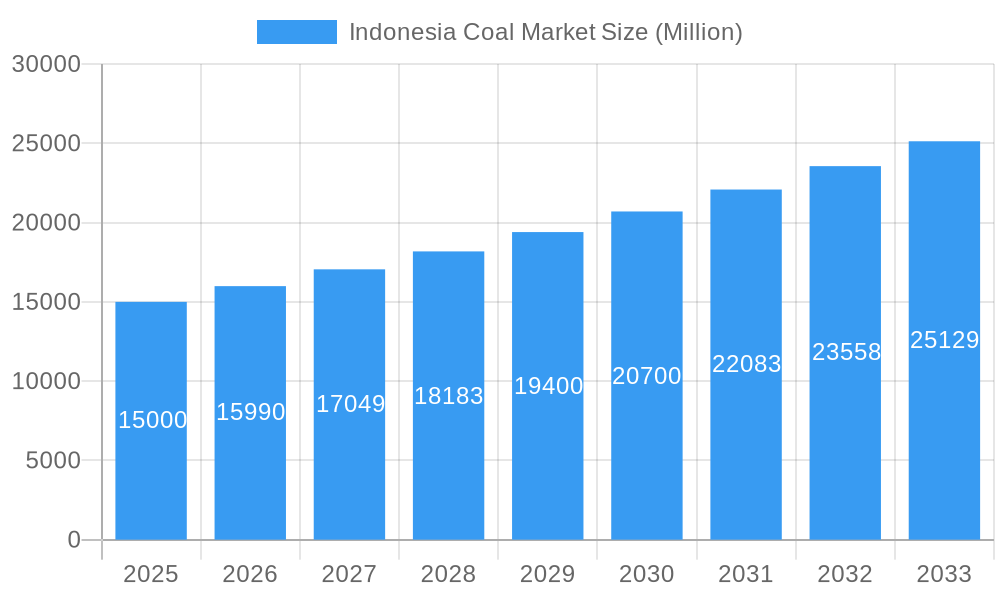

Indonesia Coal Market Company Market Share

Indonesia Coal Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Indonesian coal market, encompassing historical data (2019-2024), the base year (2025), and a comprehensive forecast (2025-2033). It's an essential resource for stakeholders seeking to understand market dynamics, identify lucrative opportunities, and navigate the evolving landscape of this crucial sector. The report meticulously examines market composition, industry evolution, key players, and future growth trajectories, providing actionable intelligence for strategic decision-making. With a focus on key segments – Electricity, Iron and Steel Industry, and Other Applications – and major players including PT Bayan Resources Tbk, Adani Group, and PT Adaro Energy Tbk, this report offers unparalleled depth and clarity. Expect detailed analysis of market concentration, regulatory changes, technological advancements, and emerging trends shaping the future of Indonesia's coal industry.

Indonesia Coal Market Composition & Trends

This section delves into the intricate structure of the Indonesian coal market, offering a comprehensive overview of market concentration, innovation drivers, regulatory dynamics, substitute products, end-user profiles, and significant M&A activities. The analysis encompasses the period from 2019 to 2033, with a particular focus on the base year 2025 and the forecast period spanning 2025-2033.

Market Concentration & Share Distribution:

- The market is moderately concentrated with the top five players holding an estimated xx% market share in 2025.

- Significant regional variations in market concentration exist, with certain regions exhibiting higher levels of competition.

- The report details the market share held by key players including PT Bayan Resources Tbk, Adani Group, PT Indo Tambangraya Megah Tbk, PT Adaro Energy Tbk, and PT Bukit Asam Tbk.

Innovation Catalysts & Regulatory Landscape:

The Indonesian coal market is influenced by a complex interplay of factors. Technological advancements in mining techniques and energy efficiency drive innovation, while government regulations significantly impact production and trade. The evolving regulatory landscape, including environmental regulations and export policies, is a major factor influencing market dynamics.

Substitute Products & End-User Profiles:

The growing adoption of renewable energy sources presents a challenge to coal's dominance. The report analyzes the impact of substitute products and identifies key end-user segments (e.g., electricity generation, iron and steel) and their evolving demand patterns.

M&A Activities:

The Indonesian coal market has witnessed significant M&A activity in recent years. The report includes an analysis of key mergers and acquisitions, including transaction values and their impact on market consolidation. Total M&A deal values between 2019 and 2024 are estimated at xx Million USD.

Indonesia Coal Market Industry Evolution

This section provides a detailed analysis of the Indonesian coal market's growth trajectory, highlighting technological advancements, shifting consumer demands, and the overall evolution of the industry from 2019 to 2033. The analysis includes data on market growth rates, adoption metrics, and key factors shaping the industry's development.

The Indonesian coal market experienced fluctuating growth throughout the historical period (2019-2024), influenced by global energy demand, economic conditions, and government policies. The estimated compound annual growth rate (CAGR) from 2019 to 2024 was approximately xx%, and the forecast period (2025-2033) projects a CAGR of xx%. Technological advancements, such as improved mining techniques and processing technologies, have enhanced efficiency and productivity within the industry. However, the increasing focus on renewable energy sources and environmental concerns present both opportunities and challenges for the sector. The report will cover the challenges and the opportunities in details in the later section. Shifting consumer demands, driven by the global transition towards cleaner energy, pose a considerable threat. Nevertheless, the sustained demand for electricity and steel in Indonesia continues to support coal consumption, albeit at a potentially slower pace compared to previous years.

Leading Regions, Countries, or Segments in Indonesia Coal Market

This section identifies the dominant regions, countries, or segments within the Indonesian coal market, focusing on the key applications: Electricity, Iron and Steel Industry, and Other Applications. It examines the factors driving their dominance, such as investment trends, regulatory support, and market dynamics.

Dominant Segment: Electricity

- Key Drivers: Indonesia's increasing electricity demand, driven by economic growth and population expansion. Significant investments in coal-fired power plants continue to fuel the segment's growth. Government support for energy infrastructure development plays a crucial role.

- Dominance Factors: Coal remains a pivotal energy source for electricity generation in Indonesia. The extensive existing coal-fired power plant infrastructure necessitates continued coal consumption for the foreseeable future.

Iron and Steel Industry:

- Key Drivers: Growth in Indonesia's construction and manufacturing sectors creates high demand for steel. Coal is essential in the iron and steel production process as a fuel source and reducing agent.

- Dominance Factors: The consistent growth in the construction sector and industrialization drives the demand for coal within the iron and steel industry.

Other Applications:

- Key Drivers: This segment encompasses diverse applications, including cement production and other industrial processes. Growth in related industries drives demand for coal in these applications.

- Dominance Factors: While smaller compared to electricity and iron and steel, this segment reflects the versatility of coal as an industrial fuel and raw material.

Indonesia Coal Market Product Innovations

Recent innovations in Indonesian coal mining and processing are significantly enhancing efficiency and mitigating environmental impact. These advancements encompass optimized extraction methods like improved longwall mining techniques and the implementation of advanced drilling technologies. Furthermore, there's a strong focus on enhancing energy efficiency throughout the value chain, from reduced energy consumption in processing plants to improved transportation logistics. Waste reduction strategies, including the utilization of coal by-products in construction materials or other industrial applications, are gaining traction. Several key players are heavily investing in research and development, exploring cleaner coal technologies such as carbon capture and storage (CCS) and investigating alternative uses for coal by-products to create a more circular economy. The industry's commitment to sustainable practices and environmental stewardship is demonstrably increasing, driven by both internal initiatives and external pressures.

Propelling Factors for Indonesia Coal Market Growth

Several robust factors are driving the expansion of the Indonesian coal market. Indonesia's sustained economic growth continues to fuel electricity demand, representing a significant portion of coal consumption. The nation's ambitious infrastructure development projects, encompassing expansive transportation networks, power plants, and industrial facilities, consistently elevate coal demand. Governmental policies aimed at ensuring energy security have historically provided market stability, although the increasing emphasis on renewable energy sources presents both challenges and opportunities for the industry to adapt and diversify. The growth of energy-intensive sectors like cement and steel production also significantly contributes to the market's upward trajectory.

Obstacles in the Indonesia Coal Market

The Indonesian coal market navigates several significant challenges. Stringent environmental regulations, aligned with global efforts to curb carbon emissions, impose considerable pressure on coal producers. The inherent volatility of global coal prices and the susceptibility to supply chain disruptions (e.g., geopolitical instability, extreme weather events) contribute to market instability. Increasing competition from renewable energy sources, coupled with the rising costs associated with regulatory compliance and environmental remediation, presents further hurdles. The need for substantial investment in modernizing infrastructure and adopting cleaner technologies also poses a significant challenge for many operators.

Future Opportunities in Indonesia Coal Market

Despite the challenges, several opportunities exist for growth in the Indonesian coal market. Technological advancements in clean coal technologies can lead to more sustainable practices. The development of value-added coal products and diversification into new applications can create additional revenue streams. Export opportunities to regional markets and strategic partnerships with international players can further enhance growth prospects.

Major Players in the Indonesia Coal Market Ecosystem

- PT Bayan Resources Tbk

- Adani Group

- PT Indo Tambangraya Megah Tbk

- PT Adaro Energy Tbk

- PT Bukit Asam Tbk

- BlackGold Group

- Golden Energy and Resources Limited

- PT Bumi Resources Tbk

- PT Bhakti Energi Persada

Key Developments in Indonesia Coal Market Industry

- November 2022: The Indonesian government approved the construction of new coal plants (13 GW) as outlined in the 10-year energy plan (2021-2030). This decision significantly impacts future coal demand and production.

- November 2022: The Asian Development Bank and a private firm partnered to refinance and prematurely retire the 660-megawatt Cirebon 1 coal plant. This highlights the growing pressure to transition away from coal-fired power generation.

Strategic Indonesia Coal Market Market Forecast

The Indonesian coal market is expected to experience moderate growth over the forecast period (2025-2033). While the transition to renewable energy sources presents a long-term challenge, continued industrialization and infrastructure development will support coal demand, particularly in the electricity and iron and steel sectors. Strategic investments in clean coal technologies and diversification into new applications will be critical for long-term sustainability and competitiveness.

Indonesia Coal Market Segmentation

-

1. Application

- 1.1. Electricity

- 1.2. Iron and Steel Industry

- 1.3. Other Applications

Indonesia Coal Market Segmentation By Geography

- 1. Indonesia

Indonesia Coal Market Regional Market Share

Geographic Coverage of Indonesia Coal Market

Indonesia Coal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Cost as Compared to Rooftop PV Systems

- 3.4. Market Trends

- 3.4.1. Electricity Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Coal Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Electricity

- 5.1.2. Iron and Steel Industry

- 5.1.3. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PT Bayan Resources Tbk

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Adani Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Indo Tambangraya Megah Tbk

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Adaro Energy Tbk

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT Bukit Asam Tbk

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BlackGold Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Golden Energy and Resources Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Bumi Resources Tbk

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PT Bhakti Energi Persada

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 PT Bayan Resources Tbk

List of Figures

- Figure 1: Indonesia Coal Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Indonesia Coal Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Coal Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Indonesia Coal Market Volume Tonnes Forecast, by Application 2020 & 2033

- Table 3: Indonesia Coal Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Indonesia Coal Market Volume Tonnes Forecast, by Region 2020 & 2033

- Table 5: Indonesia Coal Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Indonesia Coal Market Volume Tonnes Forecast, by Application 2020 & 2033

- Table 7: Indonesia Coal Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Indonesia Coal Market Volume Tonnes Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Coal Market?

The projected CAGR is approximately 4.85%.

2. Which companies are prominent players in the Indonesia Coal Market?

Key companies in the market include PT Bayan Resources Tbk, Adani Group, PT Indo Tambangraya Megah Tbk, PT Adaro Energy Tbk, PT Bukit Asam Tbk, BlackGold Group, Golden Energy and Resources Limited, PT Bumi Resources Tbk, PT Bhakti Energi Persada.

3. What are the main segments of the Indonesia Coal Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment.

6. What are the notable trends driving market growth?

Electricity Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Installation Cost as Compared to Rooftop PV Systems.

8. Can you provide examples of recent developments in the market?

In November 2022, the Indonesian government announced that they would allow the construction of new coal plants, with a combined capacity of 13 gigawatts, that have already been tendered out. The plan is laid out in the country's 10-year energy plan for 2021-2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Coal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Coal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Coal Market?

To stay informed about further developments, trends, and reports in the Indonesia Coal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence