Key Insights

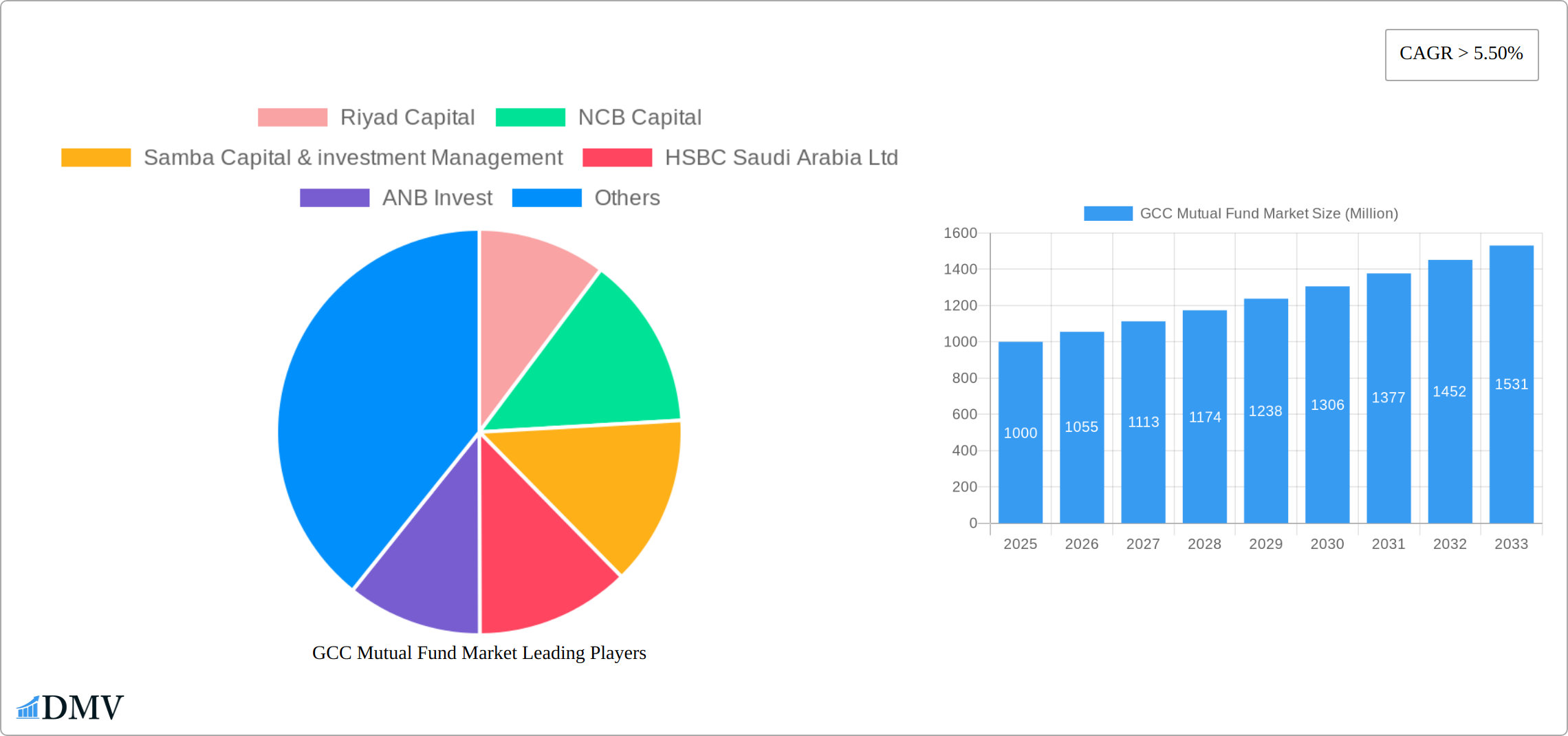

The GCC mutual fund market is poised for substantial expansion, projecting a Compound Annual Growth Rate (CAGR) of 6.5% from 2025 to 2033, with an estimated market size of $4.5 billion. This growth is propelled by heightened investor awareness of diversified investment advantages among high-net-worth individuals and institutions. Supportive regulatory environments fostering financial inclusion and market transparency, alongside government initiatives to develop the financial sector and the increasing adoption of digital investment platforms, are key growth catalysts.

GCC Mutual Fund Market Market Size (In Billion)

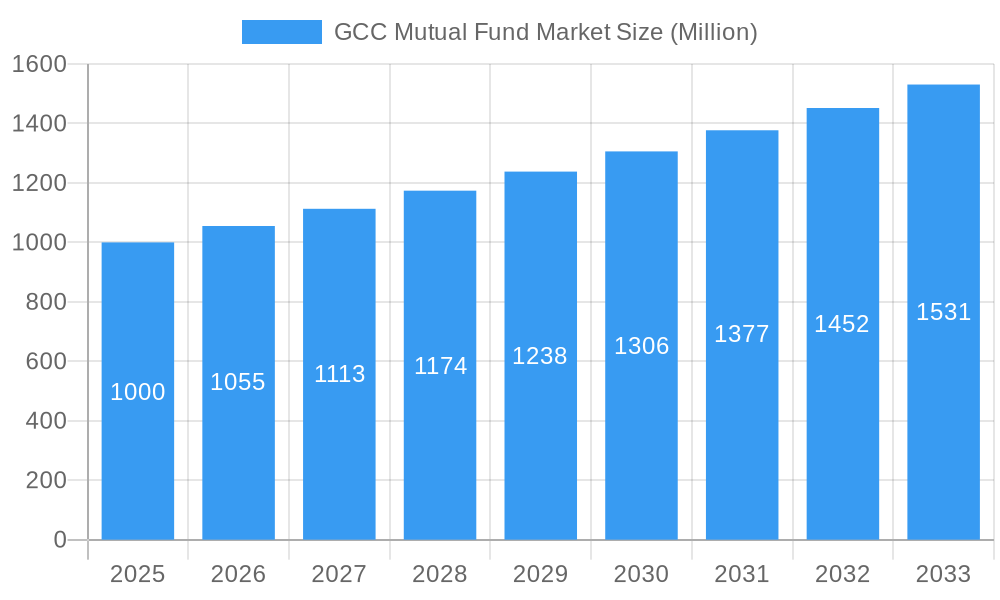

The market is segmented by fund type (equity, debt, balanced), investment strategy, and investor type (retail, institutional). Leading entities like Riyad Capital, NCB Capital, and Samba Capital are instrumental in shaping the market through innovative products and strategic alliances. Intensifying competition is anticipated, fostering innovation and more competitive investor pricing. Potential market constraints include regional economic volatility, global market fluctuations, and the impact of fluctuating oil prices on investor sentiment.

GCC Mutual Fund Market Company Market Share

The long-term outlook remains optimistic, driven by a growing GCC middle class, rising disposable incomes, and a younger demographic favoring long-term investment. Future market expansion will depend on regulatory evolution, FinTech adoption, and regional economic stability. Strategic collaborations between international and local firms are expected to enhance market penetration and product sophistication, addressing diverse investor needs.

GCC Mutual Fund Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the GCC Mutual Fund Market, offering a comprehensive overview of its current state and future trajectory. Spanning the period from 2019 to 2033, with a focus on 2025 as the base and estimated year, this study unravels the market's intricate dynamics, pinpointing key trends, challenges, and opportunities for stakeholders. The report meticulously examines market composition, leading players, technological advancements, and regulatory influences, offering crucial data-driven insights to inform strategic decision-making. With a projected market value reaching xx Million by 2033, this report is an indispensable resource for investors, fund managers, and industry professionals seeking to navigate the ever-evolving GCC mutual fund landscape.

GCC Mutual Fund Market Market Composition & Trends

This section delves into the composition and trends shaping the GCC mutual fund market. We analyze market concentration, revealing the share held by key players like Riyad Capital, NCB Capital, Samba Capital & Investment Management, HSBC Saudi Arabia Ltd, ANB Invest, Saudi Hollandi Capital, Al Rajhi Capital, Jadwa Investment, Caaam Saudi Fransi, and BNP Paribas Asset Management (list not exhaustive). The report examines innovation catalysts, including technological advancements and regulatory changes, and assesses the impact of substitute products and evolving end-user profiles. Furthermore, it explores the landscape of mergers and acquisitions (M&A) activities, analyzing deal values and their influence on market dynamics.

- Market Share Distribution (2024): Riyad Capital (xx%), NCB Capital (xx%), Samba Capital (xx%), Others (xx%). (Note: Exact figures require further research.)

- M&A Deal Value (2019-2024): Total value exceeding xx Million, with the NCB-Samba merger representing a significant portion.

- Regulatory Landscape: Analysis of existing regulations and their impact on market growth and investment strategies.

- Innovation Catalysts: Discussion of fintech advancements and their influence on fund management and investor access.

GCC Mutual Fund Market Industry Evolution

This section charts the evolution of the GCC mutual fund market from 2019 to 2033, analyzing market growth trajectories, technological advancements, and shifting consumer demands. The report provides specific data points, including annual growth rates and adoption metrics for key technologies and investment strategies. We examine the impact of macroeconomic factors, geopolitical events, and evolving investor preferences on market performance and future growth projections. The analysis includes projections for market size and segmentation through 2033. Detailed analysis of consumer behavior and investment trends is also included. Specific growth rates and detailed adoption metrics for technologies within the sector will be provided.

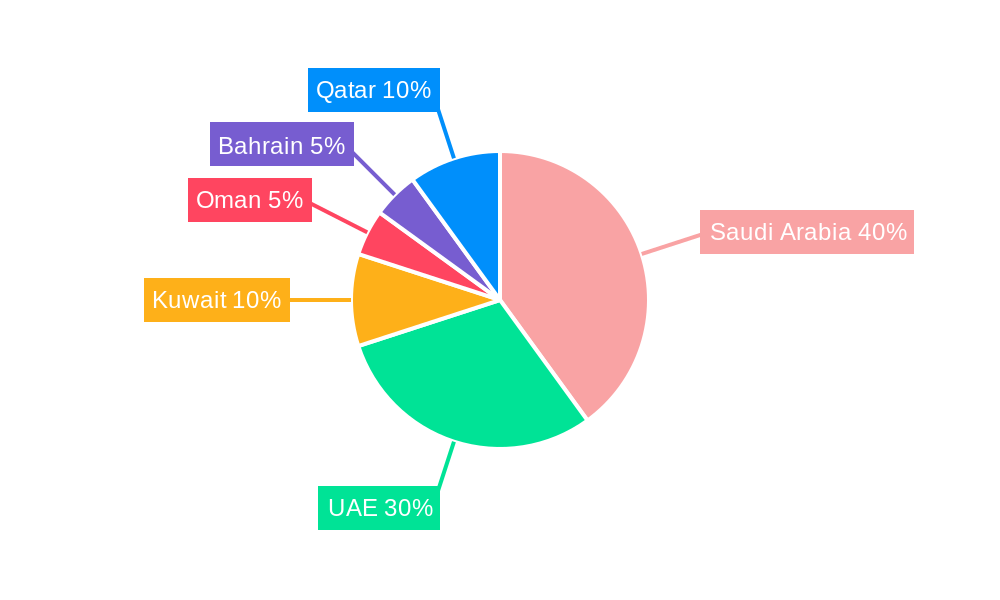

Leading Regions, Countries, or Segments in GCC Mutual Fund Market

This section provides a comprehensive analysis of the leading regions, countries, and key segments that are shaping the GCC mutual fund market. We delve into the underlying factors contributing to their prominent positions, examining evolving investment trends, supportive regulatory frameworks, and robust economic conditions that fuel their growth and dominance.

- Dominant Region/Country: Saudi Arabia and the UAE emerge as key pillars of the GCC mutual fund market, driven by significant asset inflows and a burgeoning investor base.

- Key Segments: Equity funds continue to lead in terms of AUM, followed by a growing interest in fixed-income and real estate-focused mutual funds, reflecting diversification efforts.

- Key Drivers:

- Growing Investor Sophistication: Increasing awareness and demand for diversified investment solutions among both institutional and retail investors.

- Favorable Regulatory Environment: Proactive initiatives by regulatory bodies in countries like Saudi Arabia and the UAE to enhance transparency, investor protection, and facilitate the launch of new fund products.

- Economic Diversification and Growth: National economic agendas focused on diversifying away from oil dependence are stimulating investment in various sectors, creating fertile ground for mutual funds.

- Technological Adoption: The integration of digital platforms and fintech solutions is enhancing accessibility and investor experience.

- Detailed Analysis: Saudi Arabia's market is characterized by a strong domestic investor base and government-backed initiatives promoting investment. The UAE, a regional financial hub, attracts significant foreign investment and offers a diverse range of fund products. The dominance of these regions is further bolstered by strong liquidity and a growing pool of high-net-worth individuals seeking professional asset management.

GCC Mutual Fund Market Product Innovations

This section shines a spotlight on the dynamic landscape of product innovation within the GCC mutual fund market. We explore recent groundbreaking product launches, innovative applications, and compelling performance metrics that are redefining investment strategies. The report meticulously details the unique selling propositions of newly introduced funds, alongside an in-depth assessment of how technological advancements are reshaping market dynamics. This includes an analysis of novel fund offerings, sophisticated investment methodologies, and the strategic integration of cutting-edge technologies aimed at optimizing operational efficiency, enhancing transparency, and improving the overall investor experience.

Propelling Factors for GCC Mutual Fund Market Growth

Several factors are driving the growth of the GCC mutual fund market. These include: increased government initiatives supporting investments, rising disposable incomes and awareness of investment opportunities among the population, and ongoing technological advancements enabling greater access and ease of use for investors. The regulatory environment, fostering innovation and competition, also plays a crucial role.

Obstacles in the GCC Mutual Fund Market Market

Despite a promising growth trajectory, the GCC mutual fund market faces several significant hurdles that can temper its expansion. Complex and evolving regulatory landscapes across different GCC nations can create compliance challenges for fund managers. Additionally, occasional global economic uncertainties and localized market volatility can lead to investor caution and impact fund performance. The persistent challenge of intense competition among established and emerging fund houses, all vying for a larger market share, further intensifies the operational pressures. This section will provide a quantifiable analysis of the impact of these obstacles on market development and investor confidence.

Future Opportunities in GCC Mutual Fund Market

The GCC mutual fund market is poised for substantial future growth, presenting a wealth of promising opportunities. The strategic expansion into emerging and underserved market segments, including Sharia-compliant funds and thematic investments, holds significant potential. Leveraging advancements in fintech solutions, such as AI-driven advisory services and blockchain for enhanced transparency, will be crucial. Furthermore, catering to the evolving financial needs and preferences of a growing and increasingly sophisticated investor base, particularly younger generations, represents a key avenue for development. This report will meticulously highlight these promising opportunities, providing insights into how market participants can capitalize on them.

Major Players in the GCC Mutual Fund Market Ecosystem

- Riyad Capital

- NCB Capital

- Samba Capital & Investment Management

- HSBC Saudi Arabia Ltd

- ANB Invest

- Saudi Hollandi Capital

- Al Rajhi Capital

- Jadwa Investment

- Caaam Saudi Fransi

- BNP Paribas Asset Management (List Not Exhaustive)

Key Developments in GCC Mutual Fund Market Industry

- May 2023: Riyad Capital successfully launched the Riyad Real Estate Development fund - Durrat Hitteen, valued at USD 133.3 Million. This landmark launch signifies a robust expansion within the real estate investment sector of the GCC mutual fund market, demonstrating continued investor confidence in tangible assets and professional fund management.

- January 2022: The monumental merger of NCB and Samba Financial Group created a formidable entity in the GCC financial landscape. This strategic consolidation, valued at an estimated XX Billion USD, significantly reshaped the competitive dynamics of the mutual fund industry, leading to increased market concentration and potentially offering enhanced economies of scale and broader product offerings for investors.

Strategic GCC Mutual Fund Market Market Forecast

The GCC mutual fund market is poised for significant growth, driven by increasing investments and supportive government policies. The market is expected to expand significantly in the coming years, presenting substantial opportunities for investors and stakeholders. Further technological innovation and the entry of new players will contribute to this growth. The report provides detailed forecasts for the coming years, taking into account various factors that could influence market performance.

GCC Mutual Fund Market Segmentation

-

1. Fund Type

- 1.1. Equity

- 1.2. Money market

- 1.3. Real Estate

- 1.4. Other Fund Types (Bond, Commodities, Mixed)

-

2. Geography

- 2.1. Saudi Arabia

- 2.2. Qatar

- 2.3. Abu Dhabi

- 2.4. Kuwait

- 2.5. Dubai

GCC Mutual Fund Market Segmentation By Geography

- 1. Saudi Arabia

- 2. Qatar

- 3. Abu Dhabi

- 4. Kuwait

- 5. Dubai

GCC Mutual Fund Market Regional Market Share

Geographic Coverage of GCC Mutual Fund Market

GCC Mutual Fund Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Economic Growth; Rising Wealth and Income Levels

- 3.3. Market Restrains

- 3.3.1. Economic Growth; Rising Wealth and Income Levels

- 3.4. Market Trends

- 3.4.1. Emerging Leadership of Saudi Arabia in GCC Capital Markets

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Mutual Fund Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 5.1.1. Equity

- 5.1.2. Money market

- 5.1.3. Real Estate

- 5.1.4. Other Fund Types (Bond, Commodities, Mixed)

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Saudi Arabia

- 5.2.2. Qatar

- 5.2.3. Abu Dhabi

- 5.2.4. Kuwait

- 5.2.5. Dubai

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.3.2. Qatar

- 5.3.3. Abu Dhabi

- 5.3.4. Kuwait

- 5.3.5. Dubai

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 6. Saudi Arabia GCC Mutual Fund Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fund Type

- 6.1.1. Equity

- 6.1.2. Money market

- 6.1.3. Real Estate

- 6.1.4. Other Fund Types (Bond, Commodities, Mixed)

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Saudi Arabia

- 6.2.2. Qatar

- 6.2.3. Abu Dhabi

- 6.2.4. Kuwait

- 6.2.5. Dubai

- 6.1. Market Analysis, Insights and Forecast - by Fund Type

- 7. Qatar GCC Mutual Fund Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fund Type

- 7.1.1. Equity

- 7.1.2. Money market

- 7.1.3. Real Estate

- 7.1.4. Other Fund Types (Bond, Commodities, Mixed)

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Saudi Arabia

- 7.2.2. Qatar

- 7.2.3. Abu Dhabi

- 7.2.4. Kuwait

- 7.2.5. Dubai

- 7.1. Market Analysis, Insights and Forecast - by Fund Type

- 8. Abu Dhabi GCC Mutual Fund Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fund Type

- 8.1.1. Equity

- 8.1.2. Money market

- 8.1.3. Real Estate

- 8.1.4. Other Fund Types (Bond, Commodities, Mixed)

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Saudi Arabia

- 8.2.2. Qatar

- 8.2.3. Abu Dhabi

- 8.2.4. Kuwait

- 8.2.5. Dubai

- 8.1. Market Analysis, Insights and Forecast - by Fund Type

- 9. Kuwait GCC Mutual Fund Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fund Type

- 9.1.1. Equity

- 9.1.2. Money market

- 9.1.3. Real Estate

- 9.1.4. Other Fund Types (Bond, Commodities, Mixed)

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Saudi Arabia

- 9.2.2. Qatar

- 9.2.3. Abu Dhabi

- 9.2.4. Kuwait

- 9.2.5. Dubai

- 9.1. Market Analysis, Insights and Forecast - by Fund Type

- 10. Dubai GCC Mutual Fund Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Fund Type

- 10.1.1. Equity

- 10.1.2. Money market

- 10.1.3. Real Estate

- 10.1.4. Other Fund Types (Bond, Commodities, Mixed)

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Saudi Arabia

- 10.2.2. Qatar

- 10.2.3. Abu Dhabi

- 10.2.4. Kuwait

- 10.2.5. Dubai

- 10.1. Market Analysis, Insights and Forecast - by Fund Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Riyad Capital

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NCB Capital

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Samba Capital & investment Management

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HSBC Saudi Arabia Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ANB Invest

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Saudi Hollandi Capital

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Al Rajhi Capital

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jadwa Investment

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Caaam Saudi Fransi

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BNP Paribas Asset Management**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Riyad Capital

List of Figures

- Figure 1: Global GCC Mutual Fund Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Saudi Arabia GCC Mutual Fund Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 3: Saudi Arabia GCC Mutual Fund Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 4: Saudi Arabia GCC Mutual Fund Market Revenue (billion), by Geography 2025 & 2033

- Figure 5: Saudi Arabia GCC Mutual Fund Market Revenue Share (%), by Geography 2025 & 2033

- Figure 6: Saudi Arabia GCC Mutual Fund Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Saudi Arabia GCC Mutual Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Qatar GCC Mutual Fund Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 9: Qatar GCC Mutual Fund Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 10: Qatar GCC Mutual Fund Market Revenue (billion), by Geography 2025 & 2033

- Figure 11: Qatar GCC Mutual Fund Market Revenue Share (%), by Geography 2025 & 2033

- Figure 12: Qatar GCC Mutual Fund Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Qatar GCC Mutual Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Abu Dhabi GCC Mutual Fund Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 15: Abu Dhabi GCC Mutual Fund Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 16: Abu Dhabi GCC Mutual Fund Market Revenue (billion), by Geography 2025 & 2033

- Figure 17: Abu Dhabi GCC Mutual Fund Market Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Abu Dhabi GCC Mutual Fund Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Abu Dhabi GCC Mutual Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Kuwait GCC Mutual Fund Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 21: Kuwait GCC Mutual Fund Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 22: Kuwait GCC Mutual Fund Market Revenue (billion), by Geography 2025 & 2033

- Figure 23: Kuwait GCC Mutual Fund Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Kuwait GCC Mutual Fund Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Kuwait GCC Mutual Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Dubai GCC Mutual Fund Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 27: Dubai GCC Mutual Fund Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 28: Dubai GCC Mutual Fund Market Revenue (billion), by Geography 2025 & 2033

- Figure 29: Dubai GCC Mutual Fund Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Dubai GCC Mutual Fund Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Dubai GCC Mutual Fund Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Mutual Fund Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 2: Global GCC Mutual Fund Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Global GCC Mutual Fund Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global GCC Mutual Fund Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 5: Global GCC Mutual Fund Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Global GCC Mutual Fund Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global GCC Mutual Fund Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 8: Global GCC Mutual Fund Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Global GCC Mutual Fund Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global GCC Mutual Fund Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 11: Global GCC Mutual Fund Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global GCC Mutual Fund Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global GCC Mutual Fund Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 14: Global GCC Mutual Fund Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Global GCC Mutual Fund Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global GCC Mutual Fund Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 17: Global GCC Mutual Fund Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Global GCC Mutual Fund Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Mutual Fund Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the GCC Mutual Fund Market?

Key companies in the market include Riyad Capital, NCB Capital, Samba Capital & investment Management, HSBC Saudi Arabia Ltd, ANB Invest, Saudi Hollandi Capital, Al Rajhi Capital, Jadwa Investment, Caaam Saudi Fransi, BNP Paribas Asset Management**List Not Exhaustive.

3. What are the main segments of the GCC Mutual Fund Market?

The market segments include Fund Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Economic Growth; Rising Wealth and Income Levels.

6. What are the notable trends driving market growth?

Emerging Leadership of Saudi Arabia in GCC Capital Markets.

7. Are there any restraints impacting market growth?

Economic Growth; Rising Wealth and Income Levels.

8. Can you provide examples of recent developments in the market?

May 2023: Saudi-based Riyad Capital has launched the Riyad Real Estate Development fund - Durrat Hitteen, in partnership with property developer Al Ramz Real Estate Company. The fund, with a value exceeding SAR0.5 billion (USD 133.3 million), aims to develop a mixed-use project in the Hitteen district in Riyadh with a total area of 27,119 square meters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Mutual Fund Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Mutual Fund Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Mutual Fund Market?

To stay informed about further developments, trends, and reports in the GCC Mutual Fund Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence