Key Insights

The European probiotic drinks market is projected to reach 40497.4 million by 2024, exhibiting a Compound Annual Growth Rate (CAGR) of 8.3%. This robust expansion is driven by increasing consumer awareness of gut health's impact on overall well-being, a rise in digestive disorders, and the growing demand for functional beverages offering health benefits beyond hydration. The market benefits from diverse product formats like yogurt drinks, kefir, kombucha, and probiotic juices.

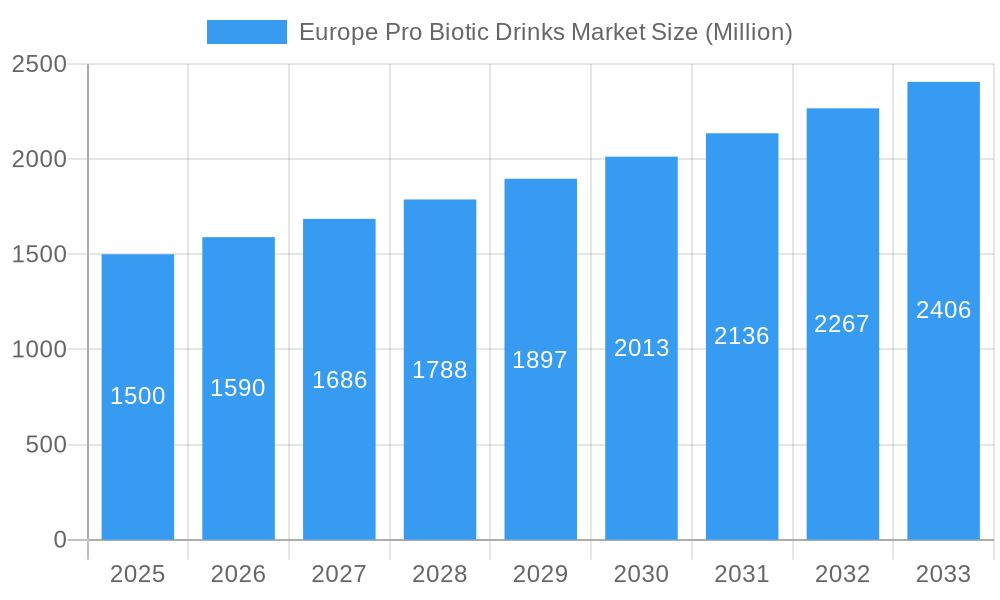

Europe Pro Biotic Drinks Market Market Size (In Billion)

Key market segments include yogurt drinks and fermented milk drinks, favored for established consumer preferences and extensive distribution. Supermarkets and hypermarkets are the primary distribution channels, with the online segment showing significant growth potential aligned with broader e-commerce trends.

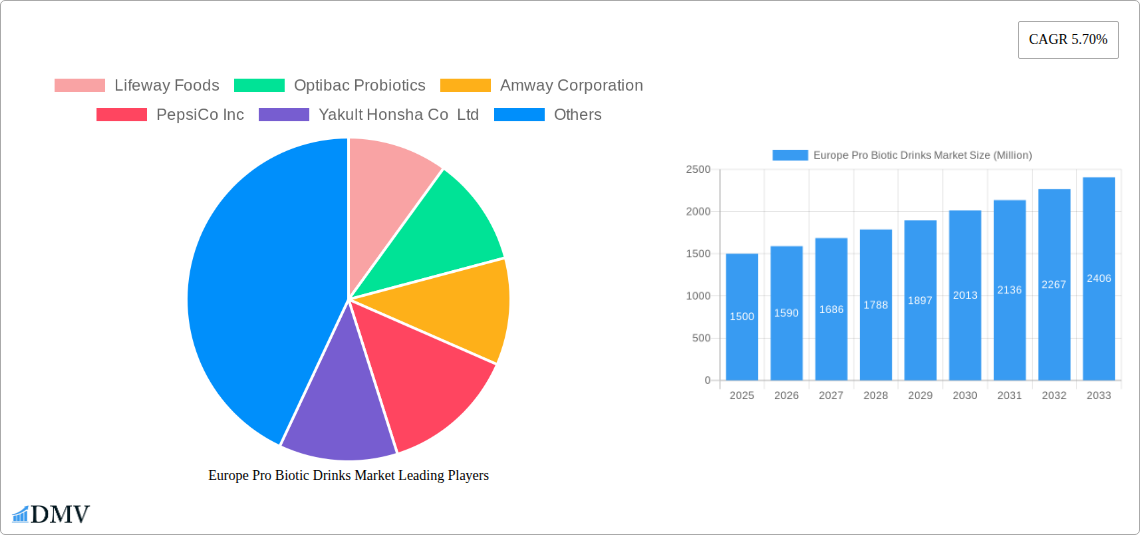

Europe Pro Biotic Drinks Market Company Market Share

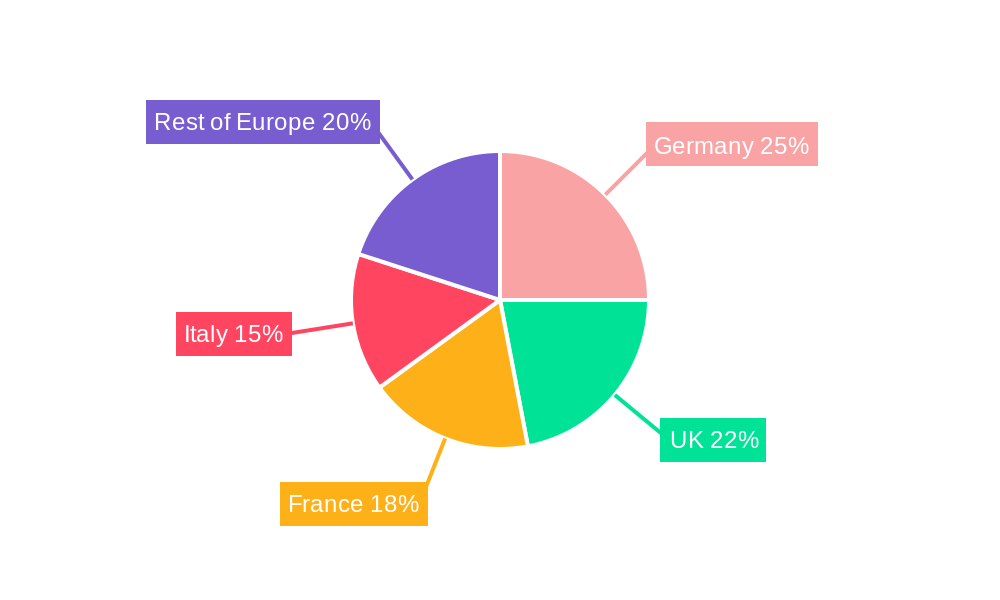

Germany, the UK, France, and Italy lead the European market due to higher disposable incomes and established health and wellness consumer bases. Emerging markets in the "Rest of Europe" also present substantial growth opportunities.

Competitive landscapes feature both multinational corporations and specialized producers, fostering diverse product offerings and pricing strategies.

Challenges include price sensitivity, requiring innovative product development and strategic pricing. Maintaining consistent product quality and probiotic viability is crucial for consumer trust. Regulatory compliance for health claims and labeling will also shape market dynamics.

Future growth will be influenced by research validating probiotic drinks' efficacy in managing specific health conditions, supported by targeted marketing highlighting unique product benefits. Continued growth hinges on balancing innovation, affordability, and stringent quality control to meet diverse European consumer needs.

Europe Probiotic Drinks Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Europe Probiotic Drinks Market, offering a comprehensive overview of market dynamics, key players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report uses a combination of historical data (2019-2024) and forecast projections (2025-2033) to provide a robust and reliable analysis for stakeholders. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Europe Probiotic Drinks Market Composition & Trends

This section delves into the intricate composition of the European probiotic drinks market, examining key aspects influencing its growth trajectory. We analyze market concentration, revealing the market share distribution among leading players like Danone S.A., Yakult Honsha Co. Ltd., and PepsiCo Inc., highlighting the competitive landscape. Innovation catalysts, including advancements in probiotic strains and functional formulations, are thoroughly examined. The regulatory landscape, encompassing food safety standards and health claims regulations across different European countries, is also assessed. We explore the impact of substitute products, such as conventional beverages, on market growth and penetration. Additionally, the report analyzes end-user profiles, categorizing consumers based on demographics, health consciousness, and purchasing behavior, along with significant M&A activities and their influence on the market consolidation, providing insights into deal values where available (e.g., xx Million).

- Market Concentration: Highly fragmented, with a few major players dominating specific segments.

- Innovation Catalysts: Growing demand for functional foods and beverages with health benefits.

- Regulatory Landscape: Stringent regulations concerning labeling, health claims, and food safety across the EU.

- Substitute Products: Competition from conventional beverages with similar attributes such as juices and soft drinks.

- End-User Profiles: Health-conscious individuals, athletes, and elderly populations are major consumer segments.

- M&A Activities: Consolidation expected as larger players acquire smaller companies to increase market share.

Europe Probiotic Drinks Market Industry Evolution

This section meticulously examines the evolution of the European probiotic drinks market, tracing its growth trajectory from 2019 to the projected year 2033. We analyze historical market growth rates, pinpointing key periods of expansion and contraction. The influence of technological advancements, such as improved fermentation techniques and enhanced probiotic strain development, on product quality and market expansion is explored. Furthermore, we examine shifting consumer demands, analyzing the increasing preference for natural and organic probiotic drinks, and the impact of health and wellness trends on market dynamics. The report quantifies these trends with data points, highlighting growth rates for specific segments (e.g., the kefir segment experiencing a xx% growth between 2022 and 2025). The adoption rate of new product categories, such as kombucha and probiotic juices, is also analyzed, providing a comprehensive picture of the market's evolution.

Leading Regions, Countries, or Segments in Europe Probiotic Drinks Market

This section pinpoints the leading regions, countries, and segments within the European probiotic drinks market. We identify the dominant players and regions, examining market share data to ascertain the relative contribution of each area. The analysis is broken down by:

Type:

- Yogurt Drinks: Strong market share due to widespread consumption and established distribution channels.

- Fermented Milk Drinks: Growing segment propelled by health awareness and increasing demand.

- Kefir: Rapid growth fueled by its unique health benefits and diverse flavor profiles.

- Kombucha: Increasing popularity, particularly among younger demographics, driving significant market expansion.

- Probiotic Juices: Emerging segment showing considerable potential for growth.

- Others: Includes niche probiotic beverages, representing a smaller, but significant, market share.

Distribution Channel:

- Supermarkets/Hypermarkets: Dominant distribution channel due to high reach and accessibility.

- Convenience Stores: Expanding segment reflecting consumer demand for on-the-go consumption.

- Pharmacies/Health Stores: Increasing sales driven by health-focused consumers seeking probiotic benefits.

- Online Stores: Growing segment facilitated by e-commerce penetration and home delivery services.

- Other Distribution Channels: Includes food service, direct sales, and other niche channels.

Country:

- United Kingdom: Significant market size driven by high consumer awareness and established distribution network.

- Germany: Strong growth potential due to rising health consciousness and increasing demand for functional foods.

- Spain: Expanding market, mirroring the trends observed in other European countries.

- France: Substantial market presence, with considerable growth opportunity in specific segments.

- Italy: Growing segment with potential for increased consumption of probiotic drinks.

- Russia: A market with promising growth potential, though hampered by economic factors.

- Rest of Europe: A collection of smaller markets with diverse characteristics and growth trajectories.

Key drivers, such as investment trends (e.g., venture capital funding in probiotic startups), regulatory support (e.g., government initiatives promoting healthy eating), and consumer behavior, are detailed for each dominant segment and country using bullet points.

Europe Probiotic Drinks Market Product Innovations

Recent years have witnessed significant product innovations within the European probiotic drinks market. Companies are continuously developing new product formulations and delivery systems to enhance both taste and functional benefits. For example, the incorporation of novel probiotic strains with enhanced viability and targeted health benefits is a key area of innovation. The development of new flavor profiles to cater to diverse consumer preferences is another significant trend. Furthermore, the use of sustainable packaging materials and eco-friendly manufacturing processes is gaining traction, aligning with the growing emphasis on environmentally conscious consumption. These innovations contribute significantly to the unique selling propositions of various brands and drive market competitiveness.

Propelling Factors for Europe Probiotic Drinks Market Growth

The growth of the European probiotic drinks market is propelled by a confluence of factors. Increasing consumer awareness regarding the gut-health connection and the associated benefits of probiotic consumption is a primary driver. Furthermore, the rising prevalence of lifestyle diseases, coupled with a growing preference for functional foods and beverages, fuels demand for probiotic drinks. Government initiatives promoting healthy eating habits and supportive regulations play a crucial role. Finally, the increasing availability of probiotic drinks through diverse distribution channels contributes to market expansion.

Obstacles in the Europe Probiotic Drinks Market

Several obstacles impede the growth of the European probiotic drinks market. Stringent regulations concerning health claims and labeling create hurdles for smaller players seeking market entry. Supply chain disruptions caused by geopolitical events and economic fluctuations negatively impact production and distribution. Intense competition among established brands and the emergence of new players intensify pressure on pricing and margins. These challenges present headwinds to market growth, requiring adaptation and innovation from businesses operating in this sector.

Future Opportunities in Europe Probiotic Drinks Market

Emerging opportunities in the European probiotic drinks market are abundant. The expansion into new markets within Europe, particularly in Eastern Europe, presents significant growth potential. The exploration of novel probiotic strains with targeted health benefits is another avenue for innovation and market expansion. Furthermore, tapping into consumer demand for personalized nutrition solutions, by offering customized probiotic blends, is a promising opportunity. Finally, the development of eco-friendly packaging and sustainable manufacturing processes will contribute to market growth and brand reputation.

Major Players in the Europe Probiotic Drinks Market Ecosystem

- Lifeway Foods

- Optibac Probiotics

- Amway Corporation

- PepsiCo Inc

- Yakult Honsha Co Ltd

- Nourish Kefir

- Archer Daniels Midland Company

- Yeo Valley Group Limited

- Danone S.A.

- Novozymes A/S

- Bio-K Plus International Inc

- GT'S Living Foods

Key Developments in Europe Probiotic Drinks Market Industry

- October 2022: Purity Brewing Company launched Pure Booch, its first kombucha line.

- August 2022: Yeo Valley Organic expanded its kefir range in the UK with three new flavors.

- February 2022: Remedy Kombucha launched a new Wild Berry flavor in the UK.

Strategic Europe Probiotic Drinks Market Forecast

The European probiotic drinks market is poised for sustained growth driven by a range of factors, including growing health consciousness, increased demand for functional foods and beverages, and continuous product innovation. The market's expansion will be further fueled by the exploration of new distribution channels and the expansion into emerging markets. The increasing adoption of sustainable practices by manufacturers will enhance market appeal, contributing to a positive and significant growth trajectory throughout the forecast period.

Europe Pro Biotic Drinks Market Segmentation

-

1. Type

- 1.1. Yogurt Drinks

- 1.2. Fermented Milk Drinks

- 1.3. Kefir

- 1.4. Kombucha

- 1.5. Probiotic Juices

- 1.6. Others

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Pharmacies/Health Stores

- 2.4. Online Stores

- 2.5. Other Distribution Channels

Europe Pro Biotic Drinks Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Pro Biotic Drinks Market Regional Market Share

Geographic Coverage of Europe Pro Biotic Drinks Market

Europe Pro Biotic Drinks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications of Oils and Fats in Different End-Use Industries; Government Initiatives and Key Players Adopting Innovative Market Expansion Strategies

- 3.3. Market Restrains

- 3.3.1. Volatility in Imports and Supply Chain of Oils

- 3.4. Market Trends

- 3.4.1. Rising Demand For Functional Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pro Biotic Drinks Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Yogurt Drinks

- 5.1.2. Fermented Milk Drinks

- 5.1.3. Kefir

- 5.1.4. Kombucha

- 5.1.5. Probiotic Juices

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Pharmacies/Health Stores

- 5.2.4. Online Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lifeway Foods

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Optibac Probiotics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amway Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PepsiCo Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yakult Honsha Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nourish Kefir

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Archer Daniels Midland Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yeo Valley Group Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Danone S A

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Novozymes A/S

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bio-K Plus International Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 GT'S Living Foods

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Lifeway Foods

List of Figures

- Figure 1: Europe Pro Biotic Drinks Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Pro Biotic Drinks Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Pro Biotic Drinks Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Europe Pro Biotic Drinks Market Volume K Liters Forecast, by Type 2020 & 2033

- Table 3: Europe Pro Biotic Drinks Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe Pro Biotic Drinks Market Volume K Liters Forecast, by Distribution Channel 2020 & 2033

- Table 5: Europe Pro Biotic Drinks Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Europe Pro Biotic Drinks Market Volume K Liters Forecast, by Region 2020 & 2033

- Table 7: Europe Pro Biotic Drinks Market Revenue million Forecast, by Type 2020 & 2033

- Table 8: Europe Pro Biotic Drinks Market Volume K Liters Forecast, by Type 2020 & 2033

- Table 9: Europe Pro Biotic Drinks Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Europe Pro Biotic Drinks Market Volume K Liters Forecast, by Distribution Channel 2020 & 2033

- Table 11: Europe Pro Biotic Drinks Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Europe Pro Biotic Drinks Market Volume K Liters Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Pro Biotic Drinks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Pro Biotic Drinks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2020 & 2033

- Table 17: France Europe Pro Biotic Drinks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Pro Biotic Drinks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Pro Biotic Drinks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Pro Biotic Drinks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Pro Biotic Drinks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Pro Biotic Drinks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Pro Biotic Drinks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Pro Biotic Drinks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Pro Biotic Drinks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pro Biotic Drinks Market?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Europe Pro Biotic Drinks Market?

Key companies in the market include Lifeway Foods, Optibac Probiotics, Amway Corporation, PepsiCo Inc, Yakult Honsha Co Ltd, Nourish Kefir, Archer Daniels Midland Company, Yeo Valley Group Limited, Danone S A, Novozymes A/S, Bio-K Plus International Inc, GT'S Living Foods.

3. What are the main segments of the Europe Pro Biotic Drinks Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 40497.4 million as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications of Oils and Fats in Different End-Use Industries; Government Initiatives and Key Players Adopting Innovative Market Expansion Strategies.

6. What are the notable trends driving market growth?

Rising Demand For Functional Beverages.

7. Are there any restraints impacting market growth?

Volatility in Imports and Supply Chain of Oils.

8. Can you provide examples of recent developments in the market?

In October 2022, Purity Brewing Company launched a range of authentically slow-brewed 'pure' kombucha drinks, called Pure Booch. This is companies first venture outside the beer market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Liters.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pro Biotic Drinks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pro Biotic Drinks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pro Biotic Drinks Market?

To stay informed about further developments, trends, and reports in the Europe Pro Biotic Drinks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence