Key Insights

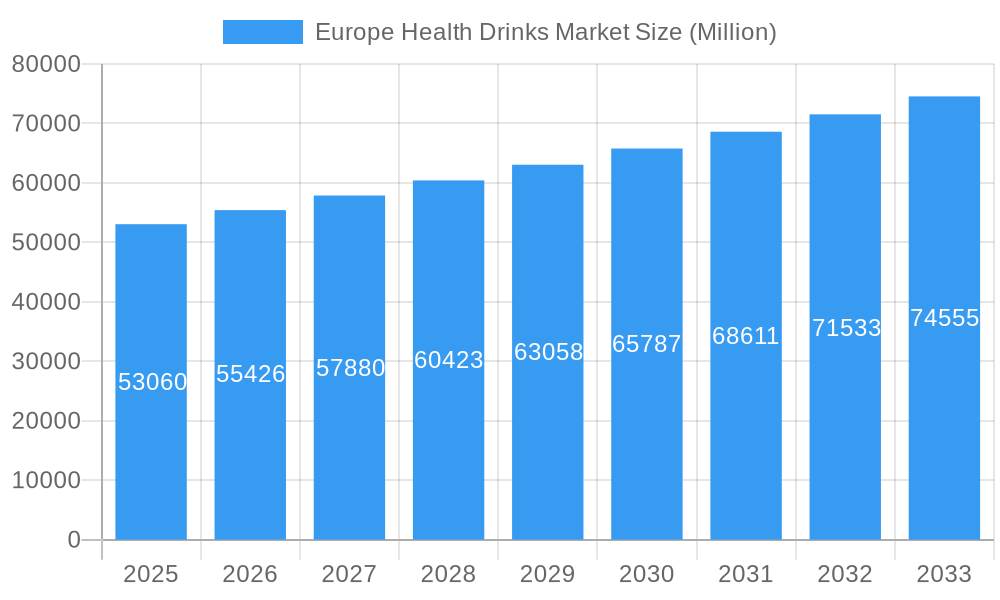

The European health drinks market, valued at €53.06 billion in 2025, is projected to experience robust growth, driven by increasing health consciousness among consumers and a rising preference for functional beverages. This market's Compound Annual Growth Rate (CAGR) of 4.61% from 2019 to 2024 indicates a steady upward trajectory, anticipated to continue through 2033. Key drivers include the growing prevalence of lifestyle diseases prompting consumers to seek functional drinks, the increasing availability of innovative products with added vitamins, minerals, and probiotics, and a surge in demand for plant-based and organic options. Furthermore, successful marketing campaigns highlighting the health benefits of these drinks are contributing to market expansion. While regulatory changes concerning labeling and ingredient standards could pose a challenge, the overall market outlook remains positive, fueled by ongoing product innovation and consumer demand.

Europe Health Drinks Market Market Size (In Billion)

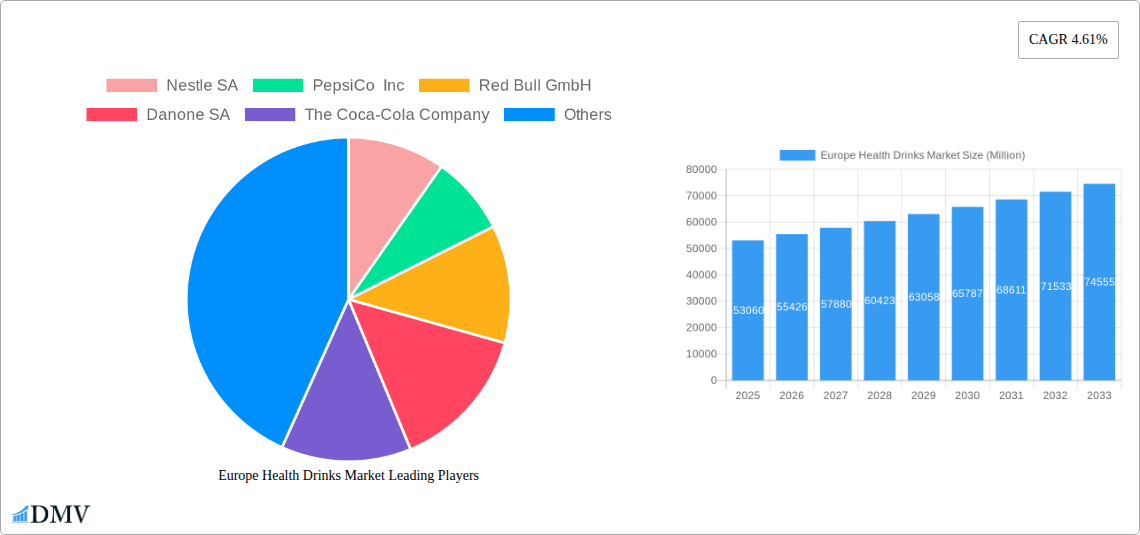

The competitive landscape is dominated by major players like Nestlé SA, PepsiCo Inc., and Coca-Cola, alongside emerging brands focusing on niche segments within the health drinks market. These companies are strategically investing in research and development to create new product offerings that cater to evolving consumer preferences, including personalized nutrition and enhanced taste profiles. The market is segmented based on factors like product type (e.g., functional beverages, sports drinks, fruit juices), distribution channels, and consumer demographics. Regional variations in consumer preferences and health trends will influence market growth within specific European countries. Continued expansion is expected across multiple segments, especially those catering to specific health needs and preferences such as energy drinks, enhanced water, and plant-based milks, thereby sustaining the market's upward trajectory.

Europe Health Drinks Market Company Market Share

Europe Health Drinks Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Health Drinks Market, encompassing historical data (2019-2024), the current market landscape (Base Year: 2025), and a comprehensive forecast (2025-2033). Valued at xx Million in 2025, the market is poised for significant growth, driven by evolving consumer preferences and innovative product launches. This report is an essential resource for stakeholders seeking to understand market dynamics, identify growth opportunities, and make informed strategic decisions.

Europe Health Drinks Market Composition & Trends

The Europe health drinks market is characterized by a moderately concentrated landscape, with key players such as Nestle SA, PepsiCo Inc., and The Coca-Cola Company holding significant market share. However, smaller, specialized brands are also gaining traction, particularly within niche segments like organic and functional beverages. Market share distribution is currently estimated at xx% for the top three players, with the remaining xx% dispersed among numerous competitors. Innovation is a key driver, with companies constantly developing new formulations, flavors, and functional benefits to cater to evolving consumer preferences. The regulatory landscape is increasingly focused on health claims, labeling requirements, and sugar content, impacting product development and marketing strategies. Substitute products, such as juices and water, pose some competitive pressure, but the health benefits associated with specific beverages, such as enhanced hydration or added vitamins, help maintain market dominance. End-users encompass a broad demographic, ranging from health-conscious individuals and athletes to those seeking convenient hydration options. M&A activity has been moderate in recent years, with deal values averaging around xx Million per transaction, primarily focused on expanding product portfolios and geographic reach.

- Market Concentration: Moderately concentrated, with top 3 players holding xx% market share.

- Innovation Catalysts: New product formulations, functional ingredients, and sustainable packaging.

- Regulatory Landscape: Focus on health claims, sugar content, and labeling.

- Substitute Products: Juices, water, and other beverages.

- End-User Profiles: Health-conscious consumers, athletes, and individuals seeking convenient hydration.

- M&A Activity: Moderate activity, with average deal values around xx Million.

Europe Health Drinks Market Industry Evolution

The Europe health drinks market has experienced steady growth over the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is primarily attributed to several factors: rising health consciousness among consumers, increasing demand for functional beverages offering specific health benefits, and the proliferation of convenient packaging formats. Technological advancements, such as improved preservation techniques and innovative ingredient sourcing, have also contributed to market expansion. Consumer demand is shifting towards healthier options, with a growing preference for low-sugar, natural, and organic beverages. This trend is further propelled by increasing awareness of the health consequences of excessive sugar consumption. The adoption rate of functional beverages, particularly those offering specific health benefits like improved immunity or enhanced energy, has shown a significant upward trajectory. The market is also witnessing an increase in the demand for plant-based and sustainable options, reflecting broader shifts in consumer values. The forecast period (2025-2033) anticipates continued growth, fueled by innovation, increasing health awareness, and expanding distribution channels, projected at a CAGR of xx%.

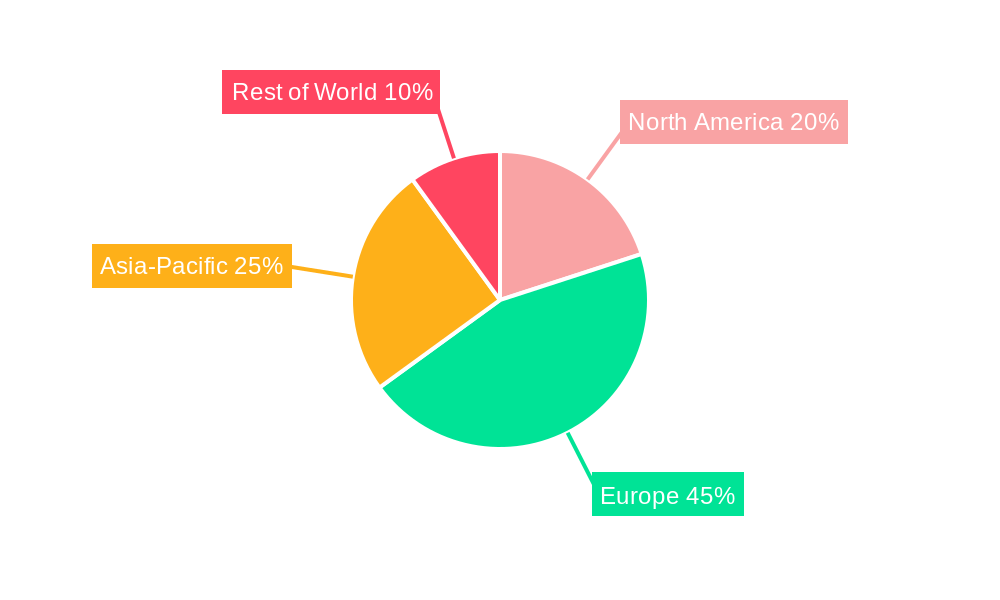

Leading Regions, Countries, or Segments in Europe Health Drinks Market

The Germany and the United Kingdom currently dominate the European health drinks market, driven by several key factors.

Key Drivers for Germany & UK Dominance:

- High disposable incomes and health-conscious consumer base.

- Strong retail infrastructure and established distribution networks.

- Favorable regulatory environment for health drink innovation.

- Significant investments in product development and marketing campaigns.

In-depth Analysis: Germany's robust economy and focus on wellness has created a strong market for premium health drinks. The UK, with its large population and diverse consumer preferences, offers considerable market potential. France and other Western European countries are also demonstrating strong growth, largely driven by rising disposable incomes and increased health awareness, whereas Eastern European markets are still emerging but show potential for high future growth. The energy drinks segment has demonstrated particularly strong growth, influenced by changing consumer lifestyles and the popularity of sports and fitness activities. The sports drinks segment, propelled by increased fitness activities and celebrity endorsements, is another strong performer. This success is underpinned by successful marketing campaigns and strategic brand collaborations (e.g., PRIME and FC Bayern Munich).

Europe Health Drinks Market Product Innovations

Recent product innovations have centered on enhancing functional benefits, improving taste profiles, and using sustainable packaging. New product launches frequently incorporate natural ingredients, added vitamins, minerals, or probiotics, to cater to the growing demand for healthier and more functional beverages. Formulations are constantly being refined to enhance taste and appeal, and many companies are focusing on eco-friendly packaging materials, such as plant-based plastics or recyclable containers, to appeal to environmentally conscious consumers. These innovations contribute to greater product differentiation and meet the evolving needs of a health-conscious consumer base.

Propelling Factors for Europe Health Drinks Market Growth

The Europe health drinks market is propelled by several key factors. Rising health consciousness among consumers fuels demand for functional beverages offering health benefits. The growing popularity of sports and fitness activities boosts demand for sports and energy drinks. Technological advancements, such as improved preservation techniques and innovative ingredients, allow for the creation of better-tasting and more nutritious products. Favorable regulatory environments in certain countries encourage innovation and market expansion. Finally, increasing disposable incomes in many European countries, particularly in Western Europe, provide more purchasing power for premium health drinks.

Obstacles in the Europe Health Drinks Market Market

Several challenges impede the growth of the Europe health drinks market. Stringent regulations regarding health claims and labeling requirements can increase the cost and complexity of product development and marketing. Supply chain disruptions, particularly those related to ingredient sourcing and packaging materials, can impact production and sales. Intense competition from both established players and new entrants creates pressure on pricing and profitability. Fluctuations in raw material prices can also influence overall production costs and profitability. The shift towards more sustainable packaging solutions presents additional challenges for many companies with regards to cost and efficacy.

Future Opportunities in Europe Health Drinks Market

The future of the Europe health drinks market holds significant opportunities. Expanding into emerging markets within Eastern Europe presents considerable potential. The development of novel functional ingredients and delivery systems, such as nano-encapsulation, can enhance the effectiveness and appeal of beverages. Growing consumer demand for personalized nutrition creates opportunities for tailored health drink solutions. Furthermore, the increasing interest in sustainability will drive the adoption of eco-friendly packaging and sustainable sourcing practices.

Major Players in the Europe Health Drinks Market Ecosystem

- Nestle SA (Nestle SA)

- PepsiCo Inc. (PepsiCo Inc.)

- Red Bull GmbH (Red Bull GmbH)

- Danone SA (Danone SA)

- The Coca-Cola Company (The Coca-Cola Company)

- Suntory Holdings Limited (Suntory Holdings Limited)

- Oatly Group AB (Oatly Group AB)

- Biona Organic

- Monster Beverage Corporation (Monster Beverage Corporation)

- Yakult Honsha Co Ltd

Key Developments in Europe Health Drinks Market Industry

- January 2024: Celsius Holdings expands into the UK and Irish markets through a partnership with Suntory Beverage & Food Great Britain. This significantly increases their European reach and presents opportunities in new markets.

- August 2023: FC Bayern Munich's partnership with PRIME boosts the sports drink's profile and expands market presence. This celebrity endorsement significantly improves brand recognition and consumer appeal.

- March 2023: Boost launches a limited-edition Raspberry and Mango flavored sports drink, leveraging a successful campaign model and capitalising on seasonal preferences. The collaboration with Leeds United Football Club provides further marketing opportunities.

Strategic Europe Health Drinks Market Forecast

The Europe health drinks market is poised for sustained growth, driven by several factors including the rising consumer focus on health and wellness, continuous product innovation, and strategic partnerships enhancing brand visibility. The expanding market within Eastern European countries and the rising demand for natural, functional, and sustainable options presents significant opportunities for market expansion. The increasing adoption of technology to enhance product quality and reduce environmental impact will further contribute to the sector’s long-term growth and competitiveness. The forecast predicts continued market expansion throughout the forecast period (2025-2033), with a substantial increase in overall market value.

Europe Health Drinks Market Segmentation

-

1. Type

- 1.1. Fruit and Vegetable Juices

- 1.2. Sports Drinks

- 1.3. Energy Drinks

- 1.4. Kombucha Drinks

- 1.5. Functional and Fortified Bottled Water

- 1.6. Dairy and Dairy Alternative Drinks

- 1.7. RTD Tea and Coffee

-

2. Distribution Channel

- 2.1. On-trade

-

2.2. Off-trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience/Grocery Stores

- 2.2.3. Online Stores

- 2.2.4. Other Off-trade Channels

Europe Health Drinks Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Spain

- 5. Italy

- 6. Belgium

- 7. Netherlands

- 8. Rest of Europe

Europe Health Drinks Market Regional Market Share

Geographic Coverage of Europe Health Drinks Market

Europe Health Drinks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Augmented Expenditure on Advertisement and Promotional Activities; Growing Consumer Inclination Toward Low-sugar/Sugar-free Beverages

- 3.3. Market Restrains

- 3.3.1. Augmented Expenditure on Advertisement and Promotional Activities; Growing Consumer Inclination Toward Low-sugar/Sugar-free Beverages

- 3.4. Market Trends

- 3.4.1. Growing Popularity of Energy Drinks Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Health Drinks Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fruit and Vegetable Juices

- 5.1.2. Sports Drinks

- 5.1.3. Energy Drinks

- 5.1.4. Kombucha Drinks

- 5.1.5. Functional and Fortified Bottled Water

- 5.1.6. Dairy and Dairy Alternative Drinks

- 5.1.7. RTD Tea and Coffee

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade

- 5.2.2. Off-trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience/Grocery Stores

- 5.2.2.3. Online Stores

- 5.2.2.4. Other Off-trade Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. France

- 5.3.4. Spain

- 5.3.5. Italy

- 5.3.6. Belgium

- 5.3.7. Netherlands

- 5.3.8. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Kingdom Europe Health Drinks Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fruit and Vegetable Juices

- 6.1.2. Sports Drinks

- 6.1.3. Energy Drinks

- 6.1.4. Kombucha Drinks

- 6.1.5. Functional and Fortified Bottled Water

- 6.1.6. Dairy and Dairy Alternative Drinks

- 6.1.7. RTD Tea and Coffee

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-trade

- 6.2.2. Off-trade

- 6.2.2.1. Supermarkets/Hypermarkets

- 6.2.2.2. Convenience/Grocery Stores

- 6.2.2.3. Online Stores

- 6.2.2.4. Other Off-trade Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Germany Europe Health Drinks Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fruit and Vegetable Juices

- 7.1.2. Sports Drinks

- 7.1.3. Energy Drinks

- 7.1.4. Kombucha Drinks

- 7.1.5. Functional and Fortified Bottled Water

- 7.1.6. Dairy and Dairy Alternative Drinks

- 7.1.7. RTD Tea and Coffee

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-trade

- 7.2.2. Off-trade

- 7.2.2.1. Supermarkets/Hypermarkets

- 7.2.2.2. Convenience/Grocery Stores

- 7.2.2.3. Online Stores

- 7.2.2.4. Other Off-trade Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Health Drinks Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fruit and Vegetable Juices

- 8.1.2. Sports Drinks

- 8.1.3. Energy Drinks

- 8.1.4. Kombucha Drinks

- 8.1.5. Functional and Fortified Bottled Water

- 8.1.6. Dairy and Dairy Alternative Drinks

- 8.1.7. RTD Tea and Coffee

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-trade

- 8.2.2. Off-trade

- 8.2.2.1. Supermarkets/Hypermarkets

- 8.2.2.2. Convenience/Grocery Stores

- 8.2.2.3. Online Stores

- 8.2.2.4. Other Off-trade Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Spain Europe Health Drinks Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fruit and Vegetable Juices

- 9.1.2. Sports Drinks

- 9.1.3. Energy Drinks

- 9.1.4. Kombucha Drinks

- 9.1.5. Functional and Fortified Bottled Water

- 9.1.6. Dairy and Dairy Alternative Drinks

- 9.1.7. RTD Tea and Coffee

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-trade

- 9.2.2. Off-trade

- 9.2.2.1. Supermarkets/Hypermarkets

- 9.2.2.2. Convenience/Grocery Stores

- 9.2.2.3. Online Stores

- 9.2.2.4. Other Off-trade Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Italy Europe Health Drinks Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Fruit and Vegetable Juices

- 10.1.2. Sports Drinks

- 10.1.3. Energy Drinks

- 10.1.4. Kombucha Drinks

- 10.1.5. Functional and Fortified Bottled Water

- 10.1.6. Dairy and Dairy Alternative Drinks

- 10.1.7. RTD Tea and Coffee

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-trade

- 10.2.2. Off-trade

- 10.2.2.1. Supermarkets/Hypermarkets

- 10.2.2.2. Convenience/Grocery Stores

- 10.2.2.3. Online Stores

- 10.2.2.4. Other Off-trade Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Belgium Europe Health Drinks Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Fruit and Vegetable Juices

- 11.1.2. Sports Drinks

- 11.1.3. Energy Drinks

- 11.1.4. Kombucha Drinks

- 11.1.5. Functional and Fortified Bottled Water

- 11.1.6. Dairy and Dairy Alternative Drinks

- 11.1.7. RTD Tea and Coffee

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. On-trade

- 11.2.2. Off-trade

- 11.2.2.1. Supermarkets/Hypermarkets

- 11.2.2.2. Convenience/Grocery Stores

- 11.2.2.3. Online Stores

- 11.2.2.4. Other Off-trade Channels

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Netherlands Europe Health Drinks Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Fruit and Vegetable Juices

- 12.1.2. Sports Drinks

- 12.1.3. Energy Drinks

- 12.1.4. Kombucha Drinks

- 12.1.5. Functional and Fortified Bottled Water

- 12.1.6. Dairy and Dairy Alternative Drinks

- 12.1.7. RTD Tea and Coffee

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. On-trade

- 12.2.2. Off-trade

- 12.2.2.1. Supermarkets/Hypermarkets

- 12.2.2.2. Convenience/Grocery Stores

- 12.2.2.3. Online Stores

- 12.2.2.4. Other Off-trade Channels

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Rest of Europe Europe Health Drinks Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Type

- 13.1.1. Fruit and Vegetable Juices

- 13.1.2. Sports Drinks

- 13.1.3. Energy Drinks

- 13.1.4. Kombucha Drinks

- 13.1.5. Functional and Fortified Bottled Water

- 13.1.6. Dairy and Dairy Alternative Drinks

- 13.1.7. RTD Tea and Coffee

- 13.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 13.2.1. On-trade

- 13.2.2. Off-trade

- 13.2.2.1. Supermarkets/Hypermarkets

- 13.2.2.2. Convenience/Grocery Stores

- 13.2.2.3. Online Stores

- 13.2.2.4. Other Off-trade Channels

- 13.1. Market Analysis, Insights and Forecast - by Type

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Nestle SA

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 PepsiCo Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Red Bull GmbH

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Danone SA

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 The Coca-Cola Company

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Suntory Holdings Limited

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Oatly Group AB

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Biona Organic

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Monster Beverage Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Yakult Honsha Co Ltd*List Not Exhaustive

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Nestle SA

List of Figures

- Figure 1: Global Europe Health Drinks Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Europe Health Drinks Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: United Kingdom Europe Health Drinks Market Revenue (Million), by Type 2025 & 2033

- Figure 4: United Kingdom Europe Health Drinks Market Volume (Billion), by Type 2025 & 2033

- Figure 5: United Kingdom Europe Health Drinks Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: United Kingdom Europe Health Drinks Market Volume Share (%), by Type 2025 & 2033

- Figure 7: United Kingdom Europe Health Drinks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 8: United Kingdom Europe Health Drinks Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 9: United Kingdom Europe Health Drinks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: United Kingdom Europe Health Drinks Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: United Kingdom Europe Health Drinks Market Revenue (Million), by Country 2025 & 2033

- Figure 12: United Kingdom Europe Health Drinks Market Volume (Billion), by Country 2025 & 2033

- Figure 13: United Kingdom Europe Health Drinks Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: United Kingdom Europe Health Drinks Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Germany Europe Health Drinks Market Revenue (Million), by Type 2025 & 2033

- Figure 16: Germany Europe Health Drinks Market Volume (Billion), by Type 2025 & 2033

- Figure 17: Germany Europe Health Drinks Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Germany Europe Health Drinks Market Volume Share (%), by Type 2025 & 2033

- Figure 19: Germany Europe Health Drinks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 20: Germany Europe Health Drinks Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 21: Germany Europe Health Drinks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Germany Europe Health Drinks Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: Germany Europe Health Drinks Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Germany Europe Health Drinks Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Germany Europe Health Drinks Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Germany Europe Health Drinks Market Volume Share (%), by Country 2025 & 2033

- Figure 27: France Europe Health Drinks Market Revenue (Million), by Type 2025 & 2033

- Figure 28: France Europe Health Drinks Market Volume (Billion), by Type 2025 & 2033

- Figure 29: France Europe Health Drinks Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: France Europe Health Drinks Market Volume Share (%), by Type 2025 & 2033

- Figure 31: France Europe Health Drinks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 32: France Europe Health Drinks Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 33: France Europe Health Drinks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: France Europe Health Drinks Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: France Europe Health Drinks Market Revenue (Million), by Country 2025 & 2033

- Figure 36: France Europe Health Drinks Market Volume (Billion), by Country 2025 & 2033

- Figure 37: France Europe Health Drinks Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: France Europe Health Drinks Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Spain Europe Health Drinks Market Revenue (Million), by Type 2025 & 2033

- Figure 40: Spain Europe Health Drinks Market Volume (Billion), by Type 2025 & 2033

- Figure 41: Spain Europe Health Drinks Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: Spain Europe Health Drinks Market Volume Share (%), by Type 2025 & 2033

- Figure 43: Spain Europe Health Drinks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 44: Spain Europe Health Drinks Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 45: Spain Europe Health Drinks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Spain Europe Health Drinks Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Spain Europe Health Drinks Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Spain Europe Health Drinks Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Spain Europe Health Drinks Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Spain Europe Health Drinks Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Italy Europe Health Drinks Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Italy Europe Health Drinks Market Volume (Billion), by Type 2025 & 2033

- Figure 53: Italy Europe Health Drinks Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Italy Europe Health Drinks Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Italy Europe Health Drinks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 56: Italy Europe Health Drinks Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 57: Italy Europe Health Drinks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Italy Europe Health Drinks Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Italy Europe Health Drinks Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Italy Europe Health Drinks Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Italy Europe Health Drinks Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Italy Europe Health Drinks Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Belgium Europe Health Drinks Market Revenue (Million), by Type 2025 & 2033

- Figure 64: Belgium Europe Health Drinks Market Volume (Billion), by Type 2025 & 2033

- Figure 65: Belgium Europe Health Drinks Market Revenue Share (%), by Type 2025 & 2033

- Figure 66: Belgium Europe Health Drinks Market Volume Share (%), by Type 2025 & 2033

- Figure 67: Belgium Europe Health Drinks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 68: Belgium Europe Health Drinks Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 69: Belgium Europe Health Drinks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 70: Belgium Europe Health Drinks Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 71: Belgium Europe Health Drinks Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Belgium Europe Health Drinks Market Volume (Billion), by Country 2025 & 2033

- Figure 73: Belgium Europe Health Drinks Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Belgium Europe Health Drinks Market Volume Share (%), by Country 2025 & 2033

- Figure 75: Netherlands Europe Health Drinks Market Revenue (Million), by Type 2025 & 2033

- Figure 76: Netherlands Europe Health Drinks Market Volume (Billion), by Type 2025 & 2033

- Figure 77: Netherlands Europe Health Drinks Market Revenue Share (%), by Type 2025 & 2033

- Figure 78: Netherlands Europe Health Drinks Market Volume Share (%), by Type 2025 & 2033

- Figure 79: Netherlands Europe Health Drinks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 80: Netherlands Europe Health Drinks Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 81: Netherlands Europe Health Drinks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 82: Netherlands Europe Health Drinks Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 83: Netherlands Europe Health Drinks Market Revenue (Million), by Country 2025 & 2033

- Figure 84: Netherlands Europe Health Drinks Market Volume (Billion), by Country 2025 & 2033

- Figure 85: Netherlands Europe Health Drinks Market Revenue Share (%), by Country 2025 & 2033

- Figure 86: Netherlands Europe Health Drinks Market Volume Share (%), by Country 2025 & 2033

- Figure 87: Rest of Europe Europe Health Drinks Market Revenue (Million), by Type 2025 & 2033

- Figure 88: Rest of Europe Europe Health Drinks Market Volume (Billion), by Type 2025 & 2033

- Figure 89: Rest of Europe Europe Health Drinks Market Revenue Share (%), by Type 2025 & 2033

- Figure 90: Rest of Europe Europe Health Drinks Market Volume Share (%), by Type 2025 & 2033

- Figure 91: Rest of Europe Europe Health Drinks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 92: Rest of Europe Europe Health Drinks Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 93: Rest of Europe Europe Health Drinks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 94: Rest of Europe Europe Health Drinks Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 95: Rest of Europe Europe Health Drinks Market Revenue (Million), by Country 2025 & 2033

- Figure 96: Rest of Europe Europe Health Drinks Market Volume (Billion), by Country 2025 & 2033

- Figure 97: Rest of Europe Europe Health Drinks Market Revenue Share (%), by Country 2025 & 2033

- Figure 98: Rest of Europe Europe Health Drinks Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Health Drinks Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Europe Health Drinks Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global Europe Health Drinks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Europe Health Drinks Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Europe Health Drinks Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Europe Health Drinks Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Europe Health Drinks Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Europe Health Drinks Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Global Europe Health Drinks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Europe Health Drinks Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Europe Health Drinks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Europe Health Drinks Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Europe Health Drinks Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Europe Health Drinks Market Volume Billion Forecast, by Type 2020 & 2033

- Table 15: Global Europe Health Drinks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Europe Health Drinks Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 17: Global Europe Health Drinks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Europe Health Drinks Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Global Europe Health Drinks Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Europe Health Drinks Market Volume Billion Forecast, by Type 2020 & 2033

- Table 21: Global Europe Health Drinks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Europe Health Drinks Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Europe Health Drinks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Europe Health Drinks Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Europe Health Drinks Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Europe Health Drinks Market Volume Billion Forecast, by Type 2020 & 2033

- Table 27: Global Europe Health Drinks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: Global Europe Health Drinks Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global Europe Health Drinks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Europe Health Drinks Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Global Europe Health Drinks Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Europe Health Drinks Market Volume Billion Forecast, by Type 2020 & 2033

- Table 33: Global Europe Health Drinks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Europe Health Drinks Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Europe Health Drinks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Europe Health Drinks Market Volume Billion Forecast, by Country 2020 & 2033

- Table 37: Global Europe Health Drinks Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Europe Health Drinks Market Volume Billion Forecast, by Type 2020 & 2033

- Table 39: Global Europe Health Drinks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 40: Global Europe Health Drinks Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 41: Global Europe Health Drinks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Europe Health Drinks Market Volume Billion Forecast, by Country 2020 & 2033

- Table 43: Global Europe Health Drinks Market Revenue Million Forecast, by Type 2020 & 2033

- Table 44: Global Europe Health Drinks Market Volume Billion Forecast, by Type 2020 & 2033

- Table 45: Global Europe Health Drinks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 46: Global Europe Health Drinks Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 47: Global Europe Health Drinks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Europe Health Drinks Market Volume Billion Forecast, by Country 2020 & 2033

- Table 49: Global Europe Health Drinks Market Revenue Million Forecast, by Type 2020 & 2033

- Table 50: Global Europe Health Drinks Market Volume Billion Forecast, by Type 2020 & 2033

- Table 51: Global Europe Health Drinks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 52: Global Europe Health Drinks Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 53: Global Europe Health Drinks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Europe Health Drinks Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Health Drinks Market?

The projected CAGR is approximately 4.61%.

2. Which companies are prominent players in the Europe Health Drinks Market?

Key companies in the market include Nestle SA, PepsiCo Inc, Red Bull GmbH, Danone SA, The Coca-Cola Company, Suntory Holdings Limited, Oatly Group AB, Biona Organic, Monster Beverage Corporation, Yakult Honsha Co Ltd*List Not Exhaustive.

3. What are the main segments of the Europe Health Drinks Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 53.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Augmented Expenditure on Advertisement and Promotional Activities; Growing Consumer Inclination Toward Low-sugar/Sugar-free Beverages.

6. What are the notable trends driving market growth?

Growing Popularity of Energy Drinks Driving the Market.

7. Are there any restraints impacting market growth?

Augmented Expenditure on Advertisement and Promotional Activities; Growing Consumer Inclination Toward Low-sugar/Sugar-free Beverages.

8. Can you provide examples of recent developments in the market?

January 2024: Celsius Holdings, an energy drink manufacturer based in Florida, United States, broadened its international reach with distribution deals in the United Kingdom. Celsius named Suntory Beverage & Food Great Britain as its exclusive sales and distribution partner to enter the Irish and UK markets. The energy drinks maker has identified Germany and other European countries as “big opportunities” for new markets as it increases its reach outside the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Health Drinks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Health Drinks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Health Drinks Market?

To stay informed about further developments, trends, and reports in the Europe Health Drinks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence