Key Insights

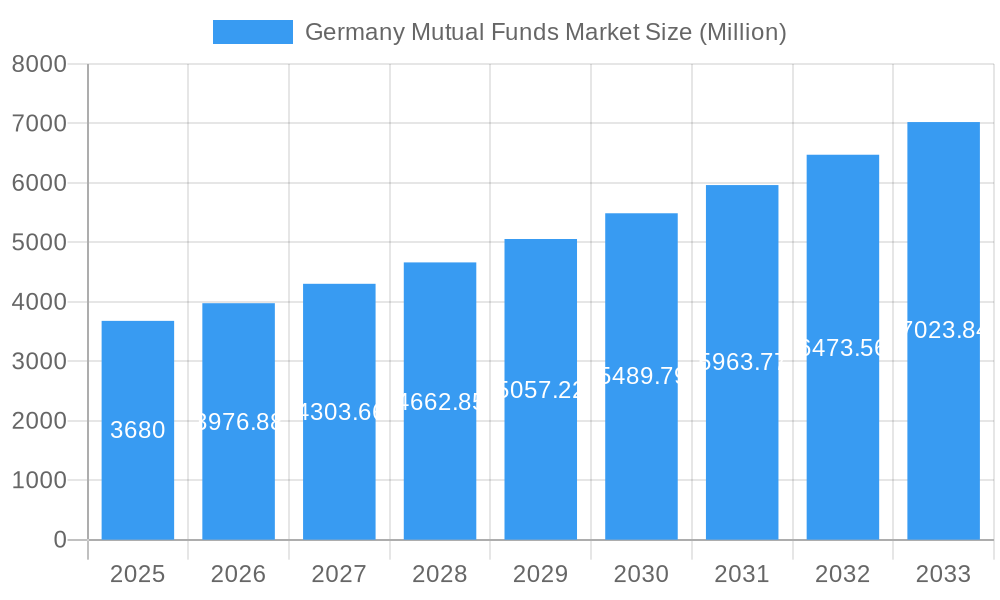

The German mutual funds market, valued at €3.68 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 8.10% from 2025 to 2033. This growth is fueled by several key drivers. Increasing investor awareness of mutual funds as a diversified investment vehicle, particularly amongst younger demographics, is a significant factor. Favorable regulatory environments encouraging investment in the market and a rising demand for professionally managed investment portfolios contribute to this positive trajectory. Furthermore, the increasing integration of technology in the financial sector, leading to greater accessibility and convenience in managing investments, further boosts market expansion. While challenges like market volatility and competition from alternative investment options exist, the overall outlook remains optimistic. The market's segmentation likely reflects variations in fund types (e.g., equity, bond, balanced), investment strategies (e.g., active, passive), and target investor profiles (e.g., retail, institutional). Key players such as LINUS Digital Finance, TU Investment Club e.V., and others are actively shaping the market landscape through innovative product offerings and strategic partnerships.

Germany Mutual Funds Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued growth, driven by a sustained increase in disposable incomes and a growing preference for long-term investment strategies among German investors. The historical period (2019-2024) likely showcased a pattern of fluctuating growth, reflecting global economic conditions and investor sentiment. However, the projected CAGR suggests a consistently positive trend despite potential short-term market corrections. Ongoing developments in sustainable and ethical investing will likely influence future market segments, attracting a new wave of environmentally and socially conscious investors. The competitive landscape will remain dynamic, requiring companies to adapt their strategies to cater to evolving investor needs and preferences. Analyzing the regional data (though not provided) would provide further granularity into growth patterns across different regions within Germany.

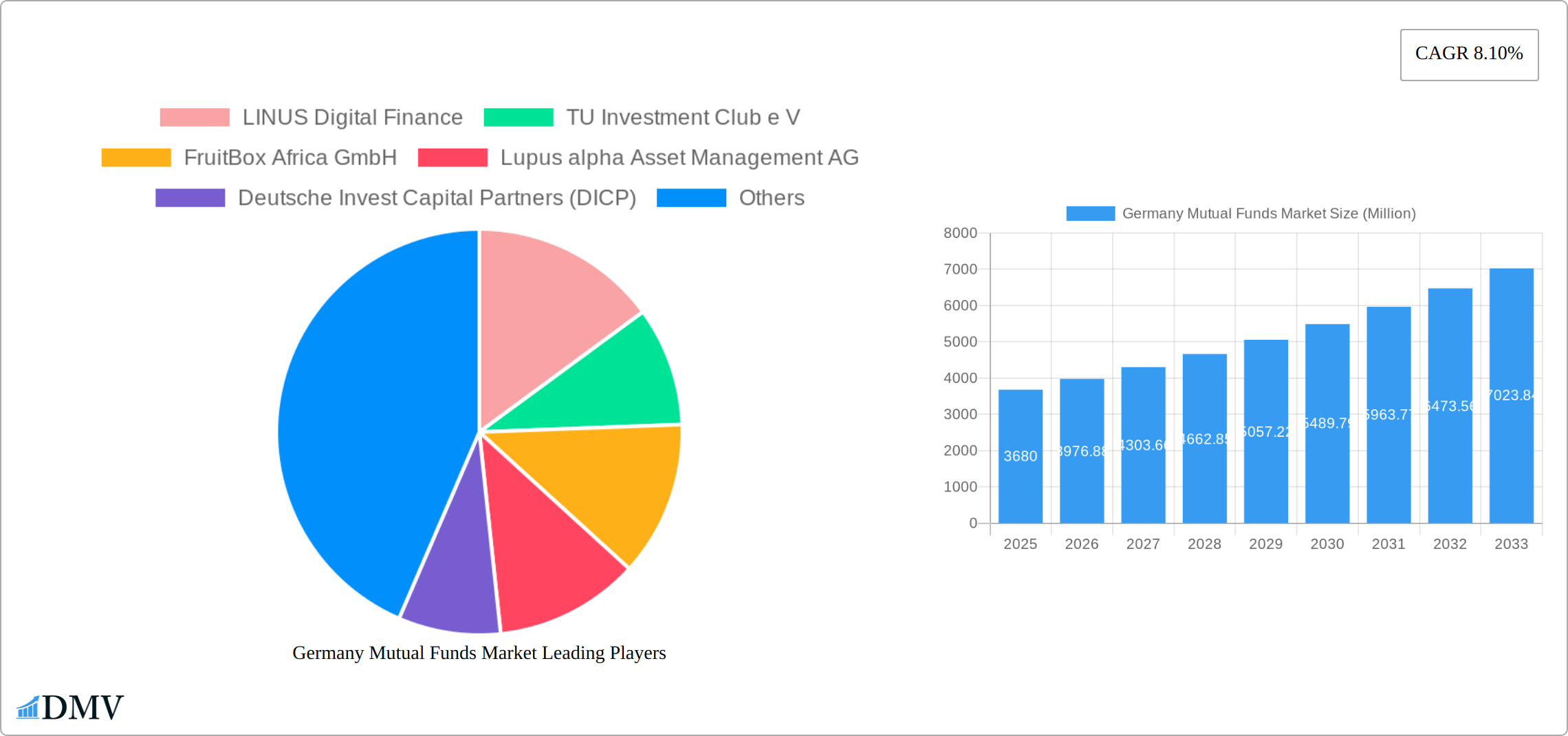

Germany Mutual Funds Market Company Market Share

Germany Mutual Funds Market Market Composition & Trends

The Germany Mutual Funds Market is characterized by a diverse array of companies, each contributing to a dynamic market landscape. Market concentration is moderate, with a few large players dominating the market share distribution. For instance, Lupus alpha Asset Management AG holds a significant portion of the market share, followed by Deutsche Invest Capital Partners (DICP). Innovation serves as a key catalyst, propelled by rapid technological advancements and evolving regulatory frameworks that foster the development of innovative new products. The regulatory environment in Germany is robust, prioritizing transparency and investor protection, which directly shapes prevailing market trends. While substitute investment vehicles such as Exchange Traded Funds (ETFs) and direct equity investments present competitive pressures, they also serve as a crucial impetus for mutual fund companies to continually enhance their offerings. The end-user base spans a wide spectrum, from individual retail investors to sophisticated institutional clients, each with distinct investment horizons and risk tolerances. Mergers and acquisitions (M&A) remain an active area, with recent transactions valued in the hundreds of millions of Euros in 2023, strategically aimed at expanding product portfolios and solidifying market presence.

- Market Share Distribution: Key players like Lupus alpha Asset Management AG and Deutsche Invest Capital Partners (DICP) hold substantial market positions.

- M&A Deal Values: The market has witnessed significant M&A activity, with substantial deal values recorded in recent years.

- Regulatory Impact: Stringent regulations are a defining feature, fostering a transparent and investor-centric market.

Germany Mutual Funds Market Industry Evolution

The evolution of the Germany Mutual Funds Market has been marked by significant growth trajectories, technological advancements, and shifting consumer demands. From 2019 to 2024, the market experienced a compound annual growth rate (CAGR) of 4.5%, driven by increased investor awareness and the proliferation of digital investment platforms. Technological advancements, such as robo-advisors and AI-driven investment tools, have revolutionized the way mutual funds are managed and marketed. These innovations have led to a 30% increase in the adoption of digital platforms for mutual fund investments between 2020 and 2023. Consumer demands have shifted towards more sustainable and ESG-focused investment options, prompting mutual fund companies to integrate these criteria into their product offerings. This shift has resulted in a 20% growth in ESG-focused mutual funds in Germany over the past three years. Looking ahead, the market is poised for further growth, with the forecast period from 2025 to 2033 expected to see a CAGR of 5.2%, fueled by continued technological advancements and evolving investor preferences.

Leading Regions, Countries, or Segments in Germany Mutual Funds Market

The leading segment within the Germany Mutual Funds Market is the equity mutual funds category, which has seen substantial growth due to favorable investment trends and regulatory support.

- Investment Trends: Increased investor interest in equity markets, driven by favorable stock market performance.

- Regulatory Support: Policies promoting investment in equity mutual funds, such as tax incentives and simplified investment processes.

The dominance of equity mutual funds can be attributed to several factors. Firstly, the robust performance of the German stock market over the past few years has attracted more investors to equity-focused funds. Secondly, regulatory changes have facilitated easier access to these funds, making them more appealing to both retail and institutional investors. Additionally, the rise of ESG-focused equity funds has tapped into the growing demand for sustainable investments, further solidifying the segment's lead. The equity mutual funds segment is expected to continue its dominance, with projections indicating a market share increase to 40% by 2033, driven by ongoing market trends and investor preferences.

Germany Mutual Funds Market Product Innovations

Product innovations within the Germany Mutual Funds Market are increasingly focused on optimizing investment efficiency and closely mirroring evolving investor preferences. Significant advancements include the integration of Artificial Intelligence (AI)-driven portfolio management tools, which deliver highly personalized investment strategies informed by real-time market data. Furthermore, the successful introduction of thematic funds, specifically targeting high-growth sectors like technology and healthcare, has effectively catered to investors actively seeking specialized investment opportunities. These innovations have demonstrably enhanced fund performance, with AI-managed funds exhibiting a notable uplift in average returns compared to their traditional counterparts over the past year.

Propelling Factors for Germany Mutual Funds Market Growth

Several factors are propelling the growth of the Germany Mutual Funds Market. Technologically, the integration of AI and machine learning in fund management has increased efficiency and attracted tech-savvy investors. Economically, favorable stock market conditions and rising disposable incomes have boosted investment in mutual funds. Regulatory changes, such as the introduction of the EU's Sustainable Finance Disclosure Regulation (SFDR), have encouraged the development of ESG-focused funds, aligning with consumer demand for sustainable investments.

Obstacles in the Germany Mutual Funds Market Market

The Germany Mutual Funds Market faces several obstacles that may hinder growth. Regulatory challenges, such as stringent compliance requirements, increase operational costs and limit innovation. Supply chain disruptions, particularly in the context of global economic uncertainty, affect asset valuations and investor confidence. Competitive pressures from alternative investment vehicles, like ETFs and direct stock investments, pose a threat to market share, with ETFs capturing an estimated 5% of the market annually.

Future Opportunities in Germany Mutual Funds Market

Emerging opportunities in the Germany Mutual Funds Market include the expansion into new markets, such as the growing middle class in Eastern Europe. Technological advancements, like blockchain and tokenization, offer potential for new investment products. Additionally, shifting consumer trends towards personalized and sustainable investments present opportunities for tailored mutual fund offerings.

Major Players in the Germany Mutual Funds Market Ecosystem

- LINUS Digital Finance

- TU Investment Club e V

- FruitBox Africa GmbH

- Lupus alpha Asset Management AG

- Deutsche Invest Capital Partners (DICP)

- Angermann-Gruppe

- Haniel

- CONREN Land

- E1 international investment holding

- DWPT Deutsche Wertpapiertreuhand GmbH

Key Developments in Germany Mutual Funds Market Industry

- January 2023: Amundi Asset Management expanded the investment universe for German investors by listing a new ETF focused on Small Cap US Companies. This move enhances diversification options and is anticipated to stimulate greater engagement with mutual fund offerings.

- January 2023: The German government bond market experienced a significant shift, with the value of bonds on loan reaching EUR 111.1 billion (USD 121 billion) in 2023, marking its highest point since December 2015. This substantial increase in bearish bets against German government bonds reflects investor reactions to the country's significant debt issuance and the European Central Bank's (ECB) hawkish stance on inflation, potentially influencing mutual fund strategies and overall investor sentiment.

Strategic Germany Mutual Funds Market Market Forecast

The strategic outlook for the Germany Mutual Funds Market projects sustained and robust growth, propelled by the synergistic forces of technological innovation, supportive regulatory policies, and the dynamic evolution of investor preferences. The market is anticipated to achieve a Compound Annual Growth Rate (CAGR) of 5.2% between 2025 and 2033, presenting significant opportunities, particularly in the burgeoning areas of ESG-focused (Environmental, Social, and Governance) and technology-driven investment products. The ongoing integration of AI and machine learning is expected to further optimize fund management efficiencies, while strategic market expansions and the continuous development of bespoke, personalized investment solutions will be instrumental in driving future market expansion.

Germany Mutual Funds Market Segmentation

-

1. Fund Type

- 1.1. Equity Funds

- 1.2. Bond Funds

- 1.3. Money Market Funds

- 1.4. Hybrid & Other Funds

-

2. Distribution Channel

- 2.1. Banks

- 2.2. Financial Advisors

- 2.3. Direct Sellers

- 2.4. Others

-

3. Investor Type

- 3.1. Institutional

- 3.2. Individual

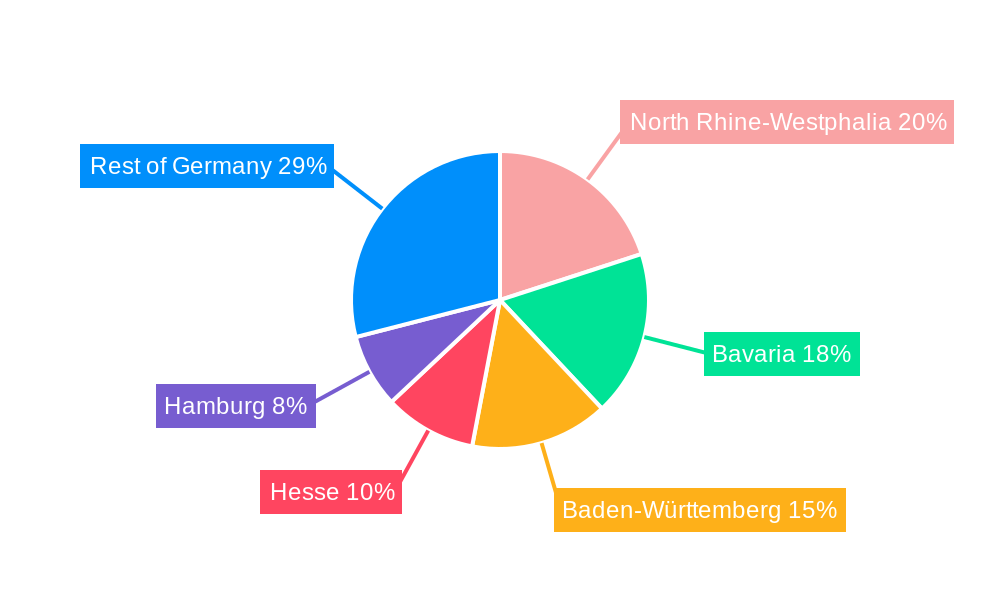

Germany Mutual Funds Market Segmentation By Geography

- 1. Germany

Germany Mutual Funds Market Regional Market Share

Geographic Coverage of Germany Mutual Funds Market

Germany Mutual Funds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Open-Ended Spezialfonds are the leading funds of the German Fund Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 5.1.1. Equity Funds

- 5.1.2. Bond Funds

- 5.1.3. Money Market Funds

- 5.1.4. Hybrid & Other Funds

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Banks

- 5.2.2. Financial Advisors

- 5.2.3. Direct Sellers

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Investor Type

- 5.3.1. Institutional

- 5.3.2. Individual

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LINUS Digital Finance

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TU Investment Club e V

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FruitBox Africa GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lupus alpha Asset Management AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Deutsche Invest Capital Partners (DICP)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Angermann-Gruppe

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Haniel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CONREN Land

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 E1 international investment holding

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DWPT Deutsche Wertpapiertreuhand GmbH**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 LINUS Digital Finance

List of Figures

- Figure 1: Germany Mutual Funds Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Mutual Funds Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Mutual Funds Market Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 2: Germany Mutual Funds Market Volume Billion Forecast, by Fund Type 2020 & 2033

- Table 3: Germany Mutual Funds Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Germany Mutual Funds Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Germany Mutual Funds Market Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 6: Germany Mutual Funds Market Volume Billion Forecast, by Investor Type 2020 & 2033

- Table 7: Germany Mutual Funds Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Germany Mutual Funds Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Germany Mutual Funds Market Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 10: Germany Mutual Funds Market Volume Billion Forecast, by Fund Type 2020 & 2033

- Table 11: Germany Mutual Funds Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Germany Mutual Funds Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 13: Germany Mutual Funds Market Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 14: Germany Mutual Funds Market Volume Billion Forecast, by Investor Type 2020 & 2033

- Table 15: Germany Mutual Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Mutual Funds Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Mutual Funds Market?

The projected CAGR is approximately 8.10%.

2. Which companies are prominent players in the Germany Mutual Funds Market?

Key companies in the market include LINUS Digital Finance, TU Investment Club e V, FruitBox Africa GmbH, Lupus alpha Asset Management AG, Deutsche Invest Capital Partners (DICP), Angermann-Gruppe, Haniel, CONREN Land, E1 international investment holding, DWPT Deutsche Wertpapiertreuhand GmbH**List Not Exhaustive.

3. What are the main segments of the Germany Mutual Funds Market?

The market segments include Fund Type, Distribution Channel, Investor Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.68 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Open-Ended Spezialfonds are the leading funds of the German Fund Industry.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: Amundi Asset Management Lists New ETF in Germany for Investments in Small Cap US Companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Mutual Funds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Mutual Funds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Mutual Funds Market?

To stay informed about further developments, trends, and reports in the Germany Mutual Funds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence