Key Insights

The Customer Self-Service Software market is projected for significant expansion, expected to reach a market size of $11.01 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 19.5%. This growth is propelled by the increasing demand for superior customer experiences and enhanced operational efficiency across diverse industries. Businesses are prioritizing customer empowerment with immediate solutions to reduce wait times and elevate satisfaction. The widespread adoption of digital channels, coupled with AI-powered chatbots and virtual assistants, is accelerating market penetration. Self-service solutions, encompassing web portals, mobile applications, and comprehensive service platforms, address a broad range of customer interaction needs. Key sectors like BFSI, Healthcare, Retail, and IT & Telecommunication are at the forefront of adopting these technologies to optimize support, manage increasing customer volumes, and lower traditional customer service costs.

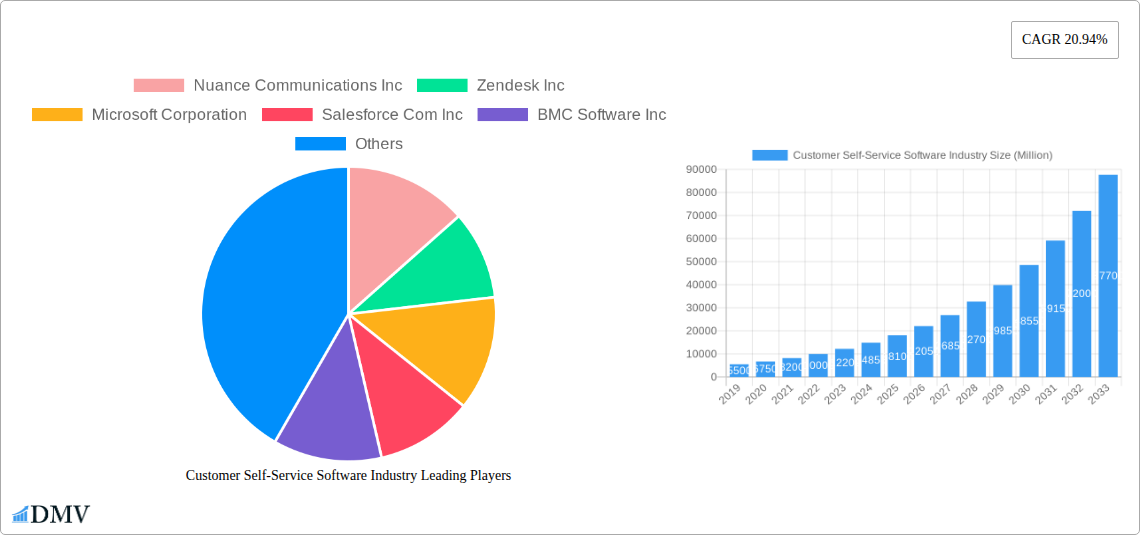

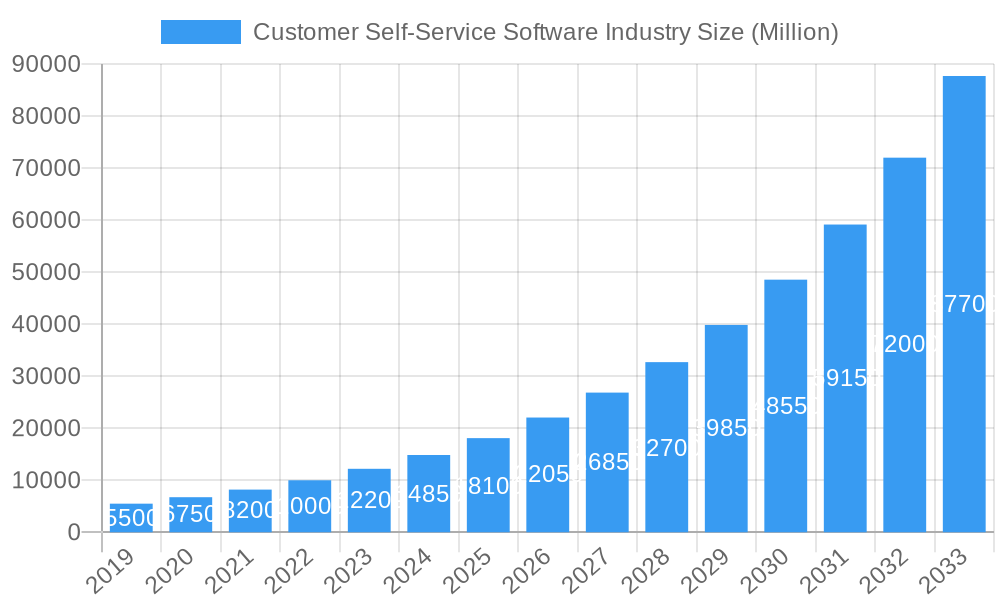

Customer Self-Service Software Industry Market Size (In Billion)

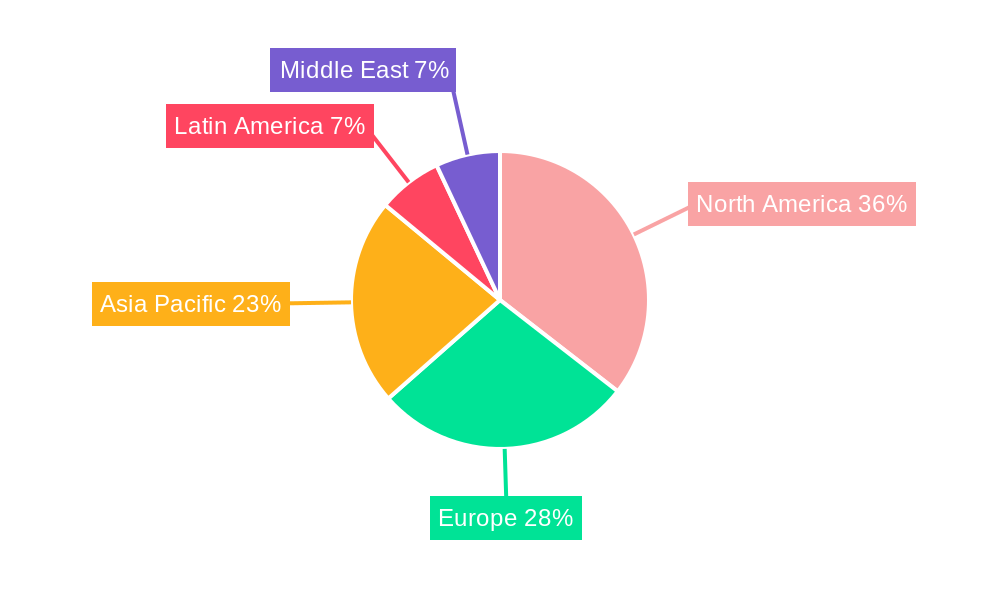

The market's future is also influenced by technological advancements and strategic business objectives. Cloud deployment models are increasingly favored for their scalability, flexibility, and cost-effectiveness, democratizing access to advanced self-service capabilities for businesses of all sizes. While the pursuit of improved customer satisfaction and reduced operational expenses drives self-service software adoption, potential challenges may arise from integrating with existing legacy systems and the initial deployment investment. Nevertheless, the long-term advantages, including heightened customer loyalty, operational agility, and a strengthened competitive position, are anticipated to surpass these hurdles. Major industry players such as Microsoft Corporation, Salesforce Com Inc., Oracle Corporation, and SAP SE are driving innovation and expanding their portfolios, fostering market competition and technological progress. North America and Europe are expected to maintain their leadership positions, with the Asia Pacific region exhibiting notable and accelerating adoption, mirroring global digital transformation trends.

Customer Self-Service Software Industry Company Market Share

This report provides an SEO-optimized and insightful overview of the Customer Self-Service Software industry, designed for maximum stakeholder engagement and clarity.

Customer Self-Service Software Industry Market Composition & Trends

This comprehensive report delves into the intricate market composition and evolving trends of the global Customer Self-Service Software Industry. We dissect the competitive landscape, revealing a moderately concentrated market with key players vying for dominance. Innovation is a primary catalyst, driven by the escalating demand for enhanced customer experience and operational efficiency. The regulatory landscape, while evolving, generally supports the adoption of self-service solutions to improve accessibility and data privacy. Substitute products, primarily traditional customer support channels, are progressively being displaced by more agile and cost-effective self-service platforms. End-user profiles showcase a diverse range of industries prioritizing customer empowerment. Mergers and acquisitions (M&A) activity is a significant indicator of market consolidation and strategic expansion, with estimated deal values reaching hundreds of millions of dollars, shaping the future trajectory of the industry. Market share distribution is dynamic, with leading companies continuously innovating to capture a larger segment of this rapidly expanding market.

- Market Concentration: Moderate, with a few dominant players and a growing number of specialized providers.

- Innovation Catalysts: AI-powered chatbots, intelligent knowledge bases, personalized self-service journeys, and omnichannel integration.

- Regulatory Landscape: Focus on data security, privacy, and accessibility, influencing platform design and deployment.

- Substitute Products: Traditional call centers, email support, and in-person assistance are being augmented or replaced.

- End-User Profiles: Businesses of all sizes across virtually every sector seeking to improve customer satisfaction and reduce operational costs.

- M&A Activities: Significant consolidation and strategic partnerships aimed at expanding service offerings and market reach.

Customer Self-Service Software Industry Industry Evolution

The Customer Self-Service Software Industry has undergone a remarkable evolution, transforming from basic FAQ pages to sophisticated, AI-driven platforms that empower customers and streamline business operations. Over the historical period of 2019–2024, we observed a consistent upward trajectory in adoption, fueled by the growing digital fluency of consumers and the imperative for businesses to deliver seamless, on-demand support. This growth has been further accelerated by the base year of 2025, which marks a pivotal moment in the industry's maturation. The market has witnessed a significant shift towards cloud-based solutions, offering scalability, flexibility, and cost-effectiveness compared to their on-premise counterparts. Technological advancements have been relentless, with artificial intelligence (AI) and machine learning (ML) integrating into self-service portals to provide intelligent chatbots, personalized recommendations, and predictive support. Natural Language Processing (NLP) has dramatically improved the ability of these systems to understand and respond to customer queries with human-like accuracy.

The offering has diversified beyond mere solutions to encompass comprehensive services, including implementation, customization, and ongoing support, ensuring maximum value realization for end-users. Consumer demand has evolved from simple problem resolution to a desire for proactive, personalized, and frictionless self-service experiences. This has pushed companies to invest heavily in user experience (UX) design, ensuring intuitive navigation and personalized content delivery. The adoption metrics reveal a substantial increase in self-service ticket deflection rates, leading to significant cost savings for businesses and improved customer satisfaction scores. For instance, a XX% increase in self-service portal usage has been observed across the BFSI sector, directly correlating with a XX% reduction in average handling time for customer support agents. Similarly, the healthcare industry is leveraging self-service for appointment scheduling and prescription refills, demonstrating a XX% increase in patient engagement. The IT and Telecommunication sector, a consistent early adopter, continues to drive innovation with advanced troubleshooting guides and automated service requests, showing a XX% growth in self-service resolution rates. The forecast period of 2025–2033 anticipates continued exponential growth, driven by further AI advancements, hyper-personalization, and the integration of self-service capabilities into the broader customer journey, with an estimated Compound Annual Growth Rate (CAGR) of XX%.

Leading Regions, Countries, or Segments in Customer Self-Service Software Industry

The Customer Self-Service Software Industry is experiencing dynamic leadership across various segments, with significant regional and deployment-based dominance. Among the deployment options, Cloud solutions are overwhelmingly leading the market. This supremacy is driven by the inherent scalability, cost-efficiency, and ease of implementation that cloud platforms offer, aligning perfectly with the agility required by modern businesses. Companies are increasingly migrating their customer service infrastructure to the cloud to leverage remote accessibility, automatic updates, and reduced IT overhead, making it the preferred choice for over XX% of new deployments. On-premise solutions, while still relevant for highly regulated industries or those with specific data sovereignty concerns, represent a shrinking segment of the market.

The IT and Telecommunication end-user industry stands out as a dominant segment. This is due to the high volume of customer interactions, the technical nature of their products and services, and the continuous need for efficient support mechanisms. These companies have been early adopters of self-service technologies to manage complex queries, provide troubleshooting guides, and facilitate account management, resulting in substantial reductions in operational costs and improved customer loyalty. The BFSI sector also exhibits strong leadership, driven by stringent security requirements and the demand for instant access to financial information and services. Self-service portals enable secure transactions, account inquiries, and application status updates, enhancing customer convenience and trust.

In terms of offering, Solution encompassing web-based and mobile-based applications are at the forefront. The ubiquitous nature of smartphones and the preference for digital interactions have propelled mobile-based self-service to significant prominence. Web-based solutions, while foundational, are increasingly integrated with mobile-first strategies. The Service component, including implementation, customization, and ongoing support, is also crucial, as businesses seek end-to-end solutions that guarantee successful adoption and maximum ROI.

Key drivers for this dominance include:

- Investment Trends: Significant R&D investment by major players and venture capital funding in innovative self-service technologies.

- Regulatory Support: While not directly a driver, favorable regulations that encourage digital transformation and customer empowerment indirectly boost self-service adoption.

- Technological Advancements: The continuous evolution of AI, ML, and NLP capabilities, making self-service more intelligent and personalized.

- Consumer Demand: A persistent and growing expectation from consumers for immediate, convenient, and personalized support.

The dominance of cloud deployment and the IT and Telecommunication end-user industry underscores the industry's trajectory towards digital-first, highly scalable, and intelligent customer engagement models.

Customer Self-Service Software Industry Product Innovations

Product innovations in the Customer Self-Service Software Industry are rapidly transforming customer interactions, driven by AI and intelligent automation. Key advancements include the development of highly sophisticated, context-aware chatbots capable of understanding complex queries and providing personalized solutions, significantly reducing the need for human intervention. Intelligent knowledge bases, powered by semantic search and machine learning, now proactively suggest relevant information to users, anticipating their needs before they even ask. Furthermore, the integration of self-service portals with CRM systems is enabling hyper-personalized self-service journeys, tailoring the experience based on individual customer history and preferences. Performance metrics showcase a dramatic improvement in first-contact resolution rates, often exceeding XX% for common inquiries, and a reduction in average customer wait times by up to XX%. Unique selling propositions are increasingly centered on the ability of these platforms to deliver frictionless, intuitive, and emotionally intelligent customer support.

Propelling Factors for Customer Self-Service Software Industry Growth

The growth of the Customer Self-Service Software Industry is propelled by a confluence of powerful factors. Technologically, the relentless advancement of Artificial Intelligence (AI), Machine Learning (ML), and Natural Language Processing (NLP) is enabling more intelligent, personalized, and efficient self-service experiences. Economically, businesses are driven by the significant cost savings associated with deflecting support tickets through self-service channels, estimated to be in the hundreds of millions annually. This directly impacts operational efficiency and profitability. Regulatory tailwinds, such as data privacy mandates and the push for digital accessibility, also encourage the adoption of robust self-service solutions. Furthermore, evolving consumer expectations for instant, 24/7 support and personalized interactions are a primary driver, compelling companies to invest in these technologies to remain competitive and enhance customer satisfaction.

Obstacles in the Customer Self-Service Software Industry Market

Despite its robust growth, the Customer Self-Service Software Industry faces several obstacles. Regulatory challenges, particularly around data privacy and security, can create compliance hurdles and necessitate significant investment in secure infrastructure, potentially costing millions in ongoing audits and certifications. The complexity of integrating self-service solutions with legacy IT systems can also be a substantial barrier, requiring extensive customization and potentially leading to implementation delays and increased costs, often in the millions. Furthermore, competitive pressures are intense, with numerous vendors vying for market share, leading to pricing wars and a need for continuous innovation, which itself demands significant R&D investment. Supply chain disruptions, though less direct, can impact the availability of hardware components for on-premise deployments, and the talent gap in AI and specialized software development can hinder faster product development and deployment, affecting market expansion.

Future Opportunities in Customer Self-Service Software Industry

The future of the Customer Self-Service Software Industry is brimming with opportunities. The increasing adoption of AI and ML will lead to even more sophisticated, predictive, and hyper-personalized self-service experiences, potentially generating billions in value. Emerging markets in developing economies represent a significant untapped potential, as digital adoption accelerates. The integration of self-service capabilities into the Internet of Things (IoT) ecosystem, enabling device-level support and diagnostics, presents a novel avenue for growth. Furthermore, the focus on proactive customer service, where self-service solutions anticipate issues and offer solutions before they arise, is a rapidly expanding frontier. The demand for specialized self-service solutions tailored to niche industries, such as advanced analytics for healthcare or personalized financial guidance for BFSI, will also drive significant market expansion.

Major Players in the Customer Self-Service Software Industry Ecosystem

- Nuance Communications Inc

- Zendesk Inc

- Microsoft Corporation

- Salesforce Com Inc

- BMC Software Inc

- Verint Systems Inc

- Oracle Corporation

- Zappix Inc

- Zoho Corporation Pvt Ltd

- SAP SE

Key Developments in Customer Self-Service Software Industry Industry

- April 2022: Oracle announced the availability of its customer-managed analytics platform: - Oracle Analytics Server 2022. This is the next generation of Oracle Business Intelligence Enterprise Edition (OBIEE) and a great path to modernization for any individual needing to deploy analytics on-premises or customer-managed in the cloud via the Oracle Cloud Infrastructure Marketplace.

- April 2022: SAP SE announced that it had simplified its services and support portfolio by pivoting to focus heavily on customer adoption and consumption. The portfolio is primarily built for the cloud and designed to help customers realize value quickly and achieve lasting success.

Strategic Customer Self-Service Software Industry Market Forecast

The strategic forecast for the Customer Self-Service Software Industry points towards sustained robust growth, projected to reach billions in value by 2033. This expansion will be fueled by the continuous innovation in AI and automation, leading to more intelligent and personalized customer interactions. The increasing demand for efficient and cost-effective customer support solutions across all end-user industries will continue to be a primary growth catalyst. Furthermore, the growing adoption of cloud-based solutions and the expansion into emerging markets will unlock new avenues for revenue generation. Companies that prioritize user experience, omnichannel integration, and data-driven insights will be best positioned to capitalize on the vast opportunities presented by this dynamic and evolving market.

Customer Self-Service Software Industry Segmentation

-

1. Deployment

- 1.1. Cloud

- 1.2. On-premise

-

2. Offering

-

2.1. Solution

- 2.1.1. Web-based

- 2.1.2. Mobile-based

- 2.2. Service

-

2.1. Solution

-

3. End-User Industry

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Retail

- 3.4. Government

- 3.5. IT and Telecommunication

- 3.6. Other End-user Industries

Customer Self-Service Software Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Customer Self-Service Software Industry Regional Market Share

Geographic Coverage of Customer Self-Service Software Industry

Customer Self-Service Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Penetration of Cloud Services; Growing Demand for Network Security and Privacy

- 3.3. Market Restrains

- 3.3.1. Evolving Market Regulations

- 3.4. Market Trends

- 3.4.1. Increased Penetration of Cloud Services in the Retail sector is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Customer Self-Service Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Cloud

- 5.1.2. On-premise

- 5.2. Market Analysis, Insights and Forecast - by Offering

- 5.2.1. Solution

- 5.2.1.1. Web-based

- 5.2.1.2. Mobile-based

- 5.2.2. Service

- 5.2.1. Solution

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Retail

- 5.3.4. Government

- 5.3.5. IT and Telecommunication

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Customer Self-Service Software Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. Cloud

- 6.1.2. On-premise

- 6.2. Market Analysis, Insights and Forecast - by Offering

- 6.2.1. Solution

- 6.2.1.1. Web-based

- 6.2.1.2. Mobile-based

- 6.2.2. Service

- 6.2.1. Solution

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry

- 6.3.1. BFSI

- 6.3.2. Healthcare

- 6.3.3. Retail

- 6.3.4. Government

- 6.3.5. IT and Telecommunication

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Customer Self-Service Software Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. Cloud

- 7.1.2. On-premise

- 7.2. Market Analysis, Insights and Forecast - by Offering

- 7.2.1. Solution

- 7.2.1.1. Web-based

- 7.2.1.2. Mobile-based

- 7.2.2. Service

- 7.2.1. Solution

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry

- 7.3.1. BFSI

- 7.3.2. Healthcare

- 7.3.3. Retail

- 7.3.4. Government

- 7.3.5. IT and Telecommunication

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Pacific Customer Self-Service Software Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. Cloud

- 8.1.2. On-premise

- 8.2. Market Analysis, Insights and Forecast - by Offering

- 8.2.1. Solution

- 8.2.1.1. Web-based

- 8.2.1.2. Mobile-based

- 8.2.2. Service

- 8.2.1. Solution

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry

- 8.3.1. BFSI

- 8.3.2. Healthcare

- 8.3.3. Retail

- 8.3.4. Government

- 8.3.5. IT and Telecommunication

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Latin America Customer Self-Service Software Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. Cloud

- 9.1.2. On-premise

- 9.2. Market Analysis, Insights and Forecast - by Offering

- 9.2.1. Solution

- 9.2.1.1. Web-based

- 9.2.1.2. Mobile-based

- 9.2.2. Service

- 9.2.1. Solution

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry

- 9.3.1. BFSI

- 9.3.2. Healthcare

- 9.3.3. Retail

- 9.3.4. Government

- 9.3.5. IT and Telecommunication

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Middle East Customer Self-Service Software Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. Cloud

- 10.1.2. On-premise

- 10.2. Market Analysis, Insights and Forecast - by Offering

- 10.2.1. Solution

- 10.2.1.1. Web-based

- 10.2.1.2. Mobile-based

- 10.2.2. Service

- 10.2.1. Solution

- 10.3. Market Analysis, Insights and Forecast - by End-User Industry

- 10.3.1. BFSI

- 10.3.2. Healthcare

- 10.3.3. Retail

- 10.3.4. Government

- 10.3.5. IT and Telecommunication

- 10.3.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nuance Communications Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zendesk Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Microsoft Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Salesforce Com Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BMC Software Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Verint Systems Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Oracle Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zappix Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Zoho Corporation Pvt Ltd*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SAP SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Nuance Communications Inc

List of Figures

- Figure 1: Global Customer Self-Service Software Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Customer Self-Service Software Industry Revenue (billion), by Deployment 2025 & 2033

- Figure 3: North America Customer Self-Service Software Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America Customer Self-Service Software Industry Revenue (billion), by Offering 2025 & 2033

- Figure 5: North America Customer Self-Service Software Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 6: North America Customer Self-Service Software Industry Revenue (billion), by End-User Industry 2025 & 2033

- Figure 7: North America Customer Self-Service Software Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 8: North America Customer Self-Service Software Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Customer Self-Service Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Customer Self-Service Software Industry Revenue (billion), by Deployment 2025 & 2033

- Figure 11: Europe Customer Self-Service Software Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 12: Europe Customer Self-Service Software Industry Revenue (billion), by Offering 2025 & 2033

- Figure 13: Europe Customer Self-Service Software Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 14: Europe Customer Self-Service Software Industry Revenue (billion), by End-User Industry 2025 & 2033

- Figure 15: Europe Customer Self-Service Software Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 16: Europe Customer Self-Service Software Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Customer Self-Service Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Customer Self-Service Software Industry Revenue (billion), by Deployment 2025 & 2033

- Figure 19: Asia Pacific Customer Self-Service Software Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 20: Asia Pacific Customer Self-Service Software Industry Revenue (billion), by Offering 2025 & 2033

- Figure 21: Asia Pacific Customer Self-Service Software Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 22: Asia Pacific Customer Self-Service Software Industry Revenue (billion), by End-User Industry 2025 & 2033

- Figure 23: Asia Pacific Customer Self-Service Software Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Asia Pacific Customer Self-Service Software Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Customer Self-Service Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Customer Self-Service Software Industry Revenue (billion), by Deployment 2025 & 2033

- Figure 27: Latin America Customer Self-Service Software Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Latin America Customer Self-Service Software Industry Revenue (billion), by Offering 2025 & 2033

- Figure 29: Latin America Customer Self-Service Software Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 30: Latin America Customer Self-Service Software Industry Revenue (billion), by End-User Industry 2025 & 2033

- Figure 31: Latin America Customer Self-Service Software Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 32: Latin America Customer Self-Service Software Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Customer Self-Service Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Customer Self-Service Software Industry Revenue (billion), by Deployment 2025 & 2033

- Figure 35: Middle East Customer Self-Service Software Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 36: Middle East Customer Self-Service Software Industry Revenue (billion), by Offering 2025 & 2033

- Figure 37: Middle East Customer Self-Service Software Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 38: Middle East Customer Self-Service Software Industry Revenue (billion), by End-User Industry 2025 & 2033

- Figure 39: Middle East Customer Self-Service Software Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 40: Middle East Customer Self-Service Software Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East Customer Self-Service Software Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Customer Self-Service Software Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 2: Global Customer Self-Service Software Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 3: Global Customer Self-Service Software Industry Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 4: Global Customer Self-Service Software Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Customer Self-Service Software Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 6: Global Customer Self-Service Software Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 7: Global Customer Self-Service Software Industry Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 8: Global Customer Self-Service Software Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Customer Self-Service Software Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 10: Global Customer Self-Service Software Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 11: Global Customer Self-Service Software Industry Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 12: Global Customer Self-Service Software Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Customer Self-Service Software Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 14: Global Customer Self-Service Software Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 15: Global Customer Self-Service Software Industry Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 16: Global Customer Self-Service Software Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Customer Self-Service Software Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 18: Global Customer Self-Service Software Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 19: Global Customer Self-Service Software Industry Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 20: Global Customer Self-Service Software Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Customer Self-Service Software Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 22: Global Customer Self-Service Software Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 23: Global Customer Self-Service Software Industry Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 24: Global Customer Self-Service Software Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Customer Self-Service Software Industry?

The projected CAGR is approximately 19.5%.

2. Which companies are prominent players in the Customer Self-Service Software Industry?

Key companies in the market include Nuance Communications Inc, Zendesk Inc, Microsoft Corporation, Salesforce Com Inc, BMC Software Inc, Verint Systems Inc, Oracle Corporation, Zappix Inc, Zoho Corporation Pvt Ltd*List Not Exhaustive, SAP SE.

3. What are the main segments of the Customer Self-Service Software Industry?

The market segments include Deployment, Offering, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.01 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Penetration of Cloud Services; Growing Demand for Network Security and Privacy.

6. What are the notable trends driving market growth?

Increased Penetration of Cloud Services in the Retail sector is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Evolving Market Regulations.

8. Can you provide examples of recent developments in the market?

April 2022: Oracle announced the availability of its customer-managed analytics platform: - Oracle Analytics Server 2022. This is the next generation of Oracle Business Intelligence Enterprise Edition (OBIEE) and a great path to modernization for any individual needing to deploy analytics on-premises or customer-managed in the cloud via the Oracle Cloud Infrastructure Marketplace.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Customer Self-Service Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Customer Self-Service Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Customer Self-Service Software Industry?

To stay informed about further developments, trends, and reports in the Customer Self-Service Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence