Key Insights

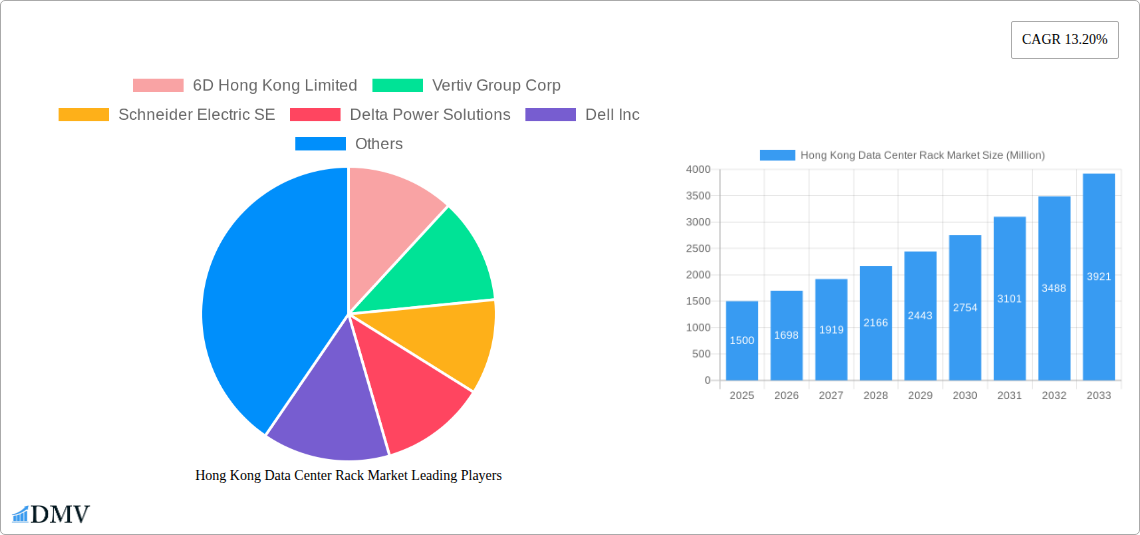

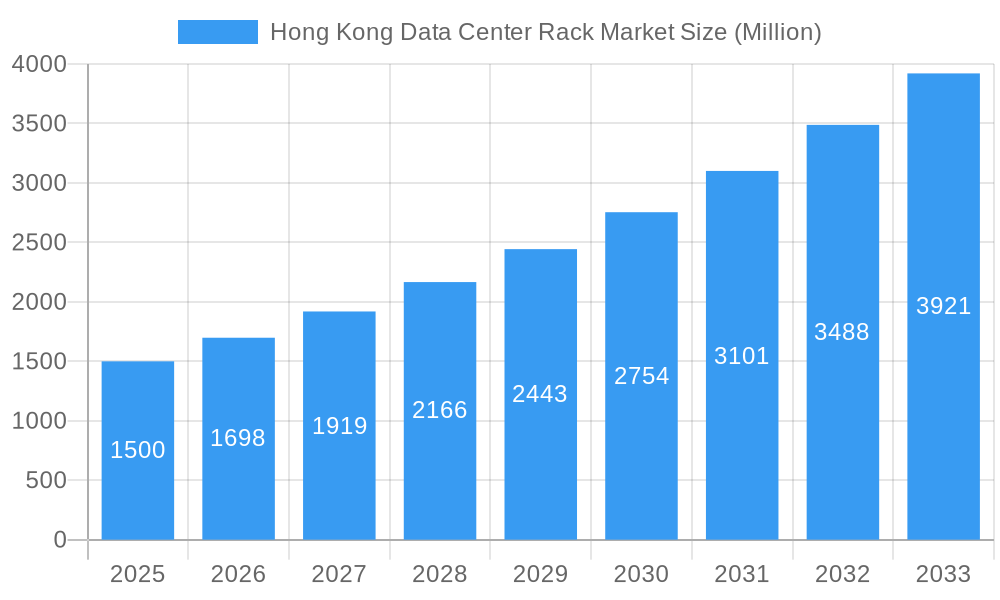

The Hong Kong Data Center Rack Market is poised for significant expansion, projected to reach a substantial market size with a robust Compound Annual Growth Rate (CAGR) of 13.20%. This growth is fueled by an escalating demand for advanced IT infrastructure, driven by the increasing digitalization across key sectors. The IT & Telecommunication industry, alongside BFSI (Banking, Financial Services, and Insurance), Government, and Media & Entertainment sectors, are leading the charge in adopting sophisticated data center solutions. This surge is attributed to the growing volume of data generated and processed, the need for enhanced cloud computing capabilities, and the proliferation of AI and IoT technologies. Furthermore, the strategic importance of Hong Kong as a major financial and business hub in Asia facilitates continuous investment in cutting-edge data center infrastructure to support these evolving technological landscapes. The market is characterized by a strong preference for flexible rack sizes, with Half Racks and Full Racks catering to diverse deployment needs, from smaller enterprise solutions to large-scale hyperscale data centers.

Hong Kong Data Center Rack Market Market Size (In Billion)

While the market benefits from strong growth drivers, certain restraints could influence the pace of expansion. These may include the high initial investment costs associated with establishing and upgrading data center facilities, stringent regulatory compliance requirements, and the ongoing challenge of acquiring and retaining skilled IT professionals. However, the persistent drive for digital transformation, the increasing adoption of edge computing, and the growing trend towards colocation services are expected to outweigh these challenges. Companies like Vertiv Group Corp, Schneider Electric SE, Eaton Corporation, and Rittal GMBH & Co KG are key players actively contributing to market innovation and expansion through their comprehensive portfolios of data center racks and related solutions. The continuous evolution of rack technology, focusing on higher density, improved cooling efficiency, and greater power distribution capabilities, will be crucial in meeting the future demands of Hong Kong's dynamic data center ecosystem.

Hong Kong Data Center Rack Market Company Market Share

This in-depth report offers a strategic analysis of the Hong Kong Data Center Rack Market, providing critical insights into its current landscape, evolutionary trends, and future trajectory. Covering the study period of 2019–2033, with a base year of 2025 and a forecast period from 2025–2033, this report is indispensable for stakeholders seeking to capitalize on the booming Asia-Pacific data center infrastructure and Hong Kong's digital transformation. Discover key drivers, emerging opportunities, competitive strategies, and technological advancements shaping the enterprise data center solutions and colocation facilities market in this dynamic region.

Hong Kong Data Center Rack Market Market Composition & Trends

The Hong Kong Data Center Rack Market is characterized by a moderate to high level of concentration, with key players like Vertiv Group Corp, Schneider Electric SE, and Rittal GMBH & Co KG holding significant market share. Innovation is primarily driven by the increasing demand for high-density server rack solutions and power distribution units (PDUs) to support burgeoning cloud computing and AI workloads. Regulatory landscapes, while generally supportive of digital infrastructure development, can present nuanced challenges related to land availability and environmental standards. Substitute products, such as modular data center solutions, are gaining traction but are yet to fully displace traditional rack infrastructure. End-user profiles are diverse, with the IT & Telecommunication sector leading adoption, followed closely by BFSI and Government entities. Mergers and acquisitions (M&A) activity is a notable trend, with significant deal values in the data center services sector, indicating a consolidation phase and a drive for expanded capacity and service offerings. M&A deal values are estimated to be in the hundreds of millions, bolstering market consolidation.

- Market Concentration: Moderate to high, dominated by established global players.

- Innovation Catalysts: Demand for high-density racks, advanced cooling solutions, and intelligent PDUs.

- Regulatory Landscape: Supportive of digital infrastructure, with evolving considerations for sustainability and land use.

- Substitute Products: Modular data centers, emerging as an alternative for rapid deployment.

- End-User Profile Dominance: IT & Telecommunication, BFSI, Government.

- M&A Activity: Significant, driving consolidation and capacity expansion.

Hong Kong Data Center Rack Market Industry Evolution

The Hong Kong Data Center Rack Market has witnessed remarkable evolution, fueled by an escalating demand for robust digital infrastructure. Over the historical period of 2019–2024, the market experienced consistent growth, driven by the rapid adoption of cloud services, the proliferation of Big Data analytics, and the growing need for reliable enterprise data storage. The estimated year of 2025 positions Hong Kong as a crucial hub for data processing and connectivity within the Asia-Pacific region. The market growth trajectory is further augmented by substantial investments in new data center facilities, responding to the exponential increase in data generation and consumption. Technological advancements have been pivotal, with a notable shift towards more energy-efficient data center racks, advanced cooling technologies such as liquid cooling, and integrated IT infrastructure management solutions. These advancements not only improve operational efficiency but also address the increasing concerns around sustainability and power consumption within data centers.

Shifting consumer demands, particularly from businesses, have also shaped the industry. The need for greater agility, scalability, and higher compute densities has spurred innovation in rack design and server enclosure capabilities. Companies are increasingly looking for colocation providers that can offer not just physical space but also comprehensive data center services, including power, cooling, and connectivity. The rise of edge computing also presents a nascent but significant demand for smaller, distributed data center footprints, which in turn influences the types of racks and associated infrastructure being developed and deployed. The IT & Telecommunication sector, being the early adopter, continues to drive demand, but the BFSI sector's increasing reliance on secure and performant data handling, alongside government initiatives for digital governance, are substantial growth propellers. The market is expected to maintain a healthy Compound Annual Growth Rate (CAGR) through the forecast period of 2025–2033, indicating sustained investor confidence and continued expansion of data center capacity. The adoption of advanced rackmount server chassis and network cabinet solutions is a direct reflection of this evolution, enabling higher equipment density and improved airflow management.

Leading Regions, Countries, or Segments in Hong Kong Data Center Rack Market

Within the Hong Kong Data Center Rack Market, the Full Rack segment commands a dominant position, driven by the escalating requirements of large-scale enterprise data centers and major colocation providers. This dominance is attributed to the inherent need for maximizing space utilization and accommodating extensive IT equipment, crucial for supporting the high-density computing demands of sectors like IT & Telecommunication and BFSI. The sheer volume of servers, storage devices, and networking hardware deployed in these environments necessitates the comprehensive capacity offered by full racks.

- Dominant Segment: Full Rack

- Drivers:

- High-Density Computing: Essential for supporting massive server deployments in large data centers.

- Scalability & Capacity: Offers the most room for expansion and housing of complex IT infrastructure.

- Cost-Effectiveness (per U): For large deployments, full racks often provide a more economical solution for housing equipment.

- Colocation Provider Preference: Standardized offering that simplifies operations and management for data center operators.

- Drivers:

The IT & Telecommunication end-user segment is a primary driver of demand for full racks. The continuous evolution of network infrastructure, the deployment of 5G technology, and the insatiable growth of cloud services necessitate significant rack space. Companies in this sector are constantly upgrading and expanding their data center footprints, making full racks the go-to solution for their consolidated IT needs.

- Dominant End-User: IT & Telecommunication

- Drivers:

- Cloud Service Expansion: Ever-increasing demand for cloud infrastructure requires massive rack deployments.

- Network Infrastructure Upgrades: 5G deployment and fiber expansion necessitate advanced server and networking equipment.

- Big Data & Analytics: Processing vast datasets requires significant server and storage capacity.

- Software-Defined Infrastructure: Increased virtualization and software-defined solutions demand dense compute and storage.

- Drivers:

Following closely, the BFSI sector's reliance on secure, high-performance, and readily accessible data for transactions, risk management, and customer service also fuels the demand for full racks. The stringent uptime requirements and data sovereignty considerations within BFSI often lead to the establishment of robust, on-premises or dedicated colocation data centers, where full racks are the norm.

- Significant End-User: BFSI

- Drivers:

- High-Frequency Trading: Requires low-latency, high-performance computing environments.

- Data Security & Compliance: Strict regulations necessitate secure and controlled data storage solutions.

- Customer Data Management: Handling vast amounts of customer data for personalized services.

- Digital Banking Transformation: Shift towards online and mobile banking services, increasing data processing needs.

- Drivers:

While Government and Media & Entertainment also contribute significantly, their specific requirements might lean towards specialized configurations or slightly smaller rack sizes depending on the scale of their operations. However, the overarching trend of digital transformation across all industries in Hong Kong points towards a sustained and growing demand for full racks as the foundational element of data center infrastructure. The continuous investment in new data center facilities, such as those planned by AirTrunk and BDx, further underscores the prominence of full racks in supporting these large-scale operations.

Hong Kong Data Center Rack Market Product Innovations

Innovation in the Hong Kong Data Center Rack Market is significantly driven by the need for enhanced efficiency, density, and manageability. Advanced server rack cabinets now feature improved airflow management systems, such as advanced venting designs and integrated fan trays, to handle the increasing thermal output of modern IT equipment. Furthermore, intelligent power distribution units (PDUs) with remote monitoring and control capabilities are becoming standard, enabling granular power management and proactive fault detection. Innovations also extend to rack cooling solutions, with a growing interest in in-row cooling and direct liquid cooling technologies to address the challenges of high-density computing. These advancements ensure optimal operating temperatures, reduce energy consumption, and extend the lifespan of sensitive IT hardware.

Propelling Factors for Hong Kong Data Center Rack Market Growth

The Hong Kong Data Center Rack Market is propelled by several key factors. Firstly, the exponential growth of cloud computing services and the increasing adoption of Big Data analytics by businesses necessitate robust and scalable data storage and processing capabilities, directly driving demand for data center racks. Secondly, substantial foreign direct investment in data center infrastructure within Hong Kong, attracted by its strategic location and favorable business environment, is fueling new facility constructions and expansions. Thirdly, government initiatives promoting digital transformation and the development of a smart city ecosystem are creating a sustained demand for advanced IT infrastructure. Finally, the increasing complexity and density of modern IT equipment, such as high-performance servers and GPUs for AI and machine learning, require specialized rack solutions that can accommodate higher power and cooling demands.

Obstacles in the Hong Kong Data Center Rack Market Market

Despite robust growth, the Hong Kong Data Center Rack Market faces certain obstacles. High land costs and limited availability in prime locations pose a significant challenge for developing new, large-scale data center facilities. Stringent environmental regulations, while necessary, can also increase the complexity and cost of construction and operation, particularly concerning power consumption and cooling methods. Furthermore, supply chain disruptions, as experienced globally, can impact the timely delivery of critical components for rack manufacturing and data center deployment. Lastly, intense competition among colocation providers and IT infrastructure vendors can lead to price pressures, affecting profit margins for rack suppliers.

Future Opportunities in Hong Kong Data Center Rack Market

Emerging opportunities within the Hong Kong Data Center Rack Market are abundant. The burgeoning demand for edge computing presents a niche but growing market for smaller, modular rack solutions in decentralized locations. The increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) workloads is creating a demand for ultra-high-density racks capable of housing specialized hardware like GPUs and TPUs. Furthermore, the continued expansion of 5G networks will necessitate more localized data processing, driving demand for racks in smaller, distributed data centers. The focus on sustainability also opens opportunities for vendors offering eco-friendly rack designs and energy-efficient cooling solutions.

Major Players in the Hong Kong Data Center Rack Market Ecosystem

- 6D Hong Kong Limited

- Vertiv Group Corp

- Schneider Electric SE

- Delta Power Solutions

- Dell Inc

- Black Box Corporation

- Cambridge Server Rack

- Rittal GMBH & Co KG

- Eaton Corporation

Key Developments in Hong Kong Data Center Rack Market Industry

- June 2023: APAC data center firm AirTrunk planned to develop a second data center facility in East New Territory, Hong Kong, with an IT load capacity of 15MW and expected to go live in mid-2024. This development signifies substantial investment and expansion in high-capacity data infrastructure.

- February 2023: Pan-Asian data center firm Big Data ExchangeX (BDx) announced that it plans to build a new 16 MW facility in an upcoming high-technology industrial area developed by Hong Kong property developer Sino Group. This initiative highlights ongoing expansion and the development of new data center sites.

Strategic Hong Kong Data Center Rack Market Market Forecast

The Hong Kong Data Center Rack Market is poised for sustained growth, driven by ongoing digital transformation initiatives and escalating demand for cloud and data-intensive services. The forecast period 2025–2033 will witness a significant uplift in the deployment of advanced rack infrastructure, particularly full racks, to accommodate the rising density of IT equipment powering AI, ML, and Big Data analytics. Strategic investments in new data center facilities by major players like AirTrunk and BDx will further catalyze market expansion. Opportunities in edge computing and sustainable rack solutions will also contribute to market diversification. The market's resilience is underpinned by Hong Kong's status as a premier financial and technological hub in Asia, ensuring continued demand for high-performance and reliable data center rack solutions.

Hong Kong Data Center Rack Market Segmentation

-

1. Rack Size

- 1.1. Quarter Rack

- 1.2. Half Rack

- 1.3. Full Rack

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-Users

Hong Kong Data Center Rack Market Segmentation By Geography

- 1. Hong Kong

Hong Kong Data Center Rack Market Regional Market Share

Geographic Coverage of Hong Kong Data Center Rack Market

Hong Kong Data Center Rack Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Advent of 5G Network Expansion and Increasing usage of IoT devices; Fiber Connectivity Network Expansion in the Country

- 3.3. Market Restrains

- 3.3.1. Increasing Cybersecurity Threats and Ransomware Attacks; Low Availability of Resources

- 3.4. Market Trends

- 3.4.1. IT & Telecom segment is expected to hold the highest market share.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Hong Kong Data Center Rack Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Rack Size

- 5.1.1. Quarter Rack

- 5.1.2. Half Rack

- 5.1.3. Full Rack

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Hong Kong

- 5.1. Market Analysis, Insights and Forecast - by Rack Size

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 6D Hong Kong Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vertiv Group Corp

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Schneider Electric SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Delta Power Solutions

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dell Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Black Box Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cambridge Server Rack

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rittal GMBH & Co KG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Eaton Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 6D Hong Kong Limited

List of Figures

- Figure 1: Hong Kong Data Center Rack Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Hong Kong Data Center Rack Market Share (%) by Company 2025

List of Tables

- Table 1: Hong Kong Data Center Rack Market Revenue Million Forecast, by Rack Size 2020 & 2033

- Table 2: Hong Kong Data Center Rack Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Hong Kong Data Center Rack Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Hong Kong Data Center Rack Market Revenue Million Forecast, by Rack Size 2020 & 2033

- Table 5: Hong Kong Data Center Rack Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Hong Kong Data Center Rack Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hong Kong Data Center Rack Market?

The projected CAGR is approximately 13.20%.

2. Which companies are prominent players in the Hong Kong Data Center Rack Market?

Key companies in the market include 6D Hong Kong Limited, Vertiv Group Corp , Schneider Electric SE, Delta Power Solutions, Dell Inc, Black Box Corporation, Cambridge Server Rack, Rittal GMBH & Co KG, Eaton Corporation.

3. What are the main segments of the Hong Kong Data Center Rack Market?

The market segments include Rack Size, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Advent of 5G Network Expansion and Increasing usage of IoT devices; Fiber Connectivity Network Expansion in the Country.

6. What are the notable trends driving market growth?

IT & Telecom segment is expected to hold the highest market share..

7. Are there any restraints impacting market growth?

Increasing Cybersecurity Threats and Ransomware Attacks; Low Availability of Resources.

8. Can you provide examples of recent developments in the market?

June 2023: APAC data center firm AirTrunk planned to develop a second data center facility in East New Territory, Hong Kong, with an IT load capacity of 15MW and expected to go live in mid-2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hong Kong Data Center Rack Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hong Kong Data Center Rack Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hong Kong Data Center Rack Market?

To stay informed about further developments, trends, and reports in the Hong Kong Data Center Rack Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence