Key Insights

The France Mobile POS Terminal Market is projected for significant expansion, with an estimated market size of 3.63 million in 2025, and a projected Compound Annual Growth Rate (CAGR) of 10.2% through 2033. This growth is primarily driven by the increasing adoption of mobile and portable point-of-sale systems across key sectors, including retail and hospitality. Businesses are recognizing the value of mobility for enhancing customer experiences, optimizing checkout processes, and improving inventory management. The transition from traditional fixed POS systems to agile, tablet-based, and handheld devices is a defining trend, offering enhanced flexibility and reduced operational costs. Furthermore, the rise of contactless payments and integrated solutions combining payment processing with business management functionalities are significant growth catalysts.

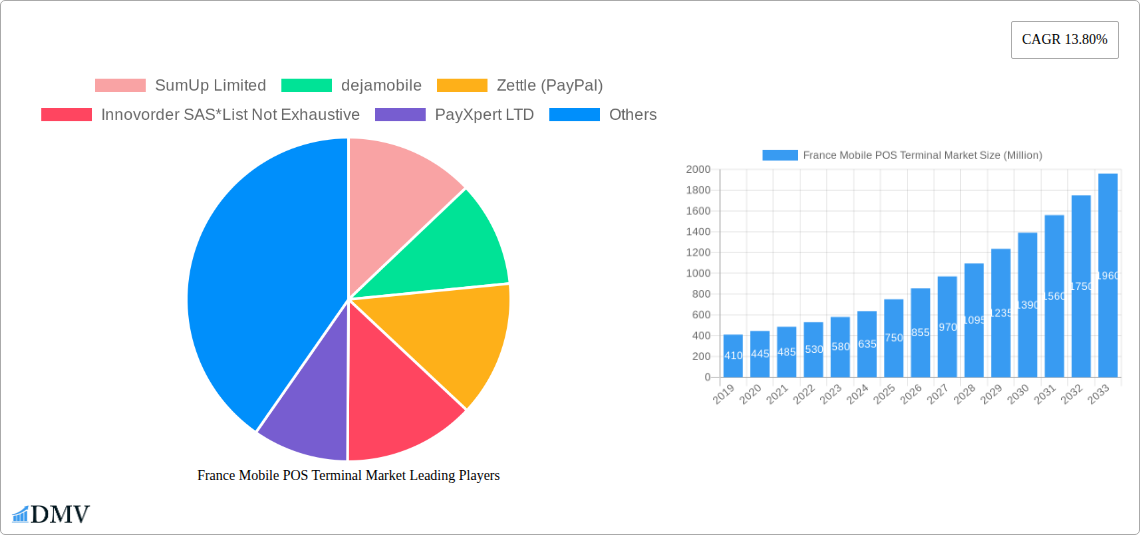

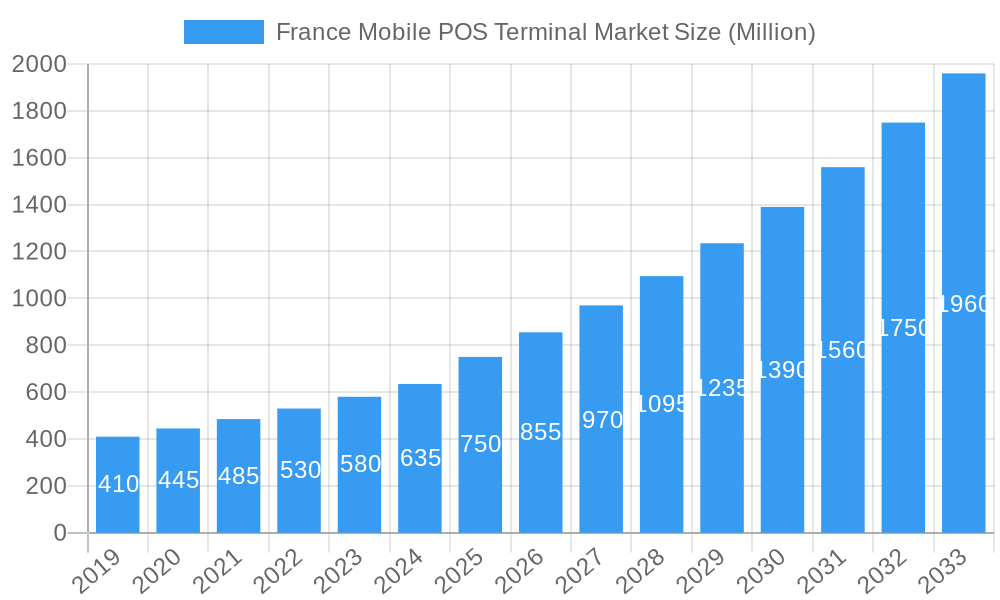

France Mobile POS Terminal Market Market Size (In Million)

Supportive government initiatives promoting digital transformation and small business digitalization, particularly in urban and tourist areas, further boost market dynamism. While widespread mobile POS adoption is a key driver, potential restraints include initial investment costs for some small businesses and the need for ongoing technical support and security updates. However, continuous innovation in hardware and software, alongside competitive pricing from leading vendors, are expected to mitigate these challenges. The market is segmented into Fixed Point-of-Sale Systems and Mobile/Portable Point-of-Sale Systems, with the latter experiencing accelerated growth. Primary end-user industries include retail, hospitality, and healthcare, with 'Others' encompassing transportation and field services.

France Mobile POS Terminal Market Company Market Share

France Mobile POS Terminal Market: Analysis and Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the France mobile POS terminal market, offering critical insights into its structure, trends, industry evolution, and future outlook. Covering the period from 2019 to 2033, with a base year of 2025, this report is an essential resource for understanding market dynamics, key players, and strategic opportunities within the French point-of-sale (POS) ecosystem. Explore the impact of mobile payment solutions, contactless payments, and Android POS devices across retail, hospitality, and healthcare sectors.

France Mobile POS Terminal Market Market Composition & Trends

The France mobile POS terminal market is characterized by a dynamic interplay of established players and emerging innovators, driving constant evolution. Market concentration is moderately fragmented, with key players like SumUp Limited, Zettle (PayPal), and Ingenico Group (Worldline) holding significant shares, yet a growing number of nimble startups are carving out niche segments. Innovation catalysts include the increasing demand for contactless payment terminals, the proliferation of smart POS devices, and the need for seamless integration with existing business management systems. The regulatory landscape, particularly concerning EMV compliance and data security, plays a crucial role in shaping product development and market entry strategies. Substitute products, such as traditional cash registers and basic card readers, are steadily being displaced by the advanced functionalities of mobile POS systems. End-user profiles range from small independent retailers and restaurants seeking cost-effective, portable solutions to larger enterprises demanding sophisticated, scalable payment ecosystems. Mergers and acquisitions (M&A) activities are a significant trend, with major players acquiring smaller companies to expand their market reach and technology portfolios. Estimated M&A deal values in the past year alone are projected to be in the range of 500 Million EUR. Key competitive factors include pricing, feature sets, security, and customer support.

- Market Share Distribution: Leading players collectively hold an estimated 70% of the market.

- M&A Activity: Focus on acquiring innovative payment gateway providers and software developers.

- Innovation Drivers: Demand for NFC payments, QR code scanning, and integrated loyalty programs.

- Regulatory Impact: Emphasis on PCI DSS compliance and data privacy.

France Mobile POS Terminal Market Industry Evolution

The France mobile POS terminal market has witnessed a remarkable transformation, evolving from basic transaction processing to comprehensive business management tools. Over the historical period (2019-2024), the market experienced a compound annual growth rate (CAGR) of approximately 12%, driven by the increasing adoption of digital payment methods and the growing need for merchants to accept payments anywhere, anytime. Technological advancements have been at the forefront of this evolution, with the introduction of sleeker, more portable mobile POS devices, the integration of Android POS systems for enhanced functionality, and the widespread adoption of contactless payment capabilities like NFC and QR codes. These innovations have significantly improved the customer payment experience, reducing transaction times and enhancing convenience. Shifting consumer demands have also played a pivotal role. French consumers are increasingly embracing digital wallets and mobile payment apps, prompting businesses to equip themselves with the necessary infrastructure to cater to these preferences. The rise of e-commerce has further blurred the lines between online and offline retail, necessitating flexible POS solutions that can support omnichannel strategies. The hospitality sector, in particular, has benefited immensely from mobile POS, enabling table-side payments and improving operational efficiency. The retail sector is rapidly adopting these solutions to reduce queues and offer a more personalized shopping experience. The healthcare industry is also beginning to explore the potential of mobile POS for patient payments and mobile clinics. The market is projected to grow at a robust CAGR of 15% from 2025 to 2033, fueled by continued technological innovation and sustained consumer preference for digital transactions. Adoption metrics for mobile POS devices among small and medium-sized enterprises (SMEs) have surged, with an estimated 65% of SMEs now utilizing some form of mobile payment solution. The average transaction value processed through mobile POS terminals is also on an upward trend, indicating increased confidence and usage.

Leading Regions, Countries, or Segments in France Mobile POS Terminal Market

Within the France mobile POS terminal market, the Mobile/Portable Point-of-sale Systems segment stands out as the dominant force, significantly outpacing its fixed counterpart. This dominance is driven by the inherent flexibility and adaptability that mobile POS offers to a wide array of businesses across the nation. The Retail end-user industry represents the largest market share within this segment, owing to the sheer volume of transactions and the continuous drive for improved customer engagement and checkout efficiency. However, the Hospitality sector is exhibiting the most rapid growth, with restaurants, cafes, and bars increasingly leveraging mobile POS for table-side payments, order management, and enhanced staff productivity.

Key drivers underpinning the dominance of mobile POS and the retail sector include:

- Investment Trends: Significant investment in cloud-based POS solutions and integrated payment processing by both large retail chains and independent businesses. A projected 450 Million EUR in capital expenditure for POS infrastructure modernization in the retail sector alone over the next five years.

- Regulatory Support: Favorable regulations promoting the adoption of secure and compliant payment technologies, encouraging businesses to invest in modern POS systems. Initiatives like the "France Relance" plan have indirectly supported digital transformation.

- Consumer Behavior: A strong consumer preference for fast, convenient, and contactless payment methods, directly pushing businesses to adopt mobile POS solutions. The adoption of contactless payments in France has exceeded 80% for card-present transactions.

- Technological Advancements: The continuous development of smaller, more powerful, and feature-rich mobile POS devices, including advanced Android POS terminals, capable of handling complex transactions and offering value-added services.

- Cost-Effectiveness: For many SMEs, especially those in retail and hospitality, mobile POS systems offer a lower entry cost compared to traditional fixed POS terminals, coupled with reduced hardware maintenance.

The Retail segment, encompassing everything from fashion boutiques and grocery stores to electronics retailers, consistently accounts for the largest portion of mobile POS adoption. The ability to process payments anywhere on the shop floor, reduce queues, and offer personalized customer experiences at the point of interaction are compelling advantages. The Hospitality sector, while smaller in overall market size than retail, is demonstrating exceptional growth potential. Mobile POS systems are revolutionizing how hotels and restaurants operate, enabling efficient order taking, split bill functionalities, and secure payment processing directly at the table or check-in desk. This operational agility is crucial in a competitive service industry.

France Mobile POS Terminal Market Product Innovations

Product innovations in the France mobile POS terminal market are primarily focused on enhancing user experience, security, and functionality. The advent of Android POS devices has been a significant leap, allowing for more sophisticated applications and greater customization for merchants. Innovations include integrated barcode scanners for faster inventory management, built-in printers for instant receipts, and advanced security features like EMV chip readers and PCI compliance. We are also observing the rise of all-in-one POS solutions that combine payment processing with inventory management, customer relationship management (CRM) tools, and loyalty programs. Performance metrics are continuously improving, with faster transaction processing times, longer battery life for portable devices, and enhanced connectivity options (Wi-Fi, 4G/5G). The unique selling proposition of many new products lies in their ability to serve as a single device for multiple business operations, reducing the need for separate hardware and software.

Propelling Factors for France Mobile POS Terminal Market Growth

Several factors are propelling the growth of the France mobile POS terminal market. The increasing consumer demand for contactless payment options and digital wallets is a primary driver. Technological advancements, such as the proliferation of smart POS devices and Android POS terminals, offer enhanced functionality and affordability. Government initiatives promoting digital transformation and cashless transactions further stimulate adoption. The growing number of SMEs in France, who benefit significantly from the cost-effectiveness and flexibility of mobile POS, also contributes to market expansion. Furthermore, the expansion of e-commerce has created a need for omnichannel payment solutions, where mobile POS plays a crucial role.

- Consumer Preference for Contactless Payments: Surging demand for NFC and QR code payments.

- Technological Advancements: Introduction of feature-rich Android POS and cloud-based solutions.

- SME Growth: Cost-effective and flexible solutions for small businesses.

- Digital Transformation Initiatives: Government support for cashless economies.

Obstacles in the France Mobile POS Terminal Market Market

Despite robust growth, the France mobile POS terminal market faces several obstacles. Intense competition among numerous vendors can lead to price wars and reduced profit margins. Regulatory hurdles, particularly concerning data security and evolving EMV standards, require continuous investment in compliance and software updates, which can be challenging for smaller businesses. Supply chain disruptions for hardware components can lead to stock shortages and delayed deliveries, impacting merchant operations. Furthermore, a segment of the market, especially older, more traditional businesses, may still exhibit a degree of resistance to adopting new technologies due to perceived complexity or upfront costs. The cost of integrating new POS systems with existing legacy infrastructure can also be a barrier for some enterprises.

- Intense Competition: Price sensitivity and margin pressures.

- Evolving Regulations: Continuous need for compliance updates.

- Supply Chain Vulnerabilities: Potential for hardware shortages.

- Technological Adoption Lag: Resistance from some traditional businesses.

Future Opportunities in France Mobile POS Terminal Market

The France mobile POS terminal market is ripe with future opportunities. The increasing adoption of biometric payment authentication and advanced fraud detection technologies presents a significant area for innovation. The expansion of mobile POS solutions into underserved sectors, such as field services and event management, offers untapped market potential. The growing trend of buy now, pay later (BNPL) integrations within POS systems will further enhance transaction value and customer satisfaction. Furthermore, the development of specialized POS applications for specific industries, like advanced inventory management for fashion retail or detailed booking systems for hospitality, will drive future growth. The continued push towards a fully digital economy in France will ensure sustained demand for sophisticated and versatile payment solutions.

- Biometric Payments: Enhanced security and user experience.

- Niche Sector Expansion: Field services, events, and mobile clinics.

- BNPL Integration: Increased transaction options for consumers.

- Industry-Specific Solutions: Tailored software for diverse business needs.

Major Players in the France Mobile POS Terminal Market Ecosystem

- SumUp Limited

- dejamobile

- Zettle (PayPal)

- Innovorder SAS

- PayXpert LTD

- NEC Corporation

- myPOS World Ltd

- Smile&Pay

- AURES Group

- Ingenico Group (Worldline)

- PAX Technology

Key Developments in France Mobile POS Terminal Market Industry

- April 2022 - Worldline has announced that it has been chosen by Monoprix to deploy its payment platform in all of its 700 stores in 250 cities in France, across its six banners: Monoprix, monop', monop'daily, monop'beauty, mono station, and Naturalia. This major deployment will enhance payment processing capabilities and customer experience across a vast retail network.

- March 2022 - PayXpert launched "PayXpress" and partnered with NetPay to sell android POS devices to merchants in France, Spain, and Taiwan. The PayXpress POS solution is ideal for travel, hospitality, and retail merchants, including hotels, restaurants, transport/taxi services, and luxury fashion brands. The solution enables merchants to accept Visa, MasterCard, American Express, Alipay, and WeChat on one single POS device, offering unparalleled payment flexibility.

Strategic France Mobile POS Terminal Market Market Forecast

The strategic forecast for the France mobile POS terminal market indicates sustained and robust growth, driven by the increasing digitalization of commerce and evolving consumer payment preferences. The market is expected to reach an estimated value of 2.5 Billion EUR by 2033, with a projected CAGR of 15% from 2025 to 2033. Key growth catalysts include the continued expansion of Android POS devices, the demand for contactless payment solutions, and the integration of value-added services such as inventory management and CRM. Emerging opportunities in areas like biometric authentication and BNPL integrations will further propel market expansion. The ongoing commitment of businesses across retail, hospitality, and other sectors to enhance customer experience and operational efficiency through advanced payment technologies will solidify mobile POS as an indispensable tool in the French business landscape.

France Mobile POS Terminal Market Segmentation

-

1. BY Type

- 1.1. Fixed Point-of-sale Systems

- 1.2. Mobile/Portable Point-of-sale Systems

-

2. End-User Industry

- 2.1. Retail

- 2.2. Hospitality

- 2.3. Healthcare

- 2.4. Others

France Mobile POS Terminal Market Segmentation By Geography

- 1. France

France Mobile POS Terminal Market Regional Market Share

Geographic Coverage of France Mobile POS Terminal Market

France Mobile POS Terminal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Payments from NFC-Compatible Smartphones and Smart Cards; Retail Sector Adopting the NFC POS Solutions Considerably; Significant Rise in the Demand for Contactless and Mobile POS Terminals

- 3.3. Market Restrains

- 3.3.1. Data Security Concerns Due to the Usage of Critical Information; Lack of Digital Infrastructure in Rural Areas

- 3.4. Market Trends

- 3.4.1. Increased Payments from NFC-Compatible Smartphones and Smart Cards

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Mobile POS Terminal Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by BY Type

- 5.1.1. Fixed Point-of-sale Systems

- 5.1.2. Mobile/Portable Point-of-sale Systems

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Retail

- 5.2.2. Hospitality

- 5.2.3. Healthcare

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by BY Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SumUp Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 dejamobile

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zettle (PayPal)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Innovorder SAS*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PayXpert LTD

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NEC Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 myPOS World Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Smile&Pay

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AURES Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ingenico Group (Worldline)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 PAX Technology

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 SumUp Limited

List of Figures

- Figure 1: France Mobile POS Terminal Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: France Mobile POS Terminal Market Share (%) by Company 2025

List of Tables

- Table 1: France Mobile POS Terminal Market Revenue million Forecast, by BY Type 2020 & 2033

- Table 2: France Mobile POS Terminal Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 3: France Mobile POS Terminal Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: France Mobile POS Terminal Market Revenue million Forecast, by BY Type 2020 & 2033

- Table 5: France Mobile POS Terminal Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 6: France Mobile POS Terminal Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Mobile POS Terminal Market?

The projected CAGR is approximately 10.2%.

2. Which companies are prominent players in the France Mobile POS Terminal Market?

Key companies in the market include SumUp Limited, dejamobile, Zettle (PayPal), Innovorder SAS*List Not Exhaustive, PayXpert LTD, NEC Corporation, myPOS World Ltd, Smile&Pay, AURES Group, Ingenico Group (Worldline), PAX Technology.

3. What are the main segments of the France Mobile POS Terminal Market?

The market segments include BY Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.63 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Payments from NFC-Compatible Smartphones and Smart Cards; Retail Sector Adopting the NFC POS Solutions Considerably; Significant Rise in the Demand for Contactless and Mobile POS Terminals.

6. What are the notable trends driving market growth?

Increased Payments from NFC-Compatible Smartphones and Smart Cards.

7. Are there any restraints impacting market growth?

Data Security Concerns Due to the Usage of Critical Information; Lack of Digital Infrastructure in Rural Areas.

8. Can you provide examples of recent developments in the market?

April 2022 - Worldline has announced that it has been chosen by Monoprix to deploy its payment platform in all of its 700 stores in 250 cities in France, across its six banners: Monoprix, monop', monop'daily, monop'beauty, mono station, and Naturalia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Mobile POS Terminal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Mobile POS Terminal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Mobile POS Terminal Market?

To stay informed about further developments, trends, and reports in the France Mobile POS Terminal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence