Key Insights

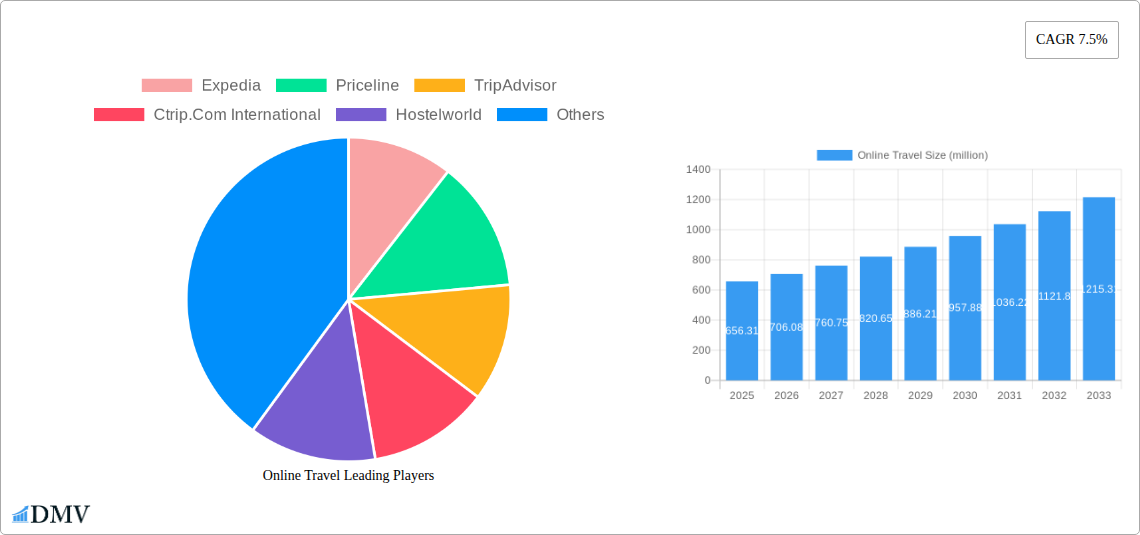

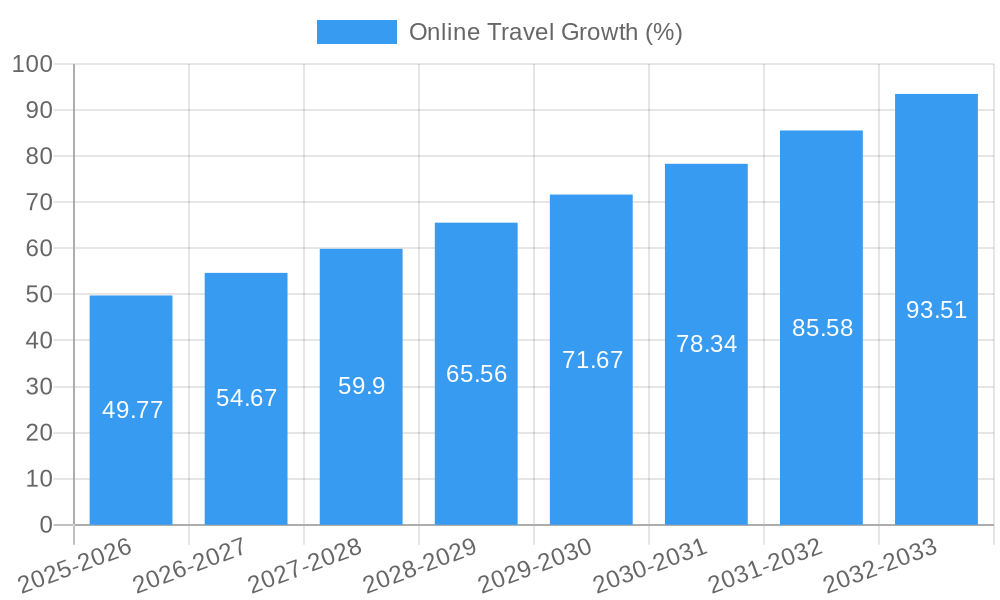

The online travel market, valued at $656.31 million in 2025, is projected to experience robust growth, driven by increasing internet and smartphone penetration, rising disposable incomes globally, and a shift towards convenient online booking platforms. Consumers are increasingly seeking personalized travel experiences, leveraging online tools for research, comparison shopping, and booking flights, hotels, and other travel-related services. The market's expansion is fueled by technological advancements such as AI-powered recommendation engines and virtual reality tours, enhancing the user experience and driving engagement. Major players like Expedia, Booking.com (Priceline), TripAdvisor, and Airbnb are constantly innovating to capture market share through competitive pricing, loyalty programs, and diversified offerings. The rise of budget airlines and the growing popularity of alternative accommodations, like Airbnb, are also contributing factors. However, challenges such as cybersecurity threats, fluctuating fuel prices, and economic downturns could impact growth. The market is segmented by various factors, including travel type (leisure, business), booking channel (mobile, desktop), and service type (flights, hotels, packages).

Looking forward to 2033, the market is poised for substantial expansion, with a projected Compound Annual Growth Rate (CAGR) of 7.5%. This growth will be propelled by continued technological innovation, the expansion of emerging markets, and the increasing adoption of online travel booking by a wider demographic. The competitive landscape remains dynamic, with established players consolidating their positions and new entrants emerging with innovative business models. To maintain a strong market presence, companies must adapt to evolving consumer preferences, invest in advanced technologies, and strengthen their customer service capabilities. Effective marketing strategies targeting specific segments, coupled with a focus on sustainable and responsible tourism practices, will be crucial for long-term success within this competitive sector.

Online Travel Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the global online travel market, projecting a market valuation exceeding $xx million by 2033. The study covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), offering a comprehensive overview of market dynamics and future opportunities. Key players such as Expedia, Priceline, TripAdvisor, and Airbnb are examined, alongside emerging trends and challenges shaping this dynamic sector. This report is crucial for stakeholders seeking strategic insights into this multi-billion-dollar industry.

Online Travel Market Composition & Trends

This section dissects the competitive landscape of the online travel market, revealing its concentration levels and identifying key trends influencing its evolution. We analyze the market share distribution among major players like Expedia, Booking Holdings (Priceline), and TripAdvisor, revealing the dominance of established giants and the emergence of niche players. Innovation catalysts, such as AI-powered personalized recommendations and blockchain-based secure transaction systems, are explored. The regulatory landscape, including evolving data privacy regulations and antitrust concerns, is critically evaluated. Substitute products, such as direct booking through hotel websites, are examined for their impact on market share. Finally, we analyze end-user profiles, segmentation based on demographics and travel styles, and major M&A activities, including deal values (in millions) and their impact on market consolidation.

- Market Share Distribution (2025): Expedia (xx%), Booking Holdings (Priceline) (xx%), TripAdvisor (xx%), Ctrip (xx%), Others (xx%).

- M&A Activity (2019-2024): Total deal value exceeding $xx million, with key acquisitions impacting market dynamics.

- Key Regulatory Developments: Focus on data privacy regulations (GDPR, CCPA) and their influence on online travel businesses.

Online Travel Industry Evolution

This section meticulously traces the evolution of the online travel industry from 2019 to 2033, analyzing market growth trajectories, technological advancements, and shifting consumer preferences. We delve into the impact of mobile technology, the rise of social media influencers, and the changing expectations of travelers concerning personalized experiences and sustainable tourism. The analysis incorporates specific data points, including compound annual growth rates (CAGR) and adoption metrics for various technologies, such as virtual reality and augmented reality for travel planning. The shift in consumer preferences towards unique and authentic travel experiences, as well as the growing influence of social media reviews, is also examined.

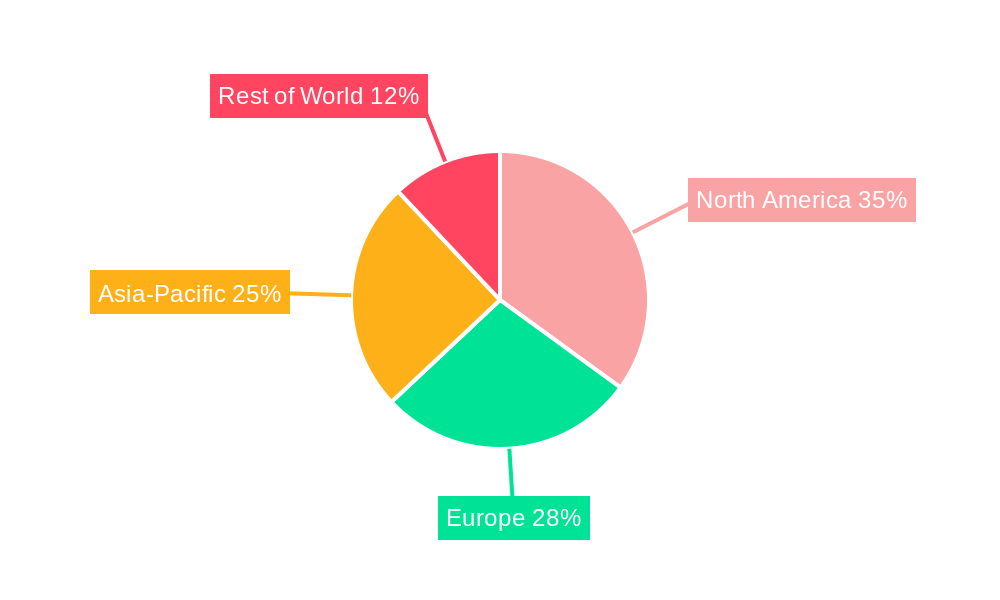

Leading Regions, Countries, or Segments in Online Travel

This section identifies the dominant regions, countries, and segments within the online travel market, pinpointing the factors driving their success. We explore the key growth drivers, focusing on investment trends, regulatory support, and infrastructure development in leading regions. A detailed analysis explains the factors contributing to the dominance of specific regions and segments.

- Leading Region (2025): North America (reasons explained in subsequent paragraphs).

- Key Drivers in Leading Region: High disposable income, robust technology infrastructure, and a strong preference for online travel booking.

- Leading Segment (2025): Flight bookings (reasons explained in subsequent paragraphs).

- Key Drivers in Leading Segment: Increased affordability of air travel, user-friendly online booking platforms, and the convenience of comparing multiple airlines.

Online Travel Product Innovations

This section showcases recent product innovations and their impact on the online travel market. We highlight unique selling propositions, including features such as AI-powered travel planning tools, personalized recommendations, and virtual reality tours. Technological advancements like blockchain for secure transactions and the integration of mobile payment gateways are also examined, and the effect of these innovations on user experience and market competition is assessed.

Propelling Factors for Online Travel Growth

Several factors contribute to the continued growth of the online travel market. Technological advancements like improved mobile applications and AI-powered personalization significantly enhance user experience. Economic factors, such as rising disposable incomes in emerging economies, fuel demand. Favorable regulatory environments, including streamlined visa processes in certain countries, also contribute positively.

Obstacles in the Online Travel Market

Despite its growth, the online travel market faces several obstacles. Stringent data privacy regulations increase compliance costs. Supply chain disruptions, like airline cancellations or hotel closures, impact customer satisfaction and profitability. Intense competition among established players and new entrants creates pressure on pricing and profitability margins, possibly impacting overall market growth by xx%.

Future Opportunities in Online Travel

The online travel market presents several exciting future opportunities. Expansion into new and emerging markets, especially in Asia and Africa, offers significant potential. The adoption of new technologies like virtual and augmented reality offers innovative ways to engage customers. The growing trend of sustainable and responsible tourism presents new niche markets with high growth potential.

Major Players in the Online Travel Ecosystem

- Expedia

- Booking Holdings (Priceline)

- TripAdvisor

- Ctrip.Com International

- Hostelworld

- Hotel Urbano

- Tourism

- CheapOair.Com

- Trivago

- Thomas Cook

- MakeMyTrip

- AirGorilla

- Hays Travel

- Airbnb

- Yatra Online

- Alibaba

- Tuniu

Key Developments in Online Travel Industry

- 2022-Q4: Launch of a new AI-powered travel planning tool by Expedia.

- 2023-Q1: Acquisition of a smaller online travel agency by Booking Holdings.

- 2023-Q3: Introduction of a new loyalty program by TripAdvisor.

Strategic Online Travel Market Forecast

The online travel market is poised for continued growth, driven by technological advancements, rising disposable incomes, and the increasing preference for online booking. Emerging markets and innovative travel products will further fuel expansion. The focus on personalization, sustainability, and enhanced security will be key factors in shaping the future of this dynamic industry. We project significant market expansion, reaching an estimated value exceeding $xx million by 2033.

Online Travel Segmentation

-

1. Application

- 1.1. Transportation

- 1.2. Travel Accommodation

- 1.3. Vacation Packages

-

2. Types

- 2.1. Online Travel Agencies

- 2.2. Direct Travel Suppliers

Online Travel Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Online Travel REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.5% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Online Travel Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Transportation

- 5.1.2. Travel Accommodation

- 5.1.3. Vacation Packages

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Online Travel Agencies

- 5.2.2. Direct Travel Suppliers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Online Travel Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Transportation

- 6.1.2. Travel Accommodation

- 6.1.3. Vacation Packages

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Online Travel Agencies

- 6.2.2. Direct Travel Suppliers

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Online Travel Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Transportation

- 7.1.2. Travel Accommodation

- 7.1.3. Vacation Packages

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Online Travel Agencies

- 7.2.2. Direct Travel Suppliers

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Online Travel Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Transportation

- 8.1.2. Travel Accommodation

- 8.1.3. Vacation Packages

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Online Travel Agencies

- 8.2.2. Direct Travel Suppliers

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Online Travel Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Transportation

- 9.1.2. Travel Accommodation

- 9.1.3. Vacation Packages

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Online Travel Agencies

- 9.2.2. Direct Travel Suppliers

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Online Travel Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Transportation

- 10.1.2. Travel Accommodation

- 10.1.3. Vacation Packages

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Online Travel Agencies

- 10.2.2. Direct Travel Suppliers

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Expedia

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Priceline

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TripAdvisor

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ctrip.Com International

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hostelworld

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hotel Urbano

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tourism

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CheapOair.Com

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Trivago

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Thomas Cook

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 MakeMyTrip

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 AirGorilla

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Hays Travel

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Airbnb

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Yatra Online

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Alibaba

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Tuniu

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Expedia

List of Figures

- Figure 1: Global Online Travel Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Online Travel Revenue (million), by Application 2024 & 2032

- Figure 3: North America Online Travel Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Online Travel Revenue (million), by Types 2024 & 2032

- Figure 5: North America Online Travel Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Online Travel Revenue (million), by Country 2024 & 2032

- Figure 7: North America Online Travel Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Online Travel Revenue (million), by Application 2024 & 2032

- Figure 9: South America Online Travel Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Online Travel Revenue (million), by Types 2024 & 2032

- Figure 11: South America Online Travel Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Online Travel Revenue (million), by Country 2024 & 2032

- Figure 13: South America Online Travel Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Online Travel Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Online Travel Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Online Travel Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Online Travel Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Online Travel Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Online Travel Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Online Travel Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Online Travel Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Online Travel Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Online Travel Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Online Travel Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Online Travel Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Online Travel Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Online Travel Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Online Travel Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Online Travel Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Online Travel Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Online Travel Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Online Travel Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Online Travel Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Online Travel Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Online Travel Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Online Travel Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Online Travel Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Online Travel Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Online Travel Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Online Travel Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Online Travel Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Online Travel Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Online Travel Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Online Travel Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Online Travel Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Online Travel Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Online Travel Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Online Travel Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Online Travel Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Online Travel Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Online Travel Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Online Travel Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Travel?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Online Travel?

Key companies in the market include Expedia, Priceline, TripAdvisor, Ctrip.Com International, Hostelworld, Hotel Urbano, Tourism, CheapOair.Com, Trivago, Thomas Cook, MakeMyTrip, AirGorilla, Hays Travel, Airbnb, Yatra Online, Alibaba, Tuniu.

3. What are the main segments of the Online Travel?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 656310 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Online Travel," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Online Travel report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Online Travel?

To stay informed about further developments, trends, and reports in the Online Travel, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence