Key Insights

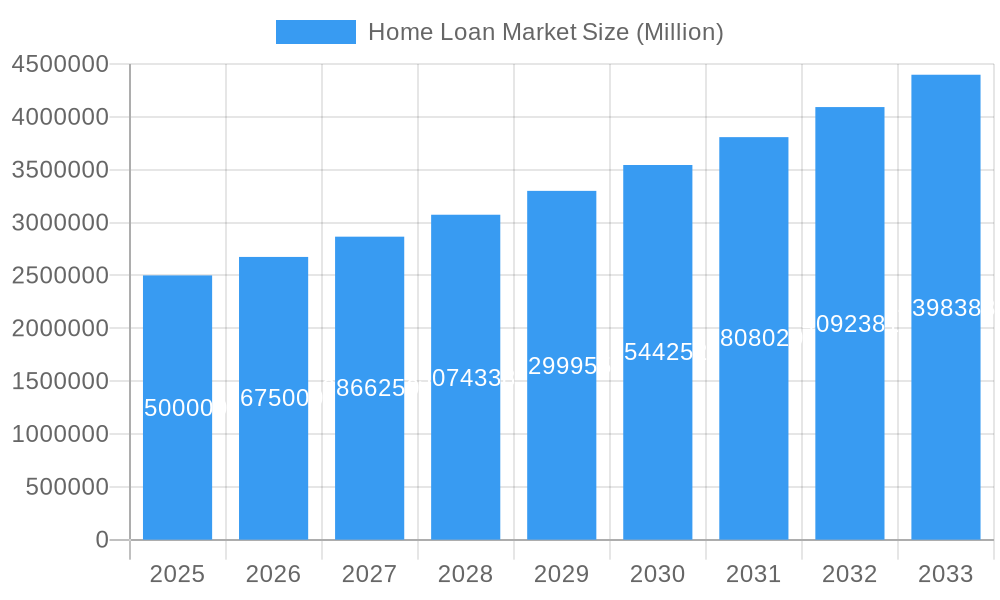

The global home loan market is experiencing significant expansion, driven by increasing urbanization, population growth, and supportive government initiatives. Factors such as rising disposable incomes and enhanced credit accessibility further fuel demand. However, economic volatility and stringent lending regulations present potential challenges. The market is segmented by loan type, term, borrower demographics, and region. Key industry players include major financial institutions and specialized housing finance corporations, with fintech companies poised to increase competition through innovative solutions. The projected Compound Annual Growth Rate (CAGR) is 5.63% from 2025 to 2033, with the market size estimated at 1.6 billion in the base year 2025.

Home Loan Market Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained market growth, influenced by macroeconomic conditions. Regional growth patterns are expected to vary, with developed markets showing steady expansion and emerging markets potentially exhibiting faster growth, contingent on local economic and regulatory factors. The emerging trend of sustainable and green mortgages is also anticipated to gain traction.

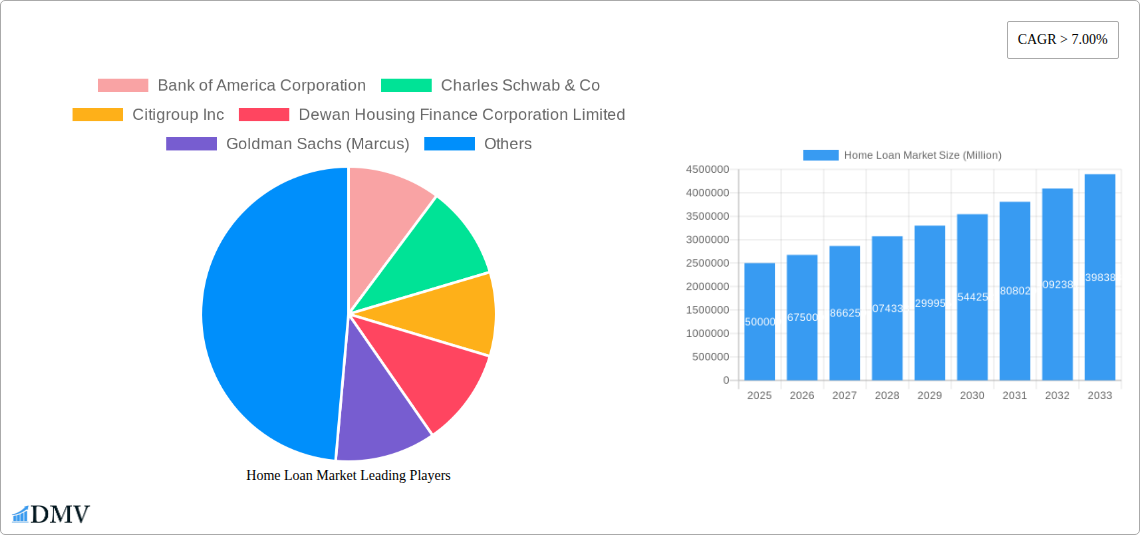

Home Loan Market Company Market Share

Global Home Loan Market Analysis: Trends, Size, and Forecast (2025-2033)

This report offers a comprehensive analysis of the global home loan market, covering market dynamics, competitive landscapes, and future growth projections for stakeholders. The market size was valued at 1.6 billion in 2025 and is projected to reach substantial figures by 2033, indicating significant growth potential.

Home Loan Market Composition & Trends

This section dissects the current Home Loan Market structure, evaluating key aspects influencing its evolution. We analyze market concentration, revealing the market share distribution among major players like Bank of America Corporation, Charles Schwab & Co, Citigroup Inc, Dewan Housing Finance Corporation Limited, Goldman Sachs (Marcus), HSBC Group, JPMorgan Chase & Co, LIC Housing Finance Limited, Morgan Stanley, and Wells Fargo & Co (list not exhaustive). The report also explores innovation catalysts, such as fintech advancements and evolving consumer preferences, alongside the regulatory landscape and its impact. Substitute products and their market penetration are also assessed. Finally, the report examines M&A activities, providing insights into deal values and their implications for market consolidation.

- Market Concentration: Analysis of market share held by top players; identification of highly concentrated segments.

- Innovation Catalysts: Discussion of Fintech integration, personalized loan offerings, and digital lending platforms.

- Regulatory Landscape: Assessment of compliance requirements and their influence on market dynamics.

- Substitute Products: Evaluation of alternative financing options and their competitive threat.

- End-User Profiles: Segmentation of borrowers based on demographics, credit scores, and income levels.

- M&A Activities: Review of significant mergers and acquisitions, including deal values and their strategic implications. Total M&A deal value in the observed period is estimated at xx Million.

Home Loan Market Industry Evolution

This section provides a comprehensive overview of the Home Loan Market's evolutionary trajectory from 2019 to 2033. We analyze market growth trajectories, dissecting the factors driving expansion and identifying potential limitations. Technological advancements, such as AI-powered credit scoring and blockchain-based security, are evaluated for their impact on efficiency and accessibility. The report also examines shifting consumer demands, incorporating factors like increased demand for sustainable housing and personalized financial solutions. Specific data points such as annual growth rates and adoption metrics of new technologies are included. For example, the market is projected to grow at a CAGR of xx% during the forecast period.

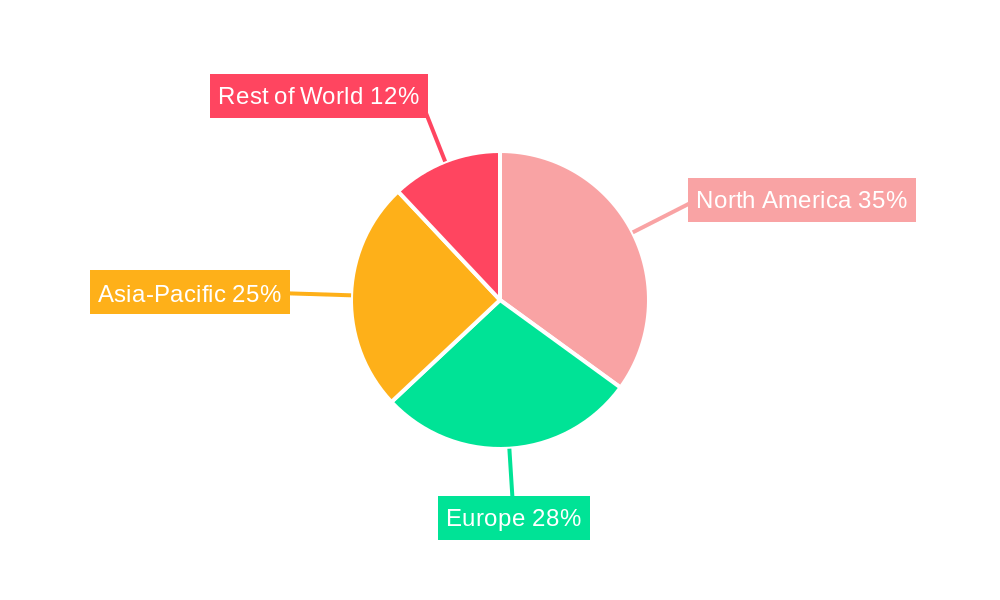

Leading Regions, Countries, or Segments in Home Loan Market

This section identifies the leading regions, countries, or segments within the Home Loan Market. Detailed analysis pinpoints the factors contributing to their dominance, including investment trends, government policies, and economic conditions.

- Key Drivers of Dominance:

- Favorable government policies promoting homeownership.

- Robust economic growth and rising disposable incomes.

- High levels of foreign direct investment in the real estate sector.

- Well-established financial infrastructure and access to credit.

- In-depth Analysis: The report offers a detailed regional analysis, highlighting specific market conditions, regulations, and consumer behaviors contributing to the dominance of the leading regions.

Home Loan Market Product Innovations

This section showcases recent product innovations within the Home Loan Market. We highlight unique selling propositions, such as customizable loan terms, bundled financial services, and improved digital onboarding processes. Technological advancements, including the integration of AI and machine learning for credit risk assessment, are also emphasized. Performance metrics, like loan approval rates and customer satisfaction scores, are included.

Propelling Factors for Home Loan Market Growth

Several factors contribute to the projected growth of the Home Loan Market. Technological advancements like AI-powered underwriting are accelerating loan processing and reducing costs, increasing efficiency and accessibility. Favorable economic conditions, including low-interest rates and rising disposable incomes, are further stimulating demand. Supportive government policies, such as tax incentives for first-time homebuyers, are also enhancing market growth.

Obstacles in the Home Loan Market

Despite the positive growth outlook, several challenges could hinder market expansion. Stringent regulatory requirements and compliance complexities can increase operational costs and slow down loan processing times. Supply chain disruptions, particularly in the construction industry, could affect the availability of housing and thus the demand for home loans. Furthermore, intense competition among lenders and the emergence of alternative financing options pose significant competitive pressures. These factors could potentially limit market growth by an estimated xx Million by 2033.

Future Opportunities in Home Loan Market

The future of the Home Loan Market presents numerous opportunities. Expanding into underserved markets with high growth potential, particularly in developing economies, offers significant potential. Further leveraging technological advancements such as blockchain for enhanced security and transparency, and AI for personalized loan offerings, will also create new avenues for growth. Catering to evolving consumer preferences, such as offering sustainable home loan options and personalized financial services, will attract a wider customer base.

Major Players in the Home Loan Market Ecosystem

- Bank of America Corporation

- Charles Schwab & Co

- Citigroup Inc

- Dewan Housing Finance Corporation Limited

- Goldman Sachs (Marcus)

- HSBC Group

- JPMorgan Chase & Co

- LIC Housing Finance Limited

- Morgan Stanley

- Wells Fargo & Co (List Not Exhaustive)

Key Developments in Home Loan Market Industry

- September 2022: Citigroup Inc. slightly reduced its mortgage workforce due to internal restructuring (less than 100 positions affected). This indicates a potential shift in strategic focus within the company's mortgage operations.

- September 2022: Bank of America launched a novel mortgage product targeting first-time homebuyers. This product offers no down payment, no mortgage insurance, and zero closing costs, expanding access to homeownership. The impact of this launch could be significant, increasing market competition and potentially attracting a wider range of borrowers.

Strategic Home Loan Market Forecast

The Home Loan Market is poised for continued growth driven by technological advancements, favorable economic conditions, and supportive government policies. Emerging opportunities in underserved markets and the increasing adoption of innovative financial technologies present significant potential for market expansion. While challenges such as regulatory hurdles and competitive pressures exist, the overall outlook remains positive, with significant growth projected throughout the forecast period.

Home Loan Market Segmentation

-

1. Provider

- 1.1. Banks

- 1.2. Housing Finance Companies

- 1.3. Other

-

2. Interest Rate

- 2.1. Fixed Interest Rate

- 2.2. Floating Interest Rate

-

3. Tenure

- 3.1. Less Than 5 years

- 3.2. 6-10 years

- 3.3. 11-24 years

- 3.4. 25-30 years

Home Loan Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Latin America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Colombia

- 2.4. Chile

- 2.5. Mexico

- 2.6. Rest of Latin America

-

3. Europe

- 3.1. UK

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Netherlands

- 3.6. Rest of Europe

-

4. Asia Pacific

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Australia

- 4.5. Singapore

- 4.6. South Korea

- 4.7. Rest of Asia Pacific

- 5. Middle East

-

6. Saudi Arabia

- 6.1. Egypt

- 6.2. UAE

- 6.3. Rest of Middle East and Africa

Home Loan Market Regional Market Share

Geographic Coverage of Home Loan Market

Home Loan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Real Estate Market Trends; Government Policies

- 3.3. Market Restrains

- 3.3.1. Real Estate Market Trends; Government Policies

- 3.4. Market Trends

- 3.4.1. Turkey has the Highest Mortgage Interest Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Home Loan Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Provider

- 5.1.1. Banks

- 5.1.2. Housing Finance Companies

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Interest Rate

- 5.2.1. Fixed Interest Rate

- 5.2.2. Floating Interest Rate

- 5.3. Market Analysis, Insights and Forecast - by Tenure

- 5.3.1. Less Than 5 years

- 5.3.2. 6-10 years

- 5.3.3. 11-24 years

- 5.3.4. 25-30 years

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Latin America

- 5.4.3. Europe

- 5.4.4. Asia Pacific

- 5.4.5. Middle East

- 5.4.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Provider

- 6. North America Home Loan Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Provider

- 6.1.1. Banks

- 6.1.2. Housing Finance Companies

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Interest Rate

- 6.2.1. Fixed Interest Rate

- 6.2.2. Floating Interest Rate

- 6.3. Market Analysis, Insights and Forecast - by Tenure

- 6.3.1. Less Than 5 years

- 6.3.2. 6-10 years

- 6.3.3. 11-24 years

- 6.3.4. 25-30 years

- 6.1. Market Analysis, Insights and Forecast - by Provider

- 7. Latin America Home Loan Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Provider

- 7.1.1. Banks

- 7.1.2. Housing Finance Companies

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Interest Rate

- 7.2.1. Fixed Interest Rate

- 7.2.2. Floating Interest Rate

- 7.3. Market Analysis, Insights and Forecast - by Tenure

- 7.3.1. Less Than 5 years

- 7.3.2. 6-10 years

- 7.3.3. 11-24 years

- 7.3.4. 25-30 years

- 7.1. Market Analysis, Insights and Forecast - by Provider

- 8. Europe Home Loan Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Provider

- 8.1.1. Banks

- 8.1.2. Housing Finance Companies

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Interest Rate

- 8.2.1. Fixed Interest Rate

- 8.2.2. Floating Interest Rate

- 8.3. Market Analysis, Insights and Forecast - by Tenure

- 8.3.1. Less Than 5 years

- 8.3.2. 6-10 years

- 8.3.3. 11-24 years

- 8.3.4. 25-30 years

- 8.1. Market Analysis, Insights and Forecast - by Provider

- 9. Asia Pacific Home Loan Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Provider

- 9.1.1. Banks

- 9.1.2. Housing Finance Companies

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Interest Rate

- 9.2.1. Fixed Interest Rate

- 9.2.2. Floating Interest Rate

- 9.3. Market Analysis, Insights and Forecast - by Tenure

- 9.3.1. Less Than 5 years

- 9.3.2. 6-10 years

- 9.3.3. 11-24 years

- 9.3.4. 25-30 years

- 9.1. Market Analysis, Insights and Forecast - by Provider

- 10. Middle East Home Loan Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Provider

- 10.1.1. Banks

- 10.1.2. Housing Finance Companies

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Interest Rate

- 10.2.1. Fixed Interest Rate

- 10.2.2. Floating Interest Rate

- 10.3. Market Analysis, Insights and Forecast - by Tenure

- 10.3.1. Less Than 5 years

- 10.3.2. 6-10 years

- 10.3.3. 11-24 years

- 10.3.4. 25-30 years

- 10.1. Market Analysis, Insights and Forecast - by Provider

- 11. Saudi Arabia Home Loan Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Provider

- 11.1.1. Banks

- 11.1.2. Housing Finance Companies

- 11.1.3. Other

- 11.2. Market Analysis, Insights and Forecast - by Interest Rate

- 11.2.1. Fixed Interest Rate

- 11.2.2. Floating Interest Rate

- 11.3. Market Analysis, Insights and Forecast - by Tenure

- 11.3.1. Less Than 5 years

- 11.3.2. 6-10 years

- 11.3.3. 11-24 years

- 11.3.4. 25-30 years

- 11.1. Market Analysis, Insights and Forecast - by Provider

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Bank of America Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Charles Schwab & Co

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Citigroup Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Dewan Housing Finance Corporation Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Goldman Sachs (Marcus)

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 HSBC Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 JPMorgan Chase & Co

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 LIC Housing Finance Limited

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Morgan Stanley

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Wells Fargo & Co **List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Bank of America Corporation

List of Figures

- Figure 1: Global Home Loan Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Home Loan Market Revenue (billion), by Provider 2025 & 2033

- Figure 3: North America Home Loan Market Revenue Share (%), by Provider 2025 & 2033

- Figure 4: North America Home Loan Market Revenue (billion), by Interest Rate 2025 & 2033

- Figure 5: North America Home Loan Market Revenue Share (%), by Interest Rate 2025 & 2033

- Figure 6: North America Home Loan Market Revenue (billion), by Tenure 2025 & 2033

- Figure 7: North America Home Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 8: North America Home Loan Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Home Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Latin America Home Loan Market Revenue (billion), by Provider 2025 & 2033

- Figure 11: Latin America Home Loan Market Revenue Share (%), by Provider 2025 & 2033

- Figure 12: Latin America Home Loan Market Revenue (billion), by Interest Rate 2025 & 2033

- Figure 13: Latin America Home Loan Market Revenue Share (%), by Interest Rate 2025 & 2033

- Figure 14: Latin America Home Loan Market Revenue (billion), by Tenure 2025 & 2033

- Figure 15: Latin America Home Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 16: Latin America Home Loan Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America Home Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Home Loan Market Revenue (billion), by Provider 2025 & 2033

- Figure 19: Europe Home Loan Market Revenue Share (%), by Provider 2025 & 2033

- Figure 20: Europe Home Loan Market Revenue (billion), by Interest Rate 2025 & 2033

- Figure 21: Europe Home Loan Market Revenue Share (%), by Interest Rate 2025 & 2033

- Figure 22: Europe Home Loan Market Revenue (billion), by Tenure 2025 & 2033

- Figure 23: Europe Home Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 24: Europe Home Loan Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Home Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Home Loan Market Revenue (billion), by Provider 2025 & 2033

- Figure 27: Asia Pacific Home Loan Market Revenue Share (%), by Provider 2025 & 2033

- Figure 28: Asia Pacific Home Loan Market Revenue (billion), by Interest Rate 2025 & 2033

- Figure 29: Asia Pacific Home Loan Market Revenue Share (%), by Interest Rate 2025 & 2033

- Figure 30: Asia Pacific Home Loan Market Revenue (billion), by Tenure 2025 & 2033

- Figure 31: Asia Pacific Home Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 32: Asia Pacific Home Loan Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Asia Pacific Home Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Home Loan Market Revenue (billion), by Provider 2025 & 2033

- Figure 35: Middle East Home Loan Market Revenue Share (%), by Provider 2025 & 2033

- Figure 36: Middle East Home Loan Market Revenue (billion), by Interest Rate 2025 & 2033

- Figure 37: Middle East Home Loan Market Revenue Share (%), by Interest Rate 2025 & 2033

- Figure 38: Middle East Home Loan Market Revenue (billion), by Tenure 2025 & 2033

- Figure 39: Middle East Home Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 40: Middle East Home Loan Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East Home Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Saudi Arabia Home Loan Market Revenue (billion), by Provider 2025 & 2033

- Figure 43: Saudi Arabia Home Loan Market Revenue Share (%), by Provider 2025 & 2033

- Figure 44: Saudi Arabia Home Loan Market Revenue (billion), by Interest Rate 2025 & 2033

- Figure 45: Saudi Arabia Home Loan Market Revenue Share (%), by Interest Rate 2025 & 2033

- Figure 46: Saudi Arabia Home Loan Market Revenue (billion), by Tenure 2025 & 2033

- Figure 47: Saudi Arabia Home Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 48: Saudi Arabia Home Loan Market Revenue (billion), by Country 2025 & 2033

- Figure 49: Saudi Arabia Home Loan Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Home Loan Market Revenue billion Forecast, by Provider 2020 & 2033

- Table 2: Global Home Loan Market Revenue billion Forecast, by Interest Rate 2020 & 2033

- Table 3: Global Home Loan Market Revenue billion Forecast, by Tenure 2020 & 2033

- Table 4: Global Home Loan Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Home Loan Market Revenue billion Forecast, by Provider 2020 & 2033

- Table 6: Global Home Loan Market Revenue billion Forecast, by Interest Rate 2020 & 2033

- Table 7: Global Home Loan Market Revenue billion Forecast, by Tenure 2020 & 2033

- Table 8: Global Home Loan Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Home Loan Market Revenue billion Forecast, by Provider 2020 & 2033

- Table 12: Global Home Loan Market Revenue billion Forecast, by Interest Rate 2020 & 2033

- Table 13: Global Home Loan Market Revenue billion Forecast, by Tenure 2020 & 2033

- Table 14: Global Home Loan Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: Brazil Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Argentina Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Colombia Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Chile Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Mexico Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Latin America Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Home Loan Market Revenue billion Forecast, by Provider 2020 & 2033

- Table 22: Global Home Loan Market Revenue billion Forecast, by Interest Rate 2020 & 2033

- Table 23: Global Home Loan Market Revenue billion Forecast, by Tenure 2020 & 2033

- Table 24: Global Home Loan Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: UK Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Germany Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: France Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Italy Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Netherlands Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of Europe Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Global Home Loan Market Revenue billion Forecast, by Provider 2020 & 2033

- Table 32: Global Home Loan Market Revenue billion Forecast, by Interest Rate 2020 & 2033

- Table 33: Global Home Loan Market Revenue billion Forecast, by Tenure 2020 & 2033

- Table 34: Global Home Loan Market Revenue billion Forecast, by Country 2020 & 2033

- Table 35: China Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: India Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Australia Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Singapore Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Korea Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Asia Pacific Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global Home Loan Market Revenue billion Forecast, by Provider 2020 & 2033

- Table 43: Global Home Loan Market Revenue billion Forecast, by Interest Rate 2020 & 2033

- Table 44: Global Home Loan Market Revenue billion Forecast, by Tenure 2020 & 2033

- Table 45: Global Home Loan Market Revenue billion Forecast, by Country 2020 & 2033

- Table 46: Global Home Loan Market Revenue billion Forecast, by Provider 2020 & 2033

- Table 47: Global Home Loan Market Revenue billion Forecast, by Interest Rate 2020 & 2033

- Table 48: Global Home Loan Market Revenue billion Forecast, by Tenure 2020 & 2033

- Table 49: Global Home Loan Market Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Egypt Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: UAE Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Middle East and Africa Home Loan Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Home Loan Market?

The projected CAGR is approximately 5.63%.

2. Which companies are prominent players in the Home Loan Market?

Key companies in the market include Bank of America Corporation, Charles Schwab & Co, Citigroup Inc, Dewan Housing Finance Corporation Limited, Goldman Sachs (Marcus), HSBC Group, JPMorgan Chase & Co, LIC Housing Finance Limited, Morgan Stanley, Wells Fargo & Co **List Not Exhaustive.

3. What are the main segments of the Home Loan Market?

The market segments include Provider, Interest Rate, Tenure.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Real Estate Market Trends; Government Policies.

6. What are the notable trends driving market growth?

Turkey has the Highest Mortgage Interest Rate.

7. Are there any restraints impacting market growth?

Real Estate Market Trends; Government Policies.

8. Can you provide examples of recent developments in the market?

September 2022: Citigroup Inc said it has slightly trimmed its mortgage workforce, due to an internal streamlining of functions.Less than 100 positions were affected.September 2022: Bank of America is launching a new mortgage product that would allow first-time homebuyers to purchase a home with no down payment, no mortgage insurance and zero closing costs.It will not require a minimum credit score and will instead consider other factors for eligibility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Home Loan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Home Loan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Home Loan Market?

To stay informed about further developments, trends, and reports in the Home Loan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence