Key Insights

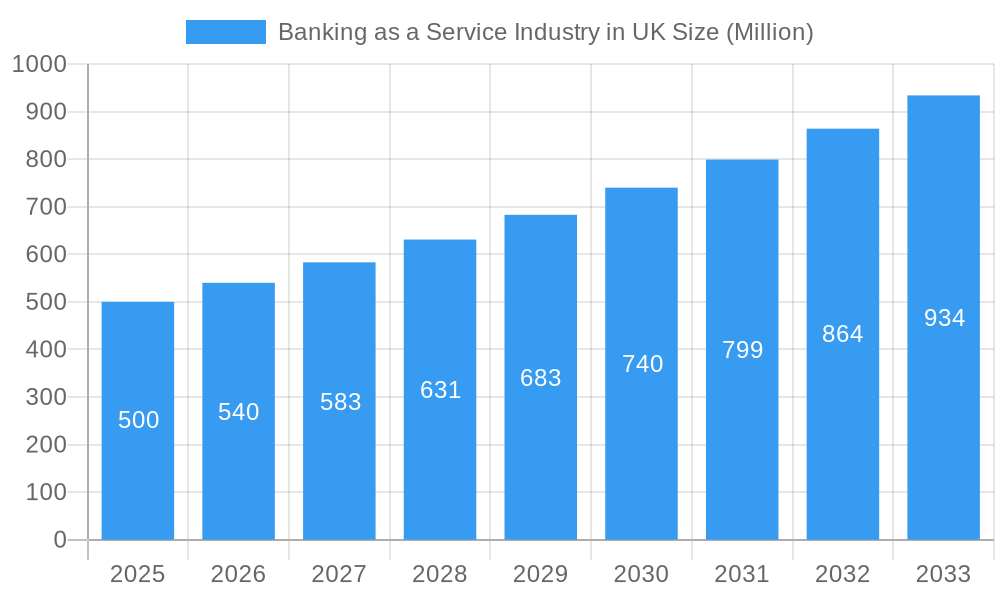

The UK Banking as a Service (BaaS) market is experiencing significant expansion, fueled by the escalating demand for digital financial solutions, the proliferation of fintech innovators, and the imperative for financial institutions to enhance operational agility and broaden service portfolios. A projected CAGR of 12.6% from 2024 to 2033 indicates robust market growth. The UK BaaS market is estimated to have reached approximately £1.1 billion in 2024. Key growth drivers include the expanding embedded finance ecosystem, enabling non-financial entities to seamlessly integrate financial services, and the widespread adoption of open banking APIs, facilitating secure data exchange between banks and third-party providers. This technological synergy accelerates the development of novel products and services that meet evolving consumer expectations for personalized and convenient financial experiences. Favorable regulatory frameworks supporting open banking and fostering competition further stimulate market expansion. Nevertheless, potential impediments such as data security vulnerabilities, regulatory intricacies, and the requirement for sophisticated integration capabilities may temper growth. The market is segmented by service type (account servicing, payment processing, lending), deployment model (cloud, on-premises), and customer vertical (banks, fintechs, enterprises). Prominent industry participants including Thought Machine, Starling Bank, and ClearBank are actively shaping the market through technological advancements and strategic alliances.

Banking as a Service Industry in UK Market Size (In Billion)

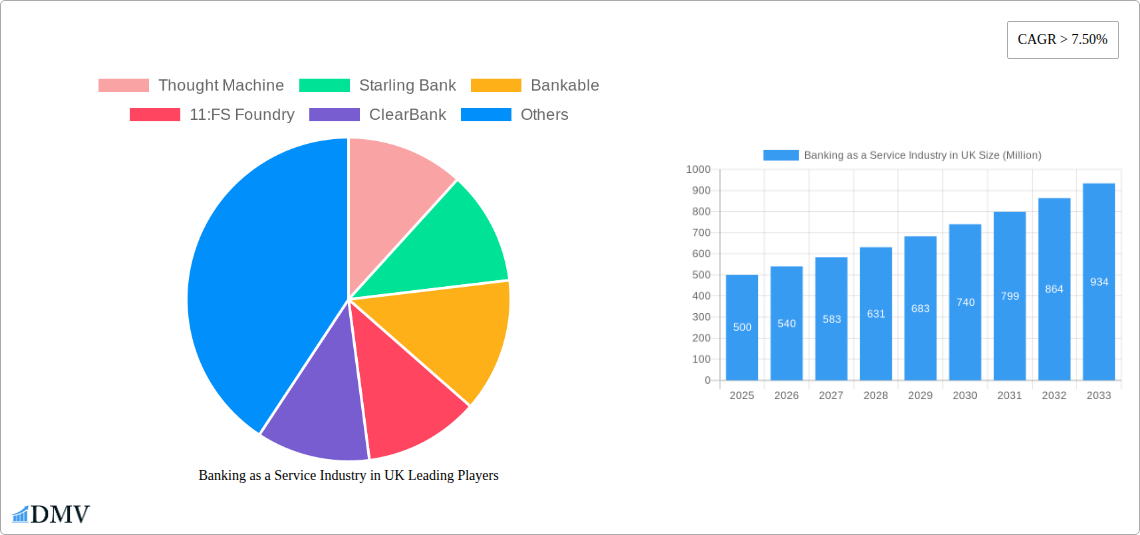

The forecast period (2025-2033) anticipates sustained market acceleration. A continued CAGR exceeding 7.5% is highly probable, driven by ongoing technological innovation and increasing market penetration. By 2033, the UK BaaS market is projected to surpass £2.5 billion, reflecting substantial future growth. This forecast is predicated on continued regulatory advocacy for open banking, intensified digitalization across the financial services landscape, and the continuous emergence of innovative BaaS solutions tailored to diverse market segments. Competitive dynamics are expected to intensify, mandating persistent innovation and strategic collaborations to secure market positioning. The market trajectory will likely emphasize enhanced security protocols, streamlined API integrations, and the extension of BaaS capabilities into complementary financial domains.

Banking as a Service Industry in UK Company Market Share

Banking as a Service Industry in UK: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UK Banking as a Service (BaaS) industry, offering invaluable insights for stakeholders seeking to navigate this rapidly evolving landscape. The study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033. We delve into market composition, competitive dynamics, technological advancements, and future growth prospects, providing crucial data to inform strategic decision-making. The UK BaaS market is projected to reach £xx Million by 2033, demonstrating significant growth potential.

Banking as a Service Industry in UK Market Composition & Trends

The UK BaaS market is characterized by a dynamic interplay of established players and emerging fintechs. Market concentration is currently moderate, with a few dominant players holding significant market share, but a fragmented landscape fostering innovation. The market share distribution is estimated as follows in 2025: ClearBank (15%), Starling Bank (12%), Thought Machine (10%), Bankable (8%), others (55%). Innovation is driven by advancements in API technology, open banking initiatives, and increasing demand for embedded finance solutions. The regulatory landscape, while evolving, presents both opportunities and challenges, with the FCA playing a key role in shaping the industry's future. Substitute products, such as traditional banking services, are facing increasing competition from the agility and customization offered by BaaS providers. End-user profiles encompass a broad range, including fintechs, large corporations, and SMEs seeking to integrate financial services into their offerings. M&A activity has been significant, with deal values exceeding £xx Million in the past five years. Key M&A activities include:

- Strategic acquisitions by larger financial institutions to bolster their digital capabilities.

- Consolidation among smaller players seeking to gain scale and market share.

- Investments by venture capitalists and private equity firms fueling innovation and growth.

Banking as a Service Industry in UK Industry Evolution

The UK's Banking as a Service (BaaS) market has experienced remarkable expansion since 2019, propelled by a confluence of transformative factors. Advancements in cloud computing, artificial intelligence (AI), and robust API integrations have dramatically lowered the barrier to entry, fostering an environment of rapid innovation for new and established players alike. Simultaneously, a discernible shift in consumer expectations towards more personalized, intuitive, and seamlessly integrated financial experiences is a primary catalyst for BaaS adoption. The compound annual growth rate (CAGR) for the period 2019-2024 is estimated at approximately **xx%**, outperforming global averages. Adoption metrics underscore a significant surge in businesses leveraging BaaS, with particular traction observed within the dynamic fintech and rapidly evolving e-commerce sectors. Projections indicate a continued impressive CAGR of **xx%** from 2025 to 2033, with the market size anticipated to reach an impressive **£xx Million** by the end of this forecast period. This substantial growth will be predominantly fueled by the widespread embrace of embedded finance solutions and the ongoing maturation of open banking initiatives across the UK. Furthermore, the escalating demand for hyper-personalized financial products and bespoke service offerings will serve as a significant growth engine. While challenges persist, notably concerning sophisticated data security protocols and the intricate landscape of regulatory compliance, the industry's overarching trajectory remains exceptionally positive and promising.

Leading Regions, Countries, or Segments in Banking as a Service Industry in UK

London emerges as the dominant hub for the UK BaaS industry. Its concentration of fintech talent, established financial infrastructure, and access to funding are key drivers.

- Key Drivers:

- High concentration of fintech startups and established financial institutions.

- Supportive regulatory environment fostering innovation.

- Significant investment from venture capitalists and private equity firms.

- Access to a large pool of skilled labor.

London's dominance stems from its established position as a global financial center, attracting both domestic and international investment in the BaaS sector. The city benefits from a robust ecosystem of supporting businesses and a skilled workforce capable of developing and implementing cutting-edge BaaS solutions. Furthermore, the government’s proactive approach to promoting fintech innovation contributes to London's leading position. Beyond London, other major UK cities are witnessing growth, although at a slower pace compared to the capital. The segment driving most growth is embedded finance, followed by digital banking solutions offered through BaaS.

Banking as a Service Industry in UK Product Innovations

The UK BaaS market is characterized by a relentless pace of product innovation, with a strategic focus on elevating user experience and broadening functional capabilities. Emerging product offerings encompass highly customizable embedded finance solutions designed for seamless integration, sophisticated tailored lending platforms catering to specific business needs, and advanced payment gateways that streamline transactions. The integration of cutting-edge technologies such as AI-powered fraud detection systems and intelligent, personalized financial management tools significantly amplifies the inherent value proposition of BaaS. Key innovations that are shaping the market include real-time payment processing for enhanced efficiency, advanced risk management frameworks for greater security and stability, and frictionless integration capabilities with existing enterprise-level business systems. These technological leaps are instrumental in driving enhanced customer satisfaction and accelerating market penetration for BaaS providers.

Propelling Factors for Banking as a Service Industry in UK Growth

Several factors contribute to the UK BaaS market's growth. Technological advancements, particularly in API technology and cloud computing, enable efficient and cost-effective delivery of financial services. Open banking regulations have fostered increased competition and innovation, leading to new product offerings and improved customer experiences. The growing adoption of digital channels and increasing demand for personalized financial services further fuel market expansion. Government initiatives to promote fintech innovation have also created a conducive environment for growth.

Obstacles in the Banking as a Service Industry in UK Market

Despite the overwhelmingly positive market outlook, the UK BaaS sector is not without its significant challenges. The complex and ever-evolving regulatory landscape, encompassing stringent compliance requirements and rigorous data privacy regulations, presents a substantial hurdle for many businesses. Furthermore, potential disruptions within the supply chain can impact the reliability and efficiency of service delivery. Intense competition, both from established, traditional banking institutions and agile, emerging fintech disruptors, exerts considerable pressure on pricing strategies and profit margins. Crucially, ongoing security concerns related to data breaches and sophisticated cyberattacks represent a persistent and evolving risk, necessitating continuous investment in robust, state-of-the-art security measures and proactive threat mitigation strategies.

Future Opportunities in Banking as a Service Industry in UK

Future opportunities lie in expanding into new market segments, such as healthcare and insurance, integrating advanced technologies like blockchain and AI, and developing innovative financial products tailored to specific consumer needs. Growth is also expected in cross-border payments and international expansion of UK BaaS providers. The increasing demand for personalized financial solutions opens further opportunities for specialized offerings.

Major Players in the Banking as a Service Industry in UK Ecosystem

- Thought Machine

- Starling Bank

- Bankable

- 11:FS Foundry

- ClearBank

- Solarisbank

- Treezor

- Unnax

- Cambr

List Not Exhaustive

Key Developments in Banking as a Service Industry in UK Industry

- July 2021: Paysafe strategically partnered with Bankable to successfully launch integrated omnichannel banking services. This significant collaboration not only amplified Bankable's market reach but also powerfully solidified its competitive position within the UK BaaS ecosystem.

- April 2022: PEXA joined forces with ClearBank to significantly broaden access to its innovative remortgage platform throughout the United Kingdom. This key partnership exemplifies the growing trend of strategic collaboration between BaaS providers and established, reputable financial institutions.

Strategic Banking as a Service Industry in UK Market Forecast

The UK BaaS market is robustly positioned for sustained and significant growth in the coming years. This upward trajectory is primarily fueled by ongoing technological advancements, a supportive regulatory environment that encourages innovation, and the ever-evolving demands of consumers and businesses. Future strategic opportunities abound in the expansion into new and underserved market segments, alongside the deep integration of pioneering technologies. The market is also anticipated to witness a notable period of consolidation, with larger, more established players strategically acquiring smaller, innovative firms to broaden their service portfolios and enhance their market share. The continued development and widespread adoption of open banking initiatives, coupled with the escalating demand for embedded finance solutions across diverse industries, will serve as powerful accelerators for market expansion, promising substantial growth and transformative impact in the years ahead.

Banking as a Service Industry in UK Segmentation

-

1. Component

- 1.1. Platform

-

1.2. Service

- 1.2.1. Professional Service

- 1.2.2. Managed Service

-

2. Product Type

- 2.1. API based BaaS

- 2.2. Cloud-based BaaS

-

3. Enterprise Size

- 3.1. Large enterprise

- 3.2. Small & Medium enterprise

-

4. End-User

- 4.1. Banks

- 4.2. NBFC/Fintech Corporations

- 4.3. Others

Banking as a Service Industry in UK Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Banking as a Service Industry in UK Regional Market Share

Geographic Coverage of Banking as a Service Industry in UK

Banking as a Service Industry in UK REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Demand for Embedded Finance is Driving Banking as a Service

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Banking as a Service Industry in UK Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Platform

- 5.1.2. Service

- 5.1.2.1. Professional Service

- 5.1.2.2. Managed Service

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. API based BaaS

- 5.2.2. Cloud-based BaaS

- 5.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 5.3.1. Large enterprise

- 5.3.2. Small & Medium enterprise

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Banks

- 5.4.2. NBFC/Fintech Corporations

- 5.4.3. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Banking as a Service Industry in UK Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Platform

- 6.1.2. Service

- 6.1.2.1. Professional Service

- 6.1.2.2. Managed Service

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. API based BaaS

- 6.2.2. Cloud-based BaaS

- 6.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 6.3.1. Large enterprise

- 6.3.2. Small & Medium enterprise

- 6.4. Market Analysis, Insights and Forecast - by End-User

- 6.4.1. Banks

- 6.4.2. NBFC/Fintech Corporations

- 6.4.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. South America Banking as a Service Industry in UK Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Platform

- 7.1.2. Service

- 7.1.2.1. Professional Service

- 7.1.2.2. Managed Service

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. API based BaaS

- 7.2.2. Cloud-based BaaS

- 7.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 7.3.1. Large enterprise

- 7.3.2. Small & Medium enterprise

- 7.4. Market Analysis, Insights and Forecast - by End-User

- 7.4.1. Banks

- 7.4.2. NBFC/Fintech Corporations

- 7.4.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Europe Banking as a Service Industry in UK Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Platform

- 8.1.2. Service

- 8.1.2.1. Professional Service

- 8.1.2.2. Managed Service

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. API based BaaS

- 8.2.2. Cloud-based BaaS

- 8.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 8.3.1. Large enterprise

- 8.3.2. Small & Medium enterprise

- 8.4. Market Analysis, Insights and Forecast - by End-User

- 8.4.1. Banks

- 8.4.2. NBFC/Fintech Corporations

- 8.4.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Middle East & Africa Banking as a Service Industry in UK Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Platform

- 9.1.2. Service

- 9.1.2.1. Professional Service

- 9.1.2.2. Managed Service

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. API based BaaS

- 9.2.2. Cloud-based BaaS

- 9.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 9.3.1. Large enterprise

- 9.3.2. Small & Medium enterprise

- 9.4. Market Analysis, Insights and Forecast - by End-User

- 9.4.1. Banks

- 9.4.2. NBFC/Fintech Corporations

- 9.4.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Asia Pacific Banking as a Service Industry in UK Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Platform

- 10.1.2. Service

- 10.1.2.1. Professional Service

- 10.1.2.2. Managed Service

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. API based BaaS

- 10.2.2. Cloud-based BaaS

- 10.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 10.3.1. Large enterprise

- 10.3.2. Small & Medium enterprise

- 10.4. Market Analysis, Insights and Forecast - by End-User

- 10.4.1. Banks

- 10.4.2. NBFC/Fintech Corporations

- 10.4.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Thought Machine

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Starling Bank

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bankable

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 11

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.1 Thought Machine

List of Figures

- Figure 1: Global Banking as a Service Industry in UK Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Banking as a Service Industry in UK Revenue (billion), by Component 2025 & 2033

- Figure 3: North America Banking as a Service Industry in UK Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Banking as a Service Industry in UK Revenue (billion), by Product Type 2025 & 2033

- Figure 5: North America Banking as a Service Industry in UK Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Banking as a Service Industry in UK Revenue (billion), by Enterprise Size 2025 & 2033

- Figure 7: North America Banking as a Service Industry in UK Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 8: North America Banking as a Service Industry in UK Revenue (billion), by End-User 2025 & 2033

- Figure 9: North America Banking as a Service Industry in UK Revenue Share (%), by End-User 2025 & 2033

- Figure 10: North America Banking as a Service Industry in UK Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Banking as a Service Industry in UK Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Banking as a Service Industry in UK Revenue (billion), by Component 2025 & 2033

- Figure 13: South America Banking as a Service Industry in UK Revenue Share (%), by Component 2025 & 2033

- Figure 14: South America Banking as a Service Industry in UK Revenue (billion), by Product Type 2025 & 2033

- Figure 15: South America Banking as a Service Industry in UK Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: South America Banking as a Service Industry in UK Revenue (billion), by Enterprise Size 2025 & 2033

- Figure 17: South America Banking as a Service Industry in UK Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 18: South America Banking as a Service Industry in UK Revenue (billion), by End-User 2025 & 2033

- Figure 19: South America Banking as a Service Industry in UK Revenue Share (%), by End-User 2025 & 2033

- Figure 20: South America Banking as a Service Industry in UK Revenue (billion), by Country 2025 & 2033

- Figure 21: South America Banking as a Service Industry in UK Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Banking as a Service Industry in UK Revenue (billion), by Component 2025 & 2033

- Figure 23: Europe Banking as a Service Industry in UK Revenue Share (%), by Component 2025 & 2033

- Figure 24: Europe Banking as a Service Industry in UK Revenue (billion), by Product Type 2025 & 2033

- Figure 25: Europe Banking as a Service Industry in UK Revenue Share (%), by Product Type 2025 & 2033

- Figure 26: Europe Banking as a Service Industry in UK Revenue (billion), by Enterprise Size 2025 & 2033

- Figure 27: Europe Banking as a Service Industry in UK Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 28: Europe Banking as a Service Industry in UK Revenue (billion), by End-User 2025 & 2033

- Figure 29: Europe Banking as a Service Industry in UK Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Europe Banking as a Service Industry in UK Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe Banking as a Service Industry in UK Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa Banking as a Service Industry in UK Revenue (billion), by Component 2025 & 2033

- Figure 33: Middle East & Africa Banking as a Service Industry in UK Revenue Share (%), by Component 2025 & 2033

- Figure 34: Middle East & Africa Banking as a Service Industry in UK Revenue (billion), by Product Type 2025 & 2033

- Figure 35: Middle East & Africa Banking as a Service Industry in UK Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Middle East & Africa Banking as a Service Industry in UK Revenue (billion), by Enterprise Size 2025 & 2033

- Figure 37: Middle East & Africa Banking as a Service Industry in UK Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 38: Middle East & Africa Banking as a Service Industry in UK Revenue (billion), by End-User 2025 & 2033

- Figure 39: Middle East & Africa Banking as a Service Industry in UK Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Middle East & Africa Banking as a Service Industry in UK Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa Banking as a Service Industry in UK Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Banking as a Service Industry in UK Revenue (billion), by Component 2025 & 2033

- Figure 43: Asia Pacific Banking as a Service Industry in UK Revenue Share (%), by Component 2025 & 2033

- Figure 44: Asia Pacific Banking as a Service Industry in UK Revenue (billion), by Product Type 2025 & 2033

- Figure 45: Asia Pacific Banking as a Service Industry in UK Revenue Share (%), by Product Type 2025 & 2033

- Figure 46: Asia Pacific Banking as a Service Industry in UK Revenue (billion), by Enterprise Size 2025 & 2033

- Figure 47: Asia Pacific Banking as a Service Industry in UK Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 48: Asia Pacific Banking as a Service Industry in UK Revenue (billion), by End-User 2025 & 2033

- Figure 49: Asia Pacific Banking as a Service Industry in UK Revenue Share (%), by End-User 2025 & 2033

- Figure 50: Asia Pacific Banking as a Service Industry in UK Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific Banking as a Service Industry in UK Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Banking as a Service Industry in UK Revenue billion Forecast, by Component 2020 & 2033

- Table 2: Global Banking as a Service Industry in UK Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Global Banking as a Service Industry in UK Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 4: Global Banking as a Service Industry in UK Revenue billion Forecast, by End-User 2020 & 2033

- Table 5: Global Banking as a Service Industry in UK Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Banking as a Service Industry in UK Revenue billion Forecast, by Component 2020 & 2033

- Table 7: Global Banking as a Service Industry in UK Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Global Banking as a Service Industry in UK Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 9: Global Banking as a Service Industry in UK Revenue billion Forecast, by End-User 2020 & 2033

- Table 10: Global Banking as a Service Industry in UK Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Banking as a Service Industry in UK Revenue billion Forecast, by Component 2020 & 2033

- Table 15: Global Banking as a Service Industry in UK Revenue billion Forecast, by Product Type 2020 & 2033

- Table 16: Global Banking as a Service Industry in UK Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 17: Global Banking as a Service Industry in UK Revenue billion Forecast, by End-User 2020 & 2033

- Table 18: Global Banking as a Service Industry in UK Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Banking as a Service Industry in UK Revenue billion Forecast, by Component 2020 & 2033

- Table 23: Global Banking as a Service Industry in UK Revenue billion Forecast, by Product Type 2020 & 2033

- Table 24: Global Banking as a Service Industry in UK Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 25: Global Banking as a Service Industry in UK Revenue billion Forecast, by End-User 2020 & 2033

- Table 26: Global Banking as a Service Industry in UK Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global Banking as a Service Industry in UK Revenue billion Forecast, by Component 2020 & 2033

- Table 37: Global Banking as a Service Industry in UK Revenue billion Forecast, by Product Type 2020 & 2033

- Table 38: Global Banking as a Service Industry in UK Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 39: Global Banking as a Service Industry in UK Revenue billion Forecast, by End-User 2020 & 2033

- Table 40: Global Banking as a Service Industry in UK Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global Banking as a Service Industry in UK Revenue billion Forecast, by Component 2020 & 2033

- Table 48: Global Banking as a Service Industry in UK Revenue billion Forecast, by Product Type 2020 & 2033

- Table 49: Global Banking as a Service Industry in UK Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 50: Global Banking as a Service Industry in UK Revenue billion Forecast, by End-User 2020 & 2033

- Table 51: Global Banking as a Service Industry in UK Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Banking as a Service Industry in UK Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Banking as a Service Industry in UK?

The projected CAGR is approximately 12.6%.

2. Which companies are prominent players in the Banking as a Service Industry in UK?

Key companies in the market include Thought Machine, Starling Bank, Bankable, 11:FS Foundry, ClearBank, Solarisbank, Treezor, Unnax, Cambr**List Not Exhaustive.

3. What are the main segments of the Banking as a Service Industry in UK?

The market segments include Component, Product Type, Enterprise Size, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.1 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Demand for Embedded Finance is Driving Banking as a Service.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

On April 2022, PEXA, the Australian-founded fintech developed of a brand new payment scheme - PEXA Pay. At the same time, PEXA has partnered with ClearBank, clearing and embedded banking platform in the UK, to broaden access to its forthcoming remortgage platform.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Banking as a Service Industry in UK," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Banking as a Service Industry in UK report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Banking as a Service Industry in UK?

To stay informed about further developments, trends, and reports in the Banking as a Service Industry in UK, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence