Key Insights

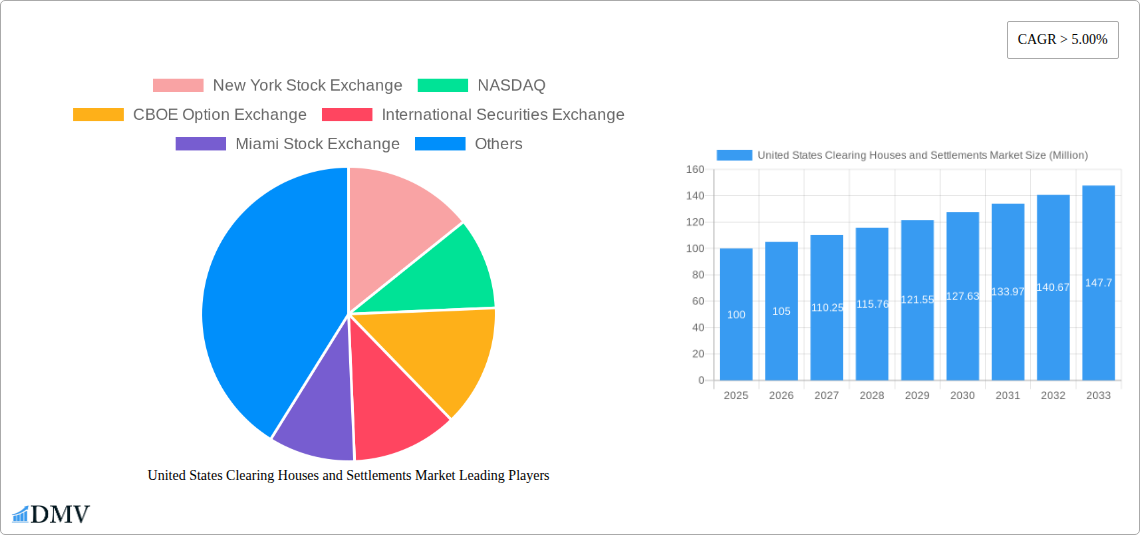

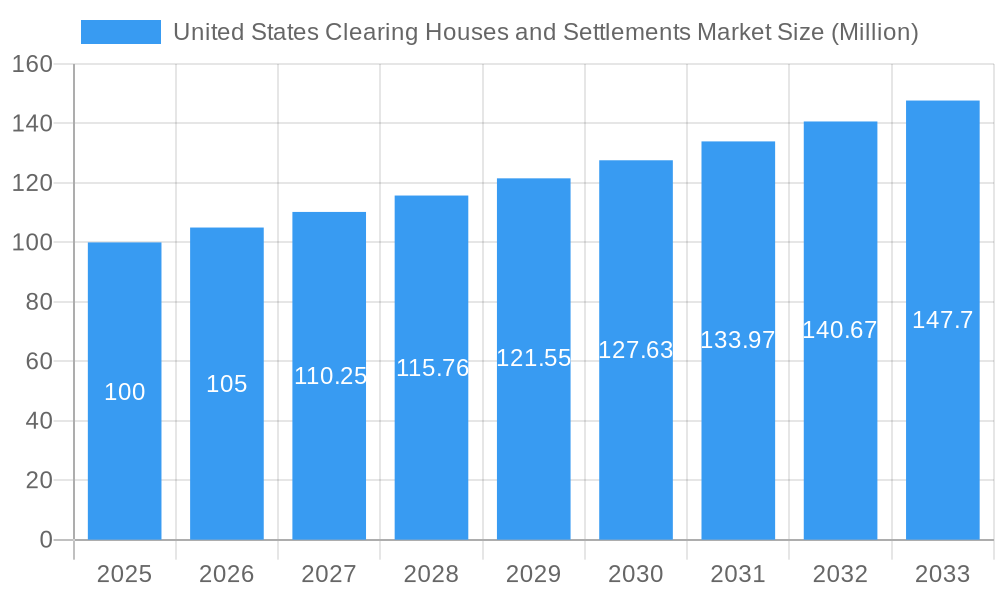

The United States clearing and settlement market is experiencing robust expansion, driven by increasing electronic trading volumes, the rise of algorithmic trading, and evolving regulatory frameworks aimed at enhancing market stability. This dynamic sector is projected to achieve a Compound Annual Growth Rate (CAGR) of 5%. Key market drivers include the necessity for efficient settlement systems, the demand for advanced risk mitigation solutions, and the integration of emerging technologies like blockchain. Major clearing houses, including those associated with the New York Stock Exchange, NASDAQ, and CBOE, continue to play a pivotal role, leveraging their established networks and specialized offerings.

United States Clearing Houses and Settlements Market Market Size (In Billion)

Technological advancements, particularly in areas such as distributed ledger technology, are poised to enhance market efficiency, transparency, and security. Despite ongoing challenges, including cybersecurity threats and the complexity of financial instruments, the market's trajectory indicates sustained growth. The overall market size was estimated at $6.75 billion in the base year of 2024, with projections pointing towards significant future expansion driven by the ongoing digitalization of financial markets and the critical need for sophisticated risk management frameworks.

United States Clearing Houses and Settlements Market Company Market Share

United States Clearing Houses and Settlements Market: Key Trends and Forecast (2024-2033)

This report offers an in-depth analysis of the United States Clearing Houses and Settlements Market, covering the period from 2024 to 2033. With a base year of 2024, the market is estimated at $6.75 billion and is forecast to exhibit substantial growth throughout the projection period at a CAGR of 5%. This study is an indispensable resource for stakeholders aiming to understand and strategically engage with this evolving market landscape.

United States Clearing Houses and Settlements Market Market Composition & Trends

This section delves into the competitive landscape, examining market concentration, innovation drivers, regulatory influences, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity within the U.S. clearing houses and settlements market. The report analyzes the market share distribution among key players, revealing the dominance of established institutions and the emergence of new competitors. It also quantifies M&A activity by providing deal values and assessing their impact on market structure. The intricate interplay of regulatory changes, technological advancements, and evolving end-user needs is carefully dissected, providing a granular view of the market's dynamics. For example, the growing adoption of digital technologies is impacting operational efficiency and driving consolidation in the market. The evolving regulatory environment, characterized by increased scrutiny and stricter compliance requirements, also influences the strategic decisions of market participants.

- Market Concentration: The market exhibits a moderately concentrated structure with a few dominant players controlling a significant portion of the market share. Further analysis detailing specific market share percentages for key players is available within the full report.

- Innovation Catalysts: Technological advancements, such as blockchain and AI, are driving innovation in clearing and settlement processes, enhancing efficiency and reducing costs.

- Regulatory Landscape: Stringent regulations aimed at mitigating systemic risk are shaping the competitive landscape, influencing strategies and investment decisions within the market.

- Substitute Products: While direct substitutes are limited, alternative trading platforms and decentralized finance (DeFi) solutions pose some level of indirect competition.

- End-User Profiles: The primary end-users include banks, brokerage firms, institutional investors, and other financial intermediaries.

- M&A Activities: The report documents significant M&A activity in recent years, including details on deal sizes and their implications for market consolidation. Estimated value of M&A deals during the historical period is $XX Million.

United States Clearing Houses and Settlements Market Industry Evolution

This section provides a detailed analysis of the U.S. clearing houses and settlements market's evolution, encompassing market growth trajectories, technological innovations, and evolving consumer demands. The analysis utilizes data points such as growth rates and adoption metrics to illustrate the market's dynamic nature. This includes examining the influence of technological advancements on efficiency gains and cost reductions within clearing and settlement processes. The report will illustrate how changing consumer needs and preferences, such as the increasing demand for faster and more transparent transactions, are driving innovation and shaping the future of the market. The impact of macroeconomic factors, such as economic growth and interest rates, on market expansion is also considered. The report projects a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). Specific examples of technological integration and their impacts on market performance are detailed within the report.

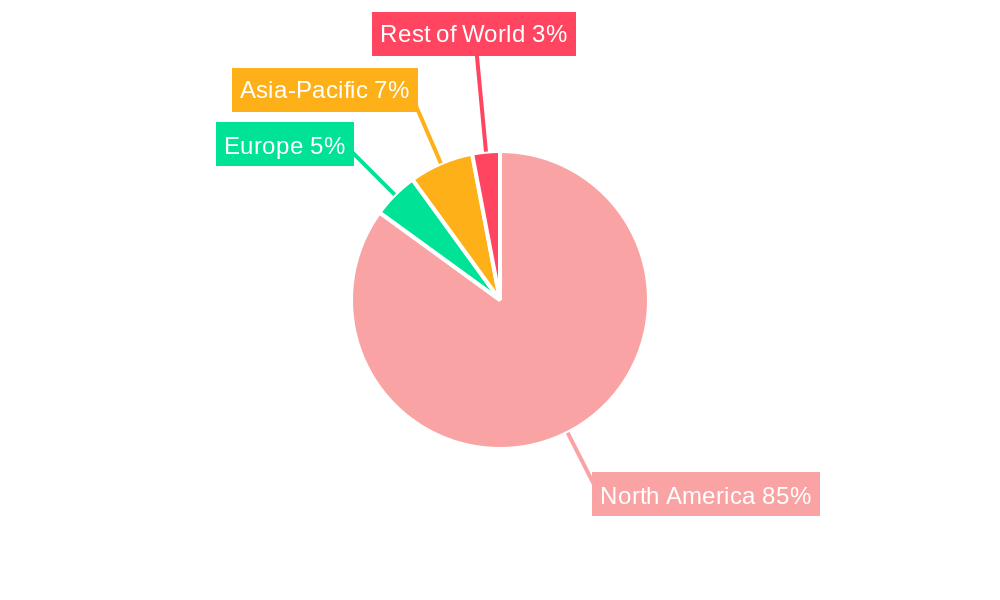

Leading Regions, Countries, or Segments in United States Clearing Houses and Settlements Market

This section identifies the dominant regions, countries, or segments within the U.S. clearing houses and settlements market. It pinpoints the key factors driving the dominance of these specific areas.

Key Drivers (New York):

- High concentration of financial institutions.

- Established infrastructure and regulatory framework.

- Significant investment in technological advancements.

Dominance Factors: The detailed analysis within the report explains the reasons behind the region's, country's, or segment's prominent position. Factors include the concentration of key players, supportive regulatory environment, robust infrastructure, and high trading volumes.

United States Clearing Houses and Settlements Market Product Innovations

The U.S. clearing houses and settlements market is witnessing significant product innovations driven by technological advancements. New solutions are enhancing efficiency, reducing risk, and improving the overall user experience. These innovations include streamlined settlement processes, sophisticated risk management tools, and improved data analytics capabilities. The unique selling propositions of these products include faster processing times, reduced operational costs, and enhanced transparency.

Propelling Factors for United States Clearing Houses and Settlements Market Growth

Several factors are propelling the growth of the U.S. clearing houses and settlements market. Technological advancements, such as automation and AI, are boosting efficiency and reducing costs. Stringent regulations aimed at minimizing systemic risk are driving increased adoption of clearinghouse services. Economic growth and increased trading volumes are also contributing to market expansion.

Obstacles in the United States Clearing Houses and Settlements Market Market

Despite the positive growth outlook, the market faces certain obstacles. These include regulatory challenges, such as evolving compliance requirements, cybersecurity risks, and the potential for supply chain disruptions. Increased competition and the need for continuous technological upgrades also present challenges. The estimated impact of these restraints on market growth is quantified in the full report.

Future Opportunities in United States Clearing Houses and Settlements Market

The U.S. clearing houses and settlements market presents several promising opportunities for growth. Expansion into new markets, particularly with the increasing adoption of digital assets, and the development of innovative solutions utilizing emerging technologies like blockchain and AI, offer significant potential. Furthermore, changes in consumer behavior and preferences are expected to create additional growth avenues in the coming years.

Major Players in the United States Clearing Houses and Settlements Market Ecosystem

- New York Stock Exchange

- NASDAQ

- CBOE Option Exchange

- International Securities Exchange

- Miami Stock Exchange

- National Stock Exchange

- Philadelphia Stock Exchange

- *List Not Exhaustive

Key Developments in United States Clearing Houses and Settlements Market Industry

- December 2023: Miami International Holdings, Inc. launched MIAX Sapphire, a new exchange combining electronic and physical trading floors in Miami. This expansion significantly enhances the market's infrastructure and expands trading capabilities.

- December 2023: New regulations mandated by Wall Street regulators require more trades to be cleared through clearinghouses, aiming to reduce systemic risk within the $26 trillion U.S. Treasury market. This regulatory shift is expected to significantly increase the volume of transactions handled by clearing houses.

Strategic United States Clearing Houses and Settlements Market Market Forecast

The U.S. clearing houses and settlements market is poised for continued growth, driven by technological innovation, regulatory changes, and increasing trading volumes. Emerging technologies and new market opportunities are expected to contribute significantly to this growth trajectory, creating a favorable environment for both existing and new market participants. The forecast anticipates a robust expansion in market size and value throughout the forecast period.

United States Clearing Houses and Settlements Market Segmentation

-

1. Type of Market

- 1.1. Primary Market

- 1.2. Secondary Market

-

2. Financial Instruments

- 2.1. Debt

- 2.2. Equity

United States Clearing Houses and Settlements Market Segmentation By Geography

- 1. United States

United States Clearing Houses and Settlements Market Regional Market Share

Geographic Coverage of United States Clearing Houses and Settlements Market

United States Clearing Houses and Settlements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Digital Assets and Digitalization is Expected to Boost the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 5.1.1. Primary Market

- 5.1.2. Secondary Market

- 5.2. Market Analysis, Insights and Forecast - by Financial Instruments

- 5.2.1. Debt

- 5.2.2. Equity

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 New York Stock Exchange

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NASDAQ

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CBOE Option Exchange

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 International Securities Exchange

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Miami Stock Exchange

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 National Stock Exchange

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Philadelphia Stock Exchange*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 New York Stock Exchange

List of Figures

- Figure 1: United States Clearing Houses and Settlements Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Clearing Houses and Settlements Market Share (%) by Company 2025

List of Tables

- Table 1: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Type of Market 2020 & 2033

- Table 2: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Financial Instruments 2020 & 2033

- Table 3: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Type of Market 2020 & 2033

- Table 5: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Financial Instruments 2020 & 2033

- Table 6: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Clearing Houses and Settlements Market?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the United States Clearing Houses and Settlements Market?

Key companies in the market include New York Stock Exchange, NASDAQ, CBOE Option Exchange, International Securities Exchange, Miami Stock Exchange, National Stock Exchange, Philadelphia Stock Exchange*List Not Exhaustive.

3. What are the main segments of the United States Clearing Houses and Settlements Market?

The market segments include Type of Market, Financial Instruments.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.75 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Digital Assets and Digitalization is Expected to Boost the Growth of the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In December 2023, Miami International Holdings, Inc. has introduced new MIAX Sapphire, physical trading floor located in Miami's Wynwood district. The new MIAX Sapphire exchange, which will run both an electronic exchange and a physical trading floor, will be MIAX's fourth national securities exchange for U.S. multi-listed options.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Clearing Houses and Settlements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Clearing Houses and Settlements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Clearing Houses and Settlements Market?

To stay informed about further developments, trends, and reports in the United States Clearing Houses and Settlements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence