Key Insights

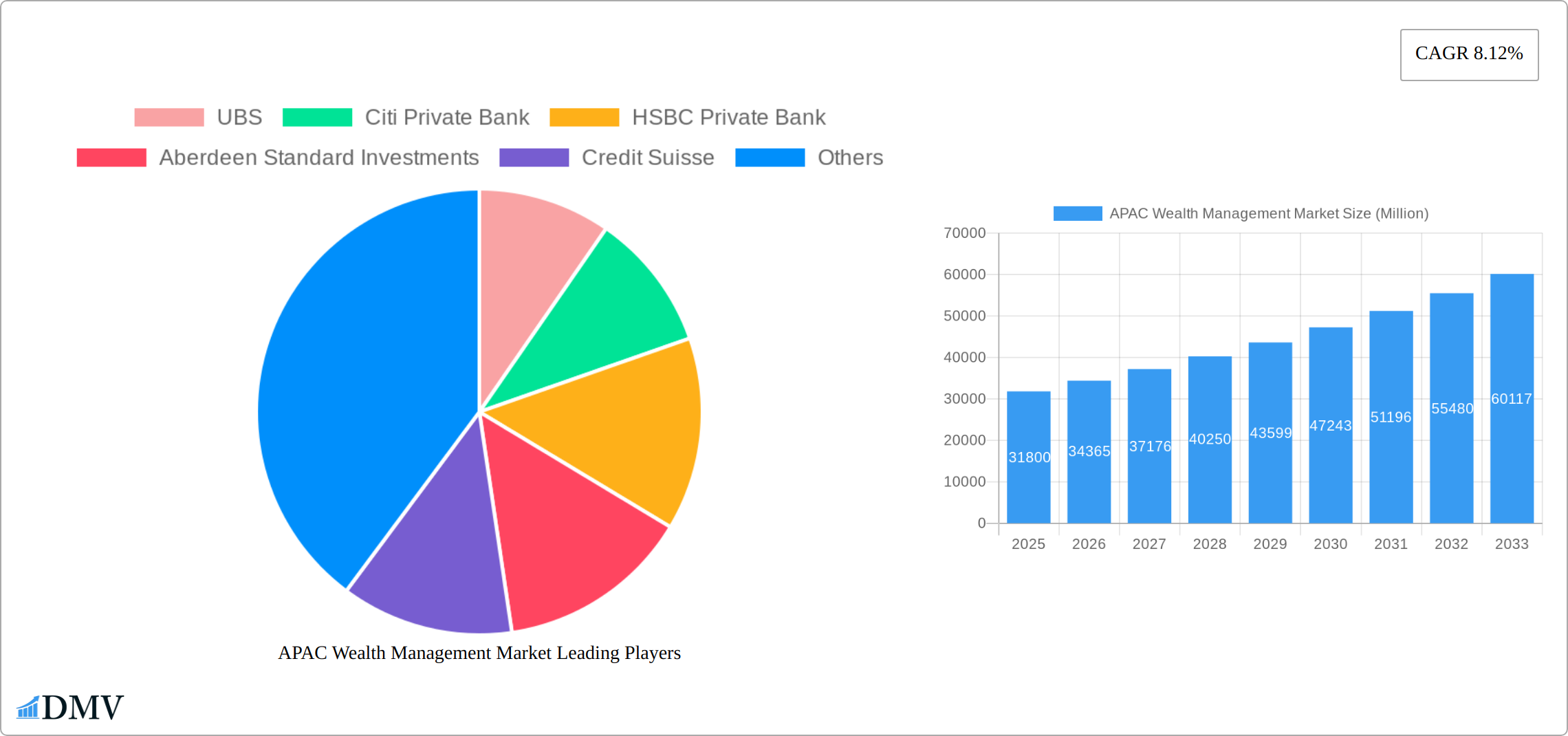

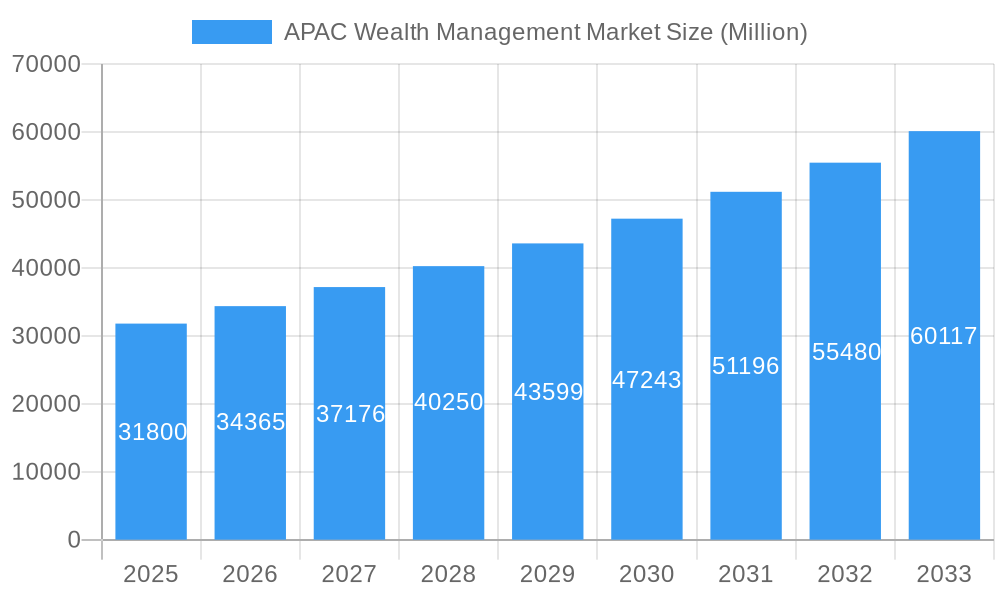

The Asia-Pacific (APAC) wealth management market is experiencing robust growth, projected to reach \$31.80 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 8.12% from 2025 to 2033. This expansion is fueled by several key factors. The rising high-net-worth individual (HNWI) population across the region, particularly in China, India, and Southeast Asia, is a significant driver. Increasing disposable incomes, coupled with a growing awareness of wealth preservation and investment strategies, are boosting demand for sophisticated wealth management services. Furthermore, technological advancements, such as the rise of robo-advisors and fintech solutions, are streamlining operations and making wealth management more accessible to a broader range of investors. Government initiatives promoting financial literacy and favorable regulatory environments in certain APAC countries also contribute positively to market growth. Competition is fierce, with established global players like UBS, Citi Private Bank, and HSBC Private Bank vying for market share alongside strong regional players such as ICICI Prudential Asset Management and China Life Private Equity. The market is segmented by service type (e.g., investment management, financial planning, trust and estate services), client segment (e.g., HNWIs, ultra-high-net-worth individuals), and geographic location (country-specific data is not available in the provided prompt, but it can reasonably be assumed to vary significantly by country, with higher growth in emerging economies).

APAC Wealth Management Market Market Size (In Billion)

Challenges remain, however. Geopolitical instability, economic fluctuations, and regulatory changes can impact investor sentiment and market growth. Furthermore, the market faces challenges in providing personalized service to a diverse clientele with varying risk appetites and financial goals across the extensive and heterogeneous APAC region. Addressing these challenges through tailored product offerings and robust risk management strategies will be crucial for continued success in this dynamic market. The successful wealth management firms will be those that can effectively adapt to the evolving needs of their clients, leverage technology to improve efficiency and client experience, and navigate the complexities of the regional landscape.

APAC Wealth Management Market Company Market Share

APAC Wealth Management Market: A Comprehensive Report (2019-2033)

This insightful report delivers a comprehensive analysis of the Asia-Pacific (APAC) wealth management market, providing a detailed overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the dynamic opportunities within this rapidly evolving market. The market size in 2025 is estimated at xx Million.

APAC Wealth Management Market Composition & Trends

This section provides a detailed analysis of the APAC wealth management market's composition and prevailing trends. We dissect market concentration, identifying key players and their market share distribution. The report further explores the innovative catalysts driving market growth, analyzes the complex regulatory landscapes across various APAC nations, examines substitute products and their impact, profiles end-users, and details significant mergers and acquisitions (M&A) activities. Data on M&A deal values (in Millions) will be presented, offering a clear picture of investment flows and strategic shifts within the industry. For example, the March 2023 acquisition of Credit Suisse by UBS significantly reshaped the competitive landscape.

- Market Concentration: Analysis of market share distribution among leading players.

- Innovation Catalysts: Examination of technological advancements and their impact on wealth management strategies.

- Regulatory Landscape: Assessment of regulatory frameworks and their influence on market operations across different APAC countries.

- Substitute Products: Evaluation of alternative investment options and their competitive pressure.

- End-User Profiles: Detailed segmentation of high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) based on demographics, investment preferences, and risk appetite.

- M&A Activities: Comprehensive overview of significant M&A deals, including deal values (in Millions) and their strategic implications.

APAC Wealth Management Market Industry Evolution

This section provides a comprehensive examination of the APAC wealth management market's historical trajectory and future projections. We meticulously analyze market growth trajectories from 2019 to 2024, capturing key historical trends. Subsequently, we present detailed growth rate projections for the crucial forecast period spanning 2025 to 2033. The analysis is further enriched by exploring the profound impact of technological advancements. This includes the accelerating adoption of sophisticated robo-advisory platforms and cutting-edge AI-driven investment solutions, and how these innovations are fundamentally reshaping client engagement models and sophisticated investment strategies. Furthermore, the report offers a deep dive into the evolving consumer demands, with a specific focus on the nuanced and changing preferences of High Net Worth Individuals (HNWIs) and Ultra High Net Worth Individuals (UHNWIs) across the diverse APAC region. Data-driven insights, including historical and projected Compound Annual Growth Rates (CAGRs) and the adoption rates of pivotal technologies, are integral to this analysis.

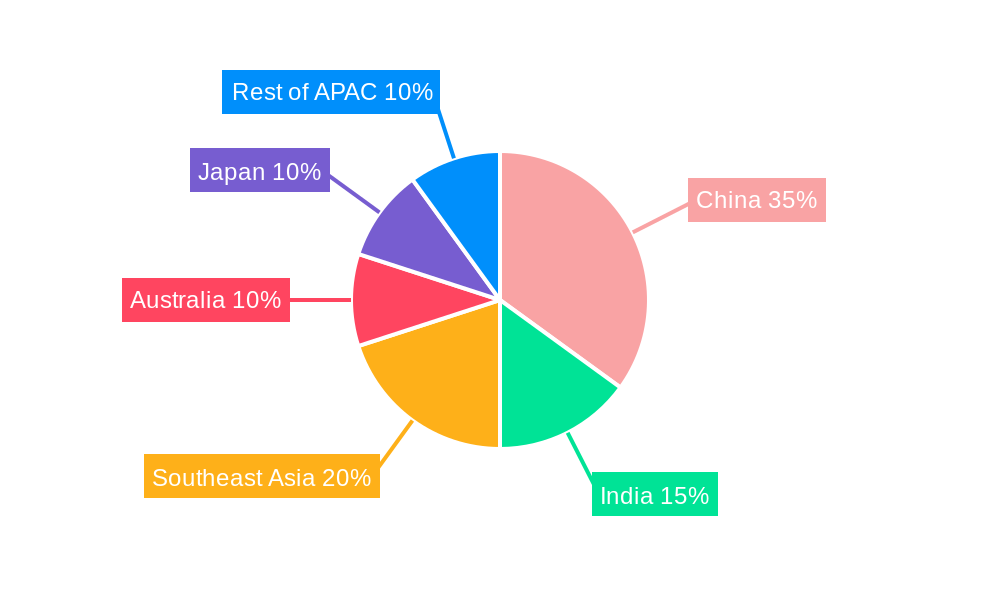

Leading Regions, Countries, or Segments in APAC Wealth Management Market

This section pinpoints and thoroughly analyzes the preeminent regions, countries, and specific segments that are currently dominating the APAC wealth management landscape. A detailed analytical framework is employed to elucidate the multifaceted factors underpinning their sustained dominance, all supported by robust empirical data and in-depth, expert explanations.

- Key Growth Catalysts (Detailed Breakdown): We undertake a granular examination of critical drivers such as evolving investment trends, supportive regulatory frameworks, robust economic expansion, significant demographic shifts, the strategic adoption of advanced technologies, and other unique, region-specific market characteristics that contribute to the leadership of each identified dominant region/country/segment.

- In-depth Market Assessment: Comprehensive narrative paragraphs offer a nuanced and sophisticated explanation of the core factors driving dominance. This includes a rigorous evaluation of current market size (presented in Millions of USD), the tangible growth potential for the foreseeable future, and a thorough assessment of the prevailing competitive landscape within these leading areas.

APAC Wealth Management Market Product Innovations

This section shines a spotlight on the most significant and recent product innovations emerging within the dynamic APAC wealth management industry. We meticulously explore their practical applications, evaluate their performance metrics, and highlight their unique selling propositions (USPs). The pivotal role of rapid technological advancements in shaping these groundbreaking innovations is a central theme. Specific attention is given to how the seamless integration of Artificial Intelligence (AI), advanced big data analytics, and disruptive blockchain technology are profoundly influencing and transforming the industry's product offerings and service delivery models.

Propelling Factors for APAC Wealth Management Market Growth

This section identifies and analyzes the key factors driving the growth of the APAC wealth management market. We'll examine technological advancements (e.g., fintech innovations), economic factors (e.g., rising disposable incomes), and favorable regulatory environments that contribute to the expansion of this market. Specific examples will be used to illustrate these influences.

Obstacles in the APAC Wealth Management Market

This section systematically identifies and critically assesses the key challenges and significant constraints that are currently impacting the sustained growth and broader development of the APAC wealth management market. Our analysis scrutinizes potential regulatory hurdles, the impact of emerging supply chain disruptions, and the ever-intensifying competitive pressures. Where feasible, the quantifiable impact of these obstacles is presented, offering insights such as estimated percentage losses in market share attributable to specific challenges.

Future Opportunities in APAC Wealth Management Market

This section explores emerging opportunities within the APAC wealth management market. We highlight new market segments, the potential of disruptive technologies (e.g., DeFi), and evolving consumer trends that are shaping future growth prospects. The focus will be on areas with significant untapped potential.

Major Players in the APAC Wealth Management Market Ecosystem

- UBS

- Citi Private Bank

- HSBC Private Bank

- Aberdeen Standard Investments

- Credit Suisse

- BlackRock

- Franklin Templeton

- ICICI Prudential Asset Management

- BNP Paribas Wealth Management

- China Life Private Equity

- List Not Exhaustive

Key Developments in APAC Wealth Management Market Industry

- March 2023: In a landmark move, UBS successfully acquired Credit Suisse, a strategic consolidation that significantly bolsters UBS's already formidable position as a leading international powerhouse in both wealth and asset management.

- June 2023: BlackRock forged a strategic partnership with Avaloq, a collaboration designed to deliver integrated and advanced technology solutions specifically tailored for the evolving needs of wealth managers across the region.

Strategic APAC Wealth Management Market Forecast

This section summarizes the key growth catalysts identified in the report, offering a concise overview of future opportunities and the overall market potential for the APAC wealth management sector. We will emphasize the long-term prospects driven by factors such as increasing affluence, technological innovation, and evolving regulatory landscapes. The forecast highlights the potential for substantial market expansion over the coming years.

APAC Wealth Management Market Segmentation

-

1. Client Type

- 1.1. HNWI

- 1.2. Retail/Individuals

- 1.3. Other Cl

-

2. Provider

- 2.1. Private Banks

- 2.2. Independent/External Asset Managers

- 2.3. Family Offices

- 2.4. Other Providers (Fintech Advisors, etc.)

-

3. Geography

- 3.1. India

- 3.2. Japan

- 3.3. China

- 3.4. Singapore

- 3.5. Indonesia

- 3.6. Malaysia

- 3.7. Vietnam

- 3.8. Hong Kong

- 3.9. Rest of Asia-Pacific

APAC Wealth Management Market Segmentation By Geography

- 1. India

- 2. Japan

- 3. China

- 4. Singapore

- 5. Indonesia

- 6. Malaysia

- 7. Vietnam

- 8. Hong Kong

- 9. Rest of Asia Pacific

APAC Wealth Management Market Regional Market Share

Geographic Coverage of APAC Wealth Management Market

APAC Wealth Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Diverse Range of Investment Opportunities in the Region Drives the Market

- 3.3. Market Restrains

- 3.3.1. Diverse Range of Investment Opportunities in the Region Drives the Market

- 3.4. Market Trends

- 3.4.1. Fintech Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Wealth Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 5.1.1. HNWI

- 5.1.2. Retail/Individuals

- 5.1.3. Other Cl

- 5.2. Market Analysis, Insights and Forecast - by Provider

- 5.2.1. Private Banks

- 5.2.2. Independent/External Asset Managers

- 5.2.3. Family Offices

- 5.2.4. Other Providers (Fintech Advisors, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. India

- 5.3.2. Japan

- 5.3.3. China

- 5.3.4. Singapore

- 5.3.5. Indonesia

- 5.3.6. Malaysia

- 5.3.7. Vietnam

- 5.3.8. Hong Kong

- 5.3.9. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.4.2. Japan

- 5.4.3. China

- 5.4.4. Singapore

- 5.4.5. Indonesia

- 5.4.6. Malaysia

- 5.4.7. Vietnam

- 5.4.8. Hong Kong

- 5.4.9. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 6. India APAC Wealth Management Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 6.1.1. HNWI

- 6.1.2. Retail/Individuals

- 6.1.3. Other Cl

- 6.2. Market Analysis, Insights and Forecast - by Provider

- 6.2.1. Private Banks

- 6.2.2. Independent/External Asset Managers

- 6.2.3. Family Offices

- 6.2.4. Other Providers (Fintech Advisors, etc.)

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. India

- 6.3.2. Japan

- 6.3.3. China

- 6.3.4. Singapore

- 6.3.5. Indonesia

- 6.3.6. Malaysia

- 6.3.7. Vietnam

- 6.3.8. Hong Kong

- 6.3.9. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 7. Japan APAC Wealth Management Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 7.1.1. HNWI

- 7.1.2. Retail/Individuals

- 7.1.3. Other Cl

- 7.2. Market Analysis, Insights and Forecast - by Provider

- 7.2.1. Private Banks

- 7.2.2. Independent/External Asset Managers

- 7.2.3. Family Offices

- 7.2.4. Other Providers (Fintech Advisors, etc.)

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. India

- 7.3.2. Japan

- 7.3.3. China

- 7.3.4. Singapore

- 7.3.5. Indonesia

- 7.3.6. Malaysia

- 7.3.7. Vietnam

- 7.3.8. Hong Kong

- 7.3.9. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 8. China APAC Wealth Management Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 8.1.1. HNWI

- 8.1.2. Retail/Individuals

- 8.1.3. Other Cl

- 8.2. Market Analysis, Insights and Forecast - by Provider

- 8.2.1. Private Banks

- 8.2.2. Independent/External Asset Managers

- 8.2.3. Family Offices

- 8.2.4. Other Providers (Fintech Advisors, etc.)

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. India

- 8.3.2. Japan

- 8.3.3. China

- 8.3.4. Singapore

- 8.3.5. Indonesia

- 8.3.6. Malaysia

- 8.3.7. Vietnam

- 8.3.8. Hong Kong

- 8.3.9. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 9. Singapore APAC Wealth Management Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 9.1.1. HNWI

- 9.1.2. Retail/Individuals

- 9.1.3. Other Cl

- 9.2. Market Analysis, Insights and Forecast - by Provider

- 9.2.1. Private Banks

- 9.2.2. Independent/External Asset Managers

- 9.2.3. Family Offices

- 9.2.4. Other Providers (Fintech Advisors, etc.)

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. India

- 9.3.2. Japan

- 9.3.3. China

- 9.3.4. Singapore

- 9.3.5. Indonesia

- 9.3.6. Malaysia

- 9.3.7. Vietnam

- 9.3.8. Hong Kong

- 9.3.9. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 10. Indonesia APAC Wealth Management Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 10.1.1. HNWI

- 10.1.2. Retail/Individuals

- 10.1.3. Other Cl

- 10.2. Market Analysis, Insights and Forecast - by Provider

- 10.2.1. Private Banks

- 10.2.2. Independent/External Asset Managers

- 10.2.3. Family Offices

- 10.2.4. Other Providers (Fintech Advisors, etc.)

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. India

- 10.3.2. Japan

- 10.3.3. China

- 10.3.4. Singapore

- 10.3.5. Indonesia

- 10.3.6. Malaysia

- 10.3.7. Vietnam

- 10.3.8. Hong Kong

- 10.3.9. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 11. Malaysia APAC Wealth Management Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Client Type

- 11.1.1. HNWI

- 11.1.2. Retail/Individuals

- 11.1.3. Other Cl

- 11.2. Market Analysis, Insights and Forecast - by Provider

- 11.2.1. Private Banks

- 11.2.2. Independent/External Asset Managers

- 11.2.3. Family Offices

- 11.2.4. Other Providers (Fintech Advisors, etc.)

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. India

- 11.3.2. Japan

- 11.3.3. China

- 11.3.4. Singapore

- 11.3.5. Indonesia

- 11.3.6. Malaysia

- 11.3.7. Vietnam

- 11.3.8. Hong Kong

- 11.3.9. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Client Type

- 12. Vietnam APAC Wealth Management Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Client Type

- 12.1.1. HNWI

- 12.1.2. Retail/Individuals

- 12.1.3. Other Cl

- 12.2. Market Analysis, Insights and Forecast - by Provider

- 12.2.1. Private Banks

- 12.2.2. Independent/External Asset Managers

- 12.2.3. Family Offices

- 12.2.4. Other Providers (Fintech Advisors, etc.)

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. India

- 12.3.2. Japan

- 12.3.3. China

- 12.3.4. Singapore

- 12.3.5. Indonesia

- 12.3.6. Malaysia

- 12.3.7. Vietnam

- 12.3.8. Hong Kong

- 12.3.9. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Client Type

- 13. Hong Kong APAC Wealth Management Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Client Type

- 13.1.1. HNWI

- 13.1.2. Retail/Individuals

- 13.1.3. Other Cl

- 13.2. Market Analysis, Insights and Forecast - by Provider

- 13.2.1. Private Banks

- 13.2.2. Independent/External Asset Managers

- 13.2.3. Family Offices

- 13.2.4. Other Providers (Fintech Advisors, etc.)

- 13.3. Market Analysis, Insights and Forecast - by Geography

- 13.3.1. India

- 13.3.2. Japan

- 13.3.3. China

- 13.3.4. Singapore

- 13.3.5. Indonesia

- 13.3.6. Malaysia

- 13.3.7. Vietnam

- 13.3.8. Hong Kong

- 13.3.9. Rest of Asia-Pacific

- 13.1. Market Analysis, Insights and Forecast - by Client Type

- 14. Rest of Asia Pacific APAC Wealth Management Market Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by Client Type

- 14.1.1. HNWI

- 14.1.2. Retail/Individuals

- 14.1.3. Other Cl

- 14.2. Market Analysis, Insights and Forecast - by Provider

- 14.2.1. Private Banks

- 14.2.2. Independent/External Asset Managers

- 14.2.3. Family Offices

- 14.2.4. Other Providers (Fintech Advisors, etc.)

- 14.3. Market Analysis, Insights and Forecast - by Geography

- 14.3.1. India

- 14.3.2. Japan

- 14.3.3. China

- 14.3.4. Singapore

- 14.3.5. Indonesia

- 14.3.6. Malaysia

- 14.3.7. Vietnam

- 14.3.8. Hong Kong

- 14.3.9. Rest of Asia-Pacific

- 14.1. Market Analysis, Insights and Forecast - by Client Type

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2025

- 15.2. Company Profiles

- 15.2.1 UBS

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Citi Private Bank

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 HSBC Private Bank

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Aberdeen Standard Investments

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Credit Suisse

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 BlackRock

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Franklin Templeton

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 ICICI Prudential Asset Management

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 BNP Paribas Wealth Management

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 China Life Private Equity**List Not Exhaustive

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.1 UBS

List of Figures

- Figure 1: APAC Wealth Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: APAC Wealth Management Market Share (%) by Company 2025

List of Tables

- Table 1: APAC Wealth Management Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 2: APAC Wealth Management Market Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 3: APAC Wealth Management Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 4: APAC Wealth Management Market Volume Trillion Forecast, by Provider 2020 & 2033

- Table 5: APAC Wealth Management Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: APAC Wealth Management Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 7: APAC Wealth Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: APAC Wealth Management Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 9: APAC Wealth Management Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 10: APAC Wealth Management Market Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 11: APAC Wealth Management Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 12: APAC Wealth Management Market Volume Trillion Forecast, by Provider 2020 & 2033

- Table 13: APAC Wealth Management Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: APAC Wealth Management Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 15: APAC Wealth Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: APAC Wealth Management Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 17: APAC Wealth Management Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 18: APAC Wealth Management Market Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 19: APAC Wealth Management Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 20: APAC Wealth Management Market Volume Trillion Forecast, by Provider 2020 & 2033

- Table 21: APAC Wealth Management Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: APAC Wealth Management Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 23: APAC Wealth Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: APAC Wealth Management Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: APAC Wealth Management Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 26: APAC Wealth Management Market Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 27: APAC Wealth Management Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 28: APAC Wealth Management Market Volume Trillion Forecast, by Provider 2020 & 2033

- Table 29: APAC Wealth Management Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: APAC Wealth Management Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 31: APAC Wealth Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: APAC Wealth Management Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 33: APAC Wealth Management Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 34: APAC Wealth Management Market Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 35: APAC Wealth Management Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 36: APAC Wealth Management Market Volume Trillion Forecast, by Provider 2020 & 2033

- Table 37: APAC Wealth Management Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: APAC Wealth Management Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 39: APAC Wealth Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: APAC Wealth Management Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 41: APAC Wealth Management Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 42: APAC Wealth Management Market Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 43: APAC Wealth Management Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 44: APAC Wealth Management Market Volume Trillion Forecast, by Provider 2020 & 2033

- Table 45: APAC Wealth Management Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: APAC Wealth Management Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 47: APAC Wealth Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: APAC Wealth Management Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 49: APAC Wealth Management Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 50: APAC Wealth Management Market Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 51: APAC Wealth Management Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 52: APAC Wealth Management Market Volume Trillion Forecast, by Provider 2020 & 2033

- Table 53: APAC Wealth Management Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 54: APAC Wealth Management Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 55: APAC Wealth Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: APAC Wealth Management Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 57: APAC Wealth Management Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 58: APAC Wealth Management Market Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 59: APAC Wealth Management Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 60: APAC Wealth Management Market Volume Trillion Forecast, by Provider 2020 & 2033

- Table 61: APAC Wealth Management Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 62: APAC Wealth Management Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 63: APAC Wealth Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 64: APAC Wealth Management Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 65: APAC Wealth Management Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 66: APAC Wealth Management Market Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 67: APAC Wealth Management Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 68: APAC Wealth Management Market Volume Trillion Forecast, by Provider 2020 & 2033

- Table 69: APAC Wealth Management Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 70: APAC Wealth Management Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 71: APAC Wealth Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 72: APAC Wealth Management Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 73: APAC Wealth Management Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 74: APAC Wealth Management Market Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 75: APAC Wealth Management Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 76: APAC Wealth Management Market Volume Trillion Forecast, by Provider 2020 & 2033

- Table 77: APAC Wealth Management Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 78: APAC Wealth Management Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 79: APAC Wealth Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 80: APAC Wealth Management Market Volume Trillion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Wealth Management Market?

The projected CAGR is approximately 8.12%.

2. Which companies are prominent players in the APAC Wealth Management Market?

Key companies in the market include UBS, Citi Private Bank, HSBC Private Bank, Aberdeen Standard Investments, Credit Suisse, BlackRock, Franklin Templeton, ICICI Prudential Asset Management, BNP Paribas Wealth Management, China Life Private Equity**List Not Exhaustive.

3. What are the main segments of the APAC Wealth Management Market?

The market segments include Client Type, Provider, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 31.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Diverse Range of Investment Opportunities in the Region Drives the Market.

6. What are the notable trends driving market growth?

Fintech Drives the Market.

7. Are there any restraints impacting market growth?

Diverse Range of Investment Opportunities in the Region Drives the Market.

8. Can you provide examples of recent developments in the market?

June 2023: BlackRock, the world's leading provider of investment, advisory, and risk management solutions, partnered with Avaloq Unveil, a wealth management technology and services provider. The aim was to provide integrated technology solutions, meeting the evolving needs of wealth managers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Wealth Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Wealth Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Wealth Management Market?

To stay informed about further developments, trends, and reports in the APAC Wealth Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence