Key Insights

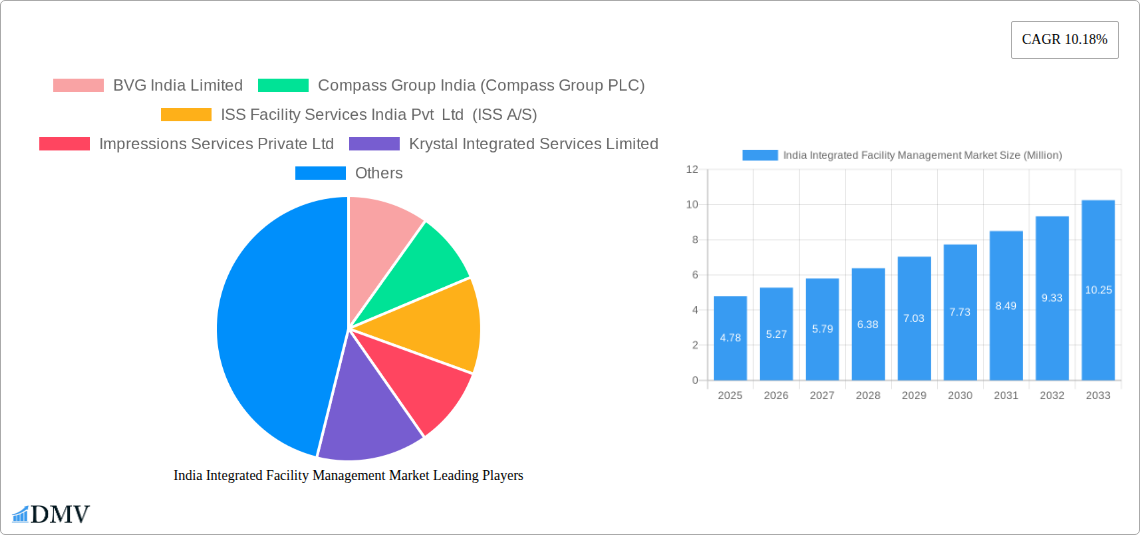

The Indian Integrated Facility Management (IFM) market is poised for robust growth, projected to reach approximately USD 4.78 million in 2025 with an impressive Compound Annual Growth Rate (CAGR) of 10.18%. This expansion is primarily fueled by the increasing adoption of outsourcing facility management services by businesses across diverse sectors. Key drivers include the growing need for cost optimization, enhanced operational efficiency, and a focus on core business activities, allowing companies to delegate non-core functions to specialized IFM providers. The escalating complexity of managing modern workplaces, coupled with stringent regulatory compliance requirements, further propels the demand for integrated solutions that encompass a wide range of services, from hard FM (maintenance, HVAC, security) to soft FM (cleaning, catering, landscaping). The government's push for smart cities and infrastructure development also presents significant opportunities for IFM players.

India Integrated Facility Management Market Market Size (In Million)

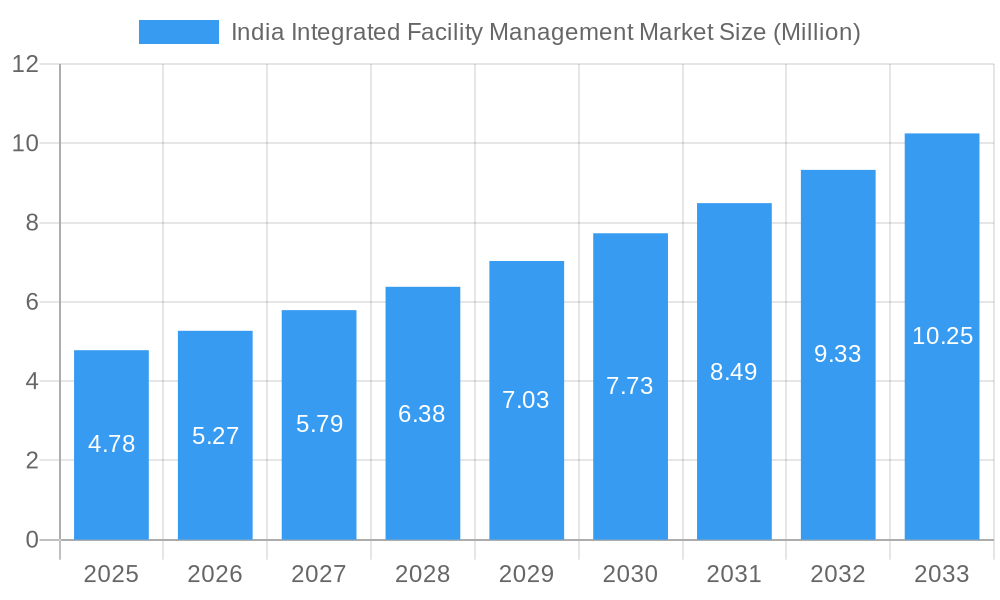

The market is characterized by a dynamic segmentation, with the "Commercial" segment expected to dominate, followed by "Retail, and Restaurants." The "Manufacturing and Industrial" sector also represents a substantial share, driven by the need for specialized maintenance and operational support. Institutional and Government sectors are also key contributors, with ongoing modernization efforts. Challenges, or restraints, such as initial high implementation costs for advanced IFM technologies and a shortage of skilled labor in certain specialized areas, are being addressed through training initiatives and technological advancements. However, the strong underlying growth drivers and the inherent benefits of IFM solutions suggest that these restraints are unlikely to impede the overall upward trajectory of the market. Leading players like BVG India Limited, Compass Group India, and ISS Facility Services India are actively shaping the market landscape through strategic expansions and service innovations.

India Integrated Facility Management Market Company Market Share

Dive deep into the burgeoning Indian Integrated Facility Management (IFM) market with this definitive report. Spanning from 2019 to 2033, with a base and estimated year of 2025, this analysis provides unparalleled insights into market composition, trends, industry evolution, and future projections. Uncover critical information on market share distribution, M&A activities, product innovations, and leading players driving this dynamic sector. The report is meticulously crafted for stakeholders seeking to understand and capitalize on the robust growth opportunities within India's IFM landscape.

India Integrated Facility Management Market Market Composition & Trends

The Indian Integrated Facility Management (IFM) market is characterized by a dynamic landscape of established players and emerging contenders, with a moderate level of market concentration. Innovation is primarily driven by technological advancements in smart building solutions, AI-powered analytics for predictive maintenance, and sustainable facility management practices. Regulatory frameworks, while evolving, are increasingly emphasizing compliance, safety, and environmental standards, influencing service provider strategies. Substitute products are generally limited in the integrated model, but advancements in specialized service offerings present competitive pressures. End-user profiles are diverse, ranging from the rapidly expanding Commercial and Retail sectors to the critical Manufacturing & Industrial segments, Government entities, and Institutional bodies. Mergers and Acquisition (M&A) activities are anticipated to be strategic, focusing on consolidating market share, expanding service portfolios, and acquiring technological capabilities. For instance, recent developments suggest a continued trend of consolidation as companies seek to achieve economies of scale and offer comprehensive solutions.

India Integrated Facility Management Market Industry Evolution

The Indian Integrated Facility Management (IFM) market has witnessed a transformative evolution, driven by a confluence of economic liberalization, rapid urbanization, and an increasing demand for professionalized building and operational management. From its nascent stages focused on basic maintenance, the industry has progressed to offering sophisticated, end-to-end solutions that optimize operational efficiency, reduce costs, and enhance occupant experience. This evolution is underpinned by significant technological advancements, including the integration of the Internet of Things (IoT) for real-time monitoring, AI and machine learning for predictive analytics in maintenance and energy management, and Building Information Modeling (BIM) for better lifecycle management of facilities. The adoption of these technologies has led to a marked increase in the adoption of IFM services across various sectors, with growth rates consistently outperforming general economic growth. Shifting consumer demands, particularly from corporate clients, have pushed IFM providers to offer more sustainable, cost-effective, and technologically advanced services. The rise of smart cities and the increasing complexity of modern infrastructure have further amplified the need for integrated solutions. The forecast period of 2025–2033 is expected to see sustained high growth, driven by the continued urbanization, the formalization of the real estate sector, and a greater appreciation for the strategic value of IFM in business operations. Adoption metrics for digital FM technologies are projected to skyrocket, with a significant portion of the market embracing AI-driven predictive maintenance and IoT-enabled resource management.

Leading Regions, Countries, or Segments in India Integrated Facility Management Market

The Indian Integrated Facility Management (IFM) market demonstrates significant regional and segment dominance, with certain areas and service types leading the growth trajectory.

Dominant Segments:

Type:

- Soft FM: This segment consistently commands a larger market share due to the widespread demand for essential services such as cleaning and housekeeping, security, landscaping, and concierge services across all end-user verticals. The growing focus on hygiene and a safe working environment further bolsters its position.

- Hard FM and HVAC: While historically smaller than Soft FM, this segment is experiencing accelerated growth. This is primarily driven by the increasing complexity of infrastructure, the need for specialized maintenance of critical systems like HVAC, electrical, and plumbing, and a greater emphasis on energy efficiency and regulatory compliance for building systems.

End-User:

- Commercial, Retail, and Restaurants: This segment represents the largest and most dynamic end-user in the Indian IFM market. The rapid expansion of office spaces, burgeoning retail complexes, and the robust growth of the F&B industry create a perpetual demand for comprehensive facility management services to ensure seamless operations, customer satisfaction, and brand reputation.

- Manufacturing and Industrial: This sector is a significant contributor, driven by the need for efficient operational management, safety compliance, and specialized maintenance of production facilities. The 'Make in India' initiative and the growth of manufacturing hubs are further fueling demand for IFM solutions.

- Institutional: This includes educational institutions and healthcare facilities, where maintaining a conducive and safe environment is paramount. Their specific needs for specialized cleaning, maintenance, and security contribute substantially to the market.

Key Drivers of Dominance:

- Rapid Urbanization and Infrastructure Development: The expansion of Tier 1 and Tier 2 cities leads to increased construction of commercial, retail, and residential spaces, directly boosting demand for FM services.

- Increasing Corporate Adoption of Outsourcing: Companies are increasingly recognizing the strategic benefits of outsourcing non-core facility management functions to specialized providers to focus on their core competencies, leading to higher adoption of IFM.

- Growing Awareness of Health, Safety, and Environmental (HSE) Standards: Stricter regulations and a heightened awareness of health and safety concerns are pushing organizations to engage professional IFM services for compliance and risk mitigation.

- Technological Integration: The adoption of smart building technologies and digital FM solutions by large commercial and industrial clients is creating a demand for integrated service providers capable of managing these complex systems.

- Foreign Direct Investment (FDI) and Global Standards: The presence of multinational corporations in India brings global FM standards and practices, further professionalizing the local market and increasing the demand for integrated services.

India Integrated Facility Management Market Product Innovations

Innovations in the Indian Integrated Facility Management (IFM) market are centered around enhancing efficiency, sustainability, and occupant well-being. Key advancements include the integration of IoT sensors for real-time building performance monitoring, AI-powered predictive maintenance algorithms to minimize downtime and optimize energy consumption, and the deployment of advanced cleaning technologies for improved hygiene standards. Furthermore, the development of integrated digital platforms that consolidate all FM services into a single interface is revolutionizing service delivery. Unique selling propositions now lie in the ability to offer data-driven insights, personalized service offerings, and proactive problem-solving, leading to significant improvements in operational efficiency and cost savings for clients.

Propelling Factors for India Integrated Facility Management Market Growth

Several key factors are propelling the growth of the India Integrated Facility Management Market. The rapid urbanization and expansion of commercial and industrial infrastructure create a constant need for professionalized management. Increasing adoption of outsourcing by businesses to focus on core competencies significantly drives demand. Furthermore, growing awareness and stringent adherence to health, safety, and environmental (HSE) regulations necessitate expert FM services. Technological advancements, including smart building solutions and IoT integration, are enhancing service delivery and efficiency, making IFM solutions more attractive. The influx of foreign investment and the adoption of global standards by multinational corporations further professionalize the market and stimulate growth.

Obstacles in the India Integrated Facility Management Market Market

Despite its robust growth, the India Integrated Facility Management Market faces several obstacles. Regulatory challenges, including complex labor laws and varying compliance standards across states, can impede seamless operations. A shortage of skilled labor and trained professionals capable of handling advanced technologies and specialized services remains a significant bottleneck. Price sensitivity among some client segments, particularly smaller businesses, can lead to a preference for unintegrated or less comprehensive solutions, impacting the adoption of true IFM. Additionally, disruptions in the supply chain for specialized equipment and materials can affect service delivery timelines and costs. Intense competition among a fragmented vendor landscape also puts pressure on profit margins.

Future Opportunities in India Integrated Facility Management Market

The future opportunities in the India Integrated Facility Management Market are vast and diverse. The burgeoning smart cities initiative across India presents a significant opportunity for IFM providers to manage complex urban infrastructure and services. The increasing demand for sustainable and green building management solutions, driven by environmental concerns and government initiatives, offers a niche for specialized services. The expansion of the healthcare and education sectors, with their unique FM requirements, presents untapped potential. Furthermore, the growing adoption of advanced technologies like AI, IoT, and robotics in FM operations will create new service lines and revenue streams. The increasing focus on employee well-being and flexible workspaces also opens avenues for tailored FM solutions.

Major Players in the India Integrated Facility Management Market Ecosystem

- BVG India Limited

- Compass Group India (Compass Group PLC)

- ISS Facility Services India Pvt Ltd (ISS A/S)

- Impressions Services Private Ltd

- Krystal Integrated Services Limited

- Lion Services Limited

- OCS Group Holdings Ltd

- Property Solutions (India) Pvt Ltd

- SIS Limited

- Sodexo India Services Private Limited (Sodexo S A)

- Updater Services Limited

Key Developments in India Integrated Facility Management Market Industry

- October 2024: CBRE South Asia Pvt. Ltd. has partnered with NetApp to manage its expansive 1.07 million sq ft office footprint in India. This three-year contract, valued at USD 3 million, encompasses account management, finance, procurement, transport, F&B, cleaning, janitorial services, and repair & maintenance.

- September 2024: Awfis is divesting its facility management arm, 'Awfis Care,' to SMS Integrated Facility Services for INR 27.5 Cr (USD 3.2 Million). This strategic move allows Awfis to concentrate on its core flexible workspace business.

Strategic India Integrated Facility Management Market Market Forecast

The strategic forecast for the India Integrated Facility Management Market indicates sustained robust growth driven by increasing adoption of advanced technologies, a growing emphasis on sustainability, and the expansion of commercial and industrial sectors. The market is poised to benefit from government initiatives promoting smart infrastructure and the increasing realization among businesses of the cost-saving and efficiency-enhancing benefits of integrated solutions. Investments in skilled workforce development and technological integration will be crucial for players to capture future opportunities and maintain a competitive edge. The market's trajectory points towards a more sophisticated, technology-driven, and service-oriented future, promising significant returns for well-positioned stakeholders.

India Integrated Facility Management Market Segmentation

-

1. Type

- 1.1. Hard FM and HVAC

- 1.2. Soft FM

-

2. End-User

- 2.1. Commercial, Retail, and Restaurants

- 2.2. Manufacturing and Industrial

- 2.3. Government, Infrastructure & Public Entities

- 2.4. Institutional

- 2.5. Other End Users

India Integrated Facility Management Market Segmentation By Geography

- 1. India

India Integrated Facility Management Market Regional Market Share

Geographic Coverage of India Integrated Facility Management Market

India Integrated Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Public Sector Investment in Construction Activities; Growing Demand for IFM from Emerging Verticals

- 3.3. Market Restrains

- 3.3.1. Increasing Public Sector Investment in Construction Activities; Growing Demand for IFM from Emerging Verticals

- 3.4. Market Trends

- 3.4.1. Hard FM and HVAC Type Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Integrated Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hard FM and HVAC

- 5.1.2. Soft FM

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Commercial, Retail, and Restaurants

- 5.2.2. Manufacturing and Industrial

- 5.2.3. Government, Infrastructure & Public Entities

- 5.2.4. Institutional

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BVG India Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Compass Group India (Compass Group PLC)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ISS Facility Services India Pvt Ltd (ISS A/S)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Impressions Services Private Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Krystal Integrated Services Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lion Services Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 OCS Group Holdings Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Property Solutions (India) Pvt Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SIS Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sodexo India Services Private Limited (Sodexo S A )

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Updater Services Limited*List Not Exhaustive 7 2 Vendor Positioning Analysi

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 BVG India Limited

List of Figures

- Figure 1: India Integrated Facility Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Integrated Facility Management Market Share (%) by Company 2025

List of Tables

- Table 1: India Integrated Facility Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Integrated Facility Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: India Integrated Facility Management Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: India Integrated Facility Management Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 5: India Integrated Facility Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Integrated Facility Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: India Integrated Facility Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: India Integrated Facility Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: India Integrated Facility Management Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 10: India Integrated Facility Management Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 11: India Integrated Facility Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Integrated Facility Management Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Integrated Facility Management Market?

The projected CAGR is approximately 10.18%.

2. Which companies are prominent players in the India Integrated Facility Management Market?

Key companies in the market include BVG India Limited, Compass Group India (Compass Group PLC), ISS Facility Services India Pvt Ltd (ISS A/S), Impressions Services Private Ltd, Krystal Integrated Services Limited, Lion Services Limited, OCS Group Holdings Ltd, Property Solutions (India) Pvt Ltd, SIS Limited, Sodexo India Services Private Limited (Sodexo S A ), Updater Services Limited*List Not Exhaustive 7 2 Vendor Positioning Analysi.

3. What are the main segments of the India Integrated Facility Management Market?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Public Sector Investment in Construction Activities; Growing Demand for IFM from Emerging Verticals.

6. What are the notable trends driving market growth?

Hard FM and HVAC Type Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Increasing Public Sector Investment in Construction Activities; Growing Demand for IFM from Emerging Verticals.

8. Can you provide examples of recent developments in the market?

October 2024: CBRE South Asia Pvt. Ltd has teamed up with NetApp to oversee its expansive 1.07 million sq ft office footprint in India. This portfolio encompasses NetApp's campus in Bengaluru, alongside sales offices situated in Bengaluru, Mumbai, and New Delhi. The three-year contract, worth USD 3 million, encompasses a suite of Facility Management services. These services include Account Management, Finance and Budget Management, Procurement Management, Transport Management, F&B (Food & Beverage) Management, Cleaning & Janitorial Services, and Repair & Maintenance.September 2024: Awfis, a leading player in the coworking space arena, is selling off its facility management division, 'Awfis Care,' to SMS Integrated Facility Services for INR 27.5 Cr (USD 3.2 Million) in a slump sale. This strategic decision enables Awfis to concentrate more intently on its core business, the flexible workspace market, while also easing its administrative and compliance responsibilities. Awfis Care has been instrumental in providing technical maintenance and operational solutions across the company's varied workspaces.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Integrated Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Integrated Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Integrated Facility Management Market?

To stay informed about further developments, trends, and reports in the India Integrated Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence