Key Insights

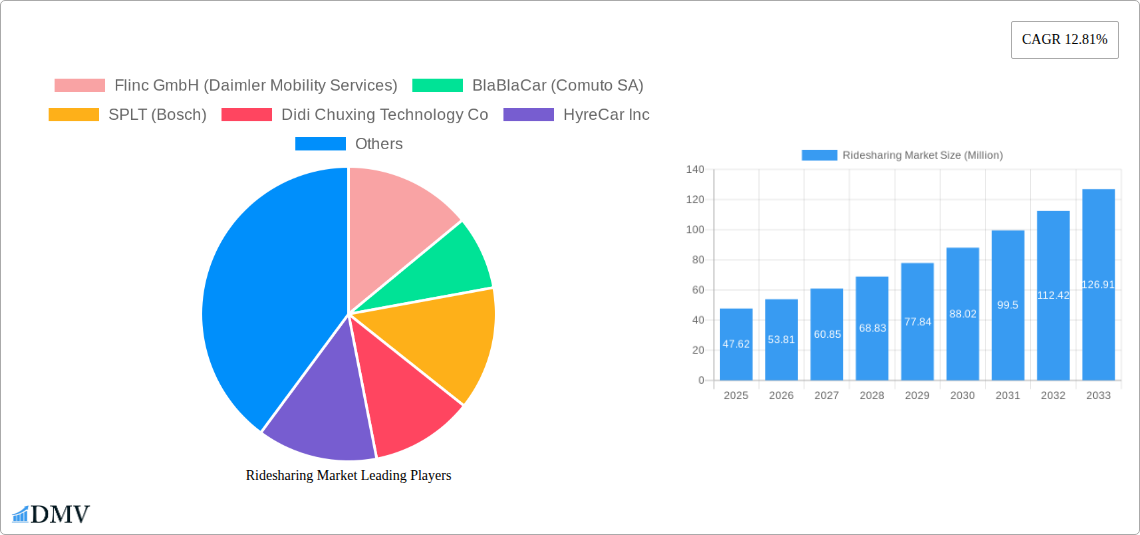

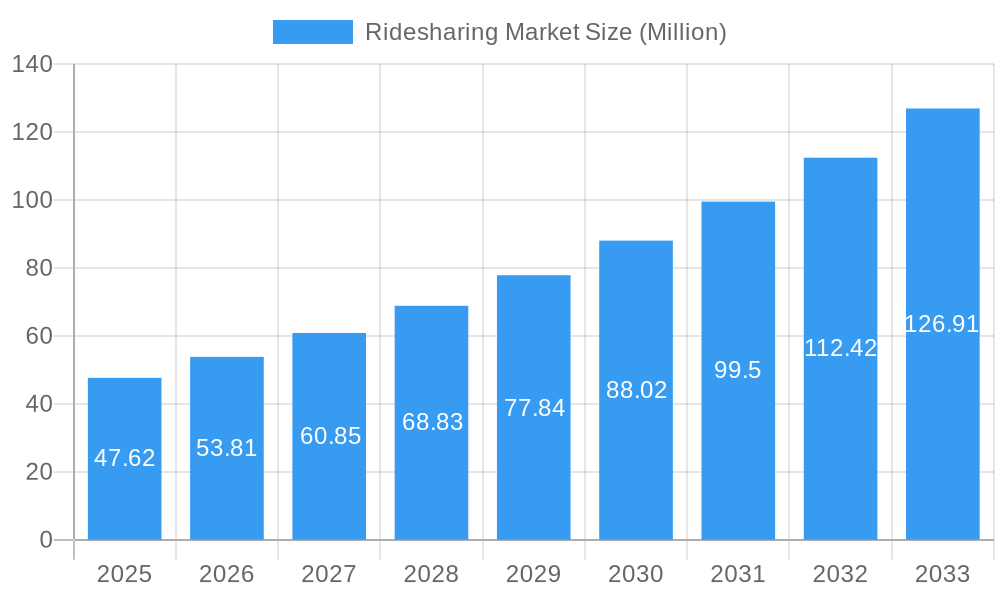

The global Ridesharing Market is experiencing robust expansion, projected to reach a substantial market size of approximately USD 47.62 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 12.81% anticipated to sustain this momentum through 2033. This growth is fueled by a confluence of transformative drivers, including increasing urbanization, a growing preference for cost-effective and flexible transportation solutions, and the escalating adoption of smart mobility technologies. The market's dynamism is further propelled by evolving consumer attitudes towards shared economy models and a heightened awareness of environmental sustainability, positioning ridesharing as a vital component of modern urban transit. Technological advancements, particularly in mobile app development and real-time tracking, have significantly enhanced user experience and operational efficiency, fostering wider market penetration.

Ridesharing Market Market Size (In Million)

The competitive landscape is characterized by a diverse range of players, from established global entities to emerging startups, all vying for market share through innovative service offerings and strategic partnerships. Key market segments, including Fixed Ridesharing, Dynamic Ridesharing, and Corporate Ridesharing, cater to distinct user needs, while the proliferation of App-Based and Web and App Based services underscores the digital-first approach driving the industry. Emerging trends like the integration of electric vehicles into ridesharing fleets and the development of subscription-based models are set to redefine the future of urban mobility. While growth is substantial, potential restraints such as evolving regulatory frameworks, intense competition, and the need for robust safety protocols require strategic navigation by market participants. The market's significant projected growth indicates a sustained demand for convenient, affordable, and increasingly sustainable transportation alternatives.

Ridesharing Market Company Market Share

Ridesharing Market Report: Navigating the Future of Urban Mobility and Sustainable Transportation

This comprehensive ridesharing market analysis provides an in-depth examination of the global carpooling and ride-hailing industry, offering critical insights for stakeholders from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this report leverages historical data from 2019-2024 to deliver actionable intelligence on market dynamics, growth drivers, and emerging opportunities. Discover the competitive landscape, segment performance, and innovative advancements shaping the future of shared mobility.

Ridesharing Market Market Composition & Trends

The ridesharing market is characterized by a dynamic interplay of established players and innovative startups, leading to a moderately concentrated landscape. Innovation catalysts are primarily driven by technological advancements in AI, mapping, and payment systems, coupled with a growing consumer demand for convenient and affordable transportation. Regulatory landscapes, while evolving, present both opportunities and challenges, with varying approaches across different regions concerning driver classification, safety standards, and data privacy. Substitute products include traditional public transportation, personal vehicle ownership, and other on-demand mobility services. End-user profiles are diverse, ranging from daily commuters seeking cost savings and convenience to tourists and business travelers prioritizing flexibility and efficiency. Mergers and acquisitions (M&A) activities are significant, with Didi Chuxing Technology Co and Uber often at the forefront, indicating a trend towards consolidation and strategic expansion. For instance, the acquisition of Vride Inc by Enterprise Holdings Inc signifies a move to integrate ridesharing into broader fleet management solutions. While exact M&A deal values fluctuate, significant capital is continuously being injected into promising mobility solutions. Key market share distribution for 2025 is estimated to see major global players holding substantial portions, with emerging regional champions carving out their niches.

Ridesharing Market Industry Evolution

The ridesharing industry's evolution has been nothing short of revolutionary, fundamentally altering urban transportation paradigms. Over the historical period of 2019-2024, the market witnessed exponential growth, fueled by the widespread adoption of smartphones and the increasing need for flexible, on-demand mobility. This period saw the transition from early adopter phases to mass market penetration, with user acquisition strategies focusing on competitive pricing and service availability. Technological advancements, particularly in app-based ridesharing platforms, have been instrumental. Sophisticated algorithms optimize rider-driver matching, minimize wait times, and enhance route efficiency. The integration of real-time traffic data and predictive analytics further refines the user experience. Shifting consumer demands have played a pivotal role, with a growing preference for cost-effective alternatives to car ownership and traditional taxis. Environmental consciousness is also emerging as a significant factor, driving interest in eco-friendly ridesharing and electric vehicle integration within fleets. For example, the study period extending to 2033 suggests a continued upward trajectory, with anticipated growth rates in the high single digits annually. Adoption metrics for ride-hailing services have surpassed 50% in major urban centers by 2024, indicating a mature but still expanding market. The shift towards dynamic ridesharing models, offering greater flexibility, is a notable trend, alongside the growth of corporate ridesharing solutions designed for employee transportation and sustainability initiatives. The integration of services like fixed ridesharing for predictable commutes and the expansion of web-based and app-based platforms ensure accessibility across diverse user needs. The market's resilience, even through global disruptions, underscores its essential role in modern urban infrastructure.

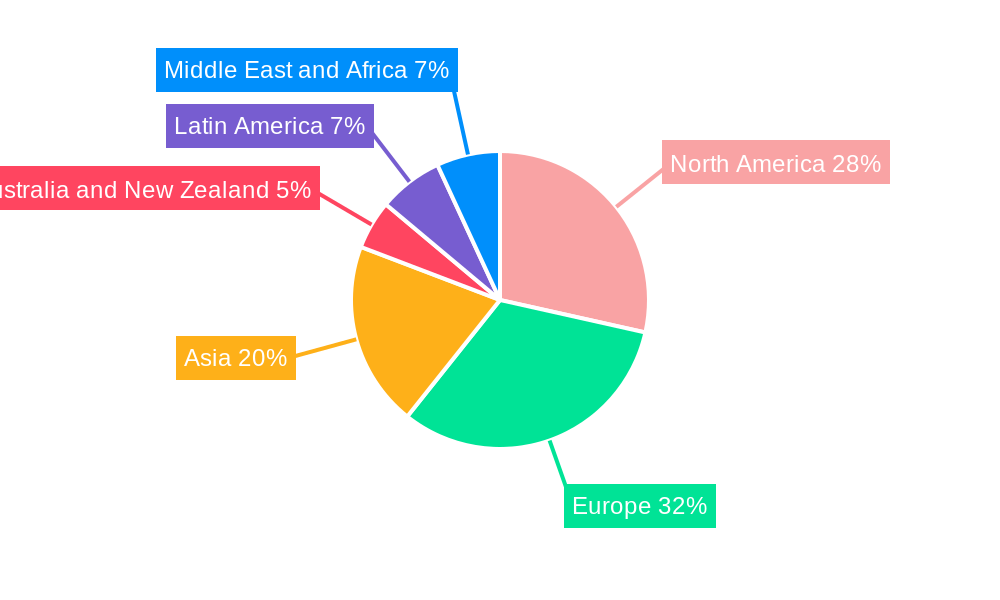

Leading Regions, Countries, or Segments in Ridesharing Market

The ridesharing market exhibits distinct leadership across various regions and segments, driven by a confluence of economic development, technological adoption, and regulatory frameworks. Globally, Asia-Pacific has emerged as a dominant region, propelled by its massive population, rapidly urbanizing cities, and a burgeoning middle class with high smartphone penetration. Countries like China, India, and Southeast Asian nations are at the forefront of this growth, with local players like Didi Chuxing Technology Co dominating significant market shares. The United States remains a mature yet substantial market, characterized by intense competition among global and domestic players.

Within the Membership Type segmentation, Dynamic Ridesharing currently leads in market penetration and revenue generation. This is due to its inherent flexibility, catering to spontaneous travel needs and offering a wider range of ride options compared to fixed plans. However, Corporate Ridesharing is experiencing robust growth, driven by corporate sustainability goals, employee benefits programs, and the increasing adoption of integrated mobility solutions by businesses. Investment trends in this segment are strong, with companies seeking to optimize employee commute costs and reduce their carbon footprint. Fixed Ridesharing, while less dominant, maintains a steady presence, particularly for predictable daily commutes where cost savings are paramount.

In terms of Service Type, App-Based services undeniably lead the market. The intuitive user experience, real-time tracking, seamless payment integration, and availability of ride-sharing options via smartphone applications have made them the preferred choice for the vast majority of users. This dominance is underpinned by significant venture capital investments poured into mobile technology development and user interface design. Web-Based services, while still relevant for certain administrative functions or for users without constant smartphone access, represent a smaller, niche market. The future trajectory points towards a continued dominance of app-based platforms, with an increasing integration of Web and App Based solutions to offer a seamless omnichannel experience. Regulatory support, particularly in developing economies, has been a key driver for ridesharing adoption, with governments recognizing its potential to alleviate traffic congestion and improve public transportation access. For instance, favorable policies in many Asian countries have facilitated the rapid expansion of ride-hailing services, contributing to the region's leading position.

Ridesharing Market Product Innovations

Product innovations in the ridesharing market are rapidly enhancing user experience and operational efficiency. Companies are investing heavily in AI-powered predictive dispatching to minimize wait times and optimize fleet utilization. Real-time vehicle diagnostics and predictive maintenance are being integrated to ensure service reliability and reduce downtime. The development of advanced safety features, including in-app emergency buttons, driver background checks, and real-time ride monitoring, is a critical focus. Furthermore, the exploration of specialized vehicles, such as electric and autonomous ridesharing options, is a significant area of innovation, aiming to address environmental concerns and revolutionize urban mobility. The introduction of integrated booking systems that allow users to book rides and other mobility services through a single platform is also a key advancement.

Propelling Factors for Ridesharing Market Growth

Several key factors are propelling the global ridesharing market forward. Technologically, the widespread adoption of smartphones and advanced GPS technology has laid the foundation for convenient, on-demand transportation. Economically, the rising cost of car ownership and maintenance, coupled with the desire for cost-effective travel options, makes ridesharing an attractive alternative. Government initiatives promoting sustainable transportation and reducing traffic congestion also provide a significant impetus. Furthermore, the increasing urbanization of populations worldwide creates a greater demand for efficient and accessible mobility solutions. The convenience and flexibility offered by ridesharing platforms, such as BlaBlaCar and Didi Chuxing, are undeniable draws for consumers seeking alternatives to traditional transportation.

Obstacles in the Ridesharing Market Market

Despite robust growth, the ridesharing market faces significant obstacles. Regulatory challenges, including driver classification debates and varying local regulations, create uncertainty and compliance burdens. Intense competition and the need for continuous promotional spending to acquire and retain users can strain profitability. Supply chain disruptions, particularly impacting the availability of vehicles and components for fleet expansion, can hinder growth. Furthermore, public perception issues related to safety, driver vetting, and surge pricing can impact user trust and adoption rates. The operational complexity of managing large fleets and a distributed workforce also presents challenges.

Future Opportunities in Ridesharing Market

Emerging opportunities in the ridesharing market are vast and diverse. The expansion of electric vehicle (EV) ridesharing presents a significant opportunity to cater to environmentally conscious consumers and meet sustainability mandates. The development of autonomous ridesharing fleets promises to revolutionize urban transport, offering potential cost reductions and increased efficiency in the long term. New markets in developing economies, with their rapidly growing urban populations, offer substantial untapped potential. Furthermore, the integration of ridesharing with other mobility services, such as public transit, micro-mobility, and delivery services, through super-apps, will create comprehensive, multimodal transportation ecosystems.

Major Players in the Ridesharing Market Ecosystem

Flinc GmbH (Daimler Mobility Services) BlaBlaCar (Comuto SA) SPLT (Bosch) Didi Chuxing Technology Co HyreCar Inc KINTO Join Limited Wunder Mobility Solutions GmbH Kangaride Canada Co GoMore Klaxit SAS (formerly Wayzup) Scoop Technologies Inc Vride Inc (Acquired by Enterprise Holdings Inc CarpoolWorld (Datasphere Corporation) Via Transportation Inc Zimride Inc

Key Developments in Ridesharing Market Industry

- June 2022: Uber launched its new UberX Share service, a carpooling feature offering riders a 20% discount in exchange for sharing rides, even if not matched with a co-rider, signaling a return to shared mobility with incentives.

- February 2022: Avolon and AirAsia partnered to create a transformational ridesharing platform in Southeast Asia by 2025, with Air Asia agreeing to lease at least 100 VX4 eVTOL aircraft to revolutionize air travel and develop an urban air mobility platform.

Strategic Ridesharing Market Market Forecast

The strategic ridesharing market forecast indicates sustained and robust growth driven by evolving consumer preferences for convenient and affordable mobility. The increasing integration of advanced technologies, including AI and the nascent stages of autonomous driving, will enhance operational efficiency and user experience. The strong emphasis on sustainability will fuel the expansion of electric vehicle fleets and the development of greener transportation solutions. Emerging markets will continue to offer significant growth potential, while established markets will witness innovation in service diversification and integrated mobility offerings, making the ridesharing market forecast optimistic for the coming years.

Ridesharing Market Segmentation

-

1. Membership Type

- 1.1. Fixed Ridesharing

- 1.2. Dynamic Ridesharing

- 1.3. Corporate Ridesharing

-

2. Service Type

- 2.1. Web-Based

- 2.2. App-Based

- 2.3. Web and App Based

Ridesharing Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Ridesharing Market Regional Market Share

Geographic Coverage of Ridesharing Market

Ridesharing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Cost Advantage and Increasing Availability of Carpooling/Corporate Pooling Services; Incentives and Rebates Provided by Governments in Major Markets

- 3.2.2 such as France; Increasing Cost of Vehicle Ownership and Environmental Benefits

- 3.3. Market Restrains

- 3.3.1. Technical Challenges Pertaining to CMP Technique

- 3.4. Market Trends

- 3.4.1. COVID-19 Has Posed Significant Threat to the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ridesharing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Membership Type

- 5.1.1. Fixed Ridesharing

- 5.1.2. Dynamic Ridesharing

- 5.1.3. Corporate Ridesharing

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Web-Based

- 5.2.2. App-Based

- 5.2.3. Web and App Based

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Membership Type

- 6. North America Ridesharing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Membership Type

- 6.1.1. Fixed Ridesharing

- 6.1.2. Dynamic Ridesharing

- 6.1.3. Corporate Ridesharing

- 6.2. Market Analysis, Insights and Forecast - by Service Type

- 6.2.1. Web-Based

- 6.2.2. App-Based

- 6.2.3. Web and App Based

- 6.1. Market Analysis, Insights and Forecast - by Membership Type

- 7. Europe Ridesharing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Membership Type

- 7.1.1. Fixed Ridesharing

- 7.1.2. Dynamic Ridesharing

- 7.1.3. Corporate Ridesharing

- 7.2. Market Analysis, Insights and Forecast - by Service Type

- 7.2.1. Web-Based

- 7.2.2. App-Based

- 7.2.3. Web and App Based

- 7.1. Market Analysis, Insights and Forecast - by Membership Type

- 8. Asia Ridesharing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Membership Type

- 8.1.1. Fixed Ridesharing

- 8.1.2. Dynamic Ridesharing

- 8.1.3. Corporate Ridesharing

- 8.2. Market Analysis, Insights and Forecast - by Service Type

- 8.2.1. Web-Based

- 8.2.2. App-Based

- 8.2.3. Web and App Based

- 8.1. Market Analysis, Insights and Forecast - by Membership Type

- 9. Australia and New Zealand Ridesharing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Membership Type

- 9.1.1. Fixed Ridesharing

- 9.1.2. Dynamic Ridesharing

- 9.1.3. Corporate Ridesharing

- 9.2. Market Analysis, Insights and Forecast - by Service Type

- 9.2.1. Web-Based

- 9.2.2. App-Based

- 9.2.3. Web and App Based

- 9.1. Market Analysis, Insights and Forecast - by Membership Type

- 10. Latin America Ridesharing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Membership Type

- 10.1.1. Fixed Ridesharing

- 10.1.2. Dynamic Ridesharing

- 10.1.3. Corporate Ridesharing

- 10.2. Market Analysis, Insights and Forecast - by Service Type

- 10.2.1. Web-Based

- 10.2.2. App-Based

- 10.2.3. Web and App Based

- 10.1. Market Analysis, Insights and Forecast - by Membership Type

- 11. Middle East and Africa Ridesharing Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Membership Type

- 11.1.1. Fixed Ridesharing

- 11.1.2. Dynamic Ridesharing

- 11.1.3. Corporate Ridesharing

- 11.2. Market Analysis, Insights and Forecast - by Service Type

- 11.2.1. Web-Based

- 11.2.2. App-Based

- 11.2.3. Web and App Based

- 11.1. Market Analysis, Insights and Forecast - by Membership Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Flinc GmbH (Daimler Mobility Services)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 BlaBlaCar (Comuto SA)

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 SPLT (Bosch)

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Didi Chuxing Technology Co

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 HyreCar Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 KINTO Join Limited

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Wunder Mobility Solutions GmbH

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Kangaride Canada Co

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 GoMore

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Klaxit SAS (formerly Wayzup)

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Scoop Technologies Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Vride Inc (Acquired by Enterprise Holdings Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 CarpoolWorld (Datasphere Corporation)

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Via Transportation Inc

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Zimride Inc

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.1 Flinc GmbH (Daimler Mobility Services)

List of Figures

- Figure 1: Global Ridesharing Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Ridesharing Market Revenue (Million), by Membership Type 2025 & 2033

- Figure 3: North America Ridesharing Market Revenue Share (%), by Membership Type 2025 & 2033

- Figure 4: North America Ridesharing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 5: North America Ridesharing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 6: North America Ridesharing Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Ridesharing Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Ridesharing Market Revenue (Million), by Membership Type 2025 & 2033

- Figure 9: Europe Ridesharing Market Revenue Share (%), by Membership Type 2025 & 2033

- Figure 10: Europe Ridesharing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 11: Europe Ridesharing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 12: Europe Ridesharing Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Ridesharing Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Ridesharing Market Revenue (Million), by Membership Type 2025 & 2033

- Figure 15: Asia Ridesharing Market Revenue Share (%), by Membership Type 2025 & 2033

- Figure 16: Asia Ridesharing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 17: Asia Ridesharing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 18: Asia Ridesharing Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Ridesharing Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Ridesharing Market Revenue (Million), by Membership Type 2025 & 2033

- Figure 21: Australia and New Zealand Ridesharing Market Revenue Share (%), by Membership Type 2025 & 2033

- Figure 22: Australia and New Zealand Ridesharing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 23: Australia and New Zealand Ridesharing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 24: Australia and New Zealand Ridesharing Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Ridesharing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Ridesharing Market Revenue (Million), by Membership Type 2025 & 2033

- Figure 27: Latin America Ridesharing Market Revenue Share (%), by Membership Type 2025 & 2033

- Figure 28: Latin America Ridesharing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 29: Latin America Ridesharing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 30: Latin America Ridesharing Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Ridesharing Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Ridesharing Market Revenue (Million), by Membership Type 2025 & 2033

- Figure 33: Middle East and Africa Ridesharing Market Revenue Share (%), by Membership Type 2025 & 2033

- Figure 34: Middle East and Africa Ridesharing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 35: Middle East and Africa Ridesharing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 36: Middle East and Africa Ridesharing Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Ridesharing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ridesharing Market Revenue Million Forecast, by Membership Type 2020 & 2033

- Table 2: Global Ridesharing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 3: Global Ridesharing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Ridesharing Market Revenue Million Forecast, by Membership Type 2020 & 2033

- Table 5: Global Ridesharing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: Global Ridesharing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Ridesharing Market Revenue Million Forecast, by Membership Type 2020 & 2033

- Table 8: Global Ridesharing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 9: Global Ridesharing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Ridesharing Market Revenue Million Forecast, by Membership Type 2020 & 2033

- Table 11: Global Ridesharing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 12: Global Ridesharing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Ridesharing Market Revenue Million Forecast, by Membership Type 2020 & 2033

- Table 14: Global Ridesharing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 15: Global Ridesharing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Ridesharing Market Revenue Million Forecast, by Membership Type 2020 & 2033

- Table 17: Global Ridesharing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 18: Global Ridesharing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Ridesharing Market Revenue Million Forecast, by Membership Type 2020 & 2033

- Table 20: Global Ridesharing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 21: Global Ridesharing Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ridesharing Market?

The projected CAGR is approximately 12.81%.

2. Which companies are prominent players in the Ridesharing Market?

Key companies in the market include Flinc GmbH (Daimler Mobility Services), BlaBlaCar (Comuto SA), SPLT (Bosch), Didi Chuxing Technology Co, HyreCar Inc, KINTO Join Limited, Wunder Mobility Solutions GmbH, Kangaride Canada Co, GoMore, Klaxit SAS (formerly Wayzup), Scoop Technologies Inc, Vride Inc (Acquired by Enterprise Holdings Inc, CarpoolWorld (Datasphere Corporation), Via Transportation Inc, Zimride Inc.

3. What are the main segments of the Ridesharing Market?

The market segments include Membership Type, Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 47.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Cost Advantage and Increasing Availability of Carpooling/Corporate Pooling Services; Incentives and Rebates Provided by Governments in Major Markets. such as France; Increasing Cost of Vehicle Ownership and Environmental Benefits.

6. What are the notable trends driving market growth?

COVID-19 Has Posed Significant Threat to the Market.

7. Are there any restraints impacting market growth?

Technical Challenges Pertaining to CMP Technique.

8. Can you provide examples of recent developments in the market?

June 2022 - Uber has launched a new UberX Share service to share rides, which is remarkably similar to Uber's pre-pandemic carpooling feature, but with a monetary incentive. Riders who choose UberX Share will be paired with another co-rider traveling in the same direction. Uber will give riders a 20% reduction on the overall fee in exchange for the inconvenience and extra time spent on the road. Even if riders are not matched with a co-rider, they will receive an up-front discount on their ride.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ridesharing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ridesharing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ridesharing Market?

To stay informed about further developments, trends, and reports in the Ridesharing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence