Key Insights

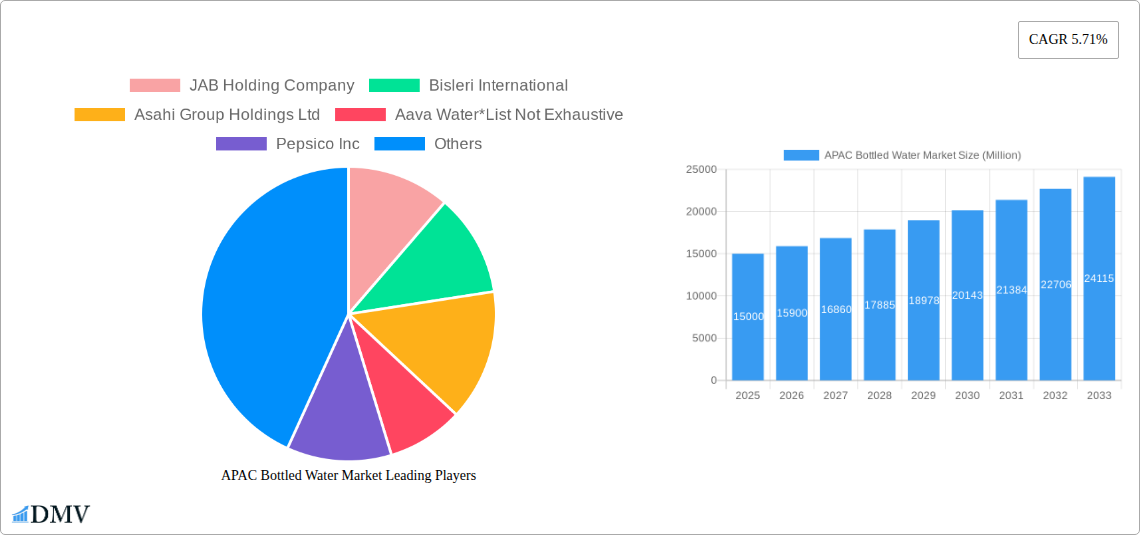

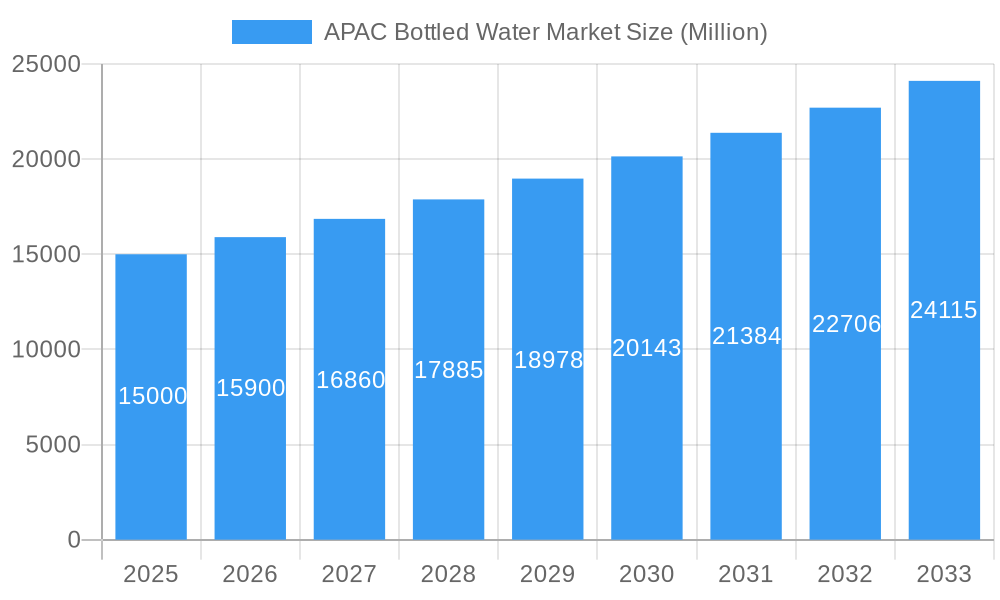

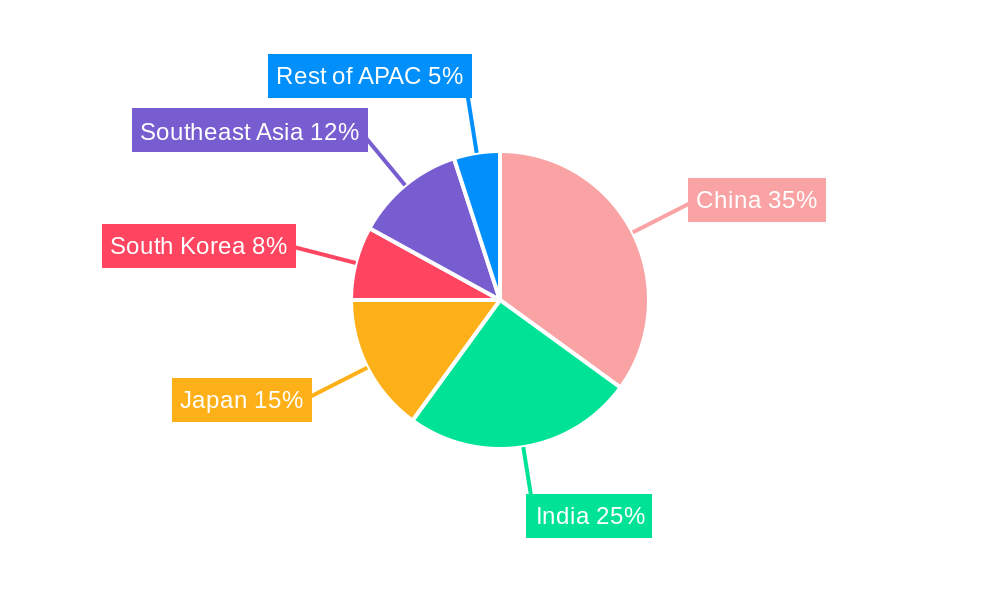

The Asia-Pacific (APAC) bottled water market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by rising health consciousness, increasing disposable incomes, and a preference for convenient hydration options. The market's Compound Annual Growth Rate (CAGR) of 5.71% from 2025 to 2033 signifies a significant expansion, with the market expected to reach approximately $YY million by 2033 (this value is a projection based on the provided CAGR and 2025 market size; the exact figure requires the missing 2025 market size). Key growth drivers include the surging popularity of functional waters enriched with vitamins and minerals, and a shift towards premium bottled water brands reflecting a growing demand for high-quality products. Expanding distribution networks, particularly in emerging economies within the region, are further fueling market expansion. However, environmental concerns related to plastic waste and fluctuating raw material prices pose challenges to sustainable growth. The market is segmented by distribution channel (on-trade and off-trade) and product type (still, sparkling, and functional water). Major players such as Coca-Cola, Nestlé, PepsiCo, and regional brands are actively competing through product innovation, strategic partnerships, and aggressive marketing campaigns to capture market share. The dominance of specific segments and regions varies. For example, countries like China and India, with their large populations and growing middle classes, represent significant market opportunities, while developed economies like Japan and South Korea exhibit more mature market dynamics.

APAC Bottled Water Market Market Size (In Billion)

The segmental breakdown indicates strong growth potential for functional waters, driven by health-conscious consumers seeking added benefits. The off-trade channel (supermarkets, convenience stores, online retailers) is likely to dominate, although the on-trade (restaurants, hotels) segment is expected to see modest growth, especially in urban areas. While the specific market share for each segment requires further data, the overall trend suggests that the still water segment will likely remain the largest, followed by sparkling and functional water, mirroring global trends. Competitive intensity is high, with both multinational corporations and local players vying for market share. Future growth will hinge on addressing sustainability concerns, adapting to evolving consumer preferences, and navigating regulatory changes within individual APAC markets.

APAC Bottled Water Market Company Market Share

APAC Bottled Water Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asia-Pacific bottled water market, encompassing market size, growth drivers, challenges, and future opportunities. The study period covers 2019-2033, with 2025 as the base and estimated year. The report offers invaluable insights for stakeholders including manufacturers, distributors, investors, and regulatory bodies seeking to navigate this dynamic market. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

APAC Bottled Water Market Composition & Trends

This section delves into the competitive landscape, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, and end-user profiles within the APAC bottled water market. We explore the impact of mergers and acquisitions (M&A) activity, providing insights into deal values and market share distribution among key players like JAB Holding Company, Bisleri International, Asahi Group Holdings Ltd, Aava Water, Pepsico Inc, Danone S A, The Coca-Cola Company, TATA Group, Suntory Beverage & Food Ltd, Tibet Water Resources Ltd, and Nestlé S A.

- Market Concentration: The APAC bottled water market exhibits a [Describe level of concentration, e.g., moderately concentrated] structure, with [Percentage]% market share held by the top 5 players in 2025.

- Innovation Catalysts: Growing consumer demand for functional and premium waters drives innovation in flavors, packaging, and sustainability.

- Regulatory Landscape: Varying regulations across APAC countries regarding water sourcing, labeling, and plastic waste management influence market dynamics.

- Substitute Products: Competition from other beverages, including juices, soft drinks, and RTD teas, influences consumer choice and market growth.

- End-User Profiles: The market caters to diverse consumer segments, including health-conscious individuals, athletes, and families, with varying preferences for water types and brands.

- M&A Activities: The total value of M&A deals in the APAC bottled water market between 2019 and 2024 reached approximately xx Million, driven by [mention reasons, e.g., expansion strategies, market consolidation].

APAC Bottled Water Market Industry Evolution

This section analyzes the historical and projected growth trajectories of the APAC bottled water market, highlighting technological advancements and evolving consumer preferences. The market witnessed significant growth during the historical period (2019-2024), with a CAGR of xx%. This growth is primarily driven by [mention factors such as rising disposable incomes, increasing health awareness, urbanization]. Technological advancements, such as improved water purification techniques and sustainable packaging solutions, have played a crucial role in shaping market trends. Consumer demand for healthier alternatives, including functional waters with added vitamins or minerals, and sparkling waters, is also contributing to market expansion. Furthermore, the shift towards premiumization, with consumers willing to pay more for high-quality, ethically sourced water, presents significant opportunities for market players. Growth is expected to continue in the forecast period (2025-2033), reaching xx Million by 2033, with a projected CAGR of xx%, fuelled by [mention key drivers, e.g., continued urbanization, rising health consciousness, increasing demand for premium products].

Leading Regions, Countries, or Segments in APAC Bottled Water Market

This section identifies the dominant regions, countries, and segments within the APAC bottled water market. Analysis focuses on distribution channels (On-Trade, Off-Trade) and water types (Still Water, Sparkling Water, Functional Water).

- Dominant Region/Country: [Identify the leading region/country, e.g., China] accounts for the largest market share due to [Explain reasons, e.g., high population density, increasing disposable incomes, strong consumer demand].

- Distribution Channels: The [Identify dominant channel, e.g., Off-Trade] channel dominates the market, accounting for [Percentage]% of total sales in 2025. This is driven by [Explain reasons, e.g., wider availability in retail stores, convenience for consumers].

- Water Types: [Identify dominant type, e.g., Still Water] remains the most popular segment, accounting for [Percentage]% of the market share. However, [Identify growing segment, e.g., Sparkling Water] is witnessing rapid growth due to [Explain reasons, e.g., changing consumer preferences, growing demand for healthier alternatives].

Key Drivers:

- Investment Trends: Significant investments in water purification infrastructure and distribution networks are fueling market growth.

- Regulatory Support: Government initiatives promoting health and wellness, and regulations encouraging sustainable packaging, positively impact the market.

APAC Bottled Water Market Product Innovations

Recent innovations include the introduction of functional waters infused with vitamins, minerals, or electrolytes, catering to the growing health-conscious consumer base. Furthermore, sparkling waters with natural fruit flavors have gained popularity, offering a healthier alternative to carbonated soft drinks. Sustainable packaging options, such as recyclable PET bottles and plant-based alternatives, are also becoming increasingly prevalent, aligning with eco-conscious consumer preferences. These innovations are driving market growth and enhancing the overall consumer experience.

Propelling Factors for APAC Bottled Water Market Growth

Several factors fuel the APAC bottled water market's growth. Rising disposable incomes in developing economies increase consumer spending on premium beverages. Growing health awareness promotes hydration and consumption of healthier alternatives to sugary drinks. Stringent government regulations promoting safe and clean drinking water further boosts the market. Finally, increasing urbanization leads to higher demand for convenient and readily available bottled water.

Obstacles in the APAC Bottled Water Market

The market faces challenges such as fluctuating raw material prices, impacting production costs. Supply chain disruptions can cause delays and shortages. Intense competition among established and emerging players adds pressure. Furthermore, environmental concerns regarding plastic waste necessitate sustainable packaging solutions.

Future Opportunities in APAP Bottled Water Market

Untapped rural markets offer significant growth potential. Demand for premium and functional waters continues to rise. Innovative packaging solutions promoting sustainability offer market expansion opportunities. Exploring new flavor profiles and health benefits can drive product differentiation and increase market share.

Major Players in the APAC Bottled Water Market Ecosystem

- JAB Holding Company

- Bisleri International

- Asahi Group Holdings Ltd

- Aava Water

- Pepsico Inc

- Danone S A

- The Coca-Cola Company

- TATA Group

- Suntory Beverage & Food Ltd

- Tibet Water Resources Ltd

- Nestlé S A

Key Developments in APAC Bottled Water Market Industry

- January 2022: Unveiling of fruit and botanical flavored sparkling water in India.

- March 2022: Danone Waters China launched its zero-sugar sparkling water.

- October 2022: The Coca-Cola Company launched SmartWater in China.

- November 2022: Aava launched its sparkling water range.

These developments highlight the increasing competition and product diversification within the APAC bottled water market.

Strategic APAC Bottled Water Market Forecast

The APAC bottled water market is poised for continued growth, driven by factors such as rising disposable incomes, increasing health consciousness, and urbanization. Emerging markets and the increasing demand for premium and functional waters present significant opportunities for market expansion. Innovation in sustainable packaging solutions and product diversification will play a crucial role in shaping the market's future trajectory.

APAC Bottled Water Market Segmentation

-

1. Type

- 1.1. Still Water

- 1.2. Sparkling Water

- 1.3. Functional Water

-

2. Distribution Channel

- 2.1. On-Trade

-

2.2. Off-Trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience Stores

- 2.2.3. Home and Office Delivery (HOD)

- 2.2.4. Online Retail Stores

- 2.2.5. Other Off-trade Channels

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

APAC Bottled Water Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. Rest of Asia Pacific

APAC Bottled Water Market Regional Market Share

Geographic Coverage of APAC Bottled Water Market

APAC Bottled Water Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Premiumization With the Growth of Fortified and Flavored Water; Lack of Safe Drinking Water Propels the Market Studied

- 3.3. Market Restrains

- 3.3.1. Unorganized Sector Coupled With Counterfeit Scandals of Bottled Water

- 3.4. Market Trends

- 3.4.1. Premiumization With the Growth of Fortified and Flavored Water

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Bottled Water Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Still Water

- 5.1.2. Sparkling Water

- 5.1.3. Functional Water

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience Stores

- 5.2.2.3. Home and Office Delivery (HOD)

- 5.2.2.4. Online Retail Stores

- 5.2.2.5. Other Off-trade Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China APAC Bottled Water Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Still Water

- 6.1.2. Sparkling Water

- 6.1.3. Functional Water

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-Trade

- 6.2.2. Off-Trade

- 6.2.2.1. Supermarkets/Hypermarkets

- 6.2.2.2. Convenience Stores

- 6.2.2.3. Home and Office Delivery (HOD)

- 6.2.2.4. Online Retail Stores

- 6.2.2.5. Other Off-trade Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. India

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Japan APAC Bottled Water Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Still Water

- 7.1.2. Sparkling Water

- 7.1.3. Functional Water

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-Trade

- 7.2.2. Off-Trade

- 7.2.2.1. Supermarkets/Hypermarkets

- 7.2.2.2. Convenience Stores

- 7.2.2.3. Home and Office Delivery (HOD)

- 7.2.2.4. Online Retail Stores

- 7.2.2.5. Other Off-trade Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. India

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. India APAC Bottled Water Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Still Water

- 8.1.2. Sparkling Water

- 8.1.3. Functional Water

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-Trade

- 8.2.2. Off-Trade

- 8.2.2.1. Supermarkets/Hypermarkets

- 8.2.2.2. Convenience Stores

- 8.2.2.3. Home and Office Delivery (HOD)

- 8.2.2.4. Online Retail Stores

- 8.2.2.5. Other Off-trade Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. India

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia APAC Bottled Water Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Still Water

- 9.1.2. Sparkling Water

- 9.1.3. Functional Water

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-Trade

- 9.2.2. Off-Trade

- 9.2.2.1. Supermarkets/Hypermarkets

- 9.2.2.2. Convenience Stores

- 9.2.2.3. Home and Office Delivery (HOD)

- 9.2.2.4. Online Retail Stores

- 9.2.2.5. Other Off-trade Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. India

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific APAC Bottled Water Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Still Water

- 10.1.2. Sparkling Water

- 10.1.3. Functional Water

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-Trade

- 10.2.2. Off-Trade

- 10.2.2.1. Supermarkets/Hypermarkets

- 10.2.2.2. Convenience Stores

- 10.2.2.3. Home and Office Delivery (HOD)

- 10.2.2.4. Online Retail Stores

- 10.2.2.5. Other Off-trade Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. India

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 JAB Holding Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bisleri International

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Asahi Group Holdings Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aava Water*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pepsico Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Danone S A

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 The Coca-Cola Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TATA Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Suntory Beverage & Food Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tibet Water Resources Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nestlé S A

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 JAB Holding Company

List of Figures

- Figure 1: Global APAC Bottled Water Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: China APAC Bottled Water Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: China APAC Bottled Water Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: China APAC Bottled Water Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 5: China APAC Bottled Water Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: China APAC Bottled Water Market Revenue (undefined), by Geography 2025 & 2033

- Figure 7: China APAC Bottled Water Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: China APAC Bottled Water Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: China APAC Bottled Water Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Japan APAC Bottled Water Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: Japan APAC Bottled Water Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Japan APAC Bottled Water Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 13: Japan APAC Bottled Water Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: Japan APAC Bottled Water Market Revenue (undefined), by Geography 2025 & 2033

- Figure 15: Japan APAC Bottled Water Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Japan APAC Bottled Water Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Japan APAC Bottled Water Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: India APAC Bottled Water Market Revenue (undefined), by Type 2025 & 2033

- Figure 19: India APAC Bottled Water Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: India APAC Bottled Water Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 21: India APAC Bottled Water Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: India APAC Bottled Water Market Revenue (undefined), by Geography 2025 & 2033

- Figure 23: India APAC Bottled Water Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: India APAC Bottled Water Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: India APAC Bottled Water Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Australia APAC Bottled Water Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Australia APAC Bottled Water Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Australia APAC Bottled Water Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 29: Australia APAC Bottled Water Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Australia APAC Bottled Water Market Revenue (undefined), by Geography 2025 & 2033

- Figure 31: Australia APAC Bottled Water Market Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Australia APAC Bottled Water Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Australia APAC Bottled Water Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of Asia Pacific APAC Bottled Water Market Revenue (undefined), by Type 2025 & 2033

- Figure 35: Rest of Asia Pacific APAC Bottled Water Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Rest of Asia Pacific APAC Bottled Water Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 37: Rest of Asia Pacific APAC Bottled Water Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Rest of Asia Pacific APAC Bottled Water Market Revenue (undefined), by Geography 2025 & 2033

- Figure 39: Rest of Asia Pacific APAC Bottled Water Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Rest of Asia Pacific APAC Bottled Water Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Rest of Asia Pacific APAC Bottled Water Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Bottled Water Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global APAC Bottled Water Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global APAC Bottled Water Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Global APAC Bottled Water Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global APAC Bottled Water Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global APAC Bottled Water Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global APAC Bottled Water Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Global APAC Bottled Water Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global APAC Bottled Water Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global APAC Bottled Water Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global APAC Bottled Water Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Global APAC Bottled Water Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global APAC Bottled Water Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global APAC Bottled Water Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global APAC Bottled Water Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Global APAC Bottled Water Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global APAC Bottled Water Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global APAC Bottled Water Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global APAC Bottled Water Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Global APAC Bottled Water Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global APAC Bottled Water Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Global APAC Bottled Water Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global APAC Bottled Water Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Global APAC Bottled Water Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Bottled Water Market?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the APAC Bottled Water Market?

Key companies in the market include JAB Holding Company, Bisleri International, Asahi Group Holdings Ltd, Aava Water*List Not Exhaustive, Pepsico Inc, Danone S A, The Coca-Cola Company, TATA Group, Suntory Beverage & Food Ltd, Tibet Water Resources Ltd, Nestlé S A.

3. What are the main segments of the APAC Bottled Water Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Premiumization With the Growth of Fortified and Flavored Water; Lack of Safe Drinking Water Propels the Market Studied.

6. What are the notable trends driving market growth?

Premiumization With the Growth of Fortified and Flavored Water.

7. Are there any restraints impacting market growth?

Unorganized Sector Coupled With Counterfeit Scandals of Bottled Water.

8. Can you provide examples of recent developments in the market?

November 2022: Aava launched its sparkling water range, which claims to retain natural minerals and makes for the perfect zero-calorie natural mixer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Bottled Water Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Bottled Water Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Bottled Water Market?

To stay informed about further developments, trends, and reports in the APAC Bottled Water Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence