Key Insights

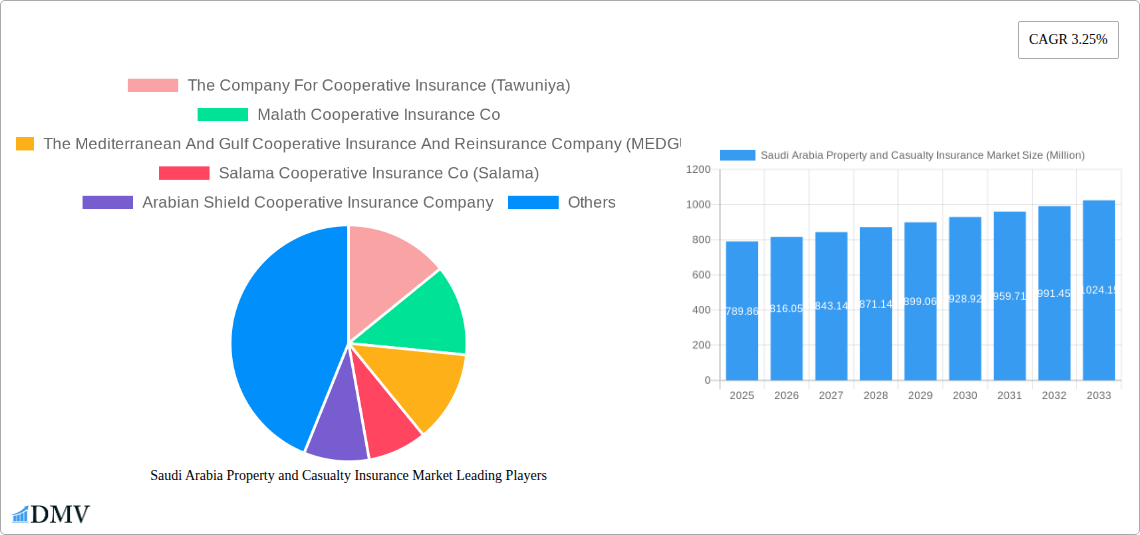

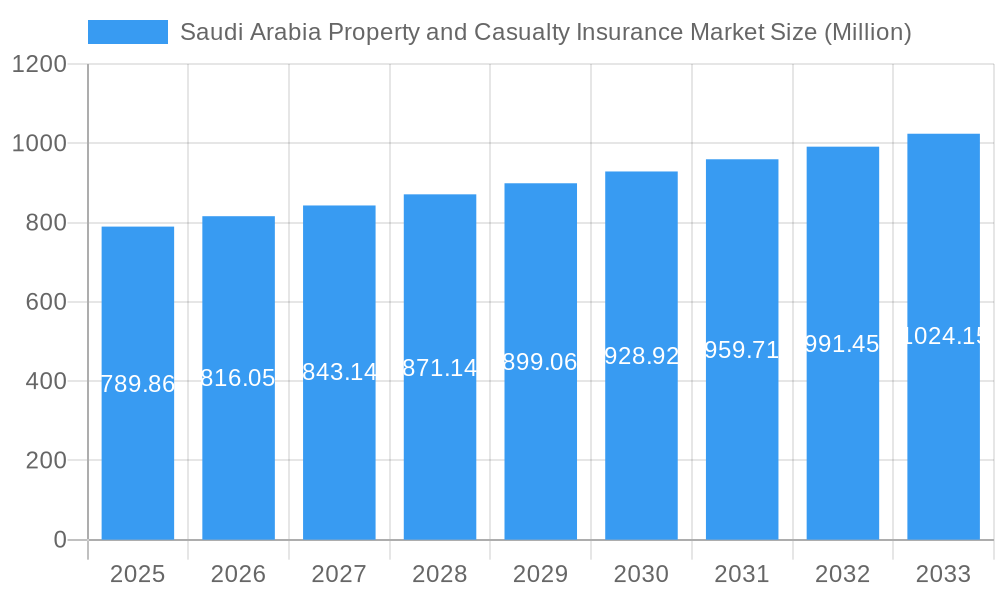

The Saudi Arabia property and casualty (P&C) insurance market exhibits robust growth potential, projected to reach a market size of $789.86 million in 2025, with a Compound Annual Growth Rate (CAGR) of 3.25%. This expansion is fueled by several key drivers. Firstly, the Kingdom's ambitious Vision 2030 initiative is driving significant infrastructure development and economic diversification, leading to increased demand for property and casualty insurance coverage. Secondly, rising awareness of risk mitigation among both individuals and businesses is contributing to higher insurance penetration rates. Thirdly, government regulations promoting financial inclusion and encouraging insurance adoption are further bolstering market growth. The market is also witnessing a shift towards digital insurance platforms and innovative product offerings, catering to the evolving needs of a technologically savvy population. However, challenges remain, including the relatively low insurance penetration compared to global averages and the potential impact of economic fluctuations on consumer spending. Competitive pressures among established players like The Company For Cooperative Insurance (Tawuniya), Malath Cooperative Insurance Co, and MEDGULF, alongside newer entrants, further shape the market dynamics.

Saudi Arabia Property and Casualty Insurance Market Market Size (In Million)

Despite these restraints, the long-term forecast for the Saudi Arabia P&C insurance market remains positive. The consistent CAGR suggests sustained growth through 2033. Market segmentation, while not explicitly provided, likely includes commercial and residential property insurance, motor insurance, and liability insurance, each exhibiting varying growth rates. Successful navigation of challenges and leveraging opportunities presented by technological advancements will be crucial for market players to capitalize on this growth trajectory. Further market segmentation analysis and a deeper understanding of regional variations within Saudi Arabia would offer more granular insights. The ongoing expansion of the Saudi economy and increasing infrastructural development are anticipated to further fuel demand for insurance products in the coming years.

Saudi Arabia Property and Casualty Insurance Market Company Market Share

Saudi Arabia Property and Casualty Insurance Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Saudi Arabia Property and Casualty Insurance market, offering a detailed overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study delivers crucial insights for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Saudi Arabia Property and Casualty Insurance Market Composition & Trends

This section delves into the competitive landscape of the Saudi Arabian Property and Casualty Insurance market, analyzing market concentration, innovative drivers, regulatory frameworks, substitute products, end-user profiles, and merger and acquisition (M&A) activities. We examine the market share distribution among key players, including The Company For Cooperative Insurance (Tawuniya), Malath Cooperative Insurance Co, The Mediterranean and Gulf Cooperative Insurance and Reinsurance Company (MEDGULF), Salama Cooperative Insurance Co (Salama), Arabian Shield Cooperative Insurance Company, Saudi Arabian Cooperative Insurance Company (Saico), Gulf Union Al Ahlia Cooperative Insurance Co, Allianz Saudi Fransi Cooperative Insurance Company, Al-Etihad Co-operative Insurance Co, and Al Sagr Cooperative Insurance Company (list not exhaustive). The analysis incorporates data on M&A deal values to highlight strategic shifts within the industry. The increasing adoption of Insurtech solutions and the impact of the evolving regulatory environment are key aspects of this assessment. Market concentration is analyzed through the Herfindahl-Hirschman Index (HHI) and market share data. The report also explores the influence of substitute products and evolving end-user preferences on market dynamics.

- Market Share Distribution: A detailed breakdown of market share amongst key players, providing insights into market concentration and competitive intensity. Tawuniya holds an estimated xx% market share in 2025.

- M&A Activity: Analysis of significant M&A transactions, including deal values and their impact on market consolidation. Total M&A deal value in 2024 estimated at xx Million.

- Regulatory Landscape: Evaluation of the impact of existing and upcoming regulations on market growth and competitive dynamics, including the recent establishment of the Insurance Authority (IA).

- Innovation Catalysts: Identification of technological advancements and innovative business models shaping the market's future.

Saudi Arabia Property and Casualty Insurance Market Industry Evolution

This section provides a comprehensive analysis of the Saudi Arabia Property and Casualty Insurance market's historical and projected growth trajectories. We analyze market size and growth rates from 2019 to 2024 (historical period) and project growth from 2025 to 2033 (forecast period). The analysis incorporates technological advancements, like the increasing use of AI and big data in risk assessment and claims processing, and the impact of these advancements on market dynamics. Furthermore, it examines the evolving needs and demands of consumers and how insurers are adapting their offerings to meet those changing preferences. The impact of economic factors such as GDP growth and inflation on insurance demand is also assessed. We will also explore the shift towards digital insurance platforms and the adoption of telematics technology for risk mitigation. The market growth rate is expected to be driven by factors like rising disposable incomes and increasing awareness of insurance products.

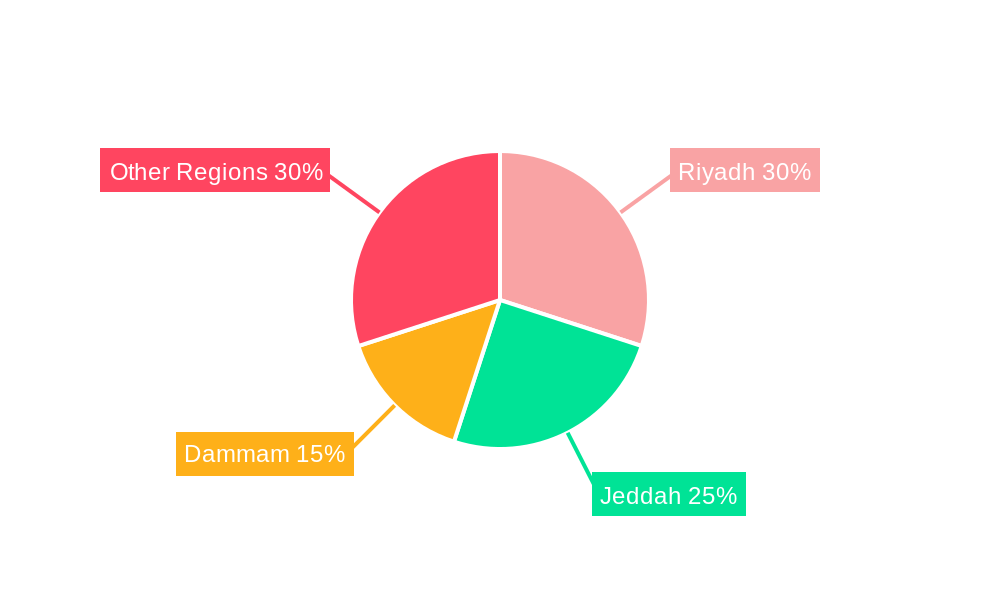

Leading Regions, Countries, or Segments in Saudi Arabia Property and Casualty Insurance Market

This section identifies the dominant regions, countries, or segments within the Saudi Arabian Property and Casualty Insurance market. The analysis focuses on the factors driving the dominance of the leading segment, considering economic indicators, investment trends, and regulatory support.

- Key Drivers of Dominance:

- Strong Economic Growth in the dominant region.

- Government initiatives and supportive regulations.

- High investment in infrastructure development.

- Growing awareness and adoption of insurance products.

The dominant region/segment is likely to be [Insert Dominant Region/Segment - e.g., Riyadh or Motor Insurance], driven by factors like high population density, robust economic activity, and significant infrastructure projects. The analysis will include a comparison with other regions to highlight the disparity and growth potential.

Saudi Arabia Property and Casualty Insurance Market Product Innovations

The Saudi Arabian Property and Casualty Insurance market is witnessing the emergence of innovative products tailored to the evolving needs of consumers. This includes the integration of technology like AI and machine learning for improved risk assessment and personalized pricing, the development of microinsurance products to reach underserved segments of the population, and the incorporation of digital distribution channels for enhanced customer convenience. These innovations aim to provide enhanced customer experience and more efficient risk management capabilities.

Propelling Factors for Saudi Arabia Property and Casualty Insurance Market Growth

Several factors are driving the growth of the Saudi Arabian Property and Casualty Insurance market. The ongoing economic development and diversification efforts of the Saudi Arabian government are fueling demand for insurance products. Increased infrastructure development creates a higher demand for property insurance. Additionally, the rising awareness of the importance of insurance, coupled with government initiatives to promote financial inclusion, is encouraging wider adoption. Technological advancements are also playing a critical role, improving efficiency and access to insurance services. The establishment of the Insurance Authority (IA) signals a commitment to fostering a regulated and transparent market environment.

Obstacles in the Saudi Arabia Property and Casualty Insurance Market

Despite the growth opportunities, the Saudi Arabian Property and Casualty Insurance market faces challenges. Regulatory changes, while promoting growth, may introduce complexities for insurers. The competition within the market is intense, and insurers constantly strive to differentiate themselves. Economic downturns can also impact consumer spending on insurance. Additionally, fraud and misrepresentation of risks can affect the profitability of insurance companies.

Future Opportunities in Saudi Arabia Property and Casualty Insurance Market

The Saudi Arabian Property and Casualty Insurance market presents numerous growth opportunities. The continued growth of the construction and infrastructure sectors, driven by Vision 2030 initiatives, will fuel demand for property insurance. Expanding into underserved markets, leveraging Insurtech advancements, and catering to the growing demand for personalized insurance solutions offer significant potential. The increasing adoption of digital channels offers growth opportunities for companies that can provide seamless online experiences.

Major Players in the Saudi Arabia Property and Casualty Insurance Market Ecosystem

- The Company For Cooperative Insurance (Tawuniya)

- Malath Cooperative Insurance Co

- The Mediterranean And Gulf Cooperative Insurance And Reinsurance Company (MEDGULF)

- Salama Cooperative Insurance Co (Salama)

- Arabian Shield Cooperative Insurance Company

- Saudi Arabian Cooperative Insurance Company (Saico)

- Gulf Union Al Ahlia Cooperative Insurance Co

- Allianz Saudi Fransi Cooperative Insurance Company

- Al-Etihad Co-operative Insurance Co

- Al Sagr Cooperative Insurance Company

(List Not Exhaustive)

Key Developments in Saudi Arabia Property and Casualty Insurance Market Industry

- August 2023: The Saudi Cabinet approved the establishment of the Insurance Authority (IA), a unified and independent regulator for the insurance sector. This is expected to significantly improve market regulation and transparency.

- January 2023: Medgulf received confirmation of its business compliance with Sharia regulations from the Sharia Review House. This enhances Medgulf’s market appeal to a significant segment of the population.

Strategic Saudi Arabia Property and Casualty Insurance Market Forecast

The Saudi Arabian Property and Casualty Insurance market is poised for substantial growth in the coming years. Driven by economic expansion, infrastructural development, and increasing insurance awareness, the market is expected to witness significant expansion. Technological advancements and regulatory reforms will further propel market growth. The ongoing government support and investment in the sector will create favorable conditions for industry expansion. The establishment of the IA will improve market stability and attract further foreign investment.

Saudi Arabia Property and Casualty Insurance Market Segmentation

-

1. Insurance Type

- 1.1. Motor

- 1.2. Property / Fire

- 1.3. Marine

- 1.4. Aviation

- 1.5. Energy

- 1.6. Engineering

- 1.7. Accident & Liability and Other

-

2. Distribution Channel

- 2.1. Insurance Agency

- 2.2. Bancassurance

- 2.3. Brokers

- 2.4. Direct Sales

- 2.5. Others

Saudi Arabia Property and Casualty Insurance Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Property and Casualty Insurance Market Regional Market Share

Geographic Coverage of Saudi Arabia Property and Casualty Insurance Market

Saudi Arabia Property and Casualty Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness and Insurance Penetration; Growing Middle Class and Urbanization

- 3.3. Market Restrains

- 3.3.1. Increasing Awareness and Insurance Penetration; Growing Middle Class and Urbanization

- 3.4. Market Trends

- 3.4.1. Motor Insurance Growth Triggered By Changing Regulatory Landscape

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Property and Casualty Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Motor

- 5.1.2. Property / Fire

- 5.1.3. Marine

- 5.1.4. Aviation

- 5.1.5. Energy

- 5.1.6. Engineering

- 5.1.7. Accident & Liability and Other

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Insurance Agency

- 5.2.2. Bancassurance

- 5.2.3. Brokers

- 5.2.4. Direct Sales

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Company For Cooperative Insurance (Tawuniya)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Malath Cooperative Insurance Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Mediterranean And Gulf Cooperative Insurance And Reinsurance Company (MEDGULF)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Salama Cooperative Insurance Co (Salama)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Arabian Shield Cooperative Insurance Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Saudi Arabian Cooperative Insurance Company (Saico)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gulf Union Al Ahlia Cooperative Insurance Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Allianz Saudi Fransi Cooperative Insurance Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Al-Etihad Co-operative Insurance Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Al Sagr Cooperative Insurance Company**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Company For Cooperative Insurance (Tawuniya)

List of Figures

- Figure 1: Saudi Arabia Property and Casualty Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Property and Casualty Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Property and Casualty Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 2: Saudi Arabia Property and Casualty Insurance Market Volume Million Forecast, by Insurance Type 2020 & 2033

- Table 3: Saudi Arabia Property and Casualty Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Saudi Arabia Property and Casualty Insurance Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 5: Saudi Arabia Property and Casualty Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Saudi Arabia Property and Casualty Insurance Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Saudi Arabia Property and Casualty Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 8: Saudi Arabia Property and Casualty Insurance Market Volume Million Forecast, by Insurance Type 2020 & 2033

- Table 9: Saudi Arabia Property and Casualty Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Saudi Arabia Property and Casualty Insurance Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 11: Saudi Arabia Property and Casualty Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Saudi Arabia Property and Casualty Insurance Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Property and Casualty Insurance Market?

The projected CAGR is approximately 3.25%.

2. Which companies are prominent players in the Saudi Arabia Property and Casualty Insurance Market?

Key companies in the market include The Company For Cooperative Insurance (Tawuniya), Malath Cooperative Insurance Co, The Mediterranean And Gulf Cooperative Insurance And Reinsurance Company (MEDGULF), Salama Cooperative Insurance Co (Salama), Arabian Shield Cooperative Insurance Company, Saudi Arabian Cooperative Insurance Company (Saico), Gulf Union Al Ahlia Cooperative Insurance Co, Allianz Saudi Fransi Cooperative Insurance Company, Al-Etihad Co-operative Insurance Co, Al Sagr Cooperative Insurance Company**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Property and Casualty Insurance Market?

The market segments include Insurance Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 789.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness and Insurance Penetration; Growing Middle Class and Urbanization.

6. What are the notable trends driving market growth?

Motor Insurance Growth Triggered By Changing Regulatory Landscape.

7. Are there any restraints impacting market growth?

Increasing Awareness and Insurance Penetration; Growing Middle Class and Urbanization.

8. Can you provide examples of recent developments in the market?

August 2023: The Saudi Cabinet approved the establishment of a new unified and independent regulator for the insurance sector, the Insurance Authority (IA). The Insurance Authority will report directly to the Prime Minister.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Property and Casualty Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Property and Casualty Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Property and Casualty Insurance Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Property and Casualty Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence