Key Insights

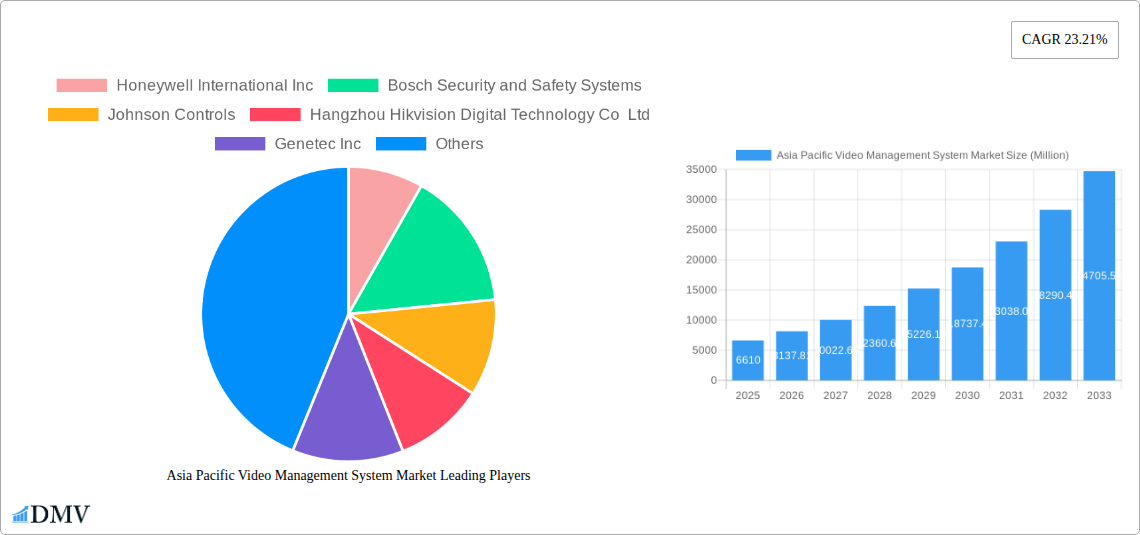

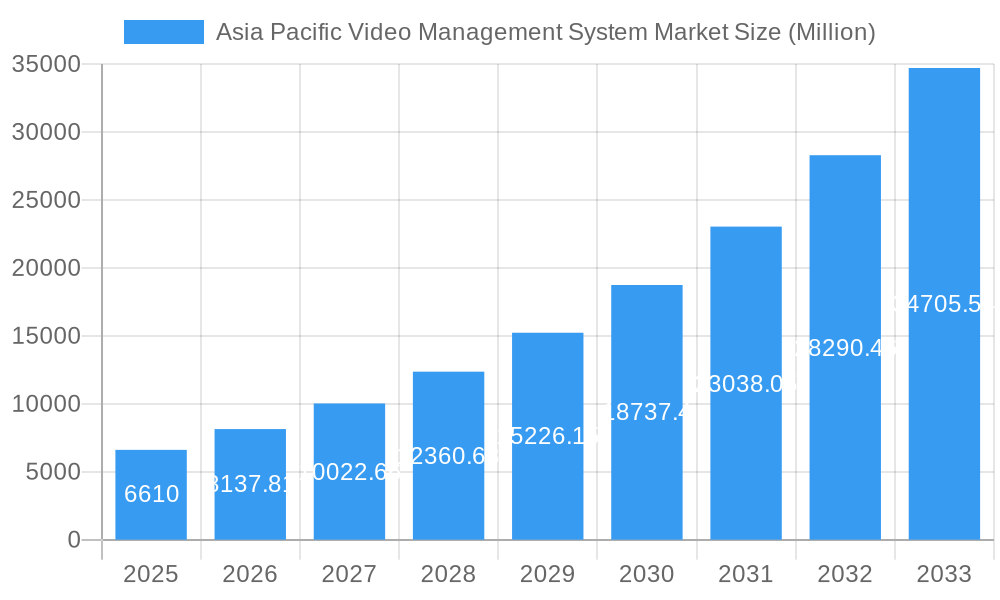

The Asia Pacific Video Management System (VMS) market is experiencing robust growth, projected to reach \$6.61 billion by 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 23.21% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing government initiatives focused on public safety and security, particularly in rapidly urbanizing areas, are fueling demand for sophisticated surveillance solutions. Secondly, the rising adoption of cloud-based VMS, offering scalability, cost-effectiveness, and remote accessibility, is significantly impacting market dynamics. Furthermore, the proliferation of connected devices (IoT) and the need for integrated security management across diverse platforms are contributing to market growth. Finally, the increasing awareness of cybersecurity threats and the demand for advanced video analytics capabilities further bolster the market.

Asia Pacific Video Management System Market Market Size (In Billion)

Major players like Honeywell, Bosch, Johnson Controls, Hikvision, and Genetec are actively shaping the market landscape through technological innovation, strategic partnerships, and geographic expansion. However, factors such as high initial investment costs associated with VMS implementation, concerns regarding data privacy and security, and the complexity of integrating various security systems present challenges to market expansion. Despite these restraints, the long-term outlook for the Asia Pacific VMS market remains positive, driven by continuous technological advancements and growing demand for enhanced security solutions across various sectors, including commercial, industrial, and residential. The market segmentation (while not provided in detail) likely includes solutions categorized by deployment (cloud, on-premise), functionality (video analytics, access control integration), and end-user industry (retail, transportation, government). The regional breakdown within Asia Pacific will likely show significant variations, with countries experiencing rapid economic growth and urbanization demonstrating the highest growth rates.

Asia Pacific Video Management System Market Company Market Share

Asia Pacific Video Management System (VMS) Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asia Pacific Video Management System market, offering a comprehensive overview of its current state, future trajectory, and key players. The study period covers 2019-2033, with 2025 as the base and estimated year. The report leverages extensive market research to deliver actionable insights for stakeholders, investors, and industry professionals. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Asia Pacific Video Management System Market Composition & Trends

This section delves into the competitive landscape of the Asia Pacific VMS market, examining market concentration, innovation drivers, regulatory frameworks, substitute technologies, end-user profiles, and mergers & acquisitions (M&A) activities. The market exhibits a moderately concentrated structure, with key players holding significant market share. However, the presence of several emerging players indicates a dynamic competitive environment.

Market Share Distribution (2024): Hangzhou Hikvision Digital Technology Co Ltd holds an estimated xx% market share, followed by Dahua Technology (xx%), Honeywell International Inc (xx%), and Bosch Security and Safety Systems (xx%). The remaining market share is distributed among other players including Johnson Controls, Genetec Inc, Axis Communications AB, AxxonSoft Inc, Identiv Inc, Milestone Systems, Qognify Inc, and Verint Systems. These figures are estimates based on available market data.

Innovation Catalysts: The increasing adoption of AI-powered video analytics, cloud-based VMS solutions, and the integration of IoT devices are key innovation drivers.

Regulatory Landscape: Government regulations concerning data privacy and security are shaping the market, particularly in regions like Japan and Australia.

Substitute Products: While VMS is the dominant technology, there's potential competition from alternative security solutions.

End-User Profiles: Key end-users include government agencies, critical infrastructure operators, commercial businesses, and residential sectors.

M&A Activities: The market has witnessed several M&A deals in recent years, valued at approximately xx Million in total, primarily focused on expanding technological capabilities and market reach. These deals reflect the consolidation trend within the industry.

Asia Pacific Video Management System Market Industry Evolution

This section traces the evolution of the Asia Pacific VMS market, analyzing its growth trajectories, technological advancements, and shifting consumer demands throughout the historical period (2019-2024). The market experienced robust growth fueled by increasing security concerns, technological advancements, and the rising adoption of IP-based surveillance systems. The growth rate during the historical period averaged xx% annually. The adoption of cloud-based VMS solutions has seen a significant increase, growing at approximately xx% annually from 2020 to 2024. This is mainly due to scalability, cost-effectiveness, and accessibility benefits. Furthermore, the demand for AI-powered analytics has witnessed considerable growth, driven by the need for improved threat detection and proactive security measures. The transition from traditional analog systems to IP-based video surveillance also played a crucial role in driving market growth during this period.

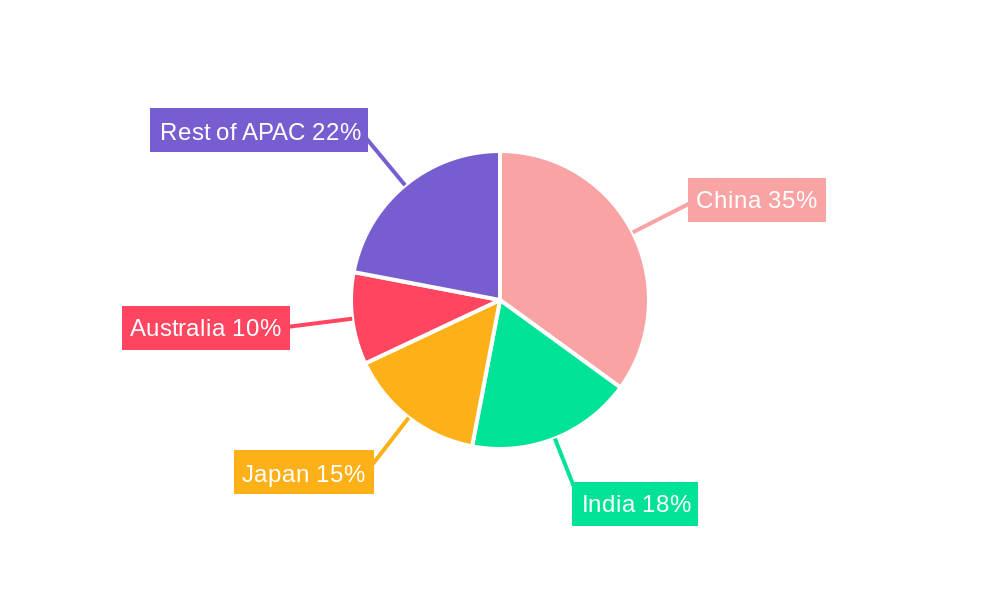

Leading Regions, Countries, or Segments in Asia Pacific Video Management System Market

China and Japan are currently the dominant markets within the Asia Pacific region, accounting for approximately xx% and xx% of the total market revenue respectively. This dominance stems from several factors:

China:

- High investment in security infrastructure due to rapid urbanization and economic growth.

- Strong government support for the development and deployment of advanced surveillance systems.

- A large and growing market for security products and services.

Japan:

- Stringent security regulations and high awareness of security threats.

- Significant investment in smart city initiatives.

- High adoption rate of technologically advanced security solutions.

Furthermore, the commercial sector has seen a high adoption rate of VMS solutions across the region. This sector constitutes a significant portion of the total market, owing to the rising demand for improved security measures in businesses and retail spaces. The expansion of smart city initiatives in countries like Singapore, South Korea, and Australia is also driving growth in the market.

Asia Pacific Video Management System Market Product Innovations

Recent product innovations focus on AI-powered video analytics, enhancing functionalities like facial recognition, object detection, and behavioral analysis. Cloud-based platforms offer improved scalability, accessibility, and cost-effectiveness. Integration with IoT devices allows for a more comprehensive security ecosystem. The introduction of edge computing capabilities reduces bandwidth consumption and improves real-time performance, making systems more responsive.

Propelling Factors for Asia Pacific Video Management System Market Growth

Several factors drive the growth of the Asia Pacific VMS market: increasing security concerns following various geopolitical tensions and terrorist attacks, rising adoption of cloud-based technologies, growing demand for AI-powered video analytics for enhanced security and operational efficiency, and government initiatives promoting smart cities. The expanding adoption of IP-based surveillance and the integration of these systems with other IoT devices are further contributing to the market growth.

Obstacles in the Asia Pacific Video Management System Market

Challenges include the high initial investment costs for advanced VMS systems, concerns regarding data privacy and security breaches, potential supply chain disruptions, and intense competition among established players and emerging technology providers. These can create cost pressures and impact the market's growth trajectory. The complexity of integrating different systems and managing large amounts of video data presents another significant hurdle.

Future Opportunities in Asia Pacific Video Management System Market

Significant opportunities exist in expanding VMS deployments to smaller businesses and residential sectors, integrating advanced analytics with other security technologies, and leveraging new technologies like blockchain for enhanced data security. Further adoption of 5G and other high-speed networks can facilitate growth, as will the increasing integration of edge computing and AI capabilities. The development and deployment of more user-friendly and cost-effective VMS solutions can further expand the market reach.

Major Players in the Asia Pacific Video Management System Market Ecosystem

- Honeywell International Inc (Honeywell International Inc)

- Bosch Security and Safety Systems (Bosch Security and Safety Systems)

- Johnson Controls (Johnson Controls)

- Hangzhou Hikvision Digital Technology Co Ltd (Hangzhou Hikvision Digital Technology Co Ltd)

- Genetec Inc (Genetec Inc)

- Axis Communications AB (Axis Communications AB)

- Dahua Technology (Dahua Technology)

- AxxonSoft Inc (AxxonSoft Inc)

- Identiv Inc (Identiv Inc)

- Milestone Systems (Milestone Systems)

- Qognify Inc (Qognify Inc)

- Verint Systems (Verint Systems)

- List Not Exhaustive

Key Developments in Asia Pacific Video Management System Market Industry

June 2024: Dahua Technology New Zealand partnered with Clear Digital, expanding its distribution network and market reach in New Zealand. This strategic move enhances Dahua's presence and reinforces its product offerings in the region.

April 2024: Secom introduced its new VMS in Japan, designed for seamless integration with numerous camera models from various manufacturers. This offers users a centralized management system with enhanced capabilities for viewing and managing video footage.

Strategic Asia Pacific Video Management System Market Forecast

The Asia Pacific VMS market is poised for significant growth driven by technological innovation, increased security concerns, and government initiatives. The market will experience continuous growth fueled by the adoption of AI-powered analytics, cloud-based solutions, and edge computing. This forecast anticipates sustained expansion across key market segments, driven by the ongoing development and adoption of advanced VMS technology and the increasing demand for enhanced security solutions across diverse sectors. The market's potential for growth is substantial, presenting numerous opportunities for both established players and new entrants.

Asia Pacific Video Management System Market Segmentation

-

1. Component

- 1.1. System

- 1.2. Services

-

2. Technology

- 2.1. Analog-based

- 2.2. IP- based

-

3. Mode of Deployment

- 3.1. On-premise

- 3.2. Cloud

-

4. End-user Industry

- 4.1. Banking and Financial Services

- 4.2. Education

- 4.3. Retail

- 4.4. Transportation

- 4.5. Logistics

- 4.6. Healthcare

- 4.7. Airports

Asia Pacific Video Management System Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Video Management System Market Regional Market Share

Geographic Coverage of Asia Pacific Video Management System Market

Asia Pacific Video Management System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Security Cameras for Surveillence; Technological Advancement in New Product Development

- 3.3. Market Restrains

- 3.3.1. Increasing Security Cameras for Surveillence; Technological Advancement in New Product Development

- 3.4. Market Trends

- 3.4.1. Cloud-based Video Management System is Expected to Grow at a Significant Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Video Management System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. System

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Analog-based

- 5.2.2. IP- based

- 5.3. Market Analysis, Insights and Forecast - by Mode of Deployment

- 5.3.1. On-premise

- 5.3.2. Cloud

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. Banking and Financial Services

- 5.4.2. Education

- 5.4.3. Retail

- 5.4.4. Transportation

- 5.4.5. Logistics

- 5.4.6. Healthcare

- 5.4.7. Airports

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bosch Security and Safety Systems

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Johnson Controls

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Genetec Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Axis Communications AB

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dahua Technology

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AxxonSoft Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Identiv Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Milestone Systems

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Qognify Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Verint Systems*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Asia Pacific Video Management System Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Video Management System Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Video Management System Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Asia Pacific Video Management System Market Volume Billion Forecast, by Component 2020 & 2033

- Table 3: Asia Pacific Video Management System Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Asia Pacific Video Management System Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 5: Asia Pacific Video Management System Market Revenue Million Forecast, by Mode of Deployment 2020 & 2033

- Table 6: Asia Pacific Video Management System Market Volume Billion Forecast, by Mode of Deployment 2020 & 2033

- Table 7: Asia Pacific Video Management System Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Asia Pacific Video Management System Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 9: Asia Pacific Video Management System Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Asia Pacific Video Management System Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Asia Pacific Video Management System Market Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Asia Pacific Video Management System Market Volume Billion Forecast, by Component 2020 & 2033

- Table 13: Asia Pacific Video Management System Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 14: Asia Pacific Video Management System Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 15: Asia Pacific Video Management System Market Revenue Million Forecast, by Mode of Deployment 2020 & 2033

- Table 16: Asia Pacific Video Management System Market Volume Billion Forecast, by Mode of Deployment 2020 & 2033

- Table 17: Asia Pacific Video Management System Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Asia Pacific Video Management System Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 19: Asia Pacific Video Management System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Asia Pacific Video Management System Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: China Asia Pacific Video Management System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: China Asia Pacific Video Management System Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Asia Pacific Video Management System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Japan Asia Pacific Video Management System Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: South Korea Asia Pacific Video Management System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Asia Pacific Video Management System Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: India Asia Pacific Video Management System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Asia Pacific Video Management System Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Australia Asia Pacific Video Management System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Australia Asia Pacific Video Management System Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: New Zealand Asia Pacific Video Management System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: New Zealand Asia Pacific Video Management System Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Indonesia Asia Pacific Video Management System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Indonesia Asia Pacific Video Management System Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Malaysia Asia Pacific Video Management System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Malaysia Asia Pacific Video Management System Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Singapore Asia Pacific Video Management System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Singapore Asia Pacific Video Management System Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Thailand Asia Pacific Video Management System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Thailand Asia Pacific Video Management System Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Vietnam Asia Pacific Video Management System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Vietnam Asia Pacific Video Management System Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Philippines Asia Pacific Video Management System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Philippines Asia Pacific Video Management System Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Video Management System Market?

The projected CAGR is approximately 23.21%.

2. Which companies are prominent players in the Asia Pacific Video Management System Market?

Key companies in the market include Honeywell International Inc, Bosch Security and Safety Systems, Johnson Controls, Hangzhou Hikvision Digital Technology Co Ltd, Genetec Inc, Axis Communications AB, Dahua Technology, AxxonSoft Inc, Identiv Inc, Milestone Systems, Qognify Inc, Verint Systems*List Not Exhaustive.

3. What are the main segments of the Asia Pacific Video Management System Market?

The market segments include Component, Technology, Mode of Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.61 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Security Cameras for Surveillence; Technological Advancement in New Product Development.

6. What are the notable trends driving market growth?

Cloud-based Video Management System is Expected to Grow at a Significant Rate.

7. Are there any restraints impacting market growth?

Increasing Security Cameras for Surveillence; Technological Advancement in New Product Development.

8. Can you provide examples of recent developments in the market?

June 2024: Dahua Technology New Zealand revealed Clear Digital as its latest distribution partner in New Zealand. This strategic collaboration is intended to strengthen Dahua's market position and offer high-quality IP surveillance hardware, video management software, and security products throughout the region.April 2024: Secom VMS was introduced in Japan. According to the company, the recently released VMS is designed to work seamlessly with more than 600 models of surveillance cameras from 25 different manufacturers. It can also centrally manage numerous surveillance cameras installed in large-scale facilities. Additionally, Secom VMS allows users to view recorded and live videos from surveillance cameras using a tablet, computer, or smartphone and effortlessly switch between split displays and select recorded data.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Video Management System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Video Management System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Video Management System Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Video Management System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence