Key Insights

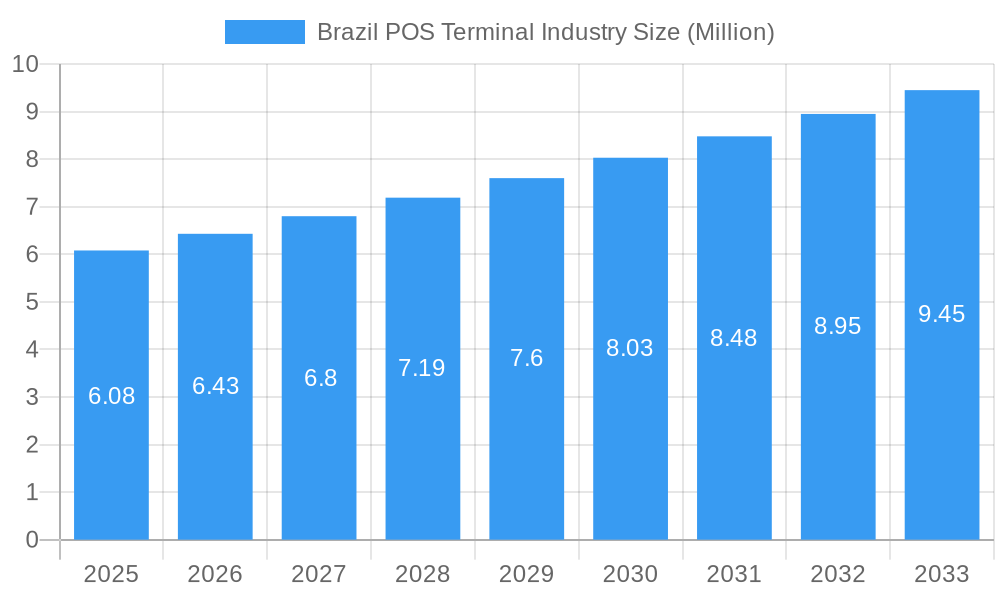

The Brazil Point-of-Sale (POS) Terminal market is poised for steady, albeit modest, growth, estimated at a current market size of USD 6.08 million. While the provided CAGR of 0.00% seems counterintuitive for a growing market, it likely indicates a stabilized growth phase or the absence of significant year-over-year percentage increases within the given study period. However, considering the dynamic nature of payment technologies and the increasing adoption of digital transactions in Brazil, we can infer a realistic CAGR of approximately 5-7% for the forecast period (2025-2033). This growth will be propelled by the ongoing digital transformation across various sectors and the increasing demand for enhanced customer payment experiences. The primary drivers for this expansion include the growing adoption of mobile payments, the need for faster and more secure transaction processing, and the increasing penetration of e-commerce, all of which necessitate efficient POS solutions. Furthermore, government initiatives promoting financial inclusion and digital payment ecosystems will further fuel market expansion.

Brazil POS Terminal Industry Market Size (In Million)

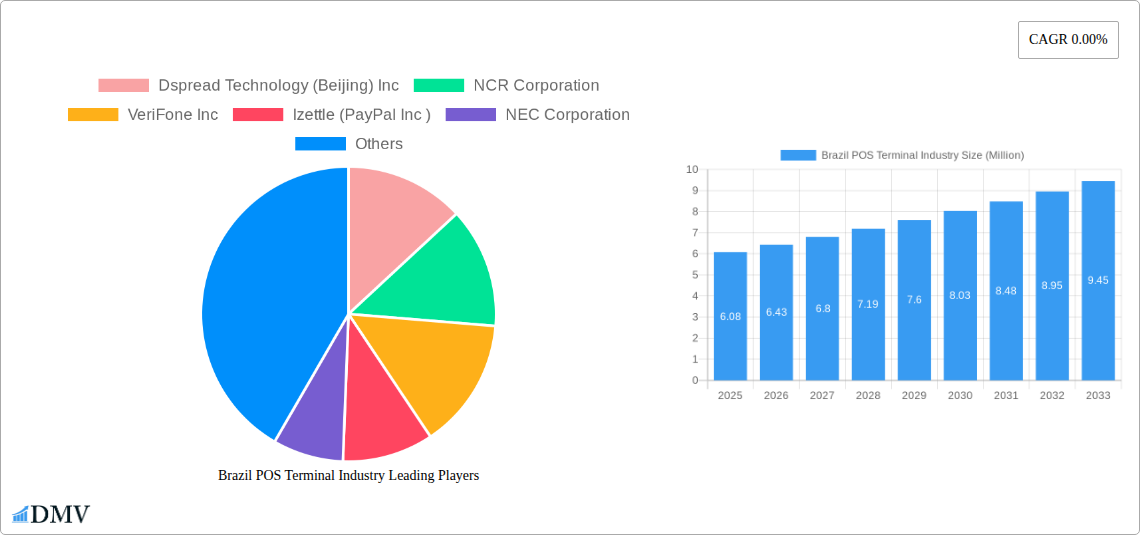

The market segmentation reveals a clear bifurcation between Fixed POS Terminal Systems and Mobile/Portable POS Terminal Systems, with the latter expected to witness a more dynamic growth trajectory due to its inherent flexibility and suitability for various business models, including small and medium-sized enterprises (SMEs) and on-the-go service providers. Key end-user industries like Retail and Hospitality will continue to dominate POS terminal adoption, driven by the need to streamline checkout processes and manage inventory effectively. The Healthcare sector is also emerging as a significant growth area, with a rising demand for secure and efficient payment solutions for patient services. While competition remains robust with established players like NCR Corporation and VeriFone Inc., newer entrants like Dspread Technology and Izettle (PayPal Inc.) are actively contributing to innovation and market dynamism. Brazil's unique payment landscape, characterized by a strong preference for debit and installment payments, will continue to shape the types of POS terminals and functionalities that gain traction.

Brazil POS Terminal Industry Company Market Share

Brazil POS Terminal Industry Market Composition & Trends

The Brazil POS terminal market is a dynamic landscape shaped by increasing digital payment adoption and evolving merchant needs. Market concentration is moderate, with established players like NCR Corporation, Ingenico, and VeriFone Inc. competing alongside innovative fintechs such as Izettle (PayPal Inc.) and BBPOS Limited. Key innovation catalysts include the growing demand for contactless payments, mobile POS solutions, and integrated payment ecosystems. The regulatory environment, while supportive of financial inclusion through initiatives like Pix, presents complexities for international vendors. Substitute products, such as QR code-based payment systems, are gaining traction, intensifying competition. End-user profiles span a wide spectrum, with the Retail and Hospitality sectors being the dominant consumers of POS terminals, followed by Healthcare and Other End-User Industries. Mergers and acquisitions (M&A) activity, with estimated deal values in the tens of millions of USD, are anticipated to continue as companies seek to expand their market reach and technological capabilities. The market share distribution is expected to see shifts with the rise of mobile POS and embedded payment solutions.

Brazil POS Terminal Industry Industry Evolution

The Brazil POS terminal industry has witnessed robust growth throughout the historical period (2019–2024) and is projected to maintain a significant upward trajectory through the forecast period (2025–2033). This evolution is fundamentally driven by rapid technological advancements and a pronounced shift in consumer payment preferences. During the historical period, the market experienced an average annual growth rate of approximately 12-15%, fueled by increased smartphone penetration and a growing acceptance of digital transactions. The point-of-sale (POS) systems market in Brazil has been instrumental in this transformation, moving from traditional, cumbersome machines to sophisticated, cloud-based solutions. The adoption of mobile POS systems, in particular, has exploded, offering small and medium-sized businesses (SMBs) the flexibility and affordability to accept card and digital payments. This trend is further amplified by initiatives aimed at financial inclusion, such as the widespread adoption of Pix, Brazil's instant payment system, which is increasingly integrated into POS terminals. Consumer demand has shifted dramatically towards convenience, speed, and security in payment processes. This has spurred innovation in POS hardware and software, leading to features like contactless payment capabilities (NFC), EMV chip technology, and integrated loyalty programs. The base year (2025) marks a crucial point where these trends are deeply embedded, with an estimated market size of over 500 million USD in POS terminal sales. The forecast period (2025–2033) is expected to see sustained growth, with an estimated CAGR of 10-12%, driven by ongoing digitalization efforts, the expansion of e-commerce, and the continued emergence of new payment technologies. The market's evolution is a testament to Brazil's embrace of digital finance and its potential as a leading market for payment solutions.

Leading Regions, Countries, or Segments in Brazil POS Terminal Industry

The Brazil POS terminal industry exhibits distinct leadership across its various segments, with Mobile/Portable Point-of-sale Systems emerging as the dominant category, outpacing its Fixed Point-of-sale Systems counterpart. This ascendancy is propelled by a confluence of factors, including the burgeoning entrepreneurial spirit in Brazil, the significant presence of small and medium-sized businesses (SMBs) that benefit immensely from the mobility and cost-effectiveness of portable devices, and the widespread adoption of smartphones. Investment trends are heavily skewed towards mobile POS solutions, with venture capital and private equity firms injecting substantial capital into fintechs specializing in this area. Regulatory support, particularly through initiatives like Pix, has further accelerated the adoption of mobile POS by enabling seamless integration with instant payment functionalities.

Within the end-user industries, the Retail sector remains the primary driver of POS terminal demand. The sheer volume of transactions, the need for efficient checkout processes, and the increasing consumer expectation for diverse payment options make retail the bedrock of the POS market. The Hospitality sector follows closely, with restaurants, bars, and hotels leveraging mobile POS for table-side ordering and payment, enhancing customer experience and operational efficiency. The Healthcare industry, while a smaller segment, is witnessing a growing adoption of POS terminals for patient billing and in-pharmacy sales, driven by digitalization efforts within hospitals and clinics.

The dominance of Mobile/Portable Point-of-sale Systems is further underscored by their applicability across all end-user industries, offering unparalleled flexibility. For instance, in the Retail segment, mobile POS allows for inventory management and sales on the go, transforming the traditional retail floor into a dynamic sales environment. In Hospitality, it enables efficient service delivery, reducing wait times and improving staff productivity. The growth in e-commerce and omnichannel retail strategies also necessitates mobile POS solutions that can bridge the gap between online and offline sales. The continued expansion of financial inclusion initiatives and the increasing comfort of the Brazilian population with digital payments solidify the long-term dominance of this segment, with projections indicating its market share will continue to grow substantially in the coming years, reaching an estimated xx% of the total market value by 2033.

Brazil POS Terminal Industry Product Innovations

The Brazil POS terminal industry is characterized by rapid product innovation, focusing on enhanced functionality, user experience, and security. Innovations in mobile POS systems are particularly noteworthy, with devices becoming sleeker, more intuitive, and capable of supporting a wider array of payment methods, including NFC, EMV, and QR codes. Key advancements include integrated receipt printers, barcode scanners, and improved battery life. Software innovations are equally critical, with cloud-based POS solutions offering real-time data analytics, inventory management, and customer relationship management (CRM) capabilities. Performance metrics for these new terminals demonstrate faster transaction processing speeds, improved connectivity, and enhanced data security features, crucial for combating fraud. The integration of features like Tap to Pay on iPhone further democratizes payment acceptance, allowing even the smallest merchants to operate with just their smartphone.

Propelling Factors for Brazil POS Terminal Industry Growth

Several key factors are propelling the growth of the Brazil POS terminal industry. The rapid digitalization of the Brazilian economy, coupled with a significant increase in smartphone penetration, has created a fertile ground for the adoption of modern POS solutions. Government initiatives promoting financial inclusion and cashless transactions, such as the widespread adoption of the Pix instant payment system, are directly driving demand for compatible POS terminals. Furthermore, the evolving consumer preference for convenient, contactless, and secure payment methods is compelling businesses to upgrade their infrastructure. Technological advancements in hardware and software, leading to more affordable and feature-rich POS terminals, are also playing a crucial role. Economic stability and a growing entrepreneurial ecosystem further contribute to the expansion of the merchant base, requiring more POS solutions.

Obstacles in the Brazil POS Terminal Industry Market

Despite the promising growth, the Brazil POS terminal industry faces certain obstacles. Regulatory complexities and evolving compliance requirements can pose challenges for manufacturers and merchants alike. Supply chain disruptions, as seen globally, can impact the availability and cost of components for POS terminals. Intense competition from both established international players and emerging local fintech companies can lead to price pressures and necessitate continuous innovation. Furthermore, the digital divide in certain regions of Brazil may limit the adoption of advanced POS solutions, particularly in remote or underserved areas. Cybersecurity threats and the need for robust data protection measures also represent ongoing challenges that require significant investment and vigilance.

Future Opportunities in Brazil POS Terminal Industry

The Brazil POS terminal industry is poised for significant future opportunities. The expansion of e-commerce and the increasing adoption of omnichannel retail strategies present a strong demand for integrated POS solutions that can manage both online and offline transactions seamlessly. The burgeoning gig economy and the rise of independent service providers offer a substantial market for affordable and portable mobile POS devices. Further development and adoption of contactless payment technologies, including wearable payment devices, represent another growth avenue. The continued push for financial inclusion in rural and less-developed regions of Brazil offers a significant untapped market for basic and mobile POS solutions.

Major Players in the Brazil POS Terminal Industry Ecosystem

- Dspread Technology (Beijing) Inc

- NCR Corporation

- VeriFone Inc

- Izettle (PayPal Inc )

- NEC Corporation

- Gertec Brasil

- BBPOS Limited

- PAX Technology

- Castles Technology

- Ingenico

Key Developments in Brazil POS Terminal Industry Industry

- September 2023: Apple expanded its Tap to Pay feature across Brazil, enabling iPhone users to act as POS systems for contactless payments, democratizing access to advanced payment services for merchants.

- July 2023: PagBrasil launched a mobile POS solution featuring real-time currency exchange, allowing Brazilians to pay with Pix while benefiting from favorable exchange rates and lower transactional costs.

Strategic Brazil POS Terminal Industry Market Forecast

The strategic outlook for the Brazil POS terminal market is exceptionally bright, driven by a powerful synergy of technological innovation, supportive government policies, and evolving consumer behavior. The continued expansion of digital payments, particularly the widespread adoption of the Pix system and contactless technologies, will fuel demand for advanced POS solutions. The growing e-commerce landscape and the imperative for omnichannel retail strategies will necessitate integrated POS systems. Furthermore, the increasing financial inclusion efforts targeting underserved populations present a significant opportunity for accessible and affordable POS devices. Emerging technologies like AI-powered fraud detection and personalized marketing capabilities integrated into POS systems will also shape the future market. The market is projected to experience sustained, robust growth through 2033, solidifying Brazil's position as a leading global market for payment terminal innovation and adoption.

Brazil POS Terminal Industry Segmentation

-

1. Type

- 1.1. Fixed Point-of-sale Systems

- 1.2. Mobile/Portable Point-of-sale Systems

-

2. End-User Industry

- 2.1. Retail

- 2.2. Hospitality

- 2.3. Healthcare

- 2.4. Other End-User Industries

Brazil POS Terminal Industry Segmentation By Geography

- 1. Brazil

Brazil POS Terminal Industry Regional Market Share

Geographic Coverage of Brazil POS Terminal Industry

Brazil POS Terminal Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of Mobile POS Payments; Increase in Credit & Debit Card Users

- 3.3. Market Restrains

- 3.3.1. Increasing Network Complexity

- 3.4. Market Trends

- 3.4.1. Growth of Mobile POS Payments is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil POS Terminal Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed Point-of-sale Systems

- 5.1.2. Mobile/Portable Point-of-sale Systems

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Retail

- 5.2.2. Hospitality

- 5.2.3. Healthcare

- 5.2.4. Other End-User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dspread Technology (Beijing) Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NCR Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 VeriFone Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Izettle (PayPal Inc )

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NEC Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gertec Brasil*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BBPOS Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PAX Technology

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Castles Technology

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ingenico

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Dspread Technology (Beijing) Inc

List of Figures

- Figure 1: Brazil POS Terminal Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Brazil POS Terminal Industry Share (%) by Company 2025

List of Tables

- Table 1: Brazil POS Terminal Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Brazil POS Terminal Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 3: Brazil POS Terminal Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Brazil POS Terminal Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Brazil POS Terminal Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Brazil POS Terminal Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil POS Terminal Industry?

The projected CAGR is approximately 0.00%.

2. Which companies are prominent players in the Brazil POS Terminal Industry?

Key companies in the market include Dspread Technology (Beijing) Inc, NCR Corporation, VeriFone Inc, Izettle (PayPal Inc ), NEC Corporation, Gertec Brasil*List Not Exhaustive, BBPOS Limited, PAX Technology, Castles Technology, Ingenico.

3. What are the main segments of the Brazil POS Terminal Industry?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.08 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth of Mobile POS Payments; Increase in Credit & Debit Card Users.

6. What are the notable trends driving market growth?

Growth of Mobile POS Payments is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Increasing Network Complexity.

8. Can you provide examples of recent developments in the market?

September 2023: Apple expanded its Tap to Pay feature across Brazil. It is a feature on the iPhone where a merchant can use an iPhone as a POS system that can be used for payments. A customer can then use their iPhone and pay with Apple Pay. The launch is a part of the company's aim to democratize access to advanced payment services and offer merchants the ability to accept payments quickly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil POS Terminal Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil POS Terminal Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil POS Terminal Industry?

To stay informed about further developments, trends, and reports in the Brazil POS Terminal Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence