Key Insights

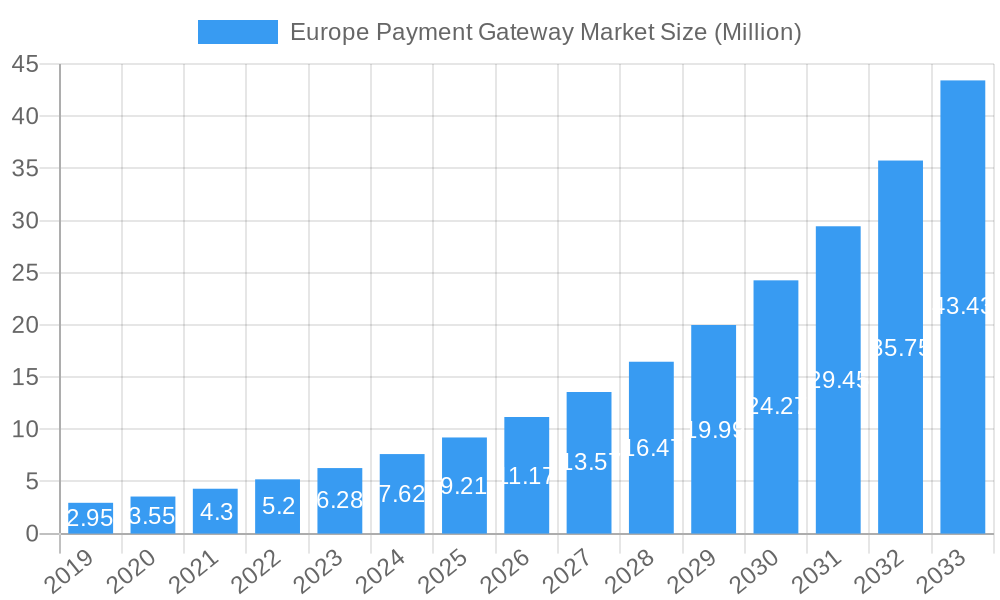

The Europe Payment Gateway Market is poised for substantial growth, projected to reach approximately USD 9.21 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 22.02% expected to continue through 2033. This robust expansion is primarily driven by the increasing adoption of digital payments across diverse sectors, accelerated by a heightened focus on secure and seamless transaction experiences. The surge in e-commerce, coupled with the proliferation of mobile payment solutions and the growing demand for cross-border transactions, are key catalysts fueling this market's upward trajectory. Furthermore, regulatory advancements aimed at enhancing payment security and interoperability within the European Union are fostering a more conducive environment for payment gateway providers. The market benefits significantly from ongoing technological innovations, including the integration of AI and machine learning for fraud detection and enhanced customer analytics, all contributing to a more efficient and trustworthy payment ecosystem.

Europe Payment Gateway Market Market Size (In Million)

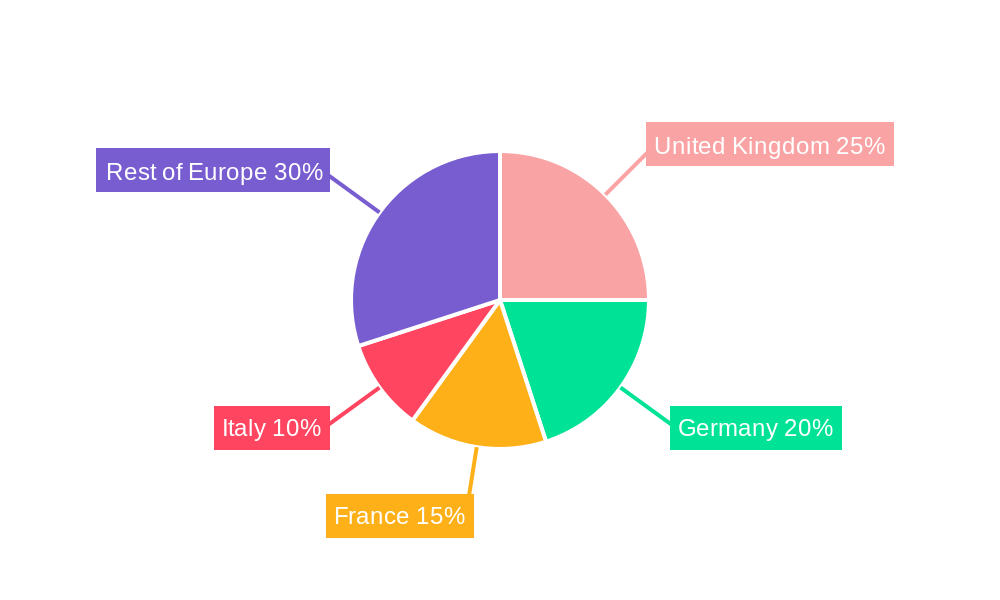

The market is segmented across various types, including hosted and non-hosted solutions, catering to a wide spectrum of enterprises from Small and Medium Enterprises (SMEs) to large corporations. End-user industries like Retail, BFSI (Banking, Financial Services, and Insurance), Travel, and Media & Entertainment are prominently leveraging these gateways to streamline their payment processes and improve customer engagement. Geographically, the European market is characterized by a strong presence of established players and a dynamic landscape of innovative startups, with significant contributions expected from countries like the United Kingdom, Germany, and France. Emerging trends such as the rise of buy now, pay later (BNPL) options and the increasing demand for integrated payment solutions that offer a holistic approach to financial management are expected to further shape the market's future, presenting both opportunities and challenges for existing and new entrants.

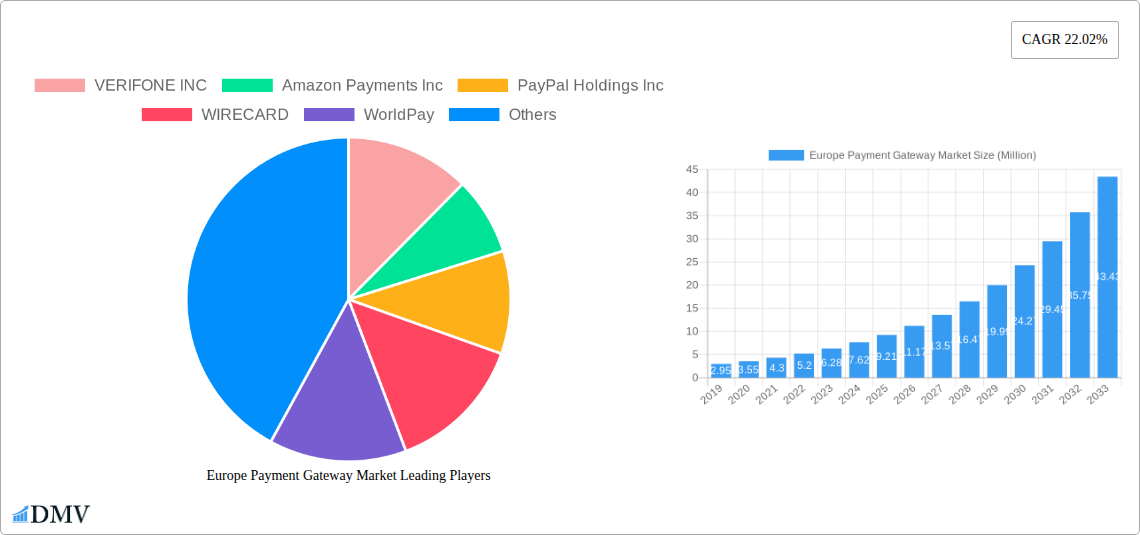

Europe Payment Gateway Market Company Market Share

Europe Payment Gateway Market: Comprehensive Analysis & Future Outlook (2019–2033)

Unlock critical insights into the dynamic Europe Payment Gateway Market. This in-depth report provides a holistic view of market composition, industry evolution, regional dominance, product innovation, growth drivers, challenges, and future opportunities, meticulously crafted for stakeholders seeking a competitive edge. Our analysis covers the historical period of 2019–2024, with a base year of 2025 and a robust forecast extending to 2033.

Europe Payment Gateway Market Market Composition & Trends

The Europe Payment Gateway Market exhibits a dynamic and evolving landscape, characterized by increasing competition and a growing emphasis on innovation. Market concentration is moderately high, with key players vying for significant market share through strategic partnerships and technological advancements. Several factors are acting as innovation catalysts, including the rise of e-commerce, the proliferation of mobile payments, and the increasing demand for secure and seamless transaction experiences. Regulatory landscapes, such as PSD2, continue to shape the market by fostering competition and enhancing security standards. Substitute products, including direct bank transfers and alternative payment methods, pose a competitive threat, but the convenience and security offered by established payment gateways often outweigh these alternatives. End-user profiles are diverse, with the Retail and BFSI sectors representing significant adoption, while emerging segments like Media and Entertainment are rapidly expanding their payment gateway integration. Mergers and acquisitions (M&A) activities are prevalent, driven by the desire for market consolidation and expansion into new geographies and service offerings. For instance, M&A deal values are estimated to range from tens of millions to billions, reflecting the strategic importance of acquiring innovative technologies and customer bases. The market is projected to witness a significant Compound Annual Growth Rate (CAGR) driven by these trends.

Europe Payment Gateway Market Industry Evolution

The evolution of the Europe Payment Gateway Market has been a testament to rapid technological adoption and shifting consumer behaviors, particularly evident between 2019 and 2033. The historical period (2019–2024) saw a steady increase in online transactions, fueled by the burgeoning e-commerce sector and a growing reliance on digital channels for purchases. This surge necessitated robust and secure payment infrastructure, driving the adoption of payment gateways across various industries. The COVID-19 pandemic acted as a significant accelerator, compelling businesses to transition to online sales and, consequently, to integrate sophisticated payment solutions. Technological advancements have been at the forefront of this evolution. The introduction and refinement of Application Programming Interfaces (APIs) have enabled greater flexibility and integration capabilities for businesses, allowing for customized payment flows. The rise of mobile payments, including contactless and in-app transactions, has fundamentally altered consumer expectations, demanding instant, frictionless experiences.

In recent years, the focus has shifted towards enhanced security measures, such as tokenization and multi-factor authentication, to combat rising fraud rates. Open banking initiatives, driven by regulations like PSD2, have further catalyzed innovation by enabling third-party providers to develop new payment services, fostering competition and offering consumers more choices. The integration of Artificial Intelligence (AI) and Machine Learning (ML) for fraud detection and personalized payment experiences is becoming increasingly crucial. Looking ahead, the forecast period (2025–2033) anticipates continued growth, driven by the expansion of cross-border e-commerce, the adoption of cryptocurrencies as a payment method, and the ongoing digital transformation of traditional industries. The market is projected to achieve an estimated market size of over XX Billion by 2025, with an anticipated CAGR of approximately XX% during the forecast period. This sustained growth trajectory underscores the indispensable role of payment gateways in the modern digital economy.

Leading Regions, Countries, or Segments in Europe Payment Gateway Market

The Europe Payment Gateway Market's dominance is multifaceted, with key regions, countries, and segments exhibiting significant growth and adoption.

Dominant Region: Western Europe, particularly Germany and the United Kingdom, consistently leads the market.

- Key Drivers:

- Robust E-commerce Infrastructure: High internet penetration and widespread adoption of online shopping.

- Technological Advancement: Early adoption of innovative payment technologies and strong digital infrastructure.

- Consumer Trust: High levels of consumer trust in digital transactions and online security.

- Regulatory Support: Favorable regulatory environments that encourage digital payments and innovation.

Dominant Country: Germany

- In-depth Analysis: Germany's market leadership is propelled by its strong economic standing and a highly digitally-savvy population. The recent launch of Wero, a new digital payment wallet by the European Payments Initiative (EPI), in collaboration with major German banks, signifies a strategic move towards account-to-account (A2A) instant payments, directly integrated into banking apps. This initiative aims to provide a secure, efficient, and user-friendly payment experience, further solidifying Germany's position as a pioneer in payment innovation. The strong presence of large enterprises and a thriving SME sector also contribute significantly to the demand for diverse payment gateway solutions.

Dominant Segment by End-User: Retail

- In-depth Analysis: The Retail sector accounts for the largest share of the Europe Payment Gateway Market. This is primarily driven by the explosive growth of e-commerce and the increasing consumer preference for online shopping. Retailers are constantly seeking payment gateways that offer a seamless checkout experience, a wide range of payment options (including mobile wallets and buy-now-pay-later solutions), and robust security features to minimize fraud. The ability to process transactions quickly and efficiently directly impacts customer satisfaction and conversion rates, making payment gateways an indispensable tool for retail businesses of all sizes. The constant evolution of consumer buying habits, with a greater emphasis on convenience and personalized shopping journeys, further cements the Retail sector's dominance.

Dominant Segment by Type: Hosted Payment Gateways

- In-depth Analysis: Hosted payment gateways remain a preferred choice for many businesses, especially SMEs, due to their ease of implementation and lower initial setup costs. They offload the complexities of payment processing and security compliance to the payment gateway provider, allowing businesses to focus on their core operations. This model typically involves redirecting customers to a secure payment page hosted by the gateway. While non-hosted solutions offer greater customization, the inherent simplicity and reduced PCI DSS compliance burden associated with hosted gateways continue to drive their widespread adoption across the European market.

Dominant Segment by Enterprise: Small and Medium Enterprise (SME)

- In-depth Analysis: SMEs constitute a significant and growing segment within the Europe Payment Gateway Market. The increasing need for SMEs to compete in the digital space, reach a wider customer base, and streamline their operations makes payment gateways essential. Hosted solutions, in particular, cater well to the budget and technical capabilities of SMEs, offering a cost-effective way to accept online payments. The growth of the gig economy and online marketplaces further fuels the demand for accessible and user-friendly payment solutions among smaller businesses.

Europe Payment Gateway Market Product Innovations

Recent product innovations in the Europe Payment Gateway Market are centered on enhancing security, streamlining user experience, and expanding payment options. Solutions are increasingly incorporating advanced fraud detection mechanisms powered by AI, offering real-time transaction monitoring and risk assessment. Tokenization and end-to-end encryption are becoming standard to safeguard sensitive customer data. Furthermore, the integration of instant payment capabilities, facilitated by open banking, allows for faster fund settlement and improved cash flow for businesses. The development of seamless, embedded payment experiences within mobile apps and websites, minimizing redirects and friction, is a key area of focus. Performance metrics such as transaction success rates, processing speed, and uptime are continuously being optimized to meet the demanding needs of a digital-first economy.

Propelling Factors for Europe Payment Gateway Market Growth

Several key factors are propelling the growth of the Europe Payment Gateway Market. Technological advancements, particularly the widespread adoption of mobile devices and the internet, have created a fertile ground for online transactions. The escalating growth of e-commerce, fueled by changing consumer preferences for convenience and accessibility, necessitates robust payment infrastructure. Regulatory initiatives, such as PSD2 and the ongoing development of open banking frameworks, are fostering competition and innovation, leading to the development of more secure and user-friendly payment solutions. Furthermore, the increasing demand for seamless, frictionless payment experiences across all touchpoints, from online checkouts to in-app purchases, is a significant growth driver. The expansion of cross-border e-commerce also necessitates payment gateways capable of handling diverse currencies and international transaction complexities.

Obstacles in the Europe Payment Gateway Market Market

Despite robust growth, the Europe Payment Gateway Market faces several obstacles. Complex and evolving regulatory landscapes can pose challenges for businesses to remain compliant, particularly with data privacy laws like GDPR. Security threats and rising fraud rates necessitate continuous investment in advanced security measures, which can be costly. Intense market competition among a large number of players can lead to price wars and pressure on profit margins. Integration complexities with existing legacy systems for some businesses can be a barrier to adoption. Furthermore, economic uncertainties and potential supply chain disruptions impacting broader business operations can indirectly affect investment in payment gateway technologies.

Future Opportunities in Europe Payment Gateway Market

The future of the Europe Payment Gateway Market is brimming with opportunities. The increasing adoption of account-to-account (A2A) payments, facilitated by initiatives like Visa A2A, presents a significant avenue for growth, offering faster and often cheaper transactions. The burgeoning demand for instant payment solutions across various sectors, from e-commerce to business-to-business (B2B) transactions, will drive innovation. The continued expansion of the gig economy and peer-to-peer (P2P) payment systems will create new use cases for payment gateways. Furthermore, the exploration and integration of emerging payment technologies, such as blockchain-based payments and stablecoins, could unlock new market segments. The growing focus on sustainable and ethical payment practices also presents an opportunity for payment gateway providers to differentiate themselves.

Major Players in the Europe Payment Gateway Market Ecosystem

- VERIFONE INC

- Amazon Payments Inc

- PayPal Holdings Inc

- WIRECARD

- WorldPay

- BitPay Inc

- WePay Inc

- AUTHORIZE NET

- VISA

- Stripe

Key Developments in Europe Payment Gateway Market Industry

- September 2024: In early 2025, Visa is set to unveil its "open system" initiative, Visa A2A, aimed at enhancing consumer control and protection in account-to-account (A2A) payments. Slated for a debut in the UK, Visa A2A promises an upgraded digital user experience, bolstered security measures, and a user-friendly dispute resolution service, ensuring consumers can reclaim their funds in case of any mishaps.

- July 2024: In Germany, the European Payments Initiative (EPI) unveiled Wero, a new digital payment wallet. This launch was a joint effort with founding partners DSGV and DZ BANK, and Deutsche Bank is slated to come on board later this year. With this service, German customers can seamlessly execute instant, account-to-account money transfers directly via their banking apps.

Strategic Europe Payment Gateway Market Market Forecast

The strategic outlook for the Europe Payment Gateway Market is exceptionally positive, driven by a confluence of accelerating digital adoption and forward-thinking regulatory frameworks. The anticipated launch of initiatives like Visa A2A in early 2025 signals a strong push towards enhancing account-to-account payment security and user experience, particularly in the UK, which will likely influence broader European adoption. Similarly, the Wero digital wallet's introduction in Germany by EPI underscores a strategic move towards instant, integrated banking transfers, reinforcing the continent's commitment to modernizing its payment infrastructure. These developments, coupled with the continued expansion of e-commerce and the growing demand for frictionless digital transactions, are expected to be significant growth catalysts. The market's potential is further amplified by ongoing investments in secure, AI-driven fraud prevention and the increasing integration of payment solutions into diverse business workflows.

Europe Payment Gateway Market Segmentation

-

1. Type

- 1.1. Hosted

- 1.2. Non-Hosted

-

2. Enterprise

- 2.1. Small and Medium Enterprise (SME)

- 2.2. Large Enterprise

-

3. End-User

- 3.1. Travel

- 3.2. Retail

- 3.3. BFSI

- 3.4. Media and Entertainment

- 3.5. Other End-users

Europe Payment Gateway Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Italy

- 5. Rest of Europe

Europe Payment Gateway Market Regional Market Share

Geographic Coverage of Europe Payment Gateway Market

Europe Payment Gateway Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased E-commerce Sales and High Internet Penetration Rate; Increased Demand for Mobile-based Payments; Growing Adoption of Payment Gateways in Retail

- 3.3. Market Restrains

- 3.3.1. Increased E-commerce Sales and High Internet Penetration Rate; Increased Demand for Mobile-based Payments; Growing Adoption of Payment Gateways in Retail

- 3.4. Market Trends

- 3.4.1. Growing Adoption of Payment Gateways in Retail to drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Payment Gateway Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hosted

- 5.1.2. Non-Hosted

- 5.2. Market Analysis, Insights and Forecast - by Enterprise

- 5.2.1. Small and Medium Enterprise (SME)

- 5.2.2. Large Enterprise

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Travel

- 5.3.2. Retail

- 5.3.3. BFSI

- 5.3.4. Media and Entertainment

- 5.3.5. Other End-users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.4.2. Germany

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Kingdom Europe Payment Gateway Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hosted

- 6.1.2. Non-Hosted

- 6.2. Market Analysis, Insights and Forecast - by Enterprise

- 6.2.1. Small and Medium Enterprise (SME)

- 6.2.2. Large Enterprise

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Travel

- 6.3.2. Retail

- 6.3.3. BFSI

- 6.3.4. Media and Entertainment

- 6.3.5. Other End-users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Germany Europe Payment Gateway Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hosted

- 7.1.2. Non-Hosted

- 7.2. Market Analysis, Insights and Forecast - by Enterprise

- 7.2.1. Small and Medium Enterprise (SME)

- 7.2.2. Large Enterprise

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Travel

- 7.3.2. Retail

- 7.3.3. BFSI

- 7.3.4. Media and Entertainment

- 7.3.5. Other End-users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Payment Gateway Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hosted

- 8.1.2. Non-Hosted

- 8.2. Market Analysis, Insights and Forecast - by Enterprise

- 8.2.1. Small and Medium Enterprise (SME)

- 8.2.2. Large Enterprise

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Travel

- 8.3.2. Retail

- 8.3.3. BFSI

- 8.3.4. Media and Entertainment

- 8.3.5. Other End-users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Italy Europe Payment Gateway Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hosted

- 9.1.2. Non-Hosted

- 9.2. Market Analysis, Insights and Forecast - by Enterprise

- 9.2.1. Small and Medium Enterprise (SME)

- 9.2.2. Large Enterprise

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Travel

- 9.3.2. Retail

- 9.3.3. BFSI

- 9.3.4. Media and Entertainment

- 9.3.5. Other End-users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Europe Europe Payment Gateway Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Hosted

- 10.1.2. Non-Hosted

- 10.2. Market Analysis, Insights and Forecast - by Enterprise

- 10.2.1. Small and Medium Enterprise (SME)

- 10.2.2. Large Enterprise

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Travel

- 10.3.2. Retail

- 10.3.3. BFSI

- 10.3.4. Media and Entertainment

- 10.3.5. Other End-users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 VERIFONE INC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Amazon Payments Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PayPal Holdings Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 WIRECARD

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 WorldPay

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BitPay Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 WePay Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AUTHORIZE NET

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 VISA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Stripe*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 VERIFONE INC

List of Figures

- Figure 1: Global Europe Payment Gateway Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Europe Payment Gateway Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: United Kingdom Europe Payment Gateway Market Revenue (Million), by Type 2025 & 2033

- Figure 4: United Kingdom Europe Payment Gateway Market Volume (Billion), by Type 2025 & 2033

- Figure 5: United Kingdom Europe Payment Gateway Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: United Kingdom Europe Payment Gateway Market Volume Share (%), by Type 2025 & 2033

- Figure 7: United Kingdom Europe Payment Gateway Market Revenue (Million), by Enterprise 2025 & 2033

- Figure 8: United Kingdom Europe Payment Gateway Market Volume (Billion), by Enterprise 2025 & 2033

- Figure 9: United Kingdom Europe Payment Gateway Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 10: United Kingdom Europe Payment Gateway Market Volume Share (%), by Enterprise 2025 & 2033

- Figure 11: United Kingdom Europe Payment Gateway Market Revenue (Million), by End-User 2025 & 2033

- Figure 12: United Kingdom Europe Payment Gateway Market Volume (Billion), by End-User 2025 & 2033

- Figure 13: United Kingdom Europe Payment Gateway Market Revenue Share (%), by End-User 2025 & 2033

- Figure 14: United Kingdom Europe Payment Gateway Market Volume Share (%), by End-User 2025 & 2033

- Figure 15: United Kingdom Europe Payment Gateway Market Revenue (Million), by Country 2025 & 2033

- Figure 16: United Kingdom Europe Payment Gateway Market Volume (Billion), by Country 2025 & 2033

- Figure 17: United Kingdom Europe Payment Gateway Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: United Kingdom Europe Payment Gateway Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Germany Europe Payment Gateway Market Revenue (Million), by Type 2025 & 2033

- Figure 20: Germany Europe Payment Gateway Market Volume (Billion), by Type 2025 & 2033

- Figure 21: Germany Europe Payment Gateway Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Germany Europe Payment Gateway Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Germany Europe Payment Gateway Market Revenue (Million), by Enterprise 2025 & 2033

- Figure 24: Germany Europe Payment Gateway Market Volume (Billion), by Enterprise 2025 & 2033

- Figure 25: Germany Europe Payment Gateway Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 26: Germany Europe Payment Gateway Market Volume Share (%), by Enterprise 2025 & 2033

- Figure 27: Germany Europe Payment Gateway Market Revenue (Million), by End-User 2025 & 2033

- Figure 28: Germany Europe Payment Gateway Market Volume (Billion), by End-User 2025 & 2033

- Figure 29: Germany Europe Payment Gateway Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Germany Europe Payment Gateway Market Volume Share (%), by End-User 2025 & 2033

- Figure 31: Germany Europe Payment Gateway Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Germany Europe Payment Gateway Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Germany Europe Payment Gateway Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Germany Europe Payment Gateway Market Volume Share (%), by Country 2025 & 2033

- Figure 35: France Europe Payment Gateway Market Revenue (Million), by Type 2025 & 2033

- Figure 36: France Europe Payment Gateway Market Volume (Billion), by Type 2025 & 2033

- Figure 37: France Europe Payment Gateway Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: France Europe Payment Gateway Market Volume Share (%), by Type 2025 & 2033

- Figure 39: France Europe Payment Gateway Market Revenue (Million), by Enterprise 2025 & 2033

- Figure 40: France Europe Payment Gateway Market Volume (Billion), by Enterprise 2025 & 2033

- Figure 41: France Europe Payment Gateway Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 42: France Europe Payment Gateway Market Volume Share (%), by Enterprise 2025 & 2033

- Figure 43: France Europe Payment Gateway Market Revenue (Million), by End-User 2025 & 2033

- Figure 44: France Europe Payment Gateway Market Volume (Billion), by End-User 2025 & 2033

- Figure 45: France Europe Payment Gateway Market Revenue Share (%), by End-User 2025 & 2033

- Figure 46: France Europe Payment Gateway Market Volume Share (%), by End-User 2025 & 2033

- Figure 47: France Europe Payment Gateway Market Revenue (Million), by Country 2025 & 2033

- Figure 48: France Europe Payment Gateway Market Volume (Billion), by Country 2025 & 2033

- Figure 49: France Europe Payment Gateway Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: France Europe Payment Gateway Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Italy Europe Payment Gateway Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Italy Europe Payment Gateway Market Volume (Billion), by Type 2025 & 2033

- Figure 53: Italy Europe Payment Gateway Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Italy Europe Payment Gateway Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Italy Europe Payment Gateway Market Revenue (Million), by Enterprise 2025 & 2033

- Figure 56: Italy Europe Payment Gateway Market Volume (Billion), by Enterprise 2025 & 2033

- Figure 57: Italy Europe Payment Gateway Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 58: Italy Europe Payment Gateway Market Volume Share (%), by Enterprise 2025 & 2033

- Figure 59: Italy Europe Payment Gateway Market Revenue (Million), by End-User 2025 & 2033

- Figure 60: Italy Europe Payment Gateway Market Volume (Billion), by End-User 2025 & 2033

- Figure 61: Italy Europe Payment Gateway Market Revenue Share (%), by End-User 2025 & 2033

- Figure 62: Italy Europe Payment Gateway Market Volume Share (%), by End-User 2025 & 2033

- Figure 63: Italy Europe Payment Gateway Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Italy Europe Payment Gateway Market Volume (Billion), by Country 2025 & 2033

- Figure 65: Italy Europe Payment Gateway Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Italy Europe Payment Gateway Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Rest of Europe Europe Payment Gateway Market Revenue (Million), by Type 2025 & 2033

- Figure 68: Rest of Europe Europe Payment Gateway Market Volume (Billion), by Type 2025 & 2033

- Figure 69: Rest of Europe Europe Payment Gateway Market Revenue Share (%), by Type 2025 & 2033

- Figure 70: Rest of Europe Europe Payment Gateway Market Volume Share (%), by Type 2025 & 2033

- Figure 71: Rest of Europe Europe Payment Gateway Market Revenue (Million), by Enterprise 2025 & 2033

- Figure 72: Rest of Europe Europe Payment Gateway Market Volume (Billion), by Enterprise 2025 & 2033

- Figure 73: Rest of Europe Europe Payment Gateway Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 74: Rest of Europe Europe Payment Gateway Market Volume Share (%), by Enterprise 2025 & 2033

- Figure 75: Rest of Europe Europe Payment Gateway Market Revenue (Million), by End-User 2025 & 2033

- Figure 76: Rest of Europe Europe Payment Gateway Market Volume (Billion), by End-User 2025 & 2033

- Figure 77: Rest of Europe Europe Payment Gateway Market Revenue Share (%), by End-User 2025 & 2033

- Figure 78: Rest of Europe Europe Payment Gateway Market Volume Share (%), by End-User 2025 & 2033

- Figure 79: Rest of Europe Europe Payment Gateway Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Rest of Europe Europe Payment Gateway Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Rest of Europe Europe Payment Gateway Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Rest of Europe Europe Payment Gateway Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Payment Gateway Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Europe Payment Gateway Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global Europe Payment Gateway Market Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 4: Global Europe Payment Gateway Market Volume Billion Forecast, by Enterprise 2020 & 2033

- Table 5: Global Europe Payment Gateway Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Global Europe Payment Gateway Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 7: Global Europe Payment Gateway Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Europe Payment Gateway Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Europe Payment Gateway Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Europe Payment Gateway Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Global Europe Payment Gateway Market Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 12: Global Europe Payment Gateway Market Volume Billion Forecast, by Enterprise 2020 & 2033

- Table 13: Global Europe Payment Gateway Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 14: Global Europe Payment Gateway Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 15: Global Europe Payment Gateway Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Europe Payment Gateway Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global Europe Payment Gateway Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Europe Payment Gateway Market Volume Billion Forecast, by Type 2020 & 2033

- Table 19: Global Europe Payment Gateway Market Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 20: Global Europe Payment Gateway Market Volume Billion Forecast, by Enterprise 2020 & 2033

- Table 21: Global Europe Payment Gateway Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 22: Global Europe Payment Gateway Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 23: Global Europe Payment Gateway Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Europe Payment Gateway Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Europe Payment Gateway Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Europe Payment Gateway Market Volume Billion Forecast, by Type 2020 & 2033

- Table 27: Global Europe Payment Gateway Market Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 28: Global Europe Payment Gateway Market Volume Billion Forecast, by Enterprise 2020 & 2033

- Table 29: Global Europe Payment Gateway Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 30: Global Europe Payment Gateway Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 31: Global Europe Payment Gateway Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Europe Payment Gateway Market Volume Billion Forecast, by Country 2020 & 2033

- Table 33: Global Europe Payment Gateway Market Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Global Europe Payment Gateway Market Volume Billion Forecast, by Type 2020 & 2033

- Table 35: Global Europe Payment Gateway Market Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 36: Global Europe Payment Gateway Market Volume Billion Forecast, by Enterprise 2020 & 2033

- Table 37: Global Europe Payment Gateway Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 38: Global Europe Payment Gateway Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 39: Global Europe Payment Gateway Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Europe Payment Gateway Market Volume Billion Forecast, by Country 2020 & 2033

- Table 41: Global Europe Payment Gateway Market Revenue Million Forecast, by Type 2020 & 2033

- Table 42: Global Europe Payment Gateway Market Volume Billion Forecast, by Type 2020 & 2033

- Table 43: Global Europe Payment Gateway Market Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 44: Global Europe Payment Gateway Market Volume Billion Forecast, by Enterprise 2020 & 2033

- Table 45: Global Europe Payment Gateway Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 46: Global Europe Payment Gateway Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 47: Global Europe Payment Gateway Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Europe Payment Gateway Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Payment Gateway Market?

The projected CAGR is approximately 22.02%.

2. Which companies are prominent players in the Europe Payment Gateway Market?

Key companies in the market include VERIFONE INC, Amazon Payments Inc, PayPal Holdings Inc, WIRECARD, WorldPay, BitPay Inc, WePay Inc, AUTHORIZE NET, VISA, Stripe*List Not Exhaustive.

3. What are the main segments of the Europe Payment Gateway Market?

The market segments include Type, Enterprise, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased E-commerce Sales and High Internet Penetration Rate; Increased Demand for Mobile-based Payments; Growing Adoption of Payment Gateways in Retail.

6. What are the notable trends driving market growth?

Growing Adoption of Payment Gateways in Retail to drive the Market.

7. Are there any restraints impacting market growth?

Increased E-commerce Sales and High Internet Penetration Rate; Increased Demand for Mobile-based Payments; Growing Adoption of Payment Gateways in Retail.

8. Can you provide examples of recent developments in the market?

September 2024: In early 2025, Visa is set to unveil its "open system" initiative, Visa A2A, aimed at enhancing consumer control and protection in account-to-account (A2A) payments. Slated for a debut in the UK, Visa A2A promises an upgraded digital user experience, bolstered security measures, and a user-friendly dispute resolution service, ensuring consumers can reclaim their funds in case of any mishaps.July 2024: In Germany, the European Payments Initiative (EPI) unveiled Wero, a new digital payment wallet. This launch was a joint effort with founding partners DSGV and DZ BANK, and Deutsche Bank is slated to come on board later this year. With this service, German customers can seamlessly execute instant, account-to-account money transfers directly via their banking apps.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Payment Gateway Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Payment Gateway Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Payment Gateway Market?

To stay informed about further developments, trends, and reports in the Europe Payment Gateway Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence