Key Insights

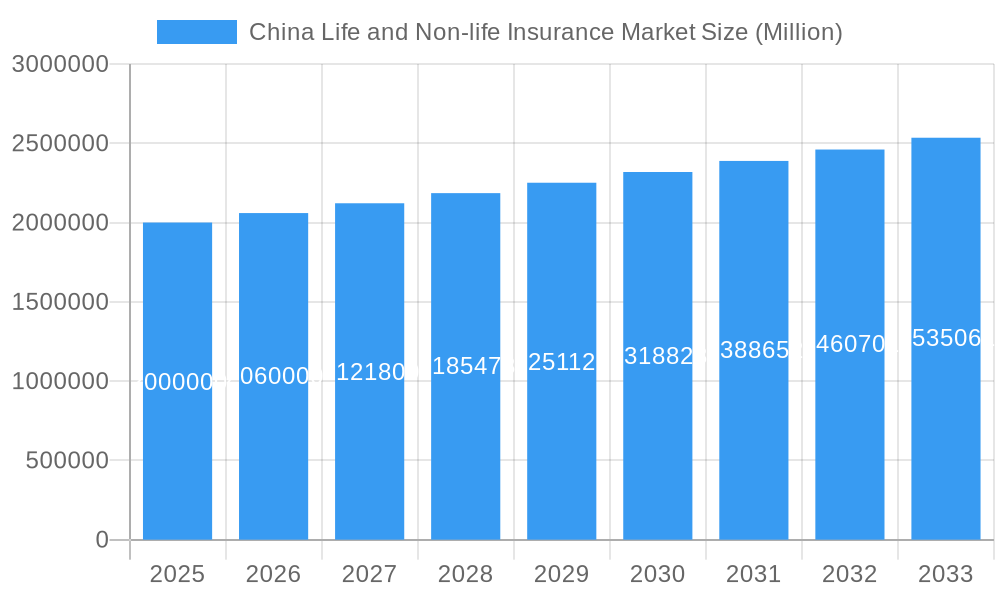

The China life and non-life insurance market is experiencing significant expansion, propelled by a growing middle class, heightened health awareness, and government-backed financial inclusion initiatives. This dynamic sector is projected to achieve a Compound Annual Growth Rate (CAGR) of 3.52%, with the market size estimated at 883.7 billion in the base year 2024. Key growth drivers include increasing demand for life insurance products driven by rising life expectancy and a desire for financial security, coupled with the escalating need for health and accident coverage in a rapidly developing economy. Emerging trends such as the digitalization of insurance services, expanded product penetration in rural areas, and the introduction of innovative offerings like micro-insurance and bundled products are further accelerating market growth. However, potential restraints include evolving regulatory landscapes, intense competition, and the imperative for robust fraud prevention and risk management.

China Life and Non-life Insurance Market Market Size (In Billion)

The projected growth trajectory underscores the necessity for strategic adaptation within the insurance sector. Companies that prioritize product innovation, leverage technology to enhance customer experiences, and actively target underserved demographics are poised for competitive advantage. Furthermore, strengthening risk management frameworks and ensuring compliance with dynamic regulatory requirements are paramount for sustained success. The integration of advanced technologies, including AI and big data analytics, will be critical for operational optimization, cost reduction, and the delivery of personalized customer solutions. Expanding into rural markets and addressing the specific needs of these populations represent substantial opportunities, demanding bespoke product designs and distribution strategies. Government efforts to promote financial literacy and encourage insurance adoption will significantly influence market expansion in the coming years.

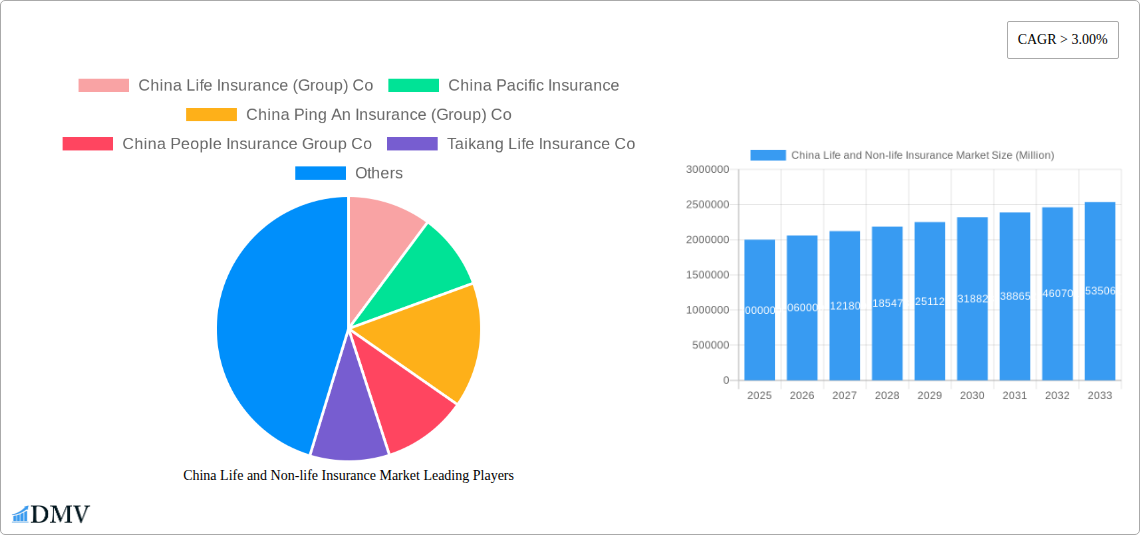

China Life and Non-life Insurance Market Company Market Share

China Life and Non-life Insurance Market Analysis: 2024-2033

This comprehensive report provides an in-depth analysis of the China life and non-life insurance market, detailing market size, key trends, influential players, and future growth projections. Covering the historical period up to the base year 2024 and extending through the forecast period to 2033, this study offers critical insights for stakeholders navigating this rapidly evolving industry. The market is projected to reach substantial value by 2033.

China Life and Non-life Insurance Market Composition & Trends

This section dives deep into the competitive landscape of the Chinese insurance market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, customer profiles, and mergers and acquisitions (M&A) activities. We examine the market share distribution among key players and assess the financial implications of significant M&A deals. The report includes a thorough evaluation of the market's evolving dynamics, incorporating data on premiums, claims, and investment returns.

- Market Concentration: The market is dominated by a few major players, with China Life Insurance (Group) Co, China Ping An Insurance (Group) Co, and China People's Insurance Group Co holding significant market share. However, smaller players and foreign entrants also contribute significantly. Market share data for 2024 will be included.

- Innovation Catalysts: Technological advancements, such as AI and big data analytics, are driving innovation in product offerings, customer service, and risk management. The adoption of Insurtech solutions is also shaping the market.

- Regulatory Landscape: Government regulations, including solvency requirements and consumer protection laws, play a crucial role in shaping market dynamics. Recent regulatory changes and their impact will be detailed.

- Substitute Products: Alternative financial products and investment options influence consumer choices within the insurance market. The report will analyze the competitive landscape posed by substitutes.

- End-User Profiles: The report segments the end-user base based on demographics, income levels, and insurance needs to better understand consumer behavior and preferences.

- M&A Activities: Recent M&A activity, including deal values and strategic implications, will be analyzed. Examples include the AIA Group's investment in China Post Life Insurance (2022). We estimate total M&A deal value in the analyzed period to be approximately xx Million.

China Life and Non-life Insurance Market Industry Evolution

This section provides a comprehensive overview of the China life and non-life insurance market's growth trajectory, technological advancements, and evolving consumer preferences throughout the study period (2019-2033). The report will analyze factors influencing market growth, including economic expansion, demographic shifts, and changing risk perceptions. Specific growth rates and adoption metrics for key technologies will be provided. The impact of macroeconomic factors on insurance demand will also be discussed. We anticipate a Compound Annual Growth Rate (CAGR) of xx% during the forecast period.

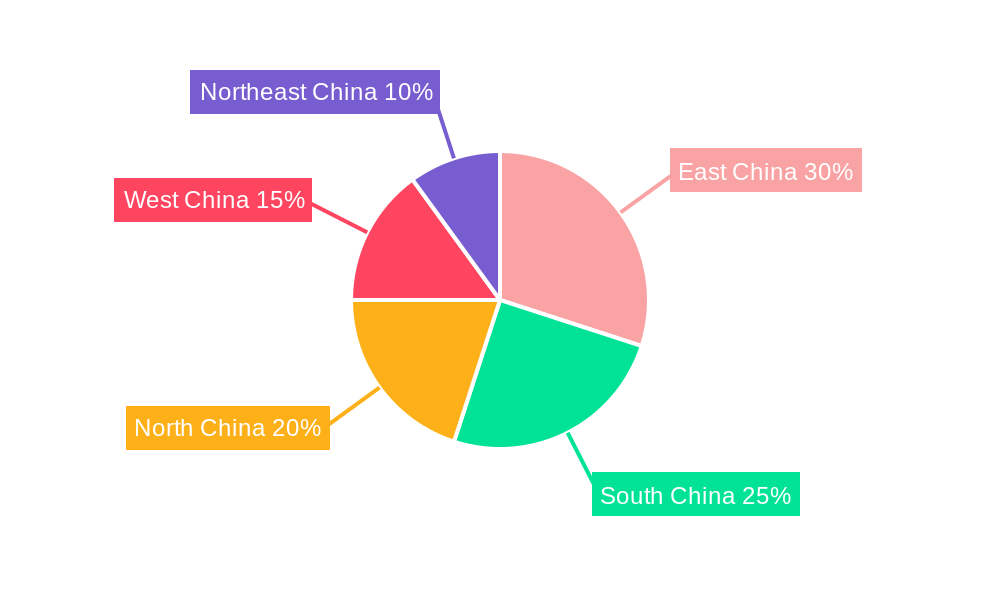

Leading Regions, Countries, or Segments in China Life and Non-life Insurance Market

This section identifies the dominant regions, countries, or segments within the China life and non-life insurance market. We'll analyze the key factors contributing to their dominance, including investment trends, regulatory support, and market penetration.

- Key Drivers:

- Robust economic growth in specific regions.

- Favorable government policies and regulatory frameworks.

- High levels of investment in infrastructure and development.

- Increasing awareness and adoption of insurance products.

- Dominance Factors: This section will provide an in-depth analysis of the factors driving the success of the dominant region/segment, including a detailed examination of market size, growth rate, and key players operating in the area.

China Life and Non-life Insurance Market Product Innovations

This section examines recent product innovations, their applications, and performance metrics. We’ll highlight unique selling propositions (USPs) and analyze the role of technological advancements, such as AI-powered underwriting and personalized insurance solutions, in shaping product offerings. The increasing demand for health and travel insurance products will be addressed.

Propelling Factors for China Life and Non-life Insurance Market Growth

Several factors are driving the growth of the China life and non-life insurance market. These include increasing disposable incomes, rising awareness of insurance benefits, favorable government policies promoting financial inclusion, and technological advancements enabling innovative product offerings and improved customer experience. The expansion of the middle class and increased demand for health and retirement planning products also contribute significantly to market growth.

Obstacles in the China Life and Non-life Insurance Market

The China life and non-life insurance market faces several challenges. These include intense competition among established players and new entrants, regulatory complexities and evolving compliance requirements, and the need to address potential supply chain disruptions. The economic slowdown and its effect on insurance premium payments should also be noted. We anticipate a xx% impact from competitive pressures on market growth during the forecast period.

Future Opportunities in China Life and Non-life Insurance Market

Despite the challenges, the China life and non-life insurance market presents numerous opportunities. These include expanding into underserved rural markets, leveraging emerging technologies such as Insurtech to improve operational efficiency, and developing innovative products catering to evolving consumer needs. The market presents significant potential for growth in areas such as health insurance, wealth management products, and digital insurance platforms.

Major Players in the China Life and Non-life Insurance Market Ecosystem

- China Life Insurance (Group) Co

- China Pacific Insurance

- China Ping An Insurance (Group) Co

- China People Insurance Group Co

- Taikang Life Insurance Co

- Xinhua Insurance

- American International Assurance Co Ltd

- Sunshine Insurance

- Funde Sino Life

- China Taiping Insurance Group Co

Key Developments in China Life and Non-life Insurance Market Industry

- April 2022: China Life Insurance Co and Tokio Marine Newa Insurance Co partnered to cross-sell insurance products, expanding distribution channels and product offerings.

- January 2022: AIA Group completed its investment in China Post Life Insurance, significantly increasing its presence in the Chinese market.

Strategic China Life and Non-life Insurance Market Forecast

The China life and non-life insurance market is poised for significant growth over the forecast period, driven by favorable demographic trends, economic expansion, and increasing insurance penetration. Continued technological advancements, regulatory support for market expansion, and the emergence of innovative insurance products will further contribute to market expansion. We project a substantial increase in market value, fueled by the factors described above.

China Life and Non-life Insurance Market Segmentation

-

1. Insurance type

- 1.1. Life Insurance

- 1.2. Non-life Insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Other Distribution Channels

China Life and Non-life Insurance Market Segmentation By Geography

- 1. China

China Life and Non-life Insurance Market Regional Market Share

Geographic Coverage of China Life and Non-life Insurance Market

China Life and Non-life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements are Driving the Market; Demographic Shifts is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Technological Advancements are Driving the Market; Demographic Shifts is Driving the Market

- 3.4. Market Trends

- 3.4.1. Digital Transformation is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Life and Non-life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Life Insurance

- 5.1.2. Non-life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Life Insurance (Group) Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Pacific Insurance

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China Ping An Insurance (Group) Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China People Insurance Group Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Taikang Life Insurance Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Xinhua Insurance

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 American International Assurance Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sunshine Insurance

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Funde Sino Life

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Taiping Insurance Group Co **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 China Life Insurance (Group) Co

List of Figures

- Figure 1: China Life and Non-life Insurance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Life and Non-life Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: China Life and Non-life Insurance Market Revenue billion Forecast, by Insurance type 2020 & 2033

- Table 2: China Life and Non-life Insurance Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: China Life and Non-life Insurance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Life and Non-life Insurance Market Revenue billion Forecast, by Insurance type 2020 & 2033

- Table 5: China Life and Non-life Insurance Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: China Life and Non-life Insurance Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Life and Non-life Insurance Market?

The projected CAGR is approximately 3.52%.

2. Which companies are prominent players in the China Life and Non-life Insurance Market?

Key companies in the market include China Life Insurance (Group) Co, China Pacific Insurance, China Ping An Insurance (Group) Co, China People Insurance Group Co, Taikang Life Insurance Co, Xinhua Insurance, American International Assurance Co Ltd, Sunshine Insurance, Funde Sino Life, China Taiping Insurance Group Co **List Not Exhaustive.

3. What are the main segments of the China Life and Non-life Insurance Market?

The market segments include Insurance type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 883.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements are Driving the Market; Demographic Shifts is Driving the Market.

6. What are the notable trends driving market growth?

Digital Transformation is Driving the Market.

7. Are there any restraints impacting market growth?

Technological Advancements are Driving the Market; Demographic Shifts is Driving the Market.

8. Can you provide examples of recent developments in the market?

April 2022: China Life Insurance Co and Tokio Marine Newa Insurance Co have recently formed a partnership to cross-sell their insurance products. Under the partnership, China Life's 15,000 sales agents would receive training from Tokio Marine Newa for them to become licensed Tokio Marine sales agents. Once licensed, these sales agents can market Tokio Marine's non-life products, including motor, fire, and travel insurance to their clients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Life and Non-life Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Life and Non-life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Life and Non-life Insurance Market?

To stay informed about further developments, trends, and reports in the China Life and Non-life Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence