Key Insights

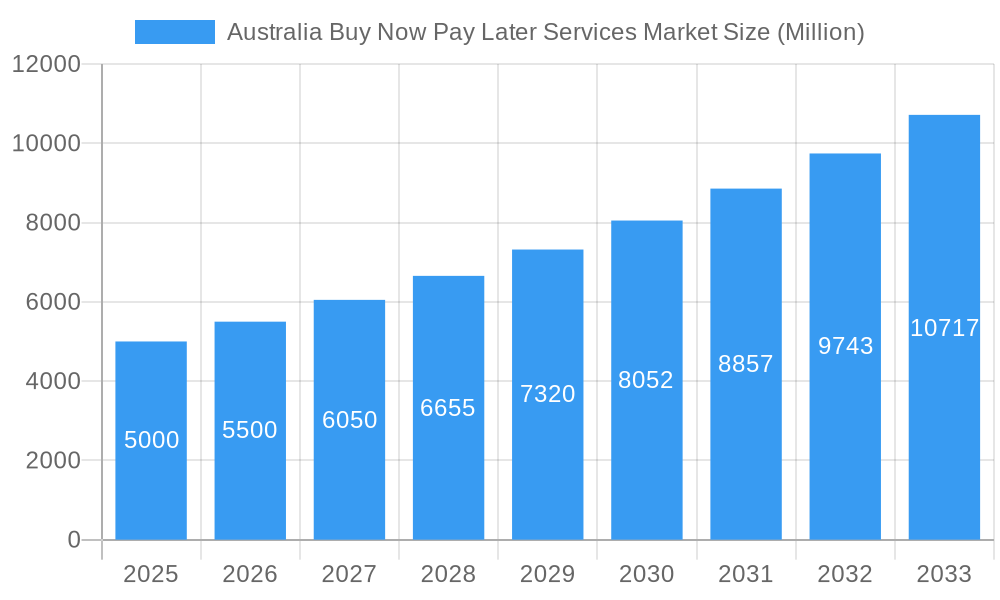

The Australian Buy Now, Pay Later (BNPL) services market is experiencing significant expansion, propelled by escalating consumer adoption and the proliferation of digital payment solutions. With a projected Compound Annual Growth Rate (CAGR) of 12.1%, the market is poised for robust growth. Key drivers include the surging popularity of e-commerce, a growing preference for flexible payment options among younger demographics, and increased BNPL accessibility through retail partnerships and online shopping platform integrations. The estimated market size for 2025 is $14.52 billion. Intense competition among established players and emerging fintech companies fosters innovation in features such as personalized payment plans and advanced fraud prevention. However, regulatory scrutiny and concerns regarding consumer debt accumulation may present market restraints. Market segmentation is anticipated to be diverse, encompassing demographics, transaction values, and various retail sectors like fashion, electronics, and travel. Continued growth is projected towards 2033, driven by technological advancements, evolving consumer behavior, and expansion into new market segments.

Australia Buy Now Pay Later Services Market Market Size (In Billion)

The projected market value for 2033 will significantly exceed current estimates, reflecting the sustained penetration of BNPL services within the Australian retail landscape. While precise regional data is absent, major metropolitan areas are likely to contribute substantially to the overall market size. Leading players will continue to differentiate themselves through strategic partnerships, advanced technologies like AI-powered credit scoring and risk management, and enhanced customer experiences. Potential risks include economic downturns impacting consumer spending and shifts in regulatory frameworks designed to protect consumers. Nevertheless, the long-term outlook for the Australian BNPL market remains positive, offering substantial growth opportunities for both established and new market entrants that can effectively navigate the regulatory environment and adapt to evolving consumer preferences.

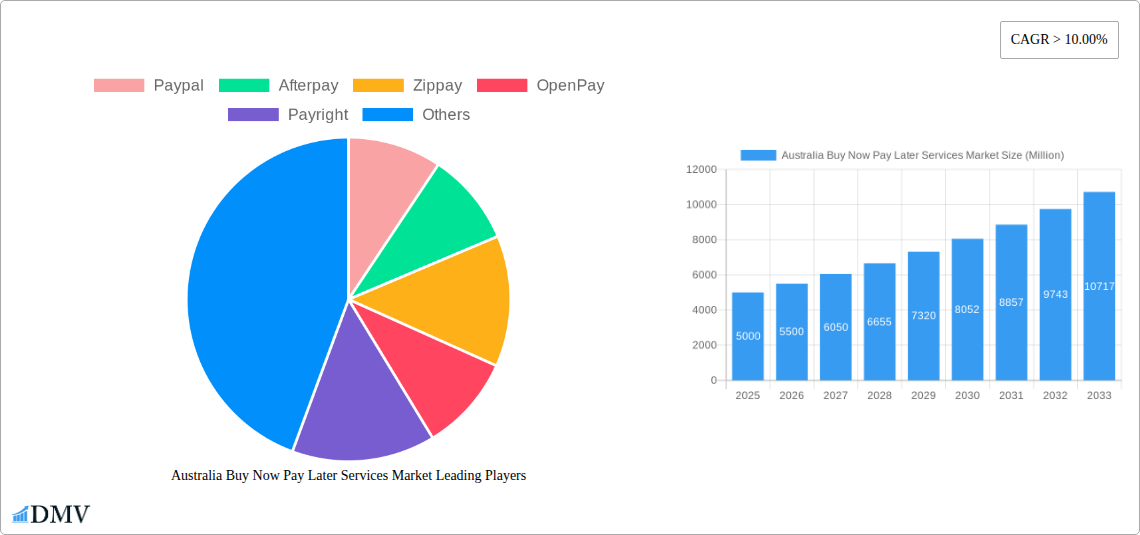

Australia Buy Now Pay Later Services Market Company Market Share

Australia Buy Now Pay Later Services Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the dynamic Australian Buy Now Pay Later (BNPL) services market, offering a comprehensive analysis of its current state, future trajectory, and key players. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report is essential for stakeholders seeking to understand and capitalize on the opportunities within this rapidly evolving sector. The market is projected to reach xx Million by 2033, demonstrating significant growth potential.

Australia Buy Now Pay Later Services Market Composition & Trends

This section delves into the competitive landscape of the Australian BNPL market, examining market concentration, innovation drivers, regulatory frameworks, substitute payment methods, user demographics, and significant M&A activities. The report analyzes the market share distribution among key players, including but not limited to Afterpay, Zippay, OpenPay, and Paypal, providing granular data on their respective performances during the historical period (2019-2024) and estimated figures for 2025. We quantify the impact of mergers and acquisitions (M&A), highlighting deals such as Zip's acquisition of Sezzle for AUD 491 Million in March 2022. The analysis also explores the influence of regulatory changes, the emergence of substitute financial products, and evolving consumer preferences on the market structure. Specific metrics include market share percentages for each major player and a detailed breakdown of M&A deal values and their effects on market consolidation.

- Market Concentration: Analysis of market share held by top players (e.g., Afterpay, Zip, PayPal).

- Innovation Catalysts: Examination of technological advancements and their impact on the market.

- Regulatory Landscape: Assessment of existing regulations and their influence on market growth.

- Substitute Products: Analysis of competing payment methods and their market share.

- End-User Profiles: Demographic and behavioral analysis of BNPL users in Australia.

- M&A Activities: Detailed overview of significant mergers and acquisitions, including deal values and market impact.

Australia Buy Now Pay Later Services Market Industry Evolution

This section provides a detailed analysis of the evolution of the Australian BNPL market, charting its growth trajectory from 2019 to 2024 and projecting its future growth until 2033. We examine technological advancements driving market expansion, such as improved mobile integration and enhanced security features. Furthermore, the analysis incorporates evolving consumer behavior, including shifts in spending habits and increased adoption of digital payment solutions. Specific data points such as compound annual growth rates (CAGR) and user adoption metrics will be presented, illustrating the market's dynamic nature and forecasting future trends. The impact of key events such as Visa's expansion into the Australian BNPL market through its Visa Installments program in October 2021, and its partnership with ANZ and Quest Payment Systems, will also be thoroughly examined. The report will explore the factors driving increasing consumer adoption and the changing landscape of the BNPL industry in Australia.

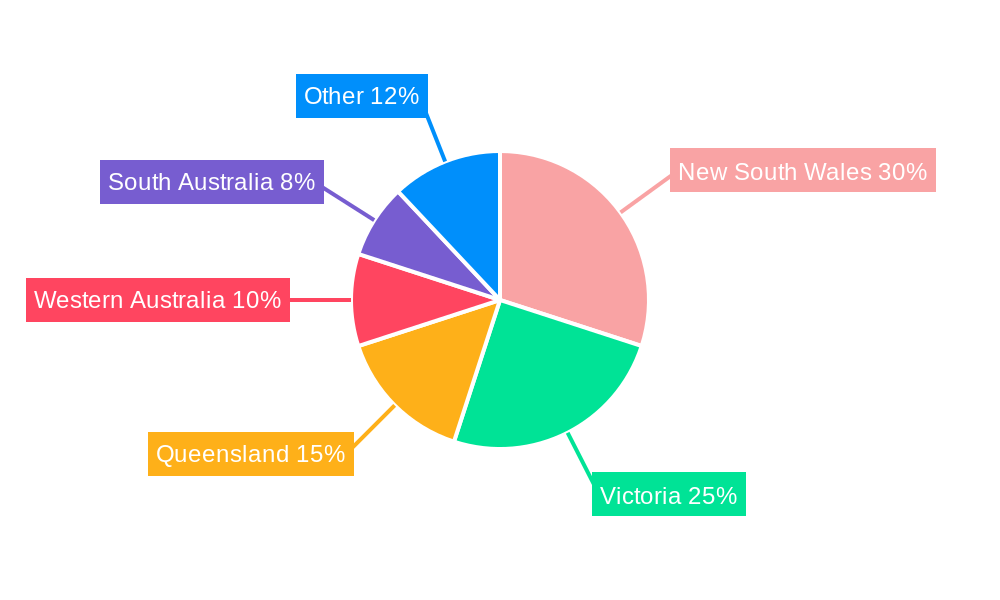

Leading Regions, Countries, or Segments in Australia Buy Now Pay Later Services Market

This section identifies the leading regions, countries, or segments within the Australian BNPL market. Through detailed analysis and the use of bullet points, the report pinpoints the key factors driving the dominance of specific regions or segments. This analysis includes an in-depth exploration of factors contributing to the leadership of the identified areas, such as demographic trends, investment patterns, regulatory support, and the concentration of key players.

- Key Drivers for Dominant Region/Segment:

- Investment trends in specific geographic locations.

- Regulatory support for BNPL services in particular regions.

- Concentration of major BNPL providers within specific areas.

- Unique consumer behaviors influencing BNPL adoption in certain markets.

Australia Buy Now Pay Later Services Market Product Innovations

This section delves into the dynamic landscape of product innovations within the Australian Buy Now Pay Later (BNPL) market. We'll dissect the latest advancements that are redefining customer experiences and merchant offerings, focusing on unique selling propositions (USPs) that differentiate players. Expect an in-depth look at features such as hyper-personalized repayment schedules tailored to individual financial habits, sophisticated in-app financial management tools that empower users with real-time budgeting insights and spending analytics, and robust, multi-layered security frameworks built on cutting-edge encryption and biometric authentication. Furthermore, this analysis will spotlight the pivotal role of technological enablers like advanced Artificial Intelligence (AI) and Machine Learning (ML) algorithms in revolutionizing risk assessment accuracy, proactive fraud detection and prevention, and the development of predictive analytics to anticipate consumer needs.

Propelling Factors for Australia Buy Now Pay Later Services Market Growth

The meteoric rise of the Australian BNPL market is underpinned by a confluence of powerful growth catalysts. Foremost among these are rapid technological advancements, manifested in the effortless integration of BNPL solutions across a vast spectrum of e-commerce platforms, mobile applications, and even in-store point-of-sale systems, thereby democratizing access and enhancing convenience. Complementing this digital revolution are favourable economic tailwinds, including a sustained period of low interest rates and robust consumer confidence, which directly translate into higher disposable income and a greater propensity for installment-based purchases. The supportive, albeit evolving, regulatory environment has also been instrumental in fostering innovation and market entry. As the market matures, we anticipate further sophistication in product offerings and a continued drive towards seamless, embedded financial services.

Obstacles in the Australia Buy Now Pay Later Services Market

Notwithstanding its impressive trajectory, the Australian BNPL market navigates a complex terrain of significant challenges. Foremost among these is the escalating regulatory scrutiny, driven by a global imperative to safeguard consumers from the risks of over-indebtedness and ensure responsible lending practices. This evolving regulatory landscape necessitates significant adaptation and investment from market participants. Intense and ever-growing competition from a diverse array of players, encompassing established financial institutions venturing into the space and nimble fintech startups, exerts considerable pressure on profit margins and market share. While not directly impacting BNPL transactions, broader global economic factors like supply chain volatility and inflationary pressures can indirectly dampen consumer spending and affect overall market sentiment, posing a further indirect impediment to sustained rapid growth.

Future Opportunities in Australia Buy Now Pay Later Services Market

The Australian BNPL market presents several compelling future opportunities. Expansion into new market segments, such as small and medium-sized businesses (SMBs), offers significant potential. The integration of innovative technologies, like blockchain and open banking, could enhance security, transparency, and efficiency. Finally, adapting to evolving consumer preferences, such as greater demand for sustainable and ethical payment options, will be crucial for capturing future market share.

Key Developments in Australia Buy Now Pay Later Services Market Industry

- March 2022: Zip Co's acquisition of Sezzle for approximately AUD 491 million marked a significant consolidation event, signaling a strategic shift towards broader market reach and enhanced scale within the Australian BNPL ecosystem.

- October 2021: The introduction of Visa Installments in Australia, a collaboration between Visa, ANZ, and Quest Payment Systems, represents a major disruption. This initiative leverages existing payment networks to offer installment payment options, intensifying competition and potentially reshaping consumer preferences and merchant adoption strategies by providing a more integrated and familiar payment experience.

- Ongoing: Increased focus on ethical lending frameworks and consumer protection measures, with regulators actively exploring and implementing stricter guidelines around affordability checks, dispute resolution, and credit reporting, reflecting a maturation of the market towards greater responsibility.

- Emerging Trends: The growing integration of BNPL options at the point of sale for physical retail environments and the exploration of 'Pay in 4' options for higher-value purchases, expanding the applicability and appeal of BNPL beyond initial e-commerce focused use cases.

Strategic Australia Buy Now Pay Later Services Market Forecast

The Australian BNPL market is poised for continued expansion, driven by increasing digital adoption, favorable economic conditions, and ongoing product innovation. While regulatory challenges persist, opportunities exist in expanding into new market segments and integrating innovative technologies. The market's potential for growth remains significant, with a projected value of xx Million by 2033. This makes the Australian BNPL sector a highly attractive market for both established players and new entrants.

Australia Buy Now Pay Later Services Market Segmentation

-

1. Channel

- 1.1. Online

- 1.2. Point of Sale (POS)

-

2. Enterprise

- 2.1. Large Enterprise

- 2.2. Small & Medium Enterprise

-

3. End User Type

- 3.1. Consumer Electronics

- 3.2. Fashion and Personal Care

- 3.3. Healthcare

- 3.4. Leisure & Entertainment

- 3.5. Retail

- 3.6. Others

Australia Buy Now Pay Later Services Market Segmentation By Geography

- 1. Australia

Australia Buy Now Pay Later Services Market Regional Market Share

Geographic Coverage of Australia Buy Now Pay Later Services Market

Australia Buy Now Pay Later Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase of Non-Cash Payments helps in Market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Buy Now Pay Later Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 5.1.1. Online

- 5.1.2. Point of Sale (POS)

- 5.2. Market Analysis, Insights and Forecast - by Enterprise

- 5.2.1. Large Enterprise

- 5.2.2. Small & Medium Enterprise

- 5.3. Market Analysis, Insights and Forecast - by End User Type

- 5.3.1. Consumer Electronics

- 5.3.2. Fashion and Personal Care

- 5.3.3. Healthcare

- 5.3.4. Leisure & Entertainment

- 5.3.5. Retail

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Paypal

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Afterpay

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zippay

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 OpenPay

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Payright

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BPay

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Payment Express

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bpoint

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 POLi

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Stripe**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Paypal

List of Figures

- Figure 1: Australia Buy Now Pay Later Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Australia Buy Now Pay Later Services Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by Channel 2020 & 2033

- Table 2: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 3: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by End User Type 2020 & 2033

- Table 4: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by Channel 2020 & 2033

- Table 6: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 7: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by End User Type 2020 & 2033

- Table 8: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Buy Now Pay Later Services Market?

The projected CAGR is approximately 12.1%.

2. Which companies are prominent players in the Australia Buy Now Pay Later Services Market?

Key companies in the market include Paypal, Afterpay, Zippay, OpenPay, Payright, BPay, Payment Express, Bpoint, POLi, Stripe**List Not Exhaustive.

3. What are the main segments of the Australia Buy Now Pay Later Services Market?

The market segments include Channel, Enterprise, End User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.52 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase of Non-Cash Payments helps in Market growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In March 2022, Australian buy now, pay later (BNPL) firm Zip has announced a definitive agreement to acquire rival US BNPL fintech Sezzle. The deal values Sezzle at approximately USD 360 million (AUD 491 million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Buy Now Pay Later Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Buy Now Pay Later Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Buy Now Pay Later Services Market?

To stay informed about further developments, trends, and reports in the Australia Buy Now Pay Later Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence