Key Insights

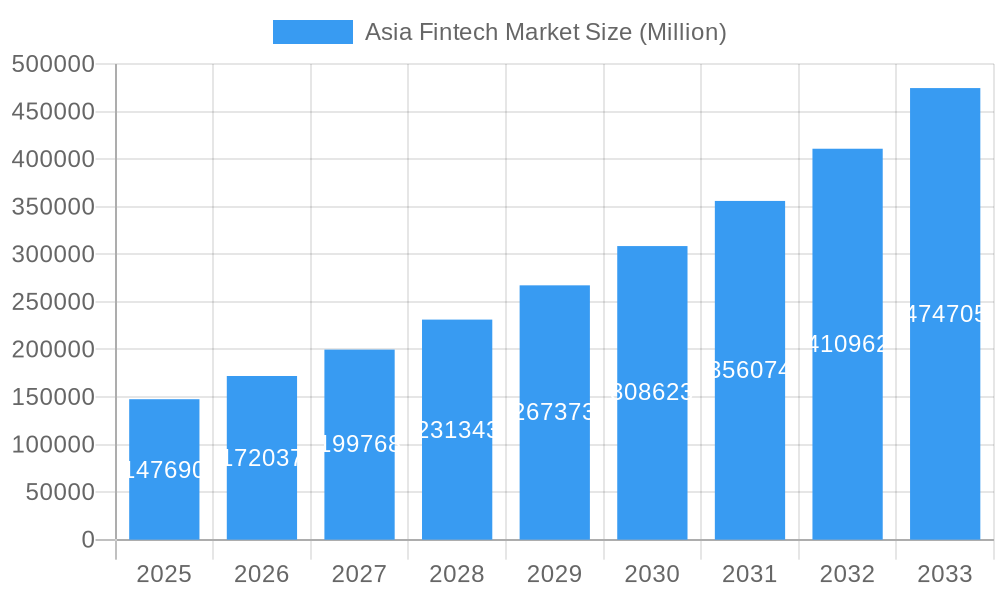

The Asia Fintech market, valued at $147.69 billion in 2025, is experiencing explosive growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 16% from 2025 to 2033. This robust expansion is fueled by several key factors. Rapid smartphone penetration and increasing internet access across the region, particularly in burgeoning economies like India, are driving widespread adoption of digital financial services. Furthermore, a young and tech-savvy population readily embraces innovative payment solutions, lending platforms, and investment tools offered by fintech companies. Government initiatives promoting financial inclusion and digitalization further accelerate market growth. The dominance of mobile payments, reflected in the success of companies like PhonePe and PayPay, underscores the region's preference for convenient and accessible digital transactions. The increasing demand for digital lending and insurance products, alongside the expansion of investment platforms, diversifies the market and contributes to its overall growth trajectory. Competition among established players and emerging startups fosters innovation and drives down costs, making fintech services increasingly accessible to a broader consumer base.

Asia Fintech Market Market Size (In Billion)

However, regulatory challenges and data security concerns present significant headwinds. Governments are striving to balance fostering innovation with protecting consumers and ensuring financial stability. Data breaches and cybersecurity risks remain a persistent concern, requiring robust security measures from fintech companies. Moreover, varying levels of digital literacy and infrastructure across the Asia-Pacific region create disparities in access to and adoption of fintech services. Despite these challenges, the long-term outlook for the Asia Fintech market remains overwhelmingly positive, driven by sustained economic growth, technological advancements, and increasing consumer demand for digital financial solutions. The market's segmentation by service proposition (money transfer and payments, savings and investments, digital lending, online insurance, and others) indicates diverse growth opportunities across various sectors. Leading companies like Ant Group, CRED, and Policy Bazaar are actively shaping the market landscape through strategic partnerships, technological innovations, and aggressive expansion strategies.

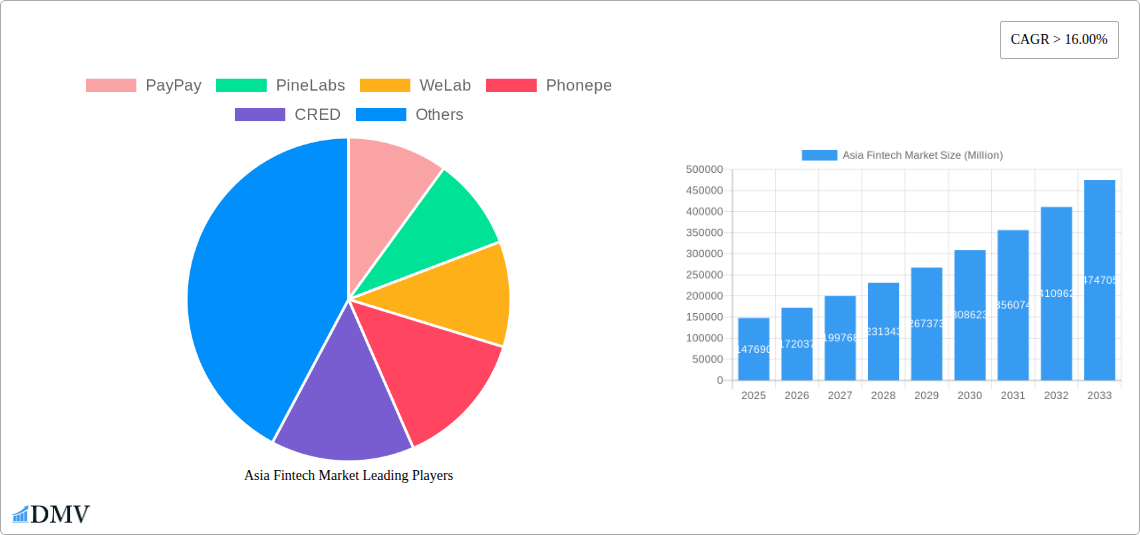

Asia Fintech Market Company Market Share

Asia Fintech Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic Asia Fintech Market, covering the period 2019-2033, with a focus on the estimated year 2025. It offers invaluable insights for stakeholders, investors, and industry professionals seeking to navigate this rapidly evolving landscape. The report utilizes a robust methodology, incorporating historical data (2019-2024), current market conditions (2025), and future projections (2025-2033) to deliver a comprehensive overview of the market's size, composition, and future trajectory. The market value in 2025 is estimated at xx Million, showcasing significant growth potential.

Asia Fintech Market Composition & Trends

The Asia Fintech Market is characterized by intense competition and rapid innovation, with a market size estimated at xx Million in 2025. Market concentration is moderate, with several key players holding significant shares, but a large number of smaller players contributing to the overall dynamism. Innovation is fueled by increasing smartphone penetration, rising internet usage, and a burgeoning young population. Regulatory landscapes vary significantly across Asian nations, ranging from highly permissive to strictly regulated environments, impacting market growth and investment strategies. Substitute products, such as traditional banking services, are facing increasing pressure, while M&A activity is robust, with deal values reaching xx Million in 2024, highlighting consolidation trends.

- Market Share Distribution (2025): PayPay (xx%), PhonePe (xx%), Ant Group (xx%), Others (xx%).

- M&A Activity (2019-2024): Total deal value estimated at xx Million, with an average deal size of xx Million.

- Key Innovation Catalysts: Open banking initiatives, AI-powered solutions, blockchain technology, and the rise of embedded finance.

- End-User Profiles: A diverse mix of consumers, businesses (SMEs and large corporations), and governments.

Asia Fintech Market Industry Evolution

The Asia Fintech Market has experienced an unprecedented surge in growth, propelled by a confluence of transformative forces. Between 2019 and 2024, the market achieved a robust Compound Annual Growth Rate (CAGR) of approximately 20-25%, a testament to the accelerating digital adoption across diverse consumer segments. Pioneering technological advancements, especially in the realms of mobile payments and digital lending, have been the cornerstones of this remarkable expansion. Evolving consumer preferences, characterized by an increasing demand for unparalleled convenience, effortless accessibility, and deeply personalized financial experiences, are fundamentally reshaping the landscape, steering away from the traditional financial services model. The penetration of mobile banking reached an impressive 70-75% in 2024, unequivocally demonstrating the profound and widespread shift towards digital-first financial solutions. Moreover, the burgeoning growth of e-commerce has acted as a significant catalyst, dramatically boosting the adoption of digital payment platforms, thereby fueling their market expansion and unlocking a wealth of new opportunities within the dynamic Fintech sector. Projections indicate a sustained and accelerated CAGR of approximately 22-28% for the period spanning 2025 to 2033.

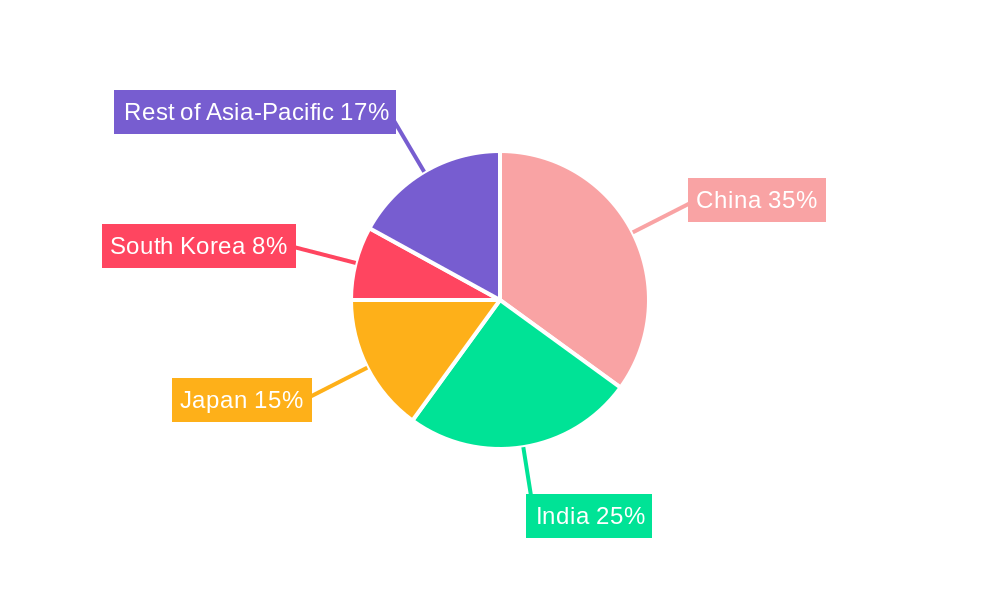

Leading Regions, Countries, or Segments in Asia Fintech Market

The Asia Fintech Market is geographically diverse, with specific regions and segments demonstrating higher growth potential.

By Service Proposition:

- Money Transfer and Payments: India and China lead this segment, driven by high mobile penetration and favorable regulatory environments. Key drivers include rising e-commerce transactions, increasing cross-border payments, and government initiatives promoting digital payments.

- Savings and Investments: Singapore and Hong Kong are prominent, attracting significant foreign investment and boasting a high proportion of digitally savvy investors. Key drivers include robust regulatory frameworks, attractive investment opportunities, and the rise of robo-advisors.

- Digital Lending & Lending Marketplaces: Southeast Asia shows strong growth due to increased demand for credit and underpenetrated traditional financial services. Key drivers include favorable demographics, rising income levels, and innovative lending models.

- Online Insurance & Insurance Marketplaces: China and India are experiencing rapid expansion, driven by rising insurance awareness and increased online adoption. Key drivers include growing middle class, increasing health concerns, and government support for insurtech initiatives.

- Other Service Proposition: This segment includes various niche financial technologies like blockchain solutions, wealth management platforms, and other specialized services, whose growth is fueled by technological advancements and evolving market needs. This segment exhibits a high degree of innovation and fragmentation.

Asia Fintech Market Product Innovations

The Asia Fintech Market is currently a vibrant hub of groundbreaking product and service innovations. Embedded finance is rapidly gaining momentum, seamlessly integrating financial functionalities into non-financial platforms, thereby elevating user experiences and creating powerful new revenue streams for businesses. The strategic application of AI-powered solutions, including sophisticated fraud detection systems, intelligent personalized financial advisory tools, and advanced risk assessment algorithms, is significantly enhancing operational efficiency and accuracy, leading to a superior overall customer journey and improved profitability. Furthermore, the exploration and implementation of blockchain technology are revolutionizing transaction security and transparency, fostering greater trust and reliability within the ecosystem. These cutting-edge innovations, combined with intuitive, user-friendly interfaces and seamless integration capabilities, are actively redefining customer engagement paradigms and elevating satisfaction levels across the board.

Propelling Factors for Asia Fintech Market Growth

A multifaceted array of factors is actively fueling the dynamic expansion of the Asia Fintech Market. Continuous technological advancements, particularly in the rapid evolution of mobile technology and the pervasive integration of artificial intelligence, are instrumental in dismantling traditional barriers to entry and dramatically increasing the accessibility of financial services for a wider population. Favorable economic conditions prevalent across many Asian nations are stimulating robust consumer spending and, consequently, intensifying the demand for innovative and efficient financial solutions. Supportive government regulations in select regions are creating an environment conducive to innovation, encouraging entrepreneurial ventures, and attracting significant investment. The widespread adoption of cloud technology is also playing a pivotal role by enhancing the scalability, flexibility, and overall operational efficiency of Fintech companies, enabling them to adapt and thrive in this fast-paced market.

Obstacles in the Asia Fintech Market

Despite its impressive growth, the Asia Fintech Market faces certain challenges. Varying regulatory frameworks across different Asian countries can create complexity for businesses operating across multiple jurisdictions. Data security and privacy concerns are paramount, requiring stringent measures to protect sensitive consumer information. Intense competition among existing players and new entrants can lead to price wars and reduced profitability. Cyber security threats remain significant, and incidents can disrupt operations and damage reputation.

Future Opportunities in Asia Fintech Market

The Asia Fintech Market presents numerous future opportunities. Expansion into underserved markets, particularly in rural areas, presents significant potential. The growing adoption of open banking can facilitate the creation of innovative financial products and services. The increasing use of big data analytics can offer more personalized customer experiences and improved risk management. The integration of sustainable finance principles can attract environmentally conscious investors and create new market segments.

Key Developments in Asia Fintech Market Industry

- February 2023: PhonePe solidified its market presence through a strategic partnership with Flipkart, strategically extending its reach and services to a vast network of millions of existing customers.

- March 2023: Ant Group launched the AntChain Exchange in Singapore, marking a significant step in the development of a secure and regulated digital asset trading platform within the region.

- April 2023: Grab Financial Group announced the expansion of its digital lending services across Southeast Asia, leveraging AI-driven credit scoring to reach underserved populations.

- May 2023: Paytm Payments Bank introduced an innovative AI-powered customer service chatbot, significantly improving response times and customer satisfaction.

- June 2023: GoPay (Indonesia) partnered with local e-commerce giants to offer integrated 'buy now, pay later' (BNPL) solutions, further boosting online commerce.

- July 2023: DBS Bank in Singapore launched a new blockchain-based trade finance platform, enhancing efficiency and security for businesses involved in international trade.

Strategic Asia Fintech Market Forecast

The Asia Fintech Market is poised for continued robust growth, driven by technological innovation, expanding digital adoption, and supportive government policies. Emerging technologies like artificial intelligence and blockchain will play a pivotal role in shaping the future of financial services in the region. The market's expansion into underserved segments and the integration of sustainable finance principles will present attractive opportunities for investors and businesses alike. The forecast period (2025-2033) anticipates a significant increase in market value, exceeding xx Million by 2033.

Asia Fintech Market Segmentation

-

1. Service Proposition

- 1.1. Money Transfer and Payments

- 1.2. Savings and Investments

- 1.3. Digital Lending & Lending Marketplaces

- 1.4. Online Insurance & Insurance Marketplaces

- 1.5. Other Service Propositions

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Australia

- 2.4. Singapore

- 2.5. Hong Kong

- 2.6. Rest of Asia-Pacific

Asia Fintech Market Segmentation By Geography

- 1. China

- 2. India

- 3. Australia

- 4. Singapore

- 5. Hong Kong

- 6. Rest of Asia Pacific

Asia Fintech Market Regional Market Share

Geographic Coverage of Asia Fintech Market

Asia Fintech Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 16.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of Digital Payments; Rising Investments in FinTech Firms

- 3.3. Market Restrains

- 3.3.1. Intense Competition; Increasing Cybersecurity Risks

- 3.4. Market Trends

- 3.4.1. China Dominates the Asia-Pacific Fintech Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Fintech Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 5.1.1. Money Transfer and Payments

- 5.1.2. Savings and Investments

- 5.1.3. Digital Lending & Lending Marketplaces

- 5.1.4. Online Insurance & Insurance Marketplaces

- 5.1.5. Other Service Propositions

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Australia

- 5.2.4. Singapore

- 5.2.5. Hong Kong

- 5.2.6. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Australia

- 5.3.4. Singapore

- 5.3.5. Hong Kong

- 5.3.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 6. China Asia Fintech Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Proposition

- 6.1.1. Money Transfer and Payments

- 6.1.2. Savings and Investments

- 6.1.3. Digital Lending & Lending Marketplaces

- 6.1.4. Online Insurance & Insurance Marketplaces

- 6.1.5. Other Service Propositions

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Australia

- 6.2.4. Singapore

- 6.2.5. Hong Kong

- 6.2.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Service Proposition

- 7. India Asia Fintech Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Proposition

- 7.1.1. Money Transfer and Payments

- 7.1.2. Savings and Investments

- 7.1.3. Digital Lending & Lending Marketplaces

- 7.1.4. Online Insurance & Insurance Marketplaces

- 7.1.5. Other Service Propositions

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Australia

- 7.2.4. Singapore

- 7.2.5. Hong Kong

- 7.2.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Service Proposition

- 8. Australia Asia Fintech Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Proposition

- 8.1.1. Money Transfer and Payments

- 8.1.2. Savings and Investments

- 8.1.3. Digital Lending & Lending Marketplaces

- 8.1.4. Online Insurance & Insurance Marketplaces

- 8.1.5. Other Service Propositions

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Australia

- 8.2.4. Singapore

- 8.2.5. Hong Kong

- 8.2.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Service Proposition

- 9. Singapore Asia Fintech Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Proposition

- 9.1.1. Money Transfer and Payments

- 9.1.2. Savings and Investments

- 9.1.3. Digital Lending & Lending Marketplaces

- 9.1.4. Online Insurance & Insurance Marketplaces

- 9.1.5. Other Service Propositions

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Australia

- 9.2.4. Singapore

- 9.2.5. Hong Kong

- 9.2.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Service Proposition

- 10. Hong Kong Asia Fintech Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Proposition

- 10.1.1. Money Transfer and Payments

- 10.1.2. Savings and Investments

- 10.1.3. Digital Lending & Lending Marketplaces

- 10.1.4. Online Insurance & Insurance Marketplaces

- 10.1.5. Other Service Propositions

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Australia

- 10.2.4. Singapore

- 10.2.5. Hong Kong

- 10.2.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Service Proposition

- 11. Rest of Asia Pacific Asia Fintech Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service Proposition

- 11.1.1. Money Transfer and Payments

- 11.1.2. Savings and Investments

- 11.1.3. Digital Lending & Lending Marketplaces

- 11.1.4. Online Insurance & Insurance Marketplaces

- 11.1.5. Other Service Propositions

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. China

- 11.2.2. India

- 11.2.3. Australia

- 11.2.4. Singapore

- 11.2.5. Hong Kong

- 11.2.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Service Proposition

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 PayPay

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 PineLabs

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 WeLab

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Phonepe

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 CRED

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Ant Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Policy Bazar

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Judobank

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Harmoney**List Not Exhaustive

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 VoltBank

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 PayPay

List of Figures

- Figure 1: Asia Fintech Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Fintech Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 2: Asia Fintech Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Asia Fintech Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Asia Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 5: Asia Fintech Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Asia Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Asia Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 8: Asia Fintech Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: Asia Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Asia Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 11: Asia Fintech Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Asia Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Asia Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 14: Asia Fintech Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Asia Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 17: Asia Fintech Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Asia Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Asia Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 20: Asia Fintech Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 21: Asia Fintech Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Fintech Market?

The projected CAGR is approximately > 16.00%.

2. Which companies are prominent players in the Asia Fintech Market?

Key companies in the market include PayPay, PineLabs, WeLab, Phonepe, CRED, Ant Group, Policy Bazar, Judobank, Harmoney**List Not Exhaustive, VoltBank.

3. What are the main segments of the Asia Fintech Market?

The market segments include Service Proposition, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 147.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise of Digital Payments; Rising Investments in FinTech Firms.

6. What are the notable trends driving market growth?

China Dominates the Asia-Pacific Fintech Market.

7. Are there any restraints impacting market growth?

Intense Competition; Increasing Cybersecurity Risks.

8. Can you provide examples of recent developments in the market?

March 2023: Ant Group announced the launch of a digital asset trading platform in Singapore named "AntChain Exchange." The platform allows users to trade various cryptocurrencies and other digital assets and is designed to offer fast and secure transactions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Fintech Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Fintech Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Fintech Market?

To stay informed about further developments, trends, and reports in the Asia Fintech Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence