Key Insights

The European Sports Team & Clubs Market is poised for substantial growth, driven by escalating fan engagement, high-value broadcasting rights, and the burgeoning sports betting sector. Our analysis indicates a Compound Annual Growth Rate (CAGR) of 4.9%, with the market size projected to reach 17.4 billion by 2025. Key growth drivers include the global appeal of elite European football clubs, amplified by social media and digital platforms, fostering international viewership and lucrative sponsorships. Strategic investments in youth development and infrastructure further bolster long-term potential. While competitive and economic factors present challenges, the market's trajectory remains positive. Segmentation encompasses football, rugby, tennis, and other sports, with influential bodies like the European Club Association (ECA) and UEFA shaping market dynamics.

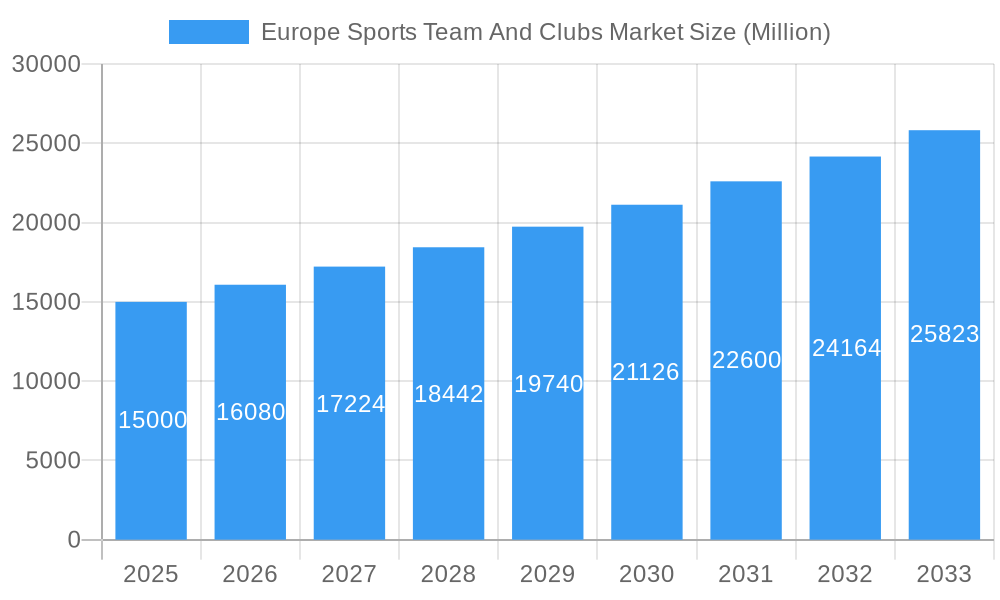

Europe Sports Team And Clubs Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued expansion, fueled by innovative monetization strategies, global broadcasting deals, and the integration of esports. The market is expected to be valued at 17.4 billion in 2025. Growth will remain strong in major football leagues, with diversification into other sports and esports offering significant revenue opportunities. Challenges include financial stability, regulatory navigation, and adapting to evolving fan consumption. However, the enduring popularity of European sports, coupled with effective management, ensures sustained market growth.

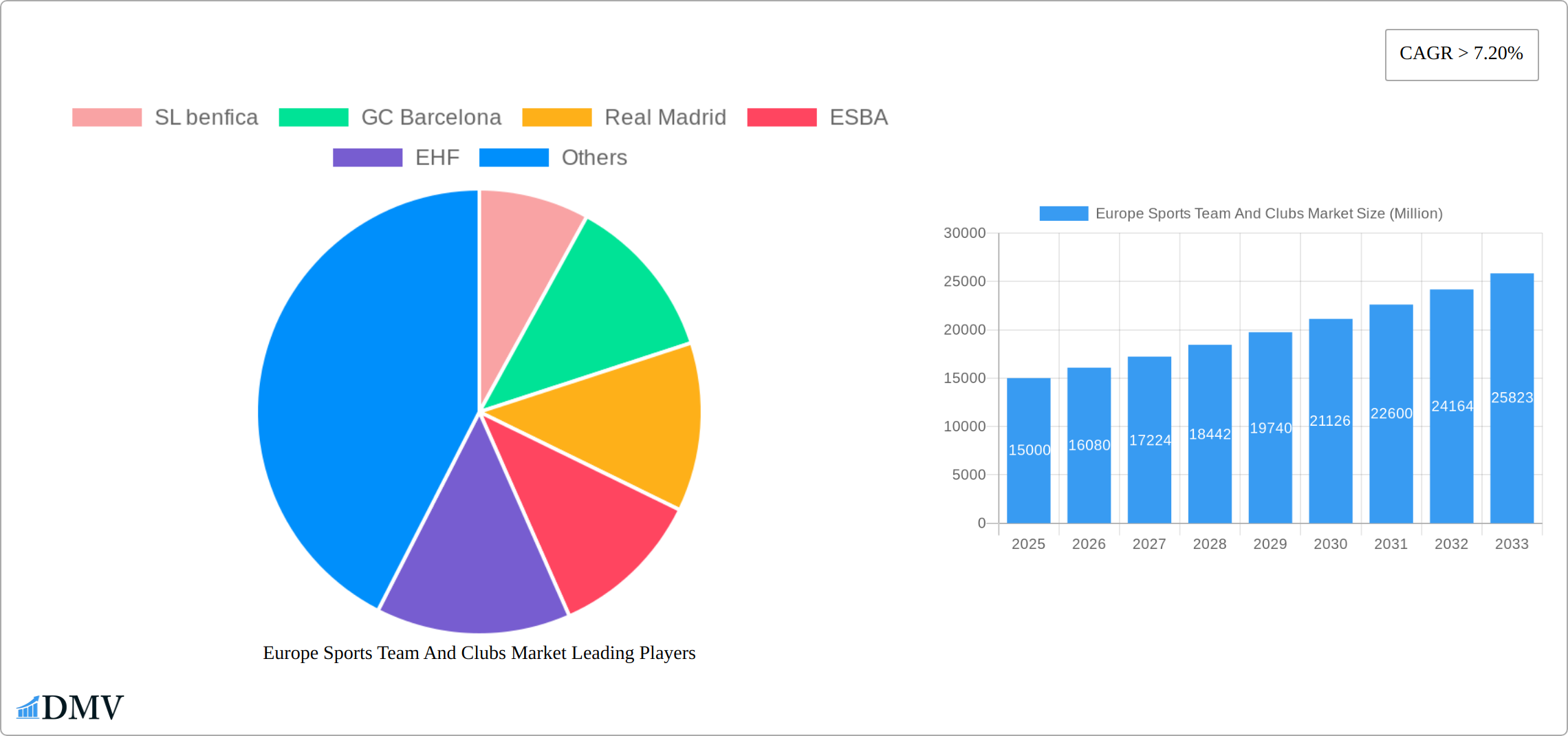

Europe Sports Team And Clubs Market Company Market Share

Europe Sports Team And Clubs Market Market Composition & Trends

The Europe Sports Team and Clubs Market is characterized by a dynamic interplay of various factors that shape its composition and trends. Market concentration in this sector is moderate, with leading clubs like Real Madrid and Bayern Munich holding significant shares, estimated at around 10% and 8% respectively. Innovation catalysts include advancements in sports analytics and digital fan engagement platforms, which have transformed the way clubs operate and monetize. The regulatory landscape is evolving, with the European Union's sports policies focusing on fairness and competition, impacting market dynamics.

Substitute products, such as eSports and virtual sports, are gaining traction, particularly among younger demographics, posing a threat to traditional sports clubs. End-user profiles are diverse, ranging from local fans to global audiences, with the latter driving revenue through merchandise and streaming services. Mergers and acquisitions (M&A) activities are prevalent, with deal values in 2022 reaching over 1.5 Billion, driven by investors seeking to capitalize on the lucrative sports market.

- Market Concentration: Moderate, with top clubs holding significant shares.

- Innovation Catalysts: Sports analytics and digital fan engagement.

- Regulatory Landscape: EU sports policies promoting fairness.

- Substitute Products: eSports and virtual sports.

- End-User Profiles: Diverse, from local to global audiences.

- M&A Activities: Deal values reached 1.5 Billion in 2022.

Europe Sports Team And Clubs Market Industry Evolution

The Europe Sports Team and Clubs Market has undergone a remarkable transformation from 2019 to 2033. The market has experienced substantial and sustained growth, projecting a compound annual growth rate (CAGR) of approximately 5% during the forecast period of 2025-2033. This surge is largely attributable to significant technological advancements, especially in the realms of data analytics and innovative fan engagement strategies. Leading clubs are now adeptly leveraging big data to refine player performance, elevate fan experiences, and consequently, boost engagement and revenue generation.

A discernible shift in consumer preferences towards personalized and immersive experiences has spurred considerable investment in virtual reality (VR) and augmented reality (AR) technologies within sports organizations. The adoption rate of these cutting-edge technologies in the sports sector is anticipated to climb by a significant 20% annually over the next decade. Furthermore, the proliferation of digital streaming platforms has fundamentally reshaped how fans consume sports content, with platforms such as DAZN and Eurosport witnessing a dramatic uptick in viewership.

Economic drivers, including lucrative sponsorship deals and substantial media rights agreements, are also pivotal to the market's evolution, having seen a notable 15% increase in value since 2019. The strategic integration of eSports into traditional sports club structures has further broadened revenue diversification. Esteemed clubs like SL Benfica and GC Barcelona have proactively established eSports divisions, aligning with the explosive growth of eSports, which is projected to captivate a global audience exceeding 500 million by 2025.

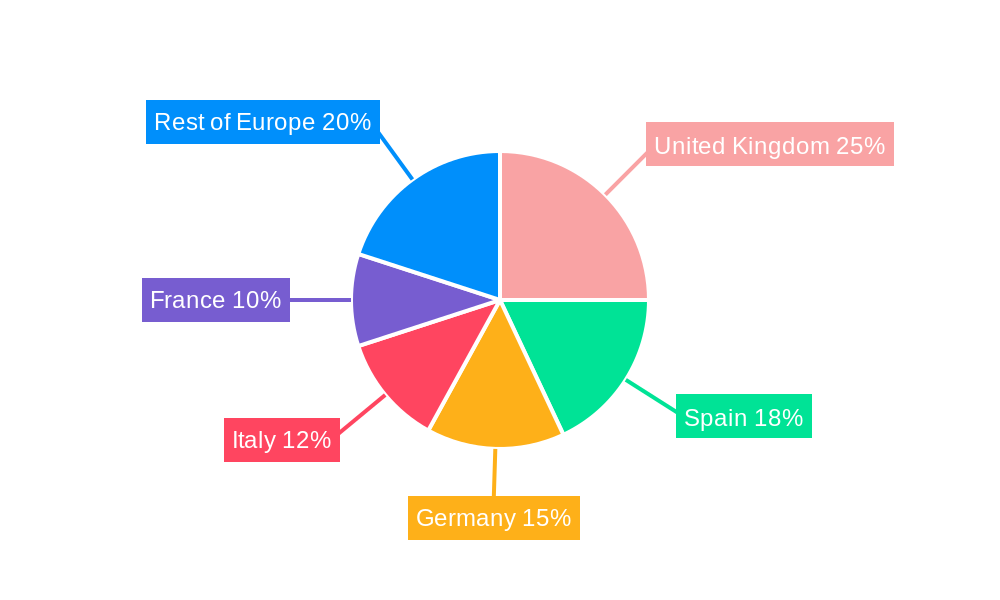

Leading Regions, Countries, or Segments in Europe Sports Team And Clubs Market

The United Kingdom stands out as the dominant country within the Europe Sports Team and Clubs Market, driven by its rich sports culture and the presence of globally recognized clubs like Liverpool and Manchester United. The UK's market share is estimated at 20%, bolstered by high levels of investment in sports infrastructure and fan engagement initiatives.

- Key Drivers:

- Investment trends: Significant investments in sports facilities and technology.

- Regulatory support: Favorable policies encouraging sports development.

- Fan base: Large and passionate fan bases driving revenue.

The dominance of the UK can be attributed to several factors. Firstly, the country's historical legacy in sports, particularly football, has created a strong foundation for the market. Secondly, the UK's robust media landscape, with extensive coverage of sports events, enhances visibility and fan engagement. The Premier League, for instance, has a global audience of over 4 Billion, contributing to substantial media rights revenue.

Moreover, the UK's approach to sports governance and regulation fosters a competitive environment that encourages innovation and growth. The Football Association's initiatives to promote grassroots sports and youth development have further solidified the UK's position. Additionally, the UK's strategic location in Europe allows it to host major international sporting events, such as the UEFA Euro and the Olympics, which attract global attention and investment.

Europe Sports Team And Clubs Market Product Innovations

Innovations within the Europe Sports Team and Clubs Market are predominantly centered on enhancing the fan experience and optimizing the performance of athletic teams. Clubs are increasingly deploying sophisticated sports analytics platforms that deliver real-time data insights into player performance, empowering coaches with actionable intelligence for data-driven decision-making. Concurrently, the widespread adoption of VR and AR technologies is revolutionizing fan engagement, offering unprecedented immersive viewing opportunities and interactive experiences. These advancements not only contribute to tangible improvements in performance metrics, such as enhanced player efficiency and elevated fan satisfaction, but also unlock novel revenue streams through hyper-personalized fan offerings and precisely targeted advertising campaigns.

Propelling Factors for Europe Sports Team And Clubs Market Growth

Several key factors are driving the growth of the Europe Sports Team and Clubs Market. Technological advancements, such as the integration of AI and machine learning in sports analytics, are enhancing team performance and fan engagement. Economically, the market benefits from increased sponsorship deals and media rights, with a 15% rise in value since 2019. Regulatory support from the EU, promoting fair competition and sports development, further propels market growth. These factors collectively contribute to a robust and expanding market.

Obstacles in the Europe Sports Team And Clubs Market Market

The Europe Sports Team and Clubs Market is not without its challenges, with several obstacles posing potential impediments to continued growth. Navigating complex regulatory landscapes, including stringent adherence to EU sports policies, can present significant barriers for emerging entities. Disruptions within supply chains, particularly concerning sports equipment and merchandise, have been amplified by recent global events, impacting club revenues. Furthermore, intense competitive pressures, exemplified by the fierce rivalry between powerhouses like Real Madrid and Bayern Munich for top-tier talent and sponsorships, could potentially lead to a market share reduction of up to 10% for smaller, less established clubs.

Future Opportunities in Europe Sports Team And Clubs Market

The landscape of future opportunities within the Europe Sports Team and Clubs Market is exceptionally promising, especially in areas like expansion into burgeoning markets such as eSports and virtual sports, which are projected to experience an impressive annual growth rate of 20%. Technological breakthroughs, notably the integration of blockchain technology for streamlining ticket sales and enhancing fan loyalty programs, present significant avenues for generating new revenue streams. Moreover, the evolving consumer preference for personalized and deeply immersive experiences creates fertile ground for clubs to innovate and cultivate more profound connections with their fan bases.

Major Players in the Europe Sports Team And Clubs Market Ecosystem

Key Developments in Europe Sports Team And Clubs Market Industry

- June 2023: The PGA Tour merged with LIV Golf, backed by the Saudi Arabia Public Investment Fund. This merger, involving a membership organization for touring professional golfers, has significant implications for the sports market, potentially leading to increased investment and global reach.

- December 2022: Eagle Football Holdings Bidco Limited, founded by John Textors, acquired a controlling stake in Olympique Lyonnais Groupe SA. This acquisition reflects the trend of private investment in sports clubs, aiming to enhance performance and market value.

Strategic Europe Sports Team And Clubs Market Market Forecast

The strategic forecast for the Europe Sports Team and Clubs Market paints a picture of robust growth potential extending through 2033. Future expansion and success will be significantly driven by the strategic integration of emerging technologies like blockchain and a concerted push into the dynamic eSports sector. The market is well-positioned to benefit from ongoing regulatory support and the ever-increasing consumer appetite for personalized and engaging experiences. With a projected CAGR of 5%, the market is on track to achieve unprecedented milestones, fueled by a relentless pursuit of innovation and judicious strategic investments.

Europe Sports Team And Clubs Market Segmentation

-

1. Type

- 1.1. Football

- 1.2. Golf

- 1.3. Rugby Union

- 1.4. Cricket

- 1.5. Boxing

- 1.6. Other Types

-

2. Revenue Source

- 2.1. Media Rights

- 2.2. Merchandising

- 2.3. Tickets

- 2.4. Sponsorship

Europe Sports Team And Clubs Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Sports Team And Clubs Market Regional Market Share

Geographic Coverage of Europe Sports Team And Clubs Market

Europe Sports Team And Clubs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Number of Spectators Watching Sports; Increase in Number of Sports Event Post COVID-19

- 3.3. Market Restrains

- 3.3.1. Increase in Number of Spectators Watching Sports; Increase in Number of Sports Event Post COVID-19

- 3.4. Market Trends

- 3.4.1. Rising Football And Soccer Industry In Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Sports Team And Clubs Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Football

- 5.1.2. Golf

- 5.1.3. Rugby Union

- 5.1.4. Cricket

- 5.1.5. Boxing

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Revenue Source

- 5.2.1. Media Rights

- 5.2.2. Merchandising

- 5.2.3. Tickets

- 5.2.4. Sponsorship

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SL benfica

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GC Barcelona

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Real Madrid

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ESBA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 EHF

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Eagel Football Holding

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The European Club

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tennis Europe

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bayern Munich

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Liverpool**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SL benfica

List of Figures

- Figure 1: Europe Sports Team And Clubs Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Sports Team And Clubs Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Sports Team And Clubs Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Sports Team And Clubs Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 3: Europe Sports Team And Clubs Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Sports Team And Clubs Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Europe Sports Team And Clubs Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 6: Europe Sports Team And Clubs Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Sports Team And Clubs Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the Europe Sports Team And Clubs Market?

Key companies in the market include SL benfica, GC Barcelona, Real Madrid, ESBA, EHF, Eagel Football Holding, The European Club, Tennis Europe, Bayern Munich, Liverpool**List Not Exhaustive.

3. What are the main segments of the Europe Sports Team And Clubs Market?

The market segments include Type, Revenue Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Number of Spectators Watching Sports; Increase in Number of Sports Event Post COVID-19.

6. What are the notable trends driving market growth?

Rising Football And Soccer Industry In Europe.

7. Are there any restraints impacting market growth?

Increase in Number of Spectators Watching Sports; Increase in Number of Sports Event Post COVID-19.

8. Can you provide examples of recent developments in the market?

June 2023: The PGA Tour merged with LIV Golf, which is backed by the Saudi Arabia Public Investment Fund, an entity controlled by Saudi Crown Prince Mohammed bin Salman. PGA Tour exists as a membership organization for touring professional golfers and co-sanctioning tournaments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Sports Team And Clubs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Sports Team And Clubs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Sports Team And Clubs Market?

To stay informed about further developments, trends, and reports in the Europe Sports Team And Clubs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence