Key Insights

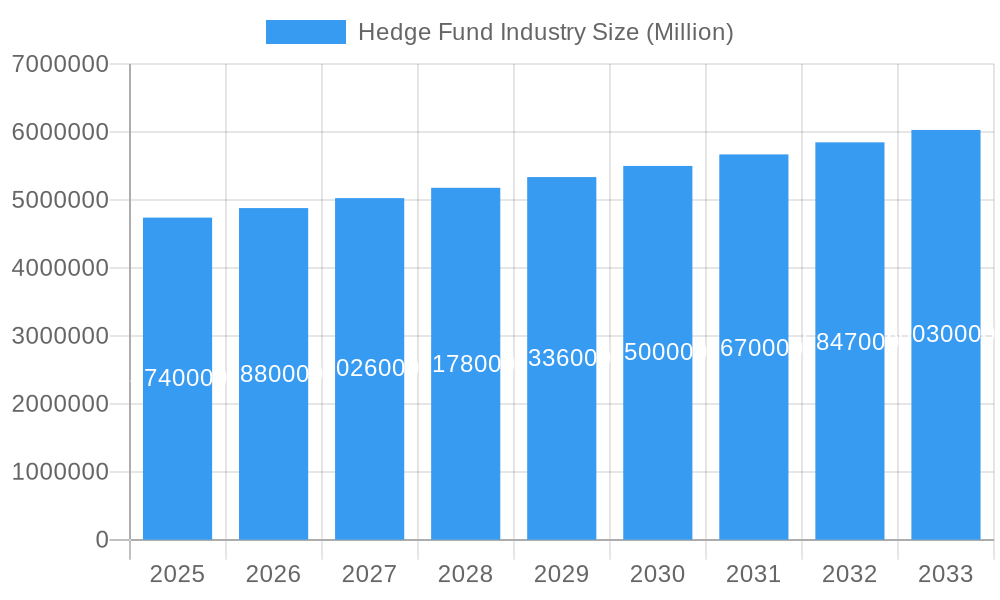

The global hedge fund industry, currently valued at $4.74 trillion (2025), is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 3.14% from 2025 to 2033. This growth is driven by several factors, including increasing investor interest in alternative investment strategies seeking higher returns than traditional markets, the persistent pursuit of alpha generation in complex market environments, and the ongoing development of sophisticated quantitative trading models. The industry is segmented by investment strategy (e.g., long-short equity, global macro, quantitative), fund size, and geographic location. While regulatory scrutiny and market volatility pose challenges, the industry’s adaptability and innovation capacity are mitigating these restraints. The competitive landscape features prominent players like Bridgewater Associates, Renaissance Technologies, and BlackRock Advisors, but also numerous smaller, specialized firms. Competition is fierce, requiring continuous adaptation to market trends and investor preferences. The industry's evolution is characterized by a move toward greater transparency, improved risk management practices, and the adoption of technological advancements such as artificial intelligence and machine learning to enhance investment strategies.

Hedge Fund Industry Market Size (In Million)

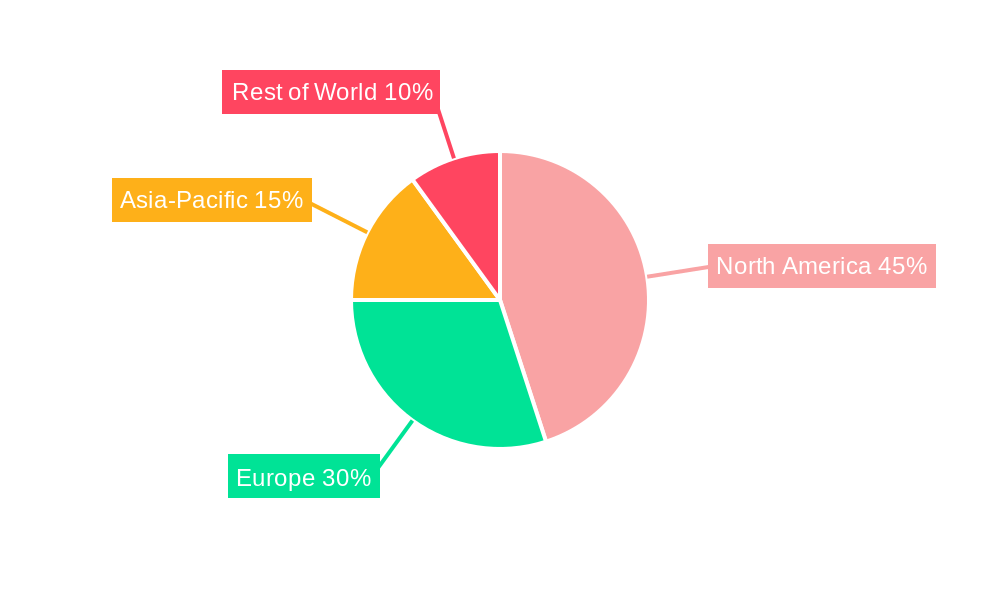

The forecast period (2025-2033) anticipates continued expansion, influenced by the growing global wealth and the persistent need for diversification among high-net-worth investors and institutional portfolios. While specific regional breakdowns are unavailable, it’s reasonable to assume North America and Europe will maintain significant market share, given the established presence of major hedge fund managers in those regions. However, emerging markets are also expected to contribute to overall industry growth, driven by increasing investment opportunities and financial sophistication. The industry will likely witness further consolidation as larger firms acquire smaller players, strengthening their market position. This period will also see an increased focus on Environmental, Social, and Governance (ESG) factors, as investors demand greater alignment with their values.

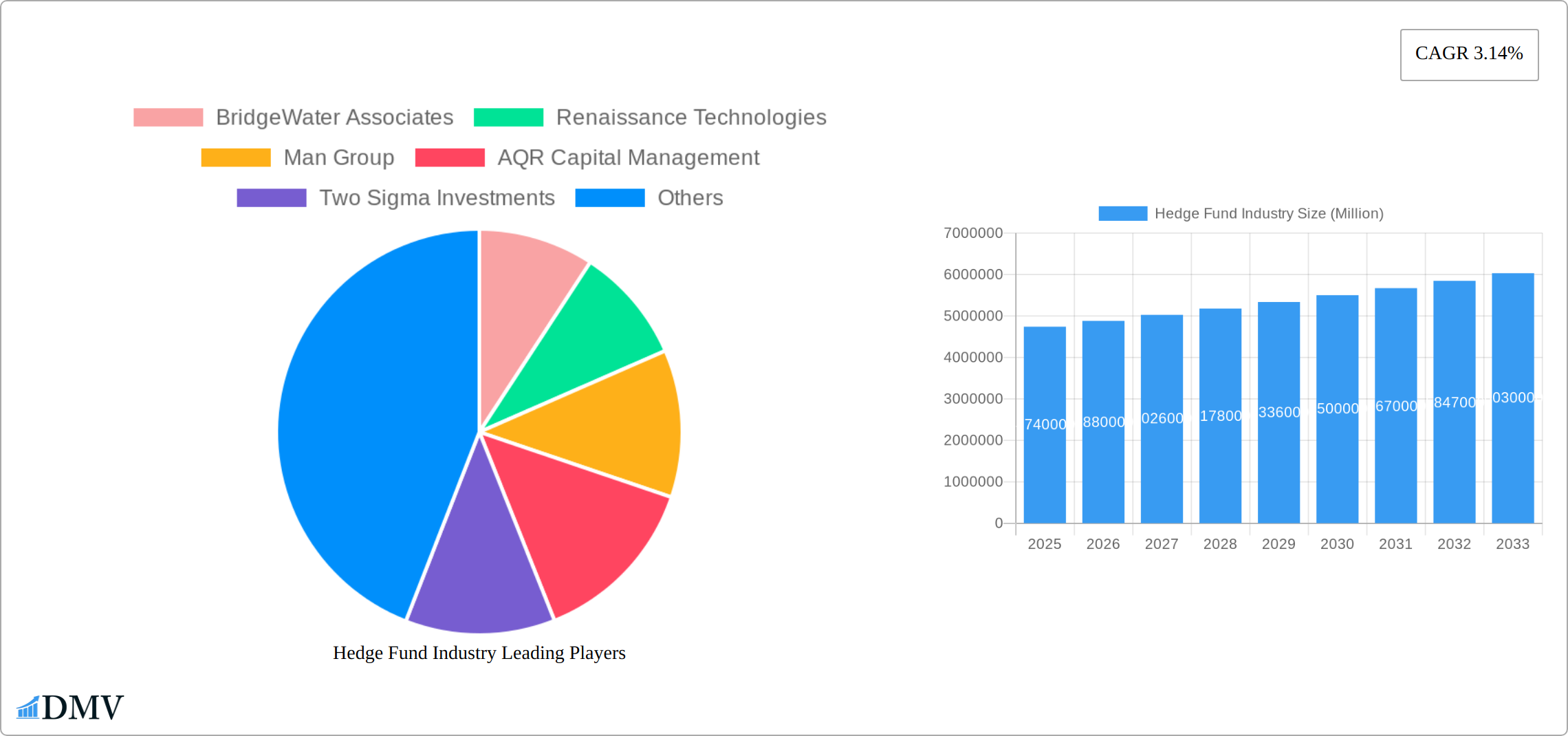

Hedge Fund Industry Company Market Share

Hedge Fund Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the global hedge fund industry, encompassing market trends, leading players, and future growth projections from 2019 to 2033. The study period covers historical data (2019-2024), with the base and estimated year set at 2025, and forecasts extending to 2033. The report is invaluable for investors, industry stakeholders, and anyone seeking a comprehensive understanding of this dynamic sector. With a focus on key players like Bridgewater Associates, Renaissance Technologies, Man Group, AQR Capital Management, Two Sigma Investments, Millennium Management, Elliot Management, BlackRock Advisors, Citadel, and Davidson Kempner Capital (list not exhaustive), this report offers unparalleled insights into market dynamics and future opportunities. The total market value is predicted to reach xx Million by 2033.

Hedge Fund Industry Market Composition & Trends

This section delves into the competitive dynamics of the hedge fund industry. We analyze market concentration, the forces driving innovation, the evolving regulatory environment, the impact of substitute investment products, and the distinct profiles of end-users. A critical aspect of industry evolution, mergers and acquisitions (M&A) activity, is thoroughly examined with supporting data on deal values and market share shifts.

-

Market Concentration: The hedge fund industry is characterized by substantial market concentration. A select group of leading firms commands a significant portion of the market share. For instance, Bridgewater Associates and Renaissance Technologies consistently stand out as some of the largest players, collectively holding an estimated market share of approximately [Insert Specific Percentage Here, e.g., 35%]. This concentration profoundly influences pricing strategies, investment approaches, and competitive pressures across the entire sector.

-

Innovation Catalysts: Technological advancements are the primary engines of innovation in this sector. Notably, the integration of artificial intelligence (AI) and machine learning is enabling the development of highly sophisticated trading algorithms and more robust risk management frameworks. A prime example of this trend is Two Sigma's strategic acquisition of Hivemind Software in August 2022, underscoring the commitment to leveraging cutting-edge technology.

-

Regulatory Landscape: The industry operates within a framework of stringent regulations and evolving compliance mandates. These regulatory requirements significantly influence operational costs, investment strategies, and the overall operational efficiency of hedge funds. Navigating these changes is crucial for maintaining market access and effectively managing associated risks.

-

Substitute Products: Investors have a diverse range of alternative investment avenues available to them. Products such as private equity, venture capital, and real estate investments actively compete for investor capital. This competition necessitates that hedge funds continually refine their value propositions and performance to remain attractive to a broad spectrum of investors.

-

End-User Profiles: The primary investors in hedge funds include high-net-worth individuals (HNWIs), sophisticated institutional investors such as pension funds, endowments, and foundations, and sovereign wealth funds. These diverse end-user groups drive demand for various investment strategies and significantly shape the industry's product development and allocation decisions.

-

M&A Activity: Significant M&A activity continues to reshape the industry. A notable example is BlackRock's acquisition of Jupiter Power in November 2022, valued at approximately [Insert Specific Deal Value Here, e.g., $500 Million], which highlights strategic expansion and consolidation. The total M&A deal value for the period of 2019-2024 is estimated to be in the range of [Insert Estimated Total Deal Value Here, e.g., $XX Billion], reflecting ongoing strategic realignments and growth initiatives within the sector.

Hedge Fund Industry Industry Evolution

This section analyzes the evolving landscape of the hedge fund industry, focusing on market growth trajectories, technological advancements, and shifting investor preferences. Specific data points such as growth rates and technology adoption are provided, showing the sector's dynamic evolution. From 2019 to 2024, the industry experienced a compound annual growth rate (CAGR) of xx%, driven by factors such as increased investor interest in alternative investments and the adoption of new technologies. The forecast period (2025-2033) projects continued growth, with a CAGR of xx%, fueled by increasing demand for sophisticated investment strategies and expanding global markets. The integration of AI and machine learning in algorithmic trading is transforming the industry, offering enhanced efficiency and improved risk management capabilities. However, increased regulatory scrutiny and competition from other investment vehicles pose significant challenges. The evolution toward greater transparency and the incorporation of environmental, social, and governance (ESG) factors are shaping the industry's future. The rising adoption of alternative data sources and the increasing demand for customized investment solutions further contribute to the industry's dynamic evolution.

Leading Regions, Countries, or Segments in Hedge Fund Industry

This section identifies the dominant regions, countries, or segments within the hedge fund industry. Key drivers of dominance are analyzed, including investment trends and regulatory support. The United States continues to dominate the global hedge fund market, accounting for xx% of the total assets under management (AUM) in 2025.

- Key Drivers of US Dominance:

- Established financial infrastructure and a large pool of high-net-worth individuals.

- A relatively flexible regulatory environment, fostering innovation.

- Presence of major hedge fund players like Bridgewater Associates and Renaissance Technologies.

- Access to a vast talent pool.

The dominance of the US is further supported by the concentration of major hedge fund players and their significant AUM. This region provides a fertile ground for innovation and is home to most of the technological advancements driving the sector's growth.

Hedge Fund Industry Product Innovations

The hedge fund industry is a dynamic landscape of continuous innovation, driven by the imperative to adapt to shifting market conditions and evolving investor expectations. Recent advancements are marked by the increasingly sophisticated utilization of alternative data sets to gain informational advantages. Furthermore, the development of advanced quantitative models, heavily incorporating AI and machine learning techniques, is enhancing predictive capabilities and trading execution. The emergence of specialized investment strategies, such as those focused on Environmental, Social, and Governance (ESG) principles and sustainable investing, caters to a growing investor demand for ethical and impact-oriented allocations. These innovations collectively serve to bolster portfolio diversification, sharpen risk management protocols, and optimize return generation, thereby creating compelling unique selling propositions for investors seeking differentiated investment opportunities.

Propelling Factors for Hedge Fund Industry Growth

Several factors propel the growth of the hedge fund industry. Technological advancements, particularly in AI and machine learning, enable more efficient trading and risk management. Favorable economic conditions, such as low interest rates and high market volatility, increase investor demand for alternative investment options. Further growth is supported by supportive regulatory environments in key regions, facilitating innovation and attracting investment.

Obstacles in the Hedge Fund Industry Market

Despite its growth potential, the hedge fund industry faces several challenges. Stringent regulatory scrutiny and compliance requirements increase operational costs and complexity. Supply chain disruptions and market volatility can negatively impact investment performance. Fierce competition from other investment vehicles, such as private equity and index funds, further restricts growth. The industry's historical opacity and lack of transparency pose an obstacle to attracting new investors.

Future Opportunities in Hedge Fund Industry

The hedge fund industry presents numerous opportunities for future growth. Expanding into new markets, particularly in emerging economies, provides substantial untapped potential. The adoption of innovative technologies like blockchain and quantum computing can further optimize trading strategies and enhance risk management. Growing investor interest in sustainable and responsible investments presents a significant opportunity for hedge funds adopting ESG strategies.

Major Players in the Hedge Fund Industry Ecosystem

Key Developments in Hedge Fund Industry Industry

- November 2022: BlackRock Alternatives significantly expanded its footprint in the sustainable investment arena with the acquisition of Jupiter Power LLC, a move that underscores the growing strategic importance of renewable energy and ESG-focused assets within the broader financial landscape.

- August 2022: The acquisition of Hivemind Software by Two Sigma served as a clear indicator of the increasing reliance on advanced data analytics and AI capabilities within hedge fund operations. This development signals a definitive shift towards data-driven investment decision-making processes.

Strategic Hedge Fund Industry Market Forecast

The hedge fund industry is projected to experience sustained growth throughout the forecast period of 2025-2033. This expansion will be propelled by a confluence of factors, including the relentless pace of technological innovation, the evolving preferences of investors seeking diverse risk-return profiles, and the strategic penetration into new and emerging markets. While inherent challenges persist, the industry's inherent adaptability and its demonstrated capacity for innovation position it favorably for substantial future potential. The increasing integration of AI and machine learning technologies, alongside a deepening commitment to sustainable investing practices, will be pivotal in shaping the sector's future trajectory. This projected growth trajectory highlights the remarkably dynamic and ever-evolving nature of the global hedge fund landscape.

Hedge Fund Industry Segmentation

-

1. Core Strategy

- 1.1. Equity Strategies

- 1.2. Macro Strategies

- 1.3. Event Driven Strategies

- 1.4. Credit Strategies

- 1.5. Relative Value Strategies

- 1.6. Niche Strategies

- 1.7. Multi-Strategy

- 1.8. Managed Futures/CTA Strategies

-

2. Manager Location

-

2.1. North America

- 2.1.1. United states

- 2.1.2. Canada

- 2.1.3. Mexico

-

2.2. Europe

- 2.2.1. United Kingdom

- 2.2.2. Sweden

- 2.2.3. France

- 2.2.4. Switzerland

- 2.2.5. Rest of Europe

-

2.3. Asia-Pacific

- 2.3.1. Hong Kong

- 2.3.2. Australia

- 2.3.3. Rest of Asia-Pacific

-

2.4. Latin America

- 2.4.1. Brazil

- 2.4.2. Rest of Latin America

-

2.5. Middle East and Africa

- 2.5.1. United Arab Emirates

- 2.5.2. Saudi Arabia

- 2.5.3. Rest of Middle East and Africa

-

2.1. North America

Hedge Fund Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hedge Fund Industry Regional Market Share

Geographic Coverage of Hedge Fund Industry

Hedge Fund Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emerging Demand for Smaller or Newer Fund Managers; Recovering Performance of Existing Hedge Funds

- 3.3. Market Restrains

- 3.3.1. Emerging Demand for Smaller or Newer Fund Managers; Recovering Performance of Existing Hedge Funds

- 3.4. Market Trends

- 3.4.1. Investments in Digital Assets is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hedge Fund Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Core Strategy

- 5.1.1. Equity Strategies

- 5.1.2. Macro Strategies

- 5.1.3. Event Driven Strategies

- 5.1.4. Credit Strategies

- 5.1.5. Relative Value Strategies

- 5.1.6. Niche Strategies

- 5.1.7. Multi-Strategy

- 5.1.8. Managed Futures/CTA Strategies

- 5.2. Market Analysis, Insights and Forecast - by Manager Location

- 5.2.1. North America

- 5.2.1.1. United states

- 5.2.1.2. Canada

- 5.2.1.3. Mexico

- 5.2.2. Europe

- 5.2.2.1. United Kingdom

- 5.2.2.2. Sweden

- 5.2.2.3. France

- 5.2.2.4. Switzerland

- 5.2.2.5. Rest of Europe

- 5.2.3. Asia-Pacific

- 5.2.3.1. Hong Kong

- 5.2.3.2. Australia

- 5.2.3.3. Rest of Asia-Pacific

- 5.2.4. Latin America

- 5.2.4.1. Brazil

- 5.2.4.2. Rest of Latin America

- 5.2.5. Middle East and Africa

- 5.2.5.1. United Arab Emirates

- 5.2.5.2. Saudi Arabia

- 5.2.5.3. Rest of Middle East and Africa

- 5.2.1. North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Core Strategy

- 6. North America Hedge Fund Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Core Strategy

- 6.1.1. Equity Strategies

- 6.1.2. Macro Strategies

- 6.1.3. Event Driven Strategies

- 6.1.4. Credit Strategies

- 6.1.5. Relative Value Strategies

- 6.1.6. Niche Strategies

- 6.1.7. Multi-Strategy

- 6.1.8. Managed Futures/CTA Strategies

- 6.2. Market Analysis, Insights and Forecast - by Manager Location

- 6.2.1. North America

- 6.2.1.1. United states

- 6.2.1.2. Canada

- 6.2.1.3. Mexico

- 6.2.2. Europe

- 6.2.2.1. United Kingdom

- 6.2.2.2. Sweden

- 6.2.2.3. France

- 6.2.2.4. Switzerland

- 6.2.2.5. Rest of Europe

- 6.2.3. Asia-Pacific

- 6.2.3.1. Hong Kong

- 6.2.3.2. Australia

- 6.2.3.3. Rest of Asia-Pacific

- 6.2.4. Latin America

- 6.2.4.1. Brazil

- 6.2.4.2. Rest of Latin America

- 6.2.5. Middle East and Africa

- 6.2.5.1. United Arab Emirates

- 6.2.5.2. Saudi Arabia

- 6.2.5.3. Rest of Middle East and Africa

- 6.2.1. North America

- 6.1. Market Analysis, Insights and Forecast - by Core Strategy

- 7. South America Hedge Fund Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Core Strategy

- 7.1.1. Equity Strategies

- 7.1.2. Macro Strategies

- 7.1.3. Event Driven Strategies

- 7.1.4. Credit Strategies

- 7.1.5. Relative Value Strategies

- 7.1.6. Niche Strategies

- 7.1.7. Multi-Strategy

- 7.1.8. Managed Futures/CTA Strategies

- 7.2. Market Analysis, Insights and Forecast - by Manager Location

- 7.2.1. North America

- 7.2.1.1. United states

- 7.2.1.2. Canada

- 7.2.1.3. Mexico

- 7.2.2. Europe

- 7.2.2.1. United Kingdom

- 7.2.2.2. Sweden

- 7.2.2.3. France

- 7.2.2.4. Switzerland

- 7.2.2.5. Rest of Europe

- 7.2.3. Asia-Pacific

- 7.2.3.1. Hong Kong

- 7.2.3.2. Australia

- 7.2.3.3. Rest of Asia-Pacific

- 7.2.4. Latin America

- 7.2.4.1. Brazil

- 7.2.4.2. Rest of Latin America

- 7.2.5. Middle East and Africa

- 7.2.5.1. United Arab Emirates

- 7.2.5.2. Saudi Arabia

- 7.2.5.3. Rest of Middle East and Africa

- 7.2.1. North America

- 7.1. Market Analysis, Insights and Forecast - by Core Strategy

- 8. Europe Hedge Fund Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Core Strategy

- 8.1.1. Equity Strategies

- 8.1.2. Macro Strategies

- 8.1.3. Event Driven Strategies

- 8.1.4. Credit Strategies

- 8.1.5. Relative Value Strategies

- 8.1.6. Niche Strategies

- 8.1.7. Multi-Strategy

- 8.1.8. Managed Futures/CTA Strategies

- 8.2. Market Analysis, Insights and Forecast - by Manager Location

- 8.2.1. North America

- 8.2.1.1. United states

- 8.2.1.2. Canada

- 8.2.1.3. Mexico

- 8.2.2. Europe

- 8.2.2.1. United Kingdom

- 8.2.2.2. Sweden

- 8.2.2.3. France

- 8.2.2.4. Switzerland

- 8.2.2.5. Rest of Europe

- 8.2.3. Asia-Pacific

- 8.2.3.1. Hong Kong

- 8.2.3.2. Australia

- 8.2.3.3. Rest of Asia-Pacific

- 8.2.4. Latin America

- 8.2.4.1. Brazil

- 8.2.4.2. Rest of Latin America

- 8.2.5. Middle East and Africa

- 8.2.5.1. United Arab Emirates

- 8.2.5.2. Saudi Arabia

- 8.2.5.3. Rest of Middle East and Africa

- 8.2.1. North America

- 8.1. Market Analysis, Insights and Forecast - by Core Strategy

- 9. Middle East & Africa Hedge Fund Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Core Strategy

- 9.1.1. Equity Strategies

- 9.1.2. Macro Strategies

- 9.1.3. Event Driven Strategies

- 9.1.4. Credit Strategies

- 9.1.5. Relative Value Strategies

- 9.1.6. Niche Strategies

- 9.1.7. Multi-Strategy

- 9.1.8. Managed Futures/CTA Strategies

- 9.2. Market Analysis, Insights and Forecast - by Manager Location

- 9.2.1. North America

- 9.2.1.1. United states

- 9.2.1.2. Canada

- 9.2.1.3. Mexico

- 9.2.2. Europe

- 9.2.2.1. United Kingdom

- 9.2.2.2. Sweden

- 9.2.2.3. France

- 9.2.2.4. Switzerland

- 9.2.2.5. Rest of Europe

- 9.2.3. Asia-Pacific

- 9.2.3.1. Hong Kong

- 9.2.3.2. Australia

- 9.2.3.3. Rest of Asia-Pacific

- 9.2.4. Latin America

- 9.2.4.1. Brazil

- 9.2.4.2. Rest of Latin America

- 9.2.5. Middle East and Africa

- 9.2.5.1. United Arab Emirates

- 9.2.5.2. Saudi Arabia

- 9.2.5.3. Rest of Middle East and Africa

- 9.2.1. North America

- 9.1. Market Analysis, Insights and Forecast - by Core Strategy

- 10. Asia Pacific Hedge Fund Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Core Strategy

- 10.1.1. Equity Strategies

- 10.1.2. Macro Strategies

- 10.1.3. Event Driven Strategies

- 10.1.4. Credit Strategies

- 10.1.5. Relative Value Strategies

- 10.1.6. Niche Strategies

- 10.1.7. Multi-Strategy

- 10.1.8. Managed Futures/CTA Strategies

- 10.2. Market Analysis, Insights and Forecast - by Manager Location

- 10.2.1. North America

- 10.2.1.1. United states

- 10.2.1.2. Canada

- 10.2.1.3. Mexico

- 10.2.2. Europe

- 10.2.2.1. United Kingdom

- 10.2.2.2. Sweden

- 10.2.2.3. France

- 10.2.2.4. Switzerland

- 10.2.2.5. Rest of Europe

- 10.2.3. Asia-Pacific

- 10.2.3.1. Hong Kong

- 10.2.3.2. Australia

- 10.2.3.3. Rest of Asia-Pacific

- 10.2.4. Latin America

- 10.2.4.1. Brazil

- 10.2.4.2. Rest of Latin America

- 10.2.5. Middle East and Africa

- 10.2.5.1. United Arab Emirates

- 10.2.5.2. Saudi Arabia

- 10.2.5.3. Rest of Middle East and Africa

- 10.2.1. North America

- 10.1. Market Analysis, Insights and Forecast - by Core Strategy

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 BridgeWater Associates

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Renaissance Technologies

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Man Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AQR Capital Management

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Two Sigma Investments

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Millennium Management

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Elliot Management

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BlackRock Advisors

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Citadel

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Davidson Kempner Capital**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 BridgeWater Associates

List of Figures

- Figure 1: Global Hedge Fund Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Hedge Fund Industry Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America Hedge Fund Industry Revenue (Million), by Core Strategy 2025 & 2033

- Figure 4: North America Hedge Fund Industry Volume (Trillion), by Core Strategy 2025 & 2033

- Figure 5: North America Hedge Fund Industry Revenue Share (%), by Core Strategy 2025 & 2033

- Figure 6: North America Hedge Fund Industry Volume Share (%), by Core Strategy 2025 & 2033

- Figure 7: North America Hedge Fund Industry Revenue (Million), by Manager Location 2025 & 2033

- Figure 8: North America Hedge Fund Industry Volume (Trillion), by Manager Location 2025 & 2033

- Figure 9: North America Hedge Fund Industry Revenue Share (%), by Manager Location 2025 & 2033

- Figure 10: North America Hedge Fund Industry Volume Share (%), by Manager Location 2025 & 2033

- Figure 11: North America Hedge Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Hedge Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 13: North America Hedge Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Hedge Fund Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Hedge Fund Industry Revenue (Million), by Core Strategy 2025 & 2033

- Figure 16: South America Hedge Fund Industry Volume (Trillion), by Core Strategy 2025 & 2033

- Figure 17: South America Hedge Fund Industry Revenue Share (%), by Core Strategy 2025 & 2033

- Figure 18: South America Hedge Fund Industry Volume Share (%), by Core Strategy 2025 & 2033

- Figure 19: South America Hedge Fund Industry Revenue (Million), by Manager Location 2025 & 2033

- Figure 20: South America Hedge Fund Industry Volume (Trillion), by Manager Location 2025 & 2033

- Figure 21: South America Hedge Fund Industry Revenue Share (%), by Manager Location 2025 & 2033

- Figure 22: South America Hedge Fund Industry Volume Share (%), by Manager Location 2025 & 2033

- Figure 23: South America Hedge Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: South America Hedge Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 25: South America Hedge Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Hedge Fund Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Hedge Fund Industry Revenue (Million), by Core Strategy 2025 & 2033

- Figure 28: Europe Hedge Fund Industry Volume (Trillion), by Core Strategy 2025 & 2033

- Figure 29: Europe Hedge Fund Industry Revenue Share (%), by Core Strategy 2025 & 2033

- Figure 30: Europe Hedge Fund Industry Volume Share (%), by Core Strategy 2025 & 2033

- Figure 31: Europe Hedge Fund Industry Revenue (Million), by Manager Location 2025 & 2033

- Figure 32: Europe Hedge Fund Industry Volume (Trillion), by Manager Location 2025 & 2033

- Figure 33: Europe Hedge Fund Industry Revenue Share (%), by Manager Location 2025 & 2033

- Figure 34: Europe Hedge Fund Industry Volume Share (%), by Manager Location 2025 & 2033

- Figure 35: Europe Hedge Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Hedge Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 37: Europe Hedge Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Hedge Fund Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Hedge Fund Industry Revenue (Million), by Core Strategy 2025 & 2033

- Figure 40: Middle East & Africa Hedge Fund Industry Volume (Trillion), by Core Strategy 2025 & 2033

- Figure 41: Middle East & Africa Hedge Fund Industry Revenue Share (%), by Core Strategy 2025 & 2033

- Figure 42: Middle East & Africa Hedge Fund Industry Volume Share (%), by Core Strategy 2025 & 2033

- Figure 43: Middle East & Africa Hedge Fund Industry Revenue (Million), by Manager Location 2025 & 2033

- Figure 44: Middle East & Africa Hedge Fund Industry Volume (Trillion), by Manager Location 2025 & 2033

- Figure 45: Middle East & Africa Hedge Fund Industry Revenue Share (%), by Manager Location 2025 & 2033

- Figure 46: Middle East & Africa Hedge Fund Industry Volume Share (%), by Manager Location 2025 & 2033

- Figure 47: Middle East & Africa Hedge Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa Hedge Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 49: Middle East & Africa Hedge Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Hedge Fund Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Hedge Fund Industry Revenue (Million), by Core Strategy 2025 & 2033

- Figure 52: Asia Pacific Hedge Fund Industry Volume (Trillion), by Core Strategy 2025 & 2033

- Figure 53: Asia Pacific Hedge Fund Industry Revenue Share (%), by Core Strategy 2025 & 2033

- Figure 54: Asia Pacific Hedge Fund Industry Volume Share (%), by Core Strategy 2025 & 2033

- Figure 55: Asia Pacific Hedge Fund Industry Revenue (Million), by Manager Location 2025 & 2033

- Figure 56: Asia Pacific Hedge Fund Industry Volume (Trillion), by Manager Location 2025 & 2033

- Figure 57: Asia Pacific Hedge Fund Industry Revenue Share (%), by Manager Location 2025 & 2033

- Figure 58: Asia Pacific Hedge Fund Industry Volume Share (%), by Manager Location 2025 & 2033

- Figure 59: Asia Pacific Hedge Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific Hedge Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 61: Asia Pacific Hedge Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Hedge Fund Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hedge Fund Industry Revenue Million Forecast, by Core Strategy 2020 & 2033

- Table 2: Global Hedge Fund Industry Volume Trillion Forecast, by Core Strategy 2020 & 2033

- Table 3: Global Hedge Fund Industry Revenue Million Forecast, by Manager Location 2020 & 2033

- Table 4: Global Hedge Fund Industry Volume Trillion Forecast, by Manager Location 2020 & 2033

- Table 5: Global Hedge Fund Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Hedge Fund Industry Volume Trillion Forecast, by Region 2020 & 2033

- Table 7: Global Hedge Fund Industry Revenue Million Forecast, by Core Strategy 2020 & 2033

- Table 8: Global Hedge Fund Industry Volume Trillion Forecast, by Core Strategy 2020 & 2033

- Table 9: Global Hedge Fund Industry Revenue Million Forecast, by Manager Location 2020 & 2033

- Table 10: Global Hedge Fund Industry Volume Trillion Forecast, by Manager Location 2020 & 2033

- Table 11: Global Hedge Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Hedge Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 13: United States Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 15: Canada Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 19: Global Hedge Fund Industry Revenue Million Forecast, by Core Strategy 2020 & 2033

- Table 20: Global Hedge Fund Industry Volume Trillion Forecast, by Core Strategy 2020 & 2033

- Table 21: Global Hedge Fund Industry Revenue Million Forecast, by Manager Location 2020 & 2033

- Table 22: Global Hedge Fund Industry Volume Trillion Forecast, by Manager Location 2020 & 2033

- Table 23: Global Hedge Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Hedge Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: Brazil Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 27: Argentina Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 31: Global Hedge Fund Industry Revenue Million Forecast, by Core Strategy 2020 & 2033

- Table 32: Global Hedge Fund Industry Volume Trillion Forecast, by Core Strategy 2020 & 2033

- Table 33: Global Hedge Fund Industry Revenue Million Forecast, by Manager Location 2020 & 2033

- Table 34: Global Hedge Fund Industry Volume Trillion Forecast, by Manager Location 2020 & 2033

- Table 35: Global Hedge Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Hedge Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 39: Germany Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 41: France Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 43: Italy Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 45: Spain Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 47: Russia Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 49: Benelux Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 51: Nordics Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 55: Global Hedge Fund Industry Revenue Million Forecast, by Core Strategy 2020 & 2033

- Table 56: Global Hedge Fund Industry Volume Trillion Forecast, by Core Strategy 2020 & 2033

- Table 57: Global Hedge Fund Industry Revenue Million Forecast, by Manager Location 2020 & 2033

- Table 58: Global Hedge Fund Industry Volume Trillion Forecast, by Manager Location 2020 & 2033

- Table 59: Global Hedge Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Hedge Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 61: Turkey Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 63: Israel Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 65: GCC Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 67: North Africa Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 69: South Africa Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 73: Global Hedge Fund Industry Revenue Million Forecast, by Core Strategy 2020 & 2033

- Table 74: Global Hedge Fund Industry Volume Trillion Forecast, by Core Strategy 2020 & 2033

- Table 75: Global Hedge Fund Industry Revenue Million Forecast, by Manager Location 2020 & 2033

- Table 76: Global Hedge Fund Industry Volume Trillion Forecast, by Manager Location 2020 & 2033

- Table 77: Global Hedge Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global Hedge Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 79: China Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 81: India Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 83: Japan Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 85: South Korea Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 89: Oceania Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hedge Fund Industry?

The projected CAGR is approximately 3.14%.

2. Which companies are prominent players in the Hedge Fund Industry?

Key companies in the market include BridgeWater Associates, Renaissance Technologies, Man Group, AQR Capital Management, Two Sigma Investments, Millennium Management, Elliot Management, BlackRock Advisors, Citadel, Davidson Kempner Capital**List Not Exhaustive.

3. What are the main segments of the Hedge Fund Industry?

The market segments include Core Strategy, Manager Location.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Emerging Demand for Smaller or Newer Fund Managers; Recovering Performance of Existing Hedge Funds.

6. What are the notable trends driving market growth?

Investments in Digital Assets is Driving the Market.

7. Are there any restraints impacting market growth?

Emerging Demand for Smaller or Newer Fund Managers; Recovering Performance of Existing Hedge Funds.

8. Can you provide examples of recent developments in the market?

November 2022: BlackRock Alternatives (BlackRock), through a fund managed by its diversified infrastructure business, agreed to acquire Jupiter Power LLC (Jupiter). Jupiter Power is a leading United States operator and developer of stand-alone, utility-scale battery energy storage systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hedge Fund Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hedge Fund Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hedge Fund Industry?

To stay informed about further developments, trends, and reports in the Hedge Fund Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence